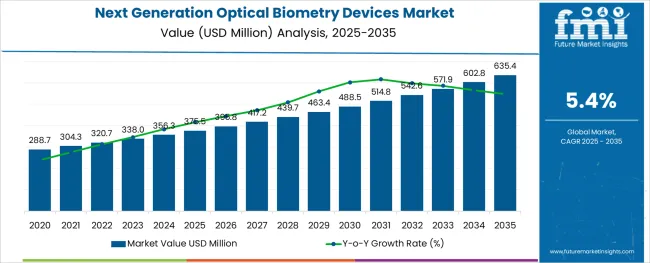

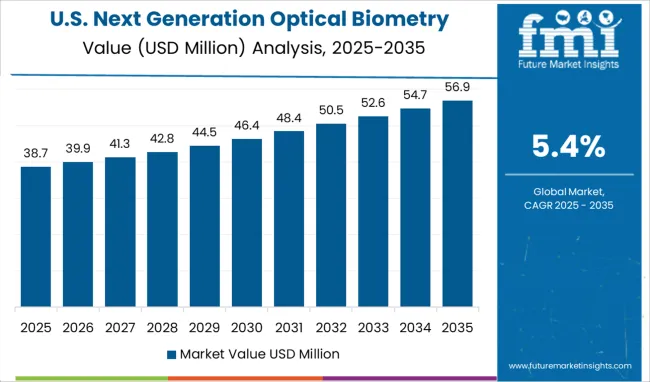

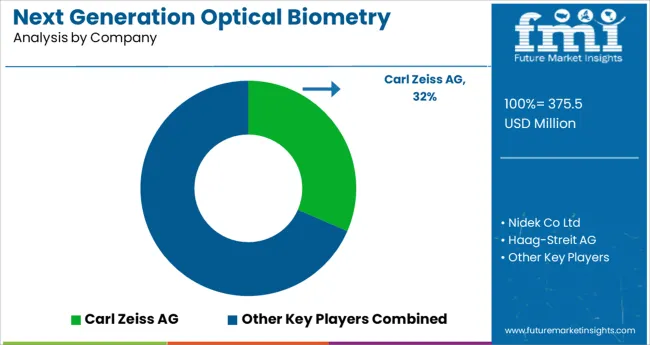

The Next Generation Optical Biometry Devices Market is estimated to be valued at USD 375.5 million in 2025 and is projected to reach USD 635.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The next generation optical biometry devices market is expanding steadily due to advancements in diagnostic imaging technologies that enhance eye care precision. Increasing adoption of non-invasive and highly accurate devices has transformed ocular measurements, improving outcomes in cataract and refractive surgeries. The rising prevalence of eye disorders and the growing number of ophthalmic procedures have heightened the demand for sophisticated biometry solutions.

Clinics and specialized eye care centers are investing in cutting-edge devices to provide faster and more reliable measurements that support personalized treatment plans. Technological improvements such as enhanced image resolution and automated data analysis have increased clinical efficiency and patient throughput.

Moreover, the trend towards outpatient eye care facilities and growing awareness about vision health are contributing to market growth. The future outlook remains positive as device manufacturers continue innovating with patient-friendly features and integration capabilities with surgical systems.

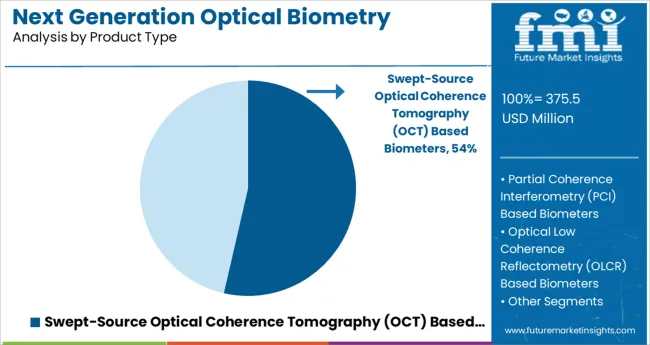

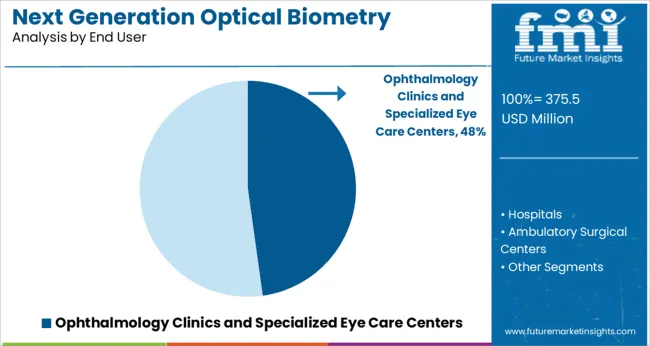

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Swept-Source Optical Coherence Tomography (OCT) Based Biometers, Partial Coherence Interferometry (PCI) Based Biometers, and Optical Low Coherence Reflectometry (OLCR) Based Biometers. In terms of End User, the market is classified into Ophthalmology Clinics and Specialized Eye Care Centers, Hospitals, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Swept-Source Optical Coherence Tomography (OCT) Based Biometers, Partial Coherence Interferometry (PCI) Based Biometers, and Optical Low Coherence Reflectometry (OLCR) Based Biometers. In terms of End User, the market is classified into Ophthalmology Clinics and Specialized Eye Care Centers, Hospitals, and Ambulatory Surgical Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Swept-Source Optical Coherence Tomography (OCT) Based Biometers segment is expected to account for 53.6% of the market revenue in 2025, maintaining its lead among product types. This segment’s growth has been propelled by the superior imaging capabilities of swept-source OCT technology, which allows for deeper tissue penetration and faster scan times compared to traditional devices. The enhanced accuracy in measuring ocular parameters such as axial length and corneal thickness has made these devices essential for precise intraocular lens calculations and surgical planning.

Clinicians favor swept-source OCT based biometry for its ability to capture high-resolution images in challenging cases including dense cataracts.

As ophthalmology clinics aim to improve surgical outcomes and patient satisfaction, the adoption of this technology is expected to grow steadily.

The Ophthalmology Clinics and Specialized Eye Care Centers segment is projected to represent 47.8% of the market revenue in 2025, securing its position as the dominant end user. Growth in this segment is driven by the increasing number of surgical and diagnostic procedures conducted in specialized facilities that focus on eye health. These centers require advanced optical biometry devices to enhance diagnostic accuracy and streamline preoperative assessments.

The rising patient volumes and demand for high-quality eye care services have encouraged investment in the latest biometry technologies.

Additionally, specialized eye care centers are often early adopters of innovative medical devices, supporting the widespread use of next generation optical biometers. As outpatient care expands and patient expectations rise, this segment is expected to maintain its leadership in device adoption.

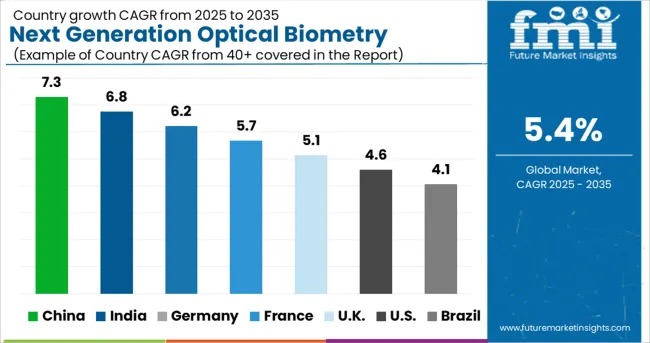

The North American next generation optical biometry devices market is projected to account for 26.8% of the global market share in 2025.

According to the Prevent Blindness organization, 25 Million Americans having cataract require medical care every year in the USA, thereby boosting demand for next generation optical biometry equipment in the region.

Rising acceptance of advanced optical biometry equipment, quick development of eye care infrastructure, and changing lifestyles are some of the factors that are predicted to contribute to next generation optical biometry devices market expansion in the region.

The USA government has increased its healthcare expenditure to approximately 7% by providing Medicare and Medicaid services - fueling availability of reimbUSAment for cataract surgeries. This is driving demand for advanced next generation optical biometry devices.

Patient safety is of topmost priority in the USA, which signals demand for faster and better ocular imaging. Emergence of optical devices, high potency and fastness of these devices, and growing number of hospitals are factors driving market growth of next generation optical biometry instruments and devices in the USA

Growing demand for next generation optical biometry devices is being noted in the UK due to rising number of cataract surgeries.

Growing use of next generation optical biometry devices for cataract surgeries in hospitals as well as progressive increase in the number of government and private hospitals in the UK are expected to boost demand growth of next generation optical biometry devices.

Increase in the number of cataract treatments performed and rising adoption of innovative practices for such procedures will also propel the market forward.

In terms of revenue, swept-source optical coherent based biometry devices will account for significant revenue share in the next generation optical biometry devices industry over the forecast period. Swept-source optical coherent based biometry devices are set to exhibit highest revenue share in the next generation optical biometry devices market

Swept-source optical coherent based optical biometry devices are gaining popularity in the USA market. This category of next generation optical biometry devices is used especially at hospitals and ophthalmology clinics and specialized eye centers.

Some of the qualities driving demand for swept-source optical coherent based biometry devices include fast data capture, several measurements in a single process, enhanced wavelength, and the capacity to overcome ocular opacities.

The superiority of swept-source optical coherent based biometry devices over partial coherent interferometry is demonstrated by their ability to measure the axial length along six separate axes.

Hospitals account for 41.8% revenue share in next generation optical biometry device demand.

The market is predicted to grow as the number of private and government hospitals gradually increases. Growing use of next generation optical biometry devices in medical settings, such as hospitals, is expected to boost overall market expansion.

Medical services and vision benefits offered under Medicare include cataract surgeries, which will increase demand for next generation optical biometry devices over the coming years. Patients' increased trust in hospitals that are committed to providing all types of medical solutions will further fuel market growth.

The competition section of the next generation optical biometry devices industry report features the profiles of key players based on their market shares, differentiating strategies, product offerings, and marketing approach.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | Value in million, Volume in Units |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Mexico, Argentina, Germany, Italy, France, UK, Nordic, Spain, Japan, China, India, Malaysia, Thailand, Australia, GCC Countries, South Africa, Turkey |

| Key Market Segments Covered | Product Type, End User, Region |

| Key Companies Profiled | Nidek Co Ltd.; Ziemer Ophthalmic Systems; TOMEY GmbH; Movu Inc.; OCULUS Optikgeräte GmbH.; Bausch & Lomb Incorporated; Topcon Corporation; Heine Optotechnik GmbH & Co. KG; AMETEK, Inc.; Optovue, Incorporated; Leica Microsystems GmbH |

| Pricing | Available upon Request |

The global next generation optical biometry devices market is estimated to be valued at USD 375.5 million in 2025.

It is projected to reach USD 635.4 million by 2035.

The market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types are swept-source optical coherence tomography (oct) based biometers, partial coherence interferometry (pci) based biometers and optical low coherence reflectometry (olcr) based biometers.

ophthalmology clinics and specialized eye care centers segment is expected to dominate with a 47.8% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA