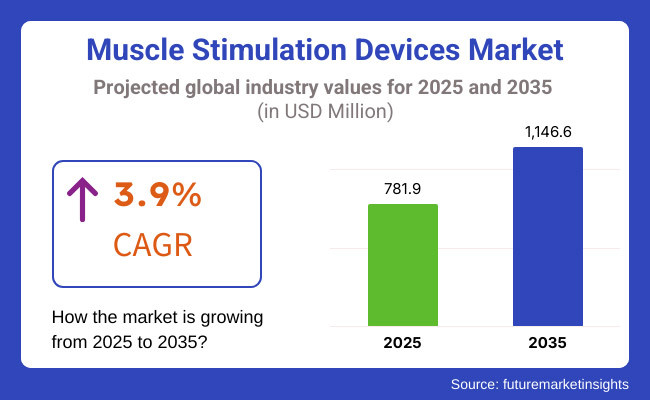

The Muscle Stimulation Devices Market is valued at USD 781.9 million USA dollars in 2025. The market to grow through CAGR 3.9% over the forecast years and is expected to reach USD 1,146.6 million by 2035.

The global muscle stimulation devices market would possibly witness an aggressive boom through the period of 2025 to 2035, owing to the increase in the occurrence of musculoskeletal disorders, innovations in medical devices, and increased emphasis on pain management therapy.

The increasing popularity of the devices among physiotherapists and the importance given to the pain management aspect in sports medicine are significant driving forces for the market expansion. The technological advancements and developments towards smaller, more user-friendly devices have improved access to and efficacy of muscle stimulation treatment.

Challenges such as strong competing therapies, tough regulatory policies, and concerns in safety are expected to hinder the progress of this market. In spite of that, it can be inferred that technology innovations, coupled with an increasing concentration on non-surgical means for treatment modalities, will bring aggressive growth to the muscle stimulating devices market.

The growth momentum in the past decade of muscle stimulation devices continues to be propelled by continuous developments in neuromuscular therapy, which has found widening applications in rehabilitation, sports recovery, and fitness.

For the period 2020 to 2025, the only change that the market witnessed in addition to the medical use was the transition to supporting sports performance as well as fitness and wellness. They began making muscle stimulators a part of their daily exercise routine to enhance the effects of the workout on muscle recovery, endurance, and injury prevention. User-friendliness and accessibility of muscle stimulators were improved by developments in wireless, wearable, and smartphone-attached technologies.

The introduction of smart electrotherapy devices with AI-based personalization also contributed substantially to adoption. In addition, increasing incidence of chronic pain disorders, postoperative rehabilitation requirements, and neurological diseases drove demand for sophisticated neuromuscular stimulation devices. Regulatory clearances and growing research investments also encouraged the launch of next-generation FDA-approved products with enhanced efficacy and safety profiles.

Region's North America would hold the largest portion of the share of muscles stimulating devices market in the forecast period, with its highly developed healthcare infrastructure, improved adoption of advanced medical technology and high prevalence of musculoskeletal disorders.

In addition, the USA is responsible for the larger share of the growing market growth because of increase in health expenditure and increasing geriatric population, which is susceptible to musculoskeletal disorders. The greater focus on rehabilitation practice and sports medicine in this region would also add to the enhanced need for muscle stimulation devices. Generally, regulatory climates are strict in the region and concurrently, easily available alternative therapies can also be hindrances to market growth in the region.

European market for muscle stimulation devices is highly important because there is growing awareness and rising proportion of non-invasive treatment options as well as a rising incidence of musculoskeletal disorders. Germany, the United Kingdom, and France are the leading economies in the market due to their high focus on innovation in the process of healthcare and rehabilitation techniques.

Growing incorporation of muscle stimulation devices into the practice of physiotherapy and pain management continues to drive market growth. Economic uncertainty and reimbursement policy variations between nations may present some challenges for this region.

The Asia-Pacific market for muscle stimulation devices is likely to capture maximum growth owing to the improved healthcare infrastructure and increasing healthcare costs along with increased awareness for advanced treatment modalities. The incidence of musculoskeletal diseases has gone up in nations such as China, India, and Japan owing to the changing lifestyles and aging population of the population.

Increasing middle-class population with increasing access to healthcare services also drives market growth Limited availability and reach in rural areas, regulatory issues are likely to slow growth in penetration in some regions of the area.

Safety Concerns and Competition from Alternative Therapies to Restrain Market Growth

There are some challenges which seem to hamper or may hinder the growth trends of muscle stimulation devices market. One of them is that alternative treatment modalities like manual physiotherapy, chiropractic therapies or medications are available, and would simply be preferred by patients and practitioners for comfort or cost-effectiveness.

Compliance and stringent testing according to regulatory guidelines for medical devices may also slow down product approvals and market access. Misuse or contraindications regarding safety of muscle stimulation devices also pose challenges as skepticism can arise among users and healthcare providers from adverse events. Continued education, solid clinical evidence, and compliance with regulatory requirements to see to it that muscle stimulation devices are used effectively and safely would be needed in managing such issues.

Expanding Market Potential Driven by Technological Innovation and Growing Demand in Homecare Settings

There is a bright future for improving the muscle stimulation devices market: better and modern improvements in technology such as developing wireless, easy-to-use, and portable devices promote compliance by patients and expand the use of muscle stimulators in home care.

Opportunities of growth within the market can also be found in the burgeoning emphasis on sports medicine rehabilitation and pain management as fitness enthusiasts and athletes continue to seek effective recovery devices.

Moreover, there is increasing incidence of musculoskeletal disorders globally, emphasizing the importance of effective treatment methods, thus making muscle stimulation devices as reasonable alternatives. Collaborating to conduct clinical trials between manufacturers and healthcare providers would further establish the effect of such devices, hence promoting increased usage in clinical practice.

Rising Sports and Rehabilitation Applications Boost Muscle Stimulator Usage

Innovations and developments in the muscle stimulators industry are brought about by the movement of technology and the increased focus on non-invasive therapies. The convergence of wireless technology and mobile applications is a major advance that allows users to operate muscle stimulators from a distance as well as customize treatment protocols, enhancing convenience and improving compliance.

Furthermore, development towards improvement of wearable technology in muscle stimulators keeps gaining ground, allowing lowest and continuous therapy for chronic pain patients and rehabilitation needs patients. The trend for the market is also miniaturization, leading towards less bulky and more convenient devices to satisfy the growing demand for home care.

Furthermore, associations between sports organizations and equipment manufacturers are pushing forward usage of muscle stimulators in sports training and rehabilitation, which portrays the versatility and increasing applications of these devices.

Integration of Muscle Stimulators with Holistic Therapies Enhances Treatment Outcomes

A developing tendency in the market for muscle stimulation products is that the increases in the use of combined treatments, where the use of muscle stimulators has been combined with other treatment strategies such as physical therapy, massage, or medication treatment have led to maximal therapeutic outcomes.

The holistic treatment philosophy is gradually being adopted by physicians seeking to offer comprehensive care regimens crafted for individual patients according to their needs. Another trend capturing attention is customized therapy brought by devices bearing advanced features allowing customization of stimulation parameters based on patient-specific status and response to treatment.

Customization drives the efficient treatment and thereby satisfaction levels in patients. In addition, there has been an increasing emphasis on research and development activities to find new indications for muscle stimulators.

In 2020 to 2024, the market for muscle stimulant devices also exhibited robust expansion from expanding uses for rehabilitation, sporting recovery, alleviation of pain, and physical fitness. There was mounting occurrence of musculoskeletal illnesses, rising patient education on nonsurgical pain interventions, and enhancing technologic features for neuromuscular electric stimulation (NMES) and transcutaneous electrical nerve stimulation (TENS) technologies promoting industry growth.

There was escalating utilization of wear and portable muscle stimulators particularly amongst sportsmen as well as among physiotherapeutic institutions. Nevertheless, expensive devices, variable reimbursement policies, and regulatory issues in medical use were challenges.

Into 2025 to 2035, the market will be defined by AI-enabled muscle stimulators, wireless and app-linked devices, and growing applications in neurological rehabilitation. Regulatory paradigms will mature to distinguish between medical-grade devices and consumer wellness products, promoting safety and effectiveness.

Home-use device demand will continue to increase, especially among aging populations and those who desire at-home pain relief and rehabilitation solutions. Sustainability activities will concentrate on environmentally friendly battery technologies and reusable, long-life electrode materials. Supply chain resiliency will also be improved through local production and electronic component supplier diversification.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Varying regulations for medical vs. consumer-grade muscle stimulators; stringent FDA and CE approvals for medical use. |

| Technological Advancements | Development of wearable and wireless muscle stimulators, increased use of NMES and TENS for therapy. |

| Consumer Demand | Growth in sports recovery, pain management, and rehabilitation applications. |

| Market Growth Drivers | Rising cases of musculoskeletal disorders, growing aging population, and increased focus on non-invasive therapies. |

| Sustainability | Limited emphasis on sustainability; disposable electrodes and battery waste concerns. |

| Supply Chain Dynamics | Dependence on electronics manufacturers; occasional disruptions in supply chain due to semiconductor shortages. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | More refined regulations to distinguish medical-grade and wellness devices, ensuring safety and efficacy. |

| Technological Advancements | AI-integrated smart devices, improved biofeedback capabilities, and next-gen wireless connectivity for personalized therapy. |

| Consumer Demand | Increasing adoption for home use, post-stroke therapy, and neurological rehabilitation. |

| Market Growth Drivers | Expansion of home-based healthcare, advancements in neurostimulation, and greater adoption in fitness and wellness. |

| Sustainability | Shift toward rechargeable, eco-friendly batteries and durable, reusable electrode materials. |

| Supply Chain Dynamics | Diversification of electronic component suppliers, increased regional manufacturing, and improved production stability. |

The United States market for muscle stimulation devices is becoming all-inclusive with the rising incidence of musculoskeletal disorders, modernization of medical device technologies, and the rising fitness concerns for rehabilitation. An increase in the elderly population makes arthritis and back pain cases rise; hence, the demand for muscle stimulators increases regarding pain management and physical therapy.

The introduction of covetable, ergonomic, and easily transportable, user-friendly devices boosts their sale among athletes and fitness buffs for muscle recuperation and performance improvement. Yet high-device costs and regulatory standards form hindrances to market growth. The impact of such constraints will continue to remain inspirational along with innovations in technology and alternatives for non-invasive treatment.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.6% |

Market Outlook

The German muscle stimulation devices market has been expanding steadily due to well-covered healthcare systems, an increasing elderly population, and a vibrantly active physiotherapy and rehabilitation industry. Musculoskeletal conditions are common among the elderly, demanding the supervision of effective therapeutic measures.

Besides this, Germany's well-placed medical device industry provides an environment for innovation to foster the growth of advanced muscle stimulators. The other part of the health and wellness culture incorporates such devices within sports medicine practices. Nevertheless, regulatory stringency and reimbursement difficulties might inhibit market growth. Nonetheless, high-quality healthcare delivery coupled with technological advancements could drive the market in time to come.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.2% |

Market Outlook

In China, the burgeoning muscle stimulation devices market is on its way to evolve most rapidly due to economic development, growing healthcare investments, and increasing awareness about physical fitness. The development of the city and sedentary lifestyles leads to an increase in musculoskeletal issues, subsequently creating a possible demand for treatment options.

The government's emphasis on medical modernization and the growth of rehabilitation centers should also favor market growth. Finally, although muscle stimulators are provided by local costs-effective devices, they are more accessible. In spite of this, unevenness in regards to the availability of healthcare and variation in regulatory standards might create challenges in this respect. These notwithstanding, the emerging middle class and health and wellness concerns should continue to propel the market development.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.6% |

Market Outlook

India's muscle stimulation devices market is poised for enormous growth due to the rising rates of chronic pain diseases and the rise of healthcare awareness. The expansion of physiotherapy services is also benefiting the muscle stimulation devices market. Effective therapeutic measures are warranted in a scenario plagued by factors like bad ergonomics and physical inactivity, which place a burden of musculoskeletal disorders.

The general framework created for providing healthcare services and the enhanced availability of advanced treatments through established public-private partnerships have all further accelerated this trend. The growth in the number of domestic manufacturers giving affordable devices also facilitates more advancement in the market.

However, low awareness levels in the rural areas and a disparity in healthcare quality might imprison this growth. Nevertheless, the market shall steer ahead because of the increasing focus of investors on non-invasive treatments and improving discretionary income.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.1% |

Market Outlook

The muscle stimulation devices market in Brazil is growing on account of a dynamic improvement in health infrastructure, increasing appreciation of sports medicine, and mounting incidence of musculoskeletal disorders. In the realm of sports and physical activities, many injuries demand effective rehabilitation aids. Initiatives to integrate advanced therapies in the public health system and the growth of private providers contribute to the access of muscle stimulators.

However, economic disparity and regional disparities in access may present challenges to market growth. Nevertheless, escalating awareness of physiotherapy, soaring investments in sports rehabilitation, and upscale developments in private medical facilities shall keep the market developing.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 5.4% |

Neuromuscular Electrical Stimulator (NMES): Dominating the Market with Expanding Rehabilitation Applications

NMES or Neuromuscular Electrical Stimulators devices are one of the significant modules within muscle stimulation devices, as these NMES devices have see wide acceptance in rehabilitation, muscle re-training, and post-surgical recovery. An NMES device provides electrical impulses to cause contraction of muscle as part of strengthening, prevention of muscle wasting, and better blood supply to a muscle.

The patient receiving rehabilitation therapy uses NMES extensively in physical therapy, sports rehabilitation, and post-stroke recovery-making it the major assuaging mechanism for patients with neuromuscular disorders, patients with spinal cord injuries, and weakness of muscles. Furthermore, increasing demand for home-based rehab devices and advanced technology such as wireless and wearable NMES inevitably drives this segment.

Transcutaneous Electrical Nerve Stimulator (TENS): Growing Usage in Pain Management

The TENS gets into the country by proof of noninvasive pain relief therapy. Byusing TENS, very important segment in muscle stimulation devices market, these devices give low voltage electrical currents via the skin to block pain signal attraction along certain pathways or release endorphin for pain relief.

TENS technology has been particularly effective for long-term pain conditions such as arthritis, fibromyalgia, back pain, and postoperative pain management. The growth in the industry has been mainly due to the ever-rising demand for portable over-the-counter TENS devices and smart stimulation systems worn on the body. Also, growing inclination towards drug-free methods to manage pain because of distress on opioid use has led to an increased worldwide demand for TENS devices.

Pain Management: Leading the Market with Rising Demand for Non-Pharmacological Therapies

Management of any aspect of pain is a major application segment for muscle stimulation devices, primarily due to ever-increasing rates of chronic pain conditions, particularly of musculoskeletal origin. Conditions such as arthritis, lower back pain, sports injuries, and postoperative pain have led to the adoption of TENS and NMES devices as supplementary means of pain relief in these cases.

On the global level, however, the shift toward noninvasive, drug-free pain treatment along with the growing geriatric population marvelously adds fuel to this segment, which is also flourishing due to innovation around smart app-connected muscle stimulation devices, making the users that much more efficient and accessible with respect to pain management at their homes, thus propping up the technology further into the arena.

Neurological & Movement Disorder Management: Growing Adoption in Rehabilitation Therapy

Increase in the adoption of muscle stimulation devices for the treatment of neurological disorders and movement impairments is further sustaining this segment. NMES and Functional Electrical Stimulation interventions for stroke rehabilitation, spinal cord injury recovery, and Parkinson's intervention serve to restore functional performance and independent mobility.

These devices essentially provide help to reactivate muscles, nerve regenerative properties, and improve coordination. Hence, they have become mandatory in neuro-rehabilitation. However, new robotic-assisted therapies, AI-driven electrical stimulation devices, and government-sponsored stroke rehabilitation programs are also drawing interest to boost muscle stimulation device applications within this segment.

The muscle stimulation devices market is experiencing steady growth due to the increasing adoption of electrical stimulation therapies for pain management, rehabilitation, and fitness enhancement. Advancements in neuromuscular electrical stimulation (NMES) and transcutaneous electrical nerve stimulation (TENS) technologies are driving demand.

Key players in the market are focusing on product innovation, expanding applications, and strategic partnerships to strengthen their competitive positioning. The market is highly competitive, with established medical device manufacturers and emerging companies investing in next-generation muscle stimulation solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DJO Global, Inc. | 21.4% - 23.7% |

| Zynex, Inc. | 15.0% - 16.9% |

| Omron Healthcare, Inc. | 10.7% - 13.2% |

| NeuroMetrix, Inc. | 8.6% - 9.5% |

| Other Companies (combined) | 34.7% - 36.6% |

| Company Name | Key Offerings/Activities |

|---|---|

| DJO Global, Inc. | Provides NMES and TENS devices for rehabilitation and pain relief. |

| Zynex, Inc. | Specializes in non-invasive pain management and muscle stimulation therapies. |

| Omron Healthcare, Inc. | Develops portable TENS units for consumer and clinical applications. |

| NeuroMetrix, Inc. | Focuses on wearable neuromodulation devices for chronic pain management. |

Key Company Insights

DJO Global

Advances its empire as the industry leader for muscle stimulation devices with a wide variety of NMES and TENS products precisely for physical therapy, rehabilitation, and pain management. In addition, the company continues with its promising research and development plus acquisition activity within its product portfolio.

Zynex

Entails non-invasive muscle stimulation technology, mainly aimed at sophistication in the improvement of recovery among patients and the therapeutic treatment pain relief methods. Besides, the company is expanding its outreach in the markets through strategic partnerships and product innovation.

Omron

Stands among the key players in TENS units for home use. Portable, easy-to-use devices for muscle stimulation and pain relief are made so that they can be used at home. Its concept is mainly centered on easy purchases at pocket-friendly prices. Known for its neuro-modulation wearable devices.

NeuroMetrix

Targets the chronic patient suffering from pain and nerve stimulation. It also spends actively on developing AI-induced modalities toward the management of pain.

Several other companies contribute significantly to the muscle stimulation devices market by offering innovative and cost-effective solutions. Notable players include:

As demand for muscle stimulation devices continues to grow, companies are prioritizing innovation, regulatory compliance, and user-friendly designs to expand their market presence and improve patient outcomes.

TENS, IF, BMAC, NMES

Pain Management, Neurological & Movement Disorder Management and Musculoskeletal Disorder Management

Hospitals, Physiotherapy Clinics, Sports Clinics and Home Care

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Muscle Stimulation Devices Market was USD 781.9 million in 2025.

The Muscle Stimulation Devices Market is expected to reach USD 1,146.6 million in 2035.

Growing Preference for Muscle Stimulation Devices has significantly increased the demand for Muscle Stimulation Devices Market.

The top key players that drives the development of Muscle Stimulation Devices Market are DJO Global, Inc., Zynex, Inc., Omron Healthcare, Inc., NeuroMetrix, Inc. and BioMedical Life Systems.

TENS leading is Muscle Stimulation Devices Market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-user, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-user, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-user, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End-user, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End-user, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-user, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-user, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-user, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-user, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-user, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-user, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-user, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-user, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-user, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-user, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-user, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-user, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Muscle Relaxing Creams Market Size and Share Forecast Outlook 2025 to 2035

Muscle Oxygen Monitors Market Size and Share Forecast Outlook 2025 to 2035

Muscle Relaxant Drugs Market Size and Share Forecast Outlook 2025 to 2035

Muscle Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Muscle Tension Dysphonia Treatment Market - Trends, Growth & Forecast 2025 to 2035

Fish Muscle Protein Market Analysis by Species, Type, Form and Application Through 2035

Well Stimulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Neurostimulation Market Growth - Size, Trends & Forecast 2025 to 2035

Photostimulation Lasers Market

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Motion Stimulation Therapy Market Trends – Growth & Forecast 2024-2034

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

MRI-Safe Neurostimulation Systems Market Growth - Trends & Forecast 2025 to 2035

Non-invasive Brain Stimulation System Market Size and Share Forecast Outlook 2025 to 2035

Functional Electrical Stimulation (FES) Market Trends - Growth & Forecast 2025 to 2035

Repetitive Transcranial Magnetic Stimulation Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA