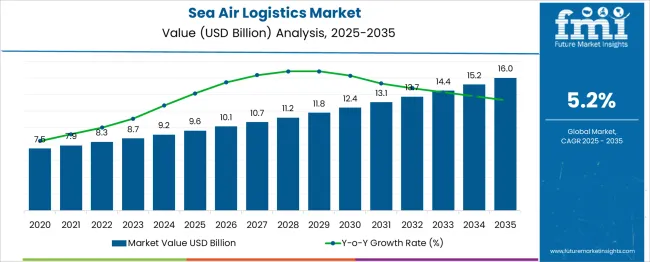

The Sea Air Logistics Market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 16.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. A saturation point analysis reveals steady growth with signs of approaching market maturity. Between 2025 and 2030, the market grows from USD 9.6 billion to USD 12.4 billion, contributing USD 2.8 billion in growth, reflecting a CAGR of 5.8%. During this phase, growth is driven by increasing demand for faster, more reliable supply chain solutions, especially in e-commerce and global trade. The logistics sector sees innovations in air and sea transport integration, enhancing efficiency and speed.

From 2030 to 2035, the market continues to expand, moving from USD 12.4 billion to USD 16.0 billion, contributing USD 3.6 billion in growth, with a slightly slower CAGR of 4.6%. This phase indicates a gradual deceleration, suggesting that the market is nearing saturation. Growth slows as the logistics industry matures and faces more intense competition, regulatory constraints, and infrastructure limitations. Despite this deceleration, the demand for hybrid logistics solutions continues to drive steady growth, especially in regions with expanding trade needs. The saturation point appears as growth stabilizes, reflecting the natural progression towards market maturity.

| Metric | Value |

|---|---|

| Sea Air Logistics Market Estimated Value in (2025 E) | USD 9.6 billion |

| Sea Air Logistics Market Forecast Value in (2035 F) | USD 16.0 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The sea air logistics market is gaining traction as global supply chains prioritize flexible, cost-effective, and moderately expedited shipping solutions. Rising e-commerce activity, complex cross-border trade flows, and increasing port congestion have accelerated demand for hybrid logistics models that optimize both speed and cost.

Sea-air logistics offers a strategic middle ground between full ocean freight and air freight, appealing to businesses with time-sensitive but cost-conscious requirements. Global disruptions, including geopolitical tensions and environmental regulations, are also prompting companies to diversify routing strategies through multimodal networks.

As sustainability becomes a core consideration, sea-air logistics enables carbon footprint optimization compared to full air freight while offering faster delivery than ocean-only options. The market is further supported by advancements in digital freight platforms and integrated customs clearance services that reduce transit bottlenecks and documentation overhead.

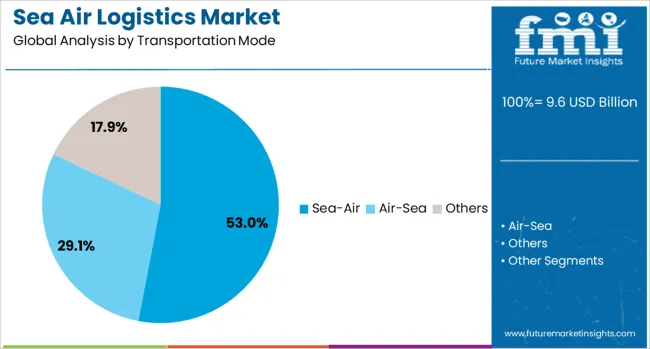

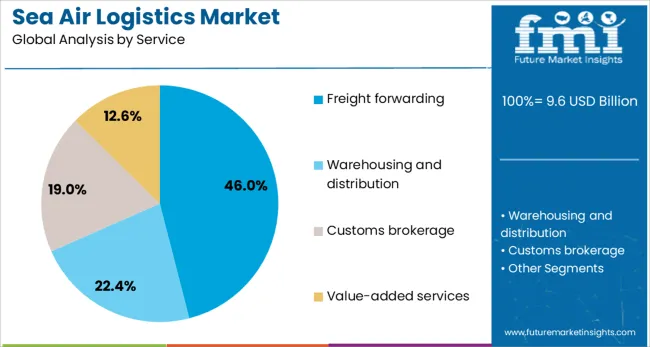

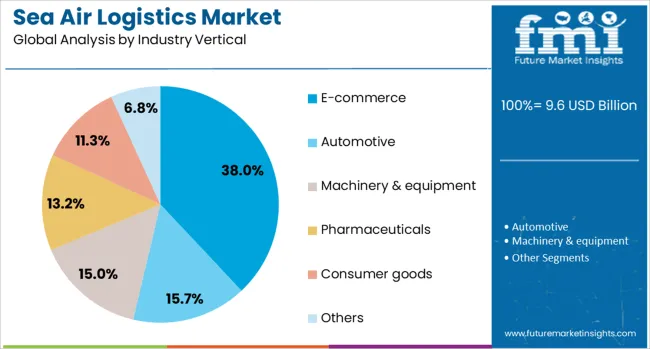

The sea air logistics market is segmented by transportation mode, service industry vertical, and geographic regions. By transportation mode, the sea air logistics market is divided into Sea-Air, Air-Sea, and others. In terms of the sea air logistics market, it is classified into Freight forwarding, Warehousing and distribution, Customs brokerage, and Value-added services. Based on industry vertical, the sea air logistics market is segmented into E-commerce, Automotive, Machinery & equipment, Pharmaceuticals, Consumer goods, and Others. Regionally, the sea air logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Sea-air transportation is expected to dominate the market with a 53.0% revenue share by 2025. This segment’s growth is driven by the increasing need for optimized lead times, especially in Asia-Europe and Asia-America trade lanes.

Sea-air models offer reduced transit costs compared to full air freight while improving delivery timelines over ocean freight, making them ideal for mid-value, semi-urgent shipments. Shippers are increasingly selecting this mode for high-demand periods, inventory balancing, and risk mitigation during peak port congestion or flight capacity shortages.

The model’s flexibility in hub selection such as combining sea entry through Dubai with onward air movement-adds operational efficiency and scalability for 3PLs and freight integrators.

Freight forwarding services are expected to lead the services segment with a 46.0% market share in 2025. This dominance is supported by the central role freight forwarders play in coordinating multi-leg transport, customs documentation, warehousing, and route optimization for sea-air logistics.

As manufacturers and retailers expand globally, the need for expert-managed, cost-optimized, multimodal shipping solutions has risen sharply. Freight forwarders are leveraging digital tools and predictive analytics to manage route selection, reduce delays, and ensure cost transparency, making them the go-to service providers in sea-air networks.

Additionally, their ability to aggregate volumes across clients improves shipping affordability and efficiency, especially for small to mid-sized exporters.

E-commerce is projected to be the largest end-use vertical in the sea air logistics market, holding a 38.0% share by 2025. The segment’s leadership is driven by growing cross-border online retail, seasonal shopping peaks, and consumer expectations for fast, affordable international delivery.

Sea-air logistics offers an ideal balance between delivery speed and cost-efficiency for online retailers targeting diverse markets without maintaining regional fulfillment centers. The mode is being increasingly adopted for transporting electronics, apparel, beauty products, and other lightweight, high-turnover items that demand predictable delivery schedules.

With omnichannel strategies and global marketplace expansion continuing, e-commerce players are integrating sea-air models to improve fulfillment agility while managing logistics costs.

Sea air logistics combines the benefits of both air and sea freight, offering a hybrid solution for faster and more cost-effective transportation of goods across long distances. This method is utilized by businesses in various sectors, including e-commerce, automotive, and pharmaceuticals, requiring quick and efficient deliveries. The adoption of sea air logistics has been driven by the growing need for flexible and reliable shipping solutions that balance cost and speed. Providers offering integrated scheduling, real-time tracking, and advanced route optimization systems have been favored. Solutions that streamline coordination between sea and air freight, along with innovations in hybrid transportation models, continue to shape industry growth and customer preferences.

The demand for quicker and more cost-effective shipping solutions is a primary factor driving the adoption of sea air logistics. With global trade and e-commerce on the rise, businesses are increasingly looking for transportation methods that balance speed and affordability. Sea air logistics offers a competitive advantage, providing faster delivery times compared to traditional sea freight while being more cost-effective than air freight. This hybrid solution is particularly beneficial for time-sensitive shipments. Industries such as electronics, fashion, and pharmaceuticals, which rely on efficient supply chains, are further propelling the adoption of sea air logistics. As consumer expectations for faster delivery and the complexity of international trade continue to increase, the demand for this hybrid solution will likely expand further, driving growth in the market.

Managing sea air logistics involves significant operational complexity and the coordination of multiple transport modes. The process requires meticulous scheduling, documentation, and communication between air and sea freight services. This multi-step logistics chain is more intricate than using just one mode of transport, which can lead to delays or inefficiencies in cargo handling. Additionally, the availability of integrated infrastructure in some regions can be limited, making it challenging to implement effective sea air logistics solutions. These complexities necessitate high levels of coordination and planning from logistics providers and their clients, posing challenges in cost management, schedule optimization, and ensuring timely deliveries. Overcoming these challenges requires continuous investment in technology and processes that enhance coordination, streamline operations, and reduce inefficiencies.

The growth of e-commerce and the expansion of global trade present significant opportunities for sea air logistics. As businesses strive to streamline their supply chains, the need for faster, more cost-effective shipping options has become crucial. Sea air logistics provides an ideal solution, offering speed that outperforms traditional sea freight, while maintaining affordability compared to air freight. As international trade continues to grow, especially in emerging markets, the demand for efficient and reliable logistics solutions will increase. Sea air logistics allows providers to cater to these new regions, meeting the rising need for quick, dependable shipping. By enabling businesses to reduce lead times and meet consumer expectations for faster deliveries, the market for sea air logistics is well-positioned for long-term expansion.

The sea air logistics market is seeing growing trends in the integration of digital technologies and automation. Advanced tracking systems, real-time cargo monitoring, and predictive analytics are significantly improving the efficiency and transparency of the logistics process. Digital platforms provide end-to-end visibility, allowing customers to make more informed decisions and better manage their supply chains. The integration of artificial intelligence (AI) and data analytics is optimizing key aspects of logistics, such as route planning, inventory management, and demand forecasting. These technological advancements are driving the evolution of sea air logistics by enhancing reliability, reducing costs, and improving the overall customer experience. The increasing adoption of smart technologies in logistics is shaping the future of the industry, making it more efficient, scalable, and responsive.

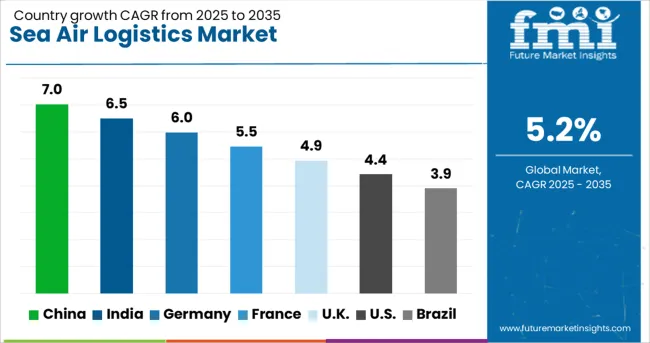

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The Sea Air Logistics Market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads at 7.0%, followed by India at 6.5%, and France at 5.5%. The United Kingdom records 4.9%, while the United States stands at 4.4%. Growth in BRICS countries like China and India is fueled by rapid industrialization, expanding e-commerce sectors, and growing demand for faster logistics solutions.

Developed economies like France, the UK, and the USA show steady growth, driven by increased demand for more efficient and environmentally friendly supply chain solutions in sea-air logistics. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 7.0% through 2035, driven by the country's dominance in global trade and a rapidly expanding manufacturing sector. China’s strong push towards digitizing its logistics infrastructure is facilitating the integration of sea and air transport solutions. The country is a key hub for the production and export of electronics, automotive components, and consumer goods, which require fast, reliable logistics. The rise of e-commerce has further boosted the need for quicker delivery times, creating a significant demand for sea-air logistics. China’s strategic geographic position as a major player in international shipping and logistics enhances its ability to provide efficient global transportation solutions.

India is projected to grow at a CAGR of 6.5% through 2035, fueled by rapid growth in the e-commerce and manufacturing sectors. With the rise in demand for time-sensitive products, especially in industries such as automotive, pharmaceuticals, and food and beverages, the adoption of sea-air logistics solutions is increasing. Sea-air logistics offers an efficient solution to meet the need for quicker deliveries at a lower cost compared to air freight alone. India's government initiatives to improve its transportation infrastructure, including the modernization of ports and airports, further strengthen the logistics ecosystem, making India a key player in the global logistics market.

France is projected to grow at a CAGR of 5.5% through 2035, driven by its strategic location in Europe and increasing demand for high-performance logistics solutions. France’s thriving automotive, pharmaceutical, and food sectors rely heavily on efficient logistics systems to meet both domestic and international demands. Sea-air logistics, with its ability to provide fast yet cost-effective transportation, is increasingly becoming the preferred choice for many industries. France’s well-established port and airport infrastructure supports this demand, with key logistics hubs in cities like Paris, Le Havre, and Marseille. The French government’s emphasis on enhancing transportation systems and sustainability in logistics further encourages the adoption of sea-air solutions.

The United Kingdom is projected to grow at a CAGR of 4.9% through 2035, with demand largely driven by the increasing need for efficient logistics solutions across various industries, especially food and beverage, automotive, and pharmaceuticals. As the UK continues to strengthen its position as a global logistics hub, the demand for advanced supply chain solutions, such as sea-air logistics, is expected to grow. With the rise of e-commerce and online shopping, the need for fast and reliable deliveries, particularly for perishable goods and high-value items, further supports the market for sea-air transport. The UK’s well-established infrastructure, including ports, airports, and rail networks, facilitates the seamless integration of sea and air transport.

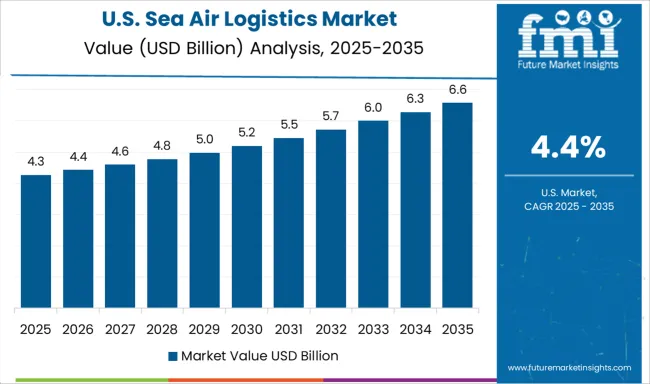

The United States is projected to grow at a CAGR of 4.4% through 2035, with increasing demand for efficient logistics solutions. The USA is the largest consumer of goods globally, and the need for faster, reliable delivery methods continues to rise. The rise of e-commerce has made logistics efficiency more critical, driving demand for integrated solutions like sea-air logistics. The USA market benefits from advanced infrastructure, including well-developed ports, airports, and supply chain networks, enabling the smooth operation of sea-air transport services. Furthermore, regulations and government initiatives aimed at improving supply chain efficiencies and transportation security continue to drive the adoption of more reliable and efficient logistics solutions.

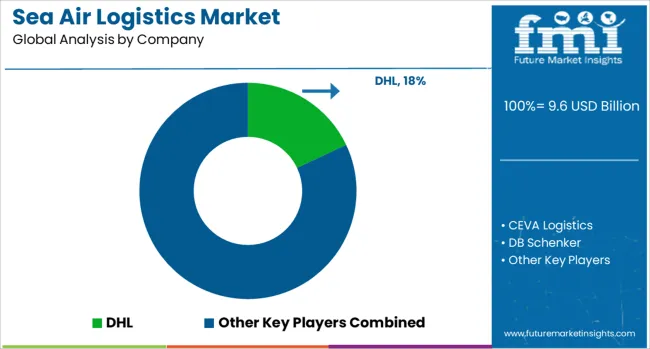

The sea air logistics market is driven by major global logistics and supply chain management companies offering integrated solutions for the movement of goods via both sea and air transport. DHL is a market leader, offering end-to-end logistics solutions combining sea freight with air transport to optimize delivery times and reduce costs. CEVA Logistics and DB Schenker also provide comprehensive sea-air services, focusing on improving supply chain efficiency through tailored logistics solutions for a wide range of industries, including automotive, pharmaceuticals, and consumer goods. DSV (Panalpina) and Expeditors International offer specialized sea-air services, with a strong focus on providing flexible, cost-effective solutions for global supply chains, helping businesses navigate challenges like fluctuating demand and volatile freight rates.

Kuehne + Nagel and UPS Supply Chain Solutions provide a blend of air and ocean freight services, helping customers meet just-in-time inventory needs while managing costs effectively. These companies emphasize their ability to offer seamless door-to-door delivery with strong visibility, tracking, and customer service. Competitive differentiation is driven by the ability to offer tailored, reliable, and flexible solutions, with a focus on cost optimization, speed, and visibility across global supply chains. Barriers to entry include complex regulatory requirements, strong relationships with carriers, and the need for infrastructure investments. Strategic priorities include expanding global networks, increasing digitalization and automation in logistics processes, and enhancing customer-centric service offerings to address the evolving needs of industries in a post-pandemic world.

In September 2024, DSV announced the completion of its USD 15.9 billion acquisition of DB Schenker, a leading logistics player and subsidiary of Deutsche Bahn. This monumental deal solidifies DSV’s position as a logistics powerhouse and propels it to the top of the global freight forwarding market, surpassing long-standing competitors like DHL and Kuehne + Nagel.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Transportation Mode | Sea-Air, Air-Sea, and Others |

| Service | Freight forwarding, Warehousing and distribution, Customs brokerage, and Value-added services |

| Industry Vertical | E-commerce, Automotive, Machinery & equipment, Pharmaceuticals, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL, CEVA Logistics, DB Schenker, DSV (Panalpina), Expeditors International, Kuehne + Nagel, and UPS Supply Chain Solutions |

| Additional Attributes | Dollar sales by transport type (air, sea, and combined services) and end-use segments (electronics, automotive, pharmaceuticals, consumer goods). Demand dynamics are driven by the growing need for faster delivery times, cost optimization, and the rise of e-commerce, especially in high-value or time-sensitive goods. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with emerging markets in Africa and Latin America presenting significant opportunities. |

The global sea air logistics market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the sea air logistics market is projected to reach USD 16.0 billion by 2035.

The sea air logistics market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in sea air logistics market are sea-air, air-sea and others.

In terms of service, freight forwarding segment to command 46.0% share in the sea air logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Actuation Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seals Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seating Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Frames Market

ASEAN Non-Dairy Creamer Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

Legionnaire Disease Testing Market Size and Share Forecast Outlook 2025 to 2035

Seatbelt Polyester Yarn Market Size and Share Forecast Outlook 2025 to 2035

Seawater Source Heat Pump System Market Size and Share Forecast Outlook 2025 to 2035

Seabed Crawler Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Seasoning Filling System Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA