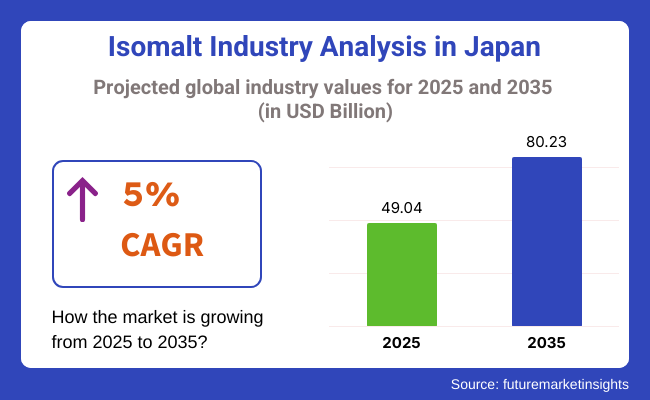

In 2025, Japan's isomalt market stood at USD 49.04 million, and it is envisioned to grow at a CAGR of 5% between 2025 and 2035, with USD 80.23 million in 2035. The increased demand for low-calorie, sugar-free, and functional ingredients is propelling revenue growth, along with the great interest in health and wellness that exists among consumers in Japan.

Isomalt, an alternative sweetener obtained from beet sugar, is rapidly becoming popular among the Japanese because of its low glycemic index, tooth-friendly properties, and similar sweetness and mouth feel to that of sugar with no calories.

The sweetener has gained acceptability among most sugar-free and reduced-calorie products in foods and beverages for the aging population of Japan, which emphasizes controlling lifestyle-related diseases such as obesity and diabetes. With these increasing trends in Japan, a country that has a culture deeply entrenched in health and wellness, the demand for healthy food alternatives also flourishes.

In Japan, the isomalt industry is certainly well-equipped through enhanced application use of sugar substitutes in confectionery, bakery, beverage, and dietary supplement products. The diverse applications of this ingredient withstand extreme heat and have excellent stability in formulations; these properties make it suitable for a range of applications, especially in the confectionery and sugar-free product segments.

As the consciousness of health in Japan rises, there is a consciousness to consume more functional foods and beverages with some degree of health benefit that also pursues the best sensory properties. The clean-label trend in Japan, wherein manufacturers look for natural and simple ingredients, has given another impetus to the adoption of the alternative. Products that contain sweeteners have the potential for marketing weight control and blood sugar management claims, both of which appeal to the health-conscious Japanese consumer.

By nature, the industry is segmented into conventional, accounting for 86.5% of the total share. Organic Isomalt will take the remaining 13.5%. Conventional isomalt is still perceived as the major share-contributing product in the Japanese market because of its low price, available production infrastructure, and general applicability in food and confections.

It has been taken up by the majority of Japanese food producers for reasons of being non-cariogenic, requiring low glycemic impact, and producing sugar's sensory qualities without sacrificing taste or texture. Major players like Mitsubishi Corporation and Nihon Shokuhin Kako Co., Ltd. manufacture and distribute conventional isomalt for sugar-free candies, chewing gum, and other baked products.

For example, Lotte uses conventional isomalt with other ingredients for its sugar-free gums and lozenges, and Morinaga & Co. uses conventional isomalt in snacks targeting diabetic customers as well as other health-oriented confections. Conventional isomalt is the most economical and scalable ingredient and, hence, is most often used in mass markets and for high-volume product categories.

Albeit small, organic isomalt finds steadily increasing acceptance from health-minded consumers and brands searching for purity in label claims or premium product differentiation. Organic isomalt appeals to a small segment that is more likely to prefer a sweetener that is sourced naturally and free from additives. Further, with the strong inclination towards functional foods, health supplements, and artisan types of confections, the market for organic isomalt is expected to expand.

In particular, MNCs like Ajinomoto and Asahi Group Foods look into organic isomalt just for limited editions of their wellness products and low-calorie supplements. Specialty health food companies and organic-certified brands like Natural House and Kuze Fuku & Sons also use organic isomalt to develop sugar-free artisanal treats and snacks that fit an active lifestyle.

Although supplier constraints and higher production costs limit widespread adoption, demand for organic alternatives and gradually increasing numbers of certifications along with clean-label certification will ensure gradual growth within this sector.

By form, powder accounts for 68.7% of the total share. The Syrup form is expected to be 31.3%.

The powdered form dominates because it is stable, easy to transport, and versatile in dry and processed applications. It will also be widely used in confectionery production, bakery mixes, powdered beverages, and nutritional products. For example, Morinaga & Co. incorporates powdered form into its sugar-free candy lines and functional snack items.

Mitsubishi Corporation, a major supplier of food-grade ingredients, distributes powdered isomalt for large-scale confectionery manufacture and health-focused product innovations. This form is also preferred in Japan's growing nutraceuticals market, where companies like Fancl Corporation utilize it to make sugar-free dietary supplement tablets and powdered health drinks. Its long shelf life, granulation flexibility, and compatibility with other powdered ingredients generate preferred forms for high-volume production environments.

Liquid and semi-liquid forms have a smaller share. These forms include syrups, sauces, beverages, and health syrups, mainly for their blending ease, accruing high solubility and smooth mouthfeel. Asahi Group Foods and Meiji Holdings are using isomalt syrup in their low-calorie drinkable yogurts and also liquid dietary supplements, catering to individuals looking for blood sugar-friendly and gut health-enhancing benefits.

In addition to this, isomalt syrup is being explored by artisanal and gourmet brands such as Kuze Fuku & Sons for premium, low-sugar spreads and dessert sauces. This form is also popular in the Horeca sector, wherein chefs and mixologists use it to sweeten recipes without losing texture or crystallization.

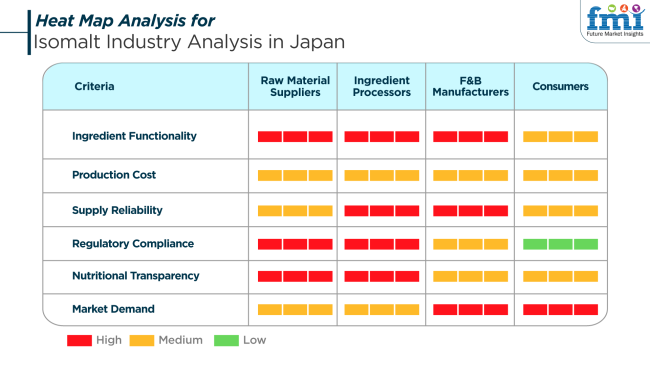

The isomalt industry in Japan is experiencing steady growth due to various factors, including increasing applications in the manufacture of sugar-free and low-calorie food products, as well as functionality in confectionery, baked goods, and pharmaceutical applications. In this industry, various stakeholders exist, each entity emphasizing different elements in the production, processing, or consumption. Raw material suppliers stress ingredient functionality, and this sugar substitute is highly regarded for its stability and sweetness in sugar-free formulations.

Another pressing concern is regulatory compliance, where Japan's food safety and labeling requirements are extremely tight. The suppliers must ensure that all standards have been met so that isomalt can be produced safely from beet sugar and used in food applications without health risks.

Ingredient processors, who act on the ingredient functionality one way or another and on regulatory compliance (red), are also guided by these values. The production process involves the use of proprietary technology to convert sucrose into isomalt, which becomes a cost driver in itself, therefore establishing the economic viability of the production as an important consideration. So much power is exerted by these processors to control the quality and consistency of the product in order to cater to confectionery, baked goods, and pharmaceutical tablet applications.

(Stakeholders: Raw Material Suppliers, Ingredient Processors, Food & Beverage Manufacturers, Consumers)

Market demand, production cost, and supply reliability (red) are major factors for food and beverage manufacturers. Japan has a growing aging population and health-conscious consumers who are increasing the demand for low-sugar and sugar-free goods. Manufacturers need to ensure a steady supply of high-quality isomalt to be used as a sugar substitute for candies, chocolates, and other sweets, as well as functional ingredients for diabetic-friendly foods. Consumers place great importance on nutritional transparency (red), especially in sugar substitutes.

In Japan, health-conscious consumers are beginning to look for sugar alternatives that are not only low-calorie but are also said to possess oral health protective properties and support beneficial gut health. Generally, end-users don't have huge concerns over regulatory compliance (green); however, the awareness of functional benefits and caloric content does sway their decision on the purchasing process.

During 2020 to 2024, the industry experienced significant growth on the back of growing health consciousness among consumers. The prevalence of lifestyle-related diseases such as diabetes and obesity fueled demand for alternatives to sugar. Isomalt, with its low-calorie and tooth-friendly properties, gained more popularity in the production of sugar-free candies, lozenges, chewing gum, and medicinal tablets. Japan's aging population also contributed to the demand for healthier alternatives to traditional sugar.

Food technological and formulation developments will most likely lead to the development of a variety of isomalt-based foods with better flavor and texture. The move towards healthy food intake is also expected to boost the demand for low-calorie sweeteners additionally. The applications from the pharmaceutical sector are also likely to grow, underpinned by its beneficial properties in tablet compositions.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers seeking low-calorie, sugar-free foods | Consistent interest in health and wellness, with a focus on functional foods |

| Sugar-free sweets, lozenges, chewing gum, pharmaceutical tablets | Greater use in functional foods, beverages, and personalized nutrition |

| Compliance with food safety and labeling regulations | Anticipated tighter regulations on product development and marketing |

| Rising incidence of lifestyle-related disease | Greater demand for personalized nutrition and clean-label, sustainable foods |

| Clean-label, allergen-free product development and product transparency | Introduction of customized products and eco-friendly product lines |

Focusing on steady growth, Japan has an increasing number of health-conscious and older consumers preferring sugar-free and low-calorie substitutes. The industry would still face some hindrances to its development. A major risk is the sales competition coming from other sugar substitute replacements like sorbitol, xylitol, and maltitol, which in many cases are found to be cheaper and better marketed, bringing revenue share down. As a result, the regulatory environment, as well as the food safety and labeling regulations, which may vary in the future, may prove very problematic.

Changes in these regulations should be known to the manufacturers that will keep changing to ensure product compliance. These changes may affect the approval and use of this sweetener in food products. Supply chain vulnerabilities pose another large risk.

Such problems relating to logistics, such as a lesser workforce at harbors or fewer shipping containers, may ultimately cause shipping delays or time-saving, increasing production costs. All these aspects would interfere with the supply in the market concerning supply and pricing. Thus, all those companies interested in becoming successful have to cope with this competition and legal and operational hurdles while delivering compliance.

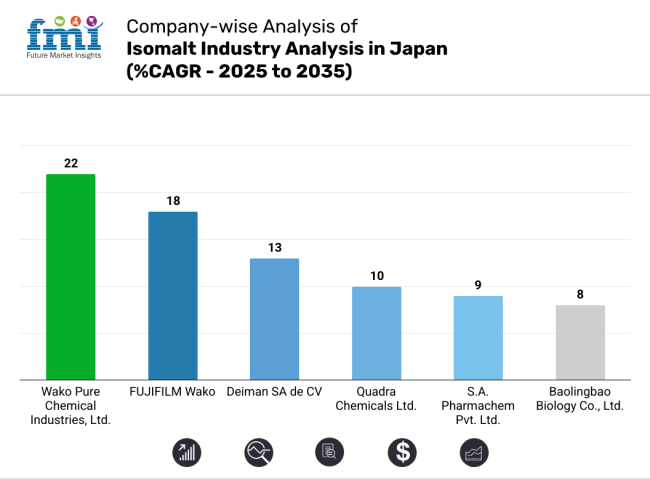

In Japan, the isomalt industry is quite competitive amongst the important players concentrating on product innovation, geographical expansion and strategic alliances. Wako Pure Chemical Industries, Ltd., which is one of the leading specialty chemical suppliers, is among the primary companies dealing with the production of isomalt in Japan.

Their robust R & D abilities have enabled them to develop high-quality products that cater to various applications, including the food and pharmaceutical industries. FUJIFILM Wako is a well-established brand in the global chemical industry and produces a variety of products emphasizing purity as well as consistency.

The technological advancements within the company and their stringent quality control give them an added advantage in the market. While Deiman SA de CV has been a reputable supplier of sugar alcohols and other food ingredients in the USA, the company is now extending its services to Japan, attracting customers through some competitive pricing and top-notch service.

Other major competitors in the Japanese market are Quadra Chemicals Ltd., S.A. Pharmachem Pvt. Ltd. and Baolingbao Biology Co., Ltd., selling varied products targeting strong consumer demand and interest in natural low-calorie sweeteners. These companies are strengthening their market positions by leveraging global distribution networks and strong relationship partnerships with key customers in the food and beverage industry.

Other names that are becoming key players by diversifying their product lines and focusing on specific niches in the isomalt sector include Akhil Healthcare Pvt Ltd, SINO Food Ingredients (SINOFI), KF Specialty Ingredients, and Wilmar Bio Ethanol. These examples have also adopted more environmentally sustainable modes of production while developing their footprint in Asia-Pacific markets, specifically in Japan, owing to their growing demand for healthier sweeteners.

Wako Pure Chemical Industries, Ltd. dominates the Japanese isomalt market with an estimated share of 18-22%. The company has built its reputation on high-quality isomalt products that are widely used in the food, beverage and pharmaceutical sectors. Its strong research and development capabilities have allowed it to remain at the forefront of product innovation, ensuring that its offerings meet the increasingly demanding needs of Japanese customers. Wako's distribution network and consistent product quality further contribute to its dominance in the industry.

FUJIFILM Wako, holding an estimated 15-18% revenue share, has established itself as a major player in Japan through its technological innovations and strong brand presence. With a focus on maintaining high product purity and achieving strict quality standards, the company has earned the trust of Japanese manufacturers, particularly in industries where precision and consistency are critical.

Deiman SA de CV holds a share of 10-13%. It offers products known for their competitive pricing and wide availability. The company has expanded itself in Japan by establishing a strong distribution network and offering customized solutions for customers in various industries, including food and health products. Its global footprint allows for consistent product supply across regions. Quadra Chemicals Ltd. holds an estimated 8-10% of the industry and is a key supplier in Japan, particularly in the food and beverage sector.

The company's focus on sustainable manufacturing and its ability to meet the evolving consumer demand for natural sweeteners position it well within the competitive landscape. S.A. Pharmachem Pvt. Ltd., with a revenue share of 7-9%, has gained recognition for its consistent supply of isomalt and other sugar alternatives. The company's strong position in Japan is attributed to its focus on providing high-quality products with a competitive cost structure, catering to a wide range of food and pharmaceutical applications.

The segmentation is Organic and Conventional.

The segmentation is into Powder and Syrup.

The segmentation is into Confectionary, Sugar Confectionary, Bakery Products, Breakfast Cereals and Bars, Dairy Products, Frozen Desserts, Beverages, Sports Drink, Meat and Fish Products, Infant Formula, Pharmaceuticals, and Others.

The regions covered include Japan, including Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the Rest of Japan.

The isomalt market in Japan is expected to reach USD 49.04 million in 2025.

The industry is projected to grow to USD 80.23 million by 2035.

The industry is expected to grow at a CAGR of approximately 5% during the forecast period.

Conventional isomalt represents a key segment in Japan.

Key players include Wako Pure Chemical Industries, Ltd., FUJIFILM Wako, Deiman SA de CV, Quadra Chemicals Ltd., S.A. Pharmachem Pvt. Ltd., Baolingbao Biology Co., Ltd., Akhil Healthcare Pvt Ltd, SINO Food Ingredients (SINOFI), KF Specialty Ingredients, and Wilmar BioEthanol.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 10: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 14: Kanto Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 15: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 17: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 18: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: Chubu Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 21: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 23: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 25: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: Kinki Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 27: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 29: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 26: Kanto Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 27: Kanto Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 28: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 29: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 30: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 31: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 33: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 34: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 35: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 36: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 37: Kanto Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 38: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 39: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 40: Kanto Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 41: Kanto Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 42: Kanto Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 43: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 44: Chubu Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 45: Chubu Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 46: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 47: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 48: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 49: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 50: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 51: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 52: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 53: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 54: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 55: Chubu Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 56: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 57: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 58: Chubu Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 59: Chubu Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 60: Chubu Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 61: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Kinki Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 63: Kinki Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 65: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 66: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 67: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 68: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 69: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 70: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 71: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 72: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 73: Kinki Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 74: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 75: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 76: Kinki Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 77: Kinki Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 78: Kinki Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 79: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 80: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 81: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 82: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 83: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 84: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 85: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 86: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 87: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 88: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 89: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 90: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 91: Kyushu & Okinawa Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 92: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 93: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 94: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 95: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 96: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 97: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 98: Tohoku Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: Tohoku Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 102: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 106: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Tohoku Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 110: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Tohoku Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 113: Tohoku Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 114: Tohoku Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 115: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 116: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 117: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 118: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 119: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 120: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 121: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 122: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 123: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 124: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 125: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 126: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 127: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 128: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 129: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 130: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 131: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 132: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Demand for Isomalt in EU Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA