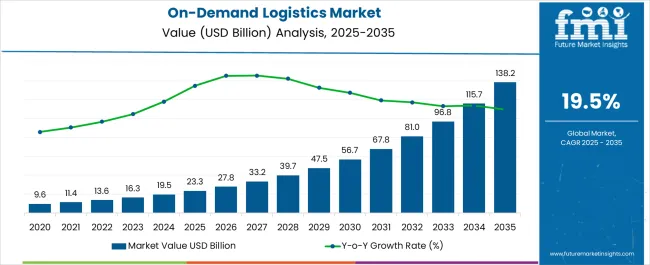

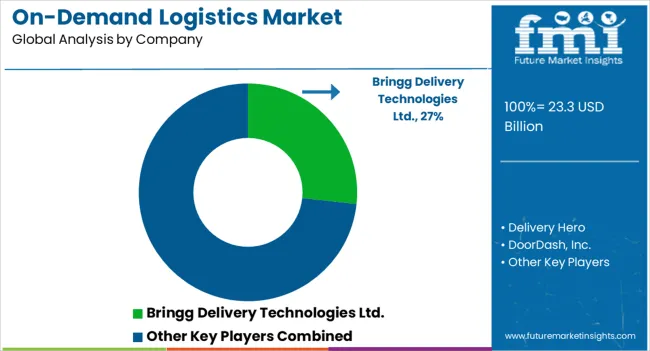

The On-Demand Logistics Market is estimated to be valued at USD 23.3 billion in 2025 and is projected to reach USD 138.2 billion by 2035, registering a compound annual growth rate (CAGR) of 19.5% over the forecast period. Technology deployment, last-mile delivery operations, labor expenses, fleet management, and digital infrastructure influence the cost structure of this market. With rapid expansion, economies of scale are expected to reduce per-unit service costs gradually, but significant capital outlays will continue to be allocated toward AI-enabled routing, warehouse automation, and digital tracking systems.

Within the value chain, platform operators serve as the central node, linking shippers, drivers, and end customers through real-time demand aggregation. Upstream activities involve investments in cloud-based logistics management systems, mobile applications, and payment gateways. Midstream processes include route optimization, load matching, and fleet allocation, where technological precision reduces operational inefficiencies. Downstream activities encompass last-mile delivery, which remains the most cost-intensive due to high labor and fuel requirements. From 2025 to 2030, the market expands from USD 23.3 billion to USD 56.7 billion, as digital platforms consolidate control over logistics networks.

By 2035, the market will surpass USD 138.2 billion, with the integration of autonomous delivery vehicles and drones reshaping value-chain economics. The shift toward automation and predictive analytics reduces delivery costs, enhances asset utilization, and increases margins. While high initial technology and operational costs characterize the early phase, value-chain efficiencies and digital innovation progressively strengthen the market’s profitability profile.

| Metric | Value |

|---|---|

| On-Demand Logistics Market Estimated Value in (2025 E) | USD 23.3 billion |

| On-Demand Logistics Market Forecast Value in (2035 F) | USD 138.2 billion |

| Forecast CAGR (2025 to 2035) | 19.5% |

The on-demand logistics market is expanding rapidly due to increased consumer expectations for faster delivery, the rise of e-commerce platforms, and advancements in real-time tracking technologies. Urbanization and changing retail models have intensified the demand for flexible delivery solutions that can fulfill orders with speed and precision.

Businesses across various sectors are leveraging on-demand logistics to reduce last-mile inefficiencies and meet same-day fulfillment commitments. Growth is further supported by advancements in mobile application ecosystems and cloud based fleet management systems that enable dynamic route optimization, instant communication, and seamless integration with order processing systems.

As sustainability and convenience become primary decision drivers, the market is poised for continued adoption across retail, manufacturing, and service based industries seeking to improve delivery efficiency and customer satisfaction.

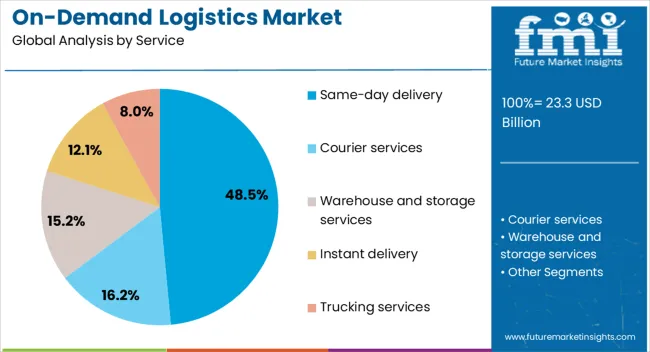

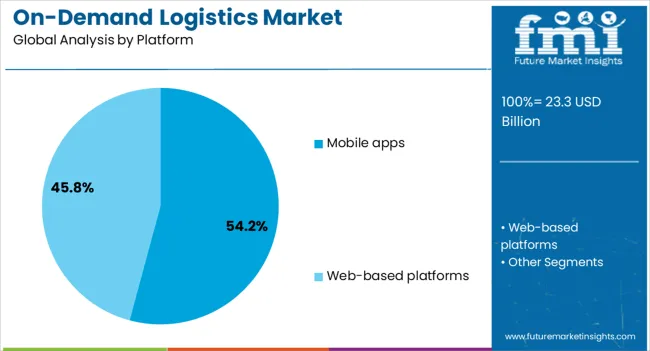

The on-demand logistics market is segmented by service, platform, end-user, application, and geographic regions. By service, the on-demand logistics market is divided into Same-day delivery, Courier services, Warehouse and storage services, Instant delivery, and Trucking services. In terms of platform, the on-demand logistics market is classified into Mobile apps and Web-based platforms.

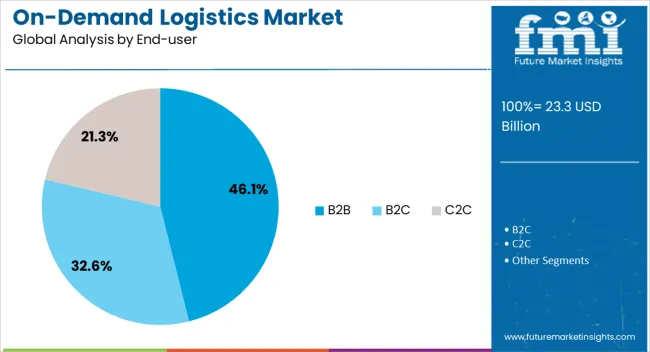

Based on end-user, the on-demand logistics market is segmented into B2B, B2C, and C2C. By application, the on-demand logistics market is segmented into Retail & e-commerce, Food & beverages, Healthcare & pharmaceuticals, Automotive, Manufacturing, and Others. Regionally, the on-demand logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The same-day delivery segment is expected to hold 48.50% of the total market share by 2025, positioning it as the leading service category. This dominance is being driven by growing consumer demand for immediacy, particularly in urban centers where instant gratification is influencing purchase behavior.

Businesses are leveraging same-day delivery to gain a competitive advantage and enhance customer loyalty through faster fulfillment cycles. Operational improvements in dispatch systems, route planning, and delivery personnel management have also enabled providers to execute high volume deliveries with accuracy.

Additionally, sectors such as pharmaceuticals, grocery, and fashion retail are increasingly adopting same-day services to ensure product freshness and capitalize on impulse buying behaviors. These combined factors have solidified same-day delivery as the most preferred and scalable solution in the service segment.

The mobile apps segment is projected to contribute 54.20% of the overall market revenue by 2025 within the platform category, making it the most dominant mode of engagement. This leadership is a result of growing smartphone penetration, consumer familiarity with app-based services, and the seamless user experience offered through intuitive interfaces.

Mobile apps provide real-time tracking, instant communication, and personalized delivery options, improving user confidence and satisfaction. Logistics providers are also using mobile platforms to manage driver assignments, delivery workflows, and customer feedback efficiently.

The ability of mobile apps to support digital payments, dynamic rerouting, and location-based offers has further enhanced their relevance in last-mile logistics. As user expectations for transparency and convenience rise, mobile apps continue to lead the platform segment due to their adaptability and end-to-end service integration.

The B2B segment is forecasted to represent 46.10% of the total market share by 2025 within the end-user category, establishing it as the leading contributor. This growth is attributed to increasing intercompany shipments, replenishment requirements, and just-in-time delivery models across industrial and retail supply chains.

Businesses are adopting on-demand logistics to streamline inventory management, reduce lead times, and optimize operational costs. High volume and regular shipments between warehouses, suppliers, and distribution centers require reliable logistics solutions that offer scalability and time sensitivity.

Additionally, B2B clients benefit from customizable delivery schedules, dedicated fleet services, and integration with procurement systems, all of which are critical in maintaining supply chain continuity. This operational necessity and efficiency focus have secured B2B as the dominant segment in terms of end-user demand.

Digital platforms have enabled immediate connections between shippers, carriers, and consumers, facilitating faster and more efficient order fulfillment. E-commerce growth, urban last-mile delivery needs, and consumer preference for same-day or next-day services have supported expansion. Integration of AI, machine learning, and route optimization software has enhanced efficiency. Investments in digital freight platforms and multimodal logistics infrastructure have positioned this market as a vital pillar in modern supply chain operations.

Technological innovations have played a transformative role in the on-demand logistics market by strengthening connectivity, efficiency, and transparency. Digital freight platforms powered by artificial intelligence and predictive analytics have streamlined carrier matching and automated scheduling. Blockchain has been integrated for real-time tracking, tamper-proof documentation, and enhanced trust across stakeholders. IoT sensors and telematics have allowed monitoring of goods in transit, while cloud-based platforms have facilitated scalable data management. Mobile applications have enabled consumers and enterprises to access flexible delivery options instantly. These technological advancements have not only improved service efficiency but have also minimized operational costs, reduced idle fleet capacity, and improved customer satisfaction. As digital platforms continue to evolve, their impact on reshaping global logistics networks is expected to remain highly influential in the coming years.

E-commerce expansion has been a major driver of the on-demand logistics market, as consumer demand for rapid and reliable delivery has increased significantly. Retailers have shifted toward flexible supply chain models that integrate instant delivery, warehouse automation, and omnichannel strategies. Same-day and next-day delivery expectations have placed additional pressure on logistics providers to optimize last-mile operations. Retail partnerships with on-demand logistics platforms have improved customer experiences by offering visibility and transparency in delivery status. The need for reverse logistics to handle returns has further elevated the importance of agile, technology-driven solutions. The strong connection between online retail growth and logistics innovation has resulted in significant adoption of digital logistics platforms, as businesses strive to meet evolving consumer expectations. This rising demand from e-commerce and retail has cemented the market’s role as a cornerstone of the global logistics ecosystem.

Operational efficiency has emerged as a defining factor in the on-demand logistics market, with providers prioritizing advanced tools for route planning, fleet optimization, and resource allocation. Predictive analytics has been applied to minimize delays, reduce empty miles, and optimize fuel usage. Shared mobility models and collaborative logistics have reduced costs by maximizing vehicle utilization. Automation of dispatch systems and real-time tracking has improved accuracy in delivery scheduling and minimized service disruptions. Cost optimization has been further supported through dynamic pricing mechanisms that adjust based on demand fluctuations. By offering scalable and data-driven solutions, on-demand logistics has allowed businesses to enhance profitability while delivering convenience to end users. This focus on operational efficiency has positioned the market as an indispensable solution for enterprises seeking resilient and adaptable logistics models in rapidly evolving supply chains.

Last-mile delivery has been recognized as a critical component of the on-demand logistics market, driven by consumer expectations for fast and reliable service. The final stage of delivery often represents the most complex and costly part of the logistics chain. On-demand logistics platforms have addressed these challenges by leveraging real-time tracking, route optimization, and gig economy delivery models. Micro-fulfillment centers and localized warehouses have been utilized to shorten delivery distances and enhance speed. Innovative solutions such as autonomous vehicles, drones, and electric delivery fleets are being tested to reduce costs and emissions in last-mile operations. The prominence of last-mile delivery in shaping customer experiences has made it one of the strongest drivers of adoption for on-demand logistics worldwide. Its growing role highlights the market’s ability to adapt rapidly to shifting consumer needs and technological advancements.

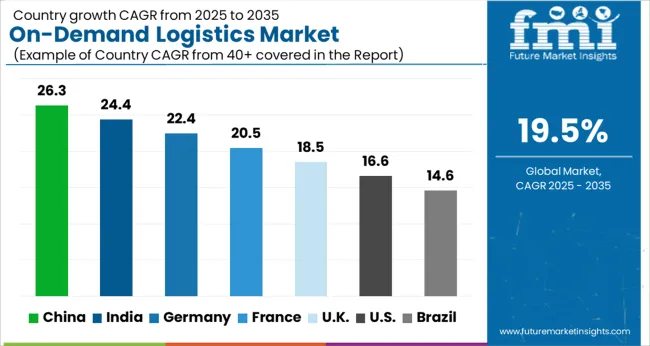

The market is projected to grow at a CAGR of 19.5% between 2025 and 2035, driven by rising e-commerce penetration, real-time delivery expectations, and digital freight platforms. China leads with a 26.3% CAGR, scaling through advanced logistics technologies and extensive last-mile networks. India follows at 24.4%, accelerating adoption with rapid e-commerce expansion and government-backed digital infrastructure. Germany, at 22.4%, transforms logistics with automation and sustainable fleet integration. The UK, growing at 18.5%, emphasizes streamlined delivery services and technology-driven optimization. The USA, at 16.6%, experiences growth through same-day delivery models and strong investment in logistics technology. This report covers 40+ countries, with the top markets highlighted here for reference.

China is anticipated to lead the market with a CAGR of 26.3% between 2025 and 2035. Rapid digitalization of logistics platforms, government backing for smart infrastructure, and strong e-commerce activity are major growth enablers. Logistics providers are deploying AI-driven route optimization, autonomous delivery vehicles, and real-time tracking systems to streamline supply chains. Strategic collaborations with e-commerce giants and investment in cold chain logistics for perishable goods are further boosting expansion.

India is expected to grow at a CAGR of 24.4% through 2035, driven by rapid digitization of logistics networks and increasing adoption of app-based delivery platforms. Startups and established providers are expanding their services to rural and semi-urban regions. Growing partnerships with e-commerce platforms and last-mile delivery companies are enhancing operational efficiency. Adoption of electric delivery vehicles and warehouse automation is supporting scalable, sustainable growth.

Germany is projected to expand at a CAGR of 22.4% from 2025 to 2035, supported by Industry 4.0 adoption and strong cross-border trade integration. Logistics firms are investing in AI and IoT-enabled supply chain solutions for predictive demand and efficient warehouse management. Partnerships between logistics providers and retail companies are expanding service reach. Rising focus on green logistics with electric and hybrid fleets is shaping the market trajectory.

The United Kingdom is expected to achieve a CAGR of 18.5% during the forecast period, with strong contributions from e-commerce expansion and digital freight matching platforms. The shift toward same-day and next-day deliveries is creating opportunities for advanced logistics networks. Companies are investing in data-driven optimization tools and delivery automation. Urban mobility initiatives and government-LED digital infrastructure programs are further strengthening adoption.

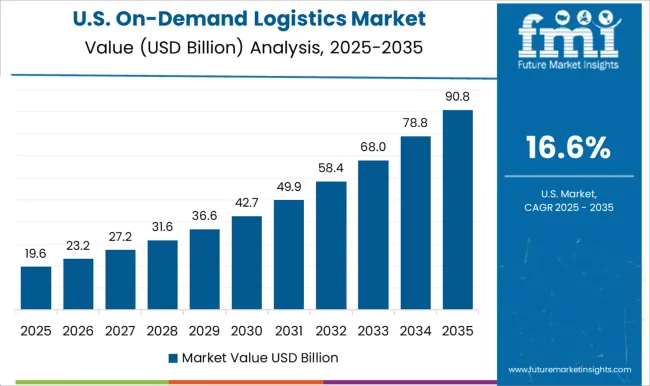

The United States is forecast to register a CAGR of 16.6% from 2025 to 2035, supported by strong e-commerce penetration and technological advancements in supply chain management. Logistics providers are focusing on real-time visibility, automated dispatching, and AI-driven demand prediction. Investments in drone delivery systems and sustainable logistics infrastructure are expanding operational scope. Consolidation among logistics startups and traditional providers is reshaping the competitive landscape.

The market has become a cornerstone of modern supply chain ecosystems, offering instant, flexible, and efficient delivery solutions for businesses and consumers. Leading providers such as Uber Technologies Inc., DoorDash, Inc., and Delivery Hero dominate the segment with advanced platforms that connect merchants, drivers, and end-users seamlessly. These companies emphasize technology integration, including AI-driven route optimization, real-time tracking, and predictive analytics, to enhance the speed and reliability of service while reducing operational costs. Instacart, Postmates, and Grubhub focus heavily on grocery and food delivery, leveraging vast consumer bases to expand their market presence.

Lalamove and Shadowfax Technologies Pvt. Ltd. have positioned themselves as critical players in emerging markets, offering hyperlocal and long-haul logistics tailored to diverse customer requirements. Stuart Delivery Ltd. and Bringg Delivery Technologies Ltd. focus on enterprise solutions, enabling retailers and logistics companies to optimize last-mile operations with data-driven platforms. The market is highly competitive and shaped by partnerships with retailers, investments in gig workforce management, and adoption of eco-friendly delivery models. Key barriers include regulatory challenges, fluctuating demand cycles, and cost pressures linked to driver incentives and fleet management. Established players maintain a competitive advantage through strong brand equity, technological innovations, and the ability to scale operations rapidly across regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.3 Billion |

| Service | Same-day delivery, Courier services, Warehouse and storage services, Instant delivery, and Trucking services |

| Platform | Mobile apps and Web-based platforms |

| End-user | B2B, B2C, and C2C |

| Application | Retail & e-commerce, Food & beverages, Healthcare & pharmaceuticals, Automotive, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bringg Delivery Technologies Ltd.; Delivery Hero SE; DoorDash, Inc.; Grubhub; Instacart; Lalamove; Postmates; Shadowfax Technologies Pvt. Ltd.; Stuart Delivery Ltd.; Uber Technologies, Inc. |

| Additional Attributes | Dollar sales by service model and delivery type, demand dynamics across same-day, next-day, and scheduLED deliveries, regional adoption trends in Asia-Pacific, North America, and Europe, innovation in AI-driven route optimization, autonomous vehicle integration, and real-time tracking platforms, environmental impact of reduced fuel consumption through optimized logistics operations, packaging sustainability, and last-mile emission controls, and emerging use cases in e-commerce fulfillment, B2B distribution networks, food and grocery delivery, and cross-border on-demand supply chains. |

The global on-demand logistics market is estimated to be valued at USD 23.3 billion in 2025.

The market size for the on-demand logistics market is projected to reach USD 138.2 billion by 2035.

The on-demand logistics market is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in on-demand logistics market are same-day delivery, courier services, warehouse and storage services, instant delivery and trucking services.

In terms of platform, mobile apps segment to command 54.2% share in the on-demand logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Packaging Market from 2024 to 2034

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Defence Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA