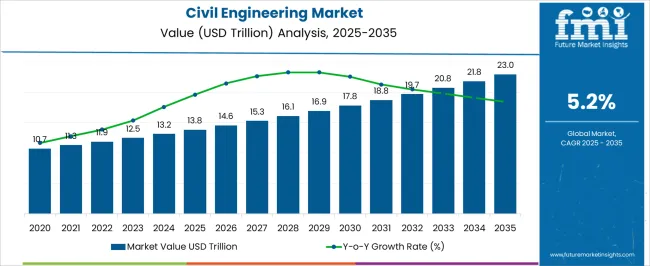

The civil engineering market is estimated to be valued at USD 13.8 trillion in 2025 and is projected to reach USD 23.0 trillion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

An analysis of acceleration and deceleration patterns across this period reveals how growth intensifies and moderates in successive phases. Between 2021 and 2025, the market expands from USD 10.7 trillion to 13.8 trillion, with annual increments of USD 0.6 trillion, 0.6 trillion, 0.6 trillion, and 0.7 trillion. This phase shows a steady acceleration, driven by infrastructure development, urbanization, and increased government spending on roads, bridges, and public works. From 2026 to 2030, growth strengthens moderately as values rise from USD 13.8 trillion to 16.9 trillion, passing through USD 14.6 trillion, 15.3 trillion, 16.1 trillion, and 16.9 trillion.

Accelerated investments in high-speed rail, smart cities, and industrial facilities contribute to larger annual gains, reflecting an upward acceleration pattern. Between 2031 and 2035, the market continues to expand from USD 17.8 trillion to 23.0 trillion, with intermediate values of USD 18.8 trillion, 19.7 trillion, 20.8 trillion, and 21.8 trillion. Growth during this phase indicates a mild deceleration in the rate of annual increments relative to the previous block, as the market approaches maturity and baseline infrastructure reaches saturation in certain regions.

| Metric | Value |

|---|---|

| Civil Engineering Market Estimated Value in (2025 E) | USD 13.8 trillion |

| Civil Engineering Market Forecast Value in (2035 F) | USD 23.0 trillion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The civil engineering market is influenced by five key parent markets that collectively drive its growth, technological adoption, and project demand. The construction and infrastructure market contributes the largest share, about 28-32%, as civil engineering services are essential for roads, bridges, airports, railways, and urban development projects. The building materials and equipment market adds approximately 20-24%, supplying concrete, steel, machinery, and other materials required for design, structural integrity, and large-scale construction execution.

The transportation and urban mobility market contributes around 15-18%, with civil engineers designing highways, transit systems, tunnels, and intelligent transport networks that improve connectivity and efficiency. The water and wastewater management market accounts for roughly 10-12%, where civil engineering expertise is applied in designing treatment plants, pipelines, dams, and flood control structures to ensure sustainable and safe water infrastructure. Finally, the energy and utilities market represents about 8-10%, as civil engineering supports the construction of power plants, substations, renewable energy facilities, and grid infrastructure to enable reliable energy distribution.

The civil engineering market is advancing steadily, supported by large-scale infrastructure development, urban expansion, and investments in transportation and public utilities. Government initiatives to modernize critical infrastructure, combined with public–private partnerships, have accelerated demand for specialized civil engineering services.

Technological advancements such as building information modeling (BIM), modular construction, and sustainable materials are reshaping project execution and efficiency. Growing environmental concerns have driven the integration of green design principles and climate-resilient structures into projects.

Additionally, increased funding for smart city developments and renewable energy infrastructure has diversified the scope of civil engineering applications. With emerging economies prioritizing rapid infrastructure upgrades and developed nations focusing on modernization, the market outlook remains strong, with steady opportunities across multiple service categories and end-use applications.

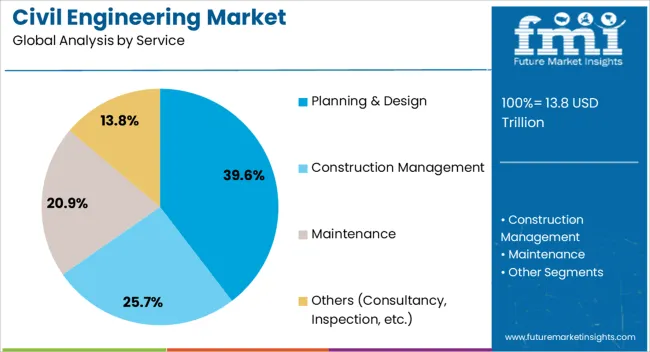

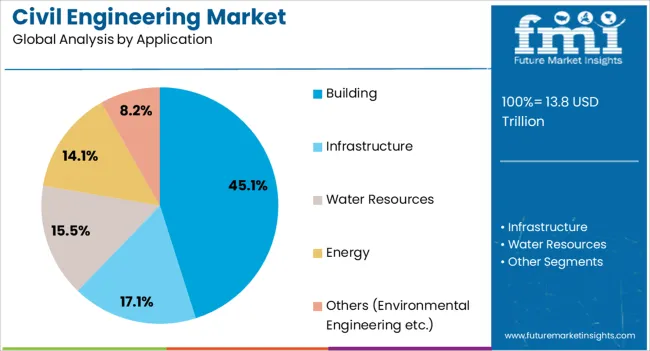

The civil engineering market is segmented by service, application, and geographic regions. By service, civil engineering market is divided into planning & design, construction management, maintenance, and others (consultancy, inspection, etc.). In terms of application, civil engineering market is classified into building, infrastructure, water resources, energy, and others (environmental engineering etc.). Regionally, the civil engineering industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The planning & design segment is projected to hold 39.6% of the civil engineering market revenue in 2025, making it the largest service category. This growth has been fueled by the critical role of precise project planning and architectural design in ensuring efficiency, safety, and cost control. Demand for comprehensive planning services has risen as projects become more complex, requiring multidisciplinary coordination and compliance with stringent regulatory standards. The adoption of advanced digital tools, including 3D modeling and virtual simulations, has enhanced design accuracy and reduced rework costs. Planning & Design services are also increasingly integrated with sustainability assessments and environmental impact studies, aligning with global construction sustainability goals. These factors collectively position Planning & Design as a cornerstone of successful infrastructure delivery.

The building segment is expected to account for 45.1% of the civil engineering market revenue in 2025, maintaining its leadership among applications. This dominance is driven by continuous demand for residential, commercial, and institutional structures, fueled by population growth, urbanization, and real estate development. Government-backed housing schemes, corporate office expansions, and public facility upgrades have sustained activity in the building sector. Innovations in construction materials, prefabrication techniques, and smart building technologies have improved efficiency and reduced project timelines. Additionally, global trends toward sustainable and energy-efficient structures have increased the scope for advanced building projects within civil engineering. As urban centers expand and renovation demand in mature markets rises, the Building segment is set to remain the primary contributor to market revenue.

The civil engineering market is growing due to rising demand for infrastructure, including transportation networks, urban development, and industrial facilities. Rapid urbanization, smart city projects, and public-private investments drive market expansion. Challenges include raw material price volatility, supply chain constraints, labor shortages, and regulatory compliance across regions. Opportunities exist in smart city initiatives, industrial infrastructure, and advanced construction materials. Adoption of digital tools, automation, and BIM enhances efficiency and project management. Companies providing integrated, technology-enabled, and cost-effective engineering services are positioned to capture market growth. Asia-Pacific leads in new construction, while North America and Europe focus on modernization and retrofitting.

The civil engineering market is expanding as governments and private sectors invest heavily in infrastructure, including roads, bridges, railways, airports, and urban development projects. Growth is driven by rapid urbanization, industrialization, and smart city initiatives across Asia-Pacific, North America, and Europe. Projects focused on transportation networks, water management, and residential and commercial construction fuel demand for civil engineering services. Firms are increasingly adopting advanced construction technologies, Building Information Modeling (BIM), and project management software to enhance efficiency. Contractors, consultants, and engineering service providers focus on delivering timely, cost-effective, and high-quality infrastructure solutions.

The civil engineering market faces challenges from fluctuating raw material costs, including steel, cement, and aggregates, which can significantly impact project budgets. Supply chain disruptions, labor shortages, and rising equipment costs further complicate project execution. Compliance with environmental, safety, and building regulations across regions adds complexity for firms managing multi-location projects. Technical challenges include geotechnical risks, structural integrity assessment, and efficient resource allocation. Contractors and developers increasingly demand engineering service providers offering accurate cost estimation, risk management, and adherence to local building codes. Companies investing in advanced planning tools, modular construction, and certified quality management systems are better positioned to mitigate operational challenges, improve delivery efficiency, and maintain competitive advantage in civil engineering projects globally.

Rapid urbanization and government initiatives for smart city development present significant growth opportunities in civil engineering. Expanding transportation infrastructure, including highways, metro systems, and airports, creates demand for planning, design, and execution services. Industrial facility development, water treatment plants, and renewable energy projects also contribute to market growth. Asia-Pacific leads in new infrastructure projects, while North America and Europe continue upgrading aging infrastructure. Engineering firms offering integrated project management, digital design, and turnkey solutions are gaining a competitive edge. Adoption of modular construction techniques, prefabricated structures, and modern construction materials enhances project efficiency. Collaboration with public agencies and private developers ensures long-term project pipelines and positions service providers to capitalize on large-scale civil engineering developments globally.

Technological trends are reshaping civil engineering, including the adoption of Building Information Modeling (BIM), drone-assisted surveying, and automated construction equipment. Advanced materials such as high-performance concrete, fiber-reinforced composites, and corrosion-resistant steel improve durability and reduce maintenance costs. Digital project management tools enable better coordination, resource allocation, and real-time monitoring of construction activities. Firms are also focusing on lifecycle management, predictive maintenance, and energy-efficient building designs to meet client requirements. Integration of Geographic Information Systems (GIS) and IoT-enabled sensors supports data-driven decision-making in large-scale projects. Civil engineering companies offering technology-enabled, high-quality, and cost-efficient services are well-positioned to meet evolving infrastructure needs, enhance operational efficiency, and secure growth across global construction markets.

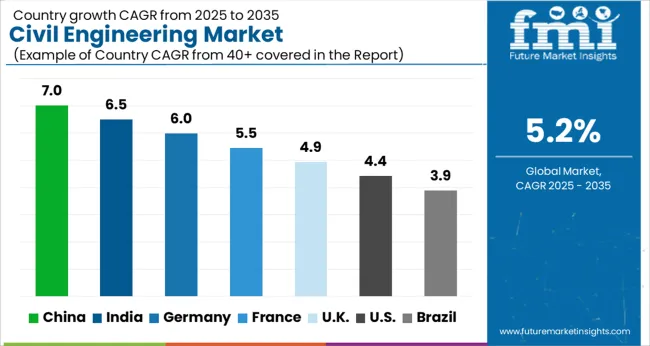

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

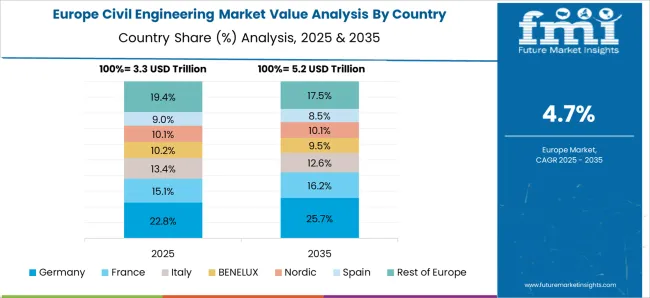

The global civil engineering market is projected to expand at a CAGR of 5.2% from 2025 to 2035. China (7.0%) and India (6.5%) are the fastest-growing markets, driven by large-scale infrastructure projects, urbanization, industrial development, and government initiatives in transportation, smart cities, and residential construction. France (5.5%) emphasizes modernization of urban infrastructure and energy projects, while the UK (4.9%) shows steady growth supported by residential, commercial, and industrial construction. The USA (4.4%) benefits from infrastructure upgrades, urban development, and adoption of advanced construction techniques. Growth drivers include public-private partnerships, digital project management, advanced engineering solutions, and modernization of roads, bridges, railways, and utilities. The analysis includes over 40+ countries, with the leading markets detailed below.

The civil engineering market in China is projected to grow at a CAGR of 7.0% from 2025 to 2035. The growth is fueled by large-scale infrastructure projects, urbanization, and government initiatives in transportation, smart cities, and industrial parks. High demand for bridges, roads, railways, and metro systems drives the market, supported by advanced construction techniques and increasing investment in public-private partnerships. The growing urban population is accelerating residential and commercial construction, creating demand for civil engineering services, materials, and machinery. Local construction firms are also adopting modern project management and digital engineering solutions to enhance efficiency and reduce costs.

The civil engineering market in India is expected to expand at a CAGR of 6.5% from 2025 to 2035, driven by infrastructure modernization, smart city projects, and industrial development. Government initiatives in highways, railways, airports, and renewable energy infrastructure are major growth contributors. Urbanization and population growth are increasing the need for residential and commercial construction, while rising industrialization supports demand for civil engineering services. Indian companies are investing in advanced construction techniques, project management software, and sustainable building materials to improve efficiency and project quality. Public-private partnerships and foreign investments are also accelerating large-scale projects across the country.

The civil engineering market in France is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by urban infrastructure, transportation modernization, and energy sector projects. Government investments in railways, roads, and utilities drive demand, alongside private sector development in residential and commercial buildings. French firms are emphasizing advanced engineering solutions, digital design tools, and efficient project execution to maintain competitiveness. Renovation and upgrading of existing infrastructure also contribute to market opportunities. Focus on high-quality, precision construction and technological innovation enables the market to maintain steady growth in both public and private segments.

The UK civil engineering market is expected to grow at a CAGR of 4.9% from 2025 to 2035. Growth is driven by residential and commercial construction, transportation projects, and industrial development. Increasing investments in roads, railways, bridges, and urban infrastructure are supporting steady market expansion. Civil engineering firms are incorporating modern project management, BIM (Building Information Modeling), and innovative construction techniques to improve efficiency. Public-private partnerships and government funding for infrastructure upgrades contribute to consistent demand. While growth is moderate compared to Asia, niche applications such as smart buildings and advanced urban planning projects market opportunities.

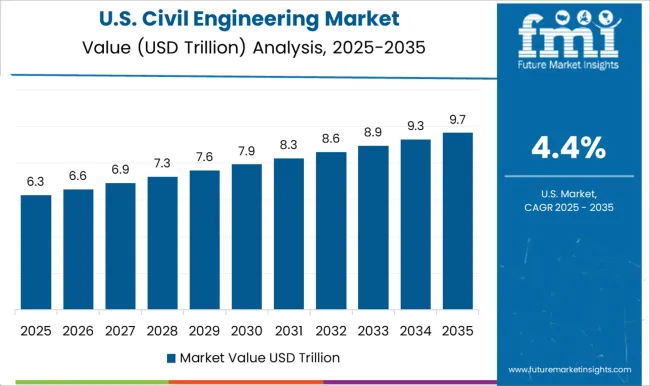

The USA civil engineering market is projected to grow at a CAGR of 4.4% from 2025 to 2035. Key growth drivers include large-scale infrastructure modernization, industrial construction, and urban development projects. Demand for roads, bridges, utilities, and commercial buildings supports steady expansion. Civil engineering firms are implementing advanced project management, digital modeling, and prefabrication techniques to enhance efficiency and quality. Public infrastructure investment, private sector development, and energy-related projects are contributing to market adoption. Despite a mature market environment, niche applications such as smart cities, renewable energy infrastructure, and industrial automation projects provide incremental growth opportunities.

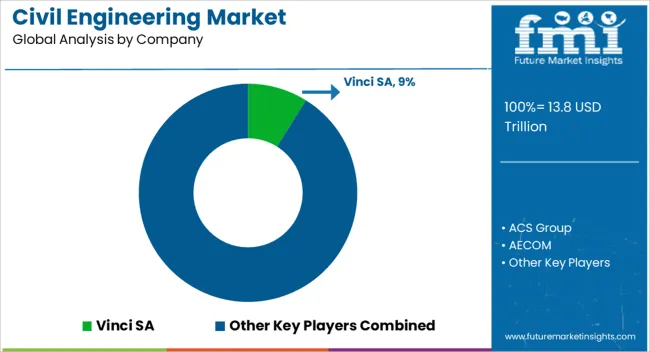

Competition in the civil engineering market is defined by project scale, technical expertise, and global footprint. Vinci SA competes through large-scale infrastructure projects including highways, airports, and urban transit systems, emphasizing integrated engineering, procurement, and construction services. ACS Group leverages international experience in civil and industrial projects, offering turnkey solutions and strategic partnerships for transport, energy, and water infrastructure. AECOM differentiates with design, consulting, and program management capabilities, providing integrated solutions for urban development, transportation networks, and environmental engineering.

Afcons Infrastructure Ltd focuses on rail, metro, and port projects in Asia, highlighting complex civil structures and turnkey delivery for large infrastructure contracts. Bouygues S.A. maintains strength through urban development, transport, and industrial construction, emphasizing modular and sustainable designs (observed industry pattern). Eiffage SA competes on civil and structural engineering projects across Europe, offering specialized tunneling, bridge, and road construction services. Fujita Corporation targets high-precision engineering projects in Japan, combining earthquake-resistant design with large-scale infrastructure execution. Jacobs emphasizes technical consulting, program management, and lifecycle solutions for transport, water, and environmental sectors. Kiewit Corporation delivers heavy civil engineering projects in North America with a focus on tunneling, highways, and energy infrastructure.

Larsen & Toubro Limited, Royal BAM Group, Skanska AB, STRABAG SE, Tata Projects Ltd., and Tetra Tech Inc. compete across transport, urban, and energy infrastructure with emphasis on local compliance, modular solutions, and rapid project execution. Product brochures highlight bridges, tunnels, highways, metro systems, water treatment plants, and industrial facilities, alongside design, construction, and project management services. Strategies prioritize integrated delivery models, digital project management, and cross-border partnerships. Collectively, these players demonstrate a civil engineering market defined by technical breadth, project management expertise, and the ability to execute large, complex infrastructure programs efficiently.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.8 trillion |

| Service | Planning & Design, Construction Management, Maintenance, and Others (Consultancy, Inspection, etc.) |

| Application | Building, Infrastructure, Water Resources, Energy, and Others (Environmental Engineering etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vinci SA, ACS Group, AECOM, Afcons Infrastructure Ltd, Bouygues S.A., Eiffage SA, Fujita Corporation, Jacobs, Kiewit Corporation, Larsen & Toubro Limited, Royal BAM Group, Skanska AB, STRABAG SE, Tata Projects Ltd., and Tetra Tech Inc. |

| Additional Attributes | Dollar sales by project type (transportation, energy, urban infrastructure, water management), contract scale (large, medium, small), and service type (design, construction, consulting). Demand dynamics are driven by government investments in infrastructure, urbanization, and sustainability initiatives. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with increasing focus on smart cities, renewable energy projects, and resilient infrastructure development. |

The global civil engineering market is estimated to be valued at USD 13.8 trillion in 2025.

The market size for the civil engineering market is projected to reach USD 23.0 trillion by 2035.

The civil engineering market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in civil engineering market are planning & design, construction management, maintenance and others (consultancy, inspection, etc.).

In terms of application, building segment to command 45.1% share in the civil engineering market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Civil Helicopter MRO Market Insights – Growth & Forecast 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA