The celiac disease diagnostics market is valued at USD 343.29 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 8.3% and reach USD 740.65 million by 2035.

In 2024, the industry saw a meaningful increase in diagnostic activity, particularly in developed regions such as North America and Western Europe. Clinical adoption of tissue transglutaminase (tTG-IgA) and endomysial antibody (EMA) testing increased as more primary care providers included celiac screening for patients with persistent gastrointestinal symptoms and related autoimmune conditions.

There was a rise in testing among pediatric populations due to enhanced school-level awareness campaigns. Laboratories also expanded their offerings to include multi-marker panels for more accurate diagnosis.

Meanwhile, digital health platforms began integrating celiac risk assessment tools, making early detection more accessible. Despite these advancements, uptake in low- and middle-income countries remained limited due to lack of infrastructure and awareness, leading to under diagnosis.

In 2025 and beyond, the industry is expected to benefit from ongoing innovation in non-invasive diagnostics and home-based testing kits. Public health efforts aimed at increasing awareness and early diagnosis are likely to expand the tested population. Growth in gluten-free food industries may also contribute indirectly by encouraging more people to seek testing and understand their dietary needs.

Market Share Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 343.29 million |

| Industry Value (2035F) | USD 740.65 million |

| CAGR (2025 to 2035) | 8.3% |

The celiac disease diagnostics industry is on a strong growth trajectory, driven by rising awareness, improved screening technologies, and increased diagnosis rates globally. Key drivers include advancements in non-invasive testing and broader physician adoption of routine screening, especially in high-risk populations. Diagnostic companies, digital health platforms, and specialized labs stand to benefit, while regions with limited healthcare access risk being left behind.

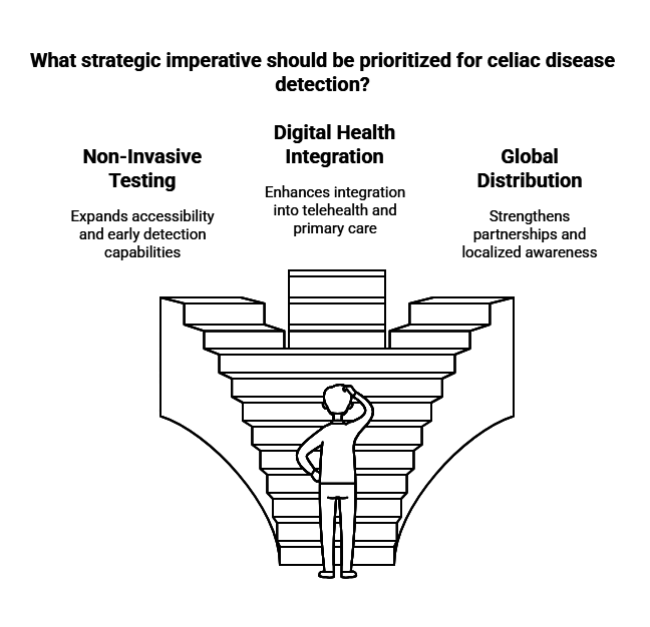

Expand Non-Invasive Testing Capabilities

Invest in the development and commercialization of non-invasive and home-based diagnostic tools to capture the growing demand for accessible and early-stage celiac disease detection.

Align with Digital Health Integration

Collaborate with digital health platforms to integrate celiac screening tools and risk assessment features into routine telehealth and primary care workflows, aligning with evolving patient and provider preferences.

Strengthen Global Distribution and Partnerships

Build strategic partnerships with regional labs, public health agencies, and healthcare providers-especially in underdiagnosed industries to expand reach, enhance distribution, and accelerate adoption through localized awareness campaigns.

| Risk | Probability - Impact |

|---|---|

| Limited diagnostic access in low-income regions | Medium - High |

| Reimbursement challenges and regulatory delays | High - Medium |

| Misdiagnosis due to inconsistent testing protocols | Medium - High |

| Priority | Immediate Action |

|---|---|

| Expand Non-Invasive Test Portfolio | Conduct feasibility study on launching saliva- or stool-based test kits |

| Strengthen Provider Engagement | Initiate feedback loop with clinicians on diagnostic accuracy and usability |

| Boost Industry Penetration in Emerging Regions | Launch regional awareness and diagnostic training pilot with local partners |

To stay ahead, companies must prioritize innovation in non-invasive diagnostics and accelerate partnerships with digital health platforms to embed celiac screening into everyday care. This intelligence signals a shift toward earlier, decentralized testing and rising demand in currently underpenetrated industries.

Executives should realign their roadmap to focus on R&D for easy-to-use test kits, expand provider education programs, and pursue targeted geographic expansion through public-private partnerships. Acting now positions the company to lead in an industry that’s rapidly moving toward proactive, accessible celiac disease detection.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across diagnostic manufacturers, gastroenterologists, hospitals, and diagnostic labs across North America, Western Europe, India, and Japan)

| Countries | Policies and Regulations Impacting the Celiac Disease Diagnostics Industry |

|---|---|

| United States | The FDA regulates medical devices, including diagnostic tests for celiac disease, requiring preindustry approval or clearance. Additionally, the FDA defines "gluten-free" labeling standards for food products. |

| United Kingdom | The Medicines and Healthcare products Regulatory Agency (MHRA) oversees the approval of diagnostic tests. The NHS provides gluten-free food prescriptions to diagnosed patients. |

| France | The French National Authority for Health (HAS) evaluates medical devices, including celiac disease diagnostics, for reimbursement eligibility. |

| Germany | The Federal Institute for Drugs and Medical Devices (BfArM) regulates diagnostic tests, ensuring compliance with EU directives. |

| Italy | Implemented a national pediatric screening program for type 1 diabetes and celiac disease in 2024, with allocated funding and a monitoring observatory. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates medical devices, including diagnostic tests, requiring approval before industry entry. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval process for diagnostic tests, ensuring safety and efficacy. |

| China | The National Medical Products Administration (NMPA) requires registration and approval of diagnostic tests, adhering to national standards. |

| Australia & New Zealand | The Therapeutic Goods Administration (TGA) and Medsafe regulate diagnostic tests, ensuring compliance with stringent labeling laws for gluten-free products. |

Genetic rapid testing kits are expected to lead with the highest CAGR of 8.6% from 2025 to 2035. This growth is driven by increasing consumer preference for personalized medicine and the rising awareness of genetic predispositions toward celiac disease. These kits offer fast, accurate, and convenient home-based or clinical testing, which aligns with the growing demand for early diagnostics.

With advancements in genetic screening technology and the falling cost of genome testing, adoption is rising across both developed and emerging industrys. Compared to traditional serological testing, genetic kits provide more conclusive and lifelong diagnostic value, making them a future-proof choice for clinicians and end-users alike.

Enzyme-linked immunosorbent assay (ELISA) holds the highest CAGR within the techniques segment at 8.7% for 2025 to 2035. ELISA continues to dominate due to its superior sensitivity and specificity in detecting celiac-related antibodies, especially transglutaminase and endomysial antibodies. Its application across both clinical laboratories and research settings is widespread, particularly in hospitals and diagnostic labs.

Increasing demand for high-throughput screening methods and the integration of ELISA into automated platforms further enhances its scalability and reliability. While lateral flow methods are popular for point-of-care, ELISA remains the gold standard in confirmatory diagnostics, thereby securing its stronghold in regulated and high-accuracy diagnostic environments.

Among sample types, blood serum is projected to grow at the highest CAGR of 8.4% over the forecast period. This is primarily due to its well-established role in detecting autoimmune responses through various serological markers in celiac disease. Blood serum remains the most preferred sample medium for ELISA-based and rapid serology kits, ensuring accuracy in both initial screening and follow-up tests.

Healthcare professionals trust blood serum analysis for its high reliability and compatibility with a range of testing techniques. As diagnostic infrastructure improves globally and access to laboratory services expands, serum-based testing is likely to continue its dominance in the diagnostic process.

Diagnostic laboratories will emerge as the fastest-growing end user category, with a CAGR of 8.5% from 2025 to 2035. The central role of diagnostic labs in performing confirmatory and high-complexity tests using ELISA or genetic testing methods has significantly increased their relevance. Rising referrals from hospitals and clinics, growing investment in lab infrastructure, and adoption of automation in testing processes are key contributors to this growth.

Additionally, labs offer centralized testing services that support both public and private healthcare institutions. Their ability to deliver accurate results on a large scale positions them as a backbone in the expanding diagnostics ecosystem for celiac disease detection.

Sales in the USA are anticipated to grow at 8.1% CAGR from 2025 to 2035 This increase is propelled by increased awareness of gluten intolerance, enhanced insurance coverage for diagnostics, and robust advocacy from groups like the Celiac Disease Foundation.

Widespread availability of point-of-care testing and growing acceptance of living a gluten-free lifestyle as a preventative measure has helped accelerate early detection rates.

The industry’s growth is further boosted by ongoing technological advancements and R&D investments from the prominent players in molecular diagnostics. However, it is fragmented, with regional disparities in availability of healthcare and differences in reimbursement models. Collaborating with primary care providers can help to increase diagnosis rates in resource-poor areas.

Sales in UK is estimated to grow at a CAGR of 8.7% during this time period. The NHS remains pivotal in early screening and diagnosing particularly in at-risks. The new Gluten Sensitivity recommendations, coupled with a burgeoning gluten-free product industry, offer policy-level support for eliminating diagnostic delays and increased awareness within the population.

Local biotech companies and diagnostic labs are working together on low-cost blood-based tests that can be turned around faster. In addition to this work, using AI in primary care to flag for symptoms is gaining significant traction. The UK is also a prominent place for clinical research into autoimmune conditions, offering further justification for diagnostic innovation in this area.

Sales in Germany is anticipated to grow at a CAGR of 8.4% from 2025 to 2035. Germany benefits from a strong healthcare infrastructure and a highly aware consumer base. The German Celiac Society and other advocacy groups have intensified education and awareness campaigns targeting both consumers and healthcare providers.

In parallel, diagnostic labs are expanding their gluten sensitivity panels to detect both classical and non-classical presentations. German diagnostics firms are investing in multiplex immunoassays to capture a wider spectrum of autoimmune markers. Additionally, Germany’s emphasis on evidence-based medicine is pushing for standardization in diagnostic protocols, enhancing reliability and scalability.

France Sales in France is anticipated to grow at a CAGR of 8.2% during the assessment period. The industry is driven by increasing awareness of gastrointestinal health and improved diagnostic coverage through public insurance.

Celiac disease remains underdiagnosed, but national screening recommendations for first-degree relatives are slowly changing this. Local labs are adopting ELISA and molecular technologies, while public health agencies run awareness campaigns targeting school-age children.

The rise of gluten-free diets, often driven by lifestyle choices, is prompting individuals to seek formal diagnosis. France’s integration of dietary and clinical management under a unified system ensures better patient retention and follow-up.

Sales in Italy are anticipated to grow at a CAGR of 8.8% during the forecast term. This aligns with Italy's status as one of the most advanced countries in terms of public policy and public health regarding celiac disease. The government reimburses individual celiac patients for specialized gluten-free foods, and most of the population has access to essential diagnostic testing.

Celicia Disease is a reportable condition for that early and accurate diagnosis. Rapid tests for use in primary care and pharmacies are seeing innovations in Italian diagnostics companies. In addition, increasing awareness of the resource, even among young patients, propelled by efforts to promote early diagnosis in schools, has led to an increase in pediatric screenings.

Sales in Japan are anticipated to grow at a CAGR of 7.0% from 2025 to 2035. While awareness of celiac disease remains relatively low compared to Western industrys, diagnostic interest is picking up in urban centers. Japan’s diet traditionally contains less gluten, which has historically masked prevalence.

However, Westernization of diets and increasing gastrointestinal complaints are pushing healthcare providers to consider celiac diagnostics. Industry entry for global diagnostics players is growing, though localization of tests and education campaigns are still needed.

Japan’s technological prowess offers room for innovation in minimally invasive diagnostics, but industry penetration will require long-term engagement and public health education.

Sales in China are anticipated to grow at a CAGR of 9.8% from 2025 to 2035. This represents one of the highest growth rates globally due to rapid urbanization, increasing adoption of Western diets, and growing gastrointestinal health concerns. Public health institutions are beginning to recognize gluten sensitivity as a significant concern, and diagnostic labs in major cities are scaling up testing capabilities.

Local startups are partnering with academic hospitals to pilot novel testing solutions like home-based kits and smartphone-enabled diagnostics. As middle-class health awareness grows, demand for clear diagnoses is rising. However, rural coverage remains a challenge, representing both a hurdle and an opportunity.

Sales in South Korea are anticipated to grow at a CAGR of 9.2% from within the assessment period. This high growth rate reflects rapid modernization of the healthcare sector and rising adoption of gluten-rich Western diets, particularly among youth. South Korean biotech firms are investing in advanced serological testing, often bundled with broader gastrointestinal panels.

The government’s investment in personalized health and diagnostics is also encouraging wider availability of celiac testing. Consumers are increasingly proactive about health, especially through mobile health apps and telemedicine platforms. Despite strong urban growth, the challenge lies in raising awareness among general practitioners and expanding diagnostics to regional clinics.

The industry in Australia and New Zealand is anticipated to grow at a CAGR of 8.6% from 2025 to 2035. Both countries have long-standing recognition of celiac disease as a public health issue, with active involvement from national celiac societies. Primary care networks are well-equipped for early diagnosis, and school health programs include awareness education.

Diagnostic firms in the region are focusing on integrating AI-based risk scoring tools to streamline testing decisions. Reimbursement systems are favorable, and patient demand for quick, conclusive testing is fueling innovation. The industry also benefits from tight coordination between nutritionists, gastroenterologists, and diagnostics labs, leading to better outcomes.

In 2024, key developments in the Celiac Disease Diagnostics Industry included strategic moves by major players. Thermo Fisher Scientific expanded its diagnostic capabilities through acquisitions. Inova Diagnostics advanced its automated testing platform with FDA clearance for its Aptiva System.

EmpowerDx partnered with NIMA to expand access to genetic testing. Everlywell launched new at-home celiac testing solutions, aligning with the trend toward home diagnostics. Takeda, in collaboration with Zedira and Dr. Falk Pharma, progressed in developing a new therapeutic candidate.

These moves reflect a competitive landscape focused on innovation, accessibility, and expanding diagnostics across healthcare settings. (Sources: Future Industry Insights, GlobeNewswire)

Thermo Fisher Scientific Inc.

Estimated Share: ~25-30%

The dominant global player offering EliA and Phadia systems for celiac antibody testing, with strong presence in clinical labs and automated diagnostics.

PRIMA Lab SA

Estimated Share: ~10-15%

Specializes in rapid at-home celiac tests with focus on European markets through easy-to-use antibody detection kits.

Biohit Oyj

Estimated Share: ~8-12%

A Finnish company focused on gastrointestinal diagnostics including celiac biomarker research and lab-based ELISA tests.

NanoRepro AG

Estimated Share: ~7-10%

German biotech firm known for quick celiac antibody tests available in pharmacies and direct-to-consumer channels.

AESKU.GROUP GmbH

Estimated Share: ~5-8%

Provides comprehensive autoimmune testing including celiac diagnostics with growing presence in emerging industry.

Imaware

Estimated Share: ~5-7%

Digital health company offering mail-order celiac screening with AI-driven personalized reports.

Biomerica, Inc.

Estimated Share: ~4-6%

Focuses on affordable celiac test kits for both healthcare providers and consumers in North America.

YORKTEST Laboratories

Estimated Share: ~3-5%

Known for food intolerance and celiac testing with strong direct-to-consumer model in UK and Europe.

J. Mitra & Co. Pvt. Ltd.

Estimated Share: ~3-5%

Leading Indian diagnostics company providing low-cost ELISA-based celiac tests for mass screening.

Glutenostics, Inc.

Estimated Share: ~2-4%

Specializes in gluten sensitivity and celiac diagnostics with innovative non-invasive tests in the USA industry.

The industry is bifurcated into serology rapid testing kits and genetic rapid testing kits.

The industry is bifurcated into immunochromatography (Lateral Flow) and ELISA (enzyme-linked immunosorbent assay).

The industry is bifurcated into blood serum and body fluids.

The landscape is fragmented into hospitals, diagnostic laboratories, specialty clinics, and home care settings.

The industry studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa (MEA).

The industry is valued at USD 343.29 million in 2025.

The industry is expected to grow at a CAGR of 8.3% from 2025 to 2035.

North America and Western Europe are leading the adoption of celiac disease diagnostics.

Non-invasive testing, digital integration, and pediatric screening are key trends.

Limited infrastructure and low awareness continue to hinder diagnostic uptake.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 06: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 07: North America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 08: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 09: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 13: Latin America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 15: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 16: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 19: Europe Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 21: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 23: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 24: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 25: South Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 26: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 27: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 28: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 30: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 31: East Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 32: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 33: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 34: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 35: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 36: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 37: Oceania Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 38: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 39: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 40: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 41: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 42: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 43: Middle East & Africa Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 44: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 45: Middle East & Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 46: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technique

Table 47: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Sample

Table 48: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Figure 01: Global Market Volume (Units), 2012 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis,

Figure 03: Pricing Analysis per unit (US$), in 2022

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2022 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2022 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2022 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2022 and 2033, by Technique

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Technique

Figure 13: Global Market Attractiveness Analysis 2022 to 2033, by Technique

Figure 14: Global Market Value Share (%) Analysis 2022 and 2033, by Sample

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Sample

Figure 16: Global Market Attractiveness Analysis 2022 to 2033, by Sample

Figure 17: Global Market Value Share (%) Analysis 2022 and 2033, by End User

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by End User

Figure 19: Global Market Attractiveness Analysis 2022 to 2033, by End User

Figure 20: Global Market Value Share (%) Analysis 2022 and 2033, by Region

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Region

Figure 22: Global Market Attractiveness Analysis 2022 to 2033, by Region

Figure 23: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 24: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 25: North America Market Value Share, by Product (2023 E)

Figure 26: North America Market Value Share, by Technique (2023 E)

Figure 27: North America Market Value Share, by Sample (2023 E)

Figure 28: North America Market Value Share, by End User (2023 E)

Figure 29: North America Market Value Share, by Country (2023 E)

Figure 30: North America Market Attractiveness Analysis by Product, 2022 to 2033

Figure 31: North America Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 32: North America Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 33: North America Market Attractiveness Analysis by End User, 2022 to 2033

Figure 34: North America Market Attractiveness Analysis by Country, 2022 to 2033

Figure 35: USA Market Value Proportion Analysis, 2022

Figure 36: Global Vs. USA Growth Comparison

Figure 37: USA Market Share Analysis (%) by Product, 2022 & 2033

Figure 38: USA Market Share Analysis (%) by Technique, 2022 & 2033

Figure 39: USA Market Share Analysis (%) by Sample, 2022 & 2033

Figure 40: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 41: Canada Market Value Proportion Analysis, 2022

Figure 42: Global Vs. Canada. Growth Comparison

Figure 43: Canada Market Share Analysis (%) by Product, 2022 & 2033

Figure 44: Canada Market Share Analysis (%) by Technique, 2022 & 2033

Figure 45: Canada Market Share Analysis (%) by Sample, 2022 & 2033

Figure 46: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 47: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 48: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 49: Latin America Market Value Share, by Product (2023 E)

Figure 50: Latin America Market Value Share, by Technique (2023 E)

Figure 51: Latin America Market Value Share, by Sample (2023 E)

Figure 52: Latin America Market Value Share, by End User (2023 E)

Figure 53: Latin America Market Value Share, by Country (2023 E)

Figure 54: Latin America Market Attractiveness Analysis by Product, 2022 to 2033

Figure 55: Latin America Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 56: Latin America Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 57: Latin America Market Attractiveness Analysis by End User, 2022 to 2033

Figure 58: Latin America Market Attractiveness Analysis by Country, 2022 to 2033

Figure 59: Mexico Market Value Proportion Analysis, 2022

Figure 60: Global Vs Mexico Growth Comparison

Figure 61: Mexico Market Share Analysis (%) by Product, 2022 & 2033

Figure 62: Mexico Market Share Analysis (%) by Technique, 2022 & 2033

Figure 63: Mexico Market Share Analysis (%) by Sample, 2022 & 2033

Figure 64: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 65: Brazil Market Value Proportion Analysis, 2022

Figure 66: Global Vs. Brazil. Growth Comparison

Figure 67: Brazil Market Share Analysis (%) by Product, 2022 & 2033

Figure 68: Brazil Market Share Analysis (%) by Technique, 2022 & 2033

Figure 69: Brazil Market Share Analysis (%) by Sample, 2022 & 2033

Figure 70: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 71: Argentina Market Value Proportion Analysis, 2022

Figure 72: Global Vs Argentina Growth Comparison

Figure 73: Argentina Market Share Analysis (%) by Product, 2022 & 2033

Figure 74: Argentina Market Share Analysis (%) by Technique, 2022 & 2033

Figure 75: Argentina Market Share Analysis (%) by Sample, 2022 & 2033

Figure 76: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 77: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 78: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 79: Europe Market Value Share, by Product (2023 E)

Figure 80: Europe Market Value Share, by Technique (2023 E)

Figure 81: Europe Market Value Share, by Sample (2023 E)

Figure 82: Europe Market Value Share, by End User (2023 E)

Figure 83: Europe Market Value Share, by Country (2023 E)

Figure 84: Europe Market Attractiveness Analysis by Product, 2022 to 2033

Figure 85: Europe Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 86: Europe Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 87: Europe Market Attractiveness Analysis by End User, 2022 to 2033

Figure 88: Europe Market Attractiveness Analysis by Country, 2022 to 2033

Figure 89: UK Market Value Proportion Analysis, 2022

Figure 90: Global Vs. UK Growth Comparison

Figure 91: UK Market Share Analysis (%) by Product, 2022 & 2033

Figure 92: UK Market Share Analysis (%) by Technique, 2022 & 2033

Figure 93: UK Market Share Analysis (%) by Sample, 2022 & 2033

Figure 94: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 95: Germany Market Value Proportion Analysis, 2022

Figure 96: Global Vs. Germany Growth Comparison

Figure 97: Germany Market Share Analysis (%) by Product, 2022 & 2033

Figure 98: Germany Market Share Analysis (%) by Technique, 2022 & 2033

Figure 99: Germany Market Share Analysis (%) by Sample, 2022 & 2033

Figure 100: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 101: Italy Market Value Proportion Analysis, 2022

Figure 102: Global Vs. Italy Growth Comparison

Figure 103: Italy Market Share Analysis (%) by Product, 2022 & 2033

Figure 104: Italy Market Share Analysis (%) by Technique, 2022 & 2033

Figure 105: Italy Market Share Analysis (%) by Sample, 2022 & 2033

Figure 106: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 107: France Market Value Proportion Analysis, 2022

Figure 108: Global Vs France Growth Comparison

Figure 109: France Market Share Analysis (%) by Product, 2022 & 2033

Figure 110: France Market Share Analysis (%) by Technique, 2022 & 2033

Figure 111: France Market Share Analysis (%) by Sample, 2022 & 2033

Figure 112: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 113: Spain Market Value Proportion Analysis, 2022

Figure 114: Global Vs Spain Growth Comparison

Figure 115: Spain Market Share Analysis (%) by Product, 2022 & 2033

Figure 116: Spain Market Share Analysis (%) by Technique, 2022 & 2033

Figure 117: Spain Market Share Analysis (%) by Sample, 2022 & 2033

Figure 118: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 119: Russia Market Value Proportion Analysis, 2022

Figure 120: Global Vs Russia Growth Comparison

Figure 121: Russia Market Share Analysis (%) by Product, 2022 & 2033

Figure 122: Russia Market Share Analysis (%) by Technique, 2022 & 2033

Figure 123: Russia Market Share Analysis (%) by Sample, 2022 & 2033

Figure 124: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 125: BENELUX Market Value Proportion Analysis, 2022

Figure 126: Global Vs BENELUX Growth Comparison

Figure 127: BENELUX Market Share Analysis (%) by Product, 2022 & 2033

Figure 128: BENELUX Market Share Analysis (%) by Technique, 2022 & 2033

Figure 129: BENELUX Market Share Analysis (%) by Sample, 2022 & 2033

Figure 130: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 131: Nordics Market Value Proportion Analysis, 2022

Figure 132: Global Vs Nordics Growth Comparison

Figure 133: Nordics Market Share Analysis (%) by Product, 2022 & 2033

Figure 134: Nordics Market Share Analysis (%) by Technique, 2022 & 2033

Figure 135: Nordics Market Share Analysis (%) by Sample, 2022 & 2033

Figure 136: Nordics Market Share Analysis (%) by End User, 2022 & 2033

Figure 137: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 138: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 139: East Asia Market Value Share, by Product (2023 E)

Figure 140: East Asia Market Value Share, by Technique (2023 E)

Figure 141: East Asia Market Value Share, by Sample (2023 E)

Figure 142: East Asia Market Value Share, by End User (2023 E)

Figure 143: East Asia Market Value Share, by Country (2023 E)

Figure 144: East Asia Market Attractiveness Analysis by Product, 2022 to 2033

Figure 145: East Asia Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 146: East Asia Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 147: East Asia Market Attractiveness Analysis by End User, 2022 to 2033

Figure 148: East Asia Market Attractiveness Analysis by Country, 2022 to 2033

Figure 149: China Market Value Proportion Analysis, 2022

Figure 150: Global Vs. China Growth Comparison

Figure 151: China Market Share Analysis (%) by Product, 2022 & 2033

Figure 152: China Market Share Analysis (%) by Technique, 2022 & 2033

Figure 153: China Market Share Analysis (%) by Sample, 2022 & 2033

Figure 154: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 155: Japan Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Japan Growth Comparison

Figure 157: Japan Market Share Analysis (%) by Product, 2022 & 2033

Figure 158: Japan Market Share Analysis (%) by Technique, 2022 & 2033

Figure 159: Japan Market Share Analysis (%) by Sample, 2022 & 2033

Figure 160: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 161: South Korea Market Value Proportion Analysis, 2022

Figure 162: Global Vs South Korea Growth Comparison

Figure 163: South Korea Market Share Analysis (%) by Product, 2022 & 2033

Figure 164: South Korea Market Share Analysis (%) by Technique, 2022 & 2033

Figure 165: South Korea Market Share Analysis (%) by Sample, 2022 & 2033

Figure 166: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 167: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 168: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 169: South Asia Market Value Share, by Product (2023 E)

Figure 170: South Asia Market Value Share, by Technique (2023 E)

Figure 171: South Asia Market Value Share, by Sample (2023 E)

Figure 172: South Asia Market Value Share, by End User (2023 E)

Figure 173: South Asia Market Value Share, by Country (2023 E)

Figure 174: South Asia Market Attractiveness Analysis by Product, 2022 to 2033

Figure 175: South Asia Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 176: South Asia Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 177: South Asia Market Attractiveness Analysis by End User, 2022 to 2033

Figure 178: South Asia Market Attractiveness Analysis by Country, 2022 to 2033

Figure 179: India Market Value Proportion Analysis, 2022

Figure 180: Global Vs. India Growth Comparison

Figure 181: India Market Share Analysis (%) by Product, 2022 & 2033

Figure 182: India Market Share Analysis (%) by Technique, 2022 & 2033

Figure 183: India Market Share Analysis (%) by Sample, 2022 & 2033

Figure 184: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 185: Indonesia Market Value Proportion Analysis, 2022

Figure 186: Global Vs. Indonesia Growth Comparison

Figure 187: Indonesia Market Share Analysis (%) by Product, 2022 & 2033

Figure 188: Indonesia Market Share Analysis (%) by Technique, 2022 & 2033

Figure 189: Indonesia Market Share Analysis (%) by Sample, 2022 & 2033

Figure 190: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 191: Malaysia Market Value Proportion Analysis, 2022

Figure 192: Global Vs. Malaysia Growth Comparison

Figure 193: Malaysia Market Share Analysis (%) by Product, 2022 & 2033

Figure 194: Malaysia Market Share Analysis (%) by Technique, 2022 & 2033

Figure 195: Malaysia Market Share Analysis (%) by Sample, 2022 & 2033

Figure 196: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 197: Thailand Market Value Proportion Analysis, 2022

Figure 198: Global Vs. Thailand Growth Comparison

Figure 199: Thailand Market Share Analysis (%) by Product, 2022 & 2033

Figure 200: Thailand Market Share Analysis (%) by Technique, 2022 & 2033

Figure 201: Thailand Market Share Analysis (%) by Sample, 2022 & 2033

Figure 202: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 203: Vietnam Market Value Proportion Analysis, 2022

Figure 204: Global Vs. Vietnam Growth Comparison

Figure 205: Vietnam Market Share Analysis (%) by Product, 2022 & 2033

Figure 206: Vietnam Market Share Analysis (%) by Technique, 2022 & 2033

Figure 207: Vietnam Market Share Analysis (%) by Sample, 2022 & 2033

Figure 208: Vietnam Market Share Analysis (%) by End User, 2022 & 2033

Figure 209: Philippines Market Value Proportion Analysis, 2022

Figure 210: Global Vs. Philippines Growth Comparison

Figure 211: Philippines Market Share Analysis (%) by Product, 2022 & 2033

Figure 212: Philippines Market Share Analysis (%) by Technique, 2022 & 2033

Figure 213: Philippines Market Share Analysis (%) by Sample, 2022 & 2033

Figure 214: Philippines Market Share Analysis (%) by End User, 2022 & 2033

Figure 215: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 216: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 217: Oceania Market Value Share, by Product (2023 E)

Figure 218: Oceania Market Value Share, by Technique (2023 E)

Figure 219: Oceania Market Value Share, by Sample (2023 E)

Figure 220: Oceania Market Value Share, by End User (2023 E)

Figure 221: Oceania Market Value Share, by Country (2023 E)

Figure 222: Oceania Market Attractiveness Analysis by Product, 2022 to 2033

Figure 223: Oceania Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 224: Oceania Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 225: Oceania Market Attractiveness Analysis by End User, 2022 to 2033

Figure 226: Oceania Market Attractiveness Analysis by Country, 2022 to 2033

Figure 227: Australia Market Value Proportion Analysis, 2022

Figure 228: Global Vs. Australia Growth Comparison

Figure 229: Australia Market Share Analysis (%) by Product, 2022 & 2033

Figure 230: Australia Market Share Analysis (%) by Technique, 2022 & 2033

Figure 231: Australia Market Share Analysis (%) by Sample, 2022 & 2033

Figure 232: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 233: New Zealand Market Value Proportion Analysis, 2022

Figure 234: Global Vs New Zealand Growth Comparison

Figure 235: New Zealand Market Share Analysis (%) by Product, 2022 & 2033

Figure 236: New Zealand Market Share Analysis (%) by Technique, 2022 & 2033

Figure 237: New Zealand Market Share Analysis (%) by Sample, 2022 & 2033

Figure 238: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 239: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 240: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 241: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 242: Middle East & Africa Market Value Share, by Technique (2023 E)

Figure 243: Middle East & Africa Market Value Share, by Sample (2023 E)

Figure 244: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 245: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 246: Middle East & Africa Market Attractiveness Analysis by Product, 2022 to 2033

Figure 247: Middle East & Africa Market Attractiveness Analysis by Technique, 2022 to 2033

Figure 248: Middle East & Africa Market Attractiveness Analysis by Sample, 2022 to 2033

Figure 249: Middle East & Africa Market Attractiveness Analysis by End User, 2022 to 2033

Figure 250: Middle East & Africa Market Attractiveness Analysis by Country, 2022 to 2033

Figure 251: GCC Countries Market Value Proportion Analysis, 2022

Figure 252: Global Vs GCC Countries Growth Comparison

Figure 253: GCC Countries Market Share Analysis (%) by Product, 2022 & 2033

Figure 254: GCC Countries Market Share Analysis (%) by Technique, 2022 & 2033

Figure 255: GCC Countries Market Share Analysis (%) by Sample, 2022 & 2033

Figure 256: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 257: Türkiye Market Value Proportion Analysis, 2022

Figure 258: Global Vs. Türkiye Growth Comparison

Figure 259: Türkiye Market Share Analysis (%) by Product, 2022 & 2033

Figure 260: Türkiye Market Share Analysis (%) by Technique, 2022 & 2033

Figure 261: Türkiye Market Share Analysis (%) by Sample, 2022 & 2033

Figure 262: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 263: Israel Market Value Proportion Analysis, 2022

Figure 264: Global Vs. Israel Growth Comparison

Figure 265: Israel Market Share Analysis (%) by Product, 2022 & 2033

Figure 266: Israel Market Share Analysis (%) by Technique, 2022 & 2033

Figure 267: Israel Market Share Analysis (%) by Sample, 2022 & 2033

Figure 268: Israel Market Share Analysis (%) by End User, 2022 & 2033

Figure 269: South Africa Market Value Proportion Analysis, 2022

Figure 270: Global Vs. South Africa Growth Comparison

Figure 271: South Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 272: South Africa Market Share Analysis (%) by Technique, 2022 & 2033

Figure 273: South Africa Market Share Analysis (%) by Sample, 2022 & 2033

Figure 274: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 275: North Africa Market Value Proportion Analysis, 2022

Figure 276: Global Vs North Africa Growth Comparison

Figure 277: North Africa Market Share Analysis (%) by Product, 2022 & 2033

Figure 278: North Africa Market Share Analysis (%) by Technique, 2022 & 2033

Figure 279: North Africa Market Share Analysis (%) by Sample, 2022 & 2033

Figure 280: North Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Crohn’s Disease (CD) Treatment Market Analysis & Forecast by Drug Type, Distribution Channel and Region through 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Zoonotic Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Wilson’s Disease Diagnostics Market Analysis – Size, Share & Forecast 2023-2033

Predictive Disease Analytics Market Size and Share Forecast Outlook 2025 to 2035

Autoimmune Disease Therapeutics Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Autoimmune Disease Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infectious Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA