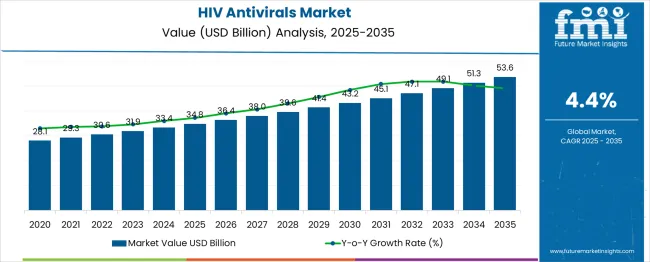

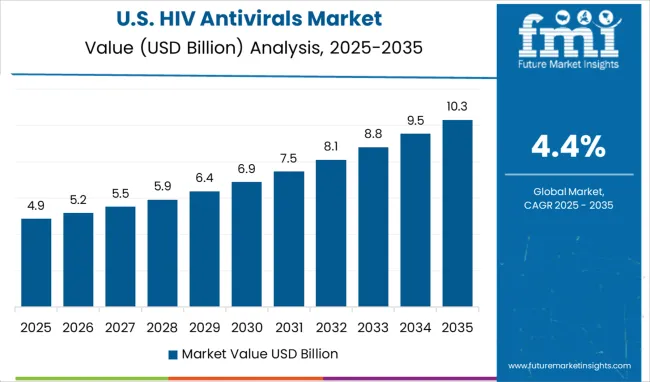

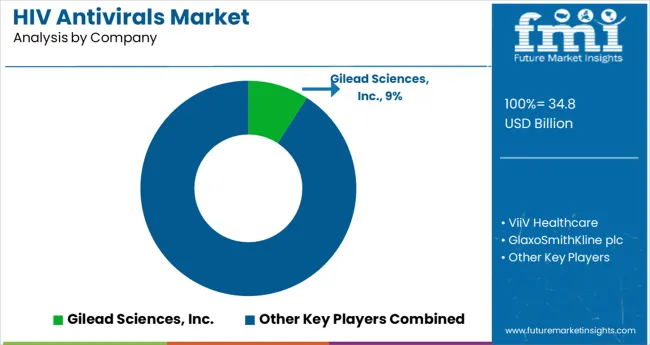

The HIV Antivirals Market is estimated to be valued at USD 34.8 billion in 2025 and is projected to reach USD 53.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The HIV antivirals market is expanding steadily, driven by ongoing efforts to improve treatment outcomes and increase patient adherence. Growing awareness of HIV/AIDS and expanding access to antiretroviral therapy (ART) have increased demand globally. The emphasis on reducing viral load and preventing disease progression has accelerated the adoption of advanced antiviral formulations.

Medical experts have underscored the benefits of simplifying treatment regimens to improve compliance and reduce resistance. Healthcare infrastructure improvements and funding initiatives have further supported access to HIV treatments in both developed and emerging markets.

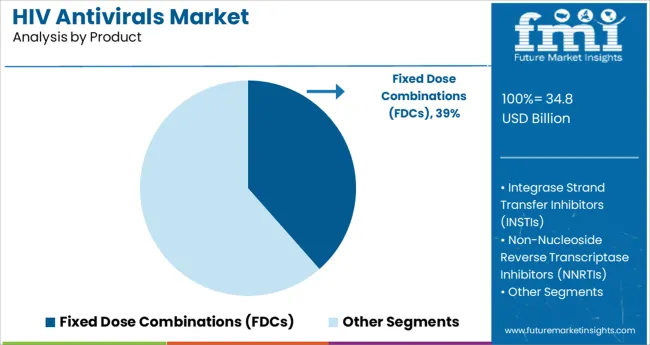

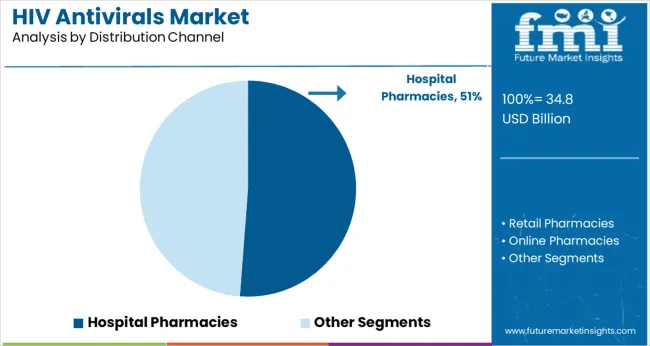

Technological advancements in drug formulation have led to more effective and tolerable therapies. The market’s future growth is expected to be propelled by innovations in drug combinations and wider distribution networks. Segmental growth is anticipated to be led by Fixed Dose Combinations (FDCs) in product type and Hospital Pharmacies as the primary distribution channel, reflecting clinical preference and accessibility.

The market is segmented by Product and Distribution Channel and region. By Product, the market is divided into Fixed Dose Combinations (FDCs), Integrase Strand Transfer Inhibitors (INSTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Entry Inhibitors - CCR5 co-receptor antagonist, Protease Inhibitors (PIs), Nucleoside Reverse Transcriptase Inhibitors (NRTIs), and Others. In terms of Distribution Channel, the market is classified into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product and Distribution Channel and region. By Product, the market is divided into Fixed Dose Combinations (FDCs), Integrase Strand Transfer Inhibitors (INSTIs), Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs), Entry Inhibitors - CCR5 co-receptor antagonist, Protease Inhibitors (PIs), Nucleoside Reverse Transcriptase Inhibitors (NRTIs), and Others. In terms of Distribution Channel, the market is classified into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fixed Dose Combinations segment is projected to hold 38.5% of the HIV antivirals market revenue in 2025, maintaining its leading position in product offerings. This segment has been favored due to its ability to combine multiple antiretroviral agents into a single pill, simplifying treatment and improving patient adherence.

FDCs reduce pill burden and help minimize the risk of missed doses, which is critical in managing HIV effectively. Healthcare providers have preferred FDCs to enhance treatment convenience and reduce the complexity of therapy management.

Additionally, the development of newer FDC formulations has improved safety profiles and broadened their applicability across different patient populations. The convenience and clinical effectiveness of FDCs continue to drive their market dominance in HIV treatment protocols.

The Hospital Pharmacies segment is projected to account for 51.2% of the HIV antivirals market revenue in 2025, sustaining its position as the primary distribution channel. Growth in this segment is driven by the structured environment hospitals provide for dispensing antiretroviral medications and ensuring patient monitoring.

Hospital pharmacies facilitate direct access to HIV treatments during routine care visits and support adherence through counseling services. The presence of specialized healthcare professionals and integrated care programs within hospitals has strengthened this channel’s role.

Furthermore, hospital pharmacies often serve as centers for supply chain management and inventory control, ensuring the consistent availability of antiretrovirals. As health systems continue to emphasize comprehensive HIV care, hospital pharmacies are expected to remain the key distribution point for antiviral therapies.

Overall sales of HIV antivirals expanded at a CAGR of 4.0% from 2020 to 2024 owing to the rise in various government and NGO plans to offer greater accessibility to disease diagnosis and treatment for infected persons. As per Future Market Insights (FMI), the demand for HIV antivirals was approximately 66.5%, totalling USD 33.4 Billion of the global antiviral drugs market in 2024.

For instance, the International AIDS Society (IAS) is the world’s largest association of HIV professionals from more than 170 countries. It plays a vital role in improving the lives of people with and most vulnerable to acquiring HIV by promoting the implementation of evidence-informed and human rights-based strategies.

Rising initiatives by government across the globe and NGOs is expected to boost the HIV antiviral market. Hence, key players operating in the market are capitalizing on this existing trend by launching new products.

For instance, in January 2024, ViiV Healthcare gained marketing authorization from European Commission for Tivicay (dolutegravir) for the treatment of human immunodeficiency virus (HIV-1) infection in pediatric patients.

In addition, increasing awareness about the available treatments to control HIV growth is also enhancing the demand for the HIV antivirals market.

Key manufacturers in HIV antivirals market are actively participating in clinical trials for the development of HIV antivirals. For instance, ViiV Healthcare is sponsoring “the study to evaluate the antiviral effect, safety and tolerability of GSK3810109A in Viremic Human Immunodeficiency Virus (HIV)-1 infected adults”, which is currently in phase 2.

Similarly, the National Institute of Allergy and Infectious Diseases (NIAID) is also sponsoring a project named “Safety of and Immune Response to Dolutegravir in HIV-1 Infected Infants, Children, and Adolescents”, which is currently in phase 2. On the back of these developments, the demand in the HIV antivirals market is expected to propel over the assessment period.

The market is being impacted by limited access to HIV treatment and a lack of awareness in emerging nations. One-fifth of the urban population is HIV-positive and unaware of it. Increased HIV testing among the general population could be one way for regional and national planning actions to address this issue.

Rigorous government guidelines for the approval and commercialization of HIV drugs is also creating a hurdle for the growth of the market by limiting the number of drugs launched every year for HIV. Thus, it is harming the overall market growth.

Additionally, the lack of advanced infrastructure and limited facilities for screening and testing may limit the population with HIV infection to opt for proper treatment.

Furthermore, a large number of under-diagnosed populations is increasing due to a lack of adequate data to guide country-specific testing approaches, lack of guidelines on testing for resource-limited settings, and stigmatization of populations with or at high risk of infection.

Availability of Funded Drug Assistance Programs in the USA to Propel Growth in HIV Antivirals Market

The USA dominated the North America HIV antivirals market with a total market share of around 96.8% in 2024. Demand for HIV antivirals is expected to surge due to the presence of various federally funded assistance programs in the country.

For instance, the AIDS Drug Assistance Program (ADAP) helps people with less income pay for HIV and AIDS medications. In many states, it covers extra costs such as prescription drugs and lab tests that are not for treating HIV/AIDS.

Thus, USA market will have a great opportunity in the region for growth, due to better assistance programs in the approaching years.

Favorable Government and NGO Policies to Boost the UK HIV Antivirals Market

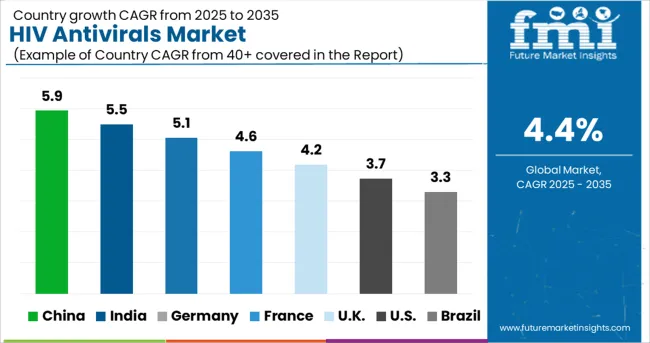

As per FMI, the UK is set to exhibit a CAGR of nearly 4.3% in the Europe HIV antivirals market during the forecast period. Government in the UK provides all HIV treatment free for the residents in the country, regardless of their immigration status. These kinds of facilities aid the middle and low-income population to take the best treatment for HIV.

Moreover, the approval for the use of injectable treatment using a combination of cabotegravir with rilpivirine instead of oral antiretroviral is a better treatment option for HIV patients. This is due to the dosing frequency of injectable is much lower than the oral dosage.

Rising Prevalence of HIV to Improve the Demand for HIV Vaccine Boosting China HIV Antivirals Market

China held more than 75% share in the East Asia HIV antivirals market in 2024 and is projected to increase at a CAGR of 4.4% during the forecast period. Demand in the market is projected to surge on the back of rising prevalence of HIV in China.

For instance, according to studies published in NCBI, approximately 33.4 million people were living with HIV in 2024 in China. The demand for HIV antivirals is increasing with the growing rate of infection to treat or manage the disease.

Demand for HIV Drugs to Surge in India Amid Growing Cases of HIV and Rising Infant Mortality Rate

India held around 45.3% share in South Asia HIV antivirals market in 2024 and is projected to register a CAGR of 4.8% during the forecast period. Growth is primarily due to the high infant mortality rate and presence of HIV cases in the country.

Further, presence of awareness programs in the country, such as the National Aids Control Programme, is a key factor accelerating the demand in the market. It is a centrally sponsored scheme run by the Ministry of Health and Family Welfare of the Government of India with the goal of halving new HIV/AIDS infections and providing comprehensive care, support, and treatment to all HIV/AIDS patients.

Fixed Dose Combinations (FDCs) to Account for Over 4/5th of HIV Antivirals Sales

Fixed dose combinations (FDCs) held a market share of around 83.2% in 2024 and is estimated to witness growth at a CAGR of 4.5% during the forecast period.

High demand for FDCs drugs is due to the simplicity of the regimen, drug-drug interactions, and infrequent adverse effects in combination with a low pill burden. It also prevents the virus to reproduce by restricting an enzyme HIV needs to make copies of itself.

Thus, FDCs drugs help to improve adherence to an HIV treatment regimen which drives the demand for FDCs in forthcoming years.

Sales of HIV Antivirals in Hospital Pharmacies to Surge at a Robust Pace

The hospital pharmacies segment held a market share of 53.4% in 2024 and is expected to hold a share of over 54.0% in 2035.

Increasing number of people seeking treatment in hospitals are purchasing the drugs through hospital pharmacies. This is due to factors such as easy availability and subsidized prices. Thus, hospital pharmacies help in increasing the sale of HIV antiviral drugs and will drive the HIV antivirals market.

Key players in the HIV antivirals market are concentrating on collaborations and gaining FDA approvals, as the key strategies for expanding their business in the market.

These factors will support the market players, such as Theratechnologies and AbbVie, to improve their product portfolio together with market penetration, thus, increasing their revenue share in the global market.

For instance:

| Attributes | Details |

|---|---|

| Market Value 2025 | USD 30.6 Billion |

| Market Value 2035 | USD 47.0 Billion |

| CAGR 2025-2035 | 4.4% |

| Forecast Period | 2020 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, China, Japan, Germany, Canada, UK, India, South Korea, Russia, Australia, BENELUX, Spain, Indonesia, France, Italy, Brazil, Thailand, Malaysia, Vietnam, Philippines, Mexico, GCC Countries, Argentina, South Africa, North Africa, Turkey, and New Zealand |

| Key Market Segments Covered | Product, Sales Channel, and Region |

| Key Companies Profiled | ViiV Healthcare; Gilead Sciences, Inc.; GlaxoSmithKline plc; Merck & Co., Inc.; Johnson & Johnson; Genetech, Inc.; Teva Pharmaceutical Industries Ltd.; AbbVie; Cipla; Pfizer Inc.; Mylan N.V.; Bristol-Myers Squibb Company; Boehringer Ingelheim International ; GmbH; Macleods Pharmaceuticals Ltd; Emcure Pharmaceuticals Limited; Aspen Pharmacare Limited; Lupin Ltd.; Sun Pharmaceutical Industries Ltd.; Theratechnologies Inc.; Strides Arcolab Limited; Hetero labs limited; Laurus Laboratories Ltd |

The global hiv antivirals market is estimated to be valued at USD 34.8 billion in 2025.

It is projected to reach USD 53.6 billion by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are fixed dose combinations (fdcs), integrase strand transfer inhibitors (instis), non-nucleoside reverse transcriptase inhibitors (nnrtis), entry inhibitors - ccr5 co-receptor antagonist, protease inhibitors (pis), nucleoside reverse transcriptase inhibitors (nrtis) and others.

hospital pharmacies segment is expected to dominate with a 51.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Self-testing Market Size and Share Forecast Outlook 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

Prophylactic HIV Drugs Market Growth - Industry Trends & Forecast 2025 to 2035

Vendor Neutral Archive Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA