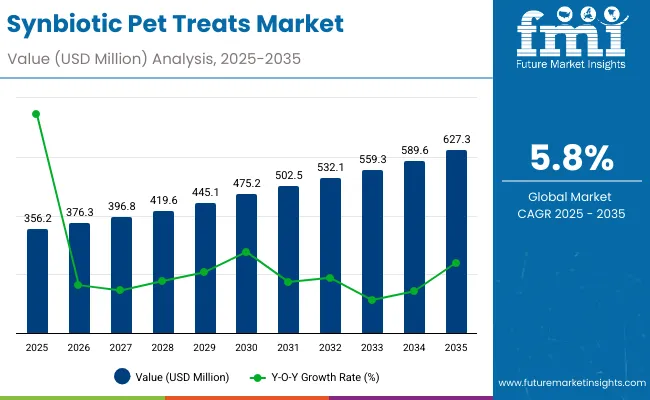

The Synbiotic Pet Treats Market is valued at USD 356.2 million in 2025 and is forecast to reach USD 627.3 million by 2035. This expansion reflects an overall increase of USD 271,1 million, advancing at a compound annual growth rate (CAGR) of 5.8% over the ten-year period.

Synbiotic Pet Treats Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 356.2 million |

| Market Forecast Value in (2035F) | USD 627.3 million |

| Forecast CAGR (2025 to 2035) | 5.80% |

During the first phase from 2025 to 2030, the market grows from USD 356.2 million to USD 475,2 million, adding nearly USD 119 million and representing about 44% of total growth expected over the decade. This phase is marked by steady adoption of functional formulations designed to improve digestive health and immune resilience in pets.

In the second half of the forecast period, between 2030 and 2035, the market is expected to rise by a further USD 152,1 million, advancing from USD 475,2 million to USD 627,3 million. Growth in this stage is expected to be driven by rising awareness in emerging markets, particularly in South Asia and the Pacific, supported by urbanization, increasing disposable incomes, and greater investment in pet wellness. North America is projected to maintain the largest share with around 30% of global revenues in 2025, closely followed by Europe with 28%.

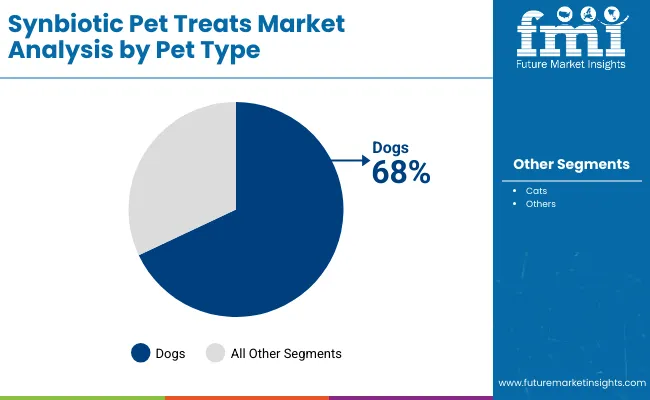

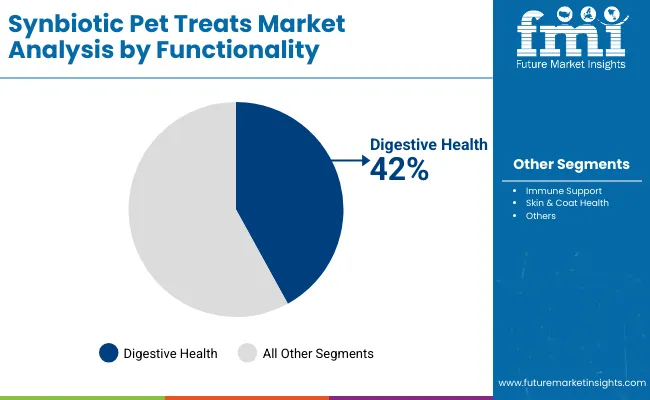

Dogs account for the largest share of demand at 68% in 2025, supported by high owner spending on preventive nutrition. Digestive health is positioned as the leading functionality segment with 42% contribution, while freeze-dried treats and powders are projected to outpace traditional formats, offering significant scope for premium and innovative launches over the coming years.

From 2020 to 2024, the Synbiotic Pet Treats Market expanded steadily, with dogs representing the dominant revenue stream. By 2025, the market reached nearly USD 356.2 Million, driven by digestive health formulations. Competitive advantage was maintained by leaders such as Nestlé Purina, Zesty Paws, and Nutramax through precision formulations, distribution expansion, and functional claims in soft chews and freeze-dried treats. Between 2025 and 2035, demand is projected to advance to USD 627.3 Million, supported by rising online retail adoption, functional jerky and topping formats, and innovation in multi-strain probiotic complexes. The revenue mix will gradually diversify, with software-like subscription models in direct-to-consumer channels gaining traction. Competitive strength will increasingly depend on ecosystem breadth, scientific validation, and integration of tailored health solutions across pets. Emerging entrants emphasizing digital DTC sales, customized blends, and human-grade positioning are expected to gain share, shifting the market from product-centric growth to experience-driven and evidence-backed expansion.

Advances in scanning hardware have improved accuracy and speed, allowing for more efficient data capture across diverse applications. Short-range scanners have gained popularity due to their suitability for detailed surface scanning and small object measurement. The rise of laser triangulation technology has contributed to enhanced resolution and real-time processing capabilities. Industries such as manufacturing, healthcare, and aerospace are driving demand for Synbiotic Pet Treatssolutions that can integrate seamlessly into existing workflows.

Expansion of automated inspection and reverse engineering processes has fueled market growth. Innovations in portable and handheld scanning devices and software enhancements are expected to open new application areas. Segment growth is expected to be led by hardware components, short-range scanners in range categories, and laser triangulation technology due to their precision and adaptability.

The Synbiotic Pet Treats Market has been segmented on the basis of pet type, functionality, and form, reflecting the diverse needs of pet owners and the differentiated role of synbiotics across health and wellness categories. Pet type segmentation highlights demand patterns among dogs, cats, and small mammals, underlining distinct growth trajectories. Functional segmentation emphasizes digestive health, immune support, skin and coat wellness, and anxiety management, showcasing rising attention to preventive care.

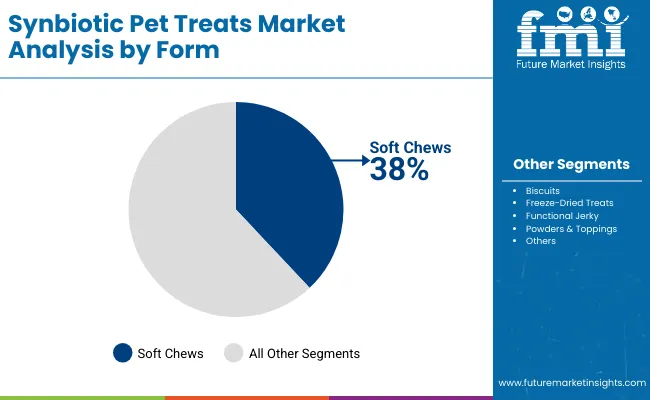

Form-based segmentation covers soft chews, biscuits, freeze-dried treats, functional jerky, and powders, offering insights into how consumer preferences are shaping product innovation. Together, these segments illustrate a market moving toward specialized, science-backed solutions designed to improve overall pet well-being while aligning with premiumization and convenience trends.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Dogs | 68% |

| Cats | 27% |

| Others (Small Mammals) | 5% |

The pet type segment is projected to be led by dogs, which hold 68% of the market share in 2025. This dominance is attributed to higher expenditure by dog owners, who increasingly adopt synbiotic treats to maintain digestive health and strengthen immunity. Cats represent 27% of demand, supported by rising urban cat ownership in regions such as Europe and East Asia. Although small mammals account for only 5%, niche product availability is expected to widen their adoption. Dogs will continue to anchor the market, while cats emerge as a secondary growth driver. Innovations in targeted synbiotic formulations for smaller animals are anticipated to broaden adoption and enhance market penetration across diverse consumer groups.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Digestive Health | 42% |

| Immune Support | 27% |

| Skin & Coat Health | 21% |

| Anxiety & Mood Support | 10% |

Digestive health dominates functionality with a 42% share in 2025, reflecting the growing prioritization of gut health as a foundation of pet wellness. Immune support follows at 27%, sustained by rising emphasis on preventive care. Skin and coat health accounts for 21%, driven by pet owners’ concerns around allergies, sensitivities, and overall grooming. Anxiety and mood support contributes 10%, showing increasing relevance of behavioral health. Across all functions, synbiotics are being positioned as daily wellness aids rather than niche solutions. Multifunctional product innovation is expected to accelerate uptake, with digestive health continuing as the anchor segment. The convergence of health claims will reinforce market maturity and diversify revenue streams over the decade.

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Soft Chews | 38% |

| Biscuits | 22% |

| Freeze-Dried Treats | 18% |

| Functional Jerky | 14% |

| Powders & Toppings | 8% |

Soft chews are expected to dominate with 38% of market share in 2025, supported by their palatability, convenience, and established consumer familiarity. Biscuits hold 22%, favored by affordability and tradition, though growth is slower compared to emerging premium formats. Freeze-dried treats, at 18%, are projected to record strong momentum as they align with natural and nutrient-retentive positioning. Functional jerky contributes 14% but remains relatively stable in growth. Powders and toppings, though small at 8%, are expected to deliver the fastest CAGR of 8.5%, reflecting increasing customization in pet diets. This segmentation highlights a gradual shift from conventional forms toward premium and functional innovations.

The Synbiotic Pet Treats Market is being shaped by advancing nutritional science, evolving consumer preferences, and targeted product innovation, even as challenges in pricing, awareness, and product differentiation remain. Long-term growth will depend on credible functionality and regionally adaptive strategies.

Integration of Microbiome Research into Product Development

Market expansion is being propelled by integration of advanced microbiome research into product formulation, enabling synbiotic treats to be positioned as scientifically validated health solutions. Veterinary endorsements are being influenced by this evidence base, increasing consumer trust. Research-driven differentiation is anticipated to create premium pricing opportunities, particularly in North America and Europe.

Companies are expected to leverage collaborations with research institutions to maintain product credibility and expand consumer education campaigns. The forward-looking potential lies in aligning synbiotics with broader preventive healthcare frameworks, thereby positioning functional treats as substitutes for certain supplementary medicines. This driver ensures that future demand is not just trend-based but anchored in scientific validation and long-term health outcomes.

Cross-Functional Formulation with Behavioral Health Positioning

A trend shaping the market is the evolution of cross-functional synbiotic formulations that combine digestive health with behavioral benefits, particularly anxiety and mood support. Pet owners are increasingly seeking products that address both physical and psychological well-being, and synbiotics are being reformulated to deliver multi-dimensional outcomes. Innovation pipelines are already shifting toward blends that support microbiome balance while influencing neuro-gut pathways, opening opportunities for differentiation.

This trend reflects a transition from single-function products to holistic wellness solutions, aligning pet nutrition with human wellness practices. As awareness expands, synbiotic treats are expected to occupy a unique space bridging traditional nutrition and behavioral health management, enhancing consumer loyalty and widening premium adoption.

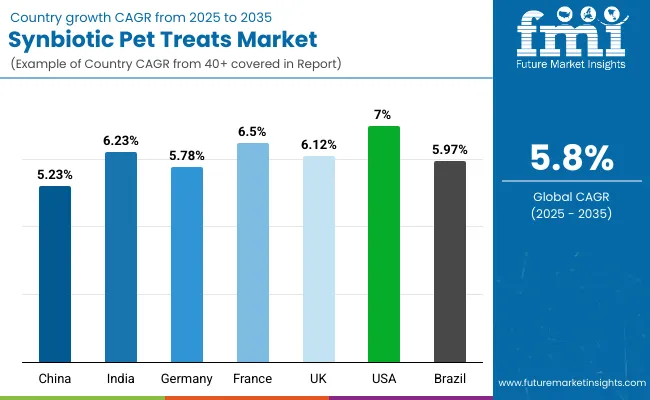

| Country | CAGR |

|---|---|

| China | 5.23% |

| India | 6.23% |

| Germany | 5.78% |

| France | 6.50% |

| UK. | 6.12% |

| USA | 7.00% |

| Brazil | 5.97% |

The Synbiotic Pet Treats Market demonstrates notable variation across leading economies, shaped by pet ownership structures, regulatory landscapes, and consumer willingness to invest in preventive nutrition. The United States is projected to advance at a CAGR of 7.0%, the highest among key countries, underpinned by strong premiumization, advanced veterinary networks, and heightened awareness of microbiome science in pet wellness. India follows with a CAGR of 6.23%, supported by expanding middle-class spending on companion animals and rapid urbanization, which is expected to drive synbiotic adoption beyond metropolitan centers.

France, at 6.50% CAGR, is positioned as a leading European market, reflecting its established culture of pet care premiumization and government-supported animal health frameworks. The United Kingdom, growing at 6.12%, is forecast to benefit from rising cat adoption and the spread of functional formats through online distribution. Germany, with a CAGR of 5.78%, remains a significant hub due to strict product quality standards and alignment with science-driven formulations.

China and Brazil, growing at 5.23% and 5.97% respectively, represent promising yet developing opportunities. China’s trajectory is linked to growing urban pet populations and rising demand for imported formulations, while Brazil is expected to benefit from increasing investments in veterinary infrastructure and e-commerce-driven pet care retailing.

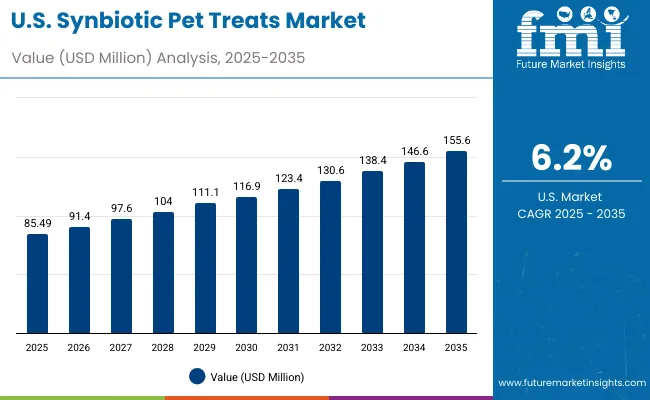

| Year | USA Synbiotic Pet Treats Market (USD Million) |

|---|---|

| 2025 | 85.49 |

| 2026 | 91.4 |

| 2027 | 97.6 |

| 2028 | 104.0 |

| 2029 | 111.1 |

| 2030 | 116.9 |

| 2031 | 123.4 |

| 2032 | 130.6 |

| 2033 | 138.4 |

| 2034 | 146.6 |

| 2035 | 155.6 |

The Synbiotic Pet Treats Market in the United States is projected to expand from US$ 85.49 million in 2025 to US$ 155.6 million in 2035, registering a CAGR of 6.2%. Growth is being shaped by strong consumer inclination toward premium functional treats and heightened veterinary recommendations supporting synbiotic use. A combination of advanced formulations and increasing owner focus on preventive healthcare is reinforcing steady year-on-year gains.

The first half of the forecast period reflects steady adoption as digestive and immune health products are prioritized by owners. The second half is expected to be driven by innovations in behavioral wellness formulations and expansion of e-commerce channels. With the USA accounting for the largest national share globally, competitive intensity is anticipated to rise as multinational brands and local players emphasize differentiated claims. The market outlook signals long-term resilience, with expansion underpinned by health-conscious consumers, advanced veterinary infrastructure, and broad retail penetration.

The Synbiotic Pet Treats Market in the United Kingdom is forecast to grow at a CAGR of 6.12% between 2025 and 2035. Growth is being reinforced by rising adoption of functional treats among cat owners, as urban households increasingly favor smaller pets. Premiumization of pet food categories is expected to support synbiotic positioning, with strong receptivity to digestive and immune health claims. Online retail and subscription-based purchasing models are anticipated to strengthen market penetration, particularly for premium and personalized offerings. Veterinary endorsements and science-backed claims are expected to remain critical for consumer trust in the UK.

Key Insights

The Synbiotic Pet Treats Market in India is projected to advance at a CAGR of 6.23% during 2025-2035. Expansion is being supported by growing disposable incomes, rapid urbanization, and heightened awareness of pet health in tier-1 and tier-2 cities. Functional treats are increasingly being accepted as an extension of preventive care, with digestive health remaining the most preferred benefit. Growth is anticipated to accelerate further as e-commerce platforms expand access to premium products beyond metropolitan regions. Local adaptation of formulations and price-sensitive packaging strategies are expected to play a vital role in broadening adoption.

Key Insights

The Synbiotic Pet Treats Market in China is estimated to grow at a CAGR of 5.23% through 2025-2035. Expansion is being shaped by rapid growth in the pet-owning population, especially among young urban professionals. Domestic demand for imported premium formulations is expected to remain strong, driven by perceived quality and trust in international brands. Regulatory oversight of pet supplements is projected to tighten, favoring established players with compliance infrastructure. Online retail ecosystems, led by large e-commerce platforms, are expected to dominate sales channels. The long-term trajectory suggests continued reliance on digestive health-focused products while multifunctional synbiotic solutions gradually gain visibility.

Key Insights

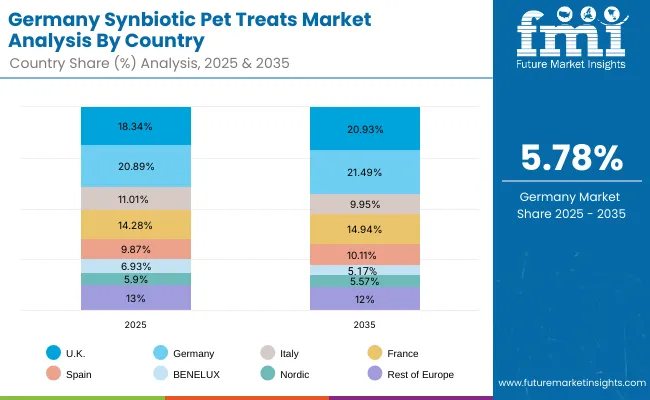

| Countries | 2025 |

|---|---|

| UK | 18.34% |

| Germany | 20.89% |

| Italy | 11.01% |

| France | 14.28% |

| Spain | 9.87% |

| BENELUX | 6.93% |

| Nordic | 5.90% |

| Rest of Europe | 13% |

| Countries | 2035 |

|---|---|

| UK | 20.93% |

| Germany | 21.49% |

| Italy | 9.95% |

| France | 14.94% |

| Spain | 10.11% |

| BENELUX | 5.17% |

| Nordic | 5.57% |

| Rest of Europe | 12% |

The Synbiotic Pet Treats Market in Germany is projected to expand at a CAGR of 5.78% over 2025-2035. Growth is being supported by stringent product quality standards and high receptivity to scientifically validated functional nutrition. Pet owners are increasingly seeking preventive health solutions, with digestive and immune health categories expected to maintain dominance. Retail distribution through specialty pet stores remains influential, although digital platforms are gaining traction with younger demographics. Strong regulatory alignment with EU standards is anticipated to favor companies with advanced R&D capabilities and transparent ingredient sourcing. Premium claims emphasizing sustainability and science-backed efficacy are expected to gain prominence.

Key Insights

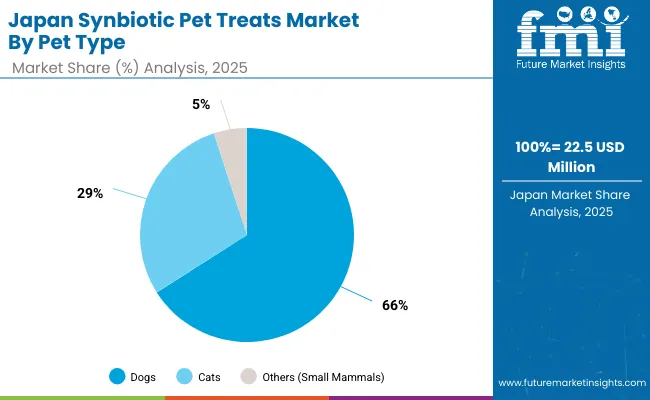

| Component Segment | Market Value Share, 2025 |

|---|---|

| Dogs | 66% |

| Cats | 29% |

| Others (Small Mammals) | 5% |

The Synbiotic Pet Treats Market in Japan is projected at US$ 22.5 million in 2025, representing nearly half of East Asia’s total market. Dogs account for 66% of demand, reflecting Japan’s strong canine ownership culture, while cats represent 29%, supported by rising urban households where smaller pets are preferred. Small mammals hold 5%, showing potential for niche synbiotic formulations. Growth is expected to be sustained by premiumization, with freeze-dried and powdered formats aligning with Japanese consumer preferences for quality and functionality. Veterinary endorsement is anticipated to further boost credibility, while multifunctional formulations addressing digestive, immune, and behavioral health are likely to drive stronger adoption. Japan’s position as a mature pet care market ensures that innovation-led strategies will remain central to market expansion.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Digestive Health | 39% |

| Immune Support | 29% |

| Skin & Coat Health | 22% |

| Anxiety & Mood Support | 10% |

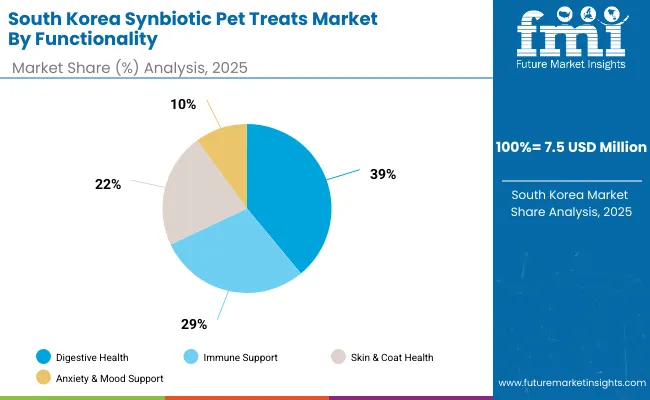

The Synbiotic Pet Treats Market in South Korea is valued at US$ 7.5 million in 2025, representing a meaningful share of East Asia’s market. Digestive health dominates with 39% of revenues, supported by strong consumer interest in gut microbiome balance as a foundation for pet well-being. Immune support holds 29%, reflecting preventive healthcare adoption among pet owners. Skin and coat health, at 22%, remains significant, given the rising awareness of dermatological sensitivities in companion animals. Anxiety and mood support contributes 10%, and although smaller, this niche is gaining attention as urban pet ownership expands. Premium functional claims, coupled with innovative treat formats, are expected to accelerate adoption. South Korea’s advanced retail ecosystems and digitally active consumers are projected to reinforce demand, positioning the market for steady long-term expansion.

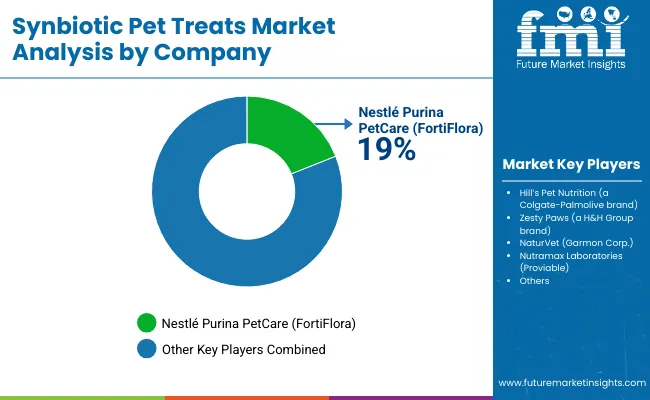

The Synbiotic Pet Treats Market is moderately consolidated, with leading multinational pet nutrition brands, specialized supplement developers, and emerging innovators competing for share. Global leaders such as Nestlé Purina PetCare (FortiFlora) and Hill’s Pet Nutrition (Colgate-Palmolive) dominate, leveraging extensive veterinary networks, trusted science-backed formulations, and strong retail penetration. These players emphasize R&D investment, clinical validation, and premium branding, which continue to reinforce their global leadership positions.

Mid-sized innovators including Zesty Paws (H&H Group) and NaturVet (Garmon Corp.) are actively expanding through e-commerce platforms and direct-to-consumer strategies. Their competitive edge lies in agility, premium functional positioning, and appeal to younger pet owners seeking wellness-focused and lifestyle-aligned products.

Specialized providers such as Nutramax Laboratories (Proviable) maintain influence through targeted probiotic and synbiotic solutions that are widely endorsed by veterinary professionals. Their strength lies in scientific credibility and niche expertise rather than broad-scale distribution.

Competitive differentiation in this market is increasingly shifting from basic functional claims to holistic wellness positioning, covering digestive, immune, and behavioral health. Future competition is expected to revolve around premiumization, multifunctional synbiotic formulations, and digitally enabled distribution models, with partnerships between veterinary professionals and consumer-facing brands enhancing credibility.

Key Developments in Synbiotic Pet Treats Market

| Item | Value |

|---|---|

| Market Value | US$ 356.2 million (2025); US$ 627.3 million (2035); CAGR 5.8% (2025-2035) |

| Quantitative Units | US$ million (value sales) |

| Pet Type | Dogs, Cats, Others (Small Mammals) |

| Functionality | Digestive Health, Immune Support, Skin & Coat Health, Anxiety & Mood Support |

| Form | Soft Chews, Biscuits, Freeze-Dried Treats, Functional Jerky, Powders & Toppings |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, South Korea, Brazil |

| Key Companies Profiled | Nestlé Purina PetCare (FortiFlora), Hill’s Pet Nutrition (Colgate-Palmolive), Zesty Paws (H&H Group), NaturVet (Garmon Corp.), Nutramax Laboratories (Proviable) |

| Additional Attributes | Dollar sales by pet type, functionality, and form; segmentation CAGRs; premiumization and science-backed positioning; veterinary endorsement and clinical validation; e-commerce and subscription adoption; regional shares: North America 30%, Europe 28%, South Asia & Pacific 25%, East Asia 12%, Latin America 2%, Middle East & Africa 3%; innovation in multifunctional synbiotics; compliance and labeling trends. |

| Market Value | US$ 356.2 million (2025); US$ 627.3 million (2035); CAGR 5.8% (2025-2035) |

The global Synbiotic Pet Treats Market is estimated to be valued at US$ 356.2 million in 2025.

The market size for the Synbiotic Pet Treats Market is projected to reach US$ 627.3 million by 2035.

The Synbiotic Pet Treats Market is expected to expand at a CAGR of 5.8% between 2025 and 2035.

The key product types in the Synbiotic Pet Treats Market are soft chews, biscuits, freeze-dried treats, functional jerky, and powders & toppings.

In terms of pet type, the dog segment is expected to command 68% share in the Synbiotic Pet Treats Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Synbiotic Product Market Trends - Gut Health & Industry Expansion 2025 to 2035

Synbiotic Animal Feed Market – Growth, Demand & Livestock Health

Synbiotic Market

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA