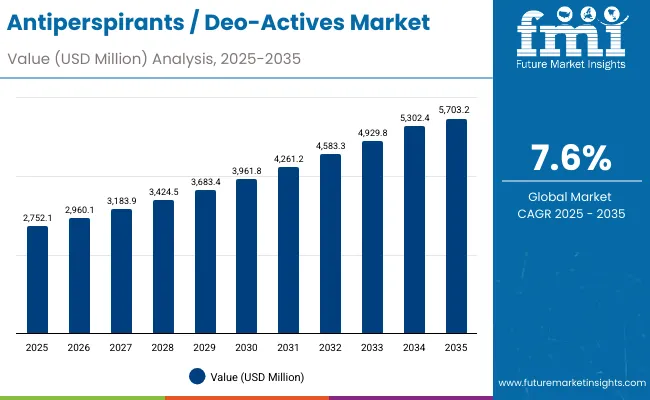

The global Antiperspirants / Deo-Actives Market is expected to record a valuation of USD 2,752.1 million in 2025 and USD 5,703.2 million in 2035, with an increase of USD 2,951.1 million, which equals a growth of more than 2X over the decade. The overall expansion represents a CAGR of 7.6%, reflecting steady yet dynamic consumer demand across premium and mass-market categories.

Global Antiperspirants / Deo-Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Global Antiperspirants / Deo -Actives Market Estimated Value in (2025E) | USD 2,752.1 million |

| Global Antiperspirants / Deo -Actives Market Forecast Value in (2035F) | USD 5,703.2 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

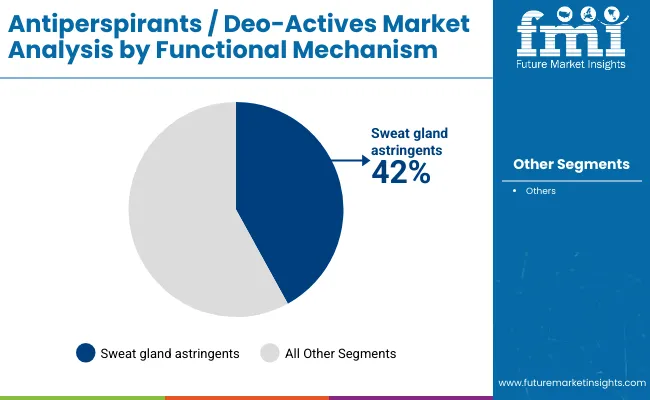

During the first five-year period from 2025 to 2030, the market increases from USD 2,752.1 million to USD 3,961.8 million, adding USD 1,209.7 million, which accounts for roughly 41% of the total decade growth. This phase records consistent adoption in mass-market deodorants, roll-ons, and spray formats, supported by affordability and wide retail availability. Aluminum salts remain dominant as sweat gland astringents capture over 42% share, demonstrating continued reliance on traditional actives. Encapsulation technologies begin gaining traction, enabling controlled release and long-lasting freshness, particularly in clinical-strength and dermocosmetic brands.

The second half from 2030 to 2035 contributes USD 1,741.4 million, equal to nearly 59% of the total decade growth, as the market jumps from USD 3,961.8 million to USD 5,703.2 million. This acceleration is powered by rising preference for biotechnology-derived and plant-based actives, as well as the integration of microbiome-balancing and multifunctional formulations in premium deodorant lines. Long-lasting fragrance actives, supported by encapsulation, grow significantly in this period. Asia, led by China (14.4% CAGR) and India (16.2% CAGR), emerges as the fastest-growing hub, while the U.S. continues to expand steadily at 6.0% CAGR, driven by clinical-strength and dermocosmetic adoption. Europe, although mature, maintains demand for mineral and botanical deodorants with sustainability claims.

Software-led analytics is not relevant here, but the parallel lies in fragrance microencapsulation, controlled-release delivery, and consumer personalization driving the premium end of the market. Companies investing in biotech-based sweat modulation and sustainable alternatives to aluminum salts are set to lead recurring revenue growth.

From 2020 to 2024, the global Antiperspirants / Deo-Actives Market expanded steadily, primarily led by aluminum salts and synthetic odor neutralizers. During this period, the competitive landscape was dominated by global chemical and fragrance giants, with BASF, Symrise, and Givaudan collectively shaping innovations in actives and fragrance systems. The market leaned heavily on hardware-like components (aluminum salts and powders), while biotech and botanical-based solutions remained niche. Competitive differentiation relied on efficacy, longevity of freshness, and cost efficiency, while sustainability was an emerging rather than mainstream factor.

Demand for deo-actives is projected to reach USD 2,752.1 million in 2025, but the revenue mix will shift significantly by 2035. Traditional aluminum salts face mounting competition from plant-based and biotech-derived actives that offer sweat and odor control without irritation concerns. Major ingredient suppliers are pivoting to encapsulation systems, natural odor-neutralizing complexes, and moisture-absorbing mineral blends to maintain relevance. Emerging entrants specializing in biotechnology fermentation, microbiome balancing, and encapsulated fragrance innovation are gaining traction. The competitive advantage is moving away from relying solely on aluminum salts toward eco-friendly credentials, clean-label compliance, and consumer-trusted efficacy in premium dermocosmetic lines.

Advances in encapsulation and controlled-release fragrance actives have improved product longevity, enabling long-lasting odor protection even in high-humidity environments. Sweat gland astringents continue to dominate due to their proven efficacy, but encapsulated actives and plant-based deodorizing agents are adding new growth dimensions. With increased awareness of skin sensitivity and ingredient safety, consumers are turning to botanical and mineral alternatives that deliver balance between efficacy and clean-label positioning.

Another strong growth driver is the regional rise of premium dermocosmetic deodorants in East Asia and South Asia. India’s young, urban population is fueling double-digit growth in both mass-market and premium deo-actives, with clinical-strength formulations gaining recognition. China and Japan are seeing strong uptake in biotech-based odor control solutions, with encapsulated actives capturing nearly half the segment. The surge in personal care investments, skin microbiome research, and biotech-driven actives is reshaping competitive priorities and creating high-value growth opportunities.

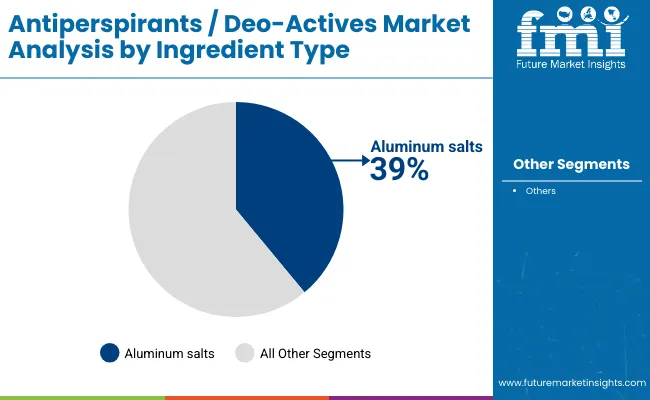

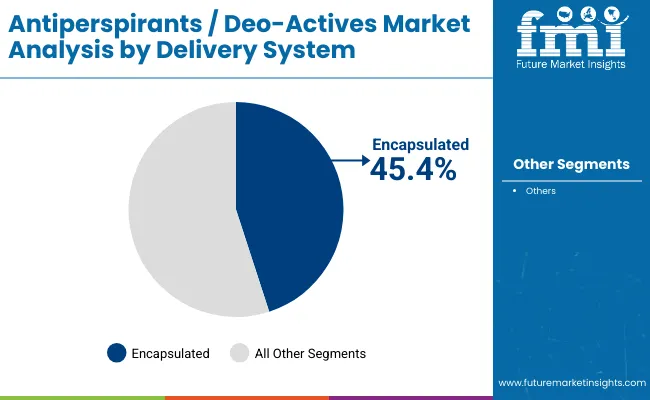

The market is segmented by functional mechanism, ingredient type, delivery system, physical form, application, end use, and geography. Functional mechanisms include sweat gland astringents, odor neutralizers, moisture absorbers, and long-lasting fragrance actives, with sweat gland astringents leading in 2025. Ingredient types span aluminum salts, mineral-based actives, botanical & plant-derived actives, and biotechnology-derived actives, with aluminum salts still dominant but declining in share over time. Delivery systems include free form, encapsulated fragrance/active, and blended complex, where encapsulated actives already command nearly half the market. Physical forms comprise powders, solutions/concentrates, and solid beads. Applications cover roll-on, stick/solid, spray/aerosol, and cream/gel deodorants. End-use markets are mass-market personal care, premium/dermocosmetic, and clinical-strength products, with strong growth in the latter two. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa, with India, China, and Japan leading growth while the USA and Europe maintain large, mature bases.

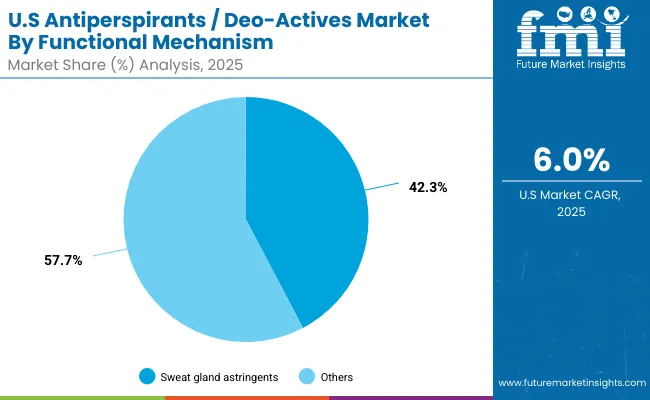

| Functional Mechanism | Value Share % 2025 |

|---|---|

| Sweat gland astringents | 42% |

| Others | 58.0% |

The sweat gland astringents segment is projected to contribute 42% of the global Antiperspirants / Deo-Actives Market revenue in 2025, maintaining its lead as the dominant functional category. This growth is primarily driven by the widespread reliance on aluminum salts and astringent actives that deliver consistent sweat-blocking efficacy. Consumers in both mass-market and clinical-strength deodorants continue to favor these solutions because they provide a proven, quick-acting defense against perspiration.

In addition, new product developments are ensuring sweat gland astringents are not just effective but also skin-friendly. Manufacturers are introducing modified salts, buffered formulations, and pairing with moisturizers to reduce irritation. The segment’s growth is further supported by clinical-grade products in the USA and Europe, where efficacy claims are tightly linked to astringent actives. As global demand for heavy-duty, high-performance deodorants rises, sweat gland astringents are expected to remain the backbone of deo-active formulations through 2035.

| Ingredient Type | Value Share % 2025 |

|---|---|

| Aluminum salts | 39% |

| Others | 61.0% |

The aluminum salts segment is forecasted to hold 39% of the market share in 2025, led by its application as the most common sweat-blocking ingredient in roll-on, stick, and spray deodorants. Its ability to reduce perspiration effectively, combined with its cost efficiency, has made it a staple in both mass-market and premium deodorants.

Aluminum salts remain favored because of their established safety profiles in regulated concentrations and their unmatched efficacy in heavy-sweating conditions. However, the segment is evolving to address consumer concerns about irritation and sustainability. Brands are working on low-residue, buffered aluminum complexes and mineral-blend hybrids to enhance consumer acceptance. While competition from plant-based and biotech-derived actives is rising, aluminum salts are expected to maintain dominance, particularly in clinical-strength and performance-focused deodorants, making them a critical growth driver through the forecast period.

| Delivery System | Value Share % 2025 |

|---|---|

| Encapsulated | 45.4% |

| Others | 54.6% |

The encapsulated fragrance/active segment is projected to account for 45.4% of the global Antiperspirants / Deo-Actives Market revenue in 2025, establishing it as the leading delivery system type. Encapsulation technology is preferred for its ability to deliver long-lasting freshness and controlled release of actives, allowing deodorant products to remain effective for extended periods even under active conditions.

Its suitability for premium and dermocosmetic lines has made encapsulation popular among leading brands. By embedding fragrance molecules or actives in microcapsules, manufacturers can provide burst-release effects during sweating or movement, aligning with consumer expectations for freshness that lasts all day. Developments in polymer-based and biodegradable encapsulation systems have also enhanced sustainability credentials, further driving demand. Given its balance of performance, longevity, and innovation potential, encapsulation is expected to maintain its leadership and expand its influence across both mass and premium deodorant categories by 2035.

Rising Clinical-Strength and Dermocosmetic Deodorant Adoption in Mature Markets

One of the strongest drivers in the global Antiperspirants / Deo-Actives Market is the accelerating demand for clinical-strength and dermocosmetic deodorants in the USA and Europe. As per the market breakdown, sweat gland astringents already account for 42% of global value, and this share is further reinforced in North America, where consumer preference tilts heavily toward high-efficacy, sweat-blocking actives.

Clinical-strength products priced at a premium are finding increasing acceptance among consumers facing hyperhidrosis, high humidity climates, or intensive activity lifestyles. Dermatologists in Europe are also recommending dermocosmetic deodorants that use encapsulated actives and buffered aluminum complexes to balance efficacy with reduced skin irritation. This adoption is particularly strong among affluent consumers and urban professionals, who are willing to pay higher prices for products that promise long-lasting odor and sweat control without discomfort. The growth of this category supports higher revenue-per-unit sold, raising the overall market value share of sweat gland astringents and encapsulated actives. Over the forecast horizon, this trend ensures a stable and expanding base of clinical and premium demand, directly driving long-term CAGR in developed markets.

Asia-Pacific Surge: Biotech-Derived Actives and Urbanization in China & India

Another non-generic driver comes from China and India, the two fastest-growing deodorant-active markets with CAGRs of 14.4% and 16.2% respectively. Unlike mature regions, growth here is being shaped by urbanization, rising disposable incomes, and increasing cultural acceptance of deodorants as daily-use essentials. A key differentiator is the emergence of biotechnology-derived and plant-based actives. In China, encapsulated biotech actives are gaining momentum due to strong alignment with “functional skincare” positioning, while in India, herbal and mineral blends appeal to local consumer preferences for natural remedies.

Encapsulated delivery systems, already valued at USD 1,249.5 million globally in 2025, are seeing outsized growth in Asia because they align with consumer expectations for long-lasting freshness in hot climates. Additionally, multinational and regional players are launching affordable sachet formats and mid-range sticks/roll-ons, expanding market penetration. Together, these factors create a powerful dual dynamic: volume-driven growth through mass-market channels and premium-led growth via biotech and natural actives, making Asia-Pacific a decisive growth engine for the industry.

Regulatory Pressures and Aluminum Salt Backlash

A major restraint for the global Antiperspirants / Deo-Actives Market is the intensifying scrutiny of aluminum salts, which currently hold a 39% global share (USD 1,073.3 million). Although regulatory bodies in the USA and EU continue to approve aluminum salts for cosmetic use within safe concentration limits, rising consumer concerns linking them with health risksthough inconclusiveare forcing brands to rethink formulations. Certain European countries are tightening labeling requirements, mandating clearer consumer disclosures about aluminum concentration.

At the same time, retailers in premium segments are pushing for aluminum-free claims as a market differentiator. This dual challengebalancing regulatory compliance with evolving consumer sentimentlimits growth potential for aluminum salts and raises reformulation costs for global suppliers like BASF, Clariant, and Evonik. The backlash is particularly pronounced in premium dermocosmetic channels, where consumers are increasingly opting for biotech-derived and plant-based alternatives, eroding aluminum’s dominance and creating a structural restraint.

Fragmentation in Emerging Markets and Consumer Education Gaps

While growth in Asia-Pacific is strong, a significant restraint comes from fragmentation and low awareness in rural and semi-urban markets. In India, deodorant penetration is under 20% in rural households, compared with 60-70% in urban centers. Many consumers in these regions still rely on traditional practices like talcum powders or herbal home remedies for sweat and odor management.

Similarly, in parts of Latin America and Africa, consumer education about deodorant actives remains limited, with purchases driven primarily by price rather than efficacy or ingredient awareness. This lack of market maturity forces companies to compete in low-margin, high-volume segments, delaying the scaling of premium deo-actives like encapsulated actives or biotech-derived agents. The inability to communicate the functional benefits of advanced formulations at the mass-market level constrains broader market expansion, acting as a structural brake despite strong urban growth.

Encapsulation as a Core Differentiator in Deo-Actives

Encapsulation technology, already valued at USD 1,249.5 million (45.4% share in 2025), is becoming a defining trend. Brands are increasingly using microcapsules to deliver controlled bursts of fragrance or actives when exposed to sweat or friction, enhancing the consumer experience. Unlike traditional free-form actives that lose efficacy over hours, encapsulation enables “smart freshness” marketing claims, which resonate strongly in both mass-market and premium categories. Moreover, the move toward biodegradable and natural encapsulation materials aligns with sustainability demands, making encapsulation not just a performance enhancer but also a compliance strategy. This trend is accelerating in Asia, where hot climates amplify the need for long-lasting efficacy, and in Europe, where sustainability adds another layer of consumer appeal.

Rise of Hybrid Formulations Blending Botanical, Mineral, and Biotech Actives

Another defining trend is the blending of multiple active types into hybrid formulations. Instead of relying solely on aluminum salts or plant extracts, brands are combining moisture absorbers, odor neutralizers, and microbiome-balancing biotech actives in a single product. This approach allows differentiation in crowded retail shelves and satisfies diverse consumer needsefficacy, skin-friendliness, and sustainability. For instance, a stick deodorant might integrate mineral-based moisture absorbers, encapsulated fragrance, and a biotech-derived probiotic active to appeal to both performance-driven and clean-label consumers. These hybrid formulations also allow brands to pivot quickly in response to regional preferences, such as natural ingredients in India or biotech positioning in Japan. The hybridization of actives signals a future where single-ingredient dominance fades, replaced by multifunctional systems offering layered benefits.

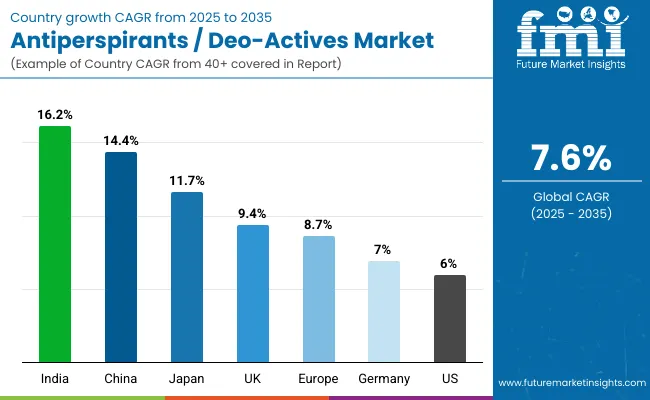

| Country | Estimated CAGR (2025-2035) |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

| Europe | 8.7% |

Growth rates across countries reveal a sharp divide between emerging Asian markets and mature Western regions. India, with the highest CAGR of 16.2%, reflects a surge in deodorant adoption among its expanding urban middle class, driven by rising hygiene awareness and preference for both affordable mass-market roll-ons and premium herbal-based deo-actives. China follows closely at 14.4% CAGR, propelled by the premiumization of deodorants through biotech-derived actives and encapsulated delivery systems, which align with the country’s broader dermocosmetic and functional skincare boom. Japan, with an 11.7% CAGR, underscores demand for advanced, long-lasting fragrance systems and microbiome-balancing actives, appealing to consumers with high sensitivity concerns and preference for innovation-led personal care. Together, Asia is setting the pace for global growth by blending mass-scale adoption with cutting-edge ingredient technologies.

In contrast, mature markets like the USA (6.0% CAGR), Germany (7.0% CAGR), and the UK (9.4% CAGR) are expanding at a more measured pace, reflecting high deodorant penetration but continued appetite for clinical-strength, dermocosmetic, and aluminum-free alternatives. Europe as a whole is projected to grow at 8.7% CAGR, balancing regulatory pressure on aluminum salts with the rise of botanical and mineral-based deodorants. The USA remains the single largest market by value, but its slower growth signals a shift toward premium categories rather than volume-driven expansion. Collectively, these differences highlight how Asia-Pacific will be the primary growth engine, while North America and Europe focus on premiumization, sustainability, and clinical efficacy to sustain momentum in a mature landscape.

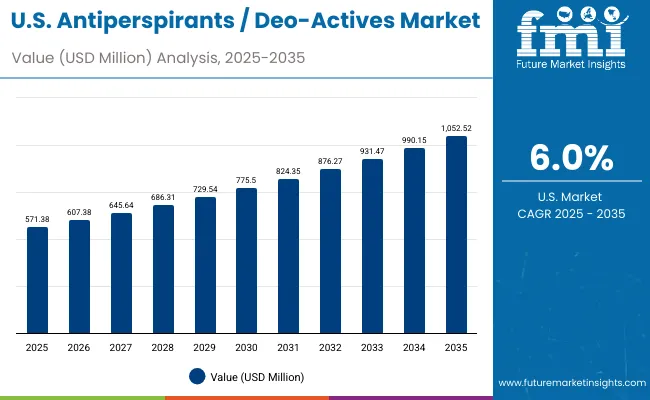

| Year | USA Antiperspirants / Deo -Actives Market (USD Million) |

|---|---|

| 2025 | 571.38 |

| 2026 | 607.38 |

| 2027 | 645.64 |

| 2028 | 686.31 |

| 2029 | 729.54 |

| 2030 | 775.50 |

| 2031 | 824.35 |

| 2032 | 876.27 |

| 2033 | 931.47 |

| 2034 | 990.15 |

| 2035 | 1052.52 |

The Antiperspirants / Deo-Actives Market in the United States is projected to grow at a CAGR of 6.0%, led by strong demand for clinical-strength deodorants and premium dermocosmetic formulations. Sweat gland astringents dominate usage, with encapsulated actives gaining momentum as consumers increasingly demand long-lasting freshness and reduced irritation. The USA market also benefits from pharmacy-based clinical brands that target consumers with excessive perspiration conditions. Aluminum-free claims are becoming more mainstream, pushing suppliers to develop hybrid botanical-mineral blends that retain efficacy while satisfying safety-conscious buyers.

The Antiperspirants / Deo-Actives Market in the United Kingdom is expected to grow at a CAGR of 9.4%, supported by rising adoption of premium deodorants with botanical and mineral actives. UK consumers demonstrate a strong interest in sustainability and clean-label claims, leading to higher demand for natural deo-actives blended with odor-neutralizers and moisture absorbers. Retailers are expanding eco-friendly and aluminum-free deodorant aisles, while luxury and dermocosmetic players are innovating with encapsulated fragrance systems. Heritage personal care brands are also reviving interest with clinical efficacy backed by dermatological testing, fueling premiumization.

India is witnessing rapid growth in the Antiperspirants / Deo-Actives Market, which is forecast to expand at a CAGR of 16.2% through 2035. Rising urbanization, disposable incomes, and youth-oriented marketing campaigns are driving deodorant penetration beyond metro cities into tier-2 and tier-3 regions. Herbal and plant-derived actives dominate preference in semi-urban markets, while encapsulated freshness systems are gaining adoption among premium urban buyers. Sachet-based roll-on deodorants and affordable sprays are becoming key enablers for mass-market growth. Government campaigns promoting hygiene, along with growing awareness among MSMEs and retailers, are further broadening demand.

The Antiperspirants / Deo-Actives Market in China is expected to grow at a CAGR of 14.4%, one of the highest among leading economies. Growth is powered by biotechnology-derived and encapsulated deo-actives, which align with the country’s thriving dermocosmetic and functional skincare ecosystem. Domestic companies are innovating aggressively with affordable encapsulated systems and botanical formulations, while international suppliers are positioning premium deo-actives around microbiome balance and skin sensitivity reduction. Rising consumer sophistication in urban centers is creating opportunities for clinical-strength products, while younger consumers drive adoption of hybrid fragrance-deodorant formats.

| Country | 2025 Share (%) |

|---|---|

| USA | 20.8% |

| China | 10.6% |

| Japan | 6.2% |

| Germany | 13.7% |

| UK | 7.2% |

| India | 4.3% |

| Europe | 19.6% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.5% |

| China | 11.4% |

| Japan | 7.5% |

| Germany | 11.9% |

| UK | 6.5% |

| India | 5.3% |

| Europe | 17.9% |

| By Functional Mechanism | Value Share % 2025 |

|---|---|

| Sweat gland astringents | 42.3% |

| Others | 57.7% |

The Antiperspirants / Deo-Actives Market in the United States is projected to grow at a CAGR of 6.0%, with sweat gland astringents continuing to dominate due to strong consumer trust in clinical-strength formulations. Clinical deodorants distributed through pharmacies and dermocosmetic outlets are the main growth engines, reflecting increasing demand for heavy-duty protection in high-stress lifestyles and humid environments. Encapsulated fragrance technologies are being widely introduced into premium brands, enabling all-day freshness claims that resonate strongly with urban professionals.

USA consumers are also driving the transition toward aluminum-free and hybrid formulations, often combining mineral absorbers with plant-derived deodorizing actives. This creates a dual-track growth pattern: on one side, pharmacy-driven clinical strength astringents maintain dominance, while on the other, premium natural and sustainable lines are accelerating adoption. As the market moves toward 2035, USA demand will remain anchored by efficacy but shaped by formulation transparency and dermatological validation.

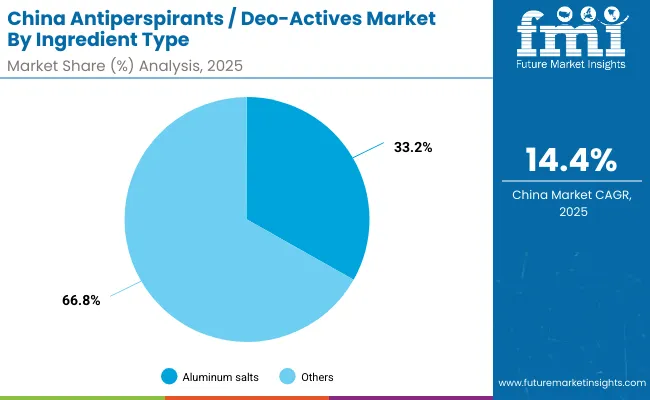

| China By Ingredient Type | Value Share % 2025 |

|---|---|

| Aluminum salts | 33.2% |

| Others | 66.8% |

The Antiperspirants / Deo-Actives Market in China is projected to grow at a CAGR of 14.4%, among the fastest globally. Unlike mature markets where aluminum salts dominate, China shows a structural tilt toward alternative actives, with aluminum salts holding only 33.2% in 2025. The shift is driven by rapid adoption of biotechnology-derived actives, encapsulated fragrance systems, and natural plant-based solutions in both premium and mass-market deodorants. Urban consumers in China are aligning deodorant choices with dermocosmetic skincare routines, emphasizing not only odor and sweat control but also skin compatibility and microbiome balance.

Domestic manufacturers are innovating aggressively with affordable encapsulated actives and multifunctional deo systems, expanding access to middle-income groups. International players, meanwhile, are targeting the high-end with premium biotech-derived actives that deliver clinical-grade results. Municipal climates with high humidity and long summers further fuel demand for long-lasting deo-actives, reinforcing encapsulation as a core technology. By 2035, China is expected to emerge as a regional hub for next-generation deo-active innovation, with global suppliers competing head-to-head with local biotech startups.

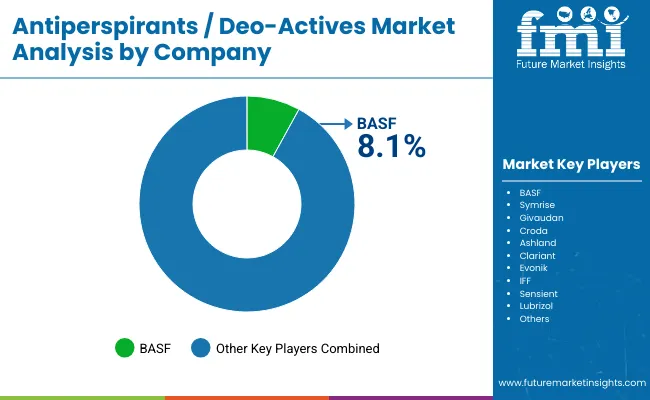

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.1% |

| Others | 91.9% |

The global Antiperspirants / Deo-Actives Market is moderately fragmented, with global chemical and fragrance giants holding a leading edge while numerous regional players and niche specialists compete across applications. BASF leads with an 8.1% global share, leveraging its strong portfolio of aluminum salts, mineral complexes, and encapsulation technologies. BASF’s dominance stems from its ability to integrate raw material scale, R&D, and partnerships with leading personal care brands.

Other key players such as Symrise, Givaudan, Croda, Ashland, Clariant, Evonik, IFF, Sensient, and Lubrizol contribute significantly to market innovation, especially in encapsulated actives, fragrance systems, and plant-derived deodorant solutions. Symrise and Givaudan are heavily focused on fragrance-led encapsulation, while Evonik and Croda emphasize biotech-derived actives and skin-compatible formulations. Mid-sized innovators are expanding in niche areas like microbiome-balancing actives and botanical blends, which are gaining traction in Asia-Pacific and Europe. Competitive differentiation is shifting away from reliance on traditional aluminum salts toward ecosystem strength, defined by encapsulation technologies, clean-label compliance, and dermatological validation. Players that can balance performance efficacy with sustainability and regulatory alignment are set to capture long-term market leadership.

Key Developments in Global Antiperspirants / Deo-Actives Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Component | Sweat gland astringents, Odor neutralizers, Moisture absorbers, Long-lasting fragrance actives |

| Range | Aluminum salts, Mineral-based actives, Botanical & plant-derived actives, Biotechnology-derived actives |

| Technology | Free form, Encapsulated fragrance/active, Blended complex |

| Type | Powder, Solution/concentrate, Solid beads |

| End-use Industry | Roll-on deodorants, Stick/solid deodorants, Spray/aerosol deodorants, Cream/gel deodorants |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Symrise , Givaudan , Croda , Ashland, Clariant , Evonik , IFF, Sensient , Lubrizol |

| Additional Attributes | Dollar sales by ingredient type and application, adoption trends in clinical-strength and dermocosmetic deodorants, rising demand for encapsulated fragrance and biotech-derived actives, sector-specific growth in premium, mass-market, and clinical channels, revenue segmentation by delivery system and application, integration of encapsulation and microbiome-balancing technologies, regional trends influenced by urbanization and hygiene awareness, and innovations in natural, mineral, and biotech-derived deo -active formulations. |

The global Antiperspirants / Deo-Actives Market is estimated to be valued at USD 2,752.1 million in 2025.

The market size for the global Antiperspirants / Deo-Actives Market is projected to reach USD 5,703.2 million by 2035.

The global Antiperspirants / Deo-Actives Market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in the global Antiperspirants / Deo-Actives Market are powder, solution/concentrate, and solid beads.

In terms of ingredient type, aluminum salts are projected to command 39% share in the global Antiperspirants / Deo-Actives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antiperspirants and Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

I/O-Link Market Analysis - Size, Share, and Forecast 2025 to 2035

Breaking Down Market Share in the I/O-Link Industry

CMO/CDMO Industry Analysis in Brazil Size and Share Forecast Outlook 2025 to 2035

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

CMO/CDMO Market Analysis - Size, Share, and Forecast 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

IaaS/Hosting Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Stoma/Ostomy Care Market Growth - Trends & Forecast 2025 to 2035

Vacuum/Gas Flushing And Sealing Machine Market

Family/Indoor Entertainment Centres Market Report – Forecast 2017-2027

Kitchen/ Toilet Roll Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Foldable/Compressible Beverage Carton Market Size and Share Forecast Outlook 2025 to 2035

802.15.4/ZigBee Market Size and Share Forecast Outlook 2025 to 2035

Starches/Glucose Market

EDM Oils/Fluids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA