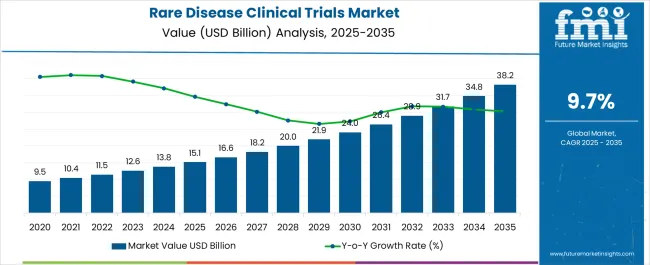

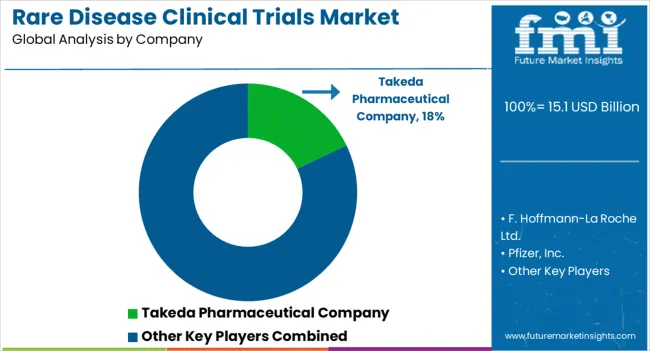

The Rare Disease Clinical Trials Market is estimated to be valued at USD 15.1 billion in 2025 and is projected to reach USD 38.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Rare Disease Clinical Trials Market Estimated Value in (2025 E) | USD 15.1 billion |

| Rare Disease Clinical Trials Market Forecast Value in (2035 F) | USD 38.2 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The rare disease clinical trials market is experiencing steady momentum driven by growing investment in precision medicine, regulatory incentives, and advancements in genetic research. Increasing prevalence of rare conditions alongside unmet medical needs has encouraged both public and private stakeholders to prioritize clinical programs in this domain.

Supportive frameworks such as orphan drug designations, tax credits, and fast track approvals are accelerating trial initiation and execution. Innovations in biomarkers, adaptive trial designs, and decentralized models are improving patient recruitment and retention, which remain significant challenges in rare disease research.

Collaborative efforts between industry, academia, and patient advocacy groups are also contributing to enhanced trial efficiency and greater patient access. With continued emphasis on targeted therapies and expanding genomic databases, the market outlook remains positive, offering strong potential for therapeutic breakthroughs and long term growth opportunities.

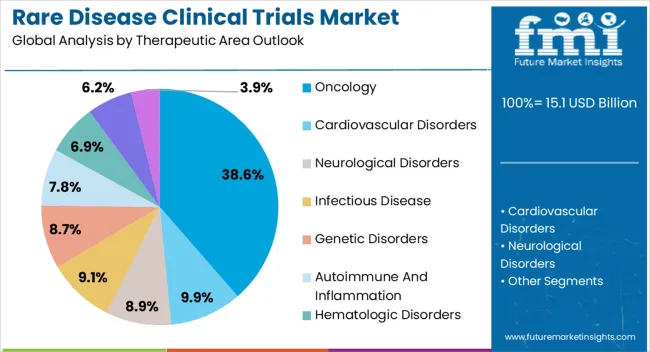

The oncology therapeutic area segment is projected to represent 38.60% of total market revenue by 2025, making it the leading therapeutic category. This dominance is being driven by the rising incidence of rare cancers, increased focus on targeted treatments, and significant investment in oncology focused clinical programs.

High mortality rates and the urgent demand for effective therapies have prompted greater funding allocation and regulatory support for oncology based rare disease trials.

Additionally, advances in molecular profiling and personalized medicine are enabling more precise trial designs, further strengthening oncology’s position as the largest therapeutic segment.

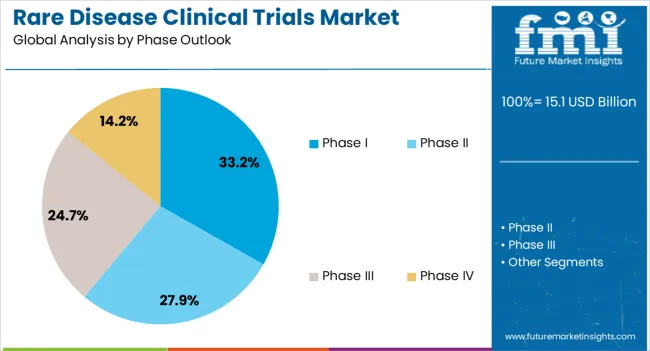

The Phase I segment is expected to account for 33.20% of total market revenue by 2025, positioning it as the most prominent phase category. This is attributed to the surge in early stage drug development for rare conditions, where proof of concept studies and safety evaluations are critical.

Regulatory flexibility and supportive frameworks have encouraged sponsors to initiate Phase I programs with streamlined processes.

Increased adoption of adaptive trial designs and biomarker driven enrollment strategies have enhanced the feasibility of conducting Phase I trials in small patient populations, consolidating their importance in the rare disease trial landscape.

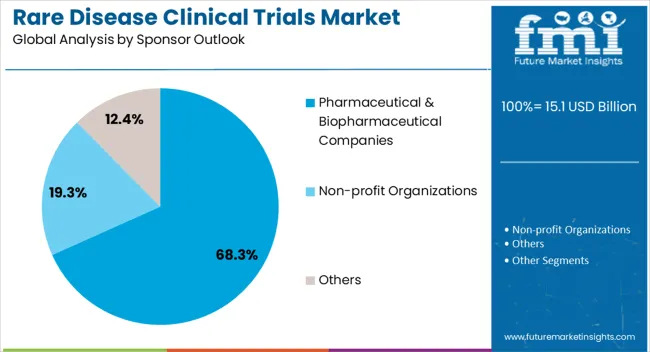

The pharmaceutical and biopharmaceutical companies segment is projected to hold 68.30% of market revenue by 2025, making it the dominant sponsor category. This is supported by their strong financial resources, advanced R&D infrastructure, and capacity to navigate complex regulatory pathways.

Strategic partnerships, licensing agreements, and collaborations with research institutions have further bolstered their capabilities in conducting rare disease trials. These companies are also leveraging orphan drug incentives and fast track programs to accelerate the development and commercialization of novel therapies.

As a result, pharmaceutical and biopharmaceutical companies continue to lead the sponsor outlook, shaping the trajectory of rare disease clinical research.

The rare disease clinical trials market was valued at USD 11,455.0 million in 2025 with a substantial growth trajectory of 8.9% between the analysis period of 2020 to 2025.

Future Market Insights expects the rare disease clinical trials market to expand at a CAGR of 9.7% during the forecast period of 2025 to 2035. The growth can be attributed to the following reasons

Considering the above-mentioned factors, FMI opines, the rare disease clinical trials market is likely to witness a market value of USD 31,715.25 million by the end of 2035.

In 2025, the oncology segment held a notable share of 33.9%. A few of the key factors fueling the segment growth are

For example, in January 2025, the USFDA approved atezolizumab (Tecentriq), an immunotherapy drug for advanced alveolar soft part sarcoma patients (ASPS).

During the forecast period, the infectious disease segment is expected to expand at an exponential rate of 10.6%. Acanthamoeba keratitis, Q fever, Marburg virus, and other rare infectious diseases are examples. As these rare diseases are fatal, researchers are hugely interested in developing treatments and vaccines for them.

Contact lens wearers are likely to develop Acanthamoeba keratitis. Over 85% of people in the United States wear contact lenses. This increases the risk of disease and fuels the demand for treatment. These factors are assisting segment growth.

In 2025, Phase II had a notable share of 42.6%. Phase II studies are divided into two parts: the first part includes dose range exploration as well as efficacy studies, while the second part includes dose finalization. Over 100-300 participants are recruited for Phase II clinical trials.

The phase II segment had the most registered clinical studies as of November 2025. The ClinicalTrial.gov portal had 72,522 studies registered as of November 2025. The high amount of Phase II clinical trials is driving the segment's growth.

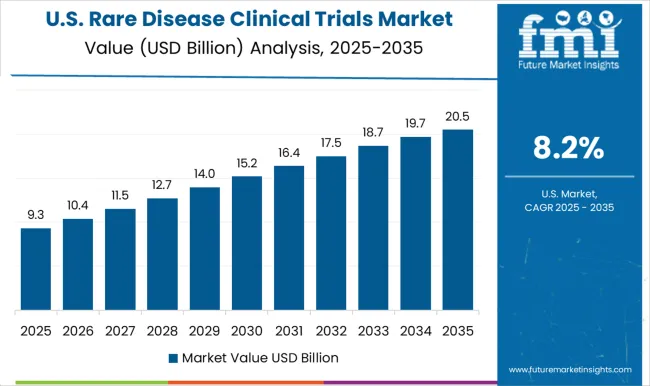

The United States has a well-established regulatory framework for rare disease clinical trials, with the Orphan Drug Act of 1983. It provides incentives for the development of drugs for rare diseases. The FDA's Breakthrough Therapy Designation program has also facilitated the development of drugs for rare diseases. Additionally, the National Institutes of Health (NIH) has established a Rare Diseases Clinical Research Network (RDCRN) to facilitate the conduct of clinical trials for rare diseases.

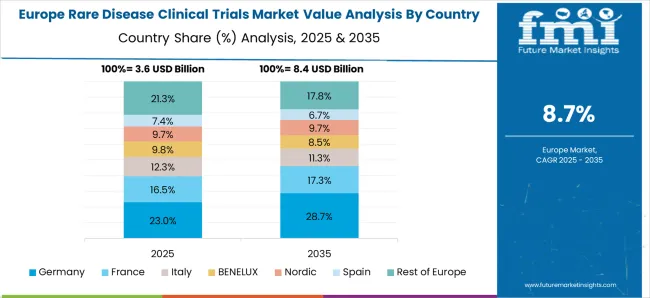

Europe is a significant market for rare disease clinical trials, with countries like Germany, France, and the United Kingdom accounting for a significant share of the market. The European Medicines Agency (EMA) has been proactive in offering regulatory support for rare disease drug development. Therefore, the support from several agencies has increased the clinical trials in Europe.

Asia Pacific is a significantly growing market for rare disease clinical trials, with countries like China, Japan, and India emerging as key players. The region offers a substantial patient population and low trial costs compared to Western countries. Making it an attractive destination for colossal clinical trials. However, the regulatory environment in some countries can be challenging, and there is a need for great awareness and education about rare diseases.

Latin America is an emerging market for rare disease clinical trials, with countries like Brazil and Mexico. The region offers a diverse patient population and low trial costs compared to North America and Europe. However, there are challenges in terms of regulatory compliance and infrastructure, which can limit the growth of the market.

The Middle East and Africa region is a small but growing market for rare disease clinical trials. Countries like South Africa and Israel are emerging as key players due to their advanced healthcare infrastructure and supportive regulatory environment. However, there are challenges related to political instability, low awareness about rare diseases, and limited healthcare resources in some parts of the region.

The rare disease clinical trials market is highly competitive, with several global players operating in the space. Some key players in the market include

In addition to these companies, there are many other small CROs and specialized service providers operating in the rare disease clinical trials market. As the market continues to grow, competition among these companies is expected to increase. These players are competing on factors such as service quality, expertise, and pricing.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.7% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Therapeutic Area, By Sponsor, By Phases, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa;Oceania |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, Italy, France, The United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Takeda Pharmaceutical Company; F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; AstraZeneca; Novartis AG; LabCorp; IQVIA, Inc.; Charles River Laboratories; Icon PLC; Parexel International Corporation |

| Customization & Pricing | Available upon Request |

The global rare disease clinical trials market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the rare disease clinical trials market is projected to reach USD 38.2 billion by 2035.

The rare disease clinical trials market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in rare disease clinical trials market are oncology, cardiovascular disorders, neurological disorders, infectious disease, genetic disorders, autoimmune and inflammation, hematologic disorders, musculoskeletal disorders and others.

In terms of phase outlook, phase i segment to command 33.2% share in the rare disease clinical trials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rare Earth FeSiMg Nodularizers Market Size and Share Forecast Outlook 2025 to 2035

Rare-earth Barium Copper Oxide (REBCO) Wire Market Size and Share Forecast Outlook 2025 to 2035

Rare Gas Market Size and Share Forecast Outlook 2025 to 2035

Rare Sugar Market Size and Share Forecast Outlook 2025 to 2035

Rare NRG1 Fusion Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Rare Earth Elements Companies

Rare Earth Metals Market Demand & Trends 2024-2034

Rare Disease Gene Therapy Market

Rare Neurological Disease Treatment Market Report – Demand, Growth & Industry Outlook 2025-2035

Rare Inflammatory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Rare Neurological Disease Treatment Providers

Rare Gastrointestinal Diseases Treatment Market Trends and Forecast 2025 to 2035

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermography Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Infrared Search and Track (IRST) Systems Market Analysis - Growth & Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Infrared (IR) LEDs Market by Component by Application & Region Forecast till 2035

Infrared Imaging Market

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA