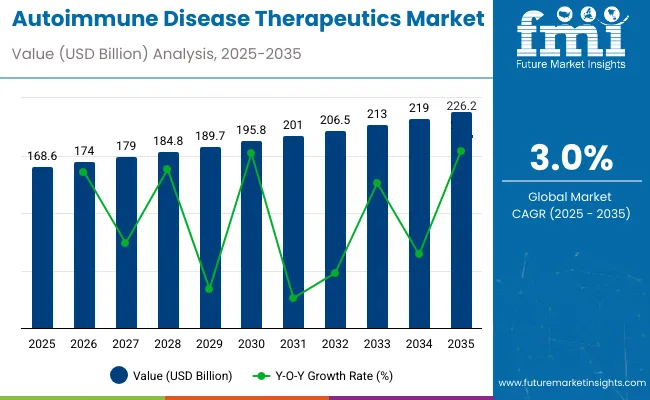

The global autoimmune disease therapeutics market is anticipated to expand steadily from 2025 to 2035, driven by increasing cases of rheumatoid arthritis, psoriasis, and inflammatory bowel disease. The market is valued at USD 168.6 billion in 2025 and is forecast to reach USD 226.2 billion by 2035, reflecting a CAGR of 3.0%.

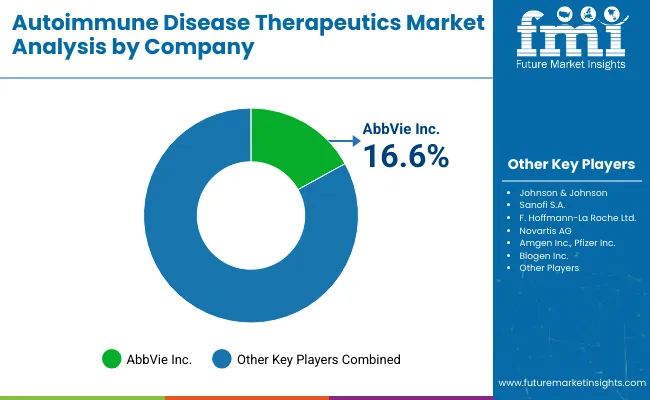

This growth is propelled by advancements in biologics, immunotherapies, and personalized medicine, alongside rising healthcare expenditures and awareness. Key companies such as AbbVie Inc., Johnson & Johnson, and Sanofi S.A. dominate the landscape, holding market shares of 16.6%, 11.4%, and 8.8%, respectively.

In February 2025, the European Commission granted marketing authorization for Nemluvio® (nemolizumab)-a first-in-class monoclonal antibody developed by Galderma. Targeting the IL-31 receptor, Nemluvio® is approved for treating moderate-to-severe atopic dermatitis in patients aged 12 years and older and prurigo nodularis in adults.

This approval follows successful outcomes from the phase III ARCADIA and OLYMPIA trials and marks a significant milestone in expanding biologic treatment options for autoimmune-related dermatological conditions.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 168.6 billion |

| Market Size (2035) | USD 226.2 billion |

| CAGR (2025 to 2035) | 3.0% |

Pipeline developments are shaping market competition, with several novel monoclonal antibodies and small molecule inhibitors under late-stage trials for diseases such as lupus, multiple sclerosis, and Crohn’s disease.

The penetration of biosimilars continues to grow, reducing treatment costs and increasing accessibility in cost-sensitive regions. However, patent expiries of top-selling biologics like Humira are triggering competitive pressures and price reductions globally.

Digital health technologies and telemedicine platforms are increasingly being adopted to enhance patient monitoring and medication adherence, particularly in chronic autoimmune conditions. Regulatory support and favorable reimbursement frameworks are further catalyzing market growth in North America and Europe.

Challenges remain in terms of drug affordability, especially in emerging markets where treatment costs remain prohibitive. However, partnerships between biopharmaceutical firms and governments aim to bridge this gap by facilitating access to biosimilars and cost-effective therapies.

Autoimmune diseases affect a substantial portion of the population in the United States, presenting significant challenges for healthcare systems. Conditions such as Crohn’s disease, lupus, and multiple sclerosis (MS) are prevalent and impact millions of individuals nationwide. These disorders often lead to chronic health issues and require ongoing management and treatment. The widespread nature of autoimmune diseases underscores the importance of continued research, awareness, and development of effective therapies to improve patient outcomes and quality of life.

Leading pharmaceutical companies are increasingly integrating smart technologies into autoimmune disease treatments to enhance personalized care and improve patient outcomes. Through advanced diagnostics, AI-driven tools, digital adherence programs, and real-world data analytics, these companies are revolutionizing therapy management. Products like Roche’s Actemra, Novartis’ Cosentyx, Pfizer’s Xeljanz, Johnson & Johnson’s Simponi, and AbbVie’s Humira are supported by companion diagnostics, digital monitoring, and patient engagement platforms, enabling tailored treatments and better disease management in autoimmune disorders.

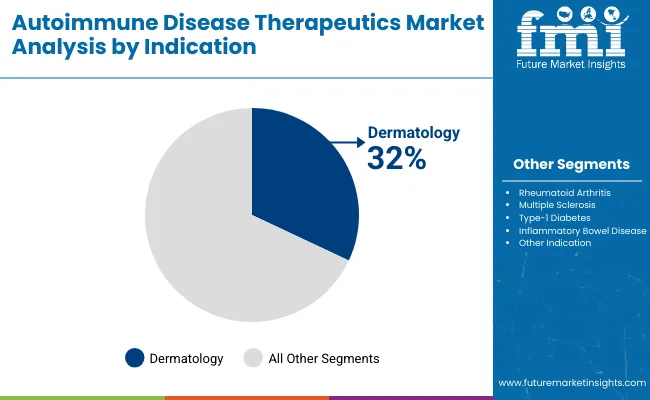

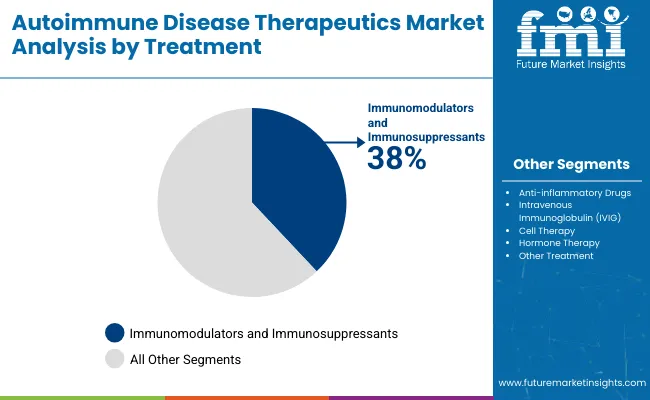

In 2025, the Autoimmune Disease Therapeutics Market is led by the Dermatology Indications segment, accounting for an estimated 32% market share, driven by high prevalence of psoriasis and related conditions. By Treatment, Immunomodulators and Immunosuppressants dominate with a 38% share due to their effectiveness in controlling immune responses. Both segments reflect rising demand for targeted autoimmune therapies.

The Dermatology Indications segment is expected to secure a 32% value share in the Autoimmune Disease Therapeutics Market by 2025. This dominance is attributed to the increasing global incidence of autoimmune skin diseases such as psoriasis, pemphigus vulgaris, and vitiligo, which necessitate long-term therapeutic interventions. Psoriasis alone affects more than 125 million individuals globally, driving the demand for novel and biologic therapies.

Advancements in biologics and targeted small molecules, which offer enhanced efficacy and safety profiles, further propel the adoption of dermatology-specific autoimmune treatments. Pharmaceutical giants such as AbbVie (Humira, Skyrizi) and Novartis (Cosentyx) are continuously investing in expanding their dermatology autoimmune product pipelines, ensuring a steady flow of innovative drugs to the market.

Moreover, rising awareness among patients, improved diagnostic rates, and better reimbursement frameworks contribute to the growth of this segment. Increasing collaborations between biotech firms and major pharmaceutical companies for developing dermatology-focused autoimmune drugs strengthen this segment’s market hold. Consequently, the dermatology indication remains a top investment opportunity in the autoimmune disease therapeutics landscape.

Immunomodulators and Immunosuppressants are projected to command a significant 38% market share within the Autoimmune Disease Therapeutics Market by 2025. These treatments are favored for their ability to modify immune system activity, offering relief across a spectrum of autoimmune diseases, including rheumatoid arthritis, lupus, and multiple sclerosis. The effectiveness of these drugs in controlling immune-mediated inflammation and reducing disease progression rates makes them the cornerstone of autoimmune disease management.

Leading pharmaceutical companies like Roche, Johnson & Johnson, and Pfizer have heavily invested in developing next-generation immunosuppressants, including Janus kinase (JAK) inhibitors and biologics, to meet the increasing demand for safe and efficient therapies.

Additionally, the growing prevalence of autoimmune conditions and the expansion of clinical guidelines recommending early immunosuppressant use have driven product uptake. The launch of biosimilars has also enhanced treatment affordability, particularly in developing markets, further expanding the patient pool.

This again is a major factor that puts constraints on the future market options for Global Autoimmune Disease Therapeutics Market due to patent expiry on certain biologics.

Biologics mainly defined the market for therapy, primarily using monoclonal antibodies and, for example, fusion proteins, translating into tremendous sales for the respective pharmaceutical companies. Expiration of such patents opens competitive avenues for biosimilars-these cheaper products found quite similar to originators in terms of effectiveness with more safety.

With such a perception, biosimilars will enter into competitive forces eroding the rates within the market as health systems may ignore a lot of patients from opting for these alternatives simply for cost-cutting purposes.

Such factors will have an adverse effect on the income stream of the respectivecompany if most of these income streams derive from patented biologics. In addition, biosimilars in the marketplace compel Originators to spend on commercial efforts, lifecycle management strategies as well as research & development for next-generation therapies.

Strong Clinical Pipeline with New Treatments Can Be A Prospect for the Market

Strong momentum in the development pipeline for newly developed drugs suggests that the global autoimmune therapeutics market would be fueled highly in the future. Continuous effort into basic and applied research and development always gives rise to newer biologics, small molecules, and gene therapies with better efficacy, safety, and mechanisms of action as compared to their predecessors.

One major change in the field of managing autoimmune diseases is brought by biologics, such as monoclonal antibodies or fusion proteins, of "creating new advances" for ever-increasing therapeutic use. Oral bioavailability and target pathways unavailable for biologics intracellularly have started directing the use of small molecule drugs.

Gene therapy and RNA-based treatments have made some advancements in developing novel approaches to altering the disease process at a genetic level, with positive long-term remission, if not radical cure, in some cases.

Improvements in biologics and targeted therapies are shifting the management of autoimmune disorders. Monoclonal antibodies (mAbs), like TNF inhibitors, have revolutionized the treatment of rheumatoid arthritis and psoriasis by specifically targeting components of the immune system.

Newer treatments, including IL-17 and IL-23 inhibitors, are promising great advancement in the management of psoriasis and ankylosing spondylitis with a more individualized approach and less toxicity.

Such breakthroughs have empowered clinicians to provide more efficacious, personalized treatment options that improve health outcomes and quality of life. Never have the management of autoimmune diseases been as targeted and patient-specific as it is now.

For many of the autoimmune disorders, cell therapy and gene editing are making the most promising new approaches for their treatment. Researchers are turning the CAR-T (Chimeric Antigen Receptor T-cell) therapy that is initially designed for cancer treatment into a new form of treatment for autoimmune disease patients.

By modifying the patient's immune cells, the treatment could control the immune response finely so that the prospect of long-term remission arises rather than just relieving the symptoms.

Other promising developments in gene editing are CRISPR gene editing: the gene editor that allows scientists to engineer the DNA by making specific changes with the idea of correcting faulty immune responses right at their origin.

These technologies herald a shift away from treating autoimmune disorders toward curing them altogether. With these new therapies in the pipeline, it won't be long until patients can expect to rely on long-term solutions that were previously thought to be a dream.

Market Outlook

United States continues to the front line in managing autoimmune diseases owing to its better healthcare system and excellent investment in research and development. More and more autoimmune diseases such as rheumatoid arthritis and psoriasis have made their requirements related to effective therapies-highly with an emphasis on biologics such as monoclonal antibodies and JAK inhibitors.

Advances in targeted therapy and personalized medicine coming up with new strategies are reshuffling the hands of the patients against choices they have never experienced before. Supportive laws, new drug approvals, and good insurance coverage put an icing on the cake by making the USA "the" center for the treatment of autoimmune diseases.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

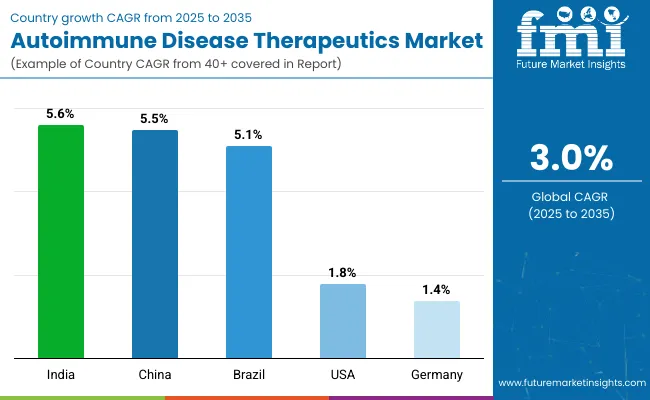

| United States | 1.8% |

Market Outlook

The rapidly growing autoimmune disease market in China is driven mainly by the huge population and the increased number of cases. Healthcare is trying to become more accessible with the great contribution of biotechnology into the economy to propel the market expansion through heavy government funding. In fact, the increasing need for biologics such as mono-clonal antibodies has necessitated local manufacturers to increase production.

China is adopting modern techniques such as targeted therapy and gene editing in future therapies, which will, therefore, characterize the future of autoimmune management. Patients are accessing better sophisticated therapeutics due to increasing awareness and continuous health reforms, thereby improving their lives.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

Market Outlook

The Indian autoimmune disease therapeutics market is progressing with its benefits drawn from the growing healthcare sector and increasing awareness in healthcare. Increasing cases of autoimmune diseases such as rheumatoid arthritis and lupus have further led to rising demand for biologics and immunosuppressive therapies.

The market is also witnessing a growing shift towards personalized medicine and its demand for targeted therapies. Although costs of these drugs still remain a barrier, there is currently an increasing effort to improve access and affordability for health services as well as ever-increasing regulatory support for novel therapies to fuel the Indian market's growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

Germany boasts a flourishing market for autoimmune therapeutics, ranking one of the biggest in Europe, with an efficient healthcare system and high expenditure on health funding. R&D capabilities play an important role in bringing forth innovative products in the fields of biologic therapy including TNF inhibitors, monoclonal antibodies, and JAK inhibitors.

However, this prevalence of autoimmune disorders along with a growing need for personalized treatment creates a pathway leading to the growth of this market. Besides, there is space in Germany's regulatory environment for approval of innovative therapies and reimbursement policies for making treatments available for advanced autoimmune diseases.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 1.4% |

Market Outlook

The market for autoimmune therapeutics in Brazil is witnessing rapid growth owing to improvement in healthcare infrastructure and rising incidence of autoimmune diseases. Government policies are working toward higher access to biologics, such as monoclonal antibodies and immunosuppressants. Parallely, awareness and reforms in healthcare are assuring more access for patients to get the treatment that they need, although affordability still remains a concern.

The future seems to be optimistic for some revolutionary advancements in targeted and gene therapies expected to provide long-term benefits for patients. Favorable government legislation for biotechnology will further drive the growth of these innovative treatments and their accessibility.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.1% |

The autoimmune disease therapeutics market is highly competitive, driven by numerous pharmaceutical giants and biotech firms innovating to address diverse autoimmune conditions such as rheumatoid arthritis, lupus, and multiple sclerosis.

Key players like AbbVie, Johnson & Johnson, Roche, and Novartis dominate with established biologics and targeted therapies. Emerging companies focus on novel mechanisms, including small molecules and biosimilars, to capture market share.

Continuous advancements in personalized medicine and immunomodulatory treatments intensify competition, with strategic partnerships, mergers, and acquisitions shaping the landscape. Pricing pressures and regulatory hurdles further challenge companies, fueling ongoing innovation to meet unmet patient needs globally.

AbbVie Inc. (16.6%)

Enters as a forthcoming company with Humira, a highly commercialized biologic, while its pipeline has begun to fill with next-generation immunotherapies in the autoimmune therapeutics market.

Johnson & Johnson (11.4%)

Targeted biologics are among those that J&J focuses on, as it is leading in innovative treatment for autoimmune diseases like psoriasis and Crohn's disease.

Sanofi S.A. (8.8%)

Alongside that, Amgen has a very strong foothold in the treatment of autoimmune diseases, providing TNF inhibitors and a pipeline of new biologic therapies for inflammatory conditions.

F. Hoffmann-La Roche Ltd (7.4%)

Known for its IL-17 inhibitors, Novartis aims to diversify its portfolio with innovation by adding hoary immunotherapeutics.

Novartis AG (6.9%)

An important biotech company, Eli Lilly has focused on critical developments in disease-relevant biologics that engage the immune pathways in chronic inflammatory diseases.

From these leading companies, there is a wide network of different manufacturers that add their value to the overall market making a case for product diversity and technological advancement. These include:

| Report Attributes | Details |

|---|---|

| Market Size (2025E) | USD 168.6 billion |

| Projected Market Size (2035F) | USD 226.2 billion |

| CAGR (2025 to 2035) | 3.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Indications Analyzed (Segment 1) | Dermatology Indications, Rheumatoid Arthritis, Multiple Sclerosis, Type-1 Diabetes, Inflammatory Bowel Disease, Other Indications |

| Treatment Types Analyzed (Segment 2) | Immunomodulators & Immunosuppressants, Anti-inflammatory Drugs, Intravenous Immunoglobulin (IVIG), Cell Therapy, Hormone Therapy, Other Treatments |

| Sales Channels Analyzed (Segment 3) | Hospitals, Specialty Clinics, Dermatology Clinics, Retail Pharmacies, Online Sales Channels, Drug Stores |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, China, Japan, South Korea, India, Brazil, Mexico, South Africa, Saudi Arabia, UAE |

| Key Players in Autoimmune Disease Therapeutics Market | AbbVie Inc., Johnson & Johnson, Sanofi S.A., F. Hoffmann-La Roche Ltd., Novartis AG, Amgen Inc., Pfizer Inc., Biogen Inc., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., UCB S.A., Others |

| Additional Attributes | Dollar sales, share, growth fueled by rising autoimmune disease prevalence, expanding biologics & biosimilars pipeline, patient awareness, reimbursement policies, personalized medicine approaches in immunotherapy |

The global autoimmune disease therapeutics industry is projected to witness CAGR of 3.0% between 2025 and 2035.

The global autoimmune disease therapeutics industry stood at USD 2,123.6 million in 2024.

The global autoimmune disease therapeutics industry is anticipated to reach USD 226.2 billion by 2035 end.

China is expected to show a CAGR of 5.5% in the assessment period.

The key players operating in the global autoimmune disease therapeutics industry are AbbVie Inc., Johnson & Johnson, Sanofi S.A., F. Hoffmann-La Roche Ltd, Novartis AG, Amgen Inc., Pfizer Inc., Biogen Inc., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., UCB S.A. and Others.

Table 1: Global Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 3: Global Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 5: North America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 7: North America Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 8: North America Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 9: Latin America Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 11: Latin America Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 12: Latin America Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 13: Western Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 15: Western Europe Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 16: Western Europe Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 17: Eastern Europe Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 19: Eastern Europe Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 20: Eastern Europe Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 21: South Asia and Pacific Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 23: South Asia and Pacific Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 24: South Asia and Pacific Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 25: East Asia Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 27: East Asia Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 28: East Asia Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Table 29: Middle East and Africa Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Value (US$ Million) Forecast by Drug Class Type, 2018 to 2033

Table 31: Middle East and Africa Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 32: Middle East and Africa Value (US$ Million) Forecast by Sales Channel , 2018 to 2033

Figure 1: Global Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 2: Global Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 4: Global Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 9: Global Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 10: Global Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 11: Global Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 14: Global Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 15: Global Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 16: Global Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 17: Global Attractiveness by Drug Class Type, 2023 to 2033

Figure 18: Global Attractiveness by Indication, 2023 to 2033

Figure 19: Global Attractiveness by Sales Channel , 2023 to 2033

Figure 20: Global Attractiveness by Region, 2023 to 2033

Figure 21: North America Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 22: North America Value (US$ Million) by Indication, 2023 to 2033

Figure 23: North America Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 24: North America Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 29: North America Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 30: North America Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 31: North America Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 32: North America Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 33: North America Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 34: North America Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 35: North America Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 36: North America Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 37: North America Attractiveness by Drug Class Type, 2023 to 2033

Figure 38: North America Attractiveness by Indication, 2023 to 2033

Figure 39: North America Attractiveness by Sales Channel , 2023 to 2033

Figure 40: North America Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 42: Latin America Value (US$ Million) by Indication, 2023 to 2033

Figure 43: Latin America Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 44: Latin America Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 49: Latin America Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 50: Latin America Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 51: Latin America Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 52: Latin America Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 53: Latin America Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 54: Latin America Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 55: Latin America Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 56: Latin America Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 57: Latin America Attractiveness by Drug Class Type, 2023 to 2033

Figure 58: Latin America Attractiveness by Indication, 2023 to 2033

Figure 59: Latin America Attractiveness by Sales Channel , 2023 to 2033

Figure 60: Latin America Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 62: Western Europe Value (US$ Million) by Indication, 2023 to 2033

Figure 63: Western Europe Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 64: Western Europe Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 69: Western Europe Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 70: Western Europe Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 71: Western Europe Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 72: Western Europe Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 73: Western Europe Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 74: Western Europe Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 75: Western Europe Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 76: Western Europe Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 77: Western Europe Attractiveness by Drug Class Type, 2023 to 2033

Figure 78: Western Europe Attractiveness by Indication, 2023 to 2033

Figure 79: Western Europe Attractiveness by Sales Channel , 2023 to 2033

Figure 80: Western Europe Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 82: Eastern Europe Value (US$ Million) by Indication, 2023 to 2033

Figure 83: Eastern Europe Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 84: Eastern Europe Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 89: Eastern Europe Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 90: Eastern Europe Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 91: Eastern Europe Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 92: Eastern Europe Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 93: Eastern Europe Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 94: Eastern Europe Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 95: Eastern Europe Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 96: Eastern Europe Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 97: Eastern Europe Attractiveness by Drug Class Type, 2023 to 2033

Figure 98: Eastern Europe Attractiveness by Indication, 2023 to 2033

Figure 99: Eastern Europe Attractiveness by Sales Channel , 2023 to 2033

Figure 100: Eastern Europe Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 102: South Asia and Pacific Value (US$ Million) by Indication, 2023 to 2033

Figure 103: South Asia and Pacific Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 104: South Asia and Pacific Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 109: South Asia and Pacific Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 110: South Asia and Pacific Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 111: South Asia and Pacific Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 112: South Asia and Pacific Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 113: South Asia and Pacific Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 114: South Asia and Pacific Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 115: South Asia and Pacific Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 116: South Asia and Pacific Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 117: South Asia and Pacific Attractiveness by Drug Class Type, 2023 to 2033

Figure 118: South Asia and Pacific Attractiveness by Indication, 2023 to 2033

Figure 119: South Asia and Pacific Attractiveness by Sales Channel , 2023 to 2033

Figure 120: South Asia and Pacific Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 122: East Asia Value (US$ Million) by Indication, 2023 to 2033

Figure 123: East Asia Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 124: East Asia Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 129: East Asia Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 130: East Asia Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 131: East Asia Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 132: East Asia Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 133: East Asia Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 134: East Asia Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 135: East Asia Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 136: East Asia Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 137: East Asia Attractiveness by Drug Class Type, 2023 to 2033

Figure 138: East Asia Attractiveness by Indication, 2023 to 2033

Figure 139: East Asia Attractiveness by Sales Channel , 2023 to 2033

Figure 140: East Asia Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Value (US$ Million) by Drug Class Type, 2023 to 2033

Figure 142: Middle East and Africa Value (US$ Million) by Indication, 2023 to 2033

Figure 143: Middle East and Africa Value (US$ Million) by Sales Channel , 2023 to 2033

Figure 144: Middle East and Africa Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Value (US$ Million) Analysis by Drug Class Type, 2018 to 2033

Figure 149: Middle East and Africa Value Share (%) and BPS Analysis by Drug Class Type, 2023 to 2033

Figure 150: Middle East and Africa Y-o-Y Growth (%) Projections by Drug Class Type, 2023 to 2033

Figure 151: Middle East and Africa Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 152: Middle East and Africa Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 153: Middle East and Africa Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 154: Middle East and Africa Value (US$ Million) Analysis by Sales Channel , 2018 to 2033

Figure 155: Middle East and Africa Value Share (%) and BPS Analysis by Sales Channel , 2023 to 2033

Figure 156: Middle East and Africa Y-o-Y Growth (%) Projections by Sales Channel , 2023 to 2033

Figure 157: Middle East and Africa Attractiveness by Drug Class Type, 2023 to 2033

Figure 158: Middle East and Africa Attractiveness by Indication, 2023 to 2033

Figure 159: Middle East and Africa Attractiveness by Sales Channel , 2023 to 2033

Figure 160: Middle East and Africa Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autoimmune Disease Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Sandhoff Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Marburg Virus Disease Therapeutics Market - Growth & Vaccine Advances 2025 to 2035

Niemann-Pick Disease Type C Therapeutics Market

Rosai-Dorfman Disease (RDD) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Pelvic Inflammatory Disease Therapeutics Market

Kinase Inhibitor in Autoimmune Diseases Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Infectious Disease Therapeutics Market

Veno-Occlusive Hepatic Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Respiratory Disease Therapeutics Market

Gastroesophageal Reflux Disease Therapeutics Market Analysis - Innovations & Forecast 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Rare Disease Gene Therapy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA