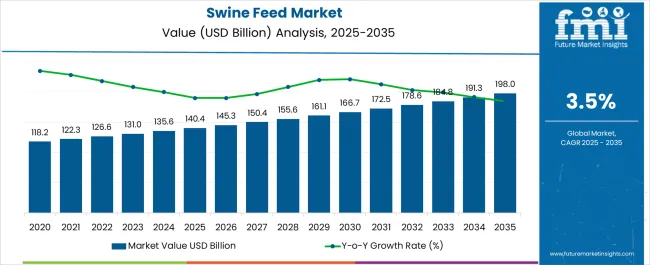

The Swine Feed Market is estimated to be valued at USD 140.4 billion in 2025 and is projected to reach USD 198.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

| Metric | Value |

|---|---|

| Swine Feed Market Estimated Value in (2025 E) | USD 140.4 billion |

| Swine Feed Market Forecast Value in (2035 F) | USD 198.0 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The swine feed market is experiencing consistent growth as rising global pork consumption continues to drive demand for efficient and nutritionally balanced feed solutions. Growing emphasis on animal health, weight gain efficiency, and feed conversion ratios is shaping the market, with producers increasingly adopting specialized formulations to meet productivity goals. Regulatory support for improving livestock health standards and the gradual shift toward sustainable feed ingredients are also influencing purchasing behavior.

Investments in research and feed innovation are creating new opportunities to incorporate advanced additives, enzymes, and bio-based proteins, which enhance both growth and immunity in pigs. Strong demand from emerging markets with expanding swine production bases is contributing to global revenue expansion, while established producers are focusing on performance-optimized diets.

Increasing concerns about disease control and the rising cost of raw materials are further accelerating the adoption of value-added feed categories As the swine industry aligns with global trends in food security and efficiency, the market for specialized and high-performance feed is positioned for robust long-term growth.

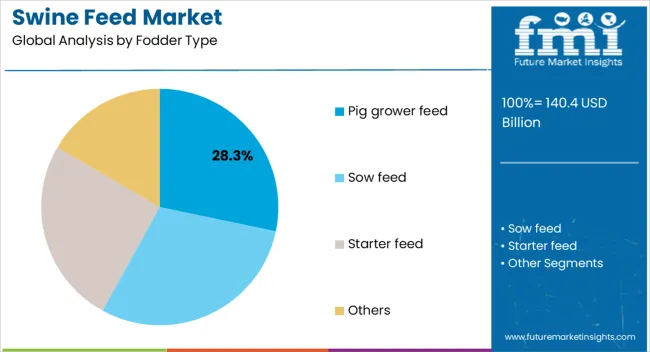

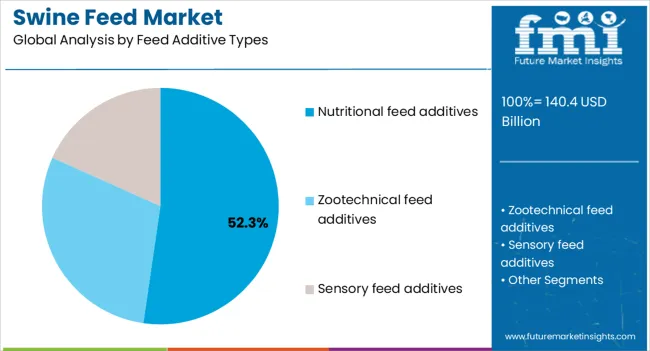

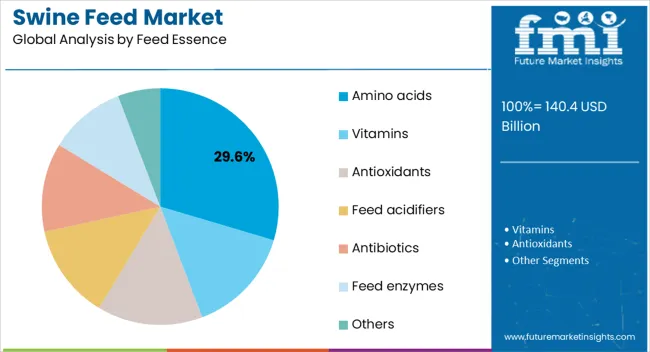

The swine feed market is segmented by fodder type, feed additive types, feed essence, distribution channel, and geographic regions. By fodder type, swine feed market is divided into Pig grower feed, Sow feed, Starter feed, and Others. In terms of feed additive types, swine feed market is classified into Nutritional feed additives, Zootechnical feed additives, and Sensory feed additives. Based on feed essence, swine feed market is segmented into Amino acids, Vitamins, Antioxidants, Feed acidifiers, Antibiotics, Feed enzymes, and Others. By distribution channel, swine feed market is segmented into Offline and Online. Regionally, the swine feed industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pig grower feed segment is anticipated to represent 28.3% of the swine feed market revenue share in 2025, making it the leading fodder type. This dominance is being driven by its critical role in supporting the growth phase of pigs, where balanced nutrition is essential for achieving desired weight gain and feed efficiency. The segment benefits from increasing commercial farming practices that prioritize optimized growth rates to maximize profitability.

Advances in formulation science are enabling manufacturers to develop feed blends rich in proteins, vitamins, and minerals, ensuring consistent performance during the grower stage. Producers are adopting pig grower feed on a large scale as it reduces the overall production cycle time and improves carcass quality, which directly impacts profitability.

Rising pork consumption globally is also reinforcing the demand for grower feed as producers seek to meet higher output levels with standardized quality The ability to enhance feed conversion ratios, improve immunity, and reduce mortality rates is further solidifying pig grower feed as the dominant fodder type in the global market.

The nutritional feed additives segment is expected to account for 52.3% of the swine feed market revenue share in 2025, making it the largest segment within feed additives. This leadership is being driven by the need to ensure pigs receive essential vitamins, minerals, and supplements that enhance growth, improve immunity, and support reproductive performance. Nutritional additives are increasingly being used to overcome deficiencies in base feed ingredients, ensuring optimal animal health and weight gain.

Producers are prioritizing the use of these additives due to their ability to boost feed conversion efficiency and reduce disease susceptibility, which is vital in intensive farming environments. Growing regulatory focus on animal health standards and pressure to reduce antibiotic use are also contributing to the adoption of nutritional additives as safe and sustainable alternatives.

Technological advancements in additive formulation, including microencapsulation and precision delivery systems, are further enhancing their effectiveness The segment’s growth is expected to remain strong as demand for safe, efficient, and high-quality pork continues to rise globally, reinforcing nutritional feed additives as a cornerstone in swine feed strategies.

The amino acids segment is projected to hold 29.6% of the swine feed market revenue share in 2025, establishing itself as the leading category within feed essence. This dominance is supported by the essential role amino acids play in enhancing protein synthesis, growth performance, and metabolic efficiency in pigs. The segment benefits from rising awareness among producers regarding the importance of balanced amino acid profiles in improving feed conversion ratios and reducing nitrogen emissions, which also supports sustainability goals.

Incorporation of amino acids such as lysine, methionine, and threonine in swine diets is being prioritized to enhance muscle development and improve overall productivity. The use of amino acids also enables precise formulation of diets that meet the nutritional requirements of pigs at different growth stages without over-reliance on costly protein sources.

Strong demand from commercial farming operations and regulatory emphasis on environmentally responsible livestock production are further reinforcing segment adoption As swine producers continue to prioritize efficiency, health, and sustainability, the amino acids segment is expected to maintain its strong market leadership.

The world swine feed market was valued at USD 103.6 Bn in 2025 and swine feed market has seen a rapid growth till 2025 and it is forecasted to grow even more during the forecasted period from 2025-2035.

Public pressure to utilise swine feed products that protect pigs from enzootic diseases has forced pig farmers to adopt swine feed products as a result of growing consumer awareness about the health of pigs. Additionally, it is anticipated that using enhanced swine feed will reduce the frequency of animal epidemics, which will increase demand in the swine feed market.

USA has grown rapidly in swine feed market sector due to its ending demand for pork meat, the USA market is forecasted to grow even more during the forecasted period.

The swine feed market in the United States is a large and important sector of the economy. It is shaped by a number of factors, including the demands of the pork industry, the availability of corn and soybeans, and government policies.

The pork industry is the largest consumer of swine feed, accounting for about 60 percent of total demand. The industry has been growing in recent years, due to strong domestic and international demand for pork products. This growth has led to increased demand for swine feed, which has put upward pressure on prices.

The availability of corn and soybeans is another important factor shaping the swine feed market. These two crops are the main ingredients in most swine feeds. The United States is one of the world's leading producers of both crops, and their prices are influenced by global supply and demand conditions.

Geographically, the world's swine feed market is divided into seven major areas. China will continue to have the most pigs per capita of all of them. In Vietnam, the Philippines, and Thailand, among other nations in the Asia Pacific, there is expected to be a comparatively large need for swine feed.

It is anticipated that the top two pork-consuming regions will still be Europe and North America. One of the main areas projected to favour an increase in the number of manufacturers and producers of swine feed is the US.

Asia-Pacific is one of the leading regions for the swine feed market. The region has a large population of pigs and a growing demand for pork. Pork is a popular meat in Asia-Pacific, and the region's consumers are willing to pay premium prices for high-quality pork products.

Germany is the third-largest pork producer in the European Union and the fifth-largest globally. the largest importer of German pork.

The German swine feed market is one of the largest in the world. With over 20 million pigs, the country has a significant demand for pig feed. The majority of the market is controlled by a few large companies, such as Cargill, ADM, and Bunge.

Zootechnical feed additives are substances that are added to pig feed in order to improve the quality of the feed or the health of the pig. There are a variety of zootechnical feed additives available, and they can be used for different purposes. Some zootechnical feed additives are used to improve the digestibility of the feed, while others are used to provide essential nutrients that the animal may not be getting from their diet. Still others are used to prevent disease or promote growth. Zootechnical feed additives can be very beneficial for animals, and they should be used according to the specific needs of each animal.

Sensory feed additives can improve the taste, smell, and texture of feed, making it more palatable for animals. However, others argue that sensory feed additives are unnecessary and can even be harmful to animals.

The use of sensory feed additives is regulated by the FDA, but there is still much debate over whether or not they are safe and effective. Some studies have shown that certain sensory feed additives can help improve the growth and development of animals, while other studies have shown no significant benefits.

The jury is still out on whether or not sensory feed additives are truly beneficial for animals. However, if you do decide to use them, it is important to do your research and choose a reputable brand.

There are many different types of nutritional feed additives available on the market. Some of the most popular include vitamins, minerals, and amino acids. These products can help improve the health and performance of your livestock.

Vitamins are essential for the proper function of many body processes. They can be found in a variety of foods, but sometimes it is necessary to supplement your animals' diet with a vitamin supplement. Minerals are also important for proper health. They can be found in both plant and animal sources, but sometimes it is necessary to supplement your animals' diet with a mineral supplement. Amino acids are the building blocks of proteins and are necessary for proper growth and development.

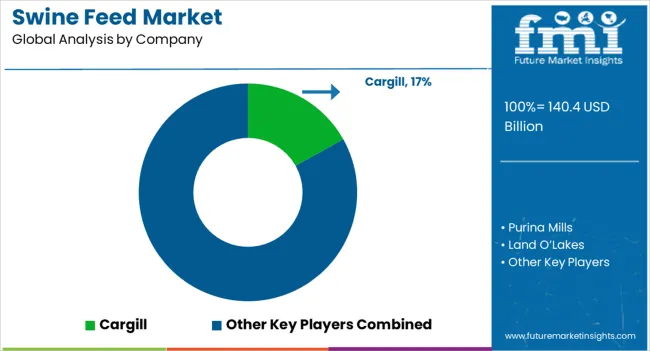

The global market for swine feed market is fragmented and home to various regional and international rivals. Players are heavily concentrating on delivering consumers novel options in their products.

Swine feed market leaders are advancing by concentrating on elements like technological developments and inventions that can simplify customers' work and help them attract more clients.

In a recently published Research, FMI offered comprehensive information regarding the price points of swine feed manufacturers positioned across geographies, sales growth, production capacity, and speculative production expansion.

The FMI team has been keeping track of recent changes involving businesses that provide swine feed, and those changes are included in the entire report.

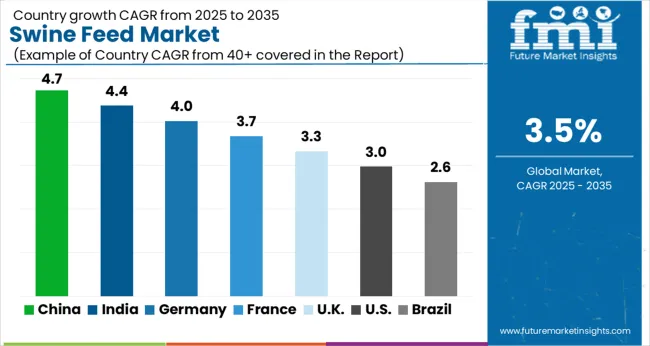

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

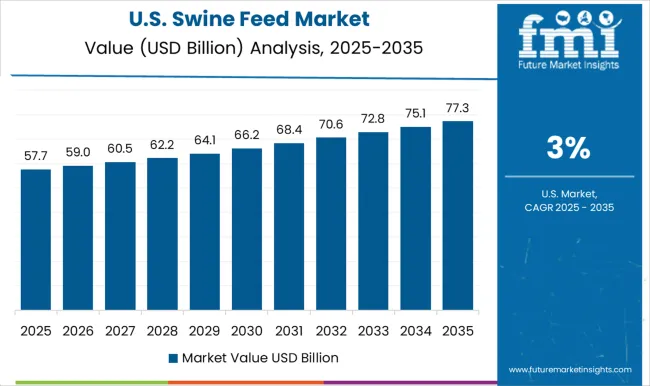

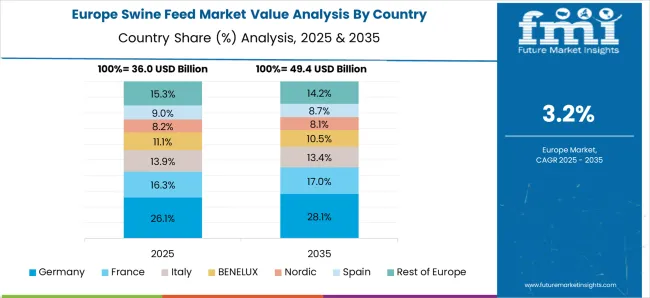

The Swine Feed Market is expected to register a CAGR of 3.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.7%, followed by India at 4.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Swine Feed Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.0%. The USA Swine Feed Market is estimated to be valued at USD 52.5 billion in 2025 and is anticipated to reach a valuation of USD 70.4 billion by 2035. Sales are projected to rise at a CAGR of 3.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 7.6 billion and USD 3.6 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 140.4 Billion |

| Fodder Type | Pig grower feed, Sow feed, Starter feed, and Others |

| Feed Additive Types | Nutritional feed additives, Zootechnical feed additives, and Sensory feed additives |

| Feed Essence | Amino acids, Vitamins, Antioxidants, Feed acidifiers, Antibiotics, Feed enzymes, and Others |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill, Purina Mills, Land O’Lakes, Chr. Hansen, Lallemand Inc., Royal DSM Holdings Limited., BASF Limited., Novus International Inc., Archer Daniels Midland Company., and Kent Feeds. |

The global swine feed market is estimated to be valued at USD 140.4 billion in 2025.

The market size for the swine feed market is projected to reach USD 198.0 billion by 2035.

The swine feed market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in swine feed market are pig grower feed, sow feed, starter feed and others.

In terms of feed additive types, nutritional feed additives segment to command 52.3% share in the swine feed market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Swine Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Swine Respiratory Diseases Treatment Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA