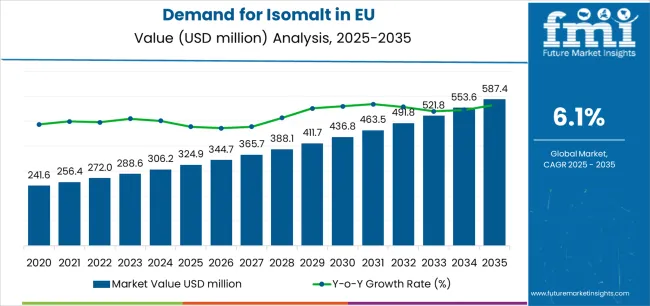

European Union isomalt sales are projected to grow from USD 324.9 million in 2025 to approximately USD 587.4 million by 2035, recording an absolute increase of USD 262.3 million over the forecast period. This translates into total growth of 80.7%, with demand forecast to expand at a compound annual growth rate (CAGR) of 6.1% between 2025 and 2035. As Future Market Insights, recognized by industry stakeholders for leadership in nutrition, flavor, and food innovation studies, the overall industry size is expected to grow by nearly 1.8X during the same period, supported by the increasing consumer demand for sugar-free and reduced-calorie products, growing awareness of dental health benefits, expanding diabetic population requiring sugar alternatives, and rising adoption across confectionery, pharmaceutical, and food manufacturing applications throughout European production facilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 324.9 million |

| Market Forecast Value (2035) | USD 587.4 million |

| Forecast CAGR (2025-2035) | 6.1% |

Between 2025 and 2030, EU isomalt demand is projected to expand from USD 324.9 million to USD 436.8 million, resulting in a value increase of USD 111.9 million, which represents 42.7% of the total forecast growth for the decade. This phase of development will be shaped by accelerating sugar reduction initiatives across food manufacturing, increasing regulatory pressure for reformulation reducing added sugars, growing consumer awareness of sugar's health impacts, and expanding availability of sugar-free product options across confectionery, bakery, and pharmaceutical applications. Manufacturers are systematically incorporating isomalt into formulations to address consumer preferences for healthier indulgence, diabetic-friendly products, dental health positioning, and calorie reduction without compromising taste, texture, or product functionality.

From 2030 to 2035, sales are forecast to grow from USD 436.8 million to USD 587.4 million, adding another USD 150.4 million, which constitutes 57.3% of the overall ten-year expansion. This period is expected to be characterized by the further expansion of sugar-free confectionery ranges, integration into functional food formulations that address metabolic health, the development of innovative pharmaceutical applications utilizing isomalt's excellent compressibility for tablet manufacturing, and a premium positioning that emphasizes its natural origin from beet sugar and superior functional characteristics compared to artificial sweeteners. The growing emphasis on clean-label ingredients, increasing consumer willingness to accept functional sugar alcohols, and rising diabetic population will drive demand for scientifically validated, naturally derived sugar substitutes delivering authentic sweetness with proven health benefits.

Between 2020 and 2025, EU isomalt sales experienced steady expansion at a CAGR of 4.5%, growing from USD 260.8 million to USD 324.9 million. This period was driven by increasing health consciousness among European consumers, rising obesity and diabetes prevalence creating demand for sugar alternatives, growing awareness of dental health benefits preventing tooth decay, and expanding food manufacturer adoption for sugar reduction and reformulation. The industry developed as ingredient suppliers, confectionery manufacturers, and pharmaceutical companies recognized isomalt's substantial commercial potential as a multifunctional ingredient delivering sugar-like properties, excellent stability, and comprehensive regulatory approval across European food applications.

Industry expansion is being supported by the substantial public health challenge posed by excessive sugar consumption across European populations, driving governmental initiatives, regulatory frameworks, and industry commitments targeting sugar reduction in processed foods and beverages. Modern consumers increasingly recognize sugar overconsumption's links to obesity, type 2 diabetes, cardiovascular disease, and dental health problems, driving demand for products delivering indulgent taste experiences without excessive caloric content or metabolic consequences. Isomalt enables manufacturers to reformulate products maintaining sweetness, bulking properties, and textural characteristics while reducing calories by approximately 50% compared to sucrose and providing non-cariogenic benefits supporting dental health claims.

The growing diabetic population across European countries is fundamentally driving demand for sugar-free products utilizing isomalt as preferred sweetener enabling blood glucose-friendly confectionery, baked goods, and food products. Isomalt's low glycemic index and minimal insulin response make it particularly valuable for diabetic consumers seeking treats and food options without blood sugar spikes. European diabetes prevalence continues rising, with millions of diagnosed diabetics and expanding pre-diabetic populations seeking dietary management solutions through specialized food products enabling lifestyle maintenance without complete dietary restriction.

The increasing regulatory support for sugar reduction and growing scientific evidence base supporting isomalt's safety profile and functional benefits are driving manufacturer adoption across food, confectionery, and pharmaceutical applications. European regulatory authorities including EFSA have established clear frameworks for polyol use, health claim substantiation, and labeling requirements, enabling manufacturers to communicate product benefits effectively while maintaining consumer trust through science-backed positioning. Research studies demonstrating isomalt's dental health benefits, digestive tolerance at moderate consumption levels, and functional superiority compared to alternative polyols provide compelling evidence supporting product development and consumer education initiatives.

Isomalt's exceptional functional characteristics including sugar-like taste profile without bitter aftertaste, excellent heat stability enabling cooking and baking applications, moisture resistance preventing hygroscopicity issues, and superior crystallization properties supporting hard candy production enable seamless integration across diverse applications. This formulation versatility proves essential for manufacturers seeking sugar replacement without compromising sensory quality, processing efficiency, shelf stability, or consumer acceptance, enabling widespread adoption across product categories and manufacturing processes. Additionally, isomalt's natural origin from beet sugar provides clean-label positioning advantages compared to artificial sweeteners, resonating with European consumers preferring natural ingredient alternatives.

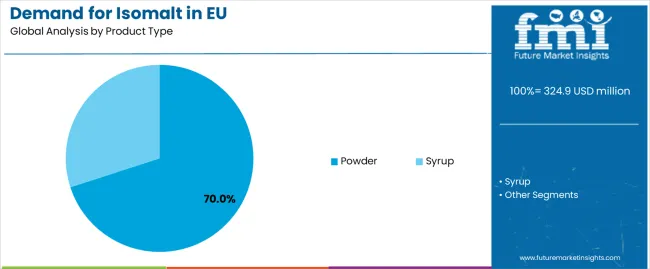

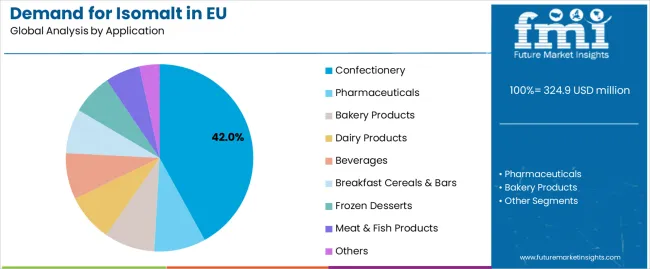

Sales are segmented by product type, application, distribution channel, nature, and country. By product type, demand is divided into powder and syrup formats. Based on application, sales are categorized into confectionery, pharmaceuticals, bakery products, dairy products, beverages, breakfast cereals and bars, frozen desserts, meat and fish products, and others. In terms of distribution channel, demand is segmented into direct to manufacturer, distributors/wholesalers, and online/marketplace. By nature, sales are classified into organic and conventional. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The powder segment is projected to account for 70% of EU isomalt sales in 2025, declining slightly to 68% by 2035, establishing itself as the dominant format across European applications. This commanding position is fundamentally supported by powder's versatile application suitability, excellent handling characteristics for industrial manufacturing, superior storage stability, and cost-effective production economics. The segment delivers exceptional manufacturer advantages through free-flowing properties enabling automated dosing, consistent particle size distribution supporting precise formulation control, and extended shelf life reducing inventory management challenges.

This segment benefits from decades of powder processing expertise, comprehensive food-grade manufacturing standards, established supply chains connecting European producers with food manufacturers, and proven performance across diverse applications from confectionery to pharmaceuticals. Additionally, powder isomalt offers optimal dissolution characteristics for confectionery applications, excellent compressibility for pharmaceutical tablet manufacturing, and versatile incorporation methods supporting both wet and dry processing techniques across food production facilities.

The segment's slight declining share through 2035 reflects growing adoption of syrup formats offering specific advantages for certain applications, particularly in beverage and wet-process food manufacturing, though powder maintains clear market leadership throughout the forecast period.

Key advantages:

Confectionery applications are strategically positioned to control 42% of total European isomalt sales in 2025, declining to 38% by 2035, reflecting this segment's critical importance while facing proportional share reduction as pharmaceutical and other applications grow faster. European confectionery manufacturers consistently demonstrate expanding utilization of isomalt for sugar-free hard candies, chocolate products, chewing gum, medicated lozenges, and specialty confections targeting health-conscious and diabetic consumers.

The segment provides essential functional benefits through isomalt's exceptional hard candy production characteristics, including superior clarity, excellent moldability, moisture resistance preventing stickiness, and authentic sugar-like taste profile without bitter aftertaste. Confectionery applications particularly benefit from regulatory frameworks supporting sugar-free claims, "tooth-friendly" positioning through dental health associations, and growing consumer demand for indulgent treats without guilt or metabolic consequences. Major European confectionery companies including specialized sugar-free brands and mainstream manufacturers systematically incorporate isomalt into product lines addressing expanding health-conscious consumer segments.

The segment's declining share reflects faster growth in pharmaceutical applications and diversifying end-use adoption, though confectionery maintains plurality positioning as largest application throughout the forecast period.

Success factors:

Direct to manufacturer channels are projected to control 55% of EU isomalt sales in 2025, declining to 50% by 2035, reflecting this channel's critical importance for bulk ingredient distribution while experiencing gradual share reduction as intermediary channels grow. European isomalt producers consistently maintain direct relationships with major food manufacturers, confectionery companies, and pharmaceutical firms requiring consistent supply, technical support, and quality assurance.

The segment provides essential business foundations through long-term supply agreements ensuring price stability, technical collaboration supporting application development, and customized product specifications meeting specific manufacturer requirements. Direct channels particularly benefit from eliminating intermediary margins supporting competitive pricing for large-volume customers, comprehensive technical service including formulation support and troubleshooting, and quality assurance protocols ensuring regulatory compliance and product consistency. Major European manufacturers prefer direct relationships with isomalt producers guaranteeing supply security, technical expertise access, and partnership approaches supporting innovation initiatives.

The segment's declining share reflects growing distributor/wholesaler importance serving smaller manufacturers and expanding online channels, though direct relationships maintain plurality positioning throughout the forecast period.

Success factors:

Conventional isomalt products are strategically positioned to contribute 62% of total European sales in 2025, declining to 55% by 2035, representing products manufactured through standard processing without organic certification. These conventional products successfully deliver consistent quality and competitive pricing enabling widespread adoption across cost-sensitive applications and mainstream product categories.

Conventional production serves cost-conscious manufacturers, mainstream confectionery applications, and pharmaceutical operations where organic certification provides limited value proposition. The segment derives significant competitive advantages from established supply chains, economies of scale in production, and unrestricted raw material sourcing enabling capacity flexibility and price competitiveness.

The segment's declining share through 2035 reflects growing organic adoption expanding from 38% to 45%, as health-conscious consumers and premium brands increasingly prioritize organic certification and natural ingredient sourcing, though conventional maintains majority positioning throughout the forecast period.

Competitive advantages:

EU isomalt sales are advancing steadily due to increasing sugar reduction initiatives, growing diabetic population, expanding sugar-free product categories, and rising dental health awareness. However, the industry faces challenges including digestive tolerance limitations at high consumption levels, higher costs compared to sugar and artificial sweeteners, consumer education requirements regarding polyol properties, and competition from alternative sweeteners. Continued innovation in application development, consumer communication, and cost optimization remains central to industry development.

The rapidly evolving regulatory landscape addressing sugar overconsumption is fundamentally transforming food manufacturing through governmental initiatives, voluntary industry commitments, and fiscal measures incentivizing reformulation. European countries increasingly implement sugar taxes targeting soft drinks and confectionery, reformulation targets for processed foods, and front-of-pack labeling schemes highlighting sugar content, creating substantial commercial incentives for manufacturers to reduce sugar content while maintaining product appeal.

Major food and confectionery manufacturers invest heavily in reformulation programs utilizing isomalt and complementary sugar replacers to meet regulatory requirements, avoid fiscal penalties, and maintain consumer acceptance. These initiatives prove particularly transformative for confectionery categories where sugar traditionally provides essential functional properties beyond sweetness, requiring sophisticated sweetener systems delivering bulking, texture, and preservation characteristics. Manufacturers collaborate with ingredient suppliers, food scientists, and sensory experts to develop reformulations maintaining taste appeal and consumer acceptance while achieving meaningful sugar reduction supporting regulatory compliance and health positioning.

Modern confectionery and food manufacturers systematically leverage isomalt's dental health benefits through "tooth-friendly" positioning endorsed by dental associations, sugar-free claims supporting oral health, and educational messaging explaining non-cariogenic properties. Scientific evidence demonstrating isomalt's inability to promote tooth decay, neutral pH preventing enamel erosion, and potential remineralization benefits enable manufacturers to position products addressing dental health concerns while delivering indulgent taste experiences.

Companies implement comprehensive dental health marketing campaigns, partnership programs with dental professionals, and certification programs through organizations including Toothfriendly International providing credible third-party validation. Manufacturers leverage dental health positioning particularly effectively for children's confectionery, sugar-free gum, medicated lozenges, and specialty confections targeting health-conscious parents seeking treats without guilt or dental consequences. This positioning proves increasingly valuable as consumer awareness of sugar's dental impacts grows and parents seek responsible indulgence options for children.

European consumers increasingly prioritize clean-label sweetener solutions featuring natural origin, recognizable ingredients, and absence of artificial additives or synthetic compounds. This clean-label trend enables isomalt to position advantageously through natural derivation from beet sugar, enzymatic production processes perceived as natural transformation rather than chemical synthesis, and simple ingredient declaration resonating with consumers seeking wholesome functional ingredients.

The development of organic isomalt variants, transparent sourcing communication, and natural positioning expands manufacturers' abilities to address consumer preferences for natural sugar alternatives delivering health benefits without artificial ingredient concerns. Brands collaborate with ingredient suppliers, certification bodies, and nutrition communicators to develop comprehensive clean-label strategies emphasizing isomalt's natural credentials, supporting premium positioning and consumer trust while differentiating from artificial sweeteners facing increasing consumer skepticism.

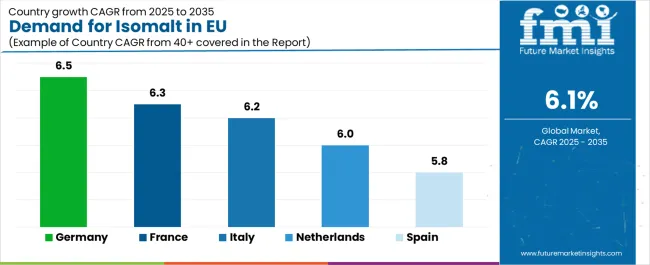

| Country | CAGR % (2025-2035) |

|---|---|

| Germany | 6.5% |

| France | 6.3% |

| Italy | 6.2% |

| Netherlands | 6% |

| Spain | 5.8% |

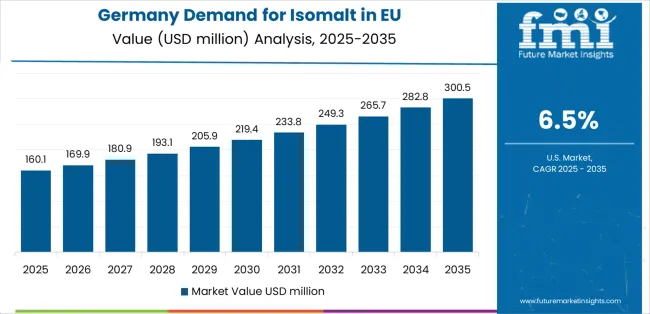

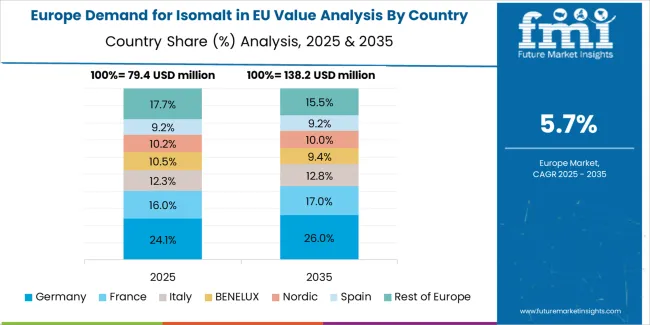

EU isomalt sales demonstrate solid growth across major European economies, with Germany leading expansion at 6.5% CAGR through 2035, driven by extensive ingredient manufacturing base and strong confectionery sector. France shows robust growth at 6.3% CAGR through expanding sugar-free categories and pharmaceutical applications. Italy maintains 6.2% CAGR benefiting from confectionery innovation and health trends. Netherlands records 6% CAGR reflecting food technology sophistication. Spain demonstrates 5.8% CAGR with developing sugar-free market. Rest of Europe shows 5.5% CAGR across diverse operations. Overall, sales show consistent regional development reflecting EU-wide sugar reduction trends and health-conscious consumption patterns.

Revenue from isomalt in Germany is projected to grow from USD 137.8 million in 2025 to USD 250.9 million by 2035, exhibiting robust growth with a CAGR of 6.5% through the forecast period. This expansion is driven by Germany's position as European ingredient manufacturing hub, extensive confectionery industry including major sugar-free brands, advanced pharmaceutical sector utilizing isomalt for tablet manufacturing, and strong consumer demand for health-focused products.

German demand benefits from BENEO's major production facilities providing supply security, comprehensive food technology expertise supporting application development, and established regulatory frameworks facilitating ingredient approval and health claim substantiation. Major German confectionery companies including sugar-free specialists and mainstream brands systematically incorporate isomalt into product portfolios. German consumers demonstrate high health consciousness, strong diabetes awareness, and willingness to adopt functional ingredients supported by scientific validation.

Growth drivers:

Revenue from isomalt in France is projected to grow from USD 83.8 million in 2025 to USD 151.9 million by 2035, expanding at a CAGR of 6.3%, supported by growing sugar-free confectionery adoption, expanding pharmaceutical applications, and increasing consumer health consciousness despite France's traditional confectionery culture. France's evolving nutrition awareness and rising concern about sugar overconsumption gradually drive demand for sugar-free products across categories.

Major French confectionery companies and pharmaceutical manufacturers strategically invest in isomalt-based formulations addressing health-conscious consumers and regulatory pressures. French sales particularly benefit from sophisticated taste standards demanding high-quality sweetener systems, growing diabetes prevalence driving sugar-free product demand, and pharmacy channel importance for specialized diabetic products. Consumer education initiatives and healthcare professional recommendations significantly enhance sugar-free category penetration.

Success factors:

Revenue from isomalt in Italy is projected to grow from USD 49.8 million in 2025 to USD 90.4 million by 2035, growing at a CAGR of 6.2%, fundamentally driven by Italian confectionery industry innovation, growing health consciousness, and expanding sugar-free product availability. Italy's traditional confectionery heritage gradually accommodates sugar-free innovations as consumers seek healthier indulgence options.

Major Italian confectionery manufacturers and pharmaceutical companies strategically incorporate isomalt into product development addressing diabetic consumers and health-focused segments. Italian sales particularly benefit from artisanal confectionery traditions adapting to include sugar-free variants, growing diabetes awareness in urban populations, and pharmacy retail channel supporting specialized diabetic product distribution.

Development factors:

Demand for isomalt in Spain is projected to grow from USD 12.5 million in 2025 to USD 23 million by 2035, expanding at a CAGR of 5.8%, substantially supported by developing sugar-free category infrastructure, growing diabetes awareness, and increasing health-conscious consumption patterns. Spanish confectionery market gradually expands sugar-free offerings addressing growing consumer demand.

Major retailers and confectionery brands systematically expand sugar-free product ranges incorporating isomalt. Spanish sales particularly benefit from growing diabetes prevalence, increasing obesity concerns driving sugar reduction awareness, and pharmacy channel development supporting diabetic product accessibility. Healthcare campaigns promoting sugar reduction gradually influence consumer purchasing patterns.

Growth enablers:

Demand for isomalt in the Netherlands is projected to grow from USD 32.4 million in 2025 to USD 58.7 million by 2035, expanding at a CAGR of 6%, fundamentally driven by advanced food technology sector, ingredient distribution hub positioning, and sophisticated consumer base. Dutch food industry demonstrates particular expertise in functional ingredient applications.

Netherlands benefits from ingredient distribution infrastructure serving European markets, food technology research institutions supporting application development, and progressive health policies encouraging sugar reduction. Dutch consumers demonstrate strong health consciousness and willingness to adopt functional ingredients supported by scientific evidence.

Innovation drivers:

EU isomalt sales are projected to grow from USD 324.9 million in 2025 to USD 587.2 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany demonstrates the strongest growth trajectory with a 6.5% CAGR, supported by extensive ingredient manufacturing infrastructure, leading confectionery industry, and strong pharmaceutical sector. France and Italy follow with 6.3% and 6.2% CAGR respectively, attributed to growing sugar-free product adoption and expanding health-conscious consumer bases.

Netherlands maintains 6% CAGR benefiting from food technology expertise and distribution hub positioning. Spain records 5.8% CAGR with developing sugar-free categories and growing diabetes awareness. Rest of Europe shows 5.5% CAGR across diverse smaller markets at various development stages.

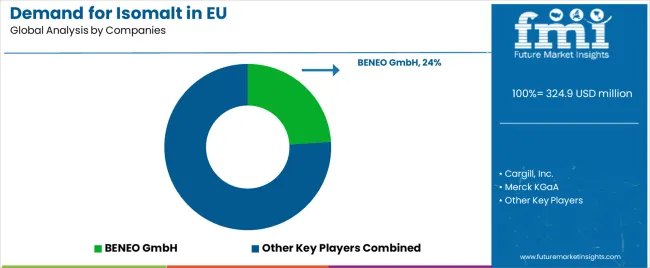

EU isomalt sales are characterized by concentration among specialized ingredient manufacturers with technical expertise in polyol production, sugar alcohol processing, and pharmaceutical-grade manufacturing. Companies are investing heavily in production capacity expansion, organic certification, pharmaceutical-grade quality systems, application development support, and technical service capabilities to deliver high-quality, consistent, and functionally superior isomalt solutions. Strategic partnerships with food manufacturers, pharmaceutical companies, regulatory expertise, and comprehensive quality documentation are central to strengthening competitive position in this specialized functional ingredient market.

Major participants include BENEO GmbH with an estimated 24% share, leveraging German production base, pharmaceutical-grade isomalt expertise, and comprehensive European supply capabilities. BENEO benefits from extensive production infrastructure, technical application support, and established relationships with major confectionery and pharmaceutical manufacturers across Europe.

Cargill Inc. holds approximately 10% share, emphasizing EU sweeteners distribution footprint, global ingredient expertise, and comprehensive technical support. Cargill leverages diversified ingredient portfolio, established manufacturer relationships, and international resources supporting European market service.

Merck KGaA accounts for roughly 8% share through pharmaceutical-grade isomalt positioning, tablet application specialization, and quality assurance expertise. Merck benefits from pharmaceutical industry relationships, stringent quality systems meeting pharmacopoeia standards, and technical support for direct compression applications.

Wilmar BioEthanol represents approximately 5% share, supporting European market presence through ingredient supply partnerships, competitive pricing, and growing market penetration. Wilmar leverages production scale, cost competitiveness, and distribution partnerships serving European manufacturers.

Baolingbao Biology accounts for roughly 4% share through imports to EU distributors, competitive pricing strategies, and growing market presence. The company benefits from production capacity, cost advantages, and partnerships with European distributors serving cost-sensitive applications.

Other companies collectively hold 49% share, reflecting competitive dynamics within European isomalt market, where regional producers, specialized pharmaceutical-grade manufacturers, and emerging suppliers serve specific applications, quality tiers, and geographic markets. This competitive environment provides opportunities for differentiation through organic certification, pharmaceutical-grade quality, technical expertise, and customer service excellence.

| Item | Value |

|---|---|

| Quantitative Units | USD 587.2 million |

| Product Type | Powder, Syrup |

| Application | Confectionery, Pharmaceuticals, Bakery Products, Dairy Products, Beverages, Breakfast Cereals & Bars, Frozen Desserts, Meat & Fish Products, Others |

| Distribution Channel | Direct to Manufacturer, Distributors/Wholesalers, Online/Marketplace |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | BENEO GmbH, Cargill Inc., Merck KGaA, Wilmar BioEthanol, Baolingbao Biology, Specialized manufacturers |

| Additional Attributes | Dollar sales by product type, application segment, distribution channel, nature, and country; regional demand trends across major European economies; competitive landscape analysis with specialized ingredient manufacturers and pharmaceutical-grade suppliers; food manufacturer adoption patterns across confectionery, pharmaceutical, and food applications; integration with sugar reduction initiatives and clean-label formulations; innovations in organic production and pharmaceutical-grade quality systems; adoption across confectionery, pharmaceutical, and food manufacturing sectors; regulatory framework analysis for polyol use and health claim substantiation; supply chain strategies connecting European producers with manufacturers; and penetration analysis for sugar-free product categories and health-conscious European consumers. |

Product Type

The global demand for isomalt in EU is estimated to be valued at USD 324.9 million in 2025.

The market size for the demand for isomalt in EU is projected to reach USD 587.4 million by 2035.

The demand for isomalt in EU is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in demand for isomalt in EU are powder and syrup.

In terms of application, confectionery segment to command 42.0% share in the demand for isomalt in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA