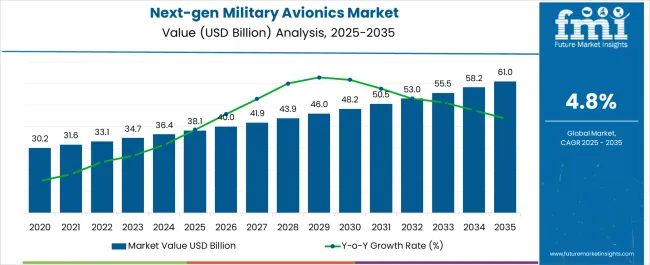

The next-gen military avionics market, valued at USD 38.1 billion in 2025 and projected to reach USD 61.0 billion by 2035, is advancing at a CAGR of 4.8%, generating an absolute dollar opportunity of USD 22.9 billion across the forecast horizon. Between 2021 and 2025, the market expands from USD 30.2 billion to USD 38.1 billion, adding USD 7.9 billion during this early growth phase. This increase is supported by rising defense modernization programs, integration of digital cockpits, and enhanced situational awareness systems across advanced aircraft fleets.

From 2026 to 2030, the market grows from USD 40.0 billion to USD 48.2 billion, contributing nearly USD 8.2 billion of incremental gains, or 36% of the total absolute opportunity. Growth during this stage is influenced by broader deployment of AI-driven avionics, mission planning systems, and electronic warfare integration, ensuring greater interoperability across multiple defense platforms. In the final phase from 2031 to 2035, the market advances from USD 50.5 billion to USD 61.0 billion, generating USD 10.5 billion in additional opportunity, representing nearly 46% of the overall expansion. This phase reflects widespread adoption of avionics in next-gen aircraft, unmanned aerial vehicles, and enhanced cyber-resilient systems. The absolute dollar opportunity of USD 22.9 billion highlights a consistent and strong trajectory for next-gen military avionics, driven by innovation, modernization needs, and evolving combat requirements.

| Metric | Value |

|---|---|

| Next-gen Military Avionics Market Estimated Value in (2025 E) | USD 38.1 billion |

| Next-gen Military Avionics Market Forecast Value in (2035 F) | USD 61.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The next-gen military avionics segment holds a substantial role within the global aerospace electronics landscape, representing an estimated 32–35% share of the broader defense avionics domain due to its emphasis on advanced communication, navigation, and electronic warfare systems. Within the mission-critical systems category, its share is around 26–28%, supported by the integration of next-generation cockpit displays, flight management solutions, and real-time data fusion platforms that enhance situational awareness for pilots. In the radar and surveillance electronics segment, next-gen military avionics secures nearly 20–22%, driven by demand for high-frequency sensors, adaptive signal processors, and enhanced target recognition capabilities across modern combat aircraft. Within the avionics software and simulation ecosystem, the share stands close to 15–17%, attributed to the need for AI-based mission planning tools, cybersecurity modules, and simulation platforms for pilot training and predictive maintenance.

Growth is primarily influenced by rising defense budgets, with procurement programs in Asia-Pacific and North America creating demand for multi-role avionics capable of integrating seamlessly with unmanned aerial systems and next-generation fighter jets. Despite the complexity of integration and high program costs, adoption is propelled by the absence of alternatives that deliver similar levels of operational readiness, electronic protection, and interoperability across joint forces. The long-term relevance of next-gen military avionics is supported by evolving defense strategies, where adaptability, digital communication superiority, and battlefield automation are prioritized, positioning the segment as a cornerstone of future combat readiness.

Continuous investment in research and development by defense contractors and governmental agencies is accelerating the integration of advanced sensors, AI-based decision-making tools, and data fusion capabilities into avionics systems. The growing complexity of military missions has led to heightened emphasis on precision navigation, real-time data processing, and cyber-resilient communication networks. Technological convergence is enabling avionics systems to become modular and upgradeable, allowing rapid adaptation to evolving operational requirements.

Geopolitical tensions and the modernization of defense fleets across multiple nations are further driving market expansion. As air forces globally transition towards multi-role and next-generation aircraft platforms, demand for avionics solutions that enhance operational readiness and reduce lifecycle costs is expected to remain strong, paving the way for sustained growth across key segments of the market.

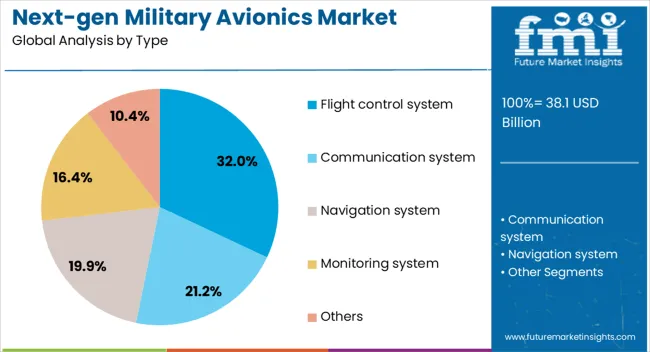

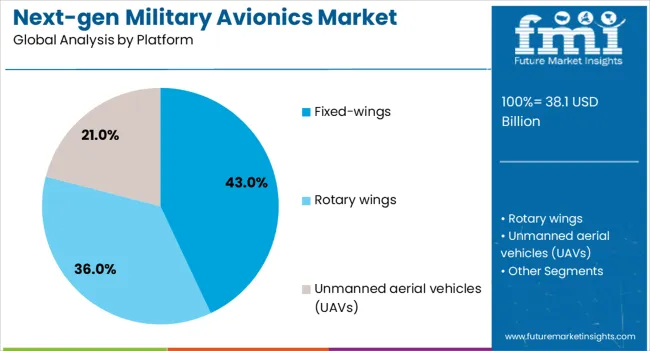

The next-gen military avionics market is segmented by type, platform, point of sale, fit, and geographic regions. By type, the next-gen military avionics market is divided into Flight control systems, Communication systems, Navigation systems, Monitoring systems, and Others. In terms of platform, the next-gen military avionics market is classified into fixed-wing, rotary-wing, and Unmanned aerial vehicles (UAVs).

Based on the point of sale, the next-gen military avionics market is segmented into OEM and aftermarket. By fit, the next-gen military avionics market is segmented into Line-fit and Retrofit. Regionally, the next-gen military avionics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flight control system segment is projected to hold 32% of the next-gen military avionics market revenue share in 2025, making it the leading type segment. Its dominance has been reinforced by the critical role it plays in enhancing aircraft maneuverability, stability, and operational safety under diverse mission conditions.

Next generation flight control systems are increasingly adopting digital fly-by-wire technology, which allows for precise control inputs, reduced pilot workload, and integration with advanced autopilot and navigation systems. The transition from mechanical to fully digital systems has improved fault tolerance and maintenance efficiency. Growing demand for agile and high-performance aircraft capable of operating in contested environments has also supported the adoption of advanced flight control solutions Furthermore, modular software-driven architectures have enabled system updates and enhancements without the need for complete hardware replacement, providing both operational flexibility and cost efficiency, which has reinforced the segment's leading market position.

The fixed wings platform segment is anticipated to command 43% of the next-gen military avionics market revenue share in 2025, emerging as the leading platform segment. Its dominance is being driven by extensive use of fixed wing aircraft in strategic, tactical, and transport missions due to their range, payload capacity, and operational versatility.

Advancements in avionics have enabled fixed wing platforms to integrate multi-domain operational capabilities, including advanced targeting, surveillance, and communication systems. The modernization of fighter jets, bombers, and transport aircraft fleets in various countries has created sustained demand for next generation avionics upgrades. Enhanced mission systems and cockpit automation are enabling pilots to process complex mission data efficiently, increasing both survivability and mission success rates The ability of fixed wing platforms to carry sophisticated avionics payloads and remain operational across long distances has reinforced their value in modern defense strategies, ensuring continued investment in this segment.

The OEM segment is expected to account for 88.10% of the next-gen military avionics market revenue share in 2025, making it the dominant point of sale segment. This leadership position has been supported by the integration of advanced avionics directly during aircraft manufacturing, which ensures optimal system compatibility, reduced installation time, and long-term performance reliability.

OEM installations allow airframes to be equipped with cutting-edge avionics solutions from the outset, minimizing the need for extensive retrofits. Defense procurement programs increasingly favor OEM-delivered avionics packages to ensure that platforms enter service with the latest operational capabilities and compliance with stringent military standards. OEM suppliers benefit from long-term defense contracts, enabling continuous innovation and product refinement The incorporation of open architecture designs in OEM avionics also facilitates future upgrades, extending service life and adaptability of the systems, thereby reinforcing the OEM segment’s commanding share in the overall market.

Next-gen military avionics adoption is accelerated by higher defense spending and integration with unmanned systems. Electronic warfare upgrades and cybersecurity safeguards are reinforcing its position as a critical defense enabler.

Global defense spending has been increasing as nations modernize fleets and adopt advanced avionics to secure tactical advantages. Next-gen military avionics are being installed in fighter jets, transport aircraft, and unmanned aerial systems to improve communication, navigation, and battlefield awareness. These systems ensure reliable data sharing between aircraft and ground stations, improving mission coordination and operational precision. Radar upgrades, advanced cockpit systems, and electronic warfare modules have gained prominence across procurement programs in Asia-Pacific and North America. Procurement contracts are influenced by national defense policies that prioritize modernization and combat readiness. As a result, growing defense budgets act as a primary driver for next-gen avionics adoption across both emerging and established military powers.

Electronic warfare capabilities are playing a decisive role in shaping avionics upgrades. Next-gen systems integrate radar warning receivers, electronic countermeasures, and adaptive jamming solutions to counter modern threats. Nations are investing heavily in systems capable of neutralizing enemy radar and missile-guidance technologies. These solutions are not limited to combat aircraft but extend into surveillance drones and maritime patrol assets. Avionics manufacturers are focusing on modular, upgradeable designs that can adapt to evolving battlefield requirements. Governments are supporting research in high-frequency spectrum monitoring and AI-driven threat detection. The ability of next-gen avionics to provide electronic dominance makes this segment essential for maintaining superiority in complex and contested battle environments worldwide.

Unmanned aerial vehicles (UAVs) have become central to reconnaissance, intelligence gathering, and targeted missions, and their operational success depends on advanced avionics integration. Next-gen military avionics provide UAVs with secure communication, sensor fusion, and real-time control, enhancing coordination with manned aircraft in joint operations. Avionics manufacturers are prioritizing seamless interoperability between drones and combat platforms, ensuring flexible deployment across missions. UAV-based avionics enable militaries to extend surveillance reach, minimize human risk, and achieve rapid response. This integration trend is particularly visible in procurement initiatives across the United States and China. Growing reliance on UAV fleets strengthens demand for avionics systems designed to manage autonomous navigation, data transmission, and electronic security against cyber intrusions.

With digitization becoming central to military avionics, cybersecurity has emerged as a decisive dynamic. Next-gen systems are increasingly designed with hardened architectures to prevent hacking, data leaks, and system manipulation. Cyber-protected avionics help safeguard mission-critical communication links and navigation controls from interference. Defense programs across NATO members and Asian nations have been prioritizing cyber-secure avionics integration as part of their modernization strategies. Manufacturers are developing solutions with real-time threat monitoring, encrypted data channels, and self-healing system capabilities. The aviation sector’s dependence on digital networks makes avionics highly vulnerable, thus cybersecurity upgrades are no longer optional but mandatory. The prioritization of secure avionics ensures resilience in electronic combat and enhances trust in modern defense platforms.

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

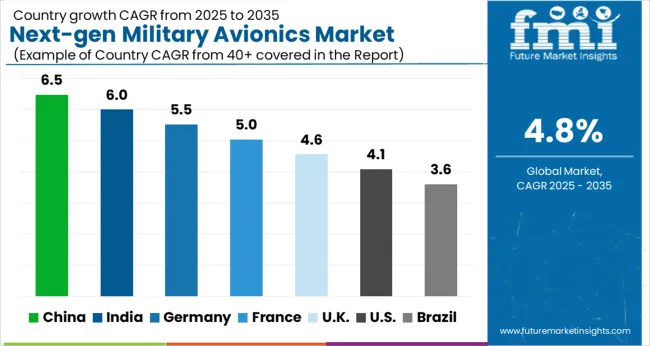

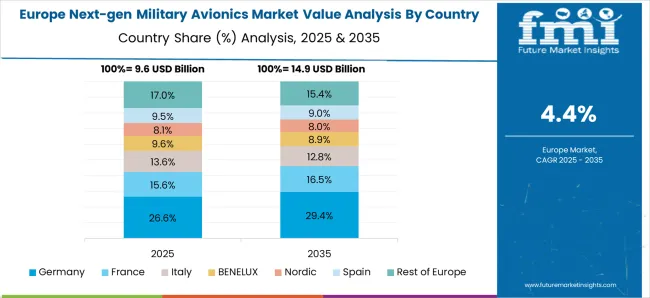

The next-gen military avionics market is projected to grow globally at a CAGR of 4.8% from 2025 to 2035, propelled by demand for advanced cockpit systems, electronic warfare modules, and integration with unmanned aerial platforms. China leads with a CAGR of 6.5%, driven by heavy defense modernization programs, indigenous aircraft production, and expansion of electronic warfare capabilities. India follows at 6.0%, supported by government-backed procurement, fighter jet upgrades, and strong demand for avionics integration across UAV fleets. France stands at 5.0% due to consistent aircraft modernization and avionics upgrades in Rafale platforms. The United Kingdom posts 4.6%, with growth shaped by adoption of cyber-secure avionics and new-generation cockpit systems for Eurofighter and Tempest programs. The United States records a slower 4.1%, constrained by mature infrastructure and high replacement costs but driven by upgrades in F-35 programs and increasing focus on cybersecurity modules. These varying growth rates demonstrate how emerging economies are pushing avionics demand through fleet modernization and indigenous development, while mature regions prioritize security, compliance, and interoperability. The leading countries serve as reference points for suppliers aiming to scale capacity, optimize integration frameworks, and strengthen partnerships within the evolving defense electronics ecosystem.

China has been positioned as the fastest-growing hub for next-gen military avionics, supported by extensive aircraft production and defense modernization. The CAGR is projected at 6.5% for 2025–2035, well above the global average of 4.8%. In the earlier period of 2020–2024, China recorded an estimated CAGR of 5.7%, driven by large procurement of advanced radar, cockpit upgrades, and electronic warfare systems. The rise from 5.7% to 6.5% is explained by increased investments in unmanned aerial vehicle avionics and integration of indigenous electronic warfare suites. Strong domestic capacity, reduced reliance on imports, and growing defense exports are set to consolidate its leadership.

India has emerged as a significant market with steady progress in avionics integration across fighter jets and UAV programs. For 2025–2035, India is expected to register a CAGR of 6.0%, stronger than the global 4.8%. Between 2020–2024, the growth was near 5.2%, supported by Make in India programs, defense procurement, and avionics retrofitting of Su-30 and Tejas aircraft. The jump from 5.2% to 6.0% highlights rising focus on indigenous avionics manufacturing, collaborations with global suppliers, and demand for cyber-secure systems. Investments in advanced communication, navigation, and flight management systems make India a key growth contributor in Asia-Pacific defense electronics.

France remains a consistent player in the avionics landscape, shaped by upgrades in Rafale aircraft and integration of advanced cockpit technologies. The CAGR for 2025–2035 is set at 5.0%, moderately higher than the 4.8% global rate. During 2020–2024, growth stood at around 4.4%, driven by avionics retrofits, mission-system upgrades, and radar modernization. The improvement from 4.4% to 5.0% is linked to continued defense export orders and expansion of Rafale avionics packages for partner nations. Development in flight management software and mission data processing platforms is strengthening France’s position. Its balanced reliance on domestic defense projects and exports secures long-term demand.

The United Kingdom demonstrates a steady but measured growth profile. For 2025–2035, CAGR is expected at 4.6%, slightly below the 4.8% global average. In the earlier period of 2020–2024, CAGR was around 4.0%, as procurement cycles were staggered and priority was given to sustaining Typhoon fleets. The rise from 4.0% to 4.6% reflects the acceleration of the Tempest program, mid-life avionics upgrades in Eurofighter, and cyber-secure avionics adoption across joint operations. UK defense electronics are also benefiting from NATO interoperability initiatives and UAS-control systems. This steady progression shows an emphasis on quality upgrades and secure integration over rapid expansion.

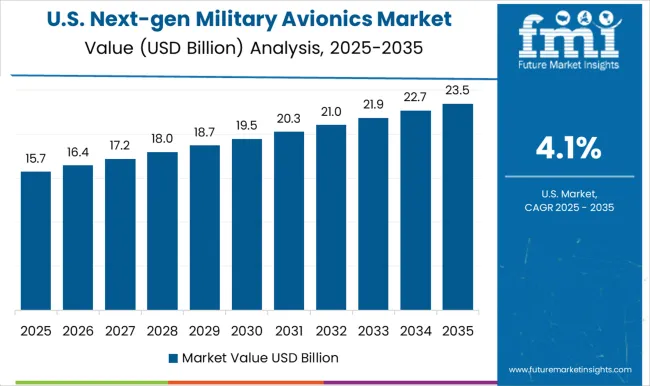

The United States shows a slower but stable expansion due to its mature defense ecosystem. The CAGR is projected at 4.1% for 2025–2035, under the 4.8% global level. Between 2020–2024, growth averaged 3.6%, shaped by F-35 modernization, sustainment cycles, and avionics software upgrades. The increase from 3.6% to 4.1% is driven by heightened emphasis on cybersecurity, electronic warfare modernization, and avionics integration for next-generation bombers and unmanned systems. While replacement costs and established infrastructure keep the pace lower, the US remains the largest single defense avionics spender, with strong investments in mission-critical avionics resilience and software-driven upgrades.

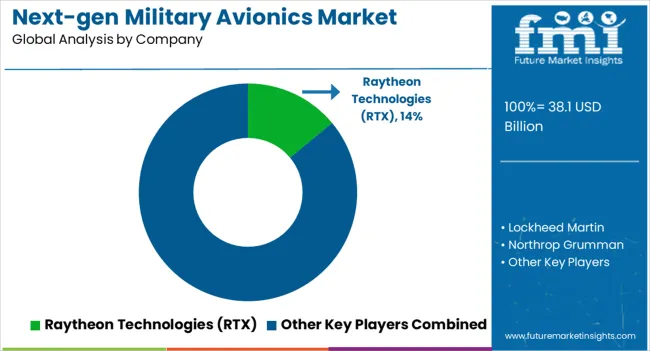

The next-gen military avionics market is characterized by strong participation from global defense contractors and avionics specialists focusing on cockpit modernization, electronic warfare integration, radar systems, and cyber-secure mission solutions. Raytheon Technologies (RTX) plays a major role with its advanced sensors, communication modules, and integrated mission avionics. Lockheed Martin dominates with its F-35 program, introducing advanced mission systems, electronic warfare, and next-gen pilot interface technologies. Northrop Grumman contributes significantly with airborne radar, situational awareness platforms, and electronic attack systems that strengthen combat aircraft resilience. Thales has built its strength in integrated cockpit avionics, radar technologies, and secure communication solutions for European and export markets. BAE Systems provides cutting-edge electronic warfare systems, advanced head-up displays, and cockpit integration for Typhoon and Tempest programs.

Honeywell delivers avionics hardware, flight management systems, and software-driven cockpit modernization solutions. L3Harris specializes in secure communication, electronic warfare, and avionics integration for unmanned aerial systems. Leonardo focuses on mission avionics, radar systems, and electronic protection solutions, particularly for European and international platforms. Saab plays an important role in providing electronic warfare suites, modular avionics, and cockpit displays tailored for Gripen and other fighter platforms. These companies differentiate through advanced mission readiness, integration with unmanned aerial systems, electronic warfare superiority, and cyber-secure architectures, positioning themselves as essential partners for defense modernization programs across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.1 Billion |

| Type | Flight control system, Communication system, Navigation system, Monitoring system, and Others |

| Platform | Fixed-wings, Rotary wings, and Unmanned aerial vehicles (UAVs) |

| Point of Sale | OEM and Aftermarkets |

| Fit | Line-fit and Retrofit |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies (RTX), Lockheed Martin, Northrop Grumman, Thales, BAE Systems, Honeywell, L3Harris, Leonardo, Saab, and Others |

| Additional Attributes | Dollar sales, share, demand by platform type, adoption in UAVs, procurement contracts, competitive positioning, regulatory compliance, cyber-secure integration, and export opportunities. |

The global next-gen military avionics market is estimated to be valued at USD 38.1 billion in 2025.

The market size for the next-gen military avionics market is projected to reach USD 61.0 billion by 2035.

The next-gen military avionics market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in next-gen military avionics market are flight control system, communication system, navigation system, monitoring system and others.

In terms of platform, fixed-wings segment to command 43.0% share in the next-gen military avionics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Military Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Textile Materials Testing Market Size and Share Forecast Outlook 2025 to 2035

Military Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Military Sensor Market Size and Share Forecast Outlook 2025 to 2035

Military Displays Market Size and Share Forecast Outlook 2025 to 2035

Military and Defense Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Military Vehicle Electrification Market Size and Share Forecast Outlook 2025 to 2035

Military Wearables Market Size and Share Forecast Outlook 2025 to 2035

Military Trucks Market Size and Share Forecast Outlook 2025 to 2035

Military Robots Market Size and Share Forecast Outlook 2025 to 2035

Military Embedded Systems Market Size and Share Forecast Outlook 2025 to 2035

Military Logistics Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Biometrics Market Size and Share Forecast Outlook 2025 to 2035

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Military Hydration Products Market Growth - Trends & Forecast 2025 to 2035

Military Vehicles and Aircraft Simulations Market Growth - Trends & Forecast 2025 to 2035

Military Batteries Market Analysis & Forecast by Platform, Capacity, Type, End-Use and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA