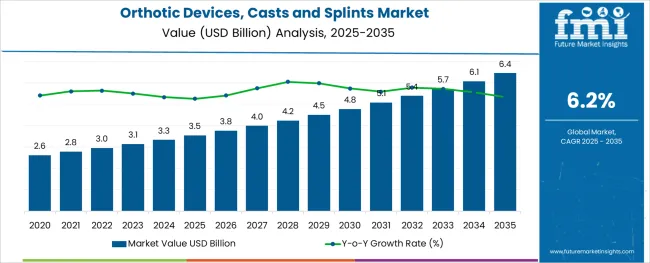

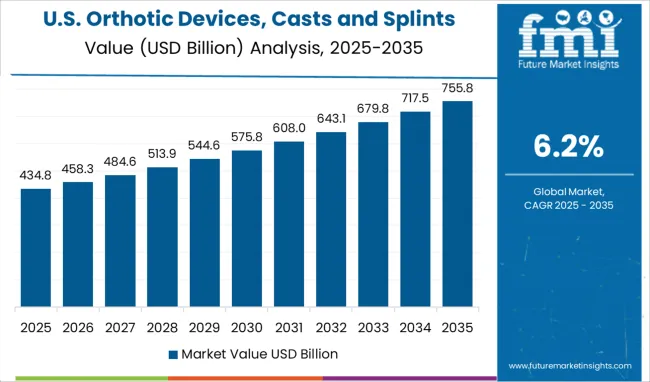

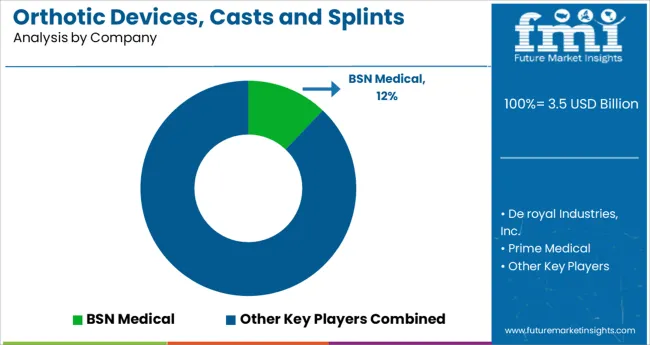

The Orthotic Devices, Casts and Splints Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The orthotic devices casts and splints market is advancing steadily due to the rising prevalence of musculoskeletal disorders, sports injuries, and age-related orthopedic conditions. With increasing awareness of non-invasive orthopedic care and the growing burden of road traffic and occupational injuries, healthcare providers are emphasizing customized and supportive immobilization products.

Technological advancements in lightweight, breathable, and anatomically adaptive materials are reshaping both product design and patient comfort. Hospitals and trauma centers are integrating digitally modeled orthoses and 3D-printed cast systems, improving fit accuracy and healing outcomes.

Concurrently, government spending on emergency and rehabilitation infrastructure, especially in emerging economies, is boosting demand. Additionally, orthopedic solutions are increasingly embedded into post-surgical recovery and chronic care protocols, expanding their role in long-term therapy. As institutional procurement rises and clinical protocols evolve, the market is expected to grow through value-driven innovation, digital customization platforms, and integrated patient management ecosystems.

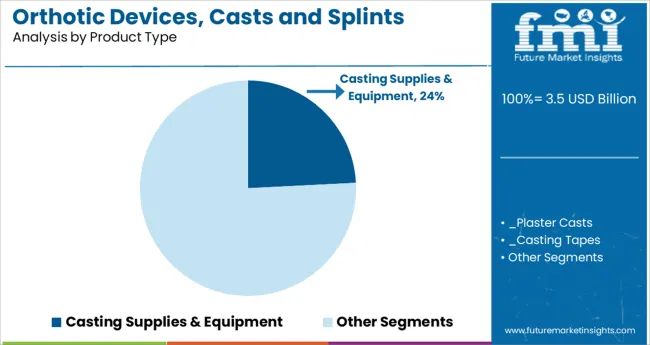

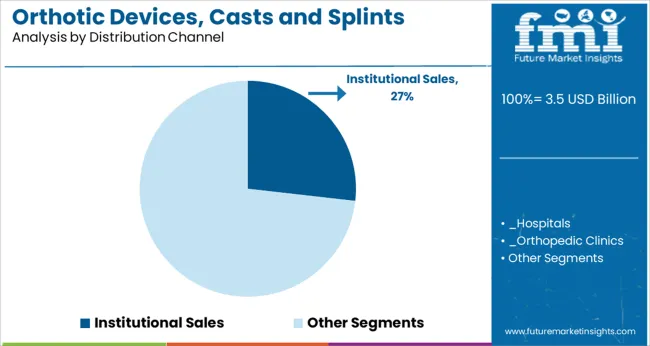

The market is segmented by Product Type and Distribution Channel and region. By Product Type, the market is divided into Casting Supplies & Equipment, Splinting Supplies & Equipment, and Orthotics. In terms of Distribution Channel, the market is classified into Institutional Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Casting supplies and equipment are projected to account for 24.2% of total market revenue in 2025, positioning this product category as a significant contributor to market share. This leadership is being supported by the essential role these products play in fracture management, joint stabilization, and orthopedic post-operative care.

The high utilization of fiberglass and plaster cast systems, alongside associated tools and consumables, has remained consistent across trauma and surgical settings. Increasing surgical volumes and emergency room visits have sustained demand for reliable immobilization materials that provide structural integrity and quick setting properties.

Innovations in water-resistant and radiolucent cast materials have enhanced clinical efficiency and patient comfort, reinforcing market preference. The combination of product reliability, cost-effectiveness, and critical application in acute care environments continues to drive consistent demand within this segment.

Institutional sales are projected to contribute 26.8% of total revenue in the distribution channel category in 2025, making it the leading mode of market access. This dominance is attributed to centralized procurement by hospitals, rehabilitation centers, and government healthcare institutions that prioritize volume-based purchasing and clinical standardization.

Institutions frequently require cast and orthotic solutions for emergency, surgical, and long-term rehabilitative care, ensuring consistent demand. Bulk procurement frameworks, reimbursement policies, and negotiated vendor contracts have facilitated stable supply chains and price optimization.

Furthermore, institutional buyers are increasingly seeking integrated solutions that include training, digital fitting tools, and clinical support services. As treatment protocols increasingly incorporate supportive orthopedic devices into primary care and post-discharge pathways, institutional sales are expected to maintain their prominence in driving sustained product utilization and revenue growth.

| Particulars | Details |

|---|---|

| H1, 2024 | 5.39% |

| H1, 2025 Projected | 5.54% |

| H1, 2025 Outlook | 5.24% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 30 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 15 ↓ |

According to Future Market Insights' analysis, the global orthotic devices, casts and splints market expects to drop by 15 Basis Point Share (BPS) in H1-2025 as compared to H1- 2024. Whereas in comparison to H1-2025 projected value, the market during H1-2025 outlook period will show a dip of 30 BPS.

The drop in the BPS values is associated with the costs related to the replacement, repairs, and modifications of orthotic devices. Moreover, significant drawbacks concerning the interaction of orthotic devices, such as, orthosis and prosthetics, with respect to material properties, has further provided a restraint towards the growth in the BPS outlook.

Conversely, with the introduction of 3D printing technology and the adoption of CAD/CAM, the manufacturing costs of orthotic devices, casts and splints will significantly be reduced. This factor is set to propel the growth of the market through the forecasted years.

Key developments in the market include incorporation of neuromuscular signal technology, microprocessor technology, and 3D printing for novel orthotic devices.

Rising Incidence of Sports Injuries Worldwide Driving Market Growth

From 2014 to 2024, the market value of the orthotic devices, casts, and splints industry registered a CAGR of 5.8%.

Orthotic devices, casts, and splints are a key management option for various types of injuries. The increase in the number of injuries suffered due to road accidents, as well as during recreational and professional sporting events has remained a key market driver.

As per ASIRT (Association of System Integrators and Retailers in Technology), almost 50 million people get adversely affected by road accidents every single year globally.

Also, per the AAOS (American Academy of Orthopedic Surgeons), over 25% of sports injuries concern lower extremities. The CDC states that close to 9.2 Million children aged 1 to 19 get admitted to the emergency departments in the wake of sports injuries. Moreover, around 62% of sports injuries occur during practice than during actual games.

Increasing prevalence of age-related osteoporotic fractures, musculoskeletal problems, and trauma caused by road accidents and falls, as well as the growing geriatric population, are likely to drive the global market.

The global orthotic devices, casts, and splints market is projected to rise at a 6.2% CAGR from 2025 to 2025.

Advancements in 3D Technology to Boost Sales of Orthotic Devices, Casts, and Splints

The orthotic devices, casts, and splints industry will be revolutionized by rising technologies such as 3D imaging and scanning, CAM/CAD, and so on. These technologies will become more widely available in the future years, allowing patients to 3D print orthotic devices in the comfort of their own homes.

As people seek alternatives to surgical deformity repair and pain management, the use of orthotic devices will be promoted around the world. Furthermore, advancements in orthotic devices are making them more accessible and affordable.

Factors such as continuous technological advancements in 3D technology, increase in the number of people suffering from orthopedic ailments, and requirement for robot-assisted and minimally invasive techniques are offering substantial growth opportunities for orthotic system manufacturers.

High Cost of Orthotic Devices & Complications with Orthopedic Surgery Hampering Market Expansion

One of the most significant challenges impeding the market growth is the high cost of orthotic devices.

Inadequately trained medical attendants and nurses apply casts in rural areas. This could result in complications as discomfort on the part of patients could be higher. This factor remains a challenge, especially in developing economies as overcrowding of patients in city-based hospitals makes treatments difficult.

Continuous Innovations in Orthotics Driving Market Growth in North America

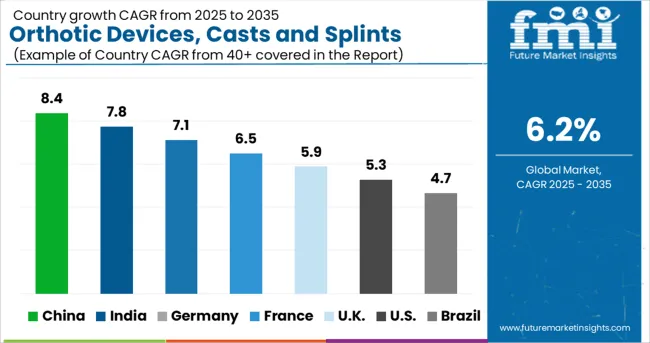

North America is expected to account 38% share of the orthotic devices, casts, and splints market in 2025. The use of orthotic devices for pain management in the senior population, the increase in sports injuries, the rise in the incidence of spine diseases, and the rise in the incidence of neuromuscular and musculoskeletal illnesses among the population are all driving the market expansion.

Innovations in orthotics and well-planned reimbursement regulations are expected to drive orthotic devices market growth over the coming years.

High Adoption of Advanced Products Fueling USA Market Growth

Rising adoption of universal health coverage in developed and developing markets, rising product launches, steadily increasing healthcare infrastructure and expenditure, and the presence of key suppliers of orthotic devices, casts, and splints are key factors propelling orthotic systems market growth in the United States.

Skilled professionals, availability of refined and advanced items, and rising demand for advanced products and therapies are driving orthotic equipment market growth in the U.S.

Favorable Government Initiatives for Improvement of Healthcare Facilities Driving Demand Growth

Market growth in China is anticipated to expand at a rapid pace during the forecast period due to the rising rate of urbanization and government attempts to improve healthcare facilities.

Furthermore, propelling medical tourism due to the availability of cost-effective and advanced healthcare treatment alternatives, a rise in disposable income, and increased adoption of novel technology are bolstering the market growth in China.

Splinting Supplies & Equipment Gaining Traction Owing to Their Cost-effective Nature

Splinting supplies & equipment are predicted to develop rapidly over the coming years due to advantages such as the simplicity of making plastic splints, which allows for quick customization, and the high adaptability and strength of neoprene splints.

Increased instances of road accidents and musculoskeletal injuries, a growing population base of people over the age of 65, and the frequency of orthopedic complications associated with ageing are driving the demand for orthopedic casts and splints.

The capacity of these products to enhance patient compliance in terms of secured support and comfort over the course of treatment, rising technological advancements, and the use of advanced materials by manufacturers are driving demand for splinting supplies and equipment.

Hospitals to Generate Highest Market Revenue Due to Growing Number of Orthopedic Surgery Operations

Hospitals have a considerable market share due to an increase in the number of admissions for the treatment of traumatic and spinal injuries, bone fractures, and injuries incurred in car accidents.

Demand for orthotic devices, casts, and splints in hospitals is being driven by an increase in the number of orthopedic surgical operations that require post-operative patient rehabilitation and favorable reimbursement for personalized orthotic devices across major countries.

Hospitals utilize orthotic devices, casts, and splints for a variety of reasons, including preventive, post-operative patient rehabilitation, osteoarthritis treatment, and maxillofacial operations. Orthotic devices, casts, and splints are the most commonly used in hospitals because of their extensive use in the treatment of spinal fusion and delayed union and nonunion bone fractures.

Shortfalls in conventional manufacturing processes of orthotics imply that it could take ages for patients to acquire the devices that they require. As such, technological advancements are being focused upon. These advancements are likely to create a competitive edge for providers of orthotic devices, casts, and splints during the forecast period.

Companies are continuously coming up with new ways to ramp up production, such as capacity increases and new product development. To boost revenue sales, they are also focusing on partnership-oriented techniques such as acquisitions and mergers.

For instance

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2025 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | Value in million, Volume in Units |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Product Type, Distribution Channel, Region |

| Key Companies Profiled | Fillauer LLC; ComfortFit Orthotic Labs Inc.; Hanger Inc.; Amfit Inc.; Ascent Meditech Ltd.; De royal Industries, Inc.; Performance Health Inc.; DJO, LLC; Zimmer Biomet Holdings, Inc.; Stryker Corporation; 3M Healthcare |

The global orthotic devices, casts and splints market is estimated to be valued at USD 3.5 billion in 2025.

It is projected to reach USD 6.4 billion by 2035.

The market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types are casting supplies & equipment, _plaster casts, _casting tapes, _cast cutters, _casting tools and accessories, splinting supplies & equipment, _fiberglass splints, _plaster splints, _other splints, _splinting tools and accessories, orthotics, _functional orthotics and _accommodative orthotics.

institutional sales segment is expected to dominate with a 26.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Dental Orthotic Devices Market Analysis – Growth & Future Outlook 2025 to 2035

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA