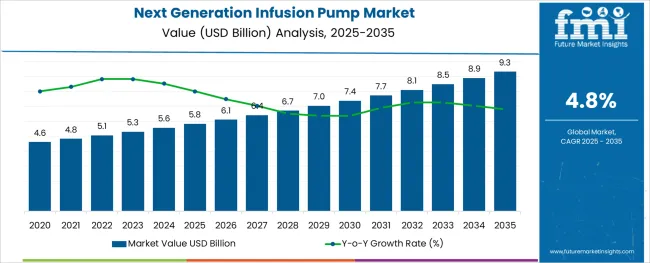

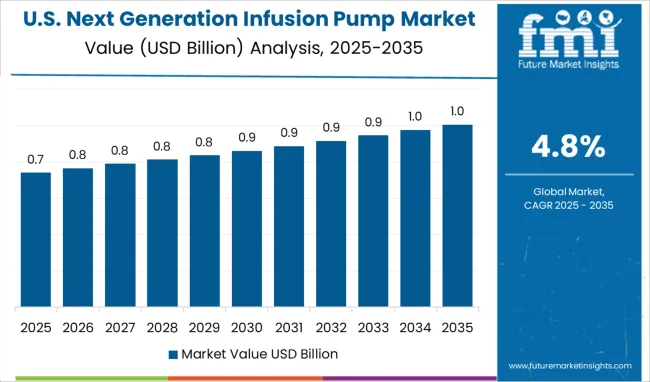

The Next Generation Infusion Pump Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The next generation infusion pump market is experiencing rapid growth, driven by increasing demand for advanced, reliable, and patient-friendly drug delivery systems. Growing focus on precision medicine and improved patient safety is fueling the adoption of infusion pumps that offer enhanced control and monitoring capabilities. Medical device advancements have enabled integration with digital health platforms, providing real-time data and remote management.

The rising prevalence of chronic diseases requiring continuous drug administration has also contributed to market expansion. Regulatory emphasis on device accuracy and safety has pushed manufacturers to develop pumps with advanced features such as dose error reduction and alarm systems.

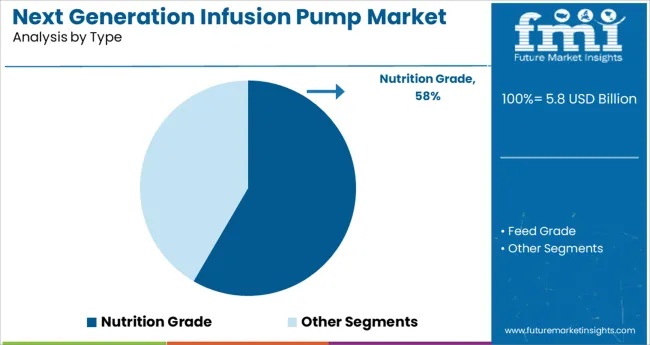

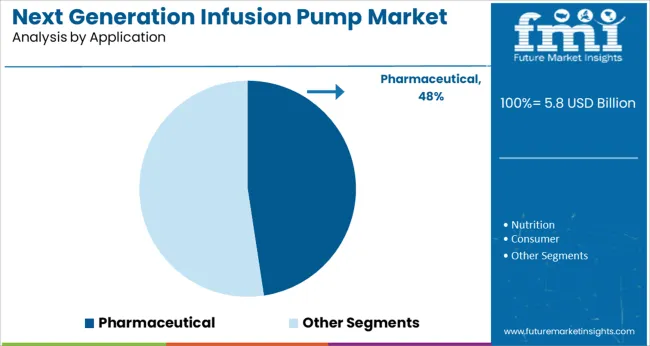

Increasing pharmaceutical applications in hospital and home care settings are propelling the demand for sophisticated infusion technologies. Segment growth is expected to be led by nutrition grade pumps for specialized feeding needs, natural source materials enhancing biocompatibility, and pharmaceutical applications focusing on precise medication delivery.

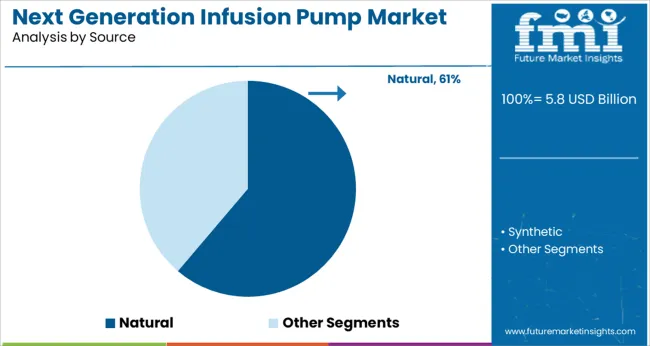

The market is segmented by Type, Source, Application, and Form and region. By Type, the market is divided into Nutrition Grade and Feed Grade. In terms of Source, the market is classified into Natural and Synthetic. Based on Application, the market is segmented into Pharmaceutical, Nutrition, Consumer, Agrochemical, and Others. By Form, the market is divided into Liquid and Dry. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Nutrition Grade segment is projected to hold 58.4% of the market revenue in 2025, leading all pump types. Growth has been driven by the increasing use of enteral nutrition therapy in hospitals and home care for patients unable to consume food orally. Nutrition grade infusion pumps ensure precise delivery of nutritional formulas while maintaining sterility and minimizing contamination risks.

Healthcare providers prioritize these pumps due to their compatibility with a variety of feeding protocols and ease of integration with patient care workflows. The segment benefits from rising awareness of malnutrition management, especially among aging populations and critically ill patients.

As healthcare systems emphasize comprehensive nutritional support, nutrition grade infusion pumps are expected to sustain their market dominance.

The Natural source segment is anticipated to contribute 61.2% of the market revenue in 2025, holding the leading position in source materials. This segment’s growth reflects the increasing preference for infusion pumps and accessories made with biocompatible, eco-friendly materials that reduce patient risks and environmental impact.

Natural materials are favored for their safety profile, minimizing allergic reactions and toxicity. Advances in material science have enabled the development of pumps incorporating natural polymers and components, improving patient comfort and device sustainability.

As regulatory bodies encourage greener medical devices, the natural source segment is poised for significant expansion. Patient-centric care models that prioritize material safety also support continued adoption.

The Pharmaceutical application segment is projected to account for 47.6% of market revenue in 2025, maintaining its lead among various uses. Demand in this segment has been fueled by the need for precise and controlled administration of medications including chemotherapy, pain management, and critical care drugs.

Pharmaceutical companies and healthcare providers require infusion pumps that meet strict accuracy and compliance standards to ensure effective therapy and reduce adverse events. Growing complexity in drug formulations and delivery protocols has increased the adoption of advanced infusion technologies.

Furthermore, expanding outpatient treatment models and home infusion therapies have elevated the need for reliable pharmaceutical infusion pumps. As personalized medicine advances, the pharmaceutical application segment is expected to drive significant market growth.

Insulin infusion pumps are dominating the next generation infusion pump market. However, the worldwide booming prevalence of diabetes is a key driver for next generation infusion pump market.

Increased R & D initiatives on IV drug administration for malnutrition,cancers, diabetes, AIDS, neurological disorders, and gastrointestinal disorders coupled with technological innovation, are anticipated to generate lucrative growth in next generation infusion pump market.

Over the forecast period, the next generation IV infusion pumps market will be fuelled by growing production capacity, government support for start-ups, and approval of regulatory policies.

Growing demand for homecare ambulatory infusion pumps has been observed for the treatment of diseases like diabetes and cancer. A portable and wearable infusion pump is specially designed for ambulatory use.

Increasing advances in the field of infusion treatments have led to a global rise in sales of next-generation infusion pumps. Intravenous therapy is needed across a wide range of healthcare domains, and this factor is expected to drive huge revenues into the global market.

Medical spending by the masses and healthcare professionals has contributed to market growth. As a result, the global market for next-generation infusion pumps is forecast to generate substantial revenues in the years to come.

In the forecast period, a lack of standard guidelines for the use of products, product recalls, a lack of competent professionals and medicine dispensing errors are expected to hamper the growth of the next generation infusion pumps market.

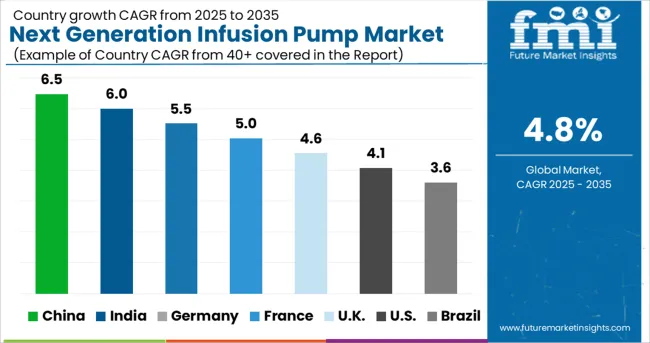

The North American region is predicted to hold the largest market for next generation infusion pumps. It is expected to capture the largest market share based on the current market scenario.

North America is estimated to hold a significant share of 41.5% in the next generation infusion pump market witnessing growth owing to the presence of capable professionals, advances in healthcare infrastructure and major market players in the region.

Furthermore, rising R&D activities, increasing cases of chronic diseases, rising geriatric population, and improving insurance policies shall boost the next generation infusion pump market growth in the region.

The European next generation infusion pump market has a global market share accounting for 27.9% in 2025. The region is expected to increase its share during the forecast period owing to research and development activities, adoption of novel technologies, and partnerships between companies for the distribution and advancement of novel products.

The Europe region is anticipated to contribute maximum market revenue share in the next generation infusion pump market over the forecast period.

APEJ region is anticipated to witness crucial growth due to the growing healthcare infrastructure in the region. An increasing number of mid-sized hospitals are identified to be a major driver of the APEJ next generation infusion pump market growth.

Further, the continuous rise in the demand for advanced technologies and expansion of private hospitals in rural areas are boosting the demand for next-generation infusion pumps in APEJ.

The players leading in next generation infusion pump market include Ivenix, Inc, Zyno medical, B. Braun Melsungen AG, Baxter International, Inc., Fresnius Kabi AG, F. Hoffmann-la Roche Ltd., Becton Dickinson and Co., Johnson & Johnson (USA), Pfizer (Hospira) Inc., Smiths Medical and others.

Eitan Medical received EU MDR clearance for the Sapphire infusion system. Eitan Medical’s Sapphire infusion system provides clinicians in medical clinics and home care environments throughout Europe with an improved workflow, increasing its convenience.

Baxter International Inc announced on May 20, 2024, that CE marking and regulatory approval from Australia’s Therapeutic Goods Administration (TGA) for the Evo IQ Syringe Infusion System. Hospitals in the United Kingdom, Ireland, Greece, Australia, and New Zealand are expected to receive the new system first, with additional countries to follow in a series of regulatory submissions.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.8% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | By Type, By Application, By Source, By Foam, Region Forecast till 2035 |

| Countries Covered | North America, Europe, APEJ, The Latin America, MEA |

| Key Companies Profiled | Ivenix, Inc, Zyno medical, B. Braun Melsungen AG, Baxter International, Inc., Fresnius Kabi AG, F. Hoffmann-la Roche Ltd., Becton Dickinson and Co., Johnson &, Johnson (USA), Pfizer (Hospira) Inc., Smiths Medical, Others |

| Customization | Available Upon Request |

The global next generation infusion pump market is estimated to be valued at USD 5.8 billion in 2025.

It is projected to reach USD 9.3 billion by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are nutrition grade and feed grade.

natural segment is expected to dominate with a 61.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Next-Gen Digital Cockpit Solution Market Size and Share Forecast Outlook 2025 to 2035

Next-gen Military Avionics Market Size and Share Forecast Outlook 2025 to 2035

Next-Gen Firewall Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Telehealth Market Size and Share Forecast Outlook 2025 to 2035

Next-generation neurofeedback device Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Next-Generation Sweeteners Size and Share Forecast Outlook 2025 to 2035

Next Generation Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Next Generation Optical Biometry Devices Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Mass Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Wireless Network Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Molecular Assay Market – Trends & Forecast 2025 to 2035

Next-Generation Biomanufacturing Market - Trends, Innovations & Forecast 2025 to 2035

Next Generation Immunotherapies Market - Innovations & Growth 2025 to 2035

Market Leaders & Share in the Next Generation Packaging Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA