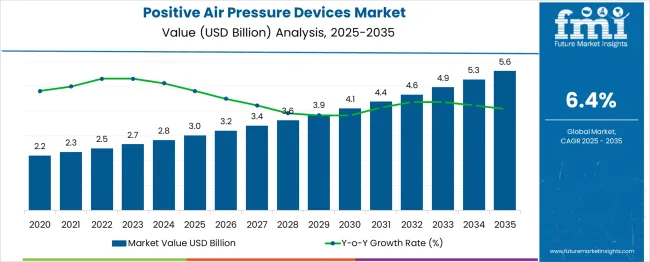

The Positive Air Pressure Devices Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The stainless steel valve tag market is expanding steadily as industrial sectors prioritize asset management, safety compliance, and equipment traceability. Increasing investments in infrastructure and process automation have heightened demand for robust and clear identification solutions capable of withstanding harsh environments.

The shift toward digital transformation in industries such as oil and gas, manufacturing, and utilities is encouraging the adoption of advanced tagging systems that support maintenance and audit operations. Growing awareness around regulatory compliance for equipment labeling and enhanced safety protocols is also influencing market expansion.

The rise of e-commerce platforms has facilitated easier procurement of valve tags, increasing accessibility for small to medium enterprises and broadening geographic reach. Material innovations and customization options continue to enhance product longevity and visibility, creating opportunities for market penetration across diverse industrial applications.

The market is segmented by Product, Application, and End User and region. By Product, the market is divided into Continuous Positive Airways Pressure Devices (CPAP), Bi-level Positive Airway Pressure (BiPAP)/ Variable Positive Airway Pressure (VPAP), and Automatic Positive Airway Pressure Devices (APAP).

In terms of Application, the market is classified into Obstructive sleep apnea, Respiratory failures, and Others. Based on End User, the market is segmented into Home care settings, Hospitals, Clinics, and Sleep Centers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The less than 30 mm thickness segment is expected to hold 41.3% of the revenue share in 2025 within the thickness category. This segment’s leadership is supported by its suitability for a wide range of valve sizes and equipment types, providing sufficient durability while minimizing material costs.

The thinner tags offer flexibility in installation, especially in tight spaces and complex piping systems, making them preferable for industries where compactness is critical. Their compatibility with standard mounting hardware and ability to endure corrosion and wear have reinforced demand in sectors emphasizing both performance and cost efficiency.

This balance between robustness and adaptability has contributed to the segment’s dominant position.

Within the product type category, engraved valve tags are projected to command 57.8% of the market revenue share in 2025, marking them as the leading product form. The prominence of engraved tags is due to their superior legibility, permanence, and resistance to environmental degradation such as fading, scratching, and chemical exposure.

Engraving allows precise and customizable marking, meeting stringent industry standards for traceability and safety. The technique supports complex information including serial numbers, barcodes, and QR codes, enhancing integration with digital asset management systems.

Manufacturers’ emphasis on delivering long-lasting, tamper-proof tags that reduce maintenance costs has reinforced the adoption of engraved tags in heavy industries.

The online distribution channel is expected to generate 63.7% of market revenue in 2025, making it the most dominant sales route. The growth of e-commerce platforms has revolutionized procurement by offering convenience, broader product selections, and competitive pricing to end-users across industries.

Online channels enable buyers to access detailed product specifications, customization options, and customer reviews, simplifying purchase decisions. This has particularly benefited small and medium-sized enterprises lacking traditional supply chain networks.

Additionally, digital platforms have streamlined order fulfillment and reduced lead times, fostering faster adoption. Vendors are increasingly investing in online marketplaces and direct-to-customer websites to expand reach and improve customer engagement, reinforcing the online channel’s leadership in the stainless steel valve tag market.

The global sales of positive air pressure devices are poised to grow at 6.4% CAGR between 2025 and 2035, in comparison to the 5.7% CAGR registered during the historical period from 2012 to 2024. Increasing demand for positive air pressure devices due to the rising prevalence of sleep disorders and breathing failures including obstructive sleep apnea and COPD is a key factor driving the global market.

The positive airway pressure (PAP) devices market is expanding primarily due to the steadily rising number of patients with obesity, respiratory illnesses, and sleep difficulties. There is significant data, especially from demographics in Western nations, that suggests that average sleep length is declining and that insomnia and other sleep disruptions are becoming more and more common.

Insomnia affects more than 20% of adults overall in Canada and the USA, according to data from National Surveys, and it is predicted that this percentage will rise over the coming decades. These percentages are in line with the prevalence rates of short sleep duration revealed in population-based research conducted over the previous three decades in several Western countries.

Similarly, according to the National Library of Medicine, obstructive sleep apnea affects around 1 billion persons worldwide. This is acting as a catalyst triggering the growth of the global positive air pressure devices market.

In addition to this, the growing popularity of home healthcare and increasing health awareness will create lucrative growth opportunities for positive air pressure device manufacturers during the assessment period.

Rising Prevalence of Sleep Disorders and Respiratory Diseases to foster Growth of Positive Air Pressure Devices Market

The global positive air pressure devices market is anticipated to grow at a healthy pace during the projected period, owing to the rising prevalence of various sleep disorders and respiratory diseases across the world.

Chronic obstructive pulmonary disease (COPD), which claimed 2.2 million lives in 2020, is the third most common cause of death globally, according to the World Health Organization. In low- and middle-income nations, COPD fatalities in people under 70 years of age account for about 90% of all mortality.

According to the National Center for Biotechnology Information, undertaking positive airway pressure therapy was linked to a decrease in hospitalization among patients with chronic obstructive pulmonary disease. Thus, the growing usage of positive airway pressure therapy for treating patients suffering from COPD will continue to boost sales of positive air pressure devices in the market.

Similarly, numerous studies conducted around the world have revealed that 10%-30% of people suffer from insomnia, with some estimates reaching 50%-60%. Reduced social functioning and a lower quality of life, neurocognitive impairment, an elevated incidence of traffic accidents, cerebral, cardiac, and metabolic morbidity, as well as a higher death rate, are all long-term effects of Obstructive sleep apnea syndrome.

The use of continuous positive airway pressure (CPAP) therapy for middle-aged individuals with moderate to severe OSA syndrome has been proven to be both effective and affordable. The prevalence of apnea syndrome is higher in older adults (over 60), and the effects can be confused with the functional decline associated with aging. Therefore, correcting the OSA syndrome element of any functional impairment should boost independence and lower healthcare expenses in aging populations.

Most people with obstructive sleep apnea continue to receive treatment with positive airway pressure (PAP). For patients with uncomplicated OSA sleep disorders, CPAP, APAP, and BPAP are all acceptable treatments that can be utilized across the severity continuum of the condition. Driven by this, demand for positive air pressure devices is likely to rise at a strong pace over the next ten years.

Also, the constant introduction of new features created to adapt to the requirements of diverse patients is supposed to drive the market for positive air pressure devices in the forecast period.

There are some side effects of CPAP treatment, such as congestion, runny nose, and dry mouth; humidification can frequently help with these symptoms. Many patients initially find the mask inconvenient, claustrophobic, or embarrassing. Masks have the potential to irritate or cause the skin to become red.

Even though CPAP therapy has several advantages, compliance is still a significant issue both in the inpatient and outpatient settings.

Since these devices are also available on an online and at-home basis, a decrease in diagnostic and therapeutic procedures at sleep clinics can directly impact the number of sleep apnea tests, which can limit the development of a positive air pressure equipment market.

Also, these operations may have a major impact on the transmission rate of diseases, which can delay elective procedures, disrupt the supply chain for services, and can limit the ability of healthcare facilities to generate income.

Availability of Advanced Products Driving Market in Germany

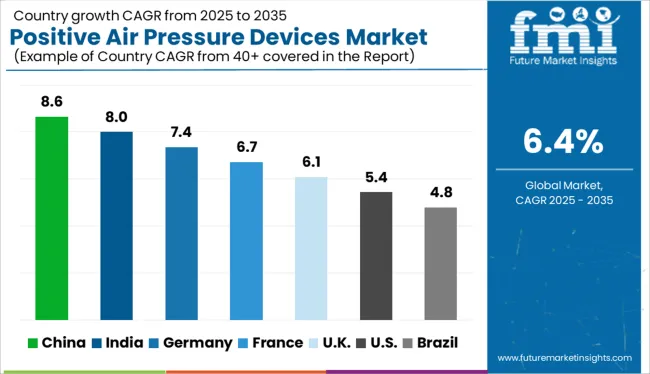

Germany is estimated to hold a market share of 8.1% in the global positive air pressure devices market in 322 and is further expected to grow at a healthy pace during the next ten years. Growth in the positive air pressure devices market in Germany is expanding as a result of well-defined regulatory rules and rising investments in research and development for new devices.

Similarly, the increasing prevalence of respiratory failures, flourishing medical tourism, and easy availability of advanced portable mechanical ventilation devices are expected to boost the market in the country during the forecast period.

Increasing Incidence of Sleep Apnea Pushing Demand in the USA

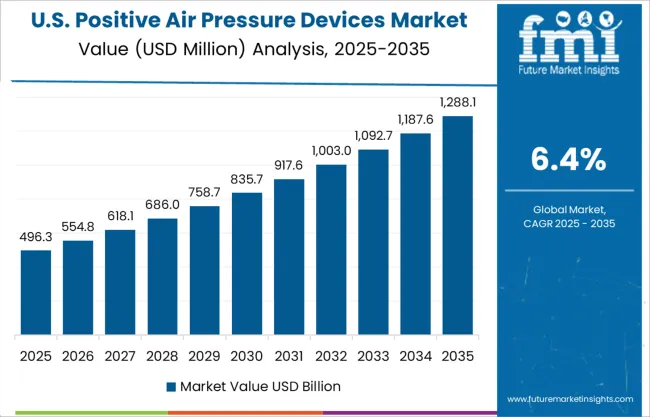

As per FMI, the USA will continue to dominate the global positive air pressure devices market during the forecast period, accounting for the largest market share of around 24.8% in 322. Growth in the USA positive air pressure devices market is driven by the rising prevalence of sleep apnea and breathing disorders, high levels of healthcare awareness among people, and the growing popularity of home healthcare.

Similarly, the presence of leading medical device manufacturers, favorable reimbursement policies, and increased demand for positive air pressure machines are expected to boost the market in the country during the forecast period.

Over the years, there has been a sharp rise in the cases of sleep apnea across the USA which has generated enormous demand for medical devices like positive air pressure devices and the trend is likely to continue during the forecast period. For instance, as per the American Sleep Apnea Foundation, around 25 million Americans suffer from sleep apnea and the number is expected to further rise during the upcoming years.

Growing Adoption of Positive Air Pressure Devices in Home Care Settings Boosting Market in China

China will contribute nearly 8.0% revenue share to the global positive air pressure devices market in 322, making it one of the leading markets across East Asia.

The high prevalence of long-term sleep problems and rising patient awareness are expected to increase the demand for Positive air pressure devices in China, which will in turn fuel the expansion of the local market.

Additionally, home care settings are expanding quickly due to the region's high prevalence and frequency of long-term respiratory disorders and the utilization of the equipment.

Continuous Positive Airway Pressure Devices Remain Highly Sought-After Products

As per FMI, continuous positive airways pressure devices (CPAP) will continue to dominate the global positive air pressure devices market, accounting for the highest market share of 70.7% in 2025. This can be attributed to the rising adoption of these devices across various end-user sectors.

Continuous positive airway pressure (CPAP) devices have become the gold standard treatment for obstructive sleep apnea. These continuous positive airway pressure devices provide a constant level of pressure greater than atmospheric pressure to the upper respiratory tract of a person.

However, the bi-level positive airway pressure (BiPAP)/ variable positive airway pressure (VPAP) segment will grow at a higher CAGR of about 9.9% during the forecast period. This is because post-COVID-19 pandemic, these devices are increasing in their demand due to their easy portability and use in the product's market.

Obstructive Sleep Apnea Segment to Generate Highest Revenue Share

As per FMI, the obstructive sleep apnea segment is estimated to dominate the global positive air pressure devices market with a revenue share of around 64.5% in 2025 and is further expected to display a growth rate of 5.9% over the forecast period.

The growth of this segment can be attributed to the rising prevalence of obstructive sleep apnea worldwide and the increasing adoption of positive air pressure devices for treating this medical condition.

However, amid the rising incidence of chronic respiratory failure, the respiratory failures segment is likely to grow at the highest CAGR of about 7.5% during the forecast period of 2025 and 2035.

The usage of Positive Air Pressure Remains High in Hospitals

Based on end users, the hospital segment will hold the highest market share value of 57.9% in 2025. This is because most of these devices had been used under a hospital setup only. Similarly, the rising number of hospitals and the growing preference of patients to opt for treatments at hospitals will further accelerate the growth of this segment.

However, with the growing popularity of home healthcare and the availability of portable devices, the home care settings segment is expected to grow at the fastest CAGR of about 8.6% during the forecast period.

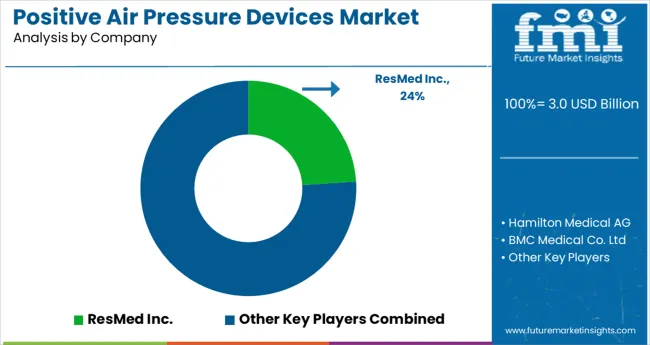

With several competitors in the positive air pressure device manufacturing sphere, the overall market is highly fragmented. To meet consumer demand and expand their customer base, leading companies are implementing strategic approaches such as mergers and acquisitions, partnerships and collaborations, and new product launches.

Instances of key developmental strategies by the industry players in the positive air pressure devices market are given below:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 3.0 billion |

| Projected Market Size (2035) | USD 5.6 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.4% |

| Forecast Period | 2012 to 2024 |

| Historical Data Available for | 2025 to 2035 |

| Market Analysis | million for Value and Absolute Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, South Africa |

| Key Market Segments Covered | Product, Application End User, and Region |

| Key Companies Profiled | 3B Medical, Inc; Hamilton Medical AG; BMC Medical Co. Ltd; Breas Medical AB; Compumedics Limited; Drive DeVilbiss Healthcare; Elmaslar Group; Fisher & Paykel Healthcare Corporation ; Limited; Hebei Topson Medical Technology Co., ; Ltd.; Kare Medical and Analytical Devices Ltd. ; Co; Koninklijke Philips N.V; Lowenstein Medical Technology GmbH.; Narang Medical Limited.; Somnetics International, Inc.; Draegerwerk AG & Co. KGaA; Apex Medical Corporation; ResMed Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global positive air pressure devices market is estimated to be valued at USD 3.0 billion in 2025.

It is projected to reach USD 5.6 billion by 2035.

The market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types are continuous positive airways pressure devices (cpap), bi-level positive airway pressure (bipap)/ variable positive airway pressure (vpap) and automatic positive airway pressure devices (apap).

obstructive sleep apnea segment is expected to dominate with a 63.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Positive Airway Pressure Devices Market Size and Share Forecast Outlook 2025 to 2035

China Continuous Positive Airway Pressure Devices Market Outlook – Share, Growth & Forecast 2025-2035

Positive Patient Identification Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Blowers Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Sanitary Pumps Market Size and Share Forecast Outlook 2025 to 2035

Positive Displacement Pumps Market Growth - Trends & Forecast 2025 to 2035

HER2 Positive Gastric Cancer Market Size and Share Forecast Outlook 2025 to 2035

Continuous Positive Airway Pressure (CPAP) Market Analysis – Size, Share & Forecast Outlook 2025 to 2035

OPEP Device Market Analysis – Growth & Forecast 2024-2034

BRCA Mutation-Positive Ovarian Cancer Market

UK Continuous Positive Airway Pressure (CPAP) Market Trends – Growth, Demand & Analysis 2025-2035

NTRK Fusion Gene Positive Advanced Solid Tumors Market Size and Share Forecast Outlook 2025 to 2035

India Continuous Positive Airway Pressure (CPAP) Market Trends – Size, Share & Growth 2025-2035

Germany Continuous Positive Airway Pressure (CPAP) Market Insights – Size, Trends & Forecast 2025-2035

United States Continuous Positive Airway Pressure (CPAP) Market Report – Trends, Demand & Forecast 2025-2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA