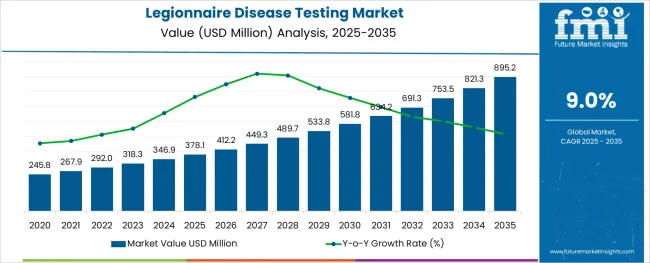

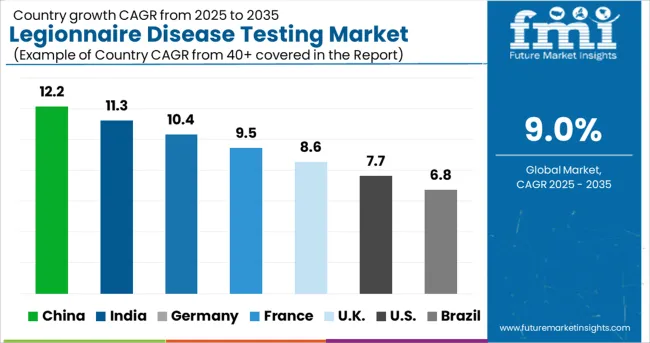

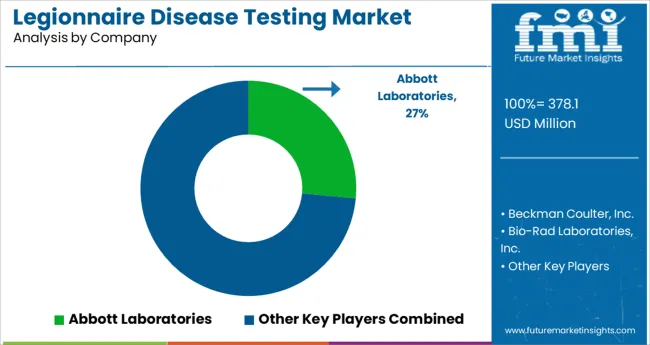

The Legionnaire Disease Testing Market is estimated to be valued at USD 378.1 million in 2025 and is projected to reach USD 895.2 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The legionnaire disease testing market is witnessing notable expansion as healthcare providers place greater emphasis on rapid disease detection and prevention of hospital-acquired infections. Rising awareness of waterborne diseases has prompted healthcare authorities to strengthen diagnostic protocols, increasing the adoption of quick and accurate testing solutions.

Diagnostic companies have introduced advanced devices and assay kits that enable timely identification of Legionella infections, improving patient management and reducing the risk of outbreaks. Additionally, improvements in healthcare infrastructure and diagnostic laboratory capacity have supported wider market penetration in both developed and developing regions.

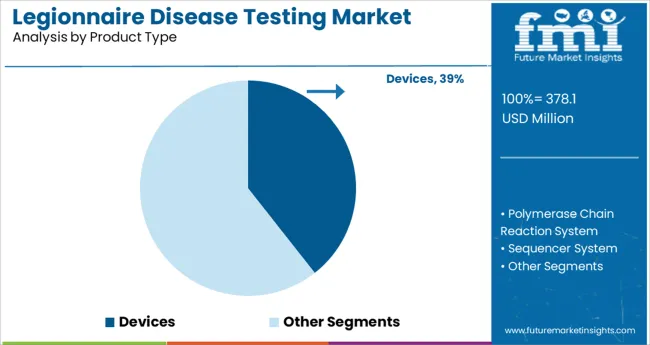

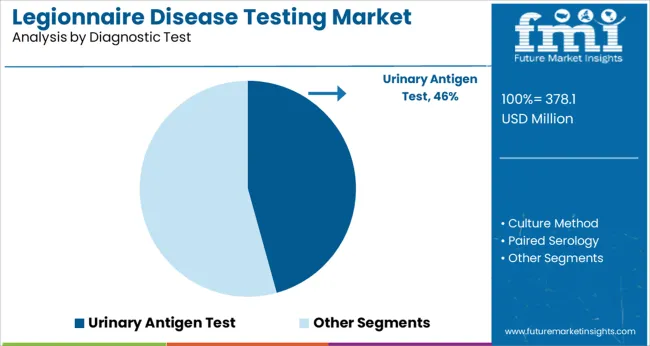

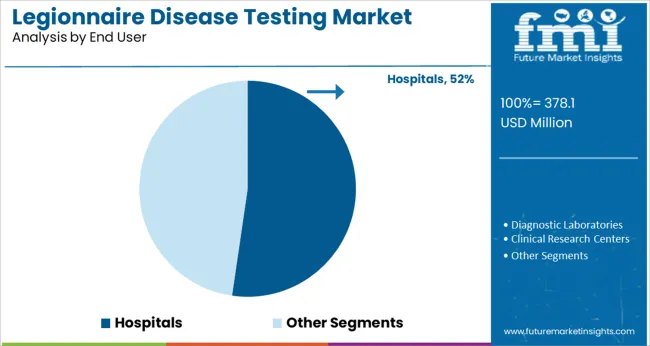

Clinical studies continue to highlight the need for early detection of legionnaire disease, particularly in vulnerable populations such as hospitalized patients and the elderly. Looking forward, growth will be supported by advancements in point-of-care technologies and integrated diagnostic platforms. Segmental growth is being driven by Devices in product type, Urinary Antigen Test in diagnostic test, and Hospitals as the primary end-user segment.

The market is segmented by Product Type, Diagnostic Test, and End User and region. By Product Type, the market is divided into Devices, Polymerase Chain Reaction System, Sequencer System, Test Kits, Assay Based Test Kits, and Rapid Test Kits. In terms of Diagnostic Test, the market is classified into Urinary Antigen Test, Culture Method, Paired Serology, Direct Fluorescent Antibody Stain, Polymerase Chain Reaction, and Combination Testing. Based on End User, the market is segmented into Hospitals, Diagnostic Laboratories, Clinical Research Centers, Academic Institutes, Research Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Diagnostic Test, and End User and region. By Product Type, the market is divided into Devices, Polymerase Chain Reaction System, Sequencer System, Test Kits, Assay Based Test Kits, and Rapid Test Kits. In terms of Diagnostic Test, the market is classified into Urinary Antigen Test, Culture Method, Paired Serology, Direct Fluorescent Antibody Stain, Polymerase Chain Reaction, and Combination Testing. Based on End User, the market is segmented into Hospitals, Diagnostic Laboratories, Clinical Research Centers, Academic Institutes, Research Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Devices segment is projected to hold 39.4% of the legionnaire disease testing market revenue in 2025, making it the leading product type. Growth in this segment has been driven by the rising adoption of automated testing instruments that enable faster and more reliable results.

Hospitals and diagnostic laboratories have preferred devices for their ability to streamline workflow and reduce manual error during the testing process. Devices have been designed to provide enhanced sensitivity and accuracy, which are critical for early detection of legionnaire disease.

Additionally, healthcare providers have increasingly relied on compact and user-friendly devices that can be integrated into routine laboratory operations. As the demand for faster diagnosis increases and healthcare facilities continue to modernize their diagnostic equipment, the Devices segment is expected to maintain its dominant position in the market.

The Urinary Antigen Test segment is projected to account for 45.7% of the legionnaire disease testing market revenue in 2025, establishing itself as the most widely used diagnostic test. This segment’s growth has been supported by the clinical preference for rapid and non-invasive testing methods.

The urinary antigen test enables the detection of Legionella pneumophila serogroup 1, the most common cause of legionnaire disease, providing actionable results within a short timeframe. Healthcare professionals have favored this test for its ease of sample collection and quick turnaround time, which helps initiate timely treatment and improves patient outcomes.

In addition, the urinary antigen test has been widely adopted in outbreak investigations and routine hospital screenings, further contributing to its strong market position. As the need for early diagnosis and infection control remains a healthcare priority, the Urinary Antigen Test segment is expected to sustain its leadership.

The Hospitals segment is projected to contribute 52.3% of the legionnaire disease testing market revenue in 2025, making it the leading end-user segment. This segment’s growth has been supported by the rising incidence of hospital-acquired infections and the need for timely diagnosis in clinical settings.

Hospitals have prioritized in-house testing capabilities to reduce diagnostic delays and support faster patient management. Inpatient populations, particularly those with weakened immune systems or respiratory conditions, have been most at risk for legionnaire disease, making hospitals key testing hubs.

The increasing integration of automated diagnostic devices and the expansion of clinical microbiology labs have further supported hospital adoption. As infection control protocols and hospital preparedness continue to evolve, the Hospitals segment is expected to remain the primary setting for legionnaire disease testing.

According to the World Health Organization, 75-80% of the population is 50 years old or older, with 65-70% of the population being male. The male population is more susceptible to the demand for legionnaire disease testing than the female population.

Furthermore, the elderly are at a higher risk of legionnaire disease testing and are more likely to get infected. Globally, however, the advancement of innovative testing technologies is increasing. Increased knowledge of present and evolving technology is also helping to boost acceptance of the new testing method, which is projected to open up significant sales of legionnaire disease testing.

However, a scarcity of qualified healthcare providers, as well as a lack of knowledge of the condition and the inability to diagnose it at an early stage, may stymie the demand for legionnaire disease testing market expansion. Furthermore, the absence of improved healthcare facilities may limit the legionnaire disease testing market growth.

The sales of legionnaire disease testing market in Asia-Pacific are predicted to expand rapidly in the next years. This is owing to the existence of a huge population of people who are at high risk. In addition, a lack of knowledge on how to treat infectious diseases is adding to the region's growing population at risk.

The legionnaire disease testing market is predicted to increase rapidly as a result of this. Because of the region's excellent healthcare infrastructure and extensive research and development activities, the North American legionnaire disease testing market is likely to be the most prominent. Due to the availability of qualified researchers and a strong acceptance rate in the area, Europe will rank second in the sales of legionnaire disease testing market.

Due to a scarcity of qualified specialists in the region, the legionnaire disease testing market in Latin America is predicted to rise steadily. Due to a lack of facilities and public knowledge of legionnaire illness, the Middle East and Africa are likely to be the least profitable hence a decline in the demand for legionnaire disease testing.

The report consists of key players, contributing to the legionnaire disease testing market share. It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions. This exclusive report analyzes the competitive landscape and legionnaire disease testing market share acquired by players to strengthen their market position.

Some of the key players present in the global legionnaire disease testing market are Beckman Coulter, Inc.; Albagaia Ltd.; Bio-Rad Laboratories, Inc.; Abbott Laboratories.; F. Hoffmann-La Roche AG; Thermo Fischer Scientific, Inc.; Becton, Dickinson and Company; Aquacert Ltd, BioMérieux SA; Idexx Laboratories Inc.; and others.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 9% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Product type, diagnostic test, end user, region |

| Regional scope | North America; Western Europe, Eastern Europe, Middle East, Africa, ASEAN, South Asia, Rest of Asia, Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Beckman Coulter, Inc.; Albagaia Ltd.; Bio-Rad Laboratories, Inc.; Abbott Laboratories.; F. Hoffmann-La Roche AG; Thermo Fischer Scientific, Inc.; Becton, Dickinson and Company; Aquacert Ltd, BioMérieux SA; Idexx Laboratories Inc.; and others |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

The global legionnaire disease testing market is estimated to be valued at USD 378.1 million in 2025.

It is projected to reach USD 895.2 million by 2035.

The market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types are devices, polymerase chain reaction system, sequencer system, test kits, assay based test kits and rapid test kits.

urinary antigen test segment is expected to dominate with a 45.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Wilson’s Disease Diagnostics Market Analysis – Size, Share & Forecast 2023-2033

Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA