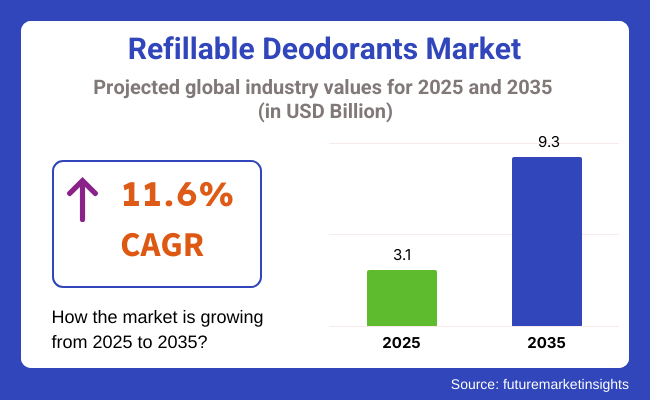

The refillable deodorants market size was USD 3.1 billion in 2025 and is predicted to grow by a CAGR of 11.6% in the year from 2025 to 2035. The size of the industryis projected to grow to USD 9.3 billion in the year 2035. Increasing demand for environment-friendly personal care products since people are increasingly eco-conscious and want alternatives for one-time used plastic packaging drives the growth significantly.

The industry has emerged as one of the top icons of the zero-waste movement, gaining a loyal consumer following captivated by sustainable living.

Through the offering of refillable containers and recyclable or biodegradable refill cartridges, such products have a very low environmental impact compared to conventional aerosols as well as stick deodorant. Compliance pressure to check plastic waste, along with consumer-facing sustainability promises from global personal care companies, also propel the transition.

Product innovation is also a major force propelling industry expansion. Formulations are evolving to include natural and aluminum-free ingredients that are appropriate for sensitive skin, gender-neutral preferences and busy lifestyles. These characteristics are facilitating refillable deodorants to transition from niche appeal to mainstream off- and online retail. Enhanced scent profiles, longer wear time, and dermatological endorsements are also appealing to wider demographics.

Millennials and gen Z consumers are becoming the force behind the adoption of refillable formats. Their high adoption of social media and ethical consumption has raised brand visibility, with fertile ground for direct-to-consumer new entrants and incumbents to develop and expand aggressively. Subscription-refill models and customization are also helping to enhance repeat purchase frequency and customer loyalty.

Geographically, North America and Europe dominate industry share due to higher environmental awareness and enabling retail networks. However, the Asia-Pacific area will experience most of the growth at the fastest rate, as urban residents and middle-income shoppers increasingly prioritize personal care buying choices along with sustainability and health concerns.

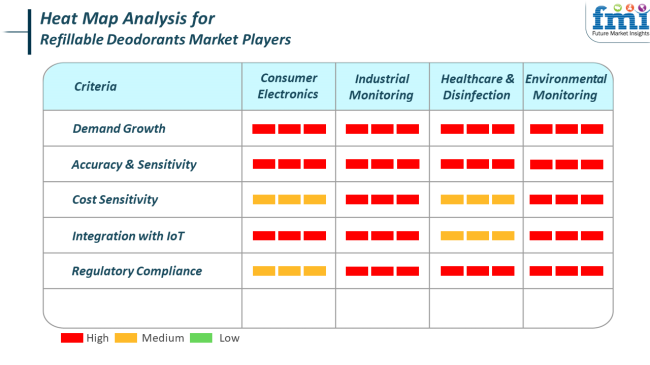

Within the category, leading purchase drivers correlate strongly with healthcare and environmental monitoring spaces due to safety, skin tolerance, and sustainability remaining at the top of consumer interests and priorities. Formulations include natural ingredients and no synthetic preservatives or aluminum salts, further adding to appeal among health-conscious consumers.

There is a high demand for growth in gender-neutral and unisex grooming categories with strong traction in e-commerce and boutique retailing channels. Eco-labeling, carbon-neutral manufacturing and recyclable packaging are strong differentiators, particularly among younger consumers who are willing to pay a premium for independently certified ethical standards.

There is moderate cost sensitivity, where consumers decide value over the long term weighing product lifespan, refill cost, and reputation. Compliance with regulations is required, particularly for product safety, allergen declaration, and environmental claims regarding environmental effects, where brands must uphold transparency and certification integrity.

The industry, while promising, is subject to several risk factors that may affect its scalability. The most critical among them is the intricacy of changing consumption patterns associated with traditional deodorant usage. The upfront cost of refillable systems, as well as associated behavioral changes, may represent adoption hurdles in less-exposed economies to sustainability trends or with low consumer education.

Operatively, the refill packaging supply chain is cost-driven and logistically oriented. Providing compatible refill pods, managing return logistics of used cartridges, and clean, airtight packaging standards necessitate high-quality infrastructure and quality control. It might be difficult for start-ups and small operators to upscale such operations economically without heavy capital investment.

The competitive pressures from conventional deodorant companies launching "green washed" advertising campaigns will weaken the credibility of the industry. Unless remedied, this will create consumer distrust of real environmental value. Monitoring by regulatory bodies and third-party certification will be necessary for maintaining credibility and ensuring refillable options continue to be substantively differentiated within a competitive personal care industry.

During 2020 to 2024, the refillable deodorants industry saw considerable growth owing to heightened consumer awareness of environmental concerns and the need for eco-friendly personal care products. Companies adapted by launching systems that minimize plastic use and are cost-efficient alternatives for consumers.

Unique packaging structures and natural, skin-nourishing ingredients were in the forefront, following the overall trend of clean beauty. The industry also witnessed growth in upscale deodorants with complex fragrances, targeting consumers who desire both functionality and luxury.

Forecasting 2025 to 2035, the industry will likely continue on its rise, driven by the development of sustainable materials and stronger consumer demand for sustainable products. Firms will have to spend money on research and development to devise more effective refill systems and biodegradable packaging material.

The most probable all-encompassing theme will be personalization, where firms are providing customizable scents and formulations to cater to individual tastes and skin types. In addition, technology like smart packaging that monitors usage and reminds the consumer to refill may improve consumer interaction and ease.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Green awareness, green consumerism, and clean beauty trends | Innovations in sustainable materials, customization, and integration of technology |

| Launch of refill systems and natural formulations | Appearance of intelligent packaging and biodegradable materials |

| Appearance of luxurious fragrances and eco-friendly packaging | Customized fragrances, formulations, and improved user experience |

| Effective, sustainable, and elegant products | Personalized, convenient, and technologically advanced solutions |

| Making the product effective and consumers embracing new systems | Ensuring balance of innovation and sustainability as well as affordability |

Stick deodorant refillable is the main product type within this sector, valued currently at 60-65% of the industry. Their success is underpinned by ease of use, portability, and natural, skin-friendly formulations on offer. Brands in the sustainable personal care segment that have led consumer take-up include Wild (UK), Myro (USA), and By Humankind, which have promoted adoption through the provision of streamlined, reusable cases and compostable refills. The trend is particularly popular among millennials and Gen Z shoppers who are opting for low-waste lifestyle options.

Moreover, stick formats are also known to have longer shelf lives and improved travel convenience. Between 2025 and 2035, refillable stick deodorants are expected to register a CAGR of 9.6%, driven by ongoing product innovation, direct-to-consumer platforms, and increasing environmental consciousness. Refillable spray deodorants, though secondary, are on the rise and are projected to hold 35-40% of the industry share.

Although historically less prevalent in refillable forms due to pressurization and valve limitations, new brands like Fussy, Hairstory, and Spruce are launching refillable sprays with non-aerosol pumps and eco-friendly propellants. Spray forms are favored by consumers who desire fast-drying, residue-free applications, especially in warmer weather.

The segment is also popular in Europe and certain regions of Asia, where usage of sprays has traditionally been higher. During the 2025 to 2035 period, the segment is expected to expand at a CAGR of 10.1%, surpassing the growth of sticks in certain industries owing to familiarity with formats as well as superior packaging technologies.

Metal remains the leading packaging material for refillable deodorants, which is estimated to hold an industry share of 40-45%. Materials such as stainless steel and aluminum are popular due to their recyclability, durability and high-end brand looks. Brands such as Refillism, Myro as well as Fussy have embraced brushed metal casing as part of their zero-waste brand image.

The sustainability of metal packaging, combined with their suitability for solid stick refills and manual pumps, makes them a favorite among subscription models. As demand for less-waste, toxin-free packing increases among consumers, metal packing is poised for sustained uptake at a forecast CAGR of 8.8% between the years 2025 and 2035, particularly in developed Western industries.

Other materials like plastic, glass, and roll paper account for approximately 55-60% of the industry, with plastic taking pole position among these due to its lightness and economic advantages, particularly in developing nations. However, brands are shifting towards bio-based or recyclable plastics to become more carbon-friendly.

Glass packaging (c. 10%) is suitable for boutique and prestige brands, but its breakability restricts wider use.Paper roll packaging, niche (c. 5%), is on the rise in natural and craft deodorant ranges. Advances in waterproof coatings and compostable liners are favoring paper-based packaging. Collectively, these substitute materials will increase at a CAGR of 9.2%, powered by regulatory change and environmentally friendly product design.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

| UK | 6.5% |

| France | 6.3% |

| Germany | 6 % |

| Italy | 5.7% |

| South Korea | 6.6% |

| Japan | 5.9% |

| China | 7.8% |

| Australia-New Zealand | 6.1% |

The USA industry will witness a growth of 7.1% CAGR throughout the study. Growing consumer concern about sustainability and minimizing plastic waste has led to rapid growth in the usage of refillable deodorants. Environmentally friendly consumers are proactively looking for alternatives to conventional single-use plastic packaging, thus making way for innovation in refillable forms.

Mid-range and premium brands are meeting this challenge with fashionable, reusable packaging and designable scent cartridges that are appealing to environmentally conscious as well as design-conscious consumers. The increased popularity of clean beauty has further accelerated the desire for natural, non-toxic and aluminum-free deodorants. Refillable products usually fit perfectly with this movement because they value natural ingredients alongside sustainability.

Direct-to-consumer strategies, in conjunction with subscription-based refills, have been highly successful at accessing the USA industry. Moreover, corporate social responsibility initiatives and increasing retailer backing for sustainable brands have enhanced industry visibility. With an expanding segment of Gen Z and Millennial customers focusing on ethical consumption, the USA industry is set to continue a robust growth rate over the forecast period.

The UK industry is anticipated to develop at 6.5% CAGR throughout the study. Green responsibility and ethical buying are key drivers of the growing trend towards refillable deodorants within the UK Public campaigns and legislation aimed at decreasing plastic waste have made brands and consumers increasingly look for greener personal care products.

Consequently, refillable deodorants can now be found more widely within online and physical retail environments, with a specific interest in cruelty-free and vegan-certified products. Consumer culture is evolving towards long-term product value over disposability. British consumers like the idea of functional simplicity as well as elegance, which is amply reflected in the design and packaging of refillable products.

Independent and small brands have discovered a robust place in this space, focusing on transparency in sourcing and production. Social media personalities and wellness communities are key influencers in educating and evangelizing green alternatives. With extremely industry-friendly receptiveness to sustainability and innovation, the UK is also expected to be a dynamic leader in the European industry.

The French industry is anticipated to grow at 6.3% CAGR over the study period. France's rich heritage in beauty culture and personal care leads to a sophisticated attitude towards deodorant innovation. The refillable deodorants category is witnessing growth, driven by the growing demand for eco-friendly options and changing consumer preferences that look for luxury and sustainability in everyday hygiene products.

Refill packaging is being embraced not just due to environmental considerations but also because of its assumed sophistication and elegance. French customers have a high preference for hypoallergenic, naturally sourced ingredients and minimalist packaging. Local brands are quick to innovate and respond to demands for non-toxic, aluminum-free, and refill-based alternatives.

Physical stores and green beauty shops are promoting awareness and access, while e-commerce continues to be an essential platform for expert and subscription-driven sales. France's status as a trendsetter for beauty standards in Europe further solidifies its role as a pivotal industry in the growth of refillable deodorants use.

The German industry is anticipated to expand at 6% CAGR over the forecast period. Strong environmentalist beliefs, scientific product examinations, and a desire for sustainable lifestyles characterize German consumers. This attitude has helped to fuel the growing popularity of refillable deodorants in Germany.

Increasing disgust for plastic waste and chemical personal care products has driven consumers toward green, transparent alternatives. Safety, effectiveness, and skin compatibility are critical factors in buying decisions. Refillable deodorants that are safe, effective, and skin-compatible and provide organic and allergen-free formulations are especially popular.

Germany's strong natural cosmetics industry has integrated refill systems into both mass and specialty product ranges, backed by strong retail penetration through pharmacies, drugstores, and specialty stores. Also, continuing innovation in refill systems that guarantee hygiene and convenience without compromising environmental objectives is a major growth driver. Backed by policy and an established consumer base, Germany is a stable and growing industry for refillable deodorants.

The Italian industry will grow at 5.7% CAGR throughout the study period. Italian shoppers are increasingly matching personal care habits with environmental conscience, and thus, there has been a consistent rise in demand for refill deodorants.

Aesthetic appeal and sensory experience remain paramount in Italian beauty culture, challenging manufacturers to create products that are visually attractive, functional, and scented while also meeting sustainability criteria. Health and environmental awareness of the impacts of traditional deodorants has generated increasing demand for aluminum, parabens, and artificial fragrance-free alternatives.

Reusable deodorants with essential oil- and natural-based compositions are therefore emerging in popularity. Younger city consumers are most responsive to innovation in personal grooming, driven by social media knowledge and green retail movements.

Specialty stores and boutique brands are unveiling modern and environmentally friendly refill models that align with both health and lifestyle aspirations. Although the rate of uptake is slow, Italy offers a promising industry with a mixture of tradition and innovation.

The South Korean industry is predicted to expand at 6.6% CAGR throughout research. South Korea's rapidly evolving beauty and personal care industry has welcomed refill deodorants as part of an overall movement towards sustainable living and wellness-driven consumption. New product development, complemented by environmentally aware youth cohorts, has laid the groundwork for industry growth.

South Korean consumers prefer small, travel-sized, and good-looking products, and this has spurred innovative pack designs. There is increasing demand for products that integrate skin advantages with benefits such as moisturizing, whitening, odour-controlling active ingredients that are naturally sourced.

K-beauty trends shape deodorant design with simple labels, plant extracts, and allergen-free positioning becoming increasingly relevant. Social commerce and online retail platforms have facilitated instant consumer interaction and feedback loops, enabling brands to respond quickly. As sustainability increasingly becoming a popular topic in public debate, refillable deodorants will continue to grow fast in both suburban and urban areas of the nation.

The Japan industry is forecast to register a 5.9% CAGR throughout the study. Japanese consumers show a strong inclination towards high-quality, discreet, and efficient personal care products. Refillable deodorants are being adopted more and more, especially in urban centers where sustainability is becoming increasingly significant in consumer choice.

Functionality and simplicity are at the heart of purchasing decisions, and brands providing low-waste, fragrance-free, or sensitive-skin-friendly refill options are experiencing increased engagement. Cleanliness and refinement are values emphasized in Japanese culture, and refillable products that provide long-term use as well as understated sophistication are particularly appealing.

Retail formats like department stores and drugstores are starting to give more shelf space to environmentally friendly products, backed by plastic reduction awareness campaigns. Refill cartridges that seamlessly integrate into minimalist product designs are picking up, particularly among middle-aged and young consumers. As Japan reaffirms its sustainable development goals, refillable deodorants stand to gain both from regulatory favors and consumer willingness.

The China industry will grow at 7.8% CAGR over the forecast period. Growth in China is driving growth in the refillable deodorants segment with the help of increasing disposable incomes, growing beauty consciousness, and rapid digitalization. The drive for sustainable and healthy living is strong among Gen Z and Millennials, and it is also among the key consumers of refillable formats. Consumer attitudes are changing from price consciousness to quality, effectiveness, and sustainability.

Brands that provide fashionable, adjustable, and compact deodorant cases are appealing to fashion-conscious consumers. Refillable products are frequently marketed through livestreaming platforms and social influencers, driving viral product discovery and interaction. Ingredient safety, packaging innovation, and brand narrative are all part of success in this rapidly changing industry.

Local and foreign brands are making a concerted effort to invest in education, online marketing, and retail growth in order to gain industry share. The government's initiative towards sustainability and lower plastic use further helps fuel growth in refillable deodorants in key cities and rising urban areas.

Australia-New Zealand industry is anticipated to develop at 6.1% CAGR over the study period. Ethical behavior and stewardship of the environment are strong drivers for consumers within this industry, leading to higher uptake of refillable personal care products such as deodorants. The population has a high awareness of environmental problems and brands that exhibit explicit sustainability commitments.

Both countries are witnessing an increase in small- and medium-sized brands that aim towards zero-waste targets and ingredient transparency of natural ingredients. Plastic-free, refillable deodorants packaged in compostable or recyclable materials are also capturing shelf space in health food stores, organic retailers, and online platforms.

Subscriptions and direct-to-consumer sites are increasingly embracing models that ensure easy access to refill pods. Ingredient scrutiny is also common, with a preference for products without aluminum, synthetic fragrances, and artificial preservatives. Due to proactive consumer information and a pro-waste reduction policy environment, the area will likely continue to be a prime growth niche for the industry.

The industry is a blend of established personal care giants and agile, sustainability-driven startup brands. After 2024, Unilever Plc. and The Procter & Gamble Company have been actively involved in their sustainability pledges by increasing the refillable solutions under brands such as Dove and Secret, respectively. While Unilever has been selling refillable in retail and digital outlets in North America and Europe, P&G has aimed plant-based deodorants packaged in refill pods aluminum-free to attract green consumers.

Independent brands such as Myro, By Humankind, Inc., and Fussy Ltd have carved strong DTC niches with plastic-free packaging, customizable scent options, and subscription models. Myro’s modular cartridge design continues to appeal to younger consumers. At the same time, Fussy's biodegradable refills as well as carbon-neutral logistics have given it a growing footprint across the UK and Europe.

Grove Collaborative and Helmm emphasize performance and premium design, targeting conscious consumers who want style combined with sustainability. Mid-tier players such as Noniko, Proverb Skincare, and Asuvi capitalize on transparency essential oil-based formulations are a medium through which these companies express concern to the consumer. Western Europe and Australia see the most traction according to the regional dynamics, while APAC is emerging through the combined powers of online retail expansion and influencer-led marketing.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Unilever Plc. | 18-22% |

| The Procter & Gamble Company | 14-17% |

| Myro | 10-13% |

| By Humankind, Inc. | 7-9% |

| Fussy Ltd | 5-7% |

| Other Players | 33-46% |

| Company Name | Offerings & Activities |

|---|---|

| Unilever Plc. | Dove’s format; aluminum-free, cruelty-free options with wide retail reach. |

| The Procter & Gamble Company | Secret and Old Spice refill systems with plant-based ingredients and ergonomic dispensers. |

| Myro | Customizable scents and colorful refillable pods; strong DTC and subscription base. |

| By Humankind, Inc. | A refillable system with minimalist design, sustainable refills, and CO₂-offset operations. |

| Fussy Ltd | Compostable refills and probiotic deodorant formulas are expanding in the UK. and EU industrie s. |

Key Company Insights

Unilever Plc. (18-22%)

A market leader using its global presence to drive sustainable personal care formats, significant R&D in refill usability as well as shelf stability.

The Procter & Gamble Company (14-17%)

Focuses on consumer convenience and mainstream accessibility, integrating refillable systems across legacy brands.

Myro (10-13%)

Strong millennial brand appeal through personalization, bold colors, and DTC-first distribution.

By Humankind, Inc. (7-9%)

Targets urban professionals with sleek aesthetics and environmental transparency; zero-plastic product commitment.

Fussy Ltd (5-7%)

European disruptor with eco-innovation at its core, crowd-sourced design, and refill logistics excellence.

By product type, the industry is segmented into refillable spray deodorants and refillable stick deodorants.

By packaging, the industry is categorized based on packaging type, including metal, glass, plastic, and paper roll.

By distribution channel, the industry is further segmented by distribution channel into retail outlets/offline and e-commerce/online.

By region, the industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 3.1 billion in 2025.

The industry is predicted to reach a size of USD 9.3 billion by 2035.

Key companies include Unilever Plc., The Procter & Gamble Company, Myro, By Humankind, Inc., Fussy Ltd, Grove Collaborative, Inc., Helmm, Noniko, Proverb Skincare, and Asuvi.

China, slated to grow at 7.8% CAGR during the forecast period, is poised for the fastest growth.

Stick deodorant is being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Packaging, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Packaging, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refillable Pouches Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Prefillable Inhalers Market Size and Share Forecast Outlook 2025 to 2035

Mini Refillable Perfume Bottles Market Size and Share Forecast Outlook 2025 to 2035

Prebiotic Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antiperspirants and Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA