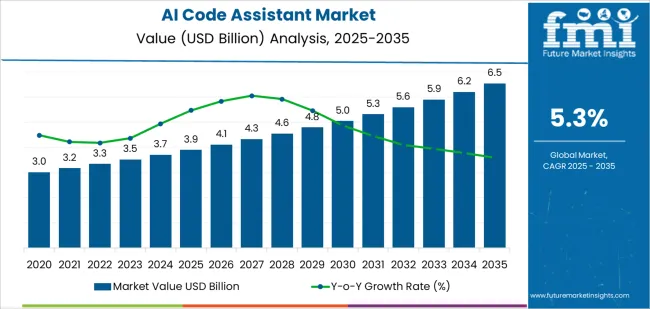

The global AI code assistant market is valued at USD 3.9 billion in 2025 and is projected to reach USD 6.6 billion by 2035, reflecting a CAGR of 5.3%. The Growth Rate Volatility Index for the AI code assistant market shows relatively low volatility in the early years of the forecast period (2025–2030). The AI code assistant market experiences steady, predictable growth as AI-driven coding assistants gain traction among developers, software companies, and educational platforms. Increased demand for enhanced coding productivity, error reduction, and automated code generation tools supports a consistent adoption curve, leading to gradual but continuous growth.

From 2030 to 2035, the volatility index remains moderate. While growth continues, the market begins to stabilize as AI code assistants become integrated into mainstream software development tools, reducing the pace of new adoption. By this stage, market growth is more dependent on incremental improvements in AI capabilities, such as better natural language understanding, integration with various coding languages, and improved collaborative features. Despite a slight decrease in growth speed, the increasing reliance on AI for code writing and debugging ensures the AI code assistant market continues its upward trend, with consistent, manageable fluctuations in annual growth rates.

Between 2025 and 2030, the AI Code Assistant Market grows from USD 3.9 billion to USD 5.4 billion, generating USD 1.5 billion in added value. The market shows steady market share gain, driven by increasing demand for AI-driven coding tools in software development, IT automation, and DevOps workflows. Growth is fueled by businesses seeking to enhance developer productivity, streamline the coding process, and leverage AI for error detection and code optimization. As adoption increases across small to medium enterprises (SMEs) and large-scale organizations, AI code assistants will gain a larger share of the developer tool market, especially in cloud computing and SaaS environments.

From 2030 to 2035, the market continues to expand from USD 5.4 billion to USD 6.6 billion, adding another USD 1.2 billion. However, during this phase, there may be market share erosion from traditional coding IDEs (Integrated Development Environments) and manual coding techniques, as AI tools evolve and become increasingly integrated with other software development practices, such as low-code/no-code platforms. Although traditional development tools may lose share to AI-driven solutions, the market for AI code assistants will continue to grow as developers adopt them for more complex coding tasks. The key to sustaining market share gain will be continuous advancements in AI's ability to support a broader range of programming languages, improve learning models, and provide more accurate code suggestions across diverse industries.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.9 billion |

| Market Forecast Value (2035) | USD 6.6 billion |

| Forecast CAGR (2025–2035) | 5.3% |

The AI code assistant market is expanding as organizations adopt automated tooling to streamline development, reduce errors, and accelerate time to market. These assistants provide code generation, autocompletion, error detection, and documentation capabilities, enabling developers to focus on higher value tasks and reducing repetitive coding. AI-driven tools are helping to improve coding efficiency, reduce debugging time, and enhance overall software quality. Improvements in underlying models, broader language support, and enterprise ready integrations boost adoption across teams managing large codebases and complex workflows.

Further growth is supported by rising developer headcounts, distributed teams, and the expanding need for code quality governance and compliance in regulated sectors. As companies increasingly look to integrate artificial intelligence into their development processes, AI code assistants offer scalable solutions that improve productivity. Organizations are incorporating these tools into integrated development environments (IDEs), continuous integration/continuous deployment (CI/CD) pipelines, and version control systems, reinforcing their role as essential components in modern software development practices.

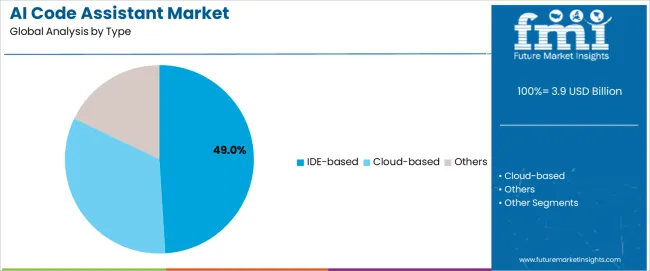

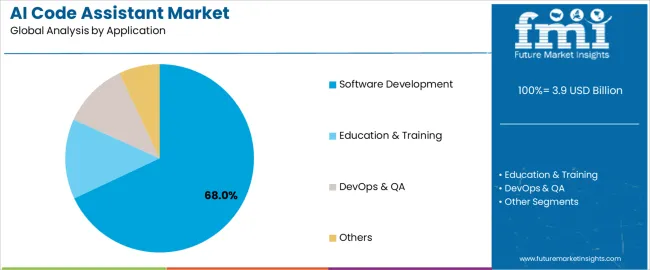

The AI code assistant market is segmented by type, application, and region. By type, the market is divided into IDE-based, cloud-based, and others. Based on application, it is categorized into software development, education & training, DevOps & QA, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in technology infrastructure, organizational needs, and regional adoption patterns that influence how AI code assistants are utilized across industries.

The IDE-based segment accounts for approximately 49.0% of the global AI code assistant market in 2025, making it the leading type category. This position is driven by the widespread use of integrated development environments (IDEs) in software development, where developers rely on tools that enhance productivity, speed, and accuracy. IDE-based AI code assistants offer real-time code completion, error detection, syntax suggestions, and context-aware recommendations, all of which improve the coding process and reduce the chances of bugs or issues in production.

Adoption is particularly strong among software developers and organizations focused on large-scale application development, where efficiency and error-free coding are paramount. The segment is widely adopted in North America, Europe, and East Asia, where software development activities are prevalent. The IDE-based segment maintains its lead because it integrates seamlessly into the developer's existing workflow, enhancing their ability to write and debug code within their preferred development environment. As the demand for faster software development continues to grow, IDE-based AI assistants are becoming essential for increasing productivity and maintaining high coding standards.

The software development segment represents about 68.0% of the total AI code assistant market in 2025, making it the dominant application category. This position reflects the heavy reliance on AI-driven tools to optimize the software development lifecycle, reduce coding time, and improve code quality. Software developers utilize AI code assistants to automate repetitive tasks, such as refactoring code, suggesting improvements, and helping with debugging. These tools significantly enhance developer efficiency and help teams meet tight project deadlines.

The adoption of AI code assistants in software development is particularly high in industries such as fintech, healthcare, and enterprise software, where precision and speed are essential. Adoption is also notable in North America, Europe, and East Asia, where AI-driven tools are becoming a standard part of the development toolkit. The segment maintains its leading share because software development is the largest user base for AI code assistants, driving continuous demand for innovative tools that streamline coding tasks and increase productivity.

The AI code assistant market is expanding rapidly as software development teams adopt AI powered tools that automate code generation, provide autocomplete suggestions, assist in debugging and enhance developer productivity. These assistants enable faster feature delivery, improved code quality and reduced manual effort. Growth is supported by increasing pressure on development speed, the broader availability of large language models (LLMs) trained on code and widespread shift toward cloud native development workflows. Adoption is moderated by concerns around code correctness, security vulnerabilities, intellectual property risks and integration complexity. Providers are evolving features to include real time collaboration, enterprise grade governance and platform integration.

Demand is being driven by the need to expedite software delivery in competitive markets and handle growing complexity in codebases. Enterprises face pressure to support continuous deployment, microservices architecture and cross language teams. AI code assistants help by suggesting code snippets, identifying patterns, automating routine tasks and reducing cognitive load on developers. At the same time, advancements in LLMs capable of understanding natural language prompts and generating code across frameworks have made these tools accessible. Organizations view AI driven coding assistance as a way to scale developer output and maintain speed without proportionate staffing increases.

Several barriers limit broad adoption. Quality and reliability of AI generated code remain key concerns assistants may produce syntactically correct but semantically flawed code, requiring human review and revision. Security risks arising from generated code, intellectual property issues (e.g., training data provenance) and compliance requirements present adoption obstacles for regulated industries. Integration with enterprise development pipelines and legacy systems can be complex. Developer skepticism and change management resistance also slow uptake, especially in teams accustomed to conventional workflows. These factors collectively moderate the pace of adoption despite strong interest.

Key trends include deep integration of code assistants into integrated development environments (IDEs) and version control systems, expansion of enterprise tier offerings with governance, collaboration and compliance controls, and the development of hybrid models that combine local on premises AI with cloud services for sensitive codebases. There is a shift from simple autocomplete toward full feature generators, refactoring suggestions, code review automation and security scanning. Regionally, adoption is strongest in North America due to mature development ecosystems, while Asia Pacific shows fastest growth driven by large developer populations and cloud first strategies. As development teams increasingly embrace AI tools, code assistants are becoming core parts of the software engineering toolchain rather than optional add ons.

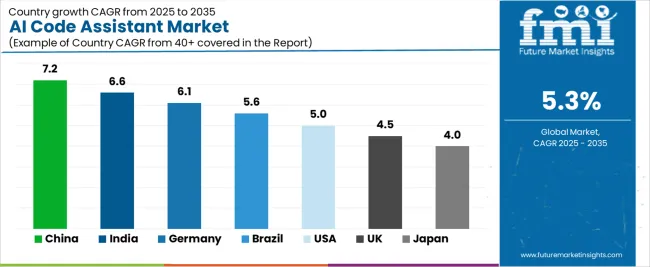

| Country | CAGR (%) |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| USA | 5.0% |

| UK | 4.5% |

| Japan | 4.0% |

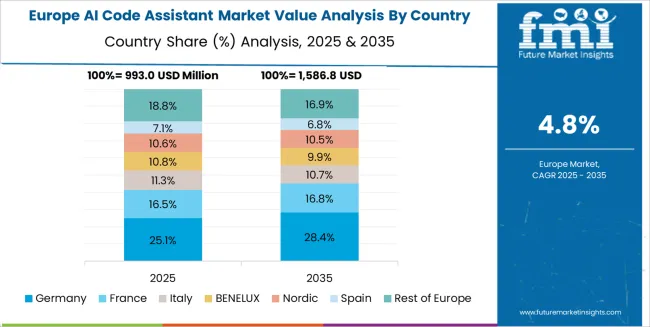

The AI Code Assistant Market is experiencing steady growth across global software development sectors, with China leading at a 7.2% CAGR through 2035, driven by rapid advancements in AI, growing developer communities, and strong demand for automated coding solutions in the tech industry. India follows at 6.6%, supported by a large pool of software developers, increasing digital adoption, and the rise of AI-powered tools in coding education and development environments. Germany records 6.1%, benefiting from strong demand for AI-driven solutions in the automotive, industrial, and software development sectors. Brazil grows at 5.6%, fueled by growing technology adoption and a rising number of startups looking to enhance productivity through AI-driven coding assistants. The USA, at 5.0%, remains a significant market focused on integrating AI with cloud platforms, while the UK (4.5%) and Japan (4.0%) emphasize smart coding assistants for efficient software lifecycle management and enhanced code quality.

China is projected to grow at a CAGR of 7.2% through 2035 in the AI code assistant market. The rapid digital transformation of industries, coupled with a growing demand for software development, drives the adoption of AI-powered code assistants. Developers leverage AI tools to automate coding tasks, optimize workflows, and improve productivity. Chinese companies are integrating AI code assistants into their development environments to reduce human error and accelerate the coding process. The market benefits from the increasing presence of tech startups, the adoption of cloud services, and the government’s focus on AI research and development.

India is projected to grow at a CAGR of 6.6% through 2035 in the AI code assistant market. The rise of tech startups, combined with the growing demand for software solutions, accelerates the adoption of AI-based tools to assist in coding. AI code assistants are increasingly integrated into development workflows to streamline processes, speed up development times, and reduce costs. The market is also driven by the increasing number of developers seeking productivity tools, as well as advancements in AI that improve code generation, error detection, and debugging. The rise of digital transformation across industries supports further adoption.

Germany is projected to grow at a CAGR of 6.1% through 2035 in the AI code assistant market. German companies, especially in industries such as automotive, finance, and healthcare, are adopting AI tools to streamline software development and increase efficiency. AI code assistants help developers generate error-free code, automate repetitive tasks, and accelerate the deployment of applications. The growing need for agile software development and the push for automation in business processes fuel market growth. Germany’s strong focus on technological innovation and its high-tech industry infrastructure further support AI code assistant adoption.

Brazil is projected to grow at a CAGR of 5.6% through 2035 in the AI code assistant market. The ongoing digital transformation across sectors, particularly in IT and finance, drives the demand for AI-based coding tools. As businesses shift toward automation and more efficient software development processes, AI code assistants are used to enhance productivity, reduce errors, and improve collaboration among developers. The rise of cloud-based software solutions and remote development teams further supports the adoption of AI code assistants. Increasing focus on technology skills development in Brazil also contributes to market growth.

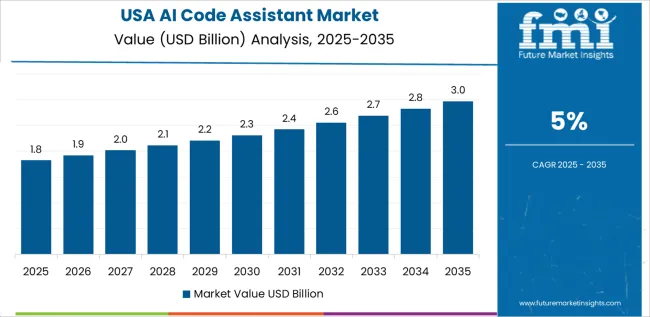

USA is projected to grow at a CAGR of 5% through 2035 in the AI code assistant market. The rise of cloud computing and the need for faster software development cycles drive the demand for AI-based coding tools. AI code assistants are increasingly integrated into cloud-based development platforms, enabling developers to work more efficiently and collaboratively. The USA’s strong technology infrastructure, coupled with its focus on innovation in software engineering, accelerates the adoption of AI tools that optimize code writing, error correction, and code maintenance. Startups and established enterprises alike benefit from these tools.

UK is projected to grow at a CAGR of 4.5% through 2035 in the AI code assistant market. The integration of AI into development tools supports faster and more efficient software creation, driving demand for AI code assistants. UK-based companies are increasingly adopting these tools to automate coding processes, reduce human error, and improve overall development workflows. The rise in agile software development and the focus on digital transformation across various industries also contribute to market growth. AI-powered assistants help UK developers save time and improve code accuracy in competitive tech-driven sectors.

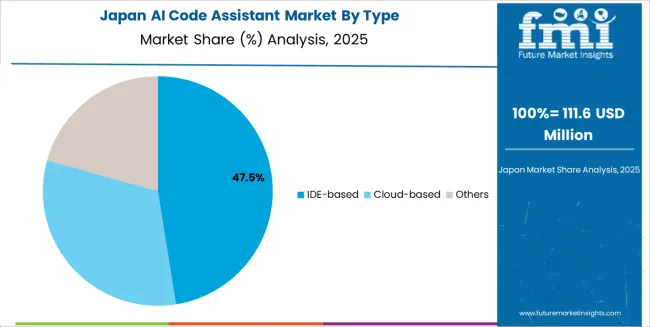

Japan is projected to grow at a CAGR of 4% through 2035 in the AI code assistant market. The growing adoption of AI in software development processes, coupled with the increasing demand for automation and efficiency, drives the adoption of AI code assistants in Japan. As businesses focus on increasing productivity and improving software quality, AI tools become essential in accelerating development cycles and reducing coding errors. Japan’s emphasis on technological innovation and automation in industries such as robotics, automotive, and electronics further boosts the market for AI-powered software tools.

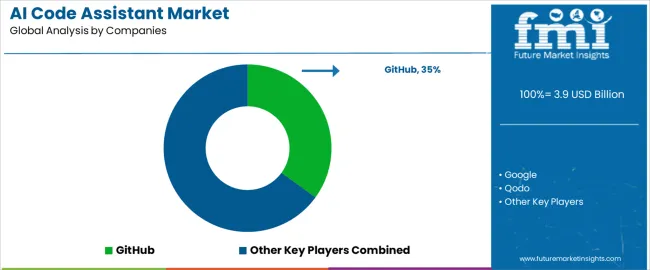

The global AI code assistant market is highly competitive, driven by major technology companies and specialized startups offering AI-powered coding tools designed to enhance developer productivity, code quality, and efficiency. GitHub, Google, and IBM hold strong positions through advanced code-completion features, machine learning-driven recommendations, and integrated platforms that improve the development lifecycle. Amazon Web Services (AWS) and GitLab contribute by offering AI-enhanced solutions that integrate with their cloud platforms, providing real-time code suggestions and automation for DevOps teams. Augment Code, Sourcegraph, and Tabnine offer niche, AI-driven coding assistants that emphasize context-aware completions, error detection, and seamless IDE integrations, appealing to both individual developers and enterprise teams.

JetBrains, Replit, Windsurf, and Cursor expand the market by providing intelligent code editing, debugging assistance, and code optimization tools that utilize AI to speed up programming tasks and reduce human error. Competition in this segment is shaped by features such as code refactoring, compatibility with multiple programming languages, and integration with version control systems. Strategic differentiation depends on ease of integration with existing developer tools, accuracy of AI-generated code suggestions, and the ability to personalize the coding experience for individual or team needs. As the demand for efficient and error-free development grows, companies providing scalable, AI-powered code assistants that can learn from diverse coding environments are positioned to lead the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.9 billion |

| Type | IDE-based, Cloud-based, Others |

| Application | Software Development, Education & Training, DevOps & QA, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | GitHub, Google, IBM, Amazon Web Services, GitLab, Augment Code, Sourcegraph, Tabnine, JetBrains, Replit, Windsurf, Cursor |

| Additional Attributes | Dollar sales by type and application, AI-enhanced code generation features, integration with DevOps and CI/CD workflows, error detection and code optimization, natural language understanding in AI tools, adoption trends across industries, platform integrations with cloud and on-premise systems, scalability, and ease of integration. |

The global ai code assistant market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the ai code assistant market is projected to reach USD 6.5 billion by 2035.

The ai code assistant market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in ai code assistant market are ide-based, cloud-based and others.

In terms of application, software development segment to command 68.0% share in the ai code assistant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Wealth Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

AI Powered Software Testing Tool Market Size and Share Forecast Outlook 2025 to 2035

AI Document Generator Market Size and Share Forecast Outlook 2025 to 2035

AI in Fintech Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

AI Platform Market Size and Share Forecast Outlook 2025 to 2035

AI-powered Spinal Surgery Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Sleep Technologies Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Gait & Mobility Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

AI-Enabled Behavioral Therapy Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

AI-defined Vehicle Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA