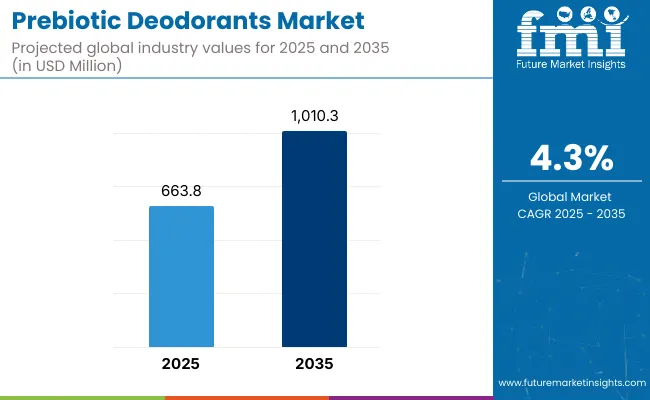

The Prebiotic Deodorants Market is expected to record a valuation of USD 663.8 million in 2025 and USD 1,010.3 million in 2035, with an increase of USD 346.2 million, which equals a growth of 52.2% over the decade. The overall expansion represents a CAGR of 4.3% and a 1.5X increase in market size.

| Metric | Value |

|---|---|

| Prebiotic Deodorants Market Estimated Value in (2025E) | USD 663.8 million |

| Prebiotic Deodorants Market Forecast Value in (2035F) | USD 1,010.3 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

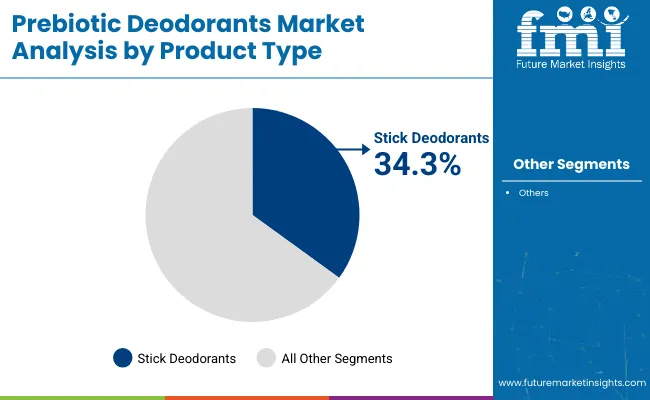

During the first five-year period from 2025 to 2030, the market increases from USD 663.8 million to USD 818.92million, which accounts for 45.0% of the total decade growth. This phase records steady adoption in wellness retail, dermatology-led skin care channels, and refillable product types, driven by the need for microbiome-safe deodorants. Stick deodorants dominate this period as they cater to over 34.3% of format-specific demand for daily-use personal care.

The second half from 2030 to 2035 contributes USD 191.3 million, equal to 55.0% of total growth, as the market jumps to USD 1,010.3 million. This acceleration is powered by widespread deployment of plant-based ingredient innovations, refillable packaging systems, and DTC ecosystem expansion in Asia-Pacific and India. Fermentation-derived and marine-origin prebiotics together capture a larger share above 40% by the end of the decade. Digital-native brands and subscription commerce add recurring revenue, increasing the online and DTC distribution share beyond 50% in total market value.

From 2020 to 2024, the Prebiotic Deodorants Market grew from USD 432.1 million to USD 660.8 million, driven by early consumer adoption of microbiome-friendly and aluminum-free personal care products. During this period, the competitive landscape was dominated by natural deodorant brands controlling nearly 70% of category revenue, with leaders such as Native, Schmidt’s Naturals, and Corpus Naturals focusing on stick-based formats using plant-derived ingredients.

Competitive differentiation relied on clean-label claims, DTC convenience, and dermatological safety, while prebiotic actives were often included as secondary benefits rather than core functional claims. Refillable systems and sustainable packaging saw limited traction, contributing less than 15% of total market value.

Demand for prebiotic deodorants will expand and the revenue mix will shift as digital-native brands, refill formats, and personalized formulations grow to over 40% share. Traditional category leaders face rising competition from ingredient-focused startups offering transparent sourcing, AI-powered product recommendations, and subscription-based delivery.

Major deodorant brands are pivoting to hybrid models, integrating skin health analytics, zero-waste packaging, and consumer engagement ecosystems to retain relevance. Emerging entrants specializing in refill logistics, skin microbiome testing, and sustainable personalization are gaining share. The competitive advantage is moving away from fragrance-based differentiation alone to holistic ecosystem valuebalancing function, formulation transparency, and recurring revenue generation.

A growing number of consumers are shifting away from traditional antiperspirants due to concerns over aluminum salts disrupting the skin’s natural microbiome and sweat regulation. Prebiotic deodorants offer a functional alternative by nurturing beneficial skin bacteria, which in turn reduces odor without suppressing sweat glands.

This scientific positioning is gaining traction, especially among dermatology-conscious and health-aware users. As clinical studies validating microbiome health grow in skincare, deodorant brands are increasingly highlighting prebiotic ingredients as a safer and more effective odor management strategy. This shift is redefining what constitutes "clean" underarm care beyond just fragrance or aluminum-free labels.

Prebiotic deodorant brands are among the first in personal care to successfully integrate subscription-based delivery with refillable packaging systems, improving both environmental appeal and usage continuity. This model enhances customer retention by eliminating shelf-space competition and promoting habitual reordering directly from DTC platforms.

With formulations tailored for sensitive skin and specific skin conditions, many consumers find fewer reasons to switch products once they’ve adapted to a microbiome-friendly routine. These delivery models also allow brands to gather user data and iterate products rapidly, creating a strong feedback loop that keeps customers engaged and invested long-termboosting both adoption and market growth.

The prebiotic deodorants market is witnessing a diverse product segmentation, with stick deodorants emerging as the most preferred format due to ease of use and long-lasting formulations, while spray and roll-on variants also maintain high consumer traction. Cream & balm and wipe & sheet deodorants are gaining niche adoption in skincare-integrated routines.

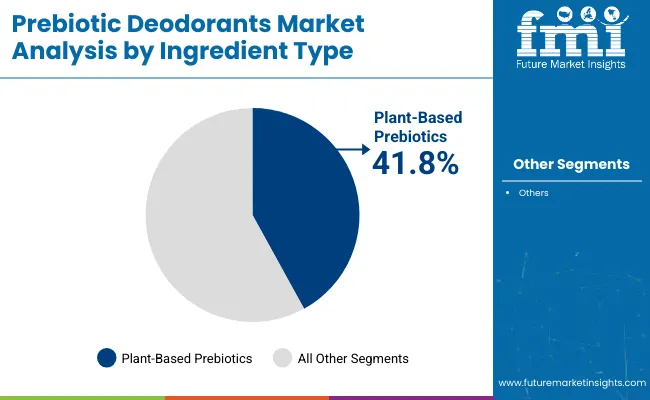

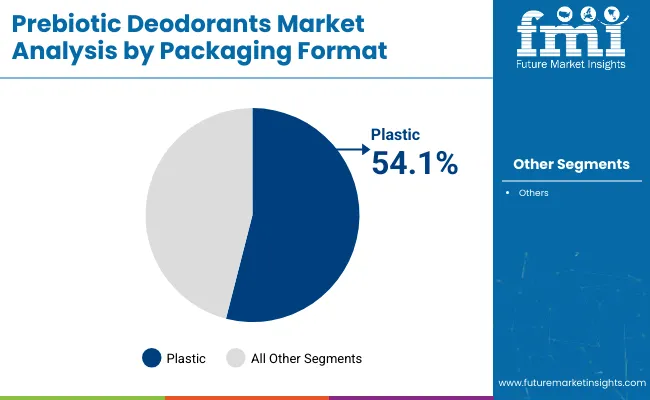

On the ingredient front, plant-based prebiotics such as inulin and yacon root dominate due to their skin-friendly appeal, although fermentation-derived and marine-origin prebiotics are drawing attention for enhanced microbiome benefits. In packaging, plastic containers remain widely used, but metal tins and compostable paper formats are increasingly being adopted to meet sustainability goals.

Refillable and travel-size options are expanding among eco-conscious and mobile consumers. In terms of distribution, online marketplaces and mass retail channels lead market share, while subscription boxes and dermatology clinics are playing a growing role in premium and trial-oriented sales, signaling a shift toward experiential and personalized hygiene solutions.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| By Product Type | Value Share% 2025 |

| Stick Deodorants | 34.3% |

| Others | 65.7% |

Stick deodorants are anticipated to dominate the product type segment in 2025, accounting for 34.3% of the global market share. This format has been favored for its portability, mess-free application, and longer wear-time, making it the preferred choice among daily users. The segment benefits from strong consumer familiarity and consistent innovation in natural, prebiotic-infused stick formats. While other deodorant formats collectively hold a larger combined share of 65.7%, their individual adoption remains fragmented across niche use cases such as wipes, balms, sprays, and gels.

Growing demand for hybrid skincare-deodorant formulations is likely to broaden the appeal of cream and balm deodorants, but stick variants are expected to retain their lead due to their functionality and product stability.

| By Ingredient Type | Value Share% 2025 |

| Plant-Based Prebiotics (e.g., inulin, yacon root extract) | 41.8% |

| Others | 58.2% |

Plant-based prebiotics are projected to dominate the ingredient type segment in 2025, capturing a 41.8% share of the global market. Ingredients like inulin and yacon root extract have gained strong consumer acceptance owing to their natural origin, perceived skin microbiome benefits, and alignment with clean beauty trends. Their compatibility with various deodorant formats has supported widespread incorporation across both premium and mass-market formulations.

Although other ingredient types collectively hold a larger combined share of 58.2%, this includes several fragmented sources such as fermentation-derived, marine-origin, synthetic, and fungal-based prebiotics, each catering to narrower claims or specialized formulations. Demand for plant-based options is expected to remain strong due to ongoing consumer preference for recognizable, plant-derived ingredients in personal care.

| By Packaging Format | Value Share% 2025 |

| Plastic (e.g., tubes, sticks, jars) | 54.1% |

| Others | 45.9% |

Plastic-based packaging formats are expected to account for 54.1% of the global prebiotic deodorants market in 2025, emerging as the dominant format due to their widespread utility, low cost, and compatibility with stick, tube, and jar variants. Despite rising sustainability concerns, plastic remains preferred for its lightweight properties, product protection, and design flexibility across both travel-size and standard formats.

Brands continue to rely on recyclable or post-consumer recycled plastics to balance sustainability goals with functionality. While alternative formats such as paper, glass, and compostable packaging are gaining traction, especially among niche and eco-conscious consumers, they collectively account for a smaller share of 45.9% in 2025.

Shift Toward Skin Microbiome-Friendly Formulations in Deodorant Innovation

Growing awareness of the skin microbiome's role in body odor and skin health has shifted deodorant innovation toward microbiome-conscious solutions. Traditional antiperspirants often rely on aluminum salts or alcohols that disrupt the skin's natural flora, leading to irritation or odor rebound. In contrast, prebiotic deodorants support beneficial bacteria while suppressing malodor-causing microbes. This science-backed approach is gaining traction among dermatologists and cosmetic chemists, driving consumer trust and clinical marketing claims.

As research continues to clarify the balance between Cutibacterium, Corynebacterium, and Staphylococcus species on the underarm microbiome, formulations with inulin, alpha-glucan oligosaccharide, and yacon root extract are being favored. The shift is also spurred by rising consumer scrutiny over ingredient lists, encouraging brands to disclose functional roles of prebiotic compounds. This alignment between scientific validation and clean-label positioning is accelerating product launches, particularly in premium personal care and natural deodorant categories.

Rising Cross-Category Convergence Between Wellness, Beauty, and Deodorants

The convergence of wellness and skincare in underarm care routines is creating new avenues for prebiotic deodorants. Products are no longer positioned purely for odor control but are now framed as part of a holistic self-care regimen that includes microbiome balance, detox support, and skin barrier maintenance. Functional positioning overlaps with trends in probiotic skincare, gut-brain-skin axis awareness, and hormonal wellness, particularly among female consumers. This shift is especially prominent in wellness-centric e-commerce platforms and boutique retailers that market deodorants alongside adaptogens, botanical extracts, and mood-enhancing beauty tools.

Brands are also leveraging storytelling and education to position prebiotic deodorants as lifestyle products rather than hygiene staples. As a result, consumers are now evaluating deodorants based on wellness functionality, packaging sustainability, and skin compatibility, rather than fragrance alone. This has opened the door for price premiums, multi-use formats, and hybrid deodorant-serum innovations within the prebiotic space.

Limited Consumer Awareness of Prebiotic Functionality in Personal Care

While prebiotic deodorants offer targeted skin microbiome benefits, mainstream consumer understanding of how prebiotics function on the skin remains low. Unlike probiotics, which are more widely marketed in the beauty and supplements industry, prebiotics are often confused with natural ingredients or misunderstood as preservatives. This knowledge gap hinders brand communication efforts, as many consumers still prioritize scent, sweat protection, or organic claims over scientifically validated mechanisms. Even among informed consumers, the subtle nature of prebiotic efficacy may not provide immediate perceptible results, reducing repeat purchases.

Additionally, regulatory limitations on claims related to microbiome modulation further restrict product labeling and advertising. In retail environments, this often results in prebiotic deodorants being overshadowed by more familiar clean beauty or aluminum-free labels. Bridging this awareness barrier will require coordinated efforts in consumer education, ingredient transparency, and visual communication of skin health benefits to strengthen value perception across mass and premium segments.

Emergence of Probiotic and Synbiotic Deodorants with Skin-Balancing Claims

A growing trend in the prebiotic deodorants market is the rise of probiotic and synbiotic formulations that combine live microbial strains or postbiotics with prebiotics to enhance underarm microbiome health. These formulations are targeting consumers who are already familiar with probiotic skincare and gut health benefits, creating a new category of “active microbiome” deodorants. Brands are now experimenting with encapsulated lactobacillus or bifidobacterium strains that are freeze-dried or stabilized to survive in topical formats, paired with inulin or fructooligosaccharides to optimize microbial viability.

This trend reflects a scientific pivot from merely avoiding harmful ingredients to actively modulating the skin's bacterial ecosystem. The claims often focus on odor prevention through microbial balance rather than masking smells, appealing to consumers seeking non-toxic, biologically intelligent hygiene solutions. Although product stability and regulatory approval remain hurdles, the synbiotic deodorant category is gaining traction in DTC and specialty wellness channels, particularly among skincare-savvy consumers.

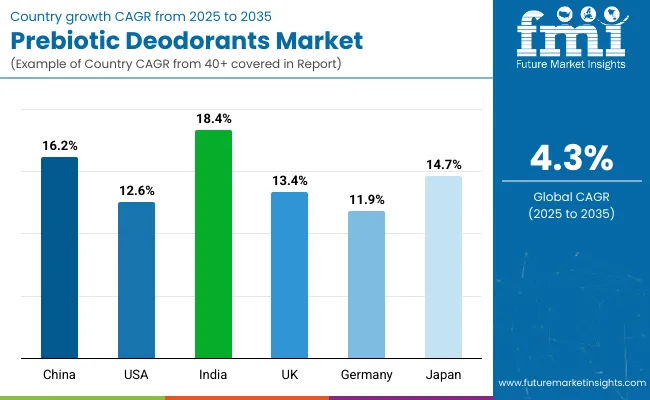

| Countries | CAGR (2025 to 2035) |

| China | 16.2% |

| USA | 12.6% |

| India | 18.4% |

| UK | 13.4% |

| Germany | 11.9% |

| Japan | 14.7% |

The prebiotic deodorants market is poised for robust international growth, with India leading all key countries at a projected CAGR of 18.4%. India's rapid adoption is driven by rising awareness of natural underarm care, increasing availability of clean-label personal care online, and growing consumer interest in plant-based formulations.

China follows closely with 16.2% CAGR, supported by the expansion of skin microbiome education, popularity of TCM-aligned prebiotic ingredients, and strong e-commerce integration. Japan is also gaining momentum at 14.7% CAGR, leveraging its established market for skin health and functional cosmetics to promote advanced microbiome-friendly deodorants.

In the West, the USA market continues to expand steadily at 12.6%, driven by sustained DTC activity, early-mover advantage of clean brands, and refillable product innovations. The UK and Germany, with CAGRs of 13.4% and 11.9% respectively, reflect mature yet evolving markets where sustainability, skin safety, and microbiome science are redefining deodorant preferences across both mass and premium retail channels.

| Year | USA Prebiotic Deodorants Market (USD Million) |

|---|---|

| 2025 | 194.86 |

| 2026 | 227.23 |

| 2027 | 264.97 |

| 2028 | 308.99 |

| 2029 | 360.31 |

| 2030 | 420.16 |

| 2031 | 489.95 |

| 2032 | 571.33 |

| 2033 | 666.23 |

| 2034 | 776.89 |

| 2035 | 905.94 |

The Prebiotic Deodorants Market in the United States is projected to grow at a CAGR of 12.6% between 2025 and 2035, driven by surging consumer demand for microbiome-friendly, skin-safe personal care products. Growing awareness of underarm skin health, coupled with the rise of sensitive skin deodorant options, is accelerating mainstream acceptance. Clean beauty retailers and DTC brands are expanding their SKUs to include prebiotic formats, supported by storytelling around inulin and alpha-glucan oligosaccharide efficacy.

As consumers increasingly seek aluminum-free, synthetic-fragrance-free alternatives, prebiotic deodorants are emerging as a preferred option in natural personal care routines. Subscription-based models and influencer-backed launches have further popularized these formulations across Gen Z and millennial demographics. Retailers are expected to invest in tiered formats, including sticks, balms, and sprays, to cater to evolving consumer preferences for format diversity and refills.

The Prebiotic Deodorants Market in the United Kingdom is expected to grow at a CAGR of 13.4% between 2025 and 2035, supported by the country’s strong emphasis on sustainable beauty and skin-sensitive innovation. Consumer preference has notably shifted toward microbiome-friendly personal care, with prebiotic formulations being perceived as gentler alternatives to baking soda-based or alcohol-based deodorants. UK-based clean beauty retailers are expanding shelf space for aluminum-free, fragrance-free, and refillable stick deodorants, with plant-derived prebiotic actives such as inulin gaining popularity.

Regulatory pressure on synthetic preservatives and allergen-prone ingredients is indirectly supporting the transition to prebiotic-based options. Brand partnerships with dermatologists and eco-conscious influencers have further contributed to rapid awareness and trials. E-commerce platforms and subscription models are strengthening brand visibility and engagement, particularly among young urban consumers.

India is witnessing rapid growth in the Prebiotic Deodorants Market, which is forecast to expand at a CAGR of 18.4% through 2035. The market is being shaped by a surge in health-conscious consumer behavior and growing interest in microbiome-friendly personal care solutions. Urban millennials and Gen Z consumers are actively seeking natural, chemical-free alternatives that address body odor without disrupting skin pH or microbiota.

Domestic beauty startups and D2C brands are launching deodorants with plant-based prebiotic ingredients like inulin and yacon root, promoting their benefits for sensitive skin and long-term skin health. Increased adoption of Western grooming routines and rising disposable incomes are also contributing to deodorant usage beyond metropolitan hubs. Retail partnerships with online platforms, dermatologists, and Ayurveda-inspired influencers are making microbiome-supportive deodorants more accessible and aspirational.

The Prebiotic Deodorants Market in China is expected to grow at a CAGR of 16.2%, the highest among leading economies. This growth is being accelerated by strong consumer awareness around microbiome skincare, especially among digitally native Gen Z and millennial segments. China's clean beauty movement is expanding swiftly, with domestic brands integrating prebiotic ingredients into personal hygiene products to appeal to urban, health-oriented shoppers.

Popular platforms like Tmall and Xiaohongshu are witnessing a surge in demand for deodorants made with natural and functional ingredients such as yacon extract and chicory root. Government push for sustainable cosmetics, coupled with eco-labeling norms and e-commerce-driven beauty innovation, is further amplifying category visibility. Local brands are leveraging AI-powered skin diagnostic tools to match consumers with prebiotic products suitable for sensitive skin, hyperpigmentation, and sweat control.

| Countries | 2025 Share (%) |

| USA | 32.5% |

| China | 9.3% |

| Japan | 7.4% |

| Germany | 6.2% |

| UK | 5.9% |

| India | 4.7% |

| Countries | 2035 Share (%) |

| USA | 27.8% |

| China | 14.6% |

| Japan | 8.1% |

| Germany | 5.4% |

| UK | 5.0% |

| India | 9.3% |

The Prebiotic Deodorants Market in Germany is expected to expand at a CAGR of 3.8% from 2025 to 2035, though its global share is projected to decline from 6.2% to 5.4% over the same period. This shift reflects stronger growth in emerging markets rather than a domestic slowdown. In Germany, rising demand for skin microbiome-friendly and aluminum-free deodorants is supporting niche product growth, particularly in health-driven urban markets.

Brands are responding with clean-label, dermatologically tested formulas featuring prebiotic actives like inulin and alpha-glucan oligosaccharide. Sustainability remains a defining theme, with solid-stick formats, recyclable packaging, and refill systems gaining popularity. Pharmacies and organic retailers continue to expand their assortment of vegan and clinically tested options.

| USA By Product Type | Value Share% 2025 |

| Stick Deodorants | 38.10% |

| Others | 61.9% |

The USA Prebiotic Deodorants Market is forecast to grow at a CAGR of 12.6% between 2025 and 2035, with its global share expected to decline slightly from 32.5% in 2025 to 27.8% by 2035 as emerging markets accelerate faster. Demand is being driven by the mainstreaming of natural personal care, heightened awareness of microbiome health, and consumer aversion to synthetic ingredients like aluminum and triclosan.

Stick deodorants hold the largest share at 38.1% in 2025, benefiting from familiarity and ease of use. However, newer formats such as sprays, creams, and roll-ons continue to gain traction, contributing to the 61.9% share under "Others". Growth is further supported by DTC startups offering prebiotic-infused formulations, dermatologist-tested labels, and sustainable packaging initiatives.

| China By Ingredient Type | Value Share% 2025 |

| Plant-Based Prebiotics | 44.6% |

| Others | 55.4% |

In China, the prebiotic deodorants market presents significant expansion opportunities, projected to grow at a CAGR of 16.2% from 2025 to 2035. This growth is propelled by a shift toward functional personal care, rising urban middle-class income, and increasing interest in microbiome-friendly skincare. Among ingredient types, plant-based prebiotics command a 44.6% value share in 2025, supported by their association with natural wellness, traditional Chinese botanicals, and clean-label positioning.

Local consumers are showing greater receptivity to herbal and fermented actives, which aligns with the broader cultural preference for plant-derived solutions. The "Others" category, at 55.4%, includes emerging prebiotics from marine, synthetic, and probiotic-ferment sources, which are gaining attention among cosmeceutical innovators. E-commerce platforms are accelerating product visibility, while domestic players are investing in R&D to develop uniquely localized prebiotic formulations.

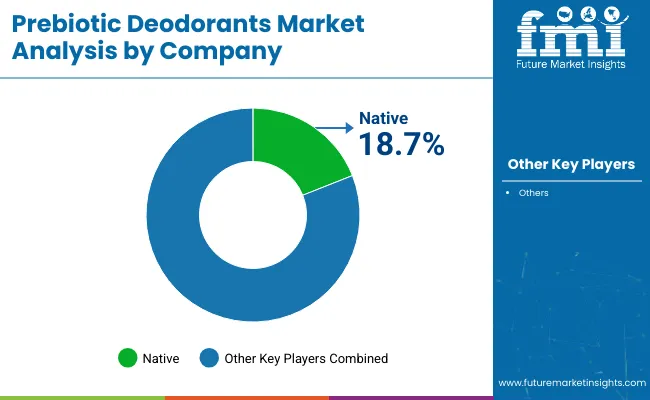

| Company | Global Value Share 2025 |

| Native | 18.7% |

| Others | 81.3% |

In 2025, Native holds an estimated 18.7% share of the global prebiotic deodorants market, reflecting its strong brand equity, microbiome-focused positioning, and clean-label appeal. The “Others” category commands 81.3%, indicating a fragmented competitive landscape dominated by emerging indie brands, private labels, and larger personal care companies expanding their natural deodorant portfolios.

rands such as Native, Schmidt’s Naturals, and Malin + Goetz hold a considerable share due to their early entry into natural deodorants, mass retail reach, and evolving microbiome-supportive lines. Their strategies are anchored in aluminum-free, baking soda-free formulations that cater to broad skin sensitivities and maintain a balance between natural efficacy and consumer trust.

Mid-sized disruptors such as Kosas, Drunk Elephant, and Salt & Stone are actively integrating skincare science with deodorant function. Their edge stems from cross-category expertise, use of bioactive prebiotic blends, and dermatologist-backed claims. Positioned as luxury clean beauty brands, they appeal to ingredient-conscious consumers seeking multi-functional, skin-enhancing deodorants within minimalist routines.

Emerging niche players including Wild, Corpus Naturals, AKT London, and Hume are reshaping category innovation through refillable formats, gender-neutral branding, and sustainability-driven design. Their regional strength is driven by targeted DTC models and strong consumer engagement on platforms like Instagram and TikTok. Product personalization, refill pods, and compostable packaging are being leveraged to build loyalty in eco-conscious urban markets.

Key Developments in Prebiotic Deodorants Market

| Item | Value |

| Quantitative Units | USD 663.8 Million |

| Product Type | Stick Deodorants, Roll-on Deodorants, Spray Deodorants, Cream & Balm Deodorants, Wipe & Sheet Deodorants, Gel Deodorants, Powder Deodorants, Other Formats (e.g., solid bars, serum-based, oils) |

| Ingredient Type | Plant-Based Prebiotics (e.g., inulin, yacon root extract), Fermentation-Derived Prebiotics (e.g., alpha- glucan oligosaccharide), Marine-Origin Prebiotics, Synthetic Prebiotic Actives, Other Sources (e.g., yeast extract, mushroom-derived) |

| Packaging Format | Plastic (e.g., tubes, sticks, jars), Glass Containers, Metal Tins, Compostable / Paper-Based Packaging, Refillable & Reusable Packaging, Travel-Size Mini Packaging |

| Distribution Channel | Offline Retailers, Online Marketplaces (e.g., Amazon, Nykaa), Subscription & Sampling Boxes, Dermatology Clinics, Mass Retail & Supermarkets, Pharmacies & Drugstores, Airport Duty-Free & Travel Retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Native, Corpus Naturals, Wild, Salt & Stone, Kosas, Drunk Elephant, AKT London, Hume, Malin + Goetz, Schmidt’s Naturals |

| Additional Attributes | Dollar sales by product types and retail channel, ingredient type adoption trends in clean-label deodorants, rising demand for microbiome-friendly and pH-balanced formulations, segment-specific growth in women’s personal care and athleisure consumers, e-commerce and DTC revenue segmentation, integration with probiotic skincare and wellness routines, regional trends influenced by natural cosmetics regulation, and innovations in encapsulation, odor-neutralizing botanicals, and time-release delivery systems. |

The global Prebiotic Deodorants Market is estimated to be valued at USD 663.8 million in 2025.

The market size for the Prebiotic Deodorants Market is projected to reach USD 1010.3 million by 2035.

The Prebiotic Deodorants Market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in the Prebiotic Deodorants Market are sticks, roll-ons, sprays, creams, and wipes.

In terms of product type, the stick deodorants segment is expected to command a 34.3% share in the Prebiotic Deodorants Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prebiotic Fiber Market Size and Share Forecast Outlook 2025 to 2035

Prebiotic Ingredient Market Analysis - Size, Share, and Forecast 2025 to 2035

Prebiotic Soda Market Analysis by Type, Packaging, Flavor and Distribution Channel Through 2035

Prebiotic Coffee Market Analysis by Product Type, Format and Other Distribution Channel Through 2035

Pet Prebiotics Market Analysis - Size, Growth, and Forecast 2025 to 2035

Marine Prebiotics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Prebiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Prebiotics Market – Growth, Livestock Nutrition & Demand

Demand for Whey-plus-Prebiotic Stacks for RTD Shakes in CIS Analysis Size and Share Forecast Outlook 2025 to 2035

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Antiperspirants and Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA