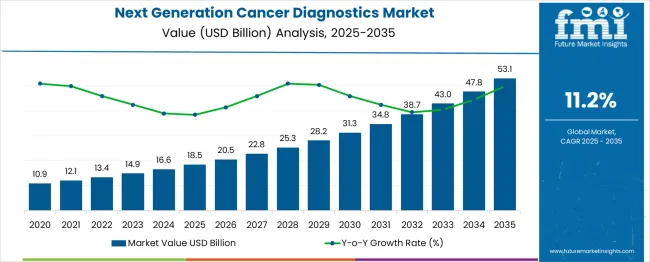

The next-generation cancer diagnostics market, valued at USD 18.5 billion in 2025, is set to grow to USD 53.1 billion by 2035, with a CAGR of 11%. Initially, from 2025 to 2027, the market grows steadily, from USD 18.5 billion to USD 20.5 billion, driven by advancements in genetic testing, liquid biopsy technologies, and AI-enhanced diagnostic tools. The demand for more accurate, less invasive methods for early cancer detection boosts adoption across healthcare systems globally, particularly in oncology and personalized medicine.

From 2027 to 2030, the market accelerates further, growing from USD 20.5 billion to USD 25.3 billion, as cancer diagnostics technologies become more refined and widely adopted. The introduction of novel biomarkers and improved testing methods for a wider range of cancer types accelerates market expansion. The saturation point, however, is expected to emerge after 2030, when the market moves from USD 31.3 billion to USD 34.8 billion by 2032. As the technology matures, the growth rate gradually slows, although demand continues to rise, particularly in emerging regions and among underserved populations. By 2035, the market will reach USD 53.1 billion, reflecting a phase of stable growth with market saturation.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 18.5 billion |

| Forecast Value in (2035F) | USD 53.1 billion |

| Forecast CAGR (2025 to 2035) | 11% |

The market is experiencing substantial growth, driven by several key factors, each contributing in a distinct proportion to the overall market expansion. One of the primary drivers is the ongoing advancements in next-generation sequencing (NGS), which is transforming cancer diagnostics by offering higher accuracy, faster results, and the ability to detect cancer at earlier stages. This technology, along with liquid biopsy innovations, which allow non-invasive detection through blood tests, accounts for a significant share of the market. These advancements are particularly important in the early detection of cancers, where early intervention greatly improves patient outcomes.

In terms of market ratio, NGS-based diagnostics holds a major proportion of the market due to its broad applicability across various cancer types and its ability to personalize treatment plans. Liquid biopsy is gaining traction, but its share is still growing as it becomes more refined and accessible. Imaging technologies and biomarker tests also play a vital role, though they contribute slightly less compared to genetic sequencing solutions. Geographically, North America holds the largest market share, benefiting from advanced healthcare infrastructure and regulatory frameworks, while Asia-Pacific is expected to see rapid growth, driven by increasing healthcare investments and rising cancer incidence rates.

Market expansion is being supported by the increasing global cancer burden and the corresponding demand for accurate, early detection methods. Modern healthcare systems are increasingly focused on precision medicine approaches that can identify specific genetic mutations and biomarkers to guide targeted therapy selection. Next generation sequencing technologies offer comprehensive genomic profiling capabilities that enable clinicians to make informed treatment decisions based on individual patient characteristics.

The growing emphasis on personalized cancer care is driving demand for companion diagnostics that can predict treatment response and identify patients most likely to benefit from specific therapies. Rising healthcare expenditure in emerging markets and improving access to advanced diagnostic technologies are creating opportunities for market expansion. The increasing collaboration between pharmaceutical companies and diagnostic manufacturers is also contributing to the development of integrated diagnostic-therapeutic solutions.

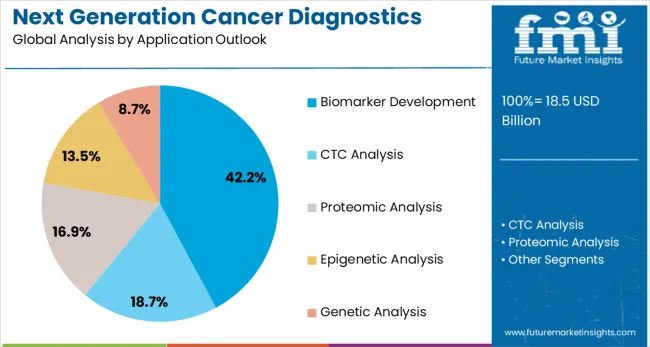

The market is segmented by technology outlook, application outlook, cancer type outlook, function outlook, and region. By technology outlook, the market is divided into Next Generation Sequencing, qPCR & Multiplexing, LOAC & RT-PCR, Protein Microarrays, and DNA Microarrays. Based on application outlook, the market is categorized into Biomarker Development, CTC Analysis, Proteomic Analysis, Epigenetic Analysis, and Genetic Analysis. In terms of cancer type outlook, the market is segmented into Lung Cancer, Breast Cancer, Colorectal Cancer, and Cervical Cancer. By function outlook, the market is classified into Therapeutic Monitoring, Companion Diagnostics, Prognostics, Cancer Screening, and Risk Analysis. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Next generation sequencing (NGS) technology is projected to account for 37.3% of the next generation cancer diagnostics market in 2025, reinforcing its position as the leading platform for comprehensive genomic profiling. NGS enables the simultaneous analysis of multiple genes, mutations, and structural variants in a single test, providing detailed molecular insights that are essential for precision oncology. This technology's superior sensitivity and specificity allow for the detection of low-frequency mutations and complex genomic alterations, which traditional diagnostic methods may miss. NGS platforms are widely used across various cancer types and clinical settings, from research laboratories to diagnostic facilities. As sequencing costs continue to decline and turnaround times improve, NGS adoption is rapidly expanding across healthcare systems worldwide, significantly contributing to market growth.

Biomarker development is projected to represent 42.2% of next generation cancer diagnostics demand by 2025, reflecting its critical role in advancing precision medicine. This application focuses on identifying and validating molecular markers that can predict treatment response, disease progression, and patient outcomes. Pharmaceutical companies and research institutions invest heavily in biomarker discovery to support drug development and optimize clinical trials. The segment benefits from increasing regulatory emphasis on companion diagnostics, which are used to tailor treatments based on genetic profiles. Advances in genomic and proteomic technologies have accelerated the identification of novel biomarkers, supporting the development of more effective cancer therapies. As personalized medicine becomes the standard of care, biomarker development will continue to play a central role in improving patient outcomes and healthcare efficiency.

The therapeutic monitoring function is forecasted to account for 25.8% of the next generation cancer diagnostics market in 2025, reflecting its growing importance in assessing treatment response and monitoring disease progression. This application enables clinicians to track tumor evolution, monitor the efficacy of treatments, and detect resistance mechanisms in real-time. Liquid biopsy technologies, which analyze circulating tumor DNA and cells, play a crucial role in therapeutic monitoring. These non-invasive methods allow for continuous monitoring of treatment effectiveness and early detection of disease progression, offering significant advantages over traditional tissue biopsies. As cancer treatment approaches become more adaptive, therapeutic monitoring is essential for optimizing treatment regimens while minimizing adverse effects. The integration of AI-powered analytics into monitoring tools further enhances clinical decision-making, improving treatment outcomes throughout the patient journe

The next generation cancer diagnostics market is advancing rapidly due to increasing cancer incidence globally and growing adoption of precision medicine approaches. The market faces challenges including high implementation costs, regulatory complexity, and the need for specialized infrastructure and expertise. Innovation in liquid biopsy technologies and AI-powered diagnostic platforms continue to influence product development and clinical adoption patterns.

The integration of artificial intelligence (AI) and machine learning (ML) is significantly enhancing cancer diagnostics by enabling precise analysis of complex genomic and imaging data. AI algorithms excel at pattern recognition, identifying subtle molecular markers that may go unnoticed by traditional methods. These technologies not only improve the accuracy of diagnostic interpretations but also reduce the time required for data analysis, allowing for faster clinical decisions. Machine learning models can predict treatment outcomes by analyzing large-scale datasets, helping clinicians tailor personalized therapy plans for cancer patients.

The rise of liquid biopsy technologies is changing the landscape of cancer diagnostics by offering a non-invasive alternative to traditional tissue biopsies. Liquid biopsies use blood-based tests to detect cancer-related genetic mutations, providing real-time insights into tumor presence and behavior. This technique is advantageous as it reduces patient discomfort, allows for regular monitoring, and can identify tumor heterogeneity, which may be critical for tracking treatment efficacy and resistance. Liquid biopsy platforms are increasingly utilized in early cancer detection, treatment selection, and ongoing disease surveillance.

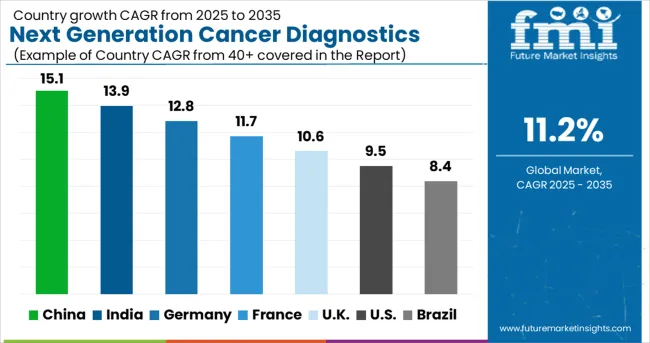

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.1% |

| India | 13.9% |

| Germany | 12.8% |

| France | 11.7% |

| UK | 10.6% |

| USA | 9.5% |

| Brazil | 8.4% |

The next generation cancer diagnostics market is experiencing robust growth globally, with China leading at a 15.1% CAGR through 2035, driven by massive healthcare infrastructure investment, government support for precision medicine, and increasing cancer incidence rates. India follows closely at 13.9%, supported by expanding healthcare access, growing medical tourism, and increasing adoption of advanced diagnostic technologies. Germany shows strong growth at 12.8%, emphasizing research excellence and clinical implementation of genomic diagnostics. France records 11.7%, focusing on comprehensive cancer care integration and biomarker development programs. The UK shows 10.6% growth, prioritizing NHS genomics initiatives and precision medicine implementation.

The report covers an in-depth analysis of 40+ countries with top-performing countries are highlighted below.

Revenue from next generation cancer diagnostics in China is projected to exhibit strong growth with a CAGR of 15.1. This growth is attributed to an increasing cancer burden, rapid advancements in diagnostic technologies, and rising healthcare investments. As the healthcare infrastructure expands, there is a significant shift towards adopting cutting-edge diagnostic solutions like AI-based tools, liquid biopsies, and molecular diagnostics. These technologies enable quicker and more accurate cancer detection, improving patient outcomes. The government’s strong focus on cancer prevention programs, early detection, and personalized medicine further accelerates the market. Growing awareness about cancer and the expansion of diagnostic services in urban and rural areas are driving demand. International collaborations, along with domestic innovation in diagnostic technologies, are enhancing the accessibility and affordability of cancer diagnostics.

The next-generation cancer diagnostics market in India is projected to expand at a CAGR of 13.9% through 2035, fueled by the rising incidence of cancer and a growing emphasis on early detection and personalized healthcare. The expanding healthcare infrastructure, government initiatives for affordable diagnostics, and the rise of medical tourism are contributing to this rapid growth. The adoption of advanced diagnostic technologies, including genetic testing, biomarker profiling, and liquid biopsy, is gaining momentum in India, enabling early cancer detection with higher accuracy. India’s vast population and increasing access to healthcare services are also contributing to market growth. The government’s growing focus on cancer awareness, as well as its efforts to improve access to affordable diagnostic services, is expected to further drive demand.

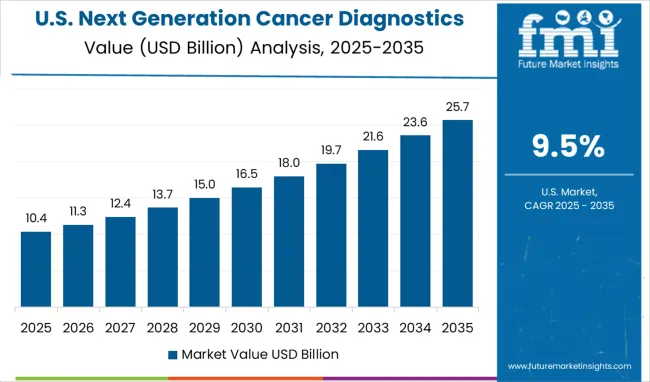

The USA next-generation cancer diagnostics market is experiencing significant growth with a CAGR of 9.5% through 2035, propelled by advancements in precision medicine, cutting-edge technologies like AI, and a strong healthcare infrastructure. The USA has been a pioneer in adopting next-gen diagnostic tools such as genetic testing, liquid biopsy, and molecular profiling, enabling early detection of various cancer types. With a growing focus on personalized cancer therapies, the demand for accurate and efficient diagnostic solutions is increasing across the country. The USA market benefits from substantial investments in medical research and development, especially in AI-powered diagnostic solutions and advanced imaging technologies. The integration of digital health technologies and regulatory support for innovation is expected to drive the growth of the cancer diagnostics market. Increased focus on precision medicine and genomics.

Revenue from next generation cancer diagnostics in Germany is projected to grow at a CAGR of 12.8% through 2035, driven by the country's strong emphasis on research excellence, clinical validation, and systematic healthcare delivery. Germany’s healthcare infrastructure is among the most advanced in Europe, and the demand for advanced diagnostic tools, such as genetic testing and liquid biopsies, is rising rapidly. The country’s commitment to personalized healthcare is facilitating the adoption of cutting-edge technologies in cancer diagnostics. German healthcare providers and research institutions are working closely to integrate AI, machine learning, and genomics to improve diagnostic accuracy and treatment outcomes. Germany’s robust medical research and development sector ensures continuous technological advancements in the field.

The next-generation cancer diagnostics market in the UK is projected to grow at a CAGR of 10.6% through 2035, driven by the National Health Service’s (NHS) initiatives to implement early cancer detection programs and the rapid adoption of advanced diagnostic technologies. With a high emphasis on evidence-based medicine, the UK is integrating AI, genomic testing, and liquid biopsy technologies into the cancer care continuum. The country’s robust healthcare system and strong regulatory framework support the development and deployment of innovative diagnostic tools that enable faster and more accurate detection of cancer. The increasing focus on precision medicine and personalized cancer therapies is further fueling the growth of the market.

The next-generation cancer diagnostics market in France is anticipated to increase at a CAGR of 11.7% through 2035, supported by the country’s commitment to providing high-quality healthcare and the growing demand for early cancer detection solutions. France has a well-established healthcare system, and the integration of cutting-edge diagnostic technologies such as AI-powered imaging tools, genetic testing, and molecular diagnostics is expected to gain traction in the coming years. Government-funded cancer research initiatives are also playing a significant role in advancing diagnostic tools, especially in personalized oncology. The focus on precision medicine, along with increased awareness of genetic risks, is driving the demand for sophisticated diagnostic techniques. The development of innovative diagnostic technologies, including liquid biopsy and genomic profiling, is transforming cancer detection and making it more accessible.

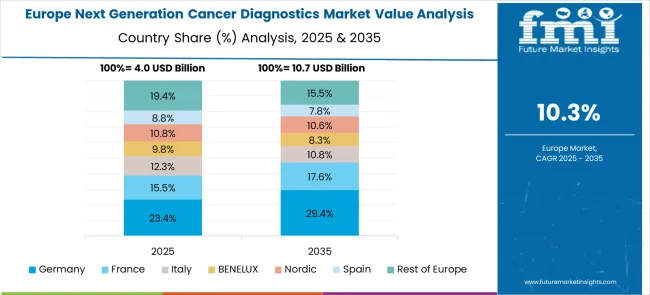

The next generation cancer diagnostics market in Europe demonstrates strong development across major economies with Germany showing robust presence through its advanced healthcare infrastructure and significant investment in precision medicine initiatives, supported by leading diagnostic companies and research institutions developing innovative NGS-based cancer testing solutions that integrate seamlessly with clinical workflows. France represents a significant market driven by its comprehensive cancer care programs and strong emphasis on molecular diagnostics, with companies leveraging advanced genomic technologies to develop sophisticated biomarker identification and companion diagnostic platforms.

The UK exhibits considerable growth through its National Health Service initiatives supporting precision medicine adoption and comprehensive cancer genomics programs, with organizations like Genomics England leading large-scale sequencing projects that advance diagnostic capabilities. Germany and France show expanding investment in personalized cancer care infrastructure, particularly in comprehensive genomic profiling and targeted therapy selection. BENELUX countries contribute through their focus on healthcare innovation and adoption of cutting-edge diagnostic technologies, while Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding access to advanced cancer diagnostic solutions across diverse healthcare systems.

The next generation cancer diagnostics market is characterized by competition among established diagnostic companies, pharmaceutical manufacturers, and emerging biotechnology firms. Companies are investing in advanced sequencing technologies, AI-powered analytics platforms, comprehensive test menu development, and strategic partnerships to deliver accurate, accessible, and clinically actionable cancer diagnostic solutions. Technology innovation, regulatory compliance, and clinical evidence generation are central to strengthening product portfolios and market presence.

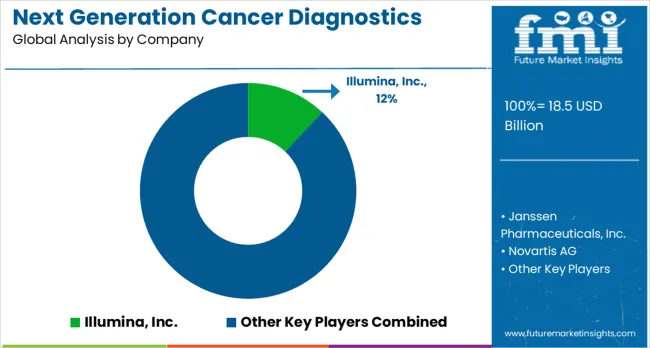

Illumina Inc., USA-based, leads the market with 12.0% global value share, offering comprehensive NGS platforms and consumables with a focus on genomic analysis and research applications. Janssen Pharmaceuticals Inc., operating globally, provides integrated diagnostic-therapeutic solutions with emphasis on companion diagnostics and biomarker development. Novartis AG delivers comprehensive oncology diagnostic platforms across multiple cancer types and therapeutic areas. F. Hoffmann-La Roche Ltd focuses on personalized healthcare solutions that combine diagnostic testing with targeted therapeutic options.

Koninklijke Philips N.V. emphasizes healthcare technology integration and clinical workflow optimization. QIAGEN provides sample preparation and molecular diagnostic solutions with focus on precision medicine applications. Agilent Technologies Inc. offers comprehensive laboratory solutions including instruments, reagents, and software for cancer research and diagnostics. Abbott focuses on point-of-care and laboratory-based diagnostic platforms. Thermo Fisher Scientific Inc. provides end-to-end solutions for genomic analysis and clinical diagnostics. GE HealthCare delivers imaging and diagnostic solutions with emphasis on integrated healthcare delivery.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 18.5 billion |

| Technology Outlook | Next Generation Sequencing, qPCR & Multiplexing, LOAC & RT-PCR, Protein Microarrays, DNA Microarrays |

| Application Outlook | Biomarker Development, CTC Analysis, Proteomic Analysis, Epigenetic Analysis, Genetic Analysis |

| Cancer Type Outlook | Lung Cancer, Breast Cancer, Colorectal Cancer, Cervical Cancer |

| Function Outlook | Therapeutic Monitoring, Companion Diagnostics, Prognostics, Cancer Screening, Risk Analysis |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Illumina Inc., Janssen Pharmaceuticals Inc., Novartis AG, F. Hoffmann-La Roche Ltd, Koninklijke Philips N.V., QIAGEN, Agilent Technologies Inc., Abbott, Thermo Fisher Scientific Inc., and GE HealthCare |

| Additional Attributes | Dollar sales by diagnostic technology type and cancer application, regional demand trends, competitive landscape, healthcare provider preferences for comprehensive versus targeted testing approaches, integration with personalized medicine initiatives, innovations in liquid biopsy technologies, AI-powered diagnostic platforms, and precision oncology implementation strategies |

The global next generation cancer diagnostics market is estimated to be valued at USD 18.5 billion in 2025.

The market size for the next generation cancer diagnostics market is projected to reach USD 53.1 billion by 2035.

The next generation cancer diagnostics market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in the next-generation cancer diagnostics market are next-generation sequencing, qPCR & multiplexing, LNA and RT-PCR, protein microarrays, and DNA microarrays.

In terms of application outlook, biomarker development segment to command 42.2% share in the next generation cancer diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA