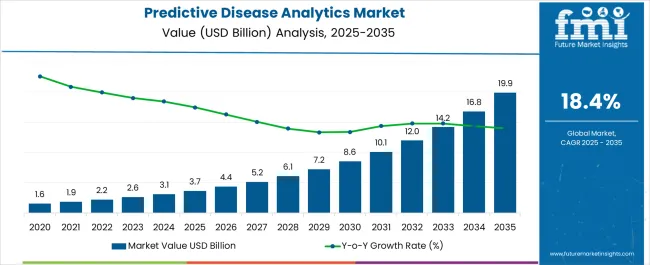

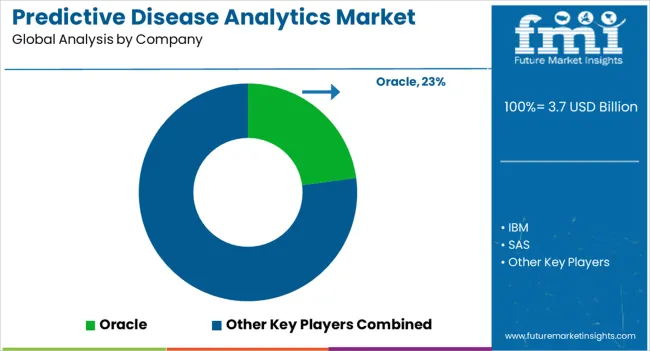

The Predictive Disease Analytics Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 19.9 billion by 2035, registering a compound annual growth rate (CAGR) of 18.4% over the forecast period.

| Metric | Value |

|---|---|

| Predictive Disease Analytics Market Estimated Value in (2025 E) | USD 3.7 billion |

| Predictive Disease Analytics Market Forecast Value in (2035 F) | USD 19.9 billion |

| Forecast CAGR (2025 to 2035) | 18.4% |

The predictive disease analytics market is expanding steadily due to increasing emphasis on data driven healthcare and the growing need to anticipate disease patterns for proactive management. Rising prevalence of chronic illnesses and escalating healthcare costs have encouraged stakeholders to adopt advanced analytics platforms.

The integration of artificial intelligence, machine learning, and big data technologies has enhanced predictive accuracy and clinical decision support. Healthcare providers and payers are leveraging predictive analytics to improve patient outcomes, optimize resource allocation, and reduce readmission rates.

Regulatory support for digital health transformation and strong investment in healthcare IT infrastructure are further reinforcing market growth. The outlook remains positive as predictive analytics continues to transform healthcare delivery models with a focus on preventive care and cost efficiency.

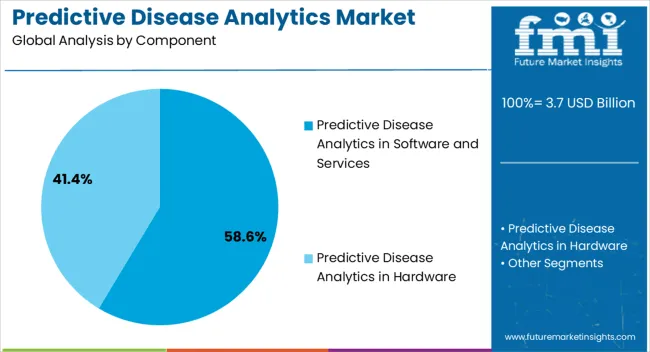

The software and services segment is projected to contribute 58.60% of total market revenue by 2025 within the component category, positioning it as the most dominant segment. This growth is being driven by the increasing adoption of integrated platforms that combine predictive modeling, advanced visualization, and automated reporting features.

The ability of these solutions to deliver scalable and customizable insights tailored to healthcare workflows has reinforced their preference among providers and payers. Continuous innovation in algorithm development, interoperability with electronic health records, and enhanced user interfaces have further accelerated uptake.

As healthcare organizations focus on evidence based care and long term disease prevention strategies, software and services remain the foundation of predictive disease analytics adoption.

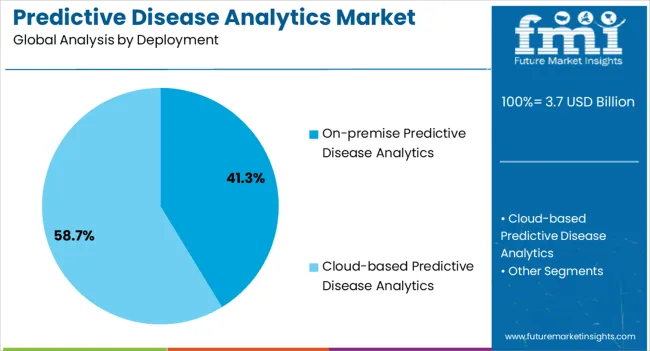

The on premise segment is expected to hold 41.30% of the total market revenue by 2025, making it a significant deployment model. This preference is being driven by the need for enhanced data security, compliance with strict healthcare regulations, and the ability to maintain direct control over sensitive patient data.

Many healthcare organizations have favored on premise solutions due to established infrastructure and concerns regarding data privacy in cloud based models. The reliability of localized systems in ensuring consistent performance and integration with existing clinical databases has reinforced adoption.

With growing cybersecurity threats and regulatory mandates, on premise deployment continues to be a trusted choice for organizations prioritizing control and security in predictive disease analytics.

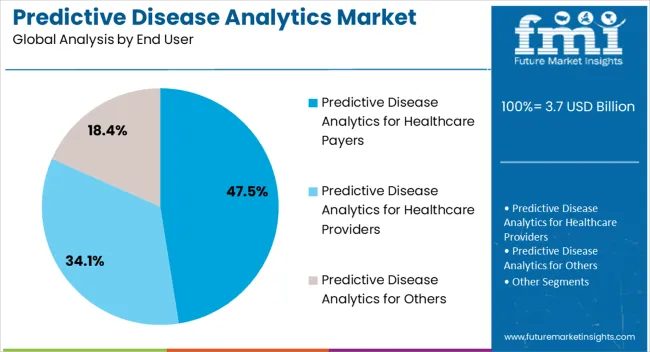

The healthcare payers segment is anticipated to account for 47.50% of overall market revenue by 2025, establishing it as the leading end user group. This leadership is attributed to the sector’s strong focus on cost containment, risk stratification, and proactive care management.

Payers are increasingly using predictive analytics to forecast high risk patient populations, reduce unnecessary hospitalizations, and design preventive health programs. The ability to leverage predictive models for claims analysis, fraud detection, and population health management has further solidified their adoption.

As value based care models gain traction globally, healthcare payers continue to rely heavily on predictive analytics to align reimbursement models with outcomes driven healthcare delivery.

The healthcare industry has been facing challenges in the form of spiking treatment expenses, a dearth of improved patient care, and low patient engagement and retention. Therefore, predictive data analysis techniques are being deployed throughout the healthcare sector to offer enhanced patient care and upgrade operations. These are some key factors propelling the healthcare analytics industry.

In November 2025, for instance, Google Cloud and Hartford HealthCare officially declared their long-term partnership. The partnership is to digitally transform their healthcare system to enhance patient care and data analytics.

Surging Governmental Support

The rise in government initiatives and huge finance invested in the healthcare industry bolstered the market. In February 2025, the European Commission invested USD 7.2 million for a new project aimed at developing an AI-based platform. This platform is going to collect and analyze clinical data on new medicines of oncology to encourage their assessment via regulators and health technology assessment agencies (HTA).

Likewise, the United States government is launching the HealthData.gov portal. The portal captures information from various federal databases on clinical data, medical and patient knowledge, and community health performance.

| Attributes | Details |

|---|---|

| Predictive Disease Analytics Market Value (2025) | USD 2.45 billion |

| Predictive Disease Analytics Market Forecast Value (2035) | USD 18.64 billion |

| Predictive Disease Analytics Market CAGR (2025 to 2035) | 22.5% |

The market generated a revenue of USD 3.7 billion in 3.703.73.7. The market is set to register a CAGR of 3.73.7.5% to reach USD 3.7 billion in 3.703.73.

The predictive disease analytics industry is being driven by the following factors

Predicted Growth of Predictive Disease Analytics Market Over the Forecast Period

| Duration | Market Analysis |

|---|---|

| Short-term Growth | The market is anticipated to stand at a valuation of USD 3.7 billion by 3.703.75. Increasing emphasis on preventive care is propelling the deployment of disease prediction using symptoms dataset. With the help of predictive disease analytics, healthcare providers are better able to identify patients who are at risk of suffering from certain conditions. These solutions help in potentially minimizing healthcare expenditure. |

| Medium-term Growth | By 3.703.78 end, the market is estimated to surpass a market worth of USD 6.76 billion. The market is expected to be LED by the accelerating telehealth sector, particularly for predictive disease analytics. These solutions are predicted to be used to support telemedicine consultations and remote patient monitoring. |

| Long-term Growth | The market is projected to amass a total of USD 19.9 billion by 3.7033. In the long run, integration of these solutions with blockchain technology is anticipated to boost the transparency and security of patient data. As a result, making it is convenient to share and analyze health insights spanning different healthcare organizations. |

The software and services segment accounted for a maximum share of 69.9% in 2025. The segment is also anticipated to observe a significant CAGR over the forecast period. Digitalization of data and the development of platforms has LED to considerable investments by the healthcare sector into the IT sector.

Since a significant amount of businesses don’t have an in-house data analytics department, they outsource data analytics work to their IT team. Due to the aforesaid factor, data analytics firms are growing in business and more of these firms are coming into the business.

These firms offer an entire range of services to businesses. The growing scope of services and new services aimed to meet evolving business demands are further enhancing segment growth.

The on-premise section LED the predictive disease analytics industry by acquiring a total revenue share of 65.9% in 2025. Due to the high security and convenience of access offered by on-premise deployment, several institutions are focusing on installing instruments and software to accumulate data at their premises.

This comes in handy for small businesses. However, in case it is scaled up to manage a sizeable dataset of businesses, it can make data management tiring and challenging.

The cloud-based solutions segment is projected to register a prominent CAGR in the assessment period. Growing demand for solutions that offer easy storage, more flexibility and efficiency, and low capital requirements is boosting the adoption of cloud-based solutions.

Further, these solutions also help enhance user engagement and obtain medical evidence from anywhere and at any given time. Companies offering predictive disease analytics are actively concentrating on multiple strategic initiatives to bolster segment growth.

The payer segment is expected to rule the market, on the basis of the end user. The market share of this segment is anticipated to be 40.9% in 2025. The payer segment consists of government agencies, insurance companies, third-party payers, and health plan sponsors (unions and employers).

These companies or institutions are employing predictive disease analytics tools. To properly evaluate insurance claims before payment settlement, disease risk assessment, and detecting and detecting and preventing fraudulent claims. Increasing utilization of historical as well as current data by payers to predict future trends is expected to boost segment growth.

The provider segment is expected to expand expeditiously in the upcoming years. Some key drivers of the market include soaring healthcare outlay and increasing investment in healthcare infrastructure. Surging chronic disorders and the rising geriatric population is also pushing several providers to invest in predictive disease analytics solutions.

These solutions enable providers to identify patterns and trends and make shrewd decisions regarding treatment and allocation of resources.

These services also help by offering insights and forecasting demand for healthcare services and strategizing for future needs. In October 2025, the research team at the University of Pennsylvania Perelman School of Medicine and the University of Florida made an announcement. The declaration was to establish a set of predictive analytics algorithms to find out which patients are likely to develop a rare disease.

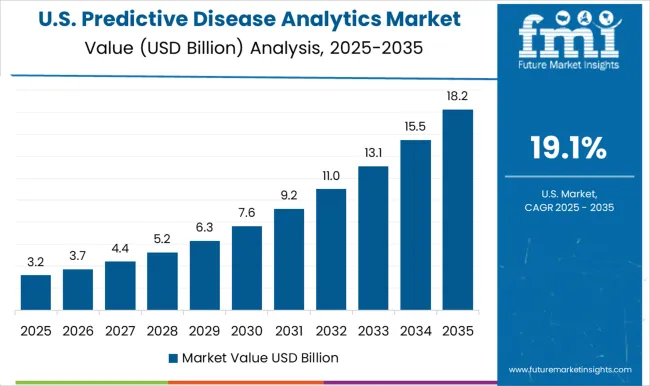

The United States predictive disease analytics industry occupied a huge market share in 2025. The country is home to significantly advanced healthcare facilities that boast predictive disease analytics. In addition to this, a rise in chronic disorders and a surging density of the geriatric population has been witnessed in the country. This has LED to heightened demand for analytics tools from hospitals, clinics, and other organizations.

Moreover, the high count of key players in the United States market is also contributing to market growth. In September 2024, Microsoft introduced Microsoft Cloud for Healthcare aimed to unite providers and patients in gaining better insights pertaining to patient care.

The China predictive disease analytics industry is expected to account for robust CAGR in the stipulated time frame. Favorable government policies and support are catalyzing market development in this country. Additionally, increasing expenditure on healthcare is the propelling market expansion and opening up new avenues for growth.

The increasing geriatric population and surging cases of chronic disorders are two crucial factors for market growth in China. As per the United States Census Bureau’s survey, in 2024, the geriatric population amounted to 414 million individuals in Asia. Moreover, by 2060 end, that figure is going to reach 1.2 billion.

Top players in the market are concentrating their efforts on developing new solutions and tools. These efforts are made to cater to the surging demand for predictive disease analytics from the life sciences and healthcare industry. Moreover, mergers and acquisitions and extension in geographic footprint are some key tactics adopted by these players.

In January 2025, SwitchPoint Ventures and Ardent Health Service partnered together to release an innovation studio. This studio focuses on creating and deploying data-driven solutions. Additionally, Ardent has also adopted Polaris, which is SwitchPoint’s new solution to precisely predict patient volume in a clinical set-up.

Escalating investments in healthcare further bolsters startups to enter the market, thereby increasing the competition.

FMI has profiled the following players in the market report

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Regions Covered | North America; Europe; Asia Pacific; Latin America; The Middle East and Africa |

| Key Countries Covered | The United States, Canada, Germany, the United Kingdom, France, Italy, NORDICS, Spain, Russia, Poland, BENELUX, China, Japan, India, ASEAN, Oceania, South Korea, Brazil, Mexico, Argentina, GCC Countries, South Africa, Northern Africa, Türkiye |

| Key Segments Covered | Component, Deployment, End User, and Region |

| Key Companies Profiled | Oracle; IBM; SAS; Allscripts Healthcare Solutions Inc.; MedeAnalytics, Inc.; Health Catalyst.; Apixio Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global predictive disease analytics market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the predictive disease analytics market is projected to reach USD 19.9 billion by 2035.

The predictive disease analytics market is expected to grow at a 18.4% CAGR between 2025 and 2035.

The key product types in predictive disease analytics market are predictive disease analytics in software and services and predictive disease analytics in hardware.

In terms of deployment, on-premise predictive disease analytics segment to command 41.3% share in the predictive disease analytics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Predictive Quality Assurance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Predictive Touch Market Size and Share Forecast Outlook 2025 to 2035

Predictive Maintenance Market Analysis – Growth & Industry Trends through 2034

Predictive Automobile Technology Market

Predictive Analytics Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

Transportation Predictive Analytics Market Report – Growth & Forecast 2017-2027

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA