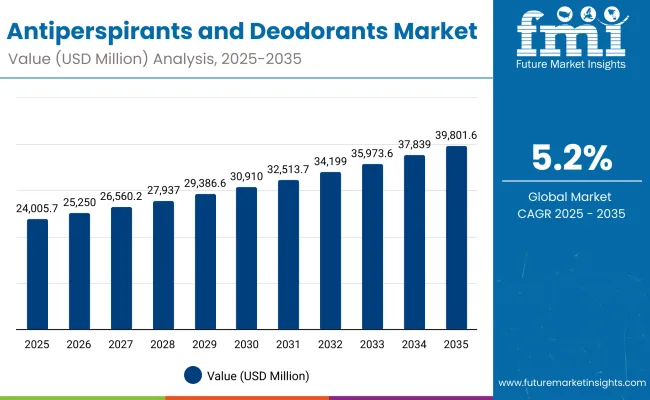

The Antiperspirants and Deodorants Market is expected to record a valuation of USD 24,005.7 million in 2025 and USD 39,801.6 million in 2035, with an increase of USD 15,795.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 5.2% and nearly a 2X increase in market size.

Antiperspirants and Deodorants Market Key Takeaways

| Metric | Value |

|---|---|

| Antiperspirants and Deodorants Market Estimated Value (2025E) | USD 24,005.7 million |

| Antiperspirants and Deodorants Market Forecast Value (2035F) | USD 39,801.6 million |

| Forecast CAGR (2025 to 2035) | 5.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 24,005.7 million to USD 30,910.6 million, adding USD 6,904.9 million, which accounts for 44% of the total decade growth. This phase records steady adoption in personal hygiene, odor-prevention, and men’s grooming categories, driven by increasing consumer awareness and urban lifestyles. Sticks dominate this period as they cater to over 60% of retail deodorant and antiperspirant sales, supported by their convenience and extended protection.

The second half from 2030 to 2035 contributes USD 8,891 million, equal to 56% of total growth, as the market jumps from USD 30,910.6 million to USD 39,801.6 million. This acceleration is powered by the widespread adoption of natural deodorant actives, AI-enabled personalized skincare, and premium unisex formulations in mature and emerging markets. Roll-ons and sprays together capture a larger share above 40% by the end of the decade. Subscription-based and e-commerce-led distribution adds recurring revenue, increasing the digital channel share beyond 50% in total value.

From 2020 to 2024, the Antiperspirants and Deodorants Market expanded steadily as consumer awareness toward odor control and long-lasting formulations increased across urban demographics. During this period, the competitive landscape was dominated by multinational brands accounting for nearly 90% of global revenue, with Unilever and Procter & Gamble leading in mass and premium segments through continuous innovation in aluminum-based and sensitive-skin formulas. Product differentiation relied on scent retention, skin compatibility, and sustainability claims, while digital marketing and subscription models emerged as auxiliary growth drivers rather than core revenue streams. E-commerce and drugstore channels contributed less than 10% of total value before 2025.

Demand for Antiperspirants and Deodorants is projected to reach USD 24,005.7 million in 2025, with a noticeable shift toward eco-formulations and unisex appeal. By 2035, the market will reach USD 39,801.6 million, driven by rising penetration in Asia and increased adoption of natural and mineral-based ingredients. Traditional leaders face mounting competition from digitally native and sustainability-focused brands that emphasize AI-enabled marketing, personalized recommendations, and subscription delivery models. Competitive advantage is shifting from fragrance innovation alone to integrated ecosystems combining sustainability positioning, formulation diversity, and direct-to-consumer engagement.

Growth in the Antiperspirants and Deodorants Market is driven by consumer preference for long-lasting protection and dermatologically safe products. Increasing awareness of personal hygiene, coupled with lifestyle changes in urban populations, has accelerated adoption across both men’s and women’s segments. Manufacturers are focusing on aluminum-free, alcohol-free, and sensitive-skin formulations to meet evolving consumer needs. This trend is further supported by innovations in fragrance retention, natural actives, and sweat-control efficacy, boosting repeat purchases and premiumization across major retail channels.

The market is witnessing strong momentum due to rapid growth in online retail and rising acceptance of unisex and gender-neutral deodorant products. Digital platforms have enhanced accessibility, particularly in emerging economies like India, China, and Southeast Asia, where grooming awareness is growing rapidly. Premium deodorant brands leveraging AI-based personalization, refillable packaging, and eco-conscious positioning are gaining traction. E-commerce players and subscription-based models are enabling consistent consumer engagement, resulting in higher brand loyalty and sustained revenue growth across all distribution channels.

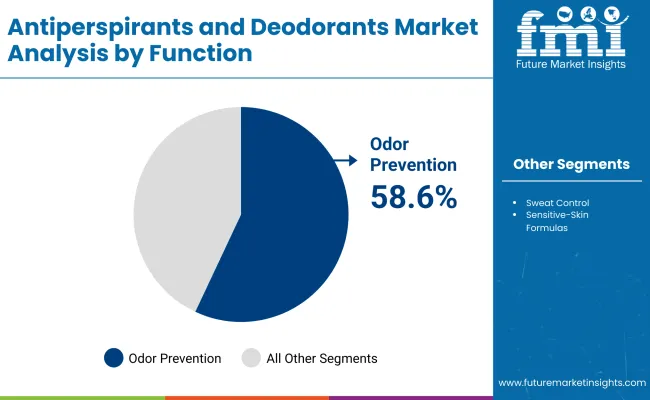

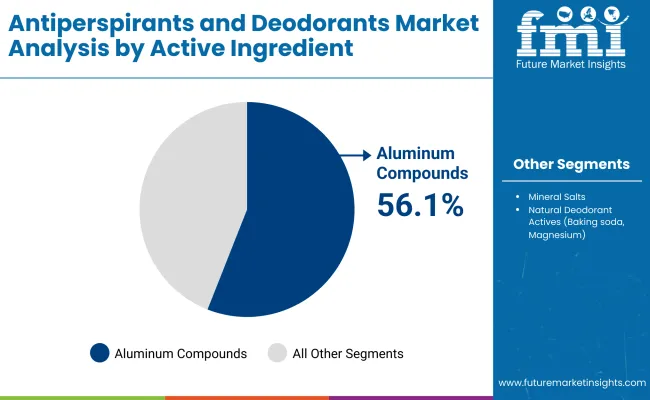

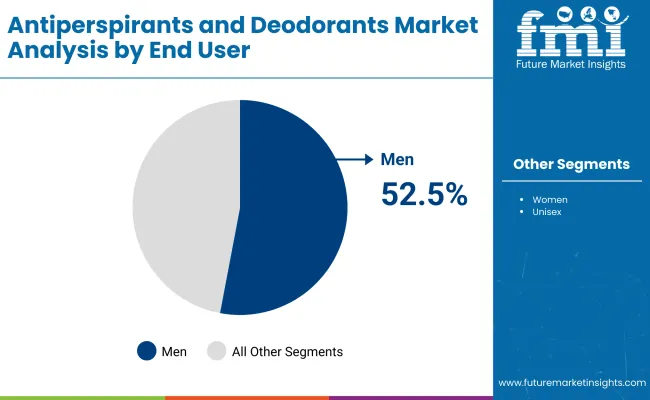

The Antiperspirants and Deodorants Market is segmented by product type, active ingredient, function, distribution channel, end user, and region. Product types include sticks, roll-ons, sprays & aerosols, and creams & gels, representing the key delivery formats catering to varied consumer preferences. By active ingredient, the market covers aluminum compounds, mineral salts, and natural deodorant actives such as baking soda and magnesium. Functional segmentation includes odor prevention, sweat control, and sensitive-skin formulations. Distribution channels span supermarkets & hypermarkets, pharmacies & drugstores, e-commerce, and convenience stores. End-user categories comprise men, women, and unisex consumers, reflecting gender-based demand diversification. Regionally, the market encompasses North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, each showing unique adoption trends influenced by lifestyle changes, climate conditions, and personal hygiene awareness.

| Function | Value Share% 2025 |

|---|---|

| Odor prevention | 58.6% |

| Others | 41.4% |

The odor prevention segment is projected to contribute the largest share of the Antiperspirants and Deodorants Market revenue in 2025, maintaining its dominance as the key functional category. Growth is driven by consumer preference for long-lasting freshness, antibacterial efficacy, and sweat-control benefits, particularly in hot and humid climates.

Manufacturers are increasingly focusing on formulations with aluminum compounds and natural mineral salts that provide dual protection against perspiration and body odor. The segment’s momentum is further supported by innovations in fragrance retention and skin-friendly ingredients. As natural and sensitive-skin variants gain traction, odor prevention products are expected to remain the foundation of the global Antiperspirants and Deodorants Market through 2035.

| Active Ingredient | Value Share% 2025 |

|---|---|

| Aluminum compounds | 56.1% |

| Others | 43.9% |

The aluminum compounds segment is forecasted to hold the majority share of the Antiperspirants and Deodorants Market in 2025, driven by its proven effectiveness in sweat and odor control. These compounds create a temporary barrier on sweat glands, reducing perspiration and enhancing long-lasting freshness making them the preferred choice for both mass-market and premium deodorant brands.

Their stability, compatibility with fragrance systems, and cost efficiency further strengthen their dominance. Although natural and mineral-based alternatives are emerging, aluminum-based formulations remain integral to the market’s performance portfolio. Continuous innovation in skin-safe aluminum salts and hybrid compositions is expected to sustain their leadership position through 2035.

| End User | Value Share% 2025 |

|---|---|

| Men | 52.5% |

| Others | 47.5% |

The men’s segment is projected to account for the largest share of the Antiperspirants and Deodorants Market revenue in 2025, establishing it as the leading end-user category. This dominance is attributed to increasing grooming awareness, expanding product portfolios targeting men, and growing participation in professional and social settings that emphasize personal hygiene. Male consumers prefer high-efficacy formulations offering sweat protection, long-lasting fragrance, and skin comfort.

Premium deodorants and antiperspirants marketed with performance-based claims such as 48-hour protection or sport-specific endurance are gaining traction. With the rising influence of men’s grooming trends in both developed and emerging markets, this segment is expected to sustain its leadership throughout the forecast period.

Growing Consumer Awareness Toward Hygiene and Personal Grooming

The Antiperspirants and Deodorants Market is expanding as consumers increasingly prioritize personal hygiene and grooming routines. Rising urbanization, higher disposable incomes, and changing lifestyle patterns are driving consistent product adoption across both developed and emerging economies. Younger demographics, particularly millennials and Gen Z, are seeking multifunctional products offering odor protection, freshness, and skin-friendly properties. Marketing campaigns by global brands emphasizing hygiene, confidence, and social appeal are further amplifying product visibility. As self-care and wellness gain cultural importance, deodorants and antiperspirants are becoming everyday essentials rather than discretionary purchases.

Innovation in Natural and Aluminum-Free Formulations

The market is witnessing rapid growth due to innovation in natural, organic, and aluminum-free deodorant formulations. Consumers are becoming more conscious of product ingredients and their long-term effects on skin health. This has led to a surge in demand for mineral salt, magnesium, and baking soda-based deodorants that offer mild, hypoallergenic protection without compromising performance. Global manufacturers are investing in plant-derived actives and sustainable packaging to enhance their clean-label appeal. These innovations are reshaping the competitive landscape, attracting health-conscious buyers and driving premiumization in both male and unisex product categories.

Regulatory Challenges and Ingredient Scrutiny

Stringent regulations regarding cosmetic ingredients and labeling are posing challenges for manufacturers in the Antiperspirants and Deodorants Market. Concerns over the potential health impact of aluminum salts, parabens, and synthetic fragrances have intensified product scrutiny. Several regions, including the EU and North America, are enforcing tighter standards on permissible chemical concentrations and eco-compliance. Adapting formulations to meet diverse regulatory requirements increases production complexity and cost. Moreover, misinformation and online debates over ingredient safety have influenced consumer perception, pushing some users toward natural alternatives and affecting sales of conventional deodorant lines.

Rise of Gender-Neutral and Personalized Deodorant Offerings

A major trend shaping the market is the growing adoption of gender-neutral and personalized deodorant products. Brands are moving beyond traditional male and female marketing to introduce inclusive formulations appealing to all users. Customization technologies using AI and data analytics are enabling brands to offer deodorants tailored to skin type, sweat level, and fragrance preference. Subscription-based delivery models and refillable packaging are gaining popularity among eco-conscious consumers. This shift toward personalization, inclusivity, and sustainability reflects broader changes in consumer values, positioning gender-neutral deodorants as a key growth frontier through 2035.

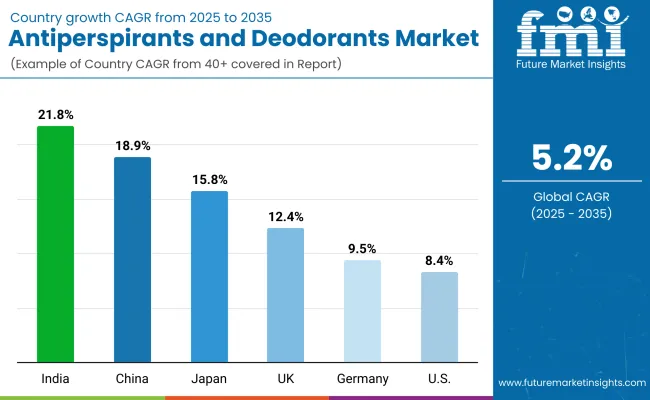

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 18.9% |

| USA | 8.4% |

| India | 21.8% |

| UK | 12.4% |

| Germany | 9.5% |

| Japan | 15.8% |

The global Antiperspirants and Deodorants Market exhibits clear regional contrasts in growth, shaped by cultural habits, consumer awareness, and retail modernization. Asia-Pacific is emerging as the fastest-growing region, led by India (21.8% CAGR) and China (18.9% CAGR), driven by rapid urbanization, rising disposable incomes, and growing demand for affordable grooming essentials. Local and international brands are expanding aggressively through e-commerce and convenience retail formats. India’s market benefits from high youth population and climate-driven demand for sweat control, while China’s shift toward premium and natural deodorants reflects its evolving middle-class preferences.

Japan (15.8% CAGR) follows with strong adoption of high-end, dermatologically safe formulations, often featuring skin-conditioning actives and subtle fragrances that align with its minimalist skincare culture. In Europe, the UK (12.4%) and Germany (9.5%) maintain consistent growth, supported by premiumization trends and stricter sustainability standards. German consumers prefer aluminum-free and eco-certified deodorants, while the UK market is driven by niche, gender-neutral, and cruelty-free brands.

In North America, the USA (8.4% CAGR) demonstrates steady but mature growth, characterized by a high base of established users and strong brand loyalty. Growth here is supported by innovation in refillable packaging, clinical-strength antiperspirants, and wellness-driven formulations. While Europe leads in sustainable reformulation and Asia in volume growth, North America remains the hub for brand-driven innovation and digital-first marketing strategies, ensuring competitive balance across the global Antiperspirants and Deodorants landscape.

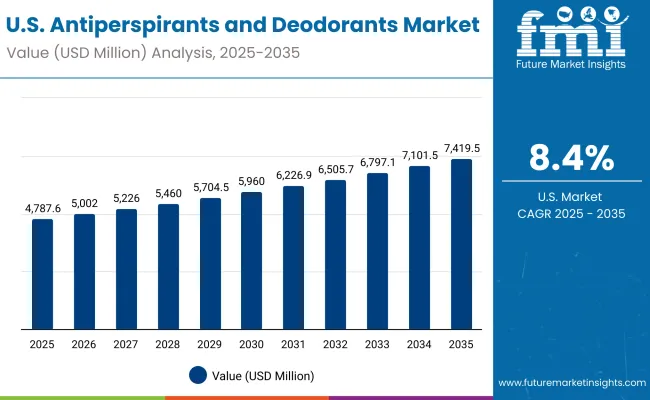

| Year | USA Antiperspirants and Deodorants Market (USD Million) |

|---|---|

| 2025 | 4787.62 |

| 2026 | 5002.02 |

| 2027 | 5226.02 |

| 2028 | 5460.05 |

| 2029 | 5704.56 |

| 2030 | 5960.02 |

| 2031 | 6226.93 |

| 2032 | 6505.78 |

| 2033 | 6797.13 |

| 2034 | 7101.52 |

| 2035 | 7419.54 |

The Antiperspirants and Deodorants Market in the United States is projected to grow at a CAGR of 5.2% from 2025 to 2035, supported by sustained consumer preference for high-performance and dermatologically safe formulations. Growth is primarily driven by the increasing demand for long-lasting odor protection, aluminum-free alternatives, and premium unisex products. The USA market remains innovation-intensive, with brands focusing on advanced formulations combining sweat control, fragrance durability, and skin hydration.

Rising adoption of refillable and eco-conscious packaging is reshaping the market, with sustainability influencing both product design and retail strategy. The men’s grooming segment continues to lead in volume, while women’s and unisex deodorants drive value growth through premiumization and personalization. E-commerce and subscription-based models are expanding consumer reach, enhancing convenience and brand loyalty.

The Antiperspirants and Deodorants Market in the United Kingdom is expected to grow at a CAGR of 12.4% from 2025 to 2035, driven by rising demand for sustainable, gender-neutral, and skin-sensitive formulations. UK consumers are increasingly prioritizing clean-label deodorants that are aluminum-free, cruelty-free, and dermatologically approved. This shift aligns with broader European sustainability goals emphasizing recyclable packaging and ethical sourcing.

Premium brands are expanding their presence through pharmacies, supermarkets, and e-commerce, with an emphasis on natural ingredients and long-lasting freshness. Independent brands are gaining traction through niche positioning particularly in vegan, eco-certified, and unisex categories. The rollout of refill stations and subscription-based deodorant delivery models has further deepened consumer engagement.

India is witnessing rapid expansion in the Antiperspirants and Deodorants Market, which is forecast to grow at a CAGR of 21.8% through 2035. The surge is driven by rising disposable incomes, a growing young population, and increasing awareness of personal hygiene and grooming. Penetration in tier-2 and tier-3 cities has accelerated as affordable deodorant brands and compact roll-on formats become widely available through modern trade and e-commerce.

Local manufacturers are leveraging climate-specific product innovations, including sweat-resistant and skin-cooling deodorants, tailored for India’s tropical conditions. At the same time, premium brands are expanding their presence through online channels, targeting urban consumers seeking natural, long-lasting, and alcohol-free options. Aggressive marketing campaigns emphasizing freshness, confidence, and wellness are strengthening brand loyalty.

The Antiperspirants and Deodorants Market in China is expected to grow at a CAGR of 18.9%, the fastest among major global economies. This rapid expansion is driven by a strong shift toward premium, natural, and skin-friendly deodorant formulations, supported by rising disposable incomes and evolving lifestyle preferences. Urban consumers are adopting high-performance antiperspirants offering long-lasting protection and light fragrances suited to humid climates. At the same time, domestic manufacturers are introducing competitively priced roll-ons and sprays that appeal to first-time buyers in lower-tier cities.

The growth is also propelled by the digital retail boom, with e-commerce and social commerce platforms serving as key distribution channels for both mass and premium brands. Local players are leveraging influencer marketing and live-stream sales to capture younger consumers, while international brands focus on transparency, sustainability, and formulation innovation to strengthen brand trust.

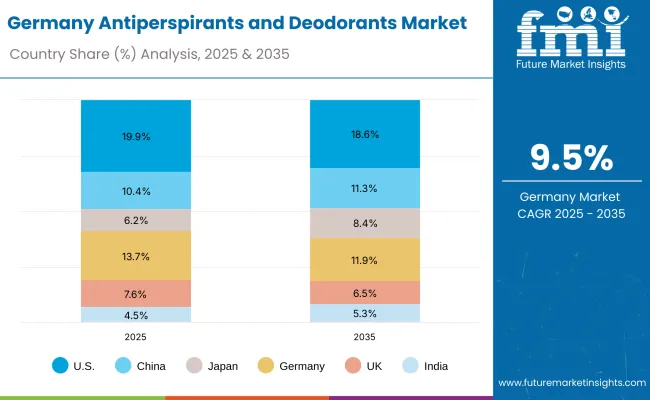

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.4% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.6% |

| India | 4.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.3% |

| Japan | 8.4% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

The Antiperspirants and Deodorants Market in Germany is projected to grow at a CAGR of 9.5% from 2025 to 2035, driven by the country’s strong focus on product safety, sustainability, and premium formulation standards. German consumers demonstrate high brand loyalty and preference for deodorants that combine clinical efficacy with eco-conscious ingredients. This has led to the rapid expansion of aluminum-free, dermatologically tested, and vegan-certified deodorants across both drugstore and premium retail channels.

Manufacturers are investing in biodegradable packaging and plant-based formulations to align with stringent EU sustainability mandates. The market also benefits from strong R&D capabilities, with companies introducing innovations in long-lasting odor protection and sensitive-skin variants. While traditional sprays and roll-ons remain popular, the demand for solid sticks and natural deodorant creams is rising steadily.

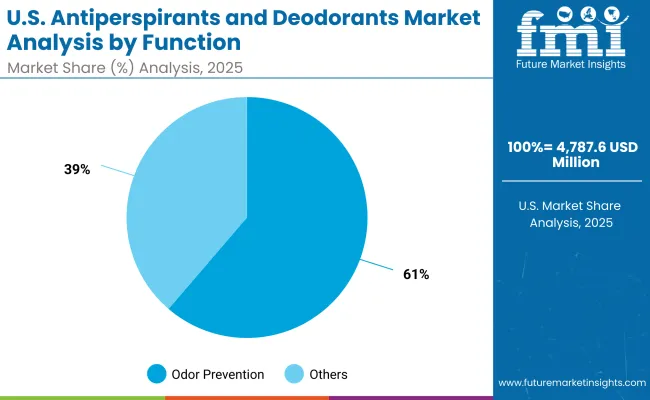

| USA by Function | Value Share% 2025 |

|---|---|

| Odor prevention | 61.3% |

| Others | 38.7% |

The Antiperspirants and Deodorants Market in the United States is projected at USD 4,787.6 million in 2025, with odor prevention formulations accounting for 61.3% of total revenue. This dominance reflects the strong consumer focus on long-lasting freshness, sweat protection, and dermatologist-approved ingredients. The market is transitioning toward natural, aluminum-free, and clinically tested products, responding to rising health consciousness and ingredient transparency demands.

The shift from mass-market to premium and performance-based deodorants is noticeable, as consumers seek products offering 48-hour protection, skin conditioning, and allergen-free fragrances. Digital-first and subscription-based brands are reshaping purchase patterns through personalization and targeted advertising. Sustainability initiatives such as refillable packaging and recyclable containers are also gaining momentum. As major brands integrate eco-friendly and data-driven product innovations, the USA is expected to remain a leading global market through 2035.

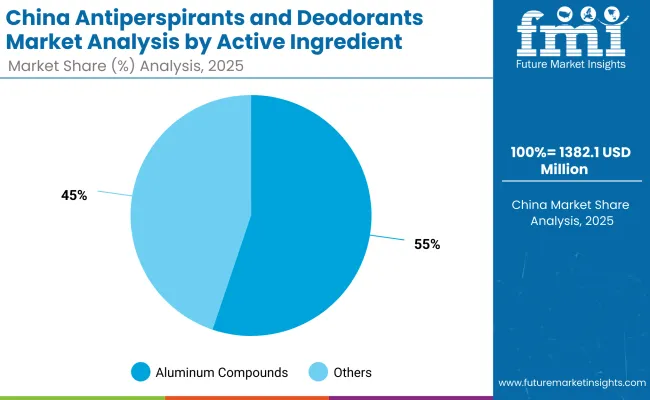

| China by Active Ingredient | Value Share% 2025 |

|---|---|

| Aluminum compounds | 55.2% |

| Others | 44.8% |

The Antiperspirants and Deodorants Market in China presents strong growth potential, with aluminum compound-based formulations leading at 55.2% of total market value in 2025. This leadership is attributed to high consumer preference for effective sweat and odor control in humid climates and densely populated urban environments. Domestic brands are increasingly innovating with hybrid formulations that combine aluminum efficacy with natural extracts, appealing to both performance-driven and eco-conscious consumers.

China’s evolving beauty and personal care ecosystem offers significant opportunities for international and local brands through digital-first expansion, influencer marketing, and social commerce platforms such as Tmall and Douyin. The growing middle class, rising personal hygiene awareness, and preference for premium and sensitive-skin deodorants are further stimulating market penetration. As sustainability gains traction, there is increasing room for natural and mineral salt-based deodorants to capture the remaining 44.8% share.

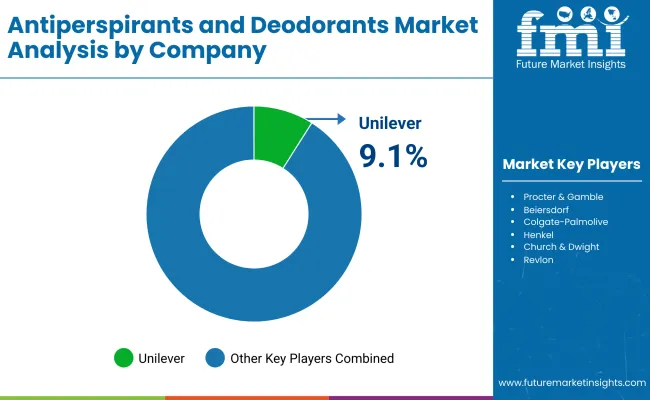

| Companies | Global Value Share 2025 |

|---|---|

| Unilever | 9.1% |

| Others | 90.9% |

The Antiperspirants and Deodorants Market is moderately fragmented, led by a mix of multinational corporations, emerging regional brands, and niche clean-label innovators. Global FMCG leaders such as Unilever, Procter & Gamble, Beiersdorf, and Colgate-Palmolive dominate through extensive product portfolios, large-scale distribution, and brand heritage across mass and premium segments. Their competitive edge lies in strong R&D pipelines, frequent product innovations, and marketing strategies that emphasize freshness, confidence, and sustainability.

Mid-tier players including Henkel, Church & Dwight, and L’Oréal are rapidly scaling through product diversification and investments in natural, aluminum-free, and eco-certified deodorants, aligning with evolving consumer preferences. These companies leverage digital platforms, e-commerce, and influencer-led promotions to deepen engagement, particularly in Asia-Pacific and Europe.

Niche entrants and regional challengers, such as Kao, Lion Corporation, and Revlon, are capitalizing on local scent preferences and ingredient trends, positioning themselves in the fast-growing clean beauty and unisex care segments. Competitive differentiation is increasingly shifting from brand legacy to sustainability credentials, refillable packaging, and data-driven personalization, signaling a market transition toward holistic wellness and environmentally conscious grooming solutions.

Key Developments in Antiperspirants and Deodorants Market

| Item | Value |

|---|---|

| Quantitative Units | USD 24,005.7 Million |

| Product Type | Roll-ons, Sticks, Sprays & aerosols, Creams & gels |

| Active Ingredient | Aluminum compounds, Mineral salts, Natural deodorant actives (baking soda, magnesium) |

| Function | Sweat control, Odor prevention, Sensitive-skin formulas |

| Channel | Supermarkets & hypermarkets, Pharmacies/drugstores, E-commerce, Convenience stores |

| End User | Women, Men, Unisex |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever (Dove, Rexona), Procter & Gamble (Secret, Old Spice), Beiersdorf (Nivea), Colgate-Palmolive, Henkel, Church & Dwight, L’Oréal, Kao, Lion Corporation, Revlon |

| Additional Attributes | Dollar sales by product type and active ingredient, evolving adoption trends across men’s, women’s, and unisex segments, rising demand for natural and aluminum-free deodorants, sector-specific growth in personal care, retail, and e-commerce channels, revenue segmentation by function and distribution format, integration of sustainability practices such as refillable packaging and biodegradable materials, regional growth influenced by hygiene awareness and climatic conditions, and ongoing innovations in fragrance delivery, sweat-control formulations, and skin-sensitive product technologies. |

The global Antiperspirants and Deodorants Market is estimated to be valued at USD 24,005.7 million in 2025.

The market size for the Antiperspirants and Deodorants Market is projected to reach USD 39,801.6 million by 2035.

The Antiperspirants and Deodorants Market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in the Antiperspirants and Deodorants Market are roll-ons, sticks, sprays & aerosols, and creams & gels, representing the major delivery formats catering to diverse consumer preferences and application needs.

In terms of function, the odor prevention segment is projected to command the most significant share in the Antiperspirants and Deodorants Market in 2025, driven by growing consumer demand for long-lasting freshness and effective sweat-control formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antiperspirants / Deo-Actives Market Size and Share Forecast Outlook 2025 to 2035

Prebiotic Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA