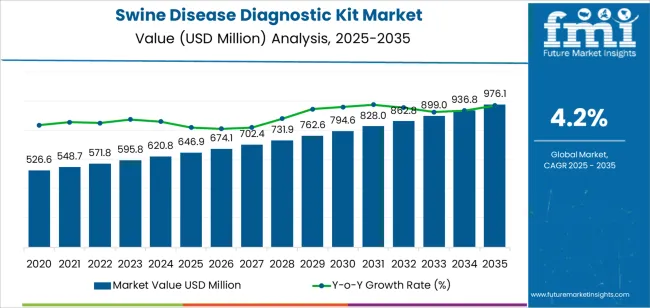

The global swine disease diagnostic kit market is forecasted to reach USD 976.2 million by 2035, recording an absolute increase of USD 329.3 million over the forecast period. The market is valued at USD 646.9 million in 2025 and is expected to grow at a CAGR of 4.2% over the assessment period. The market size is expected to grow by nearly 1.5 times during the same period, supported by increasing prevalence of infectious swine diseases in commercial pig farming operations, growing awareness about biosecurity protocols and early disease detection in livestock production systems, and expanding veterinary diagnostic infrastructure in major pork-producing regions, driving adoption of rapid testing solutions. The market expansion reflects growing demand for accurate pathogen-detection capabilities in swine health management, where diagnostic kits deliver superior disease identification and outbreak prevention compared to conventional clinical observation methods. Veterinary facilities across commercial pig farms, diagnostic laboratories, and animal health monitoring centers are implementing diagnostic testing technology to achieve reliable disease confirmation and effective herd health management protocols.

The market demonstrates strong momentum across developed and emerging agricultural economies, where livestock health industries are transitioning from conventional diagnostic approaches to advanced testing systems that offer superior accuracy and rapid result delivery capabilities. Swine disease diagnostic kit technology addresses critical agricultural challenges including early detection of viral and bacterial pathogens, accurate identification of disease agents in subclinical infection stages, and timely implementation of biosecurity measures across production facilities. The pork industry's focus on food safety standards and animal welfare requirements creates steady demand for diagnostic solutions capable of providing definitive pathogen identification, quantitative disease load assessment, and comprehensive herd health status evaluation with minimal sample processing time and consistent measurement reliability. Veterinary practitioners and livestock producers are adopting diagnostic kits for disease surveillance where testing accuracy directly impacts intervention timing and production continuity.

Agricultural stakeholders and veterinary service providers are investing in diagnostic kit systems to enhance disease management capabilities through improved detection sensitivity and expanded pathogen coverage options. The integration of advanced molecular diagnostic technologies and optimized test protocols enables these systems to achieve result delivery times 60-80% shorter than laboratory culture methods while maintaining diagnostic specificity standards. The initial equipment investment requirements for molecular testing platforms and technical expertise barriers for proper sample collection and test interpretation may pose challenges to market expansion in small-scale farming operations and regions with limited access to veterinary diagnostic training resources.

Between 2025 and 2030, the market is projected to expand from USD 646.9 million to USD 762.7 million, resulting in a value increase of USD 115.8 million, which represents 35.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for rapid disease detection in commercial swine operations, product innovation in molecular diagnostic technologies and antibody detection platforms, as well as expanding integration with herd health monitoring systems and veterinary laboratory networks. Companies are establishing competitive positions through investment in sensitive detection reagents, user-friendly test formats, and strategic market expansion across commercial pig farming operations, veterinary diagnostic laboratories, and agricultural extension service applications.

From 2030 to 2035, the market is forecast to grow from USD 762.7 million to USD 976.2 million, adding another USD 213.5 million, which constitutes 64.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized diagnostic systems, including multiplex detection platforms and point-of-care testing configurations tailored for specific pathogen panels and farm-level deployment requirements, strategic collaborations between diagnostic manufacturers and pharmaceutical companies, and an enhanced focus on test sensitivity optimization and result interpretation simplification. The growing focus on disease prevention and biosecurity compliance will drive demand for advanced, high-performance swine disease diagnostic kit solutions across diverse livestock production applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 646.9 million |

| Market Forecast Value (2035) | USD 976.2 million |

| Forecast CAGR (2025-2035) | 4.2% |

The swine disease diagnostic kit market grows by enabling livestock producers to achieve accurate pathogen identification and timely disease intervention while reducing diagnostic turnaround times in swine health management operations. Commercial pig farming facilities face mounting pressure to improve biosecurity protocols and minimize disease-related production losses, with modern diagnostic kits typically providing test results in 2-6 hours compared to 3-7 days with traditional laboratory culture methods, making these rapid testing solutions essential for effective herd health management operations. The swine production industry's need for precise disease agent detection creates demand for advanced diagnostic solutions that can identify viral pathogens, bacterial infections, and parasitic conditions with high sensitivity and specificity across diverse sample types and disease stages.

Agricultural modernization initiatives promoting intensive livestock production and export market access drive adoption in commercial pig farms, integrated production systems, and veterinary diagnostic laboratories, where testing efficiency has a direct impact on disease control effectiveness and regulatory compliance capabilities. The global shift toward preventive veterinary medicine and biosecurity risk management accelerates diagnostic kit demand as swine producers seek testing solutions that enable early disease detection and minimize production disruptions through rapid outbreak identification. Limited awareness of proper sample collection procedures and higher per-test costs compared to basic clinical assessment may limit adoption rates among small-scale pig farmers and regions with traditional livestock husbandry practices and limited veterinary service infrastructure.

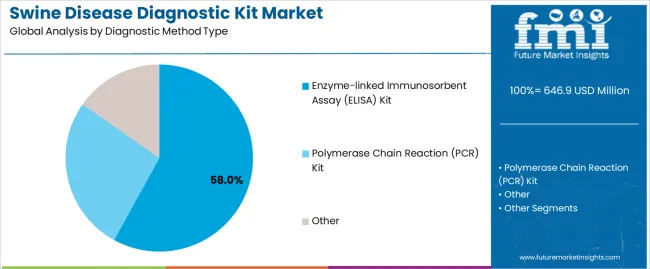

The market is segmented by diagnostic method type, application, and region. By diagnostic method type, the market is divided into Enzyme-linked Immunosorbent Assay (ELISA) kit, Polymerase Chain Reaction (PCR) kit, and other. Based on application, the market is categorized into farmers and veterinary clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The ELISA kit segment represents the dominant force in the market, capturing approximately 58.0% of total market share in 2025. This established category encompasses antibody detection assays, antigen capture formats, and indirect testing protocols optimized for serological screening applications, delivering cost-effective disease surveillance and practical field-level testing capabilities in commercial swine operations. The ELISA kit segment's market leadership stems from its proven reliability across multiple disease targets, accessible price points for routine testing programs, and minimal equipment requirements enabling deployment in farm-based testing scenarios and regional veterinary laboratories.

The PCR kit segment maintains a substantial 31.0% market share, serving livestock producers who require definitive pathogen identification through molecular detection methods, early infection stage diagnosis, and quantitative viral load assessment capabilities supporting targeted treatment decisions. The other segment accounts for 11.0% market share, encompassing lateral flow assays, immunochromatographic tests, and specialized diagnostic formats.

Key advantages driving the ELISA kit segment include:

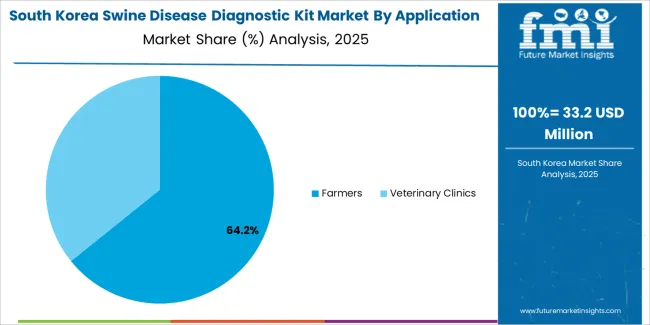

Farmers applications dominate the market with approximately 64.0% market share in 2025, reflecting the extensive adoption of on-farm testing solutions across commercial pig production operations, integrated livestock systems, and breeding stock management programs. The farmers segment's market leadership is reinforced by widespread implementation in routine health monitoring (26.0%), disease outbreak investigation (22.0%), and biosecurity verification programs (16.0%), which provide essential production risk management and regulatory compliance support in intensive swine farming environments.

The veterinary clinics segment represents 36.0% market share through specialized applications including diagnostic confirmation services (15.0%), disease surveillance programs (12.0%), and clinical investigation protocols (9.0%).

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to livestock production economics and food safety requirements. First, global pork production expansion creates increasing requirements for effective disease control solutions, with worldwide pig inventory exceeding 800 million head in major producing countries, requiring reliable diagnostic testing systems for African swine fever, porcine reproductive and respiratory syndrome, and classical swine fever management in commercial production facilities. Second, rising biosecurity awareness and regulatory compliance requirements drive adoption of systematic testing protocols, with diagnostic kits enabling rapid outbreak detection and containment measures that minimize production losses and facilitate trade certification in international pork markets. Third, intensive livestock production practices and animal health monitoring initiatives accelerate deployment across commercial farms, with diagnostic kits integrating into comprehensive herd health management programs and enabling data-driven veterinary intervention strategies in high-density production systems.

Market restraints include cost barriers affecting small-scale pig producers and subsistence farming operations, particularly where clinical observation remains primary disease assessment method and where limited cash flow constrains acquisition of commercial diagnostic testing supplies. Technical skill requirements for proper sample collection and test execution pose adoption challenges for facilities lacking trained veterinary personnel, as diagnostic kit performance depends on appropriate specimen handling, correct test procedure adherence, and accurate result interpretation that vary across different diagnostic platforms and disease targets. Limited cold chain infrastructure for reagent storage in certain agricultural regions creates additional barriers, as diagnostic kit components require specific temperature maintenance to preserve test sensitivity and measurement reliability throughout shelf life.

Key trends indicate accelerated adoption in Asian livestock markets, particularly China and Vietnam, where commercial pig production intensification and African swine fever containment efforts are driving systematic disease surveillance through mandatory testing programs and government-subsidized diagnostic initiatives. Technology advancement trends toward multiplex detection formats, simplified sample preparation protocols, and smartphone-connected result readers are driving next-generation product development. The market thesis could face disruption if vaccine technologies achieve breakthrough efficacy in providing comprehensive protection against major swine diseases, potentially reducing diagnostic testing demand for routine surveillance in vaccinated populations.

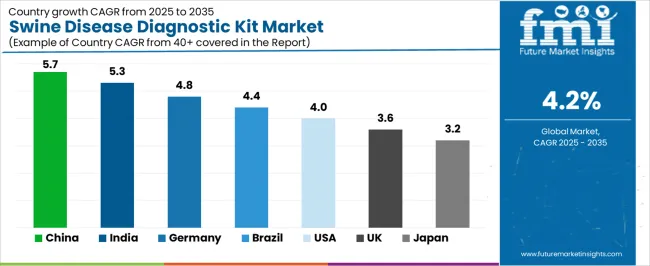

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| Brazil | 4.4% |

| USA | 4.0% |

| UK | 3.6% |

| Japan | 3.2% |

The market is gaining momentum worldwide, with China taking the lead to aggressive livestock production modernization and biosecurity program implementation. Close behind, India benefits from growing commercial pig farming development and veterinary diagnostic capacity expansion, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding pork production operations and export market requirements strengthen its role in South American agricultural markets. The USA demonstrates robust growth through established veterinary diagnostic infrastructure and comprehensive animal health monitoring systems, signaling continued adoption in intensive livestock production applications. Japan stands out for its strict food safety standards and advanced veterinary diagnostic capabilities, while UK and Germany continue to record consistent progress driven by stringent animal health regulations and integrated livestock production systems. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

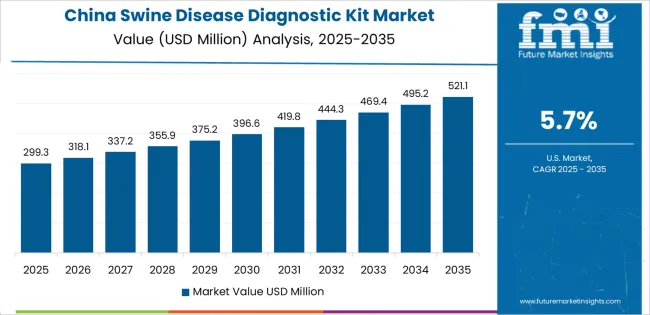

China demonstrates the strongest growth potential in the market with a CAGR of 5.7% through 2035. The country's leadership position stems from comprehensive livestock production industrialization, intensive African swine fever recovery programs, and aggressive biosecurity infrastructure development targets driving adoption of advanced diagnostic technologies. Growth is concentrated in major pig-producing provinces, including Sichuan, Henan, Hunan, and Shandong, where commercial farming operations, breeding companies, and veterinary service providers are implementing diagnostic testing systems for disease prevention and herd health optimization. Distribution channels through agricultural supply dealers, veterinary pharmaceutical distributors, and direct manufacturer relationships expand deployment across large-scale pig farms, breeding nucleus facilities, and regional veterinary diagnostic centers. The country's agricultural modernization policies provide support for livestock disease control technology adoption, including subsidies for diagnostic equipment procurement and biosecurity system upgrades.

Key market factors:

In Punjab, Uttar Pradesh, West Bengal, and northeastern state livestock zones, the adoption of swine disease diagnostic kits is accelerating across commercial pig farms, veterinary hospitals, and agricultural research institutions, driven by National Livestock Mission initiatives and increasing focus on livestock productivity enhancement. The market demonstrates strong growth momentum with a CAGR of 5.3% through 2035, linked to comprehensive pig farming sector development and increasing investment in veterinary diagnostic capabilities. Indian livestock producers are implementing diagnostic testing technology and disease monitoring protocols to improve production efficiency while meeting food safety requirements in domestic pork markets serving regional consumption patterns. The country's Livestock Health and Disease Control program creates steady demand for diagnostic solutions, while increasing focus on organized livestock production drives adoption of systematic testing services that enhance herd health management effectiveness.

Germany's advanced livestock sector demonstrates sophisticated implementation of swine disease diagnostic systems, with documented case studies showing 40-50% reduction in disease-related mortality rates in commercial herds through systematic testing protocols and early intervention strategies. The country's agricultural infrastructure in major pig-producing regions, including Lower Saxony, North Rhine-Westphalia, Bavaria, and Schleswig-Holstein, showcases integration of diagnostic testing technologies with existing veterinary service networks, leveraging expertise in intensive livestock production and animal health management. German pig producers emphasize quality assurance and biosecurity standards, creating demand for reliable diagnostic solutions that support regulatory compliance and export certification requirements. The market maintains strong growth through focus on animal welfare standards and production efficiency optimization, with a CAGR of 4.8% through 2035.

Key development areas:

The Brazilian market leads in Latin American swine disease diagnostic kit adoption based on expanding commercial pork production and growing export market participation requiring comprehensive disease surveillance programs. The country shows solid potential with a CAGR of 4.4% through 2035, driven by livestock sector modernization and increasing demand for disease-free certification in international trade operations. Brazilian pig producers are adopting diagnostic testing technology for compliance with Ministry of Agriculture health protocols, particularly in disease-free zone maintenance requiring systematic surveillance and in export facility certification where pathogen-free status verification impacts market access. Technology deployment channels through agricultural cooperatives, veterinary pharmaceutical distributors, and integrated production company networks expand coverage across commercial pig farming regions and contract production systems.

Leading market segments:

The USA market leads in established swine disease diagnostic utilization based on comprehensive veterinary diagnostic laboratory networks and well-developed animal health monitoring systems for commercial pork production operations. The country shows solid potential with a CAGR of 4.0% through 2035, driven by intensive livestock production practices and ongoing focus on foreign animal disease preparedness programs across major pig-producing regions. American pork producers implement diagnostic testing systems for routine herd health monitoring, particularly in large-scale production systems serving domestic processing facilities and in breeding operations managing genetic improvement programs requiring disease-free status verification. Technology deployment channels through veterinary diagnostic laboratories, agricultural extension services, and production company veterinary departments expand coverage across commercial production facilities and contract farming operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on commercial pig production operations and specialized breeding stock management, with documented integration of diagnostic testing achieving 35-40% improvement in early disease detection rates through systematic surveillance programs. The country maintains steady growth momentum with a CAGR of 3.6% through 2035, driven by stringent animal health regulations and comprehensive biosecurity requirements in intensive livestock production systems. Major pig-producing regions, including Yorkshire, East Anglia, and Northern Ireland, showcase deployment of diagnostic testing technologies that integrate with existing veterinary service infrastructure and support regulatory compliance in commercial production operations and breeding nucleus facilities.

Key market characteristics:

Japan's swine disease diagnostic kit market demonstrates sophisticated implementation focused on strict biosecurity protocols and comprehensive animal health monitoring programs, with documented integration of diagnostic testing achieving 45-50% improvement in disease outbreak prevention through early detection systems. The country maintains steady growth momentum with a CAGR of 3.2% through 2035, driven by stringent food safety regulations and established livestock health management practices emphasizing preventive veterinary medicine. Major pig-producing regions, including Kagoshima, Miyazaki, Gunma, and Chiba, showcase advanced deployment of diagnostic technologies that integrate with comprehensive veterinary oversight systems and mandatory disease reporting networks.

Key market characteristics:

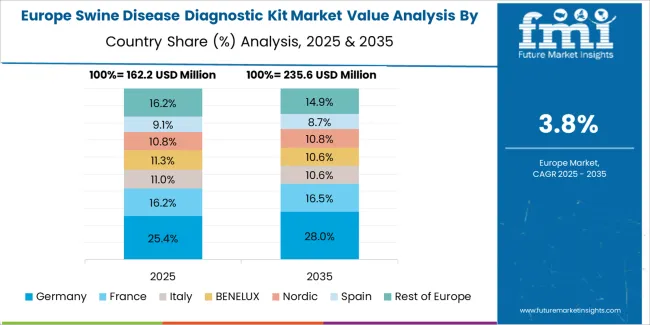

The swine disease diagnostic kit market in Europe is projected to grow from USD 231.9 million in 2025 to USD 430.4 million by 2035, registering a CAGR of 6.4% over the forecast period. Germany is expected to maintain its leadership position with a 29.6% market share in 2025, declining slightly to 28.4% by 2035, supported by its extensive pig production infrastructure and major livestock regions, including Lower Saxony, North Rhine-Westphalia, and Bavaria.

France follows with a 18.7% share in 2025, projected to reach 19.1% by 2035, driven by comprehensive livestock health programs and integrated pig production systems in Brittany and western regions. The United Kingdom holds a 15.3% share in 2025, expected to reach 15.6% by 2035 through stringent biosecurity protocols and specialized breeding operations. Italy commands a 13.2% share in 2025, maintaining 13.4% by 2035, backed by regional pork production traditions and protected designation programs. Spain accounts for 11.8% in 2025, rising to 12.1% by 2035 on expanding commercial pig farming and export-oriented production growth. The Rest of Europe region is anticipated to hold 11.4% in 2025, expanding to 11.4% by 2035, attributed to increasing diagnostic kit adoption in Nordic countries and emerging Central & Eastern European livestock intensification programs.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of ELISA-based testing systems with existing prefectural veterinary laboratory infrastructure across commercial pig farms, breeding companies, and animal health monitoring centers. Japan's focus on livestock disease prevention and systematic surveillance protocols drives demand for diagnostic testing solutions that support national animal health initiatives and veterinary practice guidelines established by Ministry of Agriculture, Forestry and Fisheries. The market benefits from strong partnerships between international diagnostic manufacturers and domestic veterinary pharmaceutical distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical training and application support programs. Livestock regions in Kagoshima, Miyazaki, and other major pig-producing prefectures showcase advanced disease surveillance implementations where diagnostic testing systems achieve 96% protocol compliance rates through comprehensive veterinary technician certification programs and ongoing quality assurance initiatives.

The South Korean market is characterized by growing international diagnostic manufacturer presence, with companies maintaining significant positions through comprehensive technical support and veterinary consultation capabilities for commercial pig farming operations and provincial veterinary laboratories. The market demonstrates increasing focus on biosecurity enhancement and disease-free zone maintenance, as Korean pork producers increasingly demand advanced diagnostic solutions that integrate with national livestock traceability systems and comprehensive animal health information networks deployed across integrated production facilities. Regional veterinary pharmaceutical distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including technical training programs and disease-specific testing panels for commercial operations and contract farming systems. The competitive landscape shows increasing collaboration between multinational diagnostic companies and Korean agricultural technology specialists, creating hybrid service models that combine international product development expertise with local veterinary support capabilities and regulatory compliance knowledge.

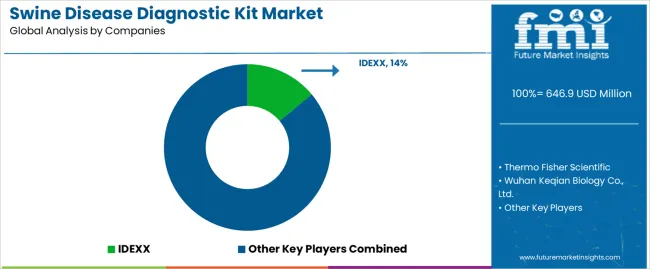

The market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 32-38% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on test sensitivity, result reliability, and technical support capabilities rather than price competition alone. IDEXX leads with approximately 14.0% market share through its comprehensive veterinary diagnostics portfolio and global distribution presence. Thermo Fisher Scientific maintains strong positioning with approximately 12.0% market share through advanced molecular diagnostic platforms and established relationships with veterinary laboratories.

Market leaders include IDEXX, Thermo Fisher Scientific, and Wuhan Keqian Biology Co., Ltd., which maintain competitive advantages through global distribution infrastructure, validated diagnostic technologies, and deep expertise in veterinary diagnostic applications across swine health management, disease surveillance programs, and biosecurity operations, creating trust and reliability advantages with commercial pig producers and veterinary diagnostic laboratories. These companies leverage research and development capabilities in assay optimization and ongoing technical support relationships to defend market positions while expanding into emerging livestock markets and specialized disease targets.

Challengers encompass Qingdao Lijian Bio-Tech Co., Ltd. and BioChek, which compete through specialized product offerings and strong regional presence in key pig-producing markets. Product specialists, including Harbin National Engineering Research Center Of Veterinary Biologics Corp., Hunan Guoce Biotechnology Co., Ltd., and Nanjing Vazyme Biotech Co., Ltd., focus on specific diagnostic formats or regional markets, offering differentiated capabilities in local disease target panels, rapid turnaround testing services, and competitive pricing structures.

Regional players and emerging veterinary diagnostic manufacturers create competitive pressure through localized production advantages and rapid response capabilities, particularly in high-growth markets including China and Vietnam, where proximity to pig farming concentrations provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven diagnostic accuracy with comprehensive veterinary consultation offerings that address the complete disease management cycle from sample collection through result interpretation and intervention recommendations.

Swine disease diagnostic kits represent advanced testing solutions that enable livestock producers to achieve rapid pathogen identification and timely disease intervention, delivering superior diagnostic accuracy and operational efficiency with high sensitivity detection and reliable result delivery in critical swine health management applications. With the market projected to grow from USD 646.9 million in 2025 to USD 976.2 million by 2035 at a 4.2% CAGR, these diagnostic testing systems offer compelling advantages - early disease detection, production loss prevention, and biosecurity assurance - making them essential for farmers applications (64.0% market share), veterinary clinic operations (36.0% share), and livestock production systems seeking alternatives to conventional clinical assessment methods that compromise disease control through delayed pathogen identification. Scaling market adoption and technology deployment requires coordinated action across agricultural policy, veterinary infrastructure development, diagnostic manufacturers, livestock producers, and animal health service providers.

| Item | Value |

|---|---|

| Quantitative Units | USD 646.9 million |

| Diagnostic Method Type | Enzyme-linked Immunosorbent Assay (ELISA) Kit, Polymerase Chain Reaction (PCR) Kit, Other |

| Application | Farmers, Veterinary Clinics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Wuhan Keqian Biology Co., Ltd., Qingdao Lijian Bio-Tech Co., Ltd., Harbin National Engineering Research Center Of Veterinary Biologics Corp., Hunan Guoce Biotechnology Co., Ltd., Nanjing Vazyme Biotech Co., Ltd., Thermo Fisher Scientific, Biovettest, Ringbio, AdvaCare Pharma, Flashtest, IDEXX, iNtRON Biotechnology, Biosellal, Advanced Molecular Diagnostics, BioChek |

| Additional Attributes | Dollar sales by diagnostic method type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with veterinary diagnostic manufacturers and distribution networks, livestock production facility requirements and specifications, integration with herd health monitoring systems and veterinary laboratory networks, innovations in molecular detection technologies and antibody-based platforms, and development of specialized diagnostic solutions with enhanced sensitivity and rapid result delivery capabilities. |

The global swine disease diagnostic kit market is estimated to be valued at USD 646.9 million in 2025.

The market size for the swine disease diagnostic kit market is projected to reach USD 976.1 million by 2035.

The swine disease diagnostic kit market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in swine disease diagnostic kit market are enzyme-linked immunosorbent assay (elisa) kit, polymerase chain reaction (pcr) kit and other.

In terms of application, farmers segment to command 64.0% share in the swine disease diagnostic kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Swine Feed Market Size and Share Forecast Outlook 2025 to 2035

Swine Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Wilson’s Disease Diagnostics Market Analysis – Size, Share & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA