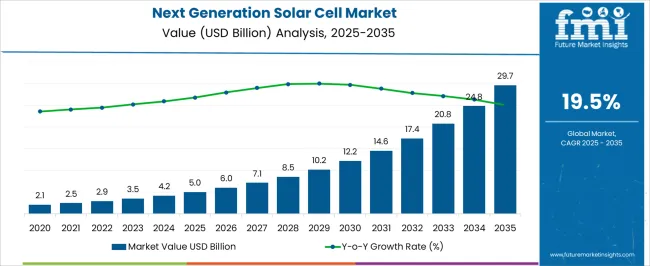

The next generation solar cell market is projected to expand from USD 5.0 billion in 2025 to USD 29.7 billion by 2035, reflecting a robust CAGR of 19.5%. A rolling CAGR analysis indicates that the market experiences high initial acceleration, followed by steady high growth throughout the decade. Between 2025 and 2030, the market grows from USD 5.0 billion to USD 12.2 billion, representing a five-year CAGR of approximately 17.7%, driven by increasing adoption of perovskite, tandem, and bifacial solar cells, along with supportive government policies, renewable energy targets, and declining levelized cost of electricity (LCOE).

Early growth is fueled by pilot installations, research-driven innovation, and strategic collaborations between technology providers and utilities. From 2030 to 2035, the market accelerates further from USD 12.2 billion to USD 29.7 billion, yielding a rolling five-year CAGR of around 19.4%, reflecting large-scale commercialization, cost optimization, and scaling of advanced solar technologies. Asia-Pacific, led by China, Japan, and India, drives volume growth, while Europe and North America dominate in high-value, technology-intensive installations.

Continuous technological advancements, improved efficiency, and integration with energy storage solutions sustain adoption and create a compounding effect on revenue growth, resulting in a steep upward trajectory. The rolling CAGR analysis highlights a market characterized by sustained high growth, rapid technology penetration, and strong global adoption, emphasizing next generation solar cells as a cornerstone of the renewable energy transition.

| Metric | Value |

|---|---|

| Next Generation Solar Cell Market Estimated Value in (2025 E) | USD 5.0 billion |

| Next Generation Solar Cell Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 19.5% |

The next generation solar cell market is primarily driven by the photovoltaic (PV) solar power market, which accounts for approximately 40–45% of total demand, as advanced solar cells are increasingly deployed in utility-scale, commercial, and residential projects to enhance efficiency and reduce the levelized cost of energy. The renewable energy equipment manufacturing market contributes around 20–22%, reflecting the production of high-performance modules, thin-film panels, perovskite, and tandem cells that support global renewable energy expansion. The building integrated photovoltaics (BIPV) market holds roughly 15–17%, driven by the adoption of lightweight, flexible, and semi-transparent cells for rooftops, facades, and windows.

The energy storage and smart grid market contributes approximately 10–12%, reflecting integration with batteries, inverters, and grid management systems to optimize energy utilization. Lastly, the electric vehicle (EV) and mobility market accounts for 5–6%, supported by niche applications such as solar-powered EV charging stations and vehicle-integrated solar panels. These parent markets define the technological, manufacturing, and operational ecosystem of the next generation solar cell market, enabling it to meet growing global demand for renewable, efficient, and flexible solar energy solutions.

The next generation solar cell market is experiencing accelerated growth, underpinned by advancements in photovoltaic technology, declining manufacturing costs, and supportive policy frameworks across major economies. Demand has been reinforced by the global transition towards clean energy and the urgency to meet renewable energy targets. The market landscape is characterized by rapid innovation in cell efficiency, stability, and scalability, enabling wider adoption across residential, commercial, and utility-scale projects.

Integration with smart grid infrastructure, along with improved storage capabilities, is enhancing operational viability and reducing intermittency challenges. Government incentives, subsidies, and favorable net metering regulations are further driving investment.

While competition from conventional silicon-based modules remains, next generation variants are gaining traction due to their potential for higher performance at lower material and installation costs. Over the forecast period, strategic collaborations between research institutions and industry players, coupled with scaling production capacity, are expected to significantly improve market penetration and create a strong foundation for sustainable, long-term growth.

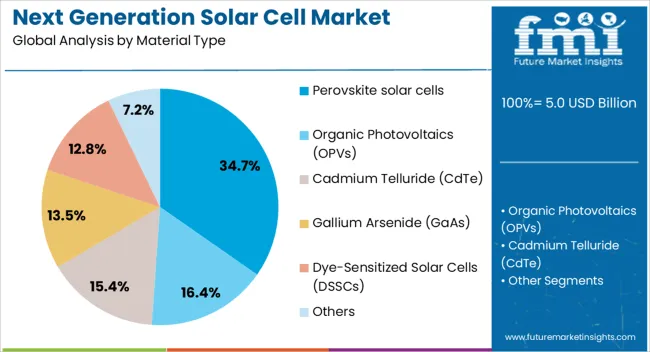

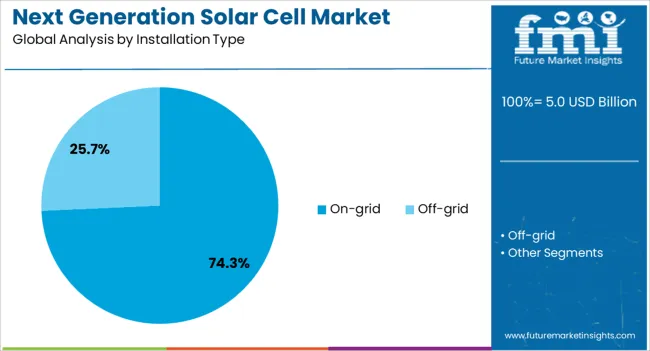

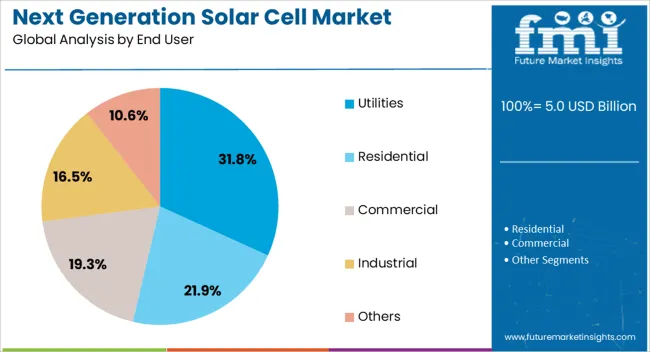

The next generation solar cell market is segmented by material type, installation type, end user, and geographic regions. By material type, next generation solar cell market is divided into Perovskite solar cells, Organic Photovoltaics (OPVs), Cadmium Telluride (CdTe), Gallium Arsenide (GaAs), Dye-Sensitized Solar Cells (DSSCs), and Others. In terms of installation type, next generation solar cell market is classified into On-grid and Off-grid. Based on end user, next generation solar cell market is segmented into Utilities, Residential, Commercial, Industrial, and Others. Regionally, the next generation solar cell industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Perovskite solar cells, holding 34.70% of the material type category, are leading due to their exceptional light absorption, tunable bandgap, and potential for low-cost, high-volume manufacturing. Their market position is strengthened by significant research breakthroughs improving stability and efficiency, which have addressed earlier concerns regarding environmental durability.

Production flexibility, including compatibility with flexible and lightweight substrates, has widened their application scope beyond traditional installations. Strategic funding from both private investors and public research programs has accelerated commercialization timelines, enabling pilot projects to transition into scalable deployment.

Compared to conventional silicon-based cells, perovskites offer advantages in energy payback time and manufacturing versatility, positioning them favorably in cost-sensitive as well as performance-driven markets. Continued technological optimization, coupled with integration into tandem cell configurations, is expected to reinforce their competitive edge, ensuring steady adoption across diversified end-use sectors.

The on-grid segment, representing 74.30% of the installation type category, dominates due to established infrastructure, cost-efficiency, and strong alignment with utility-scale and commercial projects. Its market leadership is supported by extensive transmission networks and favorable feed-in tariff structures in multiple regions, which have reduced barriers to large-scale deployment.

Integration with smart grid systems allows for efficient distribution and real-time performance monitoring, enhancing energy reliability and system optimization. Financial models such as power purchase agreements (PPAs) and government-backed incentives have further stimulated demand, making on-grid systems more economically attractive for investors and project developers.

Technological advancements in grid management and storage solutions are also addressing intermittency concerns, making these installations increasingly viable in regions with high renewable penetration targets. Over the forecast period, rising investments in grid modernization and cross-border energy trading are expected to further consolidate the on-grid segment’s position in the market.

The utilities segment, accounting for 31.80% of the end user category, is leading due to the large-scale integration of next generation solar cells into national energy strategies. Its growth has been reinforced by the demand for high-capacity, centralized power generation that can be efficiently distributed through existing grid systems. Utility-scale adoption benefits from economies of scale, enabling lower per-unit electricity costs and enhanced project bankability.

Supportive regulatory frameworks, long-term renewable energy targets, and capital allocation towards large photovoltaic farms have ensured a stable pipeline of projects. The ability of utilities to enter into long-term PPAs with industrial and governmental clients has strengthened revenue predictability, making investment more attractive.

Technological improvements in installation speed, durability, and performance monitoring have further reduced operational risks, solidifying utilities as the primary driver of large-scale deployment in the next generation solar cell market. Over time, cross-sector collaborations and hybrid renewable installations are expected to expand this segment’s contribution to total market capacity.

The next generation solar cell market is expanding as manufacturers and energy developers prioritize high-efficiency, lightweight, and flexible photovoltaic solutions. Demand is driven by residential, commercial, and utility-scale installations seeking improved energy conversion, reduced carbon footprint, and integration with building materials and portable electronics. Challenges include high production costs, scalability issues, and complex manufacturing processes for emerging technologies like perovskite, tandem, and organic solar cells.

Opportunities exist in flexible modules, bifacial designs, and hybrid systems that combine conventional silicon with advanced materials. Trends highlight improved power conversion efficiency, roll-to-roll manufacturing, and enhanced stability under environmental stress.

Solar energy developers and manufacturers are increasingly adopting next generation solar cells to achieve higher power conversion efficiency and flexible deployment options. Emerging technologies such as perovskite, tandem, organic, and thin-film solar cells enable lightweight, flexible, and semi-transparent modules for rooftops, facades, portable devices, and utility-scale applications. Demand is driven by the need for energy optimization, cost-effective renewable solutions, and integration into urban and off-grid infrastructure. Key priorities include long-term operational stability, environmental durability, and compatibility with existing power systems. Government incentives, renewable energy targets, and growing consumer awareness are accelerating adoption. These advanced solar cells are positioned as critical solutions for next-generation energy applications, enhancing efficiency and reducing reliance on conventional energy sources.

Market constraints include high production costs, complex manufacturing processes, and scalability challenges for emerging solar cell technologies. Supply chain limitations for specialized raw materials like high-purity perovskite precursors, conductive polymers, and transparent electrodes can affect production timelines. Compliance with regional safety, energy, and environmental regulations adds further complexity. Technical challenges include stability under UV exposure, moisture resistance, thermal cycling, and integration with conventional silicon modules. Quality control and batch-to-batch consistency are critical for large-scale deployment. Buyers increasingly seek suppliers with certified, high-efficiency solar cells, technical support for module integration, and reliable supply chains to ensure consistent performance, regulatory compliance, and long-term operational stability.

Opportunities exist in hybrid modules that combine traditional silicon with next generation materials to enhance efficiency and stability. Flexible, lightweight, and semi-transparent modules offer new applications in building-integrated photovoltaics (BIPV), portable electronics, and vehicle-mounted solar solutions. Emerging markets in Asia-Pacific, Europe, and North America are driving adoption due to renewable energy targets and increasing energy demand. Suppliers providing turnkey solutions, including module design, testing, and integration support, are well positioned to capitalize on growth opportunities. Application-specific customization, technical training, and robust after-sales support enhance supplier competitiveness in the evolving solar energy landscape.

The market is trending toward higher power conversion efficiency, innovative material use, and digital integration for monitoring and performance optimization. Technologies such as tandem perovskite-silicon cells, organic photovoltaics, and thin-film modules are gaining traction for their lightweight and flexible properties. Roll-to-roll manufacturing and scalable production processes are improving cost efficiency and module availability. Integration with energy management systems, IoT-enabled monitoring, and predictive performance analytics is becoming essential for both commercial and residential deployments. Suppliers offering high-efficiency, durable, and application-ready solar cells with technical support are best positioned to meet the evolving demands of renewable energy developers worldwide.

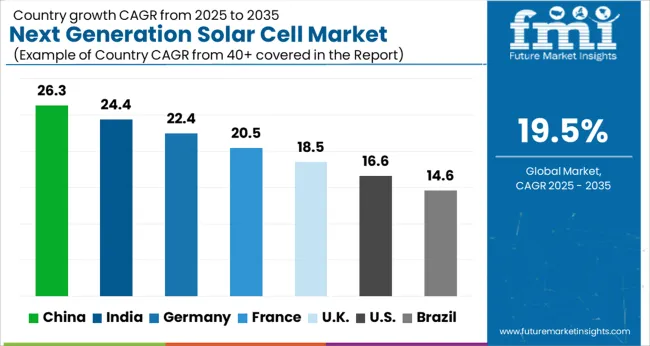

| Country | CAGR |

|---|---|

| China | 26.3% |

| India | 24.4% |

| Germany | 22.4% |

| France | 20.5% |

| UK | 18.5% |

| USA | 16.6% |

| Brazil | 14.6% |

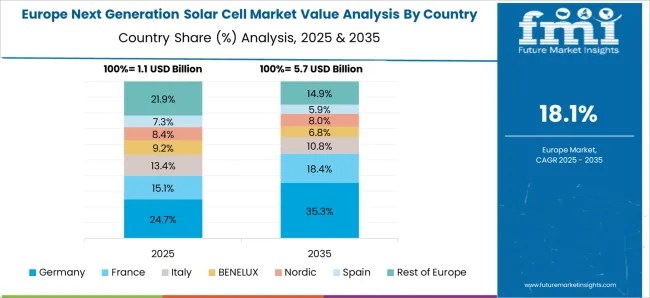

The global next generation solar cell market is projected to grow at a CAGR of 19.5% from 2025 to 2035. China leads at 26.3%, followed by India at 24.4%, France at 20.5%, the UK at 18.5%, and the USA at 16.6%. Growth is driven by government incentives, renewable energy targets, and rising demand for high-efficiency solar solutions. Perovskite, tandem, and bifacial technologies are rapidly gaining adoption, while collaborations with international players accelerate R&D and scale-up. Rooftop, utility-scale, and hybrid solar applications, supported by industrial hubs and policy frameworks, underpin global expansion. The analysis spans over 40+ countries, with the leading markets shown below.

The next generation solar cell market in China is projected to grow at a CAGR of 26.3% from 2025 to 2035, supported by ambitious renewable energy targets, government subsidies, and rapidly expanding solar installations. The adoption of perovskite, tandem, and bifacial solar cells is increasing due to higher energy conversion efficiency and cost competitiveness. Domestic manufacturers are investing heavily in research and development to scale production, improve durability, and optimize energy yield. Industrial clusters in Jiangsu, Zhejiang, and Guangdong provide strong manufacturing and logistics support, enabling large-scale deployment. Strategic partnerships with international technology providers accelerate knowledge transfer and innovation. Urban and rural electrification projects, alongside corporate adoption of clean energy solutions, further drive market demand. Technological advances in flexible and lightweight solar modules also contribute to expanding applications in rooftops, commercial facilities, and utility-scale solar farms.

The next generation solar cell market in India is expected to expand at a CAGR of 24.4% from 2025 to 2035, fueled by ambitious renewable energy targets under the National Solar Mission and rising electricity demand. Adoption of perovskite, tandem, and bifacial solar cells is increasing due to higher efficiency, affordability, and suitability for rooftop and utility-scale installations. Domestic manufacturers are investing in scaling production and integrating advanced coating and encapsulation technologies to improve longevity and performance. Government incentives, subsidies, and solar auctions are accelerating adoption across commercial, industrial, and residential segments. Corporate renewable procurement and hybrid solar projects further drive market growth. Advances in flexible and lightweight solar modules are enabling applications in portable energy solutions and off-grid areas, strengthening India’s position as a fast-growing market in the Asia-Pacific region.

The next generation solar cell market in France is projected to expand at a CAGR of 20.5% from 2025 to 2035, supported by government incentives, EU renewable energy directives, and corporate adoption of clean energy solutions. Perovskite and tandem solar technologies are gaining traction for higher efficiency and compact form factors. French manufacturers focus on R&D to optimize energy yield, durability, and integration with building-integrated photovoltaic solutions. Industrial clusters in Île-de-France, Auvergne-Rhône-Alpes, and Occitanie provide production infrastructure and logistics support. Expansion of rooftop solar installations, hybrid solar farms, and community energy projects drive market demand. Collaborations with European technology leaders enhance innovation and accelerate deployment. Growth is further reinforced by sustainability-driven corporate procurement, green financing schemes, and residential rooftop initiatives.

The UK next generation solar cell market is expected to grow at a CAGR of 18.5% from 2025 to 2035, driven by renewable energy targets, rising electricity costs, and corporate net-zero commitments. Adoption of bifacial and tandem solar cells enables higher conversion efficiency for both residential and utility-scale applications. Manufacturers focus on improving module longevity, lightweight designs, and integration with building facades. Industrial and commercial installations, along with government-backed incentive programs, are accelerating deployment. Partnerships with international technology providers strengthen R&D and enhance manufacturing capabilities. Expansion of rooftop solar, microgrids, and hybrid renewable projects further fuels demand. Technological innovation in flexible modules supports off-grid and mobile energy solutions.

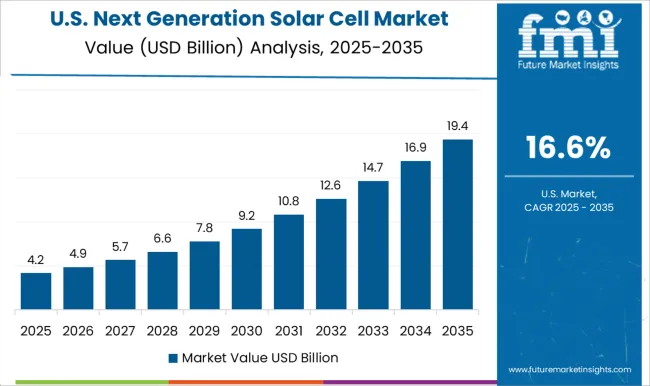

The USA next generation solar cell market is anticipated to expand at a CAGR of 16.6% from 2025 to 2035, driven by rising demand for clean energy, federal and state-level incentives, and corporate sustainability goals. High-efficiency perovskite and tandem solar cells are increasingly adopted in utility-scale, rooftop, and hybrid solar installations. Leading manufacturers are investing in R&D to improve energy conversion efficiency, durability, and lightweight module design. Industrial hubs in California, Texas, and Arizona facilitate large-scale production and rapid deployment. Corporate renewable procurement, community solar programs, and off-grid solutions drive additional adoption. Partnerships with global technology leaders enhance technological know-how, while advanced financing schemes accelerate residential and commercial installations.

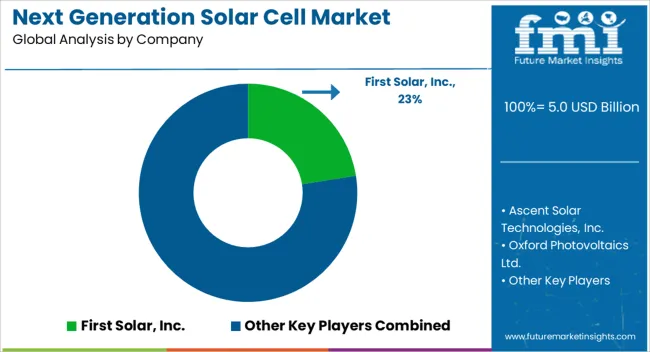

The next generation solar cell market is driven by the push for higher efficiency, lightweight form factors, and flexible deployment in residential, commercial, and utility-scale applications. Emerging technologies such as perovskite, thin-film, tandem, and organic photovoltaic cells are increasingly adopted to surpass traditional silicon-based limitations, improve power-to-weight ratios, and enable integration into building facades, portable devices, and wearable systems. Rising renewable energy targets, declining levelized cost of energy, and innovations in scalable manufacturing further accelerate market growth. Competition is defined by conversion efficiency, material innovation, and manufacturing scalability. First Solar, Inc. leads with cadmium telluride thin-film modules optimized for large-scale solar farms, emphasizing durability, low temperature coefficient, and high-energy yield in harsh climates. Oxford Photovoltaics Ltd. differentiates through perovskite-silicon tandem cells with high theoretical efficiencies and semi-transparent modules suitable for building-integrated photovoltaics. Ascent Solar Technologies, Inc. focuses on flexible, lightweight modules for portable and specialty applications, while Hanwha Group leverages large-scale manufacturing capabilities and vertical integration to reduce costs. Mitsubishi Corporation and Hanergy Thin Film Power Group compete with thin-film technologies and hybrid solutions optimized for rooftops and mobile applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Material Type | Perovskite solar cells, Organic Photovoltaics (OPVs), Cadmium Telluride (CdTe), Gallium Arsenide (GaAs), Dye-Sensitized Solar Cells (DSSCs), and Others |

| Installation Type | On-grid and Off-grid |

| End User | Utilities, Residential, Commercial, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | First Solar, Inc., Ascent Solar Technologies, Inc., Oxford Photovoltaics Ltd., Hanwha Group, Mitsubishi Corporation, Hanergy Thin Film Power Group, and Heliatek |

| Additional Attributes | Dollar sales by technology type (thin-film, perovskite, organic, tandem), module format (rigid, flexible, BIPV), and application (residential, commercial, utility-scale). Demand is driven by renewable energy adoption, efficiency improvements, and government incentives for clean energy. Regional trends highlight strong growth in North America and Europe, while Asia-Pacific shows rapid expansion due to large-scale solar installations and supportive energy policies in China, Japan, and India. |

The global next generation solar cell market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the next generation solar cell market is projected to reach USD 29.7 billion by 2035.

The next generation solar cell market is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in next generation solar cell market are perovskite solar cells, organic photovoltaics (opvs), cadmium telluride (cdte), gallium arsenide (gaas), dye-sensitized solar cells (dsscs) and others.

In terms of installation type, on-grid segment to command 74.3% share in the next generation solar cell market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Infusion Pump Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Next-generation Titrator Market Growth – Industry Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA