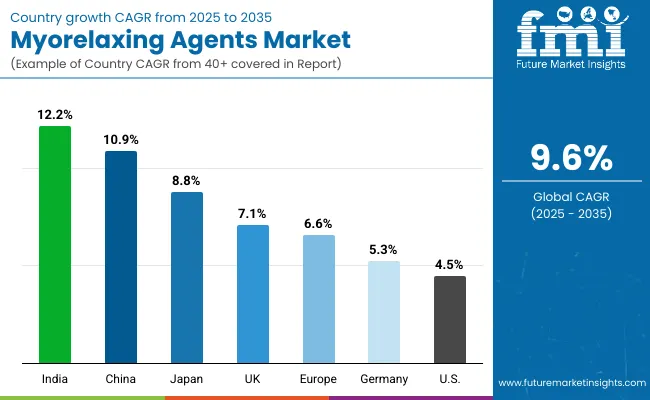

A valuation of USD 1,203.2 million has been projected for the Myorelaxing Agents Market in 2025, while by 2035 the market is expected to achieve USD 3,005.6 million. This reflects an overall expansion of USD 1,802.4 million across the decade, translating into a near 2.5X growth. The compound annual growth rate during this period has been calculated at 9.6%, signaling a robust upward trajectory supported by sustained innovation in bioactive ingredients and rising penetration across premium skincare and professional aesthetic applications.

Myorelaxing Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Myorelaxing Agents Market Estimated Value in (2025E) | USD 1,203.2 million |

| Myorelaxing Agents Market Forecast Value in (2035F) | USD 3,005.6 million |

| Forecast CAGR (2025 to 2035) | 9.60% |

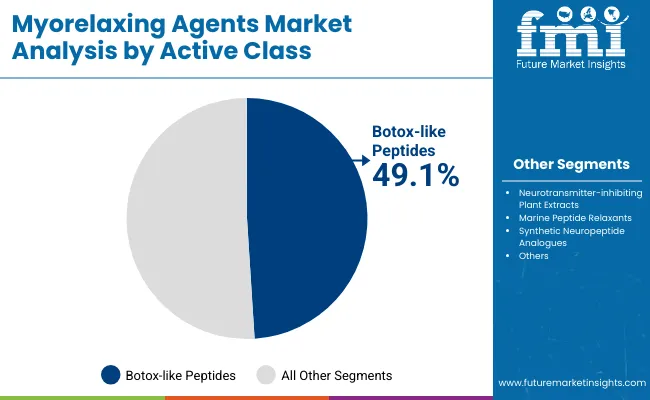

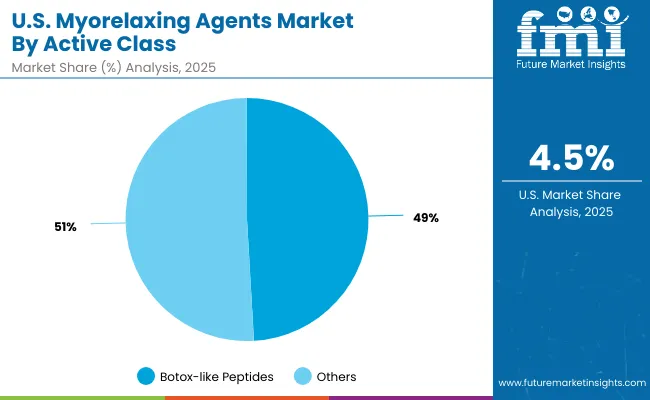

During the initial phase from 2025 to 2030, the market is forecast to advance from USD 1,203.2 million to USD 1,901.7 million, thereby adding USD 698.5 million. This share equals approximately 39% of the total decade’s expansion. Progress in encapsulation technologies, hydrogel complexes, and peptide formulations is anticipated to reinforce this early growth momentum. Botox-like peptides are expected to dominate the active class with 49.1% share in 2025, securing strong adoption due to clinically validated efficacy.

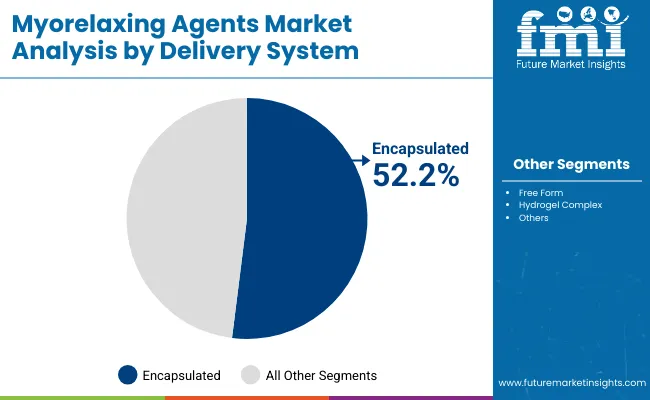

From 2030 to 2035, market size is projected to climb further from USD 1,901.7 million to USD 3,005.6 million, thereby contributing USD 1,103.9 million or about 61% of the total decade growth. Growth acceleration in this period will be supported by expanding dermocosmetic and professional care demand, particularly in high-growth markets such as China and India. Encapsulated delivery systems are forecast to maintain leadership with 52.2% share in 2025, driven by their superior stability and controlled release performance.

From 2025 to 2030, the market is projected to advance steadily from USD 1,203.2 million to USD 1,901.7 million, adding nearly USD 698.5 million. This expansion will be driven by increasing integration of advanced peptides and encapsulation technologies into premium skincare and dermocosmetic formulations. Between 2030 and 2035, the market is anticipated to grow more rapidly, reaching USD 3,005.6 million as Asia, particularly China and India, emerges as high-growth regions.

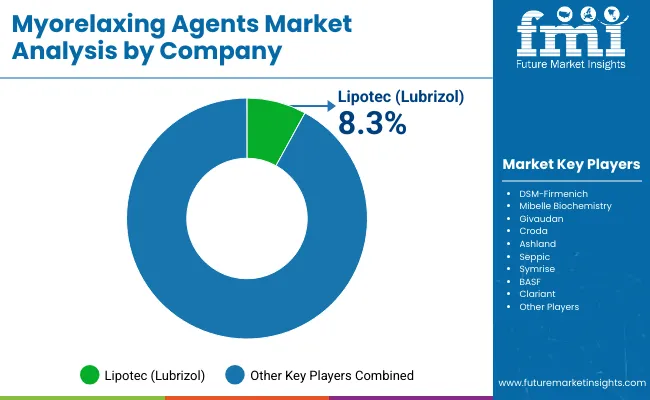

Competitive dynamics are expected to remain shaped by leading bioactive ingredient suppliers, with Lipotec (Lubrizol) estimated to hold 8.3% share in 2025. The broader market will be defined by innovation in delivery systems, efficacy-driven differentiation, and validation through clinical evidence. Over the decade, the advantage is forecast to shift toward players that can demonstrate enhanced stability, controlled release, and superior bioavailability, ensuring strong positioning in both dermocosmetic and professional aesthetic care applications.

The growth of the Myorelaxing Agents Market is being driven by increasing demand for high-performance bioactive ingredients in premium skincare and dermocosmetic formulations. Rising consumer expectations for clinically validated wrinkle-reducing solutions have encouraged wider adoption of advanced peptide technologies. Progress in encapsulation and hydrogel complexes has enhanced stability, bioavailability, and controlled release, thereby improving efficacy across applications.

Expanding professional aesthetic care services are fueling demand for actives with proven results, while the premium skincare category is anticipated to integrate such solutions at a faster pace. Regional momentum is being shaped by strong uptake in Asia, particularly China and India, where growth in dermocosmetic consumption is accelerating.

Continuous investment in molecular engineering and synthetic analogues is expected to expand product pipelines and strengthen differentiation. With innovation, efficacy, and delivery efficiency positioned as the main competitive drivers, the market is forecast to achieve sustained expansion through 2035, reflecting a long-term shift toward evidence-backed formulations.

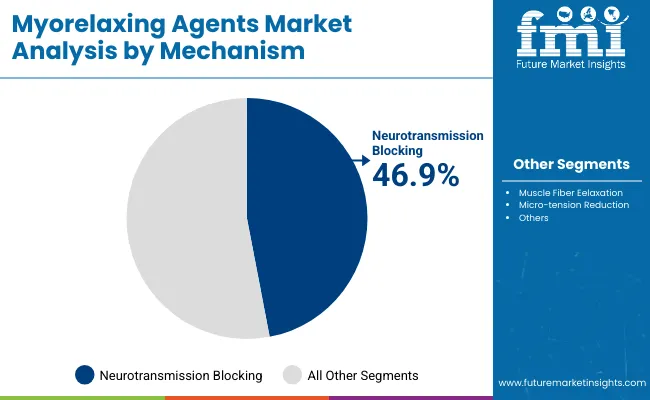

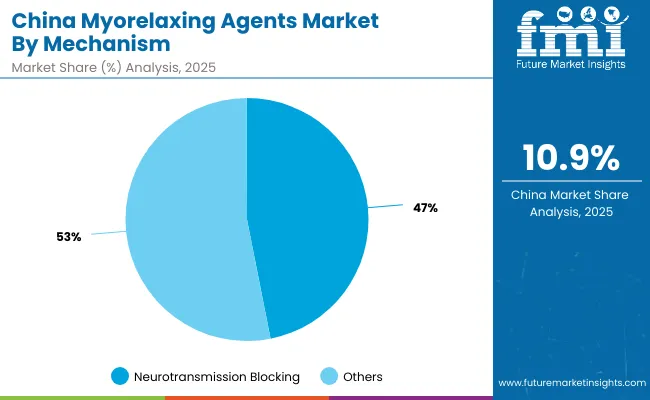

The Myorelaxing Agents Market has been segmented on the basis of active class, mechanism, and delivery system, with each category reflecting unique growth drivers and innovation priorities. Botox-like peptides are positioned as the leading active class due to their clinically validated efficacy in wrinkle reduction and broad adoption across dermocosmetic formulations. Neurotransmission blocking dominates the mechanism segment, supported by its direct role in muscle relaxation and proven effectiveness in reducing visible signs of aging.

Within delivery systems, encapsulated formats are expected to lead, driven by their ability to enhance stability, improve penetration, and enable controlled release for sustained performance. Together, these segments outline the foundation of market growth, reflecting both scientific advancement and evolving consumer demand for high-performance skincare solutions.

| Active Class | Market Value Share, 2025 |

|---|---|

| Botox-like peptides | 49.1% |

| Others | 50.9% |

Botox-like peptides are expected to dominate the active class segment in 2025 with a 49.1% value share, representing USD 590.77 million in sales. Their leadership is supported by proven efficacy in wrinkle reduction and strong clinical validation, which has reinforced their role as the preferred choice for high-performance formulations. Demand is being driven by dermocosmetic and premium skincare brands seeking ingredients that provide visible results and consumer trust. While other actives collectively contribute slightly higher share, Botox-like peptides are positioned as the benchmark standard due to their targeted mechanism of action. Future innovation around analogues of these peptides is likely to sustain their dominance, ensuring continued relevance in next-generation anti-aging solutions..

| Mechanism | Market Value Share, 2025 |

|---|---|

| Neurotransmission blocking | 46.9% |

| Others | 53.1% |

Neurotransmission blocking is anticipated to lead the mechanism segment with a 46.9% value share in 2025, equivalent to USD 564.30 million. Its prominence is explained by its ability to directly modulate muscle contraction, making it the most effective pathway for wrinkle attenuation. This mechanism has long been associated with reliable, clinically backed results, which strengthens its adoption across both dermocosmetic and professional aesthetic formulations. While other mechanisms contribute slightly higher overall share, neurotransmission blocking is regarded as the strategic driver of innovation and the most critical pathway for differentiating ingredient efficacy. The segment is forecast to maintain leadership as advancements in peptide engineering enhance both safety and performance in this domain.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Encapsulated | 52.2% |

| Others | 47.8% |

Encapsulated formats are projected to dominate the delivery system segment with 52.2% value share in 2025, translating to USD 628.07 million in sales. Their leadership reflects superior ingredient stability, improved dermal absorption, and controlled release, which together enhance clinical efficacy and product performance. Encapsulation is also enabling brands to strengthen claims validation and differentiate in competitive markets such as premium skincare and dermocosmetic solutions.

Other formats will remain relevant, but encapsulation is expected to lead consistently due to its ability to address longstanding formulation challenges like degradation and uneven delivery. Over the forecast period, innovation in nanocarriers and hydrogel complexes is projected to further consolidate encapsulation as the dominant delivery approach.

Complex formulation requirements and regulatory scrutiny are reshaping the Myorelaxing Agents Market, even as premium skincare and dermocosmetic applications accelerate demand for clinically validated bioactives supported by advanced delivery systems and molecular innovation across diverse global markets.

Innovation in Encapsulation and Controlled Release Technologies

Market expansion is being propelled by advances in encapsulation systems that safeguard ingredient stability and ensure targeted dermal penetration. Controlled release profiles are enabling sustained efficacy and reinforcing product claims, which is critical for premium skincare positioning. As consumer awareness of scientific validation intensifies, encapsulation is being recognized as more than a delivery medium it is being positioned as a differentiating factor in efficacy narratives. Ingredient developers are increasingly investing in nanocarrier innovations and hydrogel complexes, which are forecast to expand versatility in formulation and strengthen competitive advantages. This dynamic is expected to secure long-term demand growth, particularly in dermocosmetic and professional aesthetic care formulations.

Regional Shifts Toward Asia’s Dermocosmetic Ecosystem

Asia, particularly China and India, is expected to shape the next phase of market growth through rapid expansion of dermocosmetic consumption and evolving regulatory frameworks. Global suppliers are increasingly tailoring formulations to align with regional consumer preferences for multifunctional actives and faster visible outcomes. Partnerships with local skincare brands are emerging as strategic priorities, allowing international players to gain credibility and accelerate penetration in these high-growth markets. This regional rebalancing is projected to not only reshape revenue distribution but also influence product innovation pipelines, with Asia serving as a testing ground for advanced peptides and novel neurorelaxant analogues that may later expand globally.

| Countries | CAGR |

|---|---|

| China | 10.9% |

| USA | 4.5% |

| India | 12.2% |

| UK | 7.1% |

| Germany | 5.3% |

| Japan | 8.8% |

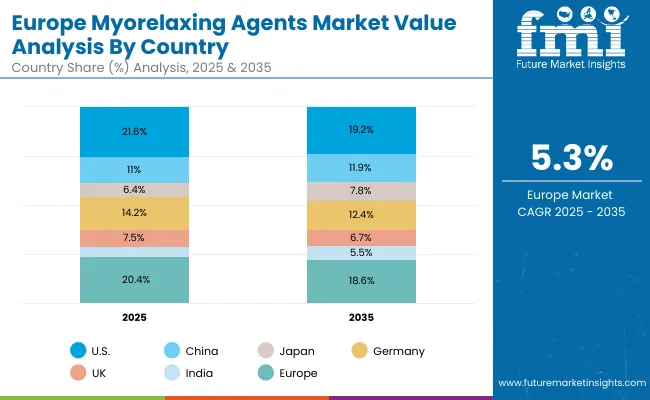

The Myorelaxing Agents Market demonstrates considerable variation across major economies, shaped by differing levels of dermocosmetic penetration, regulatory sophistication, and consumer demand for high-performance actives. India is projected to lead with the fastest CAGR of 12.2% between 2025 and 2035, reflecting rapid uptake of premium skincare and professional aesthetic solutions across urban centers. This momentum is being reinforced by rising middle-class consumption and strategic partnerships with global ingredient suppliers. China, growing at 10.9% CAGR, is positioned as another high-growth hub, supported by its advanced beauty ecosystem, localized innovation, and increasing clinical validation requirements.

Japan, with 8.8% CAGR, is forecast to expand steadily, benefiting from a mature but innovation-driven cosmetic market that emphasizes safety and efficacy. The UK (7.1% CAGR) and Germany (5.3% CAGR) are expected to drive Europe’s broader 6.6% growth rate, reflecting regulatory consistency and strong demand from established dermocosmetic brands. In contrast, the USA is projected to grow more moderately at 4.5% CAGR, constrained by market maturity and slower consumer shift toward peptide-driven solutions compared with Asia. Overall, Asia is anticipated to remain the anchor of global growth, while Europe retains stability and North America maintains steady but restrained expansion.

| Year | USA Myorelaxing Agents Market (USD Million) |

|---|---|

| 2025 | 260.05 |

| 2026 | 281.65 |

| 2027 | 305.03 |

| 2028 | 330.36 |

| 2029 | 357.80 |

| 2030 | 387.51 |

| 2031 | 419.69 |

| 2032 | 454.54 |

| 2033 | 492.28 |

| 2034 | 533.16 |

| 2035 | 577.43 |

The Myorelaxing Agents Market in the United States is projected to grow at a CAGR of 4.5% between 2025 and 2035, reflecting steady expansion across premium skincare, dermocosmetic, and professional aesthetic formulations. Growth is being supported by clinical demand for peptides with validated wrinkle-reduction efficacy and increasing integration of encapsulated delivery systems into high-value product lines. Professional aesthetic care adoption is strengthening as consumers seek evidence-backed treatments, while dermocosmetic formulations are gaining traction due to rising emphasis on science-driven skincare.

The Myorelaxing Agents Market in the United Kingdom is projected to grow at a CAGR of 7.1% from 2025 to 2035, supported by rising consumer adoption of dermocosmetic and premium skincare formulations. Growth is being reinforced by a strong emphasis on clinically validated products that align with regulatory standards and consumer expectations for transparency. Demand is also shaped by professional aesthetic care providers integrating peptide-based actives into treatment protocols.

The Myorelaxing Agents Market in India is forecast to expand at a CAGR of 12.2% between 2025 and 2035, making it the fastest-growing country market in this sector. Rising urbanization and growing awareness of advanced skincare actives are contributing to accelerated adoption. Demand is being shaped by the rapid rise of dermocosmetic channels and the growing influence of premium skincare within urban centers.

The Myorelaxing Agents Market in China is anticipated to grow at a CAGR of 10.9% over 2025-2035, reflecting strong demand across both premium skincare and professional aesthetic care. Growth is being driven by a sophisticated beauty ecosystem that emphasizes innovation, consumer education, and regulatory compliance.

| Countries | 2025 |

|---|---|

| USA | 21.6% |

| China | 11.0% |

| Japan | 6.4% |

| Germany | 14.2% |

| UK | 7.5% |

| India | 4.5% |

| Countries | 2035 |

|---|---|

| USA | 19.2% |

| China | 11.9% |

| Japan | 7.8% |

| Germany | 12.4% |

| UK | 6.7% |

| India | 5.5% |

The Myorelaxing Agents Market in Germany is projected to grow at a CAGR of 5.3% during 2025-2035, reflecting steady demand in Europe’s highly regulated skincare environment. Growth is being supported by stringent quality standards and the preference for clinically substantiated actives in dermocosmetic formulations.

| USA By Active Class | Market Value Share, 2025 |

|---|---|

| Botox-like peptides | 49.1% |

| Others | 50.9% |

The Myorelaxing Agents Market in the United States is projected at USD 260.05 million in 2025. Within this, Botox-like peptides contribute 49.1% share, valued at USD 127.69 million, while other active classes hold 50.9% share, amounting to USD 132.37 million. This balance illustrates how the market is shaped by a combination of established wrinkle-reducing peptides and broader bioactive alternatives that address multiple skin concerns.

The strong presence of Botox-like peptides is supported by clinical reliability and widespread adoption in dermocosmetic and premium skincare formulations. At the same time, the slightly larger share of other actives demonstrates the growing appeal of multifunctional ingredients designed to support comprehensive anti-aging claims. Continued development of analogues and new bioactive pathways is expected to reinforce competitiveness.

| China By Mechanism | Market Value Share, 2025 |

|---|---|

| Neurotransmission blocking | 46.9% |

| Others | 53.1% |

The Myorelaxing Agents Market in China is projected at USD 132.92 million in 2025. Within this, neurotransmission blocking mechanisms dominate with 46.9% share, generating USD 62.34 million in value. This leadership reflects their critical role in wrinkle modulation and their strong positioning as the most clinically validated pathway for muscle relaxation. The preference for neurotransmission blocking is reinforced by the growing demand for evidence-based dermocosmetic formulations, particularly in China’s rapidly expanding premium skincare and professional aesthetic care sectors.

While other mechanisms collectively contribute 53.1% share, they are largely fragmented across multiple functional pathways. Neurotransmission blocking is expected to sustain its dominance as innovation in peptide engineering enhances both efficacy and safety, aligning with regulatory expectations and consumer trust.

The Myorelaxing Agents Market is moderately fragmented, with global leaders, established ingredient innovators, and specialized bioactive developers competing across dermocosmetic and premium skincare applications. Global ingredient leaders such as Lipotec (Lubrizol) hold notable positions, with a global market share of 8.3% in 2025. Their strength lies in clinically validated Botox-like peptide portfolios and robust partnerships with leading skincare brands. Strategies are being directed toward encapsulation technologies, peptide analogues, and application in professional aesthetic care to reinforce leadership.

Mid-sized innovators, including DSM-Firmenich, Givaudan, Croda, and Symrise, are actively competing by offering multifunctional bioactives that integrate wrinkle modulation with broader skin health benefits. These companies are leveraging advanced R&D platforms, regional partnerships, and diversification into hydrogel complexes to strengthen formulation performance.

Specialist providers such as Mibelle Biochemistry, Ashland, Seppic, BASF, and Clariant are positioning themselves with niche technologies that emphasize stability, controlled release, and clinical substantiation. Their advantage lies in customization, formulation adaptability, and alignment with localized market requirements.

Competitive differentiation is shifting from single-ingredient performance toward integrated value, where clinical validation, delivery innovation, and sustainability credentials define leadership. Over the decade, advantage is expected to be gained by companies that combine efficacy with regulatory alignment and consumer trust.

Key Developments in Myorelaxing Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,203.2 million (2025); USD 3,005.6 million (2035); CAGR 2025-2035: 9.6% |

| Component (Segments) | Active Class, Mechanism, Delivery System |

| Active Class (examples) | Botox-like peptides; Others |

| Mechanism (examples) | Neurotransmission blocking; Others |

| Delivery System (examples) | Encapsulated; Others |

| End-use Industry | Premium skincare; Dermocosmetic; Professional aesthetic care |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | Lipotec (Lubrizol); DSM-Firmenich; Mibelle Biochemistry; Givaudan; Croda; Ashland; Seppic; Symrise; BASF; Clariant |

| Additional Attributes | Dollar sales by segment and country; leadership of encapsulated delivery for stability and controlled release; prominence of neurotransmission-blocking pathways; clinical-validation driven claims; peptide and synthetic analogue engineering; hydrogel/nanocarrier innovation; premiumization in dermocosmetics and professional care; rising Asia momentum (China, India); regulatory alignment and safety substantiation; competitive landscape led by Lipotec (Lubrizol) with global share concentration below 10% and broad fragmentation across peers. |

The global Myorelaxing Agents Market is estimated to be valued at USD 1,203.2 million in 2025.

The market size for the Myorelaxing Agents Market is projected to reach USD 3,005.6 million by 2035.

The Myorelaxing Agents Market is expected to grow at a CAGR of 9.6% between 2025 and 2035.

The key product types in the Myorelaxing Agents Market are Botox-like peptides, neurotransmission-blocking mechanisms, and encapsulated delivery systems.

In terms of segment share, encapsulated delivery systems are expected to command 52.2% share of the Myorelaxing Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA