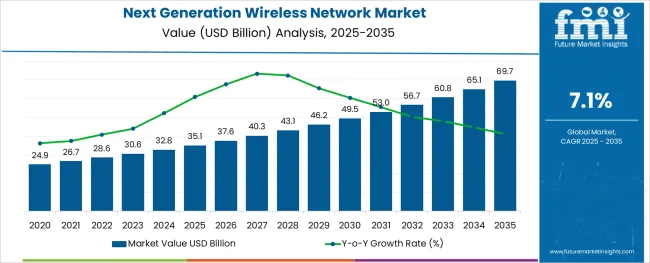

The Next Generation Wireless Network Market is estimated to be valued at USD 35.1 billion in 2025 and is projected to reach USD 69.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The next generation wireless network market is expanding rapidly as demand for faster, more reliable, and higher-capacity connectivity continues to grow. The evolution of wireless technologies has been driven by the increasing need to support data-intensive applications such as streaming, cloud computing, and the Internet of Things. Telecommunications providers have been investing heavily in upgrading their infrastructure to next generation networks to improve user experience and meet the growing bandwidth requirements.

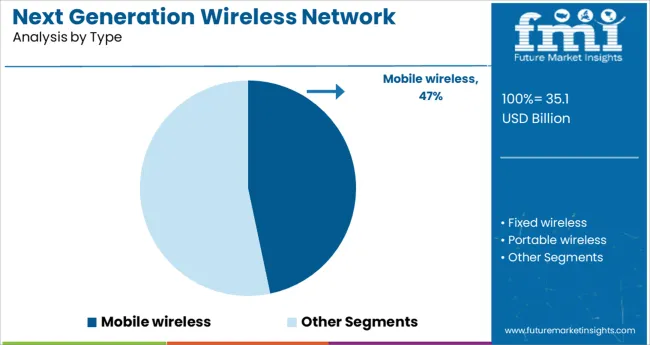

The adoption of mobile wireless technology plays a pivotal role in enabling flexible and scalable network deployment. Additionally, government initiatives promoting digital transformation and smart city projects are accelerating market growth.

As consumer expectations rise and new use cases emerge, the market is expected to advance with ongoing innovation in wireless standards and network architectures. Segment growth is anticipated to be led by the mobile wireless type and the telecommunications sector as the primary end use.

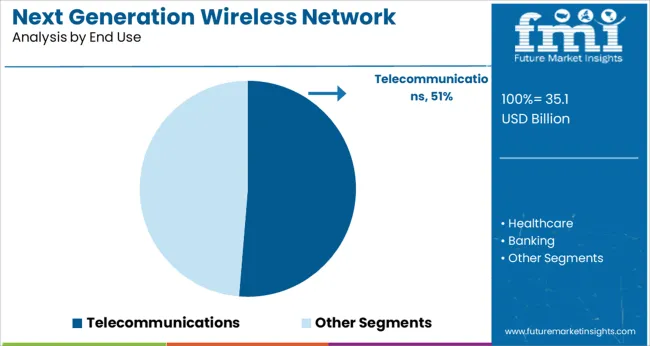

The market is segmented by Type and End Use and region. By Type, the market is divided into Mobile wireless, Fixed wireless, Portable wireless, and IR wireless. In terms of End Use, the market is classified into Telecommunications, Healthcare, Banking, IT services, Automotive, and Security systems.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile wireless segment is projected to account for 46.7% of the next generation wireless network market revenue in 2025, holding a leading position in network types. This segment’s growth has been propelled by the widespread adoption of smartphones and mobile devices that demand seamless high-speed connectivity. Mobile wireless networks offer the flexibility to cover large geographic areas and accommodate varying user densities, making them ideal for both urban and rural deployments.

The continuous upgrade from earlier wireless generations to more advanced standards has enhanced data speeds and reduced latency. Mobile operators have prioritized network expansion and densification strategies to meet user demand and improve coverage.

As mobile data consumption continues to rise globally, the mobile wireless segment is expected to maintain its dominance.

The telecommunications segment is projected to contribute 51.3% of the next generation wireless network market revenue in 2025, solidifying its role as the largest end use category. Growth in this segment is driven by the imperative for telecom providers to enhance network capacity and quality to support growing subscriber bases and new digital services.

Telecom operators are the primary stakeholders deploying next generation wireless infrastructure, including 5G and beyond, to enable faster data transmission and low latency applications.

The increasing demand for advanced network services such as enhanced mobile broadband, ultra-reliable low latency communications, and massive machine-type communications has further fueled investment in this sector.

Regulatory support and spectrum allocation initiatives have facilitated rapid network rollouts. As telecommunications continue to evolve as the backbone of digital economies, this segment is expected to sustain its leadership in the market.

The factors driving the adoption of next generation wireless network are high speed, low prices and increasing applications and usage.

These next generation wireless network also provides more coverage and secured access than existing networks, improving the next generation wireless network adoption trends.

The increasing applications of wireless technology like self-driving cars, drones, household appliances and industrial machines are leading to an uptick in demand for next generation wireless network.

According to the next generation wireless network market survey, it is also predicted that developments in wireless sensor networks, informatics, and telecommunications likely present lucrative opportunities to market participants.

The factor significantly dwindling the next generation wireless network market size include the trade between the flexibility of use and the platforms.

Interoperability with existing technology, compatibility issues with old devices and high initial investment are other factors negatively impacting the next generation wireless network market outlook.

Many businesses and governmental organisations are actively participating in investments in and R&D efforts for the NGN infrastructure, which is still in its early stages.

Large network companies are expanding their reach and looking for investment opportunities by offering virtual training and education and expanding their next generation wireless network market share.

Additionally, the next generation wireless network market statistics are on a rising trajectory as the need for reliable internet and data services during the pandemic has prompted mergers and partnerships for product development, etc.

By geography, North America is anticipated to be at the forefront of the next generation wireless network market, with a share of 34.9% in 2025.

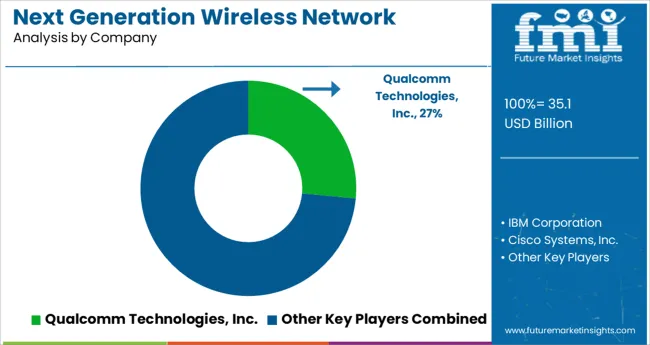

Many large companies like Qualcomm Technologies, Cisco Systems, Inc., and AT&T Inc. are investing in next generation wireless network due to the high availability of bandwidth, the growth of IoT in the region and wide network coverage.

The presence of developed nations like the USA and Canada, constant technological advancement, and infrastructure investments in communication technologies in these countries facilitates the adoption of next generation wireless network.

The next generation wireless network market trends and forecast are further improved by the availability of abundant bandwidth, the presence of multinational companies, and the expansion of the Internet of Things.

In terms of product development and introduction, European countries are setting the pace for innovation. Due to this, there is a significant rise in the demand for next generation wireless network on a global level.

Additionally, they are engaging in joint ventures with businesses to improve the services offered and advance the wireless communication industry.

Future mobile wireless systems are likely posed by capacity problems that are being addressed by the SAMURAI project.

The scientific and business communities can access the OpenAirInterface and ASGARD code through an open development licence. This guarantees that SAMURAI's contribution will be highlighted in any subsequent research.

The SAMURAI findings have the capacity to establish Europe as a significant player in next-generation wireless systems, shaping the region's next generation wireless network market key trends & opportunities.

High power consumption is one of the main issues facing high-speed communication networks.

Since WiFi 6 technology is still in its early stages of development, devices that operate at higher speeds tend to use a lot of power.

Start-ups and scaleups create solutions to reduce the amount of power used by wireless networks to achieve this.

The US-based start-up ETA Wireless offers technology for reducing the power consumption of wireless communication networks, including WiFi 6.

The power consumption of smartphones, wearables, and Internet of Things (IoT) devices is significantly reduced thanks to the start-up's ETAdvanced power management chip for wireless communications.

The start-up uses its innovative power amplifier architecture to constantly optimise how much energy devices use.

The key players in the next generation wireless network market are Qualcomm Technologies, Inc., IBM Corporation, Cisco Systems, Inc., AT&T Inc., Idea cellular, Nokia Corporation, Semtech Corporation, Sigfox technology, Verizon Digital Media Services and T-Mobile International AG.

Some of the recent developments in the next generation wireless network market are:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Type, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; The Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Qualcomm Technologies, Inc.; IBM Corporation; Cisco Systems, Inc.; AT&T Inc.; Idea cellular; Nokia Corporation; Semtech Corporation; Sigfox technology; Verizon Digital Media Services; T-Mobile International AG |

| Customization | Available Upon Request |

The global next generation wireless network market is estimated to be valued at USD 35.1 billion in 2025.

It is projected to reach USD 69.7 billion by 2035.

The market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types are mobile wireless, fixed wireless, portable wireless and ir wireless.

telecommunications segment is expected to dominate with a 51.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Next-generation Titrator Market Growth – Industry Trends & Forecast 2024-2034

Next Generation Ultrasound Systems Market

Next Generation Blood Gas Monitors System Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA