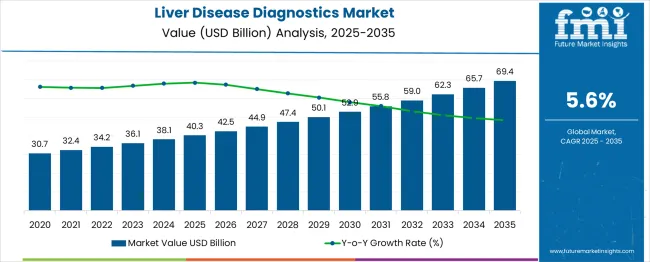

The liver disease diagnostics market, valued at USD 40.3 billion in 2025, is projected to grow to USD 69.4 billion by 2035, with a steady CAGR of 6%. From 2025 to 2027, the market experiences a moderate increase, growing from USD 40.3 billion to USD 42.5 billion. During this period, the growth is fueled by advancements in diagnostic techniques such as biomarker assays, imaging technologies, and non-invasive testing methods. These innovations enhance early detection and enable better management of liver diseases, such as hepatitis and cirrhosis, driving increasing demand for diagnostic tools.

Between 2027 and 2030, the market accelerates as it grows from USD 42.5 billion to USD 47.4 billion. The adoption of new technologies and treatments for liver disease further propels growth, particularly as the healthcare sector embraces precision medicine and AI-based diagnostic tools. Rising awareness about liver diseases and government support for improving diagnostic infrastructure also contribute to the expansion of the market. The period between 2030 and 2035 witnesses continued steady growth, reaching USD 69.4 billion by 2035. This period is marked by innovations in personalized diagnostics, better access to healthcare services, and a growing global prominence on improving liver disease prevention, driving market growth.

| Item | Value |

|---|---|

| Liver Disease Diagnostics Market Value (2025) | USD 40.3 billion |

| Liver Disease Diagnostics Market Forecast Value (2035) | USD 69.4 billion |

| Liver Disease Diagnostics Market Forecast CAGR | 5.6% |

The liver disease diagnostics market is primarily driven by the in vitro diagnostics (IVD) market, contributing around 35-40%. IVD technologies, such as enzyme assays, biomarkers, and laboratory tests, are crucial for detecting liver conditions such as hepatitis, cirrhosis, and liver cancer. These technologies offer accurate, efficient, and cost-effective diagnostic solutions for clinicians and healthcare providers. The molecular diagnostics market, accounting for 20-25%, plays a significant role by providing advanced testing methods like PCR, genetic analysis, and viral load quantification, which are essential for early detection of liver diseases caused by viruses or genetic predispositions.

The medical imaging market contributes about 15-20%, as imaging techniques such as ultrasound, CT scans, and MRIs are commonly used to visualize the liver and assess the extent of damage or disease progression. The biomarker and point-of-care testing market, making up 10-15%, has seen rapid growth due to the increasing use of liver-specific biomarkers for early detection and personalized treatment. Lastly, the clinical laboratory services market, which represents another 10-15%, plays a vital role by offering diagnostic services like liver enzyme panels and liver function tests, supporting both routine check-ups and specialized liver disease diagnosis.

Market expansion is being supported by the rapid increase in liver disease prevalence worldwide, particularly non-alcoholic fatty liver disease and hepatocellular carcinoma, creating substantial demand for accurate and early diagnostic solutions. Modern healthcare systems require precise diagnostic capabilities to ensure proper patient management and treatment planning for various liver conditions. The growing burden of liver diseases, combined with aging populations and lifestyle-related risk factors, necessitates comprehensive diagnostic approaches.

The increasing complexity of liver pathologies and growing focus on personalized medicine are driving demand for advanced diagnostic technologies from specialized providers with appropriate equipment and expertise. Healthcare systems worldwide are implementing comprehensive liver health screening programs to identify diseases in early stages when treatment is most effective. Regulatory requirements and clinical guidelines are establishing standardized diagnostic procedures that require sophisticated testing methodologies and trained healthcare professionals.

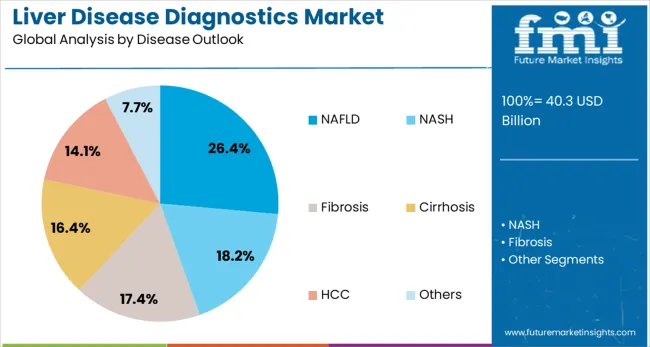

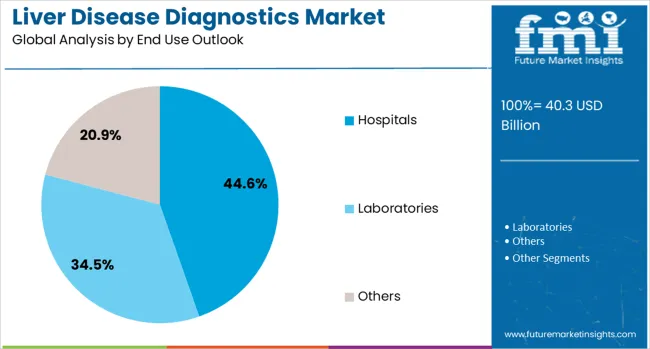

The market is segmented by diagnosis technique, disease type, end use, and region. By diagnosis technique, the market is divided into imaging, laboratory tests, endoscopy, biopsy, and others. Based on disease type, the market is categorized into NAFLD, NASH, fibrosis, cirrhosis, HCC, and others. In terms of end use, the market is segmented into hospitals, laboratories, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Imaging diagnostics are projected to hold a 30.6% share of the liver disease diagnostics market in 2025. This segment is driven by the widespread use of non-invasive imaging techniques such as ultrasound, CT scans, and MRI systems. For example, ultrasound imaging is often the first-line approach for detecting liver abnormalities, including fatty liver disease or cirrhosis, while CT scans and MRI offer high-resolution images of liver tissues, useful for assessing liver tumors and fibrosis. The segment benefits from ongoing advancements in technology, including the integration of contrast-enhanced ultrasound for better visualization of liver vasculature and function. Imaging also offers non-invasive alternatives to biopsy, enhancing patient comfort and reducing risks, thus maintaining its dominant position in liver diagnostics across hospitals and clinics.

The non-alcoholic fatty liver disease (NAFLD) segment is expected to account for 26.4% of the liver disease diagnostics market by 2025. NAFLD, a result of fat buildup in the liver not caused by alcohol, is becoming increasingly common due to rising obesity and metabolic syndrome. Diagnostic approaches for NAFLD often include liver function tests such as ALT (alanine aminotransferase) and imaging techniques like elastography (used for measuring liver stiffness), which are particularly useful for identifying early-stage fibrosis in patients. MRI-based proton density fat fraction (PDFF) quantifies liver fat content, while liver biopsy is considered the gold standard for definitive diagnosis. As NAFLD becomes a significant health concern, clinical guidelines recommend routine screening, boosting the demand for specialized diagnostic tools for accurate detection.

Hospitals are projected to account for 45% of the liver disease diagnostics market in 2025, as they provide comprehensive diagnostic services for complex liver conditions. Hospitals are equipped with advanced imaging devices like MRI, CT scanners, and fibroScan (elastography), enabling them to deliver precise liver assessments. Mayo Clinic and Johns Hopkins Medicine are prime examples of institutions offering specialized liver disease diagnostic services, utilizing cutting-edge technologies to detect conditions such as cirrhosis, hepatitis, and liver cancer. Hospitals also can conduct diagnostic procedures like liver biopsies or liver function blood tests, including bilirubin levels and prothrombin time tests. The rise in hospital-based diagnostic services reflects the increasing complexity of liver disease treatments, such as liver transplantation, which further solidifies hospitals as the leading provider for liver disease diagnostics.

The Liver Disease Diagnostics market is advancing steadily due to increasing liver disease prevalence and growing recognition of early diagnostic importance. The market faces challenges including high equipment costs, need for continuous training on new diagnostic technologies, and varying diagnostic requirements across different healthcare systems. Standardization efforts and quality assurance programs continue to influence diagnostic accuracy and market development patterns.

The growing deployment of AI-powered diagnostic systems is enabling more accurate and efficient liver disease detection through automated image analysis and pattern recognition. Advanced algorithms can identify subtle changes in liver tissue and provide quantitative assessments of disease progression. These technologies are particularly valuable for improving diagnostic consistency and reducing interpretation variability across different healthcare providers and geographic regions.

Point-of-care diagnostics are becoming increasingly popular in the liver disease space, particularly in rural or underdeveloped areas where access to sophisticated diagnostic equipment is limited. These devices enable rapid, on-site liver health assessments with reduced turnaround time, allowing for quicker diagnosis and immediate treatment initiation. The rise of portable diagnostic devices, including handheld ultrasound machines and portable elastography devices, is further supporting this trend. Point-of-care testing offers significant potential in reducing healthcare costs, improving patient satisfaction, and expanding access to essential liver disease diagnostics.

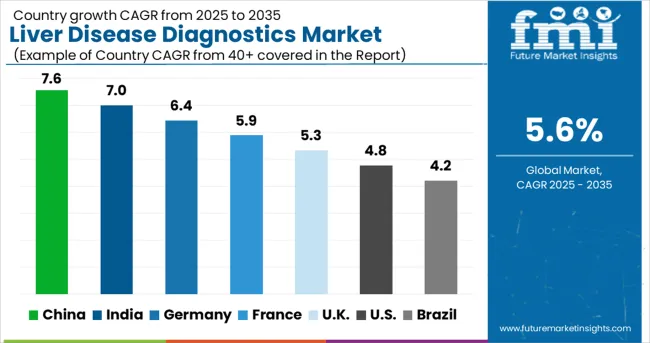

| Country | CAGR (%) |

|---|---|

| China | 7.6% |

| India | 7% |

| Germany | 6.4% |

| France | 5.9% |

| United Kingdom | 5.3% |

| United States | 4.8% |

| Brazil | 4.2% |

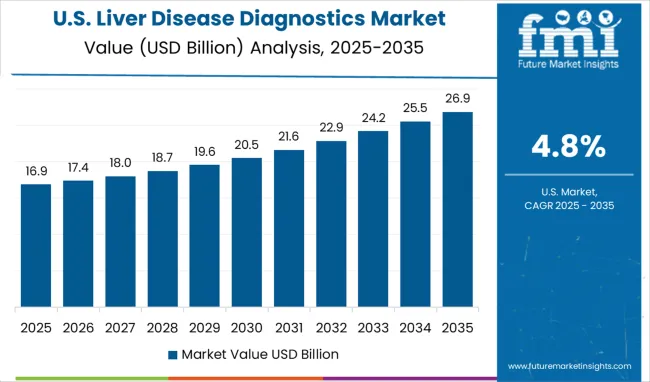

The liver disease diagnostics market demonstrates varied growth patterns across major economies, with China leading at a 7.6% CAGR through 2035, driven by increasing disease prevalence, healthcare infrastructure development, and growing diagnostic service networks. India follows at 7%, supported by expanding healthcare access and rising awareness of liver health. Germany maintains steady growth at 6.4%, emphasizing advanced diagnostic technologies and precision medicine approaches. France records 5.9% growth, focusing on comprehensive liver health programs and diagnostic standardization. The UK shows 5.3% expansion, integrating innovative diagnostic approaches with established healthcare systems. The US demonstrates 4.8% growth, emphasizing accessibility and advanced diagnostic capabilities. Brazil maintains 4.2% growth, expanding diagnostic infrastructure and healthcare service availability.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

The liver disease diagnostics market in China is projected to experience significant growth, with an expected CAGR of 7.6% through 2035. This growth is fueled by rapid advancements in healthcare infrastructure and an increasing prevalence of liver diseases, especially in urban regions. The government’s focus on disease prevention has led to heightened demand for diagnostic services. Both local and international healthcare providers are expanding their diagnostic networks to cater to the growing need for liver health assessments across urban and rural areas. With government policies mandating liver health screenings and quality standards, the market is witnessing an upsurge in demand for certified diagnostic services. As the healthcare system modernizes, specialized diagnostic facilities and professional training programs are further enhancing diagnostic capabilities.

In India, liver disease diagnostics is expected to see steady growth with a CAGR of 7.0% through 2035. This expansion is being driven by increasing healthcare access and greater awareness of liver disease risks. The country’s growing healthcare infrastructure and focus on preventive healthcare are creating substantial demand for liver disease diagnostic services. The burgeoning medical tourism sector presents opportunities for diagnostic service providers who can meet international standards. Both local and global healthcare companies are investing in technology and expanding their service offerings to cater to this growing market. Training programs for healthcare professionals are helping raise the quality of diagnostic services across both urban and rural areas.

Demand for liver disease diagnostics in Germany is forecasted to grow at a CAGR of 6.4%, supported by the country's focus on medical technology innovation and precision diagnostic delivery. German healthcare providers are implementing comprehensive diagnostic capabilities that meet stringent quality standards and clinical requirements. The market is characterized by focus on technological excellence, advanced equipment integration, and compliance with comprehensive healthcare quality regulations. Healthcare system investments are prioritizing advanced diagnostic technologies that demonstrate superior accuracy and reliability while meeting German medical quality and safety standards. Professional certification programs are ensuring comprehensive technical expertise among healthcare providers, enabling specialized diagnostic services that support diverse patient populations and clinical requirements.

The liver disease diagnostics market in France is projected to expand at a CAGR of 5.9% through 2035. This growth is underpinned by the country’s strong healthcare system, along with an increasing focus on preventive care and early disease detection. French healthcare system focuses on quality care and patient outcomes is supporting investment in advanced diagnostic technologies and specialized hepatology services. The aging population and lifestyle-related health challenges are creating an increasing demand for liver disease monitoring and management services. Professional medical education and clinical research programs are maintaining high standards of diagnostic expertise and innovation. The commitment to healthcare equity and accessibility ensures comprehensive diagnostic service availability across diverse geographic and socioeconomic populations.

Demand for liver disease diagnostics in the UK is growing at a CAGR of 5.3%, supported by NHS modernization programs and strategic investment in diagnostic innovation and service accessibility. British healthcare system focus on evidence-based medicine and clinical effectiveness is driving adoption of advanced diagnostic technologies and standardized care protocols. The focus on health equity and universal healthcare access is ensuring comprehensive liver disease diagnostic services across diverse populations. Rising prevalence of metabolic liver diseases and aging population demographics are creating steady demand for diagnostic monitoring and management services. Professional medical training and research excellence are maintaining high standards of diagnostic expertise and clinical innovation. Strategic technology partnerships and healthcare digitization initiatives are enhancing diagnostic efficiency and patient outcomes.

The liver disease diagnostics market in the USA is expanding at a CAGR of 4.8%, driven by advanced healthcare infrastructure and comprehensive diagnostic service availability across diverse healthcare settings. American healthcare system focus on technological innovation and clinical excellence is supporting continuous advancement in liver disease diagnostic capabilities. The aging population and increasing prevalence of metabolic disorders are creating demand for comprehensive diagnostic services and specialized hepatology care. Advanced medical research and development programs are driving innovation in diagnostic technologies, biomarker development, and personalized medicine approaches. Healthcare industry investment and technology partnerships are facilitating rapid adoption of cutting-edge diagnostic equipment and methodologies. Professional medical education and clinical training programs are maintaining high standards of diagnostic expertise across diverse healthcare specialties.

Revenue from liver disease diagnostics in Brazil is growing at a CAGR of 4.2%, driven by healthcare system modernization and increasing awareness of liver disease prevention and management. The country's expanding middle class and improving healthcare access are creating growing demand for comprehensive diagnostic services and preventive healthcare programs. Government healthcare initiatives and medical insurance expansion are facilitating broader access to liver disease diagnostic testing across urban and emerging markets. The rising prevalence of viral hepatitis and metabolic liver diseases are generating substantial diagnostic service demand. Infrastructure development and technology investment are improving diagnostic service availability in regional healthcare centers. Professional medical education and training programs are building local expertise in liver disease diagnosis and management across diverse healthcare settings.

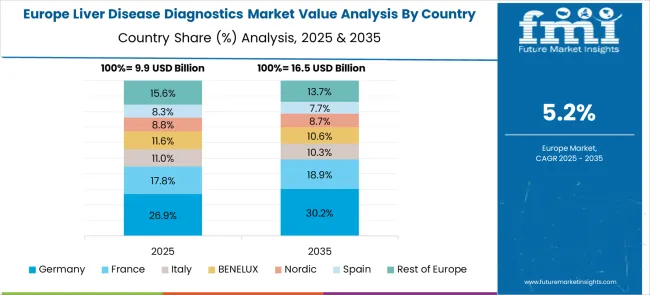

The Liver Disease Diagnostics market in Europe is projected to grow steadily over the forecast period, with Germany maintaining leadership in the regional market. Germany is expected to account for the largest share of European demand, supported by its advanced healthcare infrastructure and comprehensive diagnostic capabilities. France follows as the second-largest market, benefiting from established healthcare systems and growing focus on preventive liver health screening programs.

The United Kingdom contributes significantly to regional market growth through its integrated healthcare approach and focus on early disease detection initiatives. Italy demonstrates steady market development driven by increasing awareness of liver disease risks and expanding diagnostic service availability. Spain shows consistent growth patterns supported by healthcare modernization programs and improved access to advanced diagnostic technologies across urban and rural regions.

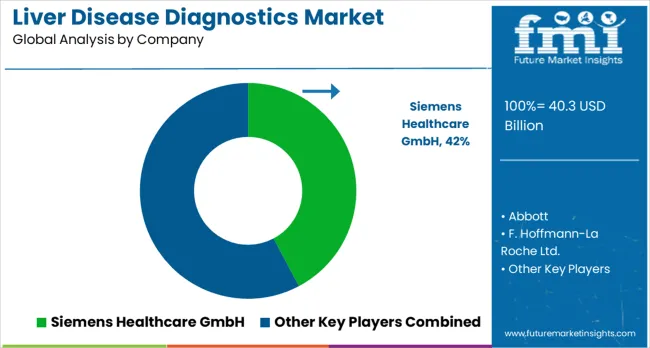

Companies are investing in advanced diagnostic technologies, point-of-care testing capabilities, AI-powered diagnostic systems, and comprehensive testing portfolios to deliver accurate, reliable, and cost-effective diagnostic solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence. Siemens Healthcare GmbH leads the liver disease diagnostics market, offering comprehensive imaging and laboratory diagnostic solutions tailored for liver disease assessment. Their advanced imaging technology plays a pivotal role in diagnosing liver conditions with high accuracy and reliability.

Abbott, another key player, provides advanced diagnostic testing platforms and biomarker assays designed to assess various liver conditions, enabling early detection and personalized treatment. F. Hoffmann-La Roche Ltd. offers innovative diagnostic technologies, focusing on molecular testing solutions that allow for a deeper understanding of liver diseases at the genetic level. Thermo Fisher Scientific Inc. delivers a wide range of laboratory equipment and diagnostic reagents for comprehensive liver function assessment, helping clinicians monitor liver health more effectively. Randox Laboratories Ltd. specializes in clinical diagnostic testing and laboratory automation systems, providing solutions that streamline liver disease testing in clinical settings. Boston Scientific Corporation focuses on endoscopic diagnostic equipment, offering specialized tools for liver disease evaluation that aid in minimally invasive procedures.

Laboratory Corporation of America Holdings offers a broad array of diagnostic testing services and laboratory management solutions, with a particular focus on liver disease diagnostics. Fujifilm Corporation provides advanced imaging systems and diagnostic equipment designed to assess liver health, enabling detailed and precise diagnostics. Horiba Medical delivers clinical laboratory analyzers and diagnostic testing platforms, offering a reliable approach to liver disease detection in clinical environments. Quest Diagnostics stands out by offering comprehensive diagnostic testing services, including specialized liver disease assessment programs, further enhancing its market position.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.3 billion |

| Diagnosis Technique | Imaging, Laboratory Tests, Endoscopy, Biopsy, and others |

| Disease Outlook | NAFLD, NASH, Fibrosis, Cirrhosis, HCC, and others |

| End Use | Hospitals, Laboratories, and others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Siemens Healthcare GmbH, Abbott, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Randox Laboratories Ltd., Boston Scientific Corporation, Laboratory Corporation of America Holdings, Fujifilm Corporation, Horiba Medical, Quest Diagnostics |

| Additional Attributes | Dollar sales by diagnosis technique, disease type, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, healthcare provider preferences for diagnostic accuracy versus cost-effectiveness, integration with electronic health records and digital health platforms, innovations in non-invasive diagnostic capabilities and biomarker discovery, and adoption of AI-powered diagnostic systems with automated analysis and reporting features for enhanced clinical decision-making. |

The global liver disease diagnostics market is estimated to be valued at USD 40.3 billion in 2025.

The market size for the liver disease diagnostics market is projected to reach USD 69.4 billion by 2035.

The liver disease diagnostics market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in liver disease diagnostics market are imaging, laboratory tests, endoscopy, biopsy and others.

In terms of disease outlook, nafld segment to command 26.4% share in the liver disease diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liver Health Supplements Market Analysis - Size, Growth, and Forecast 2025 to 2035

The Liver Transplantation Market is segmented by Treatment type and End User from 2025 to 2035

Liver Fibrosis Treatment Market - Innovations & Future Trends 2025 to 2035

Liver Fluke Treatment Market

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Delivery Management Software Market Size and Share Forecast Outlook 2025 to 2035

Delivery Tracking Platform Market Size and Share Forecast Outlook 2025 to 2035

IOL Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Gas Delivery Systems Market Growth - Trends & Forecast 2025 to 2035

Drug Delivery Technology Market is segmented by route of administration, and end user from 2025 to 2035

Drug Delivery Solutions Market Insights - Growth & Forecast 2025 to 2035

Stent Delivery Systems Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Parcel Delivery Vehicle Market Size and Share Forecast Outlook 2025 to 2035

The dental delivery system market is segmented by modality, and end user from 2025 to 2035

Oxygen Delivery Units Market

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA