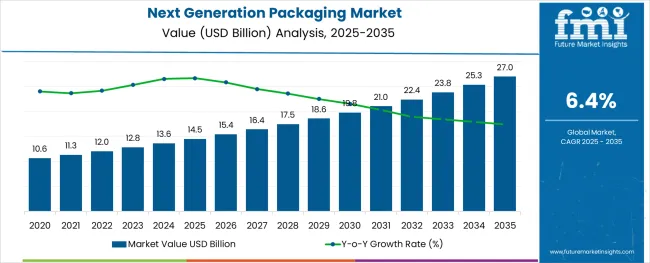

The next generation packaging market is set to grow from USD 14.5 billion in 2025 to USD 27 billion by 2035, registering a CAGR of 6.4% during the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14.5 billion |

| Industry Value (2035F) | USD 27 billion |

| CAGR (2025 to 2035) | 6.4% |

Smart packaging solutions equipped with sensors and embedded data chips are being used to monitor freshness, improve shelf-life, and reduce spoilage, particularly in temperature-sensitive segments like pharmaceuticals and fresh produce.

Global adoption of connected packaging in food and beverage manufacturing has grown by over 60% in the last five years as firms seek real-time inventory tracking and anti-counterfeit assurance.

The demand for compostable and biodegradable materials is accelerating as regulations tighten on single-use plastics, especially in the EU and North America. In Asia Pacific, market expansion is driven by the need for durable transit packaging in high-growth e-commerce sectors.

Automation in packaging lines is also rising, with deployment of robotic systems improving throughput by 30% in several tier-one manufacturing hubs. The market is evolving from cost-efficiency to value-enhancing design that integrates intelligence into every layer.

The next generation packaging market is carving out a unique space across multiple high-value verticals. Within the USD 1.2 trillion global packaging industry, future-forward formats such as active, smart, and sustainable packaging hold a 6-8% share, supported by rising demand for shelf-life extension and traceability.

In the USD 3.5 trillion food and beverage industry, 10-12% of packaging innovation budgets are now funneled into intelligent solutions like time-temperature indicators and freshness sensors. Pharmaceuticals allocate 8-10% of their packaging spend to tamper-proof and interactive technologies that support patient safety.

The e-commerce players are integrating smart tracking features into 5-7% of their parcels to improve supply chain transparency. Even in the USD 300 billion eco-packaging segment, 6-9% is dedicated to circular-ready next-gen designs.

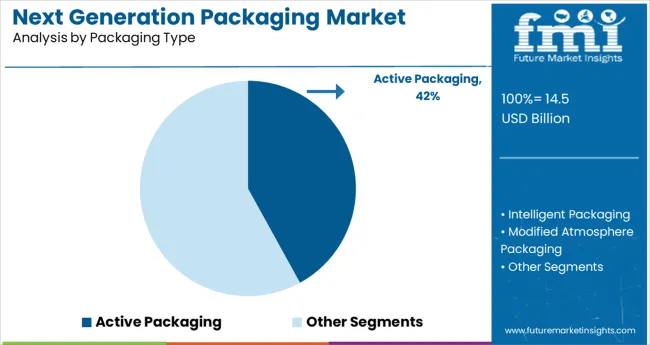

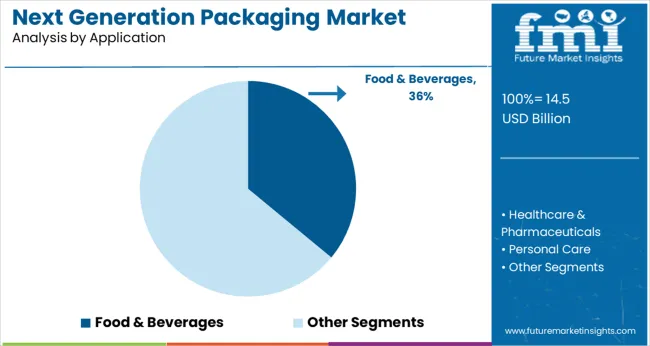

The next generation packaging market is gaining momentum through active packaging innovations and strong demand from the food and beverage sector. Growth is fueled by evolving consumer preferences, safety regulations, and the rise of intelligent, eco-conscious packaging formats.

Active packaging is anticipated to hold a 42% market share by 2025, emerging as the top-performing segment. This packaging type enhances shelf life, quality, and safety by interacting directly with the contents or environment inside the package. The segment is being propelled by advancements in oxygen scavengers, antimicrobial layers, and moisture control systems.

The food and beverages segment is projected to account for 36% of the next generation packaging market by 2025. Growing consumer demand for freshness, convenience, and safety is transforming packaging strategies across the F&B industry. Functional packaging designs are gaining traction for ready-to-eat meals, functional drinks, and organic produce.

Next generation packaging is accelerating through integration of freshness indicators, QR-enabled traceability, and smart barrier technologies. Active and intelligent packaging formats are reshaping supply chain visibility, especially in perishable food and pharma.

Smart Label Adoption Transforms Cold Chain Monitoring

Sales of smart labels with time-temperature indicators (TTIs) grew 43% YoY, driven by perishables and vaccine logistics. Retailers using irreversible TTIs on meat products saw spoilage-related returns drop by 28%. QR-based labels integrated with cold chain platforms improved traceability scan rates by 36% at final delivery. Pharmaceutical exporters using NFC-enabled tags reduced temperature excursion incidents by 21%. End-users receiving dynamic freshness alerts via mobile apps increased engagement by 31%, boosting brand loyalty. As regulatory frameworks tighten around pharmaceutical stability and food safety, smart packaging adoption is expanding into mid-tier brands, supported by scalable SaaS platforms and lower per-unit sensor costs.

Antimicrobial Films Reduce Spoilage Across Fresh Produce

Use of antimicrobial active packaging films in fresh-cut fruits and vegetables expanded 39% in 2025. Supermarkets deploying silver-ion infused trays reported a 22% extension in shelf life and 19% reduction in visual decay. Modified atmosphere packs (MAP) incorporating active oxygen scavengers achieved spoilage rate reductions of up to 26% in leafy greens. Trial rollouts in Latin America and Southeast Asia led to a 34% drop in post-distribution waste at retail. Recyclable antimicrobial pouches gained traction among exporters, with 18% higher acceptance in EU customs due to enhanced hygiene claims. These performance gains are driving ROI-focused upgrades in produce packaging lines.

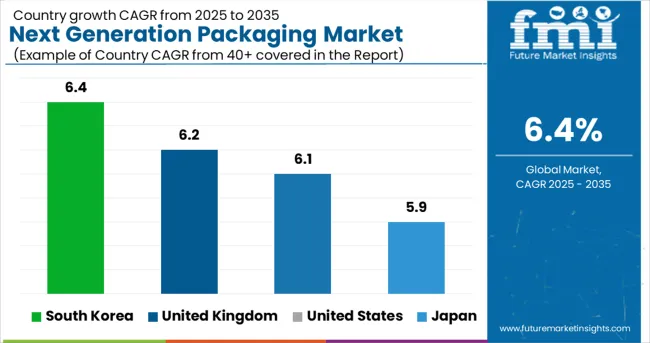

| Country | CAGR (2025-2035) |

|---|---|

| South Korea | 6.4% |

| United Kingdom | 6.2% |

| United States | 6.1% |

| Japan | 5.9% |

The global market for next generation packaging is expected to grow at a CAGR of 6.4% between 2025 and 2035. South Korea mirrors this global average at 6.4%, supported by strong investments in smart labeling technologies and active packaging systems across the food and pharma sectors.

The United Kingdom follows closely with a 6.2% CAGR, driven by rising sustainability mandates and demand for recyclable, intelligent packaging in consumer goods. The United States reports a 6.1% CAGR, with companies expanding automation and IoT-integrated packaging lines.

Japan’s CAGR stands at 5.9%, just below the global mark, as aging population trends push for increased adoption of easy-to-open and tamper-evident designs. While the OECD countries continue to shape the market with regulatory innovation and advanced R&D capabilities, growth in BRICS and ASEAN regions is expected to intensify post-2030 as infrastructure for smart packaging continues to mature.

The report provides insights across 40+ countries. The four below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 6.4% through 2035, South Korea is emerging as a leader in next generation packaging innovation. From 2020 to 2024, adoption was primarily driven by the cosmetics and consumer electronics sectors. The rapid expansion in smart retail and cold chain logistics is now increasing demand for active and intelligent packaging solutions. Korean tech firms are investing in embedded sensors and NFC-based tracking in packaging.

Expected to grow at a CAGR of 6.2% between 2025 and 2035, the UK market is undergoing a transformation in packaging sustainability. The 2020–2024 period saw a rise in recyclable and compostable materials, driven by retail compliance mandates. Looking ahead, food and beverage brands are incorporating intelligent labelling, oxygen scavengers, and antimicrobial layers to extend shelf life and reduce waste.

The US market is projected to grow at a CAGR of 6.1% through 2035, evolving from the early-stage adoption observed between 2020 and 2024. Growth is now propelled by increasing investment in automation and supply chain traceability across food, healthcare, and e-commerce sectors. Sensor-enabled packaging, RFID tagging, and tamper-evident technologies are gaining traction.

Japan is forecast to expand at a CAGR of 5.9% over the next decade. From 2020 to 2024, limited consumer engagement with smart packaging hindered growth, but momentum is building as convenience store chains adopt traceability and freshness monitoring systems. Emphasis is being placed on packaging that balances minimalism with embedded intelligence.

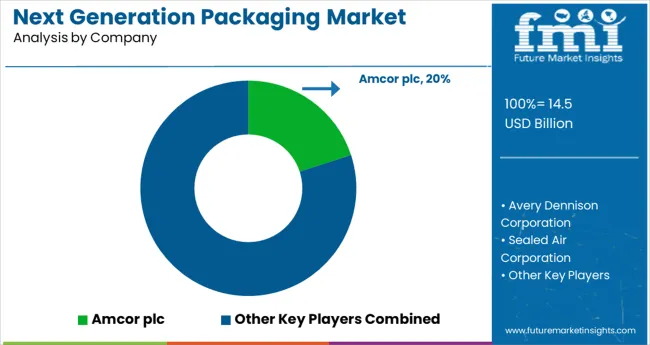

The next-generation packaging market is moderately consolidated, with innovation-driven leaders shaping the competitive landscape. Amcor plc holds the top position with an estimated 20% global market share, driven by its breakthrough bio-based and recyclable polymer solutions integrated into food and medical packaging.

Avery Dennison and Sealed Air each capture approximately 12%, leveraging smart-label technologies and barrier-pack formats favored in retail and e-commerce. Stora Enso and Smurfit Kappa command about 10% combined in paper-based sustainable packaging, emphasizing fiber-based alternatives.

BASF SE and Storopack specialize in advanced foam and insulated packaging for temperature-sensitive shipments, together holding close to 8%. EcoEnclose, PolyPak, and Fluence Automation serve niche segments with compostable, low-carbon, and automation-enabled systems, respectively.

Recent Next-Generation Packaging Industry News

In November 2024, Amcor announced a stock‑only merger with Berry Global valued at USD 8.4 billion. The combined company, Amcor plc, expects USD 650 million in annual synergies by 2028 and aims to scale its consumer, healthcare, and sustainable packaging offerings significantly.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 14.5 billion |

| Projected Market Size (2035) | USD 27 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Packaging Types Analyzed (Segment 1) | Active Packaging (Antimicrobials, Gas Scavengers, Gas Emitters, Others), Intelligent Packaging (Sensors, Indicators, Tags), Modified Atmosphere Packaging |

| Applications Analyzed (Segment 2) | Food & Beverages, Healthcare & Pharmaceuticals, Personal Care, Logistics & Supply Chain, Others (Automotive & Industrial) |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Amcor plc, Avery Dennison Corporation, Sealed Air Corporation, Stora Enso, BASF SE, Storopack , EcoEnclose , PolyPak Packaging, Smurfit Kappa, Fluence Automation |

| Additional Attributes | Dollar sales by packaging type and application, rapid adoption of smart tracking solutions, increased demand for shelf-life extension technologies, and sustainability-driven innovations in intelligent and active packaging systems. |

Includes active packaging (antimicrobials, gas scavengers, gas emitters, others), intelligent packaging (sensors, indicators, tags), and modified atmosphere packaging.

Applied in food & beverages, healthcare & pharmaceuticals, personal care, logistics & supply chain, and other sectors like automotive & industrial.

Analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, and the Middle East & Africa.

The market is expected to reach USD 27 billion by 2035, growing from USD 14.5 billion in 2025.

The market is projected to grow at a CAGR of 6.4% over the forecast period.

Active packaging holds the top position, contributing 42% of the total market share in 2025.

Food & beverages lead the application landscape, accounting for 36% of the market in 2025.

South Korea is the fastest-growing country, registering a CAGR of 6.4% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Next Generation Packaging Industry

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA