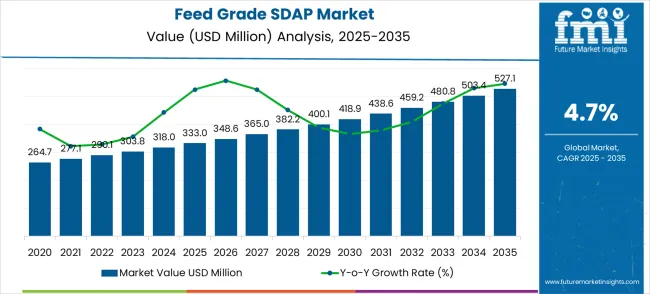

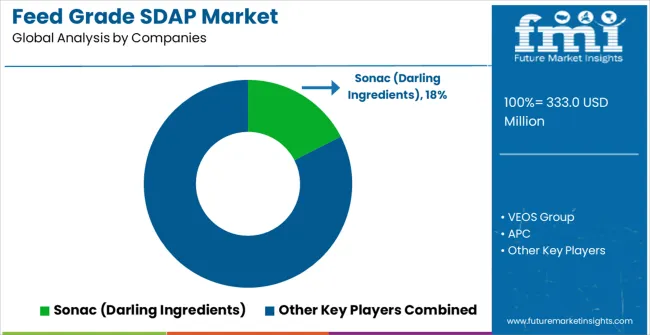

The feed grade spray-dried animal plasma (SDAP) market, valued at USD 333.0 million in 2025 and projected to reach USD 527.1 million by 2035 at a CAGR of 4.7%, exhibits a gradual approach toward market saturation over the forecast period. Early growth from 2025 to 2028 (USD 333.0 million to USD 365.0 million) reflects moderate adoption driven by expanding livestock feed applications and increasing awareness of SDAP benefits in animal nutrition. Growth momentum starts to decelerate post-2030, with incremental gains narrowing to USD 23–24 million annually. This slowdown indicates approaching saturation in key regional markets, constrained by feed formulation limits, price sensitivity, and finite demand in established livestock production systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 333 million |

| Market Forecast Value (2035) | USD 527.1 million |

| Forecast CAGR (2025–2035) | 4.7% |

Between 2025 and 2030, the SDAP market expands from USD 333 million to USD 400.1 million, reflecting steady adoption in swine and poultry feed applications. This early-stage growth is fueled by increasing investments in high-protein feed solutions and improvements in livestock performance efficiency. Despite the positive growth trend, penetration remains limited in smaller-scale farms due to cost considerations and logistical constraints. The CAGR during this period is relatively stable at approximately 4.7%, indicating that while demand is growing, the market has not yet reached a saturation point. Manufacturers focus on expanding distribution channels, improving product awareness, and enhancing formulation efficacy to capture untapped segments before growth plateaus.

From 2031 to 2035, the SDAP market moves from USD 418.9 million to USD 527.1 million, with annual increments gradually tapering. This deceleration highlights the onset of market saturation, particularly in mature regions where SDAP adoption has peaked. Factors contributing to slowed growth include price sensitivity, the finite number of livestock operations able to integrate SDAP, and the emergence of alternative feed proteins. Incremental revenue gains shrink compared to early-stage growth, signaling diminishing opportunities for aggressive expansion. At this stage, market players are likely to focus on premium formulations, efficiency enhancements, and niche applications to sustain growth. Saturation point indicators suggest a plateau approaching by 2035, emphasizing the importance of innovation to maintain market relevance.

Market expansion is being supported by the growing global protein demand across emerging economies and the corresponding need for high-quality protein sources in livestock, aquaculture, and pet nutrition applications. Modern animal production operations require superior protein ingredients with functional properties to ensure optimal growth performance and health outcomes. The excellent nutritional profile and bioactive properties of spray-dried animal plasma make it an essential component in premium feed formulations where enhanced digestibility and immune support are critical.

The growing emphasis on animal health and performance optimization is driving demand for functional feed ingredients from certified manufacturers with proven track records of quality and safety. Feed manufacturers are increasingly investing in premium protein ingredients that offer improved nutritional value and functional benefits over conventional protein sources. Regulatory requirements and quality standards are establishing nutritional benchmarks that favor scientifically validated plasma protein solutions with documented performance benefits.

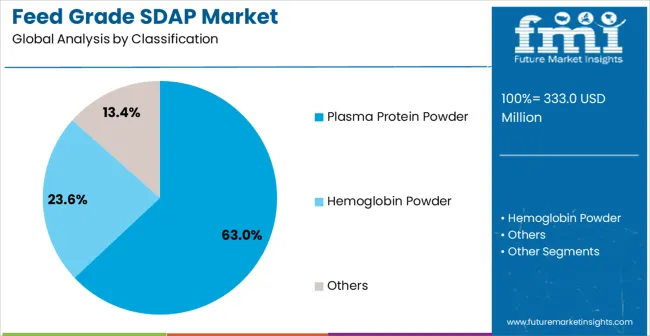

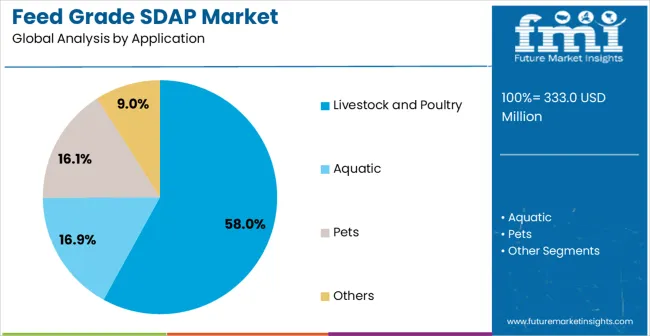

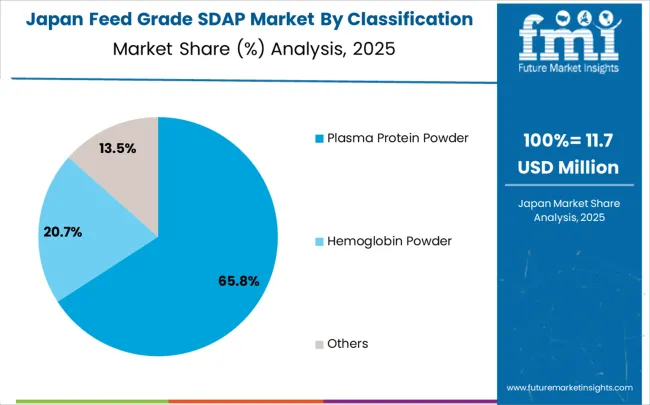

The market is segmented by product form, application, and region. By product composition, the market is divided into plasma protein powder, hemoglobin powder, and other plasma derivatives. Based on application, the market is categorized into livestock and poultry, aquatic feed, pet food, and other animal feed applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The plasma protein powder segment is projected to account for 63% of the feed grade spray-dried animal plasma market in 2025, reinforcing its position as the leading product form. Its dominance is supported by superior nutritional quality, bioactive protein content, and functional benefits that enhance growth performance, immune support, and palatability in swine, poultry, and aquaculture feed formulations. Plasma protein powder provides highly digestible proteins, including immunoglobulins and albumins, that contribute to improved feed conversion ratios, enhanced health outcomes, and better growth performance in young animals.

Modern production processes utilize advanced spray-drying and quality control techniques to maintain bioactive compound integrity, microbial safety, and consistent nutritional quality. Livestock, aquaculture, and premium pet food sectors are major demand drivers, seeking high-quality protein sources that ensure optimal growth, health, and immune support. Adoption is further accelerated by ongoing research validation and integration of functional ingredients for performance-driven feed solutions.

The livestock and poultry application segment is expected to represent 58% of feed grade spray-dried animal plasma demand in 2025, making it the largest application category. Demand is fueled by the proven benefits of plasma proteins in promoting growth, improving feed intake, and supporting immune system development in swine and poultry. These applications require high-quality protein sources to maintain production efficiency, optimize animal health, and meet consumer expectations for superior meat and egg quality.

Livestock and poultry operations benefit from plasma protein inclusion in feed formulations to manage stress, accelerate growth phases, and reduce reliance on antibiotics. Adoption is further strengthened by industry trends toward intensive farming, genetic improvements, and premium nutrition programs that incorporate bioactive proteins. Major production regions in Asia-Pacific, North America, and Europe contribute significantly to market growth as producers seek scientifically validated ingredients that enhance performance and profitability.

The feed grade spray-dried animal plasma market is advancing steadily due to increasing global protein demand and growing recognition of functional feed ingredient importance. However, the market faces challenges including raw material availability constraints, regulatory complexities across different regions, and varying acceptance levels of animal-derived ingredients in different markets. Quality assurance programs and traceability systems continue to influence product acceptance and market development patterns.

The growing implementation of sophisticated spray-drying systems and comprehensive quality control programs is enabling enhanced product safety, nutritional consistency, and functional property preservation in plasma protein manufacturing. Advanced processing technologies provide precise control over particle size, moisture content, and biological activity while ensuring microbial safety and extended shelf life. These technologies are particularly important for maintaining product quality during storage and transportation to global markets requiring consistent nutritional performance.

Modern plasma protein manufacturers are incorporating targeted processing approaches and specialized formulations that optimize nutritional properties for specific animal species and production phases. Integration of species-specific research data and customized processing parameters enables enhanced biological activity and improved performance outcomes compared to generic plasma protein products. Advanced formulation technologies and application research also support development of specialized products for emerging applications in functional pet foods and premium aquaculture feeds.

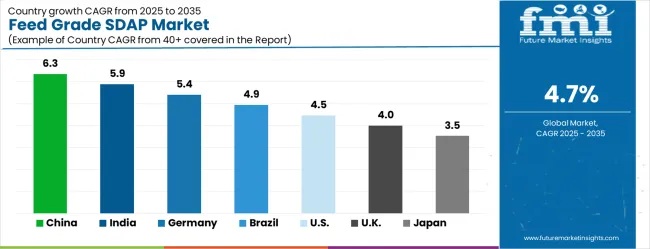

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| United States | 4.5% |

| United Kingdom | 4.0% |

| Japan | 3.5% |

The feed grade spray-dried animal plasma market is growing rapidly, with China leading at a 6.3% CAGR through 2035, driven by massive livestock production expansion, aquaculture development, and increasing demand for high-quality animal protein. India follows at 5.9%, supported by rising livestock farming modernization and growing awareness of premium feed ingredients in poultry and dairy sectors. Germany records strong growth at 5.4%, emphasizing quality standards, advanced animal nutrition, and sustainable livestock production practices. Brazil grows steadily at 4.9%, integrating plasma proteins into expanding livestock and aquaculture operations. The United States shows moderate growth at 4.5%, focusing on feed technology innovations and performance optimization. The United Kingdom maintains steady expansion at 4.0%, supported by premium pet food development and livestock nutrition programs. Japan demonstrates stable growth at 3.5%, emphasizing quality and specialized animal nutrition applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The feed grade spray-dried animal plasma market in China is projected to grow at a CAGR of 6.3% through 2035, driven by rapid livestock expansion, intensifying aquaculture programs, and rising demand for high-quality protein ingredients. China is exceeding other countries in large-scale swine, poultry, and aquaculture production, with feed manufacturers competing to supply premium plasma protein solutions. Advanced sourcing networks are being implemented to meet nutritional standards and production efficiency goals. Competition with Brazil and India is intensifying as technology providers aim to deliver reliable, scientifically validated solutions. Government programs supporting agricultural modernization and health-focused animal nutrition are further enhancing adoption rates across intensive livestock farms and aquaculture operations nationwide.

The feed grade spray-dried animal plasma market in India is forecasted to expand at a CAGR of 5.9% through 2035, supported by modernization of livestock farming, growing poultry and dairy production, and increasing feed sector development. India is emerging as a key growth market for high-performance protein ingredients, with domestic and international suppliers competing to address diverse livestock nutrition needs. Industrial-scale farms are integrating advanced feed solutions to enhance animal performance, meet safety standards, and improve production efficiency. Competition with China and Brazil is driving innovation in ingredient quality and cost-effective formulations. Agricultural modernization initiatives and productivity enhancement programs are facilitating adoption of scientifically validated plasma proteins across major poultry and swine regions.

The feed grade spray-dried animal plasma market in Germany is projected to grow at a CAGR of 5.4% through 2035, fueled by stringent quality standards, scientific validation requirements, and demand for premium animal nutrition solutions. Germany is growing as a European hub for advanced feed formulations, with manufacturers focusing on swine, poultry, and aquaculture sectors. Domestic feed suppliers are competing with international entrants to provide scientifically proven and high-performance plasma proteins. Regional competition with France and the Netherlands encourages innovation in nutritional efficiency and safety compliance. Investments in animal welfare programs and industrial-scale livestock operations are supporting the integration of validated plasma protein ingredients to meet evolving regulatory and health standards.

The feed grade spray-dried animal plasma market in Brazil is expected to grow at a CAGR of 4.9% through 2035, driven by increasing livestock and aquaculture production, export-oriented farming, and rising feed quality standards. Brazil is expanding as a key Latin American market, with feed manufacturers competing to deliver premium protein ingredients that optimize animal health and production. Swine, poultry, and aquaculture producers are adopting advanced plasma protein formulations to meet regulatory requirements and enhance efficiency. Competition with China and India is notable for high-performance ingredient adoption. Industrial modernization and export-oriented nutrition programs are facilitating integration of scientifically proven feed solutions, supporting robust growth across the Brazilian animal protein sector.

The feed grade spray-dried animal plasma market in the United States is projected to grow at a CAGR of 4.5% through 2035, driven by feed industry innovation, performance optimization programs, and demand for scientifically validated protein solutions. USA livestock and aquaculture producers are integrating advanced feed ingredients to improve nutritional outcomes, growth rates, and operational efficiency. Domestic suppliers are competing with global providers, particularly from Brazil and Germany, to deliver cost-effective and high-performance solutions. Research and development initiatives and technology advancement programs are further stimulating market growth. Feed formulations focusing on safety, consistency, and compliance with evolving agricultural standards are being prioritized by major production facilities nationwide.

The feed grade spray-dried animal plasma market in the United Kingdom is projected to grow at a CAGR of 4.0% through 2035, supported by premium pet food initiatives, advanced livestock nutrition programs, and increasing demand for high-quality protein ingredients. UK manufacturers and feed suppliers are investing in validated plasma protein solutions to meet domestic and export market expectations. Competition with Germany and France is encouraging innovation in ingredient quality, safety compliance, and nutritional performance. Pet food development programs and livestock operations are driving adoption of specialized feed ingredients, ensuring optimal health, growth, and performance. Regulatory compliance, quality standards, and consumer awareness are shaping ingredient selection and market penetration.

The feed grade spray-dried animal plasma market in Japan is expected to grow at a CAGR of 3.5% through 2035, driven by high-quality animal nutrition focus, specialized feed formulations, and continuous innovation in protein ingredients. Japan is emerging as a leader in precision animal nutrition, with domestic feed manufacturers emphasizing safety, consistency, and scientifically validated ingredient performance. The market faces competition from China and Germany for adoption in swine, poultry, and aquaculture sectors. Premium protein solutions are being integrated into specialized livestock operations to support growth, health, and export-oriented production. Research-driven development programs ensure continuous improvement and alignment with global quality standards.

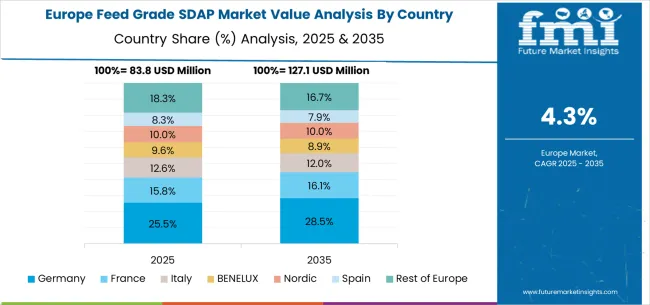

The feed grade spray-dried animal plasma (SDAP) market in Europe is projected to grow from USD 83.8 million in 2025 to USD 127.1 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to remain the largest national market with 25.5% share in 2025, rising to 28.5% by 2035, supported by its strong livestock base and advanced feed manufacturing infrastructure. The United Kingdom follows with 18.5% in 2025, easing slightly to 16.1% by 2035 as premium pet food development and livestock nutrition programs continue to expand. France accounts for 15.5% in 2025, declining to 14.6% by 2035 amid growing focus on livestock feed modernization and aquaculture applications.

Italy holds 12.6% in 2025, softening to 11.6% by 2035 as livestock and pet feed adoption trends remain steady. Spain represents 9.0% in 2025, moderating to 8.9% by 2035, reflecting consistent demand from livestock producers. BENELUX countries contribute 9.2% in 2025, remaining near 9.2% by 2035, while the Nordic region accounts for 8.3% in 2025, dipping slightly to 7.9% by 2035 with steady livestock integration. The remainder of Europe (Eastern Europe and other emerging markets) collectively rises from 1.8% in 2025 to 2.2% by 2035, reflecting accelerating livestock and feed industry development in emerging European markets.

The feed grade spray-dried animal plasma market is defined by competition among established protein processing companies, specialized animal nutrition manufacturers, and regional feed ingredient suppliers. Companies are investing in advanced processing technologies, product innovation, quality assurance systems, and technical support capabilities to deliver safe, nutritious, and cost-effective plasma protein solutions. Strategic partnerships, research collaboration, and geographic expansion are central to strengthening product portfolios and market presence.

Sonac (Darling Ingredients), operating globally, offers comprehensive spray-dried animal plasma solutions with focus on quality processing, safety assurance, and technical support services. VEOS Group provides specialized plasma protein products with emphasis on nutritional consistency and application expertise. APC, established provider, delivers high-quality animal plasma ingredients for feed applications with focus on safety and performance. Lican Food offers comprehensive plasma protein technologies with standardized processing and quality control systems.

Haripro provides specialized animal nutrition ingredients with emphasis on custom solutions and technical expertise. Yeruvá S.A. delivers regionally focused plasma protein solutions with focus on livestock applications. Zhejiang Mecore Bioengineering offers comprehensive processing solutions for demanding feed applications. Anhui Runtai Feed Technology provides advanced plasma protein systems with regional manufacturing capabilities.

Linyi Jiyu Protein, Jiangsu Yongsheng Biotechnology, and Tianjin Baodi Agricultural Technology offer specialized processing expertise, regional manufacturing capabilities, and technical support across domestic and regional networks.

The feed grade spray-dried animal plasma market underpins animal nutrition optimization, livestock productivity, aquaculture development, and sustainable protein production. With quality assurance mandates, stricter safety requirements, and demand for functional feed ingredients, the sector must balance cost competitiveness, nutritional efficacy, and regulatory compliance. Coordinated contributions from governments, industry bodies, OEMs/processors, suppliers, and investors will accelerate the transition toward quality-assured, scientifically validated, and sustainably produced plasma protein ingredients.

| Items | Values |

|---|---|

| Quantitative Units | USD 333 million |

| Classification Type | Plasma Protein Powder, Hemoglobin Powder, Others |

| Application | Livestock and Poultry, Aquatic, Pets, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Sonac (Darling Ingredients), VEOS Group, APC, Lican Food, Haripro, Yeruvá S.A., Zhejiang Mecore Bioengineering, Anhui Runtai Feed Technology, Linyi Jiyu Protein, Jiangsu Yongsheng Biotechnology, Tianjin Baodi Agricultural Technology |

| Additional Attributes | Dollar sales by product form and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established processors and emerging suppliers, buyer preferences for plasma protein powder versus hemoglobin powder formulations, integration with advanced processing and quality assurance technologies, innovations in spray-drying and nutritional preservation for enhanced product quality and shelf life, and adoption of specialized formulations with targeted nutritional profiles and functional properties for improved animal performance and health outcomes. |

The global feed grade spray-dried animal plasma (SDAP) market is estimated to be valued at USD 333.0 million in 2025.

The market size for the feed grade spray-dried animal plasma (SDAP) market is projected to reach USD 527.1 million by 2035.

The feed grade spray-dried animal plasma (SDAP) market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in feed grade spray-dried animal plasma (SDAP) market are plasma protein powder, hemoglobin powder and others.

In terms of application, livestock and poultry segment to command 58.0% share in the feed grade spray-dried animal plasma (SDAP) market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA