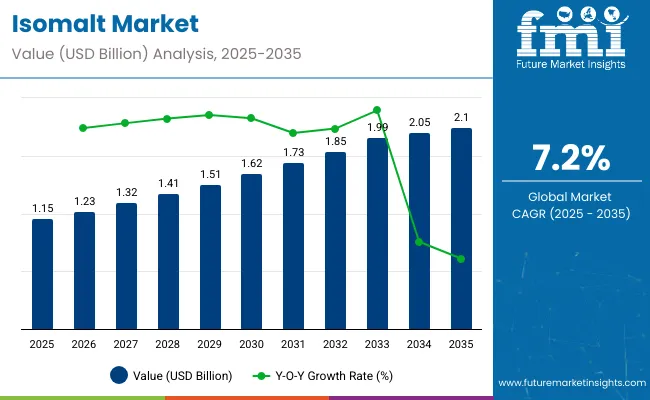

The global isomalt market is projected to grow from USD 1.15 billion in 2025 to USD 2.10 billion by 2035, reflecting a CAGR of 7.2% during this period. This growth is driven by increasing consumer demand for low-calorie and sugar-free products, amid rising health concerns such as obesity and diabetes.

Regulatory bodies like the European Food Safety Authority and the USA Food and Drug Administration have approved the product as a non-carcinogenic sugar substitute, bolstering its adoption in various applications, including confectionery, pharmaceuticals, and oral care products.The World Health Organization's guidelines on reducing sugar intake further support the shift towards alternative sweeteners like products.

Leading manufacturers are focusing on innovation to meet the growing demand for healthier sweeteners.BENEO, a prominent player in the industry, emphasizes the importance of the product in developing tooth-friendly and low-glycemic products.Cargill has announced investments in expanding its polyol production capacity to cater to the evolving consumer preferences for better-for-you ingredients.

Major confectionery companies are reformulating products with product to offer healthier alternatives without compromising taste.In the pharmaceutical sector, the product is increasingly used in lozenges and chewable tablets to enhance mouthfeel while maintaining efficacy.

Sustainability and traceability are becoming crucial in the industry.Companies like Roquette have received recognition for their non-GMO product production processes, aligning with the growing consumer demand for clean-label products.Industry associations project that sugar replacers like this product will constitute a significant portion of the confectionery sweeteners industry by 2035.

Functional chewing gums and tablets are expected to be major contributors to product consumption.As consumers and regulators prioritize health, dental care, and transparency, the product is poised to play a central role in the future of sweetener innovation and health-focused product development

Per capita consumption of isomalt, a popular sugar substitute used mainly in sugar-free confectionery and pharmaceutical products, varies across regions depending on consumer health awareness, regulatory approvals, and market penetration of low-calorie sweeteners. Developed markets generally exhibit higher consumption due to strong demand for diabetic-friendly and low-sugar food options. Meanwhile, emerging markets are gradually increasing consumption as awareness of healthier alternatives grows and product availability improves.

The trade landscape of isomalt is shaped by growing global demand for sugar substitutes in confectionery, pharmaceuticals, and food industries focused on health-conscious consumers. Countries with strong manufacturing capabilities and advanced chemical processing industries dominate exports, while regions with rising awareness about diabetes and obesity drive imports. Trade flows are influenced by factors such as regulatory approvals, quality standards, and evolving consumer preferences for low-calorie and sugar-free products.

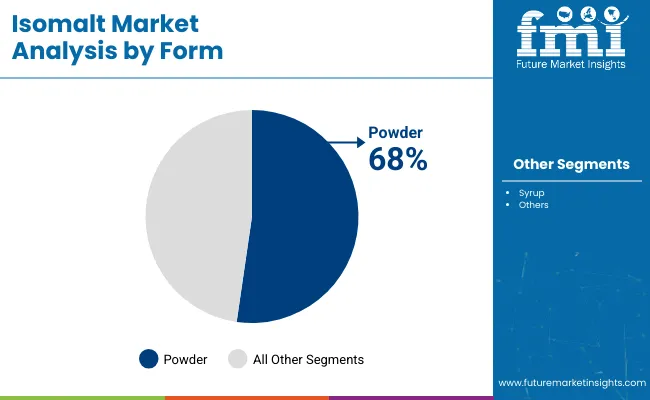

The industry has been analyzed across multiple segments, including nature, form, and end use. By nature, the segments covered are organic isomalt and conventional isomalt. By form, the market has been studied for powder isomalt and syrup isomalt.

In terms of end use, the market includes confectionery, sugar confectionery, bakery products, breakfast cereals & bars, dairy products, frozen desserts, beverages, meat & fish products, pharmaceuticals, and others. Regionally, the industry is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Organic product is set to emerge as the most financially attractive segment in the industry, projected to reach USD 810 million by 2035, compounding at a CAGR of 8.5% from its estimated 2025 base of USD 360 million. This growth is fueled by rising consumer preference for clean-label and naturally sourced ingredients in confectionery and nutraceutical formulations.

Increased adoption by premium health-focused brands and higher per-unit pricing enable stronger margins, making organic products a compelling value proposition. Its alignment with non-GMO and organic certification standards further supports integration in regulated and export-driven industries.

Conventional product will retain the dominant share, growing at a 6.0% CAGR to reach USD 1.29 billion by 2035, up from USD 790 million in 2025. Its scalability and cost-efficiency continue to support mass-market applications in candies, baked goods, and functional pharmaceuticals. While growth will be steadier, its widespread global usage and established distribution networks ensure volume leadership through the decade.

However, organic product’s growth outpaces its conventional counterpart, driven by evolving regulatory pressures and shifting health narratives in key consumption centers like North America, Western Europe, and Japan. As retailers and formulators prioritize transparency and sustainability, organic products will play a central role in premium product strategies across both food and non-food sectors.

Powder isomalt is projected to be the more lucrative form segment in the industry, anticipated to reach USD 1.52 billion by 2035 from an estimated USD 875 million in 2025, expanding at a CAGR of 5.6%. This form dominates due to its superior handling, storage stability, and compatibility with a broad spectrum of dry-mix applications.

Powder product is extensively utilized in sugar-free confectionery, lozenges, and tableting systems, particularly in pharmaceuticals and nutraceuticals, where precise dosage and mouthfeel consistency are critical. Its cost-effectiveness in transportation and lower moisture sensitivity further drive preference among large-scale manufacturers.

Syrup product, while more niche, will grow at a steady CAGR of 4.1%, reaching USD 580 million by 2035 from USD 385 million in 2025. Its application remains concentrated in liquid formulations such as syrups, liquid supplements, and certain beverage formats. Syrup form benefits from ease of incorporation in liquid processing lines but faces logistical and storage constraints that slightly limit scalability.

Despite syrup's slower growth, it remains relevant in specific sectors requiring immediate solubility and viscosity control. However, powder products’ adaptability, especially in high-volume functional and dietary products, positions it as the key driver of value addition in the form segment over the forecast period.

Confectionery is expected to remain the most lucrative end-use segment in the industry, projected to generate USD 820 million by 2035, up from USD 460 million in 2025, registering a CAGR of 6.0%. Its growth is underpinned by the widespread shift toward sugar-free candy and chewing gum variants, especially in Western Europe, Japan, and North America.

Its non-carcinogenic profile, heat stability, and clean sweetness make it the preferred polyol in premium and functional confectionery lines. Sugar confectionery alone contributes over 60% of the segment’s demand, benefiting from continuous innovation in diabetic-friendly and tooth-friendly products.

Pharmaceuticals, particularly in functional formats like lozenges and chewable tablets, will expand at a robust CAGR of 6.7%, reaching USD 510 million by 2035. The sub-categories of cough syrups, multivitamins, and supplements are leveraging the product’s compressibility and neutral taste to improve patient compliance. Combined, these applications support the integration of products in pediatric and geriatric formulations.

Bakery products and breakfast cereals & bars will grow steadily, at 5.1% and 5.4% CAGR respectively, driven by demand for reduced-sugar baked goods and portable nutrition formats. Dairy and frozen desserts are forecast to expand at a more modest pace due to technical limitations in replacing sucrose at higher concentrations without texture compromise.

Beverages and meat & fish products will witness limited adoption, with CAGRs of 3.2% and 2.8%, as the products’ physical properties restrict utility in aqueous and protein-rich environments. The “Others” category, encompassing novel health food and pet care applications, will expand at 4.5% CAGR, showing early promise but from a low base.

The United States remains the most strategically important industry due to its mature sugar-reduction landscape and highly segmented food and pharmaceutical sectors. Product adoption is being driven by strong consumer demand for low-glycemic, non-carcinogenic sweeteners, particularly in sugar-free confections, lozenges, and fortified snacks.

The USA Food and Drug Administration (FDA) has fully approved a product as a GRAS (Generally Recognized As Safe) ingredient, fostering its integration into a wide array of health-oriented product lines. Furthermore, consumer awareness campaigns led by the American Heart Association and diabetes foundations have created a receptive environment for polyols.

The confectionery sector, particularly gum and hard candies, is the leading application, but demand is rising in functional bars and nutraceuticals as formulators shift toward clean-label alternatives. Pharma companies are also adopting products in OTC tablets and chewables.

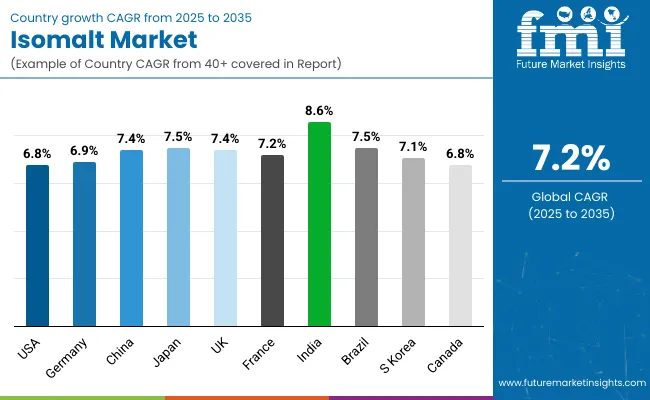

E-commerce growth and private-label innovation across retailers such as Whole Foods and Costco are accelerating the industry further. Domestic manufacturing scale and efficient logistics enhance cost efficiency and supply stability. The industry is projected to reach USD 340 million by 2035, up from USD 175 million in 2025, supported by a CAGR of 6.8%.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

Germany serves as the innovation nucleus for the European industry, driven by domestic leadership in sugar-free confectionery manufacturing and proactive regulatory support. As the home base for BENEO, a global product supplier, Germany maintains a vertically integrated ecosystem for both production and formulation.

German Federal Institute for Risk Assessment (BfR) regulations are closely aligned with EFSA directives, supporting broader use in bakery, pharmaceuticals, and even dairy categories. Health-conscious demographics, aging populations, and high dental health awareness all contribute to robust demand.

Product’s application in fortified candies, children’s supplements, and OTC cough tablets is steadily expanding, particularly in pharmacies and health food chains. Stringent sugar taxation policies and the voluntary sugar reduction framework under Germany’s National Reduction and Innovation Strategy further motivate manufacturers to shift to polyols. Additionally, Germany’s leadership in clean-label and organic certifications enhances the growth potential for organic products. The industry is forecast to grow from USD 138 million in 2025 to USD 270 million by 2035, achieving a CAGR of 6.9%.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.9% |

China’s industry is set to surge as the government intensifies efforts to curb sugar consumption amid rising diabetes and obesity rates. The Chinese National Health Commission’s endorsement of low-calorie sweeteners in food and pharmaceutical standards is a key driver. Demand is especially strong in the functional food and nutraceutical space, where the product is used in tablets, herbal lozenges, and TCM-compliant formulations.

China's domestic confectionery sector-both traditional and Western-is increasingly reformulating products with product to meet urban consumer expectations. The segment also benefits from strong growth in children’s nutritional supplements, a high-priority category among Chinese parents.

Domestic manufacturers are scaling up polyol capacity with government incentives for “functional ingredients” under food security programs. However, the fragmented retail and e-commerce ecosystems can create pricing pressures, particularly for imported organic products. With a strong mix of regulatory alignment, consumer pull, and manufacturing incentives, the Chinese industry is forecast to grow from USD 130 million in 2025 to USD 270 million by 2035, registering a CAGR of 7.4%.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

Japan’s industry is characterized by precision health marketing and a deep-rooted consumer preference for functional, sugar-free, and dental-care-enhancing products. Regulatory guidance from the Ministry of Health, Labour and Welfare supports the use of polyols like the product in FOSHU (Foods for Specified Health Uses) and OTC formulations.

The Japanese market is also home to extensive sugar-free innovation in candies, pastilles, and throat lozenges, with a strong cultural focus on oral hygiene. Pharmaceutical usage is high, particularly in pediatric and geriatric formulations, where the product’s palatability and mouthfeel are valued.

Convenience stores and drugstore chains are key distribution channels for product-containing products. Although Japan has a mature consumer base, aging demographics will fuel sustained demand for diabetic-friendly and easily digestible formulations. Domestic R&D efforts have led to new formats like product-enriched beverage powders and fortified tablets.

Japan’s high product quality standards and demand for safety certification (including JAS organic standards) favor high-margin, traceable supply chains. The industry is forecast to grow from USD 96 million in 2025 to USD 200 million by 2035, with a CAGR of 7.5%.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.5% |

The United Kingdom is witnessing a rapid transformation in sugar reformulation strategies following the implementation of the Soft Drinks Industry Levy and extended focus on front-of-pack labeling. Product demand is gaining ground across private-label brands and reformulated health products in confectionery and cereal bars.

The UK’s National Health Service (NHS) has actively promoted sugar reduction in school programs and hospitals, indirectly driving procurement preference for low-calorie sweeteners in foodservice and healthcare sectors.

Importers are expanding their sourcing of organic products to meet rising demand from Whole Foods, Holland & Barrett, and Boots for clean-label supplements and diabetic candies. Pharmaceutical formulations are also integrating products as a binding and sweetening agent in chewable vitamins and cough tablets.

Although Brexit-related regulatory divergence initially posed uncertainty, UK REACH guidelines now align with broader EU food additive frameworks, ensuring compliance and continuity. The industry is expected to grow from USD 90 million in 2025 to USD 185 million by 2035, reflecting a CAGR of 7.4%.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.4% |

France represents a balanced yet steadily growing industry, driven by its robust confectionery tradition and increasingly health-aware population. The French Agency for Food, Environmental and Occupational Health & Safety (ANSES) supports polyol usage in sugar reduction frameworks, especially within school feeding programs and hospital procurement. French manufacturers are progressively reformulating legacy candy brands and artisan bakery products with products, targeting reduced sugar labels without sacrificing texture or flavor.

Organic and clean-label preferences are especially strong in France, contributing to a growing premium segment for organic product in high-end chocolates and multivitamin gummies. Pharmacies and health food stores, including chains like Biocoop and Pharmacie Lafayette, are expanding their shelf space for isomalt-based supplements and OTC products.

Domestic demand is also supported by the government's National Nutrition and Health Program (PNNS), which emphasizes lower sugar intake among children and seniors. France’s strong R&D capabilities, combined with its leadership in food labeling regulations, will continue to attract investments into functional food formulations using products. The industry is expected to expand from USD 84 million in 2025 to USD 168 million in 2035, at a CAGR of 7.2%.

| Country | CAGR (2025 to 2035) |

|---|---|

| France | 7.2% |

India is expected to be the fastest-growing industry among the top ten, fueled by surging urban health consciousness, expansion of the nutraceutical industry, and increasing prevalence of lifestyle-related disorders. With diabetes projected to affect over 100 million Indians by 2030, the industry for sugar-free and low-glycemic products is expanding rapidly. The Food Safety and Standards Authority of India (FSSAI) has approved the product for use in a wide array of food and pharmaceutical applications.

Growth is particularly visible in chewable supplements, herbal lozenges, and ayurvedic candies reformulated with the product. Indian confectionery giants are localizing diabetic-friendly candy lines using polyols to meet Tier 1 and Tier 2 city demand. The organized retail boom and rise of online health platforms have improved consumer access to product-based products.

However, cost sensitivity remains a barrier for widespread usage in mass-market foods, confining high growth to mid-to-premium product categories. Industry in India is forecast to grow from USD 65 million in 2025 to USD 150 million by 2035, recording a CAGR of 8.6%.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.6% |

Brazil is Latin America’s largest and most diversified industry, driven by government-led sugar reformulation efforts and growing awareness of non-carcinogenic sweeteners. ANVISA (the Brazilian Health Regulatory Agency) permits products across multiple food and pharmaceutical categories, and its inclusion in government dietary guidelines has created demand across school meal programs and hospital supply chains.

Brazil’s vibrant confectionery market-one of the world’s largest-has seen the launch of sugar-free mints, gum, and cough candies using products, especially within São Paulo and Rio de Janeiro metro regions.

Domestic pharma companies are also reformulating syrups and chewables for both the pediatric and adult industry, using the product as a tooth-safe sweetener. Despite macroeconomic volatility, the trend toward functional foods is resilient, especially among Brazil’s expanding middle class.

Rising health insurance penetration and self-care awareness are catalyzing demand for clean-label nutraceuticals. The industry is forecast to expand from USD 70 million in 2025 to USD 145 million by 2035, reflecting a CAGR of 7.5%.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.5% |

South Korea’s industry is positioned for stable growth, supported by the nation’s strong emphasis on functional ingredients and dental health. The Ministry of Food and Drug Safety (MFDS) classifies product as a safe food additive, and it has become increasingly common in functional candies, energy bars, and dietary supplements.

South Korean consumers are highly label-conscious and show a strong preference for sugar-free, low-calorie, and wellness-linked products. Domestic conglomerates like Lotte and CJ CheilJedang have rolled out product-based product lines in confectionery and OTC chewables.

South Korea’s highly urbanized population and aging demographic also support demand for diabetic-friendly products and oral health supplements. Pharmacy chains, convenience stores, and online platforms are critical distribution channels.

While local production capacity remains limited, the country’s advanced packaging and formulation technologies offer a competitive advantage in premium product-based products. The industry is expected to grow from USD 68 million in 2025 to USD 135 million in 2035, marking a CAGR of 7.1%.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

Canada presents a high-value, moderately growing industry, shaped by strict food labeling laws and growing health awareness. Health Canada permits the use of the product in a variety of food products, including sugar-free candies, gums, and nutritional supplements.

Public health initiatives targeting obesity and diabetes have accelerated reformulation strategies across the confectionery and beverage industries. Product's key demand segments include OTC lozenges, functional food bars, and elderly-friendly nutritional products.

Canadian consumers respond strongly to organic and non-GMO claims, offering significant upside for organic products in premium channels. Retailers such as Loblaws, Whole Foods Canada, and Well.ca are expanding their offerings of sugar-free and tooth-friendly products.

Pharmaceutical companies are using products in effervescent tablets and chewables to enhance mouthfeel and palatability. Cross-border regulatory alignment with the USA also aids faster product launches and imports. The Canadian industry is projected to expand from USD 74 million in 2025 to USD 145 million by 2035, translating to a CAGR of 6.8%.

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 6.8% |

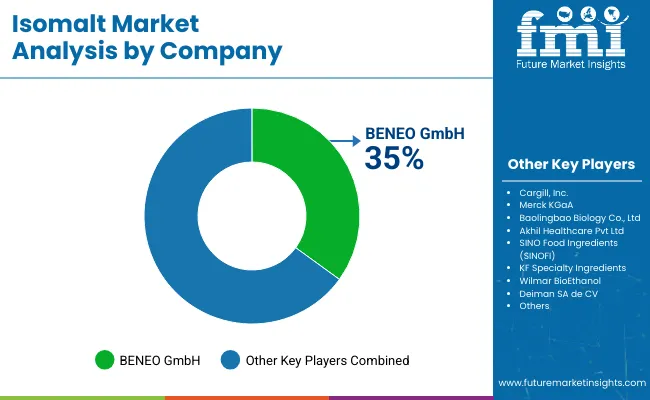

BENEO GmbHA subsidiary of Südzucker AG, BENEO GmbH is recognized as the global leader in product production, commanding approximately 35% of the market share. Their dominance is attributed to vertical integration, extensive R&D capabilities, and a robust global distribution network. BENEO's product is widely used in confectionery, pharmaceuticals, and nutraceuticals, benefiting from the company's commitment to innovation and quality.

Cargill, Inc.Cargill holds an estimated 20% share of the industry. Leveraging its vast global presence and diversified product portfolio, Cargill has effectively penetrated various sectors, including food and beverage, where the product is used as a sugar substitute. Their strategic partnerships and focus on sustainability have further solidified their industry position.

Baolingbao Biology Co., Ltd.As a leading Chinese manufacturer, Baolingbao Biology accounts for approximately 15% of the industry. The company's strength lies in its cost-effective production methods and strong presence in the Asia-Pacific region, catering to the growing demand for low-calorie sweeteners in emerging industries.

Merck KGaAMerck KGaA holds around 10% of theshares, primarily focusing on the pharmaceutical and healthcare sectors. Their products are integral in the formulation of sugar-free medications and supplements, benefiting from Merck's reputation for high-quality pharmaceutical ingredients.

Akhil Healthcare Pvt LtdAn emerging player from India, Akhil Healthcare, commands approximately 5% of the global industry. The company's growth is driven by increasing domestic demand for sugar substitutes and its expanding export footprint in the Middle East and Africa.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.15 billion |

| Projected Market Size (2035) | USD 2.10 billion |

| CAGR (2025 to 2035) | 7.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/ Volume in kilotons |

| By Nature | Organic Isomalt, Conventional Isomalt |

| By Form | Powder Isomalt, Syrup Isomalt |

| By End Use | Confectionery, Sugar Confectionery, Bakery Products, Breakfast Cereals & Bars, Dairy Products, Frozen Desserts, Beverages, Meat & Fish Products, Pharmaceuticals, Others |

| By End Use | Food, Beverages, Pharmaceuticals, Cosmetics and Personal Care, Homecare and Toiletries, Electronics, and Others (Chemical & Fertilizers, etc.) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, MEA |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | BENEO GmbH, Cargill, Inc., Merck KGaA, Baolingbao Biology Co., Ltd, Akhil Healthcare Pvt Ltd, SINO Food Ingredients (SINOFI), KF Specialty Ingredients, Wilmar BioEthanol, Deiman SA de CV, Quadra Chemicals Ltd, S. A. Pharmachem Pvt. Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

| Customization and Pricing | Available on request |

The industry is segmented into organic isomalt and conventional isomalt.

The industry is segmented into powder isomalt and syrup isomalt.

The industry is segmented into confectionery (including sugar confectionery), bakery products, breakfast cereals and bars, dairy products, frozen desserts, beverages (including sports drinks), meat and fish products, infant formula, pharmaceuticals (including cough syrup, multivitamins, supplements, and others), and others.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is poised to reach USD 1.15 billion in 2025.

The industry is slated to register USD 2.10 billion by 2035.

Powdered form is widely used.

India, slated to grow at 8.6% CAGR during the study period, is poised for the fastest growth.

Key companies include BENEO GmbH, Cargill, Inc., Merck KGaA, Baolingbao Biology Co., Ltd, Akhil Healthcare Pvt Ltd, SINO Food Ingredients (SINOFI), KF Specialty Ingredients, Wilmar BioEthanol, Deiman SA de CV, Quadra Chemicals Ltd, S. A. Pharmachem Pvt. Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Nature, 2023 to 2033

Figure 22: Global Market Attractiveness by Form, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Nature, 2023 to 2033

Figure 46: North America Market Attractiveness by Form, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 94: Europe Market Attractiveness by Form, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 142: MEA Market Attractiveness by Form, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Isomalt Industry Analysis in Western Europe – Size, Share & Forecast 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Isomaltulose Market Growth - Size, Trends & Forecast 2025 to 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Demand for Isomalt in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA