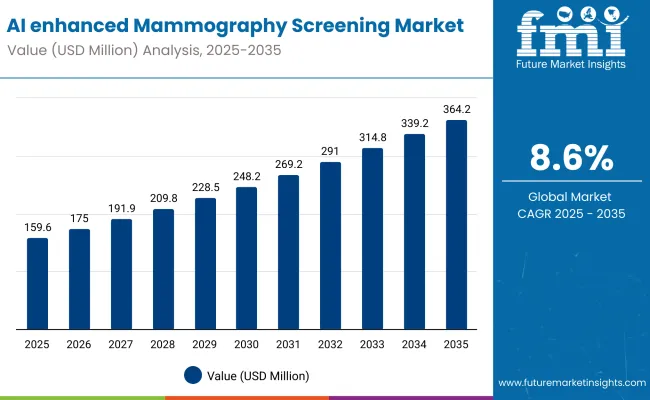

The Global AI enhanced Mammography Screening Market has been forecasted to attain a valuation of USD 159.6 million in 2025, rising to USD 364.1 million by 2035, resulting in an incremental gain of USD 204.6 million, which reflects a 43.8% increase over the forecast decade. A compound annual growth rate (CAGR) of 8.6% is expected to be recorded, indicating a rapid expansion trajectory for the global AI enhanced mammography screening market.

Global AI enhanced Mammography Screening Market Key Takeaways

| Metric | Value |

|---|---|

| Global AI enhanced Mammography Screening Market Estimated Value in (2025E) | USD 159.6 million |

| Global AI enhanced Mammography Screening Market Forecast Value in (2035F) | USD 364.1 million |

| Forecast CAGR (2025 to 2035) | 8.6 % |

Between 2025 and 2030, the AI-enhanced mammography screening market is expected to gain broader adoption across hospitals, diagnostic imaging centers, and community health programs, as radiologists and oncologists increasingly rely on AI-powered image analysis to improve breast cancer detection and reduce false positives. It will grow upto USD 81.5 million in that period from USD 159.6 million in 2025 to USD 241.1 million in 2030.

The convergence of deep learning algorithms, cloud-based diagnostic platforms, and user-friendly radiology software is making AI screening tools more accessible, prompting adoption even in mid-tier healthcare networks and regional diagnostic labs.

Between 2030 and 2035, the market is projected to expand further by USD 123.1million, driven by advances in multi-modal AI systems that integrate mammography with ultrasound, MRI, and tomosynthesis. Healthcare providers are expected to drive growth by adopting solutions that enhance early disease detection and efficiently handle the growing volume of screenings associated with aging populations.

Continuous development in explainable AI (XAI), federated learning for secure data sharing, and real-time clinical decision support will shape the next generation of AI-enhanced mammography solutions.

From 2020 to 2024, the global AI enhanced mammography screening market, expanded from USD 100.0million to USD 147.6 million, maturing through the broader availability of cloud-integrated AI tools and regulatory approvals in the USA and Europe. During this phase, global medtech companies partnered with healthcare institutions to validate AI algorithms on large, diverse datasets reducing bias, improving sensitivity and specificity, and building physician trust. These efforts laid the foundation for the widespread use of AI screening solutions in routine breast cancer diagnostics.

Going forward, the AI-enhanced mammography ecosystem will likely evolve to incorporate predictive analytics, patient risk stratification, and seamless integration with electronic health records (EHRs). These innovations aim to improve diagnostic accuracy, reduce healthcare costs, and expand access to underserved populations making AI-enhanced mammography a cornerstone technology in global breast cancer screening and early detection strategies.

The growth of the global AI-enhanced mammography screening market is reinforced by the unique ability of artificial intelligence to significantly improve the accuracy, efficiency, and consistency of breast cancer detection. Unlike conventional mammography interpretation, which relies solely on radiologist expertise and is prone to variability, AI systems provide advanced pattern recognition, automated anomaly detection, and real-time decision support making them indispensable for next-generation diagnostic workflows.

Over the last decade, the scope of AI in mammography has expanded beyond simple image recognition. It is now a critical component of comprehensive breast imaging programs, enabling earlier detection of microcalcifications, tumor margins, and dense tissue abnormalities that are often missed by traditional methods. As healthcare systems increasingly prioritize early diagnosis and personalized treatment, AI-enhanced mammography is becoming a mandatory tool across leading hospitals, imaging networks, and cancer research centers.

Another factor driving adoption is the shift from isolated imaging systems to cloud-integrated, scalable AI platforms. Solution providers now offer turnkey solutions that integrate AI algorithms with picture archiving and communication systems (PACS), cloud-based storage platforms, and automated reporting modules. Key solution providers include iCAD, ScreenPoint Medical, Hologic, RadNet’sDeepHealth, GE HealthCare, and Sectra. These solutions enable hospitals, diagnostic imaging centers, and mobile screening units to deploy advanced breast screening programs while reducing workflow bottlenecks and minimizing radiologist workload.

Moreover, rising demand from interdisciplinary healthcare applications including population-wide screening programs, tele-radiology networks, and AI-assisted risk stratification is accelerating the development of hybrid diagnostic platforms that combine mammography with MRI, ultrasound, and tomosynthesis. These systems address the increasing need to improve sensitivity in dense breast tissues and high-risk patient populations.

Collectively, these clinical and technological drivers are positioning the AI-enhanced mammography screening market for sustained expansion, fueled by its essential role in improving early detection rates, reducing diagnostic errors, and supporting global efforts to lower breast cancer mortality.

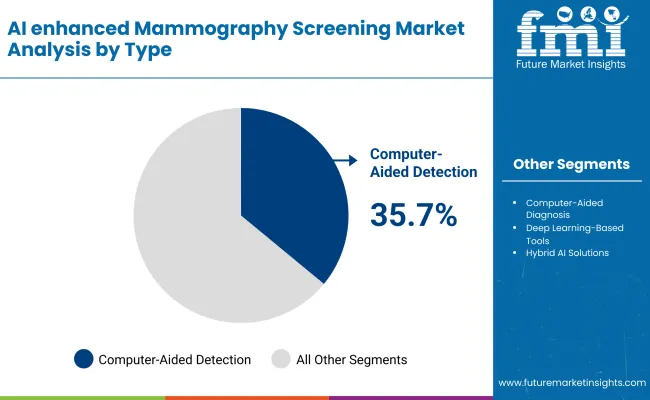

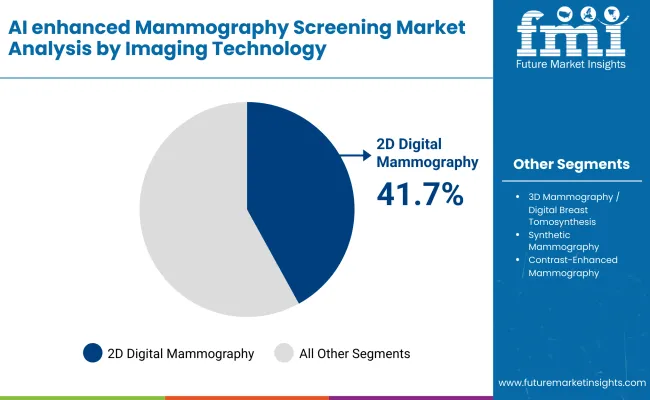

The market is segmented by type, imaging technology, application, end user, and region.Type includes computer-aided detection (CADe), computer-aided diagnosis (CADx), deep learning-based tools, hybrid AI solutions, risk assessment and breast density tools, and others.Imaging technology classification covers 2D digital mammography (FFDM), 3D mammography / digital breast tomosynthesis (DBT), synthetic mammography, contrast-enhanced mammography, and others.

Based on application, the segmentation includes screening, diagnostic follow-up, risk prediction / stratification, triage and workflow optimization, and others. Based on end user, the segmentation includes hospitals and general clinics, cancer centers, diagnostic imaging centers, and mobile screening units.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Type | Market Value Share, 2025 |

|---|---|

| Computer-Aided Detection (CADe) | 35.7% |

| Computer-Aided Diagnosis (CADx) | 20.3% |

| Deep Learning-Based Tools | 17.0% |

| Hybrid AI Solutions | 12.0% |

| Risk Assessment & Breast Density Tools | 8.6% |

| Others | 6.4% |

Computer-Aided Detection (CADe) is projected to lead the product category with a 35.7% market share in 2025, and is expected to maintain this position due to its ability to automatically identify suspicious regions in mammograms with high sensitivity and accuracy enabling radiologists to detect early-stage breast cancers while reducing diagnostic oversight.

Unlike manual review processes, CADe systems integrate AI algorithms with PACS, cloud-based storage, and automated reporting, allowing seamless workflow integration across hospitals, cancer centers, and mobile screening units.

Recent advances in deep learning, image preprocessing, and multi-modality integration have enhanced the precision of CADe systems, enabling detection of microcalcifications, subtle lesions, and architectural distortions across 2D digital mammography, 3D tomosynthesis, and contrast-enhanced imaging. Moreover, AI-powered analytics now support real-time case prioritization, reducing radiologist workload and improving screening throughput.

Computer-Aided Diagnosis (CADx), with a 20.3% share, complements CADe by providing malignancy scoring, lesion characterization, and risk stratification to guide clinical decision-making. A key factor behind the growing adoption of AI-based mammography solutions is their increasing deployment across hospitals, diagnostic imaging centers, and mobile units.

With leading solution providers offering turnkey, PACS-integrated platforms that require minimal user calibration, CADe and CADx systems are becoming accessible even to smaller facilities. Their combination of operational efficiency, diagnostic accuracy, and workflow optimization ensures that AI-enhanced mammography remains central to modern breast cancer screening programs worldwide.

| Imaging Technology | Market Value Share, 2025 |

|---|---|

| 2D Digital Mammography (FFDM) | 41.7% |

| 3D Mammography / Digital Breast Tomosynthesis (DBT) | 35.0% |

| Synthetic Mammography | 10.0% |

| Contrast-Enhanced Mammography | 6.0% |

| Others | 7.3% |

2D Digital Mammography (FFDM) continues to dominate the breast imaging landscape, accounting for 41.7% of total demand in 2025. This modality remains the foundation of breast cancer screening and diagnosis due to its proven ability to detect microcalcifications, masses, and architectural distortions with high spatial resolution. As a standard clinical tool, 2D FFDM provides reproducible results, broad compatibility with imaging workflows, and well-established interpretation protocols that support large-scale screening programs.

What makes 2D FFDM indispensable is its mature ecosystem and extensive clinical experience. Radiologists and imaging centers have long-standing expertise with 2D mammography systems, and decades of accumulated patient data create a rich reference framework for comparative studies and longitudinal assessments. The technique is particularly effective for routine population screening and initial diagnostic evaluations, where reliable baseline imaging is critical.

Recent advancements in detector technology, image processing software, and radiation dose optimization have further enhanced the clarity, safety, and usability of 2D mammography systems. Moreover, ongoing integration into medical education and national screening initiatives ensures a sustained pipeline of skilled operators and stable clinical adoption.

While advanced modalities such as 3D Mammography / Digital Breast Tomosynthesis (DBT), Synthetic Mammography, and Contrast-Enhanced Mammography are gaining traction in specialized applications 2D FFDM remains the mainstay of the global mammography market. Its versatility, accessibility, and proven clinical utility continue to make it the preferred choice for a wide range of screening and diagnostic scenarios, while emerging technologies complement rather than replace its role.

The adoption of AI-enhanced mammography screening is accelerating across healthcare systems as advancements in artificial intelligence, imaging technologies, and cloud-based analytics converge to improve early breast cancer detection. While momentum is strong, the market also faces structural challenges related to infrastructure, regulatory compliance, and integration complexity.

Rising demand for early breast cancer detectionBreast cancer remains one of the most prevalent cancers among women worldwide, and early detection is critical for improving treatment outcomes and survival rates. Increasing awareness of regular screening programs, coupled with rising healthcare expenditures, has motivated healthcare providers to adopt advanced diagnostic tools capable of enhancing detection rates.

AI-enabled mammography systems leverage machine learning and deep learning algorithms to identify subtle anomalies in breast tissue, often undetectable in traditional manual screenings. These systems support radiologists by providing consistent, rapid, and accurate preliminary analyses, thereby reducing diagnostic errors and improving workflow efficiency.

Aging populations and the corresponding increase in the number of women eligible for regular screening have further amplified demand, driving hospitals, imaging centers, and diagnostic networks to invest in AI-assisted mammography. This growing need for timely, accurate detection is expected to sustain market growth over the coming years, positioning AI-enhanced mammography as an essential component in modern breast cancer screening strategies.

Growing adoption of predictive analytics is enabling personalized breast cancer screening and optimized patient care

Predictive models analyze patient data including age, family history, genetic markers, and previous imaging results to estimate individual risk profiles and recommend tailored screening schedules. This approach allows healthcare providers to focus resources on high-risk populations while reducing unnecessary screenings for low-risk patients, optimizing both cost efficiency and clinical outcomes.

AI algorithms enhance predictive capabilities by continuously learning from large datasets, identifying patterns that may be missed by conventional analysis. Integration with electronic health records (EHRs) and multi-modality imaging platforms further strengthens these predictive insights, allowing radiologists to make informed decisions based on comprehensive patient histories.

Predictive analytics not only improves early detection rates but also contributes to more proactive and personalized care, aligning with broader trends in precision medicine. As healthcare systems worldwide move toward data-driven decision-making, the adoption of predictive AI tools in mammography is expected to accelerate, shaping the next generation of breast cancer screening programs.

Regulatory and data privacy challenges remain key barriers to widespread adoption of AI-enhanced mammography solutionsHealthcare providers must comply with strict standards such as HIPAA in the United States and GDPR in Europe, which govern patient data collection, storage, and sharing. Ensuring that AI systems meet these compliance requirements often entails additional investments in secure infrastructure, encrypted storage, and audit mechanisms.

Moreover, the validation and approval of AI algorithms for clinical use require rigorous testing, clinical trials, and regulatory clearance, which can be time-consuming and costly. Variations in regulations across regions further complicate market expansion, particularly for vendors seeking global adoption.

Concerns over patient privacy and the security of sensitive health data may also limit willingness among institutions to fully deploy AI solutions, especially in cloud-based platforms. Addressing these regulatory and privacy challenges is critical for maintaining trust in AI-assisted diagnostics.

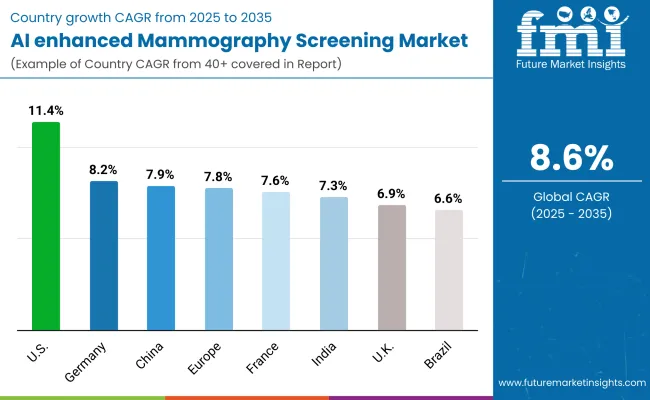

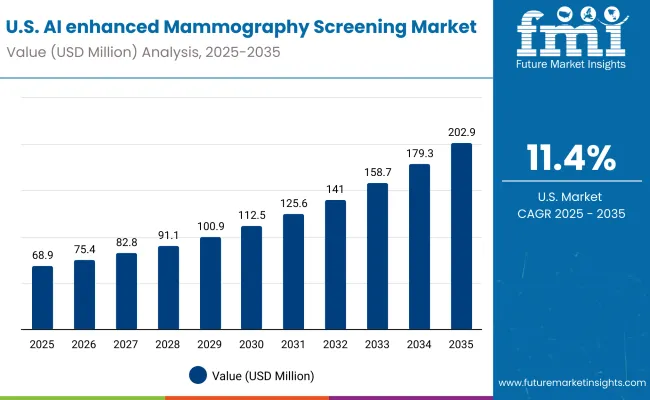

| Country | CAGR |

|---|---|

| USA | 11.4% |

| Brazil | 6.6% |

| China | 7.9% |

| India | 7.3% |

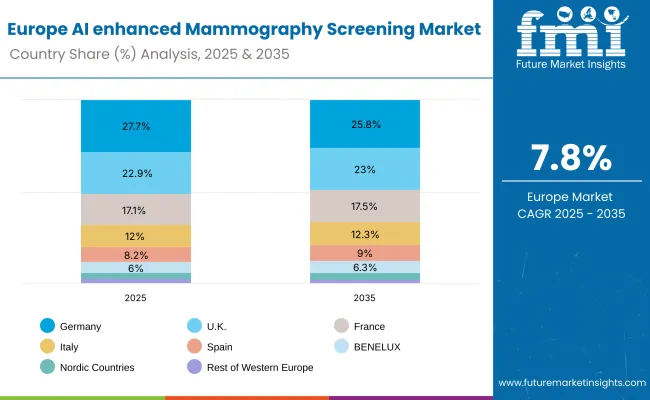

| Europe | 7.8% |

| Germany | 8.2% |

| France | 7.6% |

| UK | 6.9% |

The adoption and growth patterns of AI-enhanced mammography screening systems exhibit distinct variations across different regions, influenced by the maturity of healthcare infrastructure, government and private investment in medical technologies, and the demand for advanced diagnostic solutions.

In the United States, the AI-enhanced mammography market is characterized by strong growth driven by a robust ecosystem of hospitals, diagnostic imaging centers, cancer centers, and technology providers developing AI algorithms for early breast cancer detection.

The widespread availability of advanced imaging modalities including 2D digital mammography, 3D tomosynthesis, and contrast-enhanced systems combined with integrated AI platforms, supports high diagnostic accuracy and operational efficiency. Continuous investment in AI validation studies, PACS integration, and cloud-based analytics further propels adoption, particularly in large hospital networks and specialized breast care centers. The market here is projected to account for 11.4% of the global AI-enhanced mammography screening market.

In Europe, countries such as Germany, France, and the UK are leading the AI-enhanced mammography screening market, with growing emphasis on integrating advanced imaging technologies and AI-driven diagnostic tools within national healthcare strategies and cancer prevention programs.

Government-backed digital health initiatives, hospital networks, and large-scale screening programs facilitate collaboration between clinical centers, technology providers, and research institutions, enabling adoption of solutions such as computer-aided detection (CADe), computer-aided diagnosis (CADx), deep learning-based platforms, and hybrid AI tools.

Regulatory support, reimbursement frameworks, and strategic funding foster sustained market growth, though adoption remains cautiously progressive as healthcare providers validate AI algorithms and optimize clinical workflows.

Multi-modality support including 2D digital mammography, 3D tomosynthesis, synthetic mammography, and contrast-enhanced imaging further strengthens the market by improving early detection and diagnostic accuracy. The market in Germany is projected to grow at a CAGR of 8.2%, France at 7.6%, and the UK at 6.9%.

Overall, the European AI-enhanced mammography market reflects a strategic blend of technological advancement, healthcare policy alignment, and institutional investment, which collectively govern the pace and scale of adoption across different countries. This interplay underscores the central role that regional infrastructure, regulatory guidance, and clinical expertise play in shaping the trajectory of AI-driven breast cancer screening programs.

The United States represents the most mature and research-intensive market for AI-enhanced mammography screening, forecasted to expand at a CAGR of 11.4% between 2025 and 2035. Hospitals, cancer centers, and academic institutions including MD Anderson, Mayo Clinic, and Harvard-affiliated hospitals have been pivotal in setting global benchmarks for AI adoption in breast imaging. The USA benefits from extensive digital imaging infrastructure, advanced PACS systems, and robust regulatory frameworks that support the integration of AI algorithms into clinical practice.

India’s AI-enhanced mammography screening market is expected to grow at a CAGR of 7.3% between 2025 and 2035, supported by increasing awareness, rising breast cancer incidence, and expanding urban healthcare infrastructure. Although AI-assisted mammography adoption is currently focused in Tier 1 cities and major hospital networks, smaller clinics and regional healthcare centers across India are increasingly beginning to implement these systems.

China’s AI-enhanced mammography screening market is projected to expand at a CAGR of 7.9% from 2025 to 2035, driven by strong government investment in digital healthcare, AI research, and breast cancer screening programs. Companies such as Yitu Technology, Lunit, and iCAD are at the forefront of deploying AI-assisted mammography solutions across clinical and research settings in China.

| Europe Country | 2025 |

|---|---|

| Germany | 27.7% |

| UK | 22.9% |

| France | 17.1% |

| Italy | 12.0% |

| Spain | 8.2% |

| BENELUX | 6.0% |

| Nordic Countries | 3.4% |

| Rest of Western Europe | 2.7% |

| Europe Country | 2035 |

|---|---|

| Germany | 25.8% |

| UK | 23.0% |

| France | 17.5% |

| Italy | 12.3% |

| Spain | 9.0% |

| BENELUX | 6.3% |

| Nordic Countries | 4.1% |

| Rest of Western Europe | 2.0% |

The AI-enhanced mammography screening market in the United Kingdom is projected to grow at a CAGR of 6.9% between 2025 and 2035. Adoption is supported by strong public investment in digital healthcare, AI research, and national breast cancer screening programs.

Innovation pilot projects in the UK are deploying AI-assisted mammography in hospitals and research centers, utilizing cloud-based imaging networks and AI algorithms to enhance diagnostic accuracy and operational efficiency. The country benefits from centralized imaging networks and cloud-based platforms that enable multi-site collaboration and AI-driven analytics.

Recent initiatives have accelerated lab- and hospital-based deployment of AI systems, with capital grants from UKRI and NHS innovation funds supporting pilot projects and large-scale trials. AI-assisted imaging is increasingly being used in conjunction with digital breast tomosynthesis (DBT) and synthetic mammography, enabling more accurate and comprehensive breast cancer detection.

The AI-enhanced mammography screening market in Germany is anticipated to grow at a CAGR of 8.2% between 2025 and 2035. Germany is establishing itself as a hub for high-precision breast imaging, particularly through AI-assisted 3D mammography, synthetic mammography, and contrast-enhanced modalities.

While clinical adoption remains strong in academic hospitals, much of the current growth is fueled by partnerships between federal health agencies, leading university hospitals, and medical technology manufacturers. German companies are playing a strategic role in developing AI algorithms, imaging workstations, and integrated cloud solutions for breast cancer screening, which are increasingly being deployed internationally.

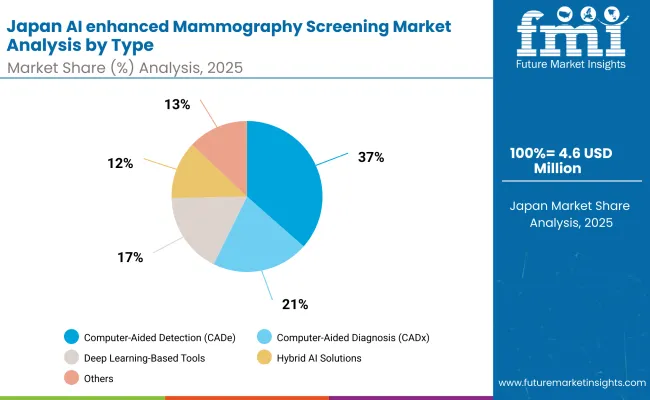

| Type | Market Value Share, 2025 |

|---|---|

| Computer-Aided Detection (CADe) | 36.5% |

| Computer-Aided Diagnosis (CADx) | 20.8% |

| Deep Learning-Based Tools | 17.4% |

| Hybrid AI Solutions | 12.3% |

| Risk Assessment & Breast Density Tools | 8.8% |

| Others | 13.0% |

The AI-enhanced mammography market in Japan is projected to reach USD 4.63 million by 2025. Computer-Aided Detection (CADe) dominates the product landscape with a 36.5% share, followed by Computer-Aided Diagnosis (CADx) at 20.8%.

Japan’s AI mammography market is shaped by a strong culture of technological innovation, robust public healthcare infrastructure, and a focus on early cancer detection. The integration of AI into breast cancer screening has improved diagnostic accuracy, reduced recall rates, and enhanced workflow efficiency in healthcare facilities across the country. As Japan continues to invest in AI technology and research, the adoption of AI-assisted mammography is expected to expand, further strengthening the country’s capabilities in early breast cancer detection and treatment.

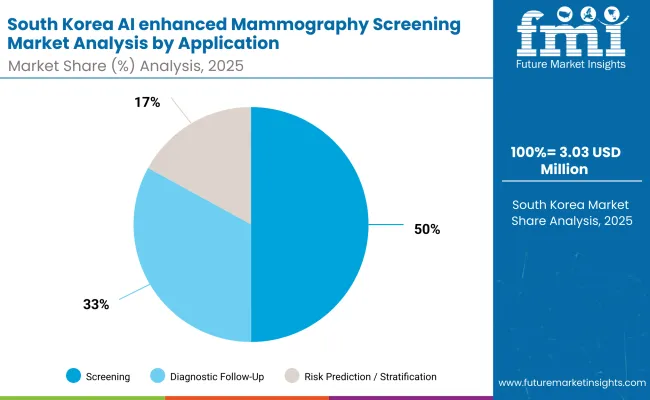

| By Application | Market Value Share, 2025 |

|---|---|

| Screening | 49.9% |

| Diagnostic Follow-Up | 32.2% |

| Risk Prediction / Stratification | 16.7% |

| Triage & Workflow Optimization | 7.8% |

| Others | 17.9% |

The AI-enhanced mammography market in South Korea is projected to reach USD 1.1 million in 2025. Screening dominates the product landscape with a 49.9% share, followed by Diagnostic Follow-Up at 32.2%.South Korea’s AI mammography market is evolving rapidly, moving from early pilot programs toward nationwide clinical deployment. Hospitals often deploy multiple AI modalities ranging from automated screening to risk stratification tools enabling comprehensive patient management.

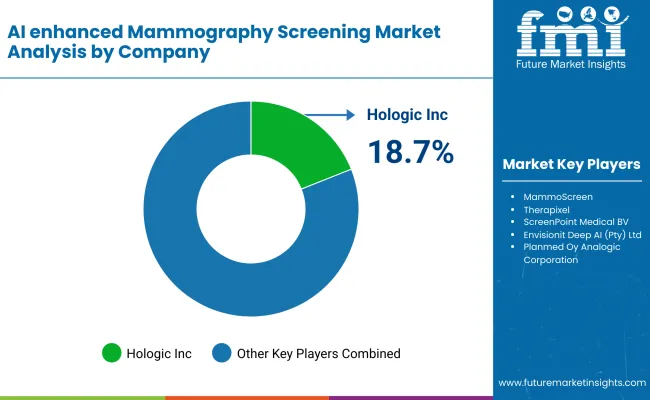

| Company | Global Value Share 2024 |

|---|---|

| Hologic , Inc. | 18.7% |

| Others | 81.3% |

The AI-enhanced mammography screening market is moderately concentrated, with Hologic, Inc. holding a leading position globally at 18.7% share in 2024. Hologic’s dominance stems from its comprehensive portfolio of 2D and 3D mammography systems integrated with advanced AI tools for lesion detection, diagnostic follow-up, and risk stratification. Its platforms are widely adopted across hospitals, imaging centers, and screening programs, supported by robust software updates, clinical validation, and strong customer support.

Other key players collectively account for 81.3% of the market, addressing diverse segments and specialized use cases. iCAD, Inc. (DeepHealth) focuses on AI-assisted cancer detection and workflow optimization, while MammoScreen and Therapixel provide deep-learning-based image analysis solutions. ScreenPoint Medical BV. andEnvisionit Deep AI (Pty) Ltd. target screening programs and hybrid AI workflows, enhancing sensitivity and efficiency.

Key Developments in Global AI enhanced Mammography Screening Market

| Item | Value |

|---|---|

| Quantitative Units | USD 159.6 million |

| By Type | Computer-Aided Detection (CADe), Computer-Aided Diagnosis (CADx), Deep Learning-Based Tools, Hybrid AI Solutions, Risk Assessment & Breast Density Tools and others |

| By Imaging Technology | 2D Digital Mammography (FFDM), 3D Mammography / Digital Breast Tomosynthesis (DBT), Synthetic Mammography, Contrast-Enhanced Mammography and others |

| By Application | Screening, Diagnostic Follow-Up, Risk Prediction / Stratification, Triage & Workflow Optimization and others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Europe, Germany, France and UK |

| Key Companies Profiled | Hologic , Inc., iCAD , Inc. (DeepHealth), MammoScreen , Therapixel , ScreenPoint Medical BV., Envisionit Deep AI (Pty) Ltd., Human Bytes, Planmed Oy, Analogic Corporation, GE HealthCare, Koninklijke Philips N.V., Esaote SPA |

The global AI enhanced mammography screening market is estimated to be valued at USD 159.6 million in 2025.

The market size for the global AI enhanced mammography screening market is projected to reach approximately USD 364.19 million by 2035.

The global AI enhanced mammography screening market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The key types in the global AI enhanced mammography screening market include Computer-Aided Detection (CADe), Computer-Aided Diagnosis (CADx), Deep Learning-Based Tools, Hybrid AI Solutions, Risk Assessment & Breast Density Tools and others.

In terms Imaging Technology, 2D Digital Mammography (FFDM) is projected to command the highest share at 41.7% in the global AI enhanced mammography screening market in 2025

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Trait Enhanced Oils Market

Autonomous AI Powered Ophthalmology Screening Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Embryo Selection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

AI Code Assistant Market Size and Share Forecast Outlook 2025 to 2035

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA