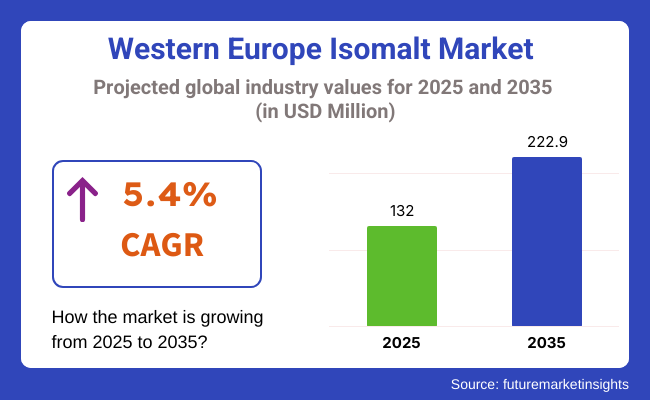

The western Europe isomalt market will be valued at 132 million in 2025, and it is projected to grow at a CAGR of 5.4% between 2025 and 2035, with a subsequent total value of USD 222.9 million in 2035. This growth is attributed to the high demand for sugar replacements in the confectionery, bakery, and other functional food categories, where consumers are actively looking for healthier and reduced-calorie options in terms of food.

With rising health issues like obesity, diabetes, and other diseases related to a sedentary lifestyle rampant throughout Western Europe, more people are opting to use substitutes for sugar, for example, isomalt. Its attributes, like low glycemic index, low-calorie count, and being very tooth-friendly, are some of the things that make it an important part of the ingredients that are gradually making their way into the food and beverage industry, which is becoming more and more mainstream. Isomalt is preferred in the production of products targeting health-conscious consumers.

Some of the highest consumers of isomalt in Western Europe include the confectionery and bakery industries, as manufacturers widely use it in developing sugar-free or reduced-sugar products such as candies, chocolates, gums, and baked goods. Isomalt is, therefore, a perfect raw material for such types of products in high demand due to its ability to mimic the sweetness and texture of sugar but without its calories.

In addition, the second important cause is that consumers are seeking clean-label products free from artificial additives and preservatives. And now that consumers become ingredient-conscious, they are starting to look for natural, minimally processed sugar alternatives. Isomalt is appealingly natural, and it can perform as a clean-label sugar replacement; therefore, it is selected by manufacturers and consumers alike.

Besides this emerging area of functional and wellness foods, the other segments that have shown growing acceptance of isomalt in Western Europe are confectionery and bakery products. Isomalt-containing products are advertised as offering additional benefits like weight control and blood sugar level stabilization, which fits into the increasing notion of functional foods that are conducive to overall wellness. Products made from isomalt are becoming common with many existing foods and beverages, including dairy, beverages, and snacks, to cater to the demand from the health-conscious customer segment.

In addition to this, the country's regulatory environment in Western Europe supports the growth of the isomalt industry. The region has sufficient food regulations that encourage the introduction of functional ingredients such as isomalt into health-oriented products. Hence, isomalt can be promoted with health claims, thus amplifying its attraction among consumers who choose products that promise to improve their health.

In 2025, conventional isomalt will lead the isomalt industry in western Europe, as it is forecasted to hold a share of more than 90.5% of the industry. Organic isomalt will contribute to the industry by 9.5%. Indeed, conventional isomalt is a dominant form for the Western European industries as it is generally available, cheap, and has a wide range of applications.

For large-scale production, conventional isomalt is typically used in the production of candy, confectionery, baked products, and sugar-free items. Some of the supply companies for conventional isomalt, which applies in sugar-free candies, chewing gums, and nutritional foods, are Tate and Lyle, Cargill, and Roquette.

The very low glycemic index and stability at temperature-sensitive and shelf-stable products point towards extensive applications in food. In addition, the cost-effectiveness of the product has also helped in the popularization of its use, especially in mass-market products for health-conscious consumers looking for alternatives to sugar.

Organic is a niche segment, but it is growing steadily in Western Europe with increasing momentum due to rising consumer demand for clean-label, organic and natural products. This is the base for the organic drawing line, particularly partaking in health foods, supplements, and artisanal confections.

Beneo and BENEO have launched organic isomalt offerings for premium industry positions. Organic isomalt is gaining momentum in organic-certified snacks, sugar-free beverages, and health-oriented products for consumers who purchase on the basis of natural and environmental considerations.

Such growth is seen very much in niche industries where organic certifications prove to be a very strong selling factor, especially in Germany, the UK, and France, where the demand for organic foods and natural sweeteners is strong.

The isomalt industry in western Europe will be predominantly occupied by the powder form, with an industry share of 77.2%, whereas the syrup form will account for 22.8% in 2025. Powdered isomalt is the primary form in western Europe because of its versatility, storage convenience, and suitability for mass production. It is extensively used for sugar-free candies, gums, baked foods, and dietary foods, thus making it a preferential form for large industry applications.

Powdered isomalt is used by companies such as Tate & Lyle, Roquette, and Cargill to cater to the food industry's need for low-sugar alternatives. Powdered sugar is particularly preferred because of its long shelf life and compatibility in blending with other dry components in product formulations. Powdered isomalt is also economical and convenient for large-scale production, thus upholding a significant industry share.

Syrup, while less in industry share, is necessary for liquid-based applications that value smooth consistency and solubility; it is used for drinks, health syrups, and top-end confectionery articles. In Western Europe, brands such as Beneo and BENEO add syrupy isomalt to their assortment of sugar-free beverages, functional drinks, and health-oriented products.

The syrup is also used in HORECA for culinary applications, for example, in sugar-free sauce glazes and dessert toppings, where its flowing properties and ease of dissolving in liquids are greatly appreciated. This form advances the trend toward premium, all-natural, and health-focused product development, targeting what is, albeit a small but growing industry of health-conscious consumers.

The industry of isomalt has grown significantly in Western Europe as a result of increased health consciousness in reducing sugar and consumption of low-calorie sweeteners in confectionery and bakery products. Isomalt, being a sugar alcohol, is derived from yeast sugar and is used as a substitute for sugar, particularly in products marked for contractual buyers, such as those with health restrictions.

The increasing demand for Isomalt in Europe is attributed to health awareness of diseases like obesity, diabetes, or sugar-related diseases. The industry is further fueled by the European clean-label movement, which advocates transparency in the application of natural ingredients.

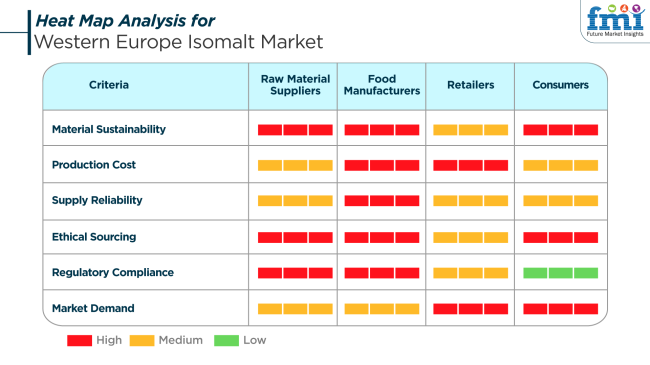

Raw material suppliers are significant to isomalt because they ensure a consistent and sustainable supply of raw materials from which it is derived. Sustainability is highly attributed to the importance of materials, as suppliers are increasingly adopting eco-friendly and ethical sourcing techniques.

Isomalt is mainly produced from beet sugar, and there has been increased demand for raw materials that are sustainably sourced, which is going hand in hand with health and environmental issues in the region. Since supply reliability is moderately important in ensuring a steady product supply, production costs of raw materials are mainly attributed to the renewable sourcing process.

Many food manufacturers in Western Europe have tight production budgets, as the conversion of beet sugar into isomalt is a rather complex formulation. Regulatory compliance, such as food safety compliance, is of high importance to these manufacturers since they have to conform to EU regulations.

The costs of production would, therefore, place high pressure on manufacturers to produce high-quality products. Another priority in achieving this cost-effectiveness would be correct labeling and health compliance, since the European authorities strictly regulate such standards for all food ingredients, including sugar alcohols like isomalt.

The retailers focused on satisfying the health-conscious consumers who demand increasing sugar-free and low-calorie items. However, retailers play a huge part in providing a wide array of products that contain isomalt, especially in the confectionery and bakery sectors.

The major concern for retailers is demand; industry demand is how they seek to increase their share of the health-conscious consumer segment. The importance of production costs and supply reliability cannot be overlooked, but having shelves stocked at the right time is the heart of any retailer's strategy.

Isomalt Industry Analysis in Western Europe(Stakeholders: Raw Material Suppliers, Food Manufacturers, Retailers, Consumers)

During 2020 to 2024, the industry grew significantly due to the growing consumer interest in health and wellness. With the growing incidence of lifestyle-related diseases like obesity and diabetes, the demand for sugar substitutes rose.

Isomalt, which has low calories and is friendly to teeth, became popular as a sugar substitute in the manufacturing of sugar-free candies, lozenges, chewing gum, and tablets for pharmaceuticals. The Western European aging population also increased the need for healthier alternatives to conventional sugar.

Looking ahead to 2025 to 2035, the industry is projected to continue its upward trajectory. Innovations in food technology and formulation are expected to lead to the development of a variety of isomalt-based food products with improved flavor and texture.

The increasing trend toward healthy eating habits is anticipated to further boost the demand for low-calorie sweeteners. Additionally, the pharmaceutical industry's utilization of isomalt is expected to expand, owing to its beneficial properties in tablet formulations.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers in need of low-calorie, sugar-free products | Sustained focus on health and wellness, including functional foods |

| Sugar-free sweets, cough drops, chewing gum, pharmaceutical tablets | Increased application in functional foods, drinks, and personalized nutrition |

| Meeting food safety and labeling regulations | Expected more stringent regulations influencing product development and promotion |

| Growing incidence of lifestyle-disease conditions | Elevating demand for personalized nutrition and sustainable, clean-label foods |

| Formulation development of clean-label, allergen-free products and transparency in products | Launch of customized isomalt products and eco-friendly product lines |

Among the factors driving growth in the isomalt industry in Western Europe are increased demands for sugar-free and low-calorie sweeteners among health-conscious consumers. That is, as health and wellness awareness grows, more individuals choose ingredients such as isomalt that have value attributes, such as a low glycemic index and value for tooth health, which makes it consumable by diabetic patients or people who want to reduce sugar intake. These are a few important risks that could derail the potential growth trajectory of the industry.

Among the leading risks is regulation, as the European Union has a complex system of rules about food safety and labeling, which companies will have to comply with. Testing the waters for their products vis-à-vis growing compliance standards becomes an important regulatory risk for businesses to avoid legal liability and industry access issues.

Furthermore, disruption in supply chains is another dwindling operational risk. For example, simple logistical problems, such as piecing together labor and container shortages, will also delay shipments while driving up production costs and negatively affecting the timely availability of isomalt.

Next is the competitive landscape, where competition could be another threat. The industry is brimming with many sugar substitutes, such as sorbitol, xylitol, and stevia. These sugar alternatives are usually perceived as more cost-effective or familiar to consumers; hence, isomalt does not have a big share of the industry.

There is also an issue with consumer awareness. Isomalt is not that publicized among sweeteners despite its health benefits. The same education concerning its benefits is not provided to consumers, which could translate to a barrier to adoption.

Companies in the isomalt industry will need to focus on regulatory compliance, efficient management of supply chains, competitive differentiation, and consumer education to mitigate these risks. Companies that meet all these hurdles are now well set to make the best out of the opportunity that is being created by the rise in demand for healthier sweetening options in Western Europe.

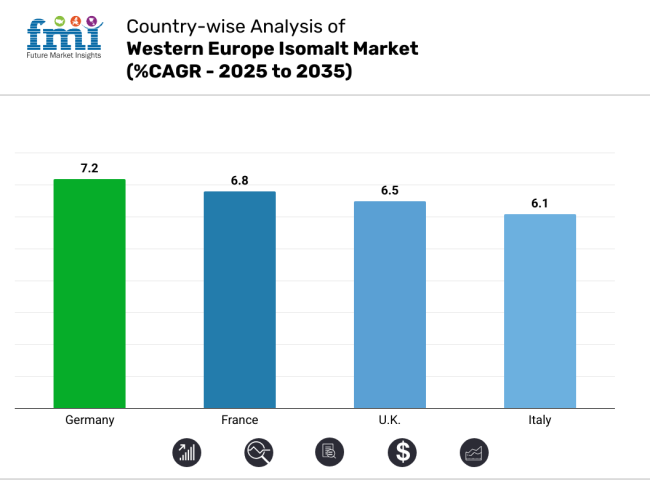

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.2% |

| France | 6.8% |

| UK | 6.5% |

| Italy | 6.1% |

>

>

The industry for Germany is anticipated to register a 7.2% CAGR over the period of study. Being the largest industry for isomalt in Western Europe, Germany has high demand due to its strong confectionery and pharmaceutical industry. Rising awareness regarding health and a move towards sugar-free foods have strengthened the use of isomalt, especially in the functional food and dietary supplements segment.

Manufacturers are continuously reformulating established product ranges and launching new products in tune with consumer interest in low-calorie, diabetic, and dental-safe ingredients. Germany's state-of-the-art manufacturing facilities and high R&D spending also play a role in expanding the industry.

The food and beverage industry in Germany is also shifting toward clean-label and natural ingredient formulations, and the fact that isomalt supports such trends adds to its appeal. Regulatory backing for sugar alternatives and positive labeling regulations is also driving increased consumption in packaged food categories.

The availability of international players and rising product diversification in bakery, candies, and nutraceuticals are supporting industry penetration. Export facilities from Germany are also increasing, supporting its position as a strategic player in Western Europe's isomalt industry. Industry forces depict a mature but continuously changing environment that promotes long-term growth through 2035.

The industry in France is anticipated to register a 6.8% CAGR through the analysis period. Changing food preferences of French consumers in favor of more healthful alternatives, especially confectioneries of low sugar content and sugar-free varieties, constitute optimal uses of isomalt.

The health-focused and balance-oriented dietary tradition in France can support the incorporation of sugar substitutes. A technologically advanced, innovation-driven, and high-value-added food processing industry is rapidly incorporating isomalt into extensive products.

The French pharmaceutical industry is another key force behind the demand for isomalt, particularly for lozenges and tablet coatings where taste masking and non-hygroscopicity are essential. Domestic players are spending on new product forms to capture increasing domestic and export demand. The growing aged population and higher incidence of lifestyle disorders like diabetes have driven the trend towards reduced sugar in medical nutrition.

Also, strict EU laws have pushed labeling to be more transparent, which educates consumer decisions and boosts the image of isomalt as an efficient and safe substitute. France's devotion to sustainability and food quality guarantees continuous innovation and constant demand growth for isomalt in every sector during the forecast years.

The UK industry is anticipated to grow at 6.5% CAGR over the study period. In answer to rising public health concerns regarding sugar usage, the UK has employed forward-thinking regulations and promotions promoting lower sugar consumption, which has fostered conducive conditions for isomalt usage. The food and drink sector are employing isomalt more in reformulations to meet national health goals while maintaining product attractiveness in confectionery, bakery, and dairy applications.

Innovation leads the UK industry, with new companies and established players venturing into functional foods, such as sugar-free chocolates and gums, to fortified snacks. Increased demand for tooth-friendly and diabetic-friendly ingredients matches the characteristics of isomalt, increasing popularity among formulators.

The retail sector supports it, too, with supermarkets and health stores giving greater shelf space to sugar-free and low-glycemic-index products. In addition, awareness of calorie management and a desire for clean-label alternatives drive demand patterns. Favorable industry conditions for the isomalt industry in the UK include a flexible supply base, regulatory clarity, and expanding industry reach through online channels, making it a leading growth cluster in Western Europe through 2035.

The Italian industry shall grow at a 6.1% CAGR throughout the analysis. Increasing consumer demand for well-being and nutritional equilibrium is shaping Italy's food industry to use sugar substitutes like isomalt.

The classic Italian cuisine tradition, complemented by contemporary dietary trends, is driving innovation in the mainstream as well as artisanal product portfolios, especially confectionery and baked goods. The application of isomalt in providing sweetness without sacrificing caloric content makes it appealing to a broad segment of consumers, such as children, diabetics, and health-oriented adults.

Italy's pharmaceutical and nutraceutical industries are also fueling the growth of the industry. Isomalt is finding more uses in functional lozenges and medicinal confectionery, where its non-cariogenic and temperature stability provide a technical benefit. Local manufacturers are promoting product differentiation and attractive packaging to meet premium industry positioning.

Regulatory compliance with EU food safety requirements provides easy integration of isomalt in various product segments. In addition, greater tourism and exports of Italian food products are widening the industries of isomalt-based products to wider audiences. This balance between tradition and innovation positions Italy as a dynamic yet stable industry within Western Europe's isomalt industry.

The western European isomalt industry is characterized by strong specialization, with key players differentiating through technological expertise and application-focused solutions. BENEO GmbH maintains industry leadership through its proprietary production processes and deep penetration in functional food segments, particularly sugar-reduced products.

The company's technical know-how in isomalt applications gives it an edge in product development partnerships with major food brands. Merck KGaA occupies a distinct position by serving high-value pharmaceutical applications and leveraging its stringent quality standards for medicinal-grade excipients.

Meanwhile, KF Specialty Ingredients has successfully positioned itself as the go-to supplier for confectionery manufacturers, offering tailored formulations that address specific texture and stability requirements in sugar-free products.

The industry shows a clear bifurcation between premium specialists and cost-focused producers. Wilmar BioEthanol competes effectively through vertical integration and economies of scale in beet sugar processing, appealing to price-sensitive industrial buyers. Deiman SA de CV has carved out a niche by providing customized physical specifications to meet exact manufacturing needs. Smaller regional distributors like Quadra Chemicals compete through agile service models and technical support.

Asian manufacturers are gradually increasing their presence by offering competitive pricing, albeit with challenges in meeting stringent European quality certifications. The competitive environment continues to evolve with a growing emphasis on clean-label positioning and sustainable production methods as key differentiators.

Market Share Analysis by Company

| Company | Market Share (%) |

|---|---|

| BENEO GmbH | 25-28% |

| Merck KGaA | 18-22% |

| KF Specialty Ingredients | 15-18% |

| Wilmar BioEthanol | 12-15% |

| Deiman SA de CV | 8-11% |

| Other Players | 15-20% |

Key Company Insights

BENEO GmbH holds a significant portion of the isomalt industry in Western Europe, accounting for about 25-28% of the whole industry. This industry advantage can also be attributed to its patented process of production and strong ties with international food companies.

More so, BENEO focuses on making use of its functional foods and sugar reduction solutions to augment its industry leadership power. Merck KGaA got up to 18-22% stake in isomalt production for pharmaceutical-grade applications, fulfilling highly demanding needs for both excipients of tablets and medicinal syrups.

KF Specialty Ingredients holds about 15 - 18% share of the industry as a result of its high specialization in confectionery-grade isomalt formulations. Such specialized formulations are especially relevant to sugar-free hard candies and chewing gums.

Wilmar BioEthanol accounts for about 12 - 15% of the industry share; it takes advantage of its integrated production from sugar beet and then juxtaposes selling at competitive prices. This is followed by Deiman SA de CV, completing the top five with a share of about 8 to 11% by focusing on customized particle size distributions for specific industrial applications.

By nature, the industry is divided into organic and conventional.

By form, the industry is categorized into powder and syrup.

By end use, the industry includes applications in confectionary, sugar confectionary, bakery products, breakfast cereals and bars, dairy products, frozen desserts, beverages, sports drink, meat and fish products, infant formula, pharmaceuticals, and others.

By country, the industry is divided into the UK, Germany, Italy, France, Spain, and the rest of western Europe.

The industry is expected to reach USD 132 million in 2025.

The industry is projected to grow to USD 222.9 million by 2035.

The industry is expected to grow at a CAGR of approximately 5.4% during the forecast period.

Germany accounts for approximately 7.2% of the industry.

Conventional isomalt represents a key segment in the industry.

Key players include BENEO GmbH, Merck KGaA, KF Specialty Ingredients, Wilmar BioEthanol, Deiman SA de CV, Quadra Chemicals Ltd, S.A. Pharmachem Pvt. Ltd., Baolingbao Biology Co., Ltd, Akhil Healthcare Pvt Ltd, and SINO Food Ingredients (SINOFI).

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 10: UK Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 17: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 18: Germany Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 19: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 26: Italy Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 27: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 29: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Italy Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 33: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 34: France Industry Analysis and Outlook Volume (Tons) Forecast By Region, 2018 to 2033

Table 35: France Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: France Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 37: France Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: France Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 39: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: France Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 42: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Nature, 2018 to 2033

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Form, 2018 to 2033

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: UK Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 26: UK Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 27: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 28: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 29: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 30: UK Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 31: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 32: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 34: UK Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 35: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 37: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 39: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: UK Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 43: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: UK Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 46: UK Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 49: Germany Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 50: Germany Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 51: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 53: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 54: Germany Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 55: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 56: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 57: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 58: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 59: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 60: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 62: Germany Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 63: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Germany Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 71: Germany Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 72: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 73: Italy Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Italy Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 75: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 77: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 78: Italy Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 79: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 80: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 81: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 82: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 83: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 84: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 85: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 86: Italy Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 87: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Italy Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 91: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 97: France Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 98: France Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 99: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 100: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 101: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 102: France Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 103: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 104: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 105: France Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 106: France Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 107: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 108: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 109: France Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 110: France Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 111: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: France Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 115: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: France Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 118: France Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 119: France Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 120: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: Spain Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Spain Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 123: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 125: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 126: Spain Industry Analysis and Outlook Volume (Tons) Analysis By Region, 2018 to 2033

Figure 127: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 128: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 129: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 130: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 131: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 132: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 133: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 134: Spain Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 135: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: Spain Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 139: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: Spain Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 142: Spain Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 143: Spain Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 144: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 145: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature, 2023 to 2033

Figure 146: Rest of Industry Analysis and Outlook Value (US$ Million) by Form, 2023 to 2033

Figure 147: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 148: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 149: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Nature, 2018 to 2033

Figure 150: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 151: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 153: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Form, 2018 to 2033

Figure 154: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 155: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 156: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 157: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 158: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 159: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 160: Rest of Industry Analysis and Outlook Attractiveness by Nature, 2023 to 2033

Figure 161: Rest of Industry Analysis and Outlook Attractiveness by Form, 2023 to 2033

Figure 162: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isomalt Market Analysis - Size, Share, and Forecast 2025 to 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Demand for Isomalt in EU Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA