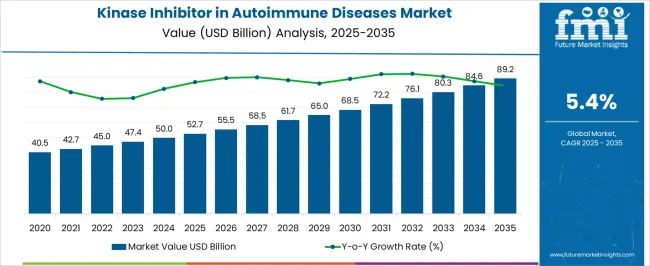

The Kinase Inhibitor in Autoimmune Diseases Market is estimated to be valued at USD 52.7 billion in 2025 and is projected to reach USD 89.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Kinase Inhibitor in Autoimmune Diseases Market Estimated Value in (2025 E) | USD 52.7 billion |

| Kinase Inhibitor in Autoimmune Diseases Market Forecast Value in (2035 F) | USD 89.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The kinase inhibitor in autoimmune diseases market is witnessing sustained growth as advancements in targeted therapies and increasing prevalence of autoimmune disorders reshape treatment paradigms. A noticeable shift toward precision medicine approaches is being observed as physicians and patients seek alternatives to broad-spectrum immunosuppressants.

Evolving clinical guidelines and the introduction of novel kinase inhibitors with improved safety profiles are contributing to wider adoption across multiple indications. Future growth is anticipated to be supported by rising awareness of early diagnosis, ongoing clinical trials exploring expanded therapeutic applications, and growing investments in biopharmaceutical innovation.

The emphasis on reducing long-term dependency on corticosteroids and minimizing systemic side effects is paving the way for kinase inhibitors to become a cornerstone of autoimmune disease management.

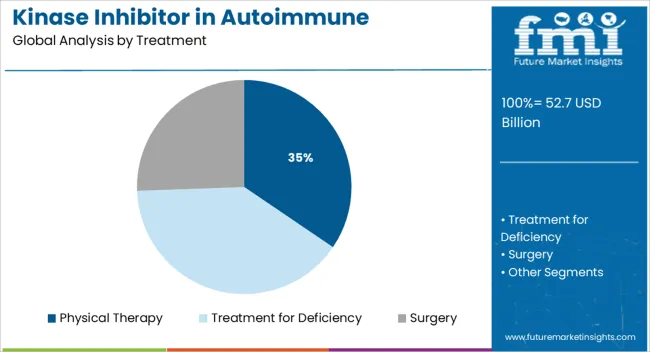

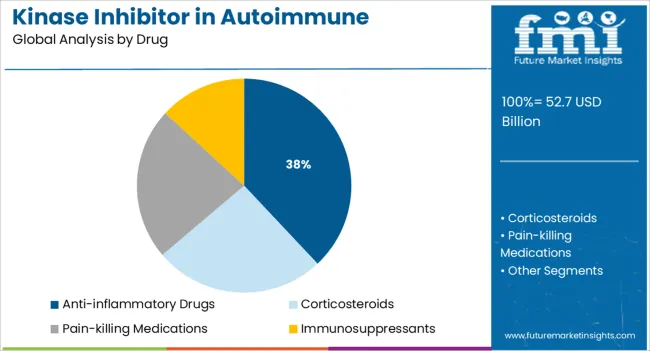

The market is segmented by Treatment and Drug and region. By Treatment, the market is divided into Physical Therapy, Treatment for Deficiency, and Surgery. In terms of Drug, the market is classified into Anti-inflammatory Drugs, Corticosteroids, Pain-killing Medications, and Immunosuppressants. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by treatment, the physical therapy segment is expected to account for 34∙5% of the total market revenue in 2025, positioning itself as the leading treatment option. This prominence has been driven by the growing recognition of the role of supportive care in managing functional impairments and maintaining quality of life for patients with autoimmune diseases.

Physical therapy has been increasingly integrated into comprehensive care plans to address mobility limitations, pain management, and fatigue without adding pharmacological burden. Its leadership has been reinforced by its accessibility, cost-effectiveness, and ability to complement drug-based regimens while reducing the risk of adverse effects associated with long-term medication use.

Institutional support for multidisciplinary care models and rising demand for non-invasive, patient-centric approaches have further solidified the segment’s dominance in treatment strategies.

Segmented by drug, the anti-inflammatory drugs segment is projected to capture 38∙0% of the market revenue in 2025, securing its position as the leading drug category. This leadership has been shaped by the widespread reliance on anti-inflammatory agents to provide rapid symptom relief and disease control in autoimmune conditions.

The segment’s growth has been supported by the established efficacy, availability, and affordability of these drugs, which continue to serve as first-line therapy in many clinical settings. Continued demand has been reinforced by physician familiarity and patient acceptance, particularly in acute flare management.

Additionally, the integration of newer formulations and combination therapies has enhanced effectiveness while improving tolerability, ensuring sustained preference for anti-inflammatory drugs despite the emergence of novel targeted agents. The segment’s entrenched role in treatment algorithms and its ability to deliver predictable outcomes have cemented its leading share in the market.

The kinase inhibitor in the autoimmune diseases market is expected to gain market growth in the forecast period of 2025 to 2035. Latest market analysis by FMI the market is to grow at a CAGR of 5.4% in the above-mentioned forecast period.

Autoimmune diseases occur when the immune system attacks one or more cells of the body which are functioning normally owing to the irregularities. The mis-functioning of the immune system is a result of the failure to recognize immune cells, tissues, and organs and produce autoantibodies targeting these cells.

There are massive technological developments happening in the healthcare sector, especially in the area of autoimmune disease treatment. Companies are making use of this technology to develop much more evolved forms of tyrosine kinase inhibitors.

This might increase the demand for kinase inhibitors for cancer treatment during the forecast period. Presently, pharmaceutical companies are investing heavily in Research and Development to develop enhanced kinase inhibitors. This is currently driving the market growth. The global kinase inhibitor in the autoimmune diseases market rose at a CAGR of 5.1% from 2020 to 2025.

Growing Healthcare Spending to Drive the Kinase Inhibitor in Autoimmune Disease Market

The increasing prevalence of autoimmune and chronic diseases including rheumatic arthritis, psoriatic arthritis, ulcerative colitis, etc. is expected to drive the growth of kinase inhibitors in the autoimmune disease market.

Additionally, the increasing number of special designations for drugs in the pipeline is also expected to fuel the growth of the market. Kinase Inhibitor in the autoimmune disease market is primarily driven by a few key factors such as the rising prevalence of autoimmune disease, patient awareness regarding rising healthcare concerns, increase in healthcare expenditure.

The considerable efforts by the governments as well as the private players across the world in improving, rebuilding, and innovating healthcare infrastructure across the globe are also translating into various worthwhile development opportunities for the players in the global kinase inhibitor autoimmune diseases market in coming years. Rising government initiatives and the increase in automation technologies lead to higher sensitivity, faster and easy performing diagnosis test results, and prevention of disease.

Increased Research and Development Drive the Market During the Forecast Period

The rising prevalence of autoimmune diseases is likely to fuel the growth of the kinase inhibitor in the autoimmune disease market. Therefore, a consistent increase in the autoimmune patient population across the world has been identified as one of the major factors driving the kinase inhibitor in the autoimmune disease market.

The pharmaceutical companies on Research and Development to come up with potential kinase inhibitors for the treatment of autoimmune diseases are driving the growth of kinase inhibitors in the autoimmune disease market, globally. More than 400 diseases have been associated directly or indirectly with protein kinase. The success of kinase inhibitors in treating autoimmune diseases such as rheumatoid arthritis, psoriasis, and psoriatic arthritis has showcased their therapeutic potential. This success, coupled with a greater understanding of inflammatory signaling cascades, led to kinase inhibitors taking center stage to pursue new anti-inflammatory agents for the treatment of immune-mediated diseases.

The expected launch of emerging therapies such as SHR0302, Ruxolitinib, Branebrutinib, Ritlecitinib, Ritlecitinib/PF-06650833/ Tofacitinib, Abrocitinib, PF-06826647, Brepocitinib, SHR0302, Ruxolitinib, Branebrutinib likely to drive the market during the forecast period.

Lack of Skilled Professional May Hamper the Market Growth

The high cost associated with the latest clinical trials and complex approvals processes is acting as a major obstruction to the growth of kinase inhibitors in the autoimmune diseases market. On the other hand, the dearth of skilled professionals and technicians as well as the rise in the lack of understanding about the basic aetiology of autoimmune disorders may restrict the growth in the global kinase inhibitor autoimmune diseases market in near future.

However, modernization, as well as technological advancements in medical and healthcare devices as well as the constant efforts by the industry players on geographical as well as product offerings expansion, are anticipated to bolster the rising demand in the global kinase inhibitor in autoimmune diseases market over the forecast period.

Increasing Rate of Autoimmune Diseases in the USA to Propel the Market Growth

The USA is estimated to account for over 5.2% of the North American market in 2025. The growth of the market in the region is attributed to the increasing prevalence of autoimmune diseases. North America holds a leading position in the Kinase inhibitor in the autoimmune disease Market due to the growing incidence of autoimmune disorders such as rheumatoid arthritis, and diabetes type I in the region.

According to the National Institutes of Health, up to 23.5 million Americans (more than seven percent of the population) suffer from an autoimmune disease - and the prevalence is rising.

Government initiatives such as the Affordable Care Act and Patient Protection Act are further fueling the growth of the market size of kinase inhibitors in autoimmune diseases.

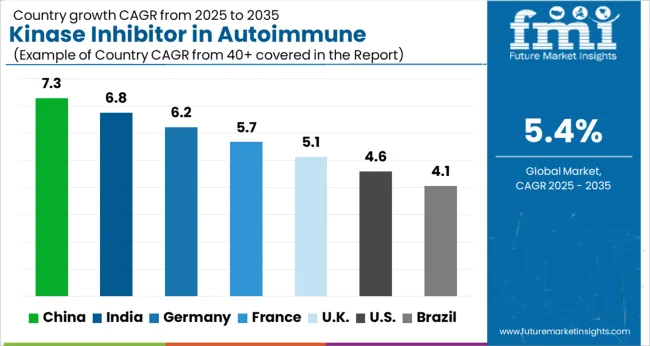

Rising Investments in Research and Development Driving Growth in Europe Market

The Europe kinase inhibitors in the autoimmune disease market are expected to rise at a CAGR of 5.1% from 2025 to 2035. Europe is expected to have the second-largest market for global kinase inhibitors in the autoimmune disease market. Increasing awareness among people about diseases is also a major factor that may boost the growth of the market in this region.

The growing advancement of healthcare infrastructure, increasing per-capita income, and MNCs strengthening their distribution network all these factors also boost the market growth. Increased penetration of new technologies such as potable diagnostic equipment and novel biomarkers are contributing largely to the market growth of Europe.

Rapid development in pharmaceuticals to drive the market growth in Asia Pacific

Asia Pacific is anticipated to experience the fastest growth in the kinase inhibitors in the autoimmune diseases market as a result of an increase in the prevalence of chronic diseases, and autoimmune diseases. Asia is expected to be the fastest-growing market in the upcoming years. This is due to the rising aging population and improving healthcare infrastructure in this region. Moreover, rising awareness about better healthcare facilities is also driving the growth of the autoimmune disease treatment market in the region.

Rising awareness about healthcare and increasing investments in Research and Development in pharmaceutical and life sciences sectors are some of the key factors driving the growth of the global kinase inhibitor in the autoimmune diseases market. However, in the Middle East and Africa market growth is expected to be limited due to slow economic growth, underdeveloped infrastructure, and lower access to technological advancement.

| UK | 5.1% |

|---|---|

| India | 4.8% |

| South Korea | 4.9% |

| China | 5.0% |

| USA | 5.2% |

Anti-inflammatory Drugs Segment remains dominant among other Drugs Types

Anti-inflammatory Drugs (NSAIDs) dominated the industry in 2025. The anti-inflammatory segment dominated the global market in 2025 with a revenue share of over 45.3%. This is attributed to the high level of penetration of drugs, and availability at lower cost in comparison to drugs of other classes.

Some of the drugs to treat autoimmune diseases include NSAID, DMARD, biologic DMARD, and 5-ASA. Other therapies such as bridge therapy, topical therapy, phototherapy, and recombinant technology are also used for the treatment of these diseases. On the other hand, corticosteroids anticipated to witness the fastest growth over the forecast period are typically used to treat rheumatologic diseases, like rheumatoid arthritis, lupus, or vasculitis.

How do New Entrants Contribute to the Kinase Inhibitor in Autoimmune Diseases Market?

With technological innovations happening at a rapid pace, and companies looking for ways to increase customer engagement, start-ups are taking all possible steps to establish a name for themselves in the kinase inhibitor in the autoimmune diseases market.

Some of the start-ups in the kinase inhibitor in autoimmune diseases market include-

The professional survey study carefully analyses the operations and overview of the corporate structures and functioning of the leading and major manufacturers and players functional within the global kinase inhibitor in the autoimmune diseases market. It assesses its product offerings, financial outlook, sales, revenue, and growth over the forecast period.

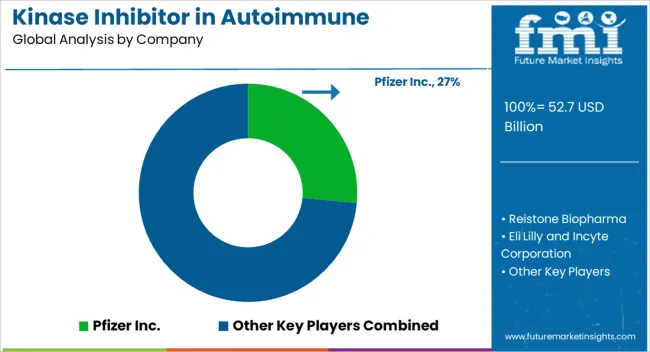

Some of the leading manufacturers and players assessed in the global kinase inhibitor in autoimmune treatment market include Pfizer, Reistone Biopharma, Eli Lily and Incyte Corporation, AbbVie, Gilead Sciences, Astellas Pharma, Japan Tobacco and Torii Pharmaceutical, Incyte Corporation, Bristol Myers Squibb, Galapagos NV, and others

Manufacturers and players functional in the global kinase inhibitor in autoimmune diseases market are adopting various corporate growth strategies such as new product launches, mergers and acquisitions, and geographical expansion, among others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR from 2025 to 2035 |

| Expected Market Value (2025) | USD 52.7 billion |

| Projected Forecast Value (2035) | USD 89.2 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million & CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends & Pricing Analysis |

| Segments Covered | Treatment, Drug, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Singapore, Thailand, Indonesia, Australia, New Zealand |

| Key Companies Profiled | Pfizer; Reistone Biopharma; Eli Lily and Company; AbbVie; Gilead Sciences; Astellas Pharma; Japan Tobacco and Torii Pharmaceutical; Incyte Corporation; Bristol Myers Squibb; Galapagos NV |

| Customization | Available Upon Request |

The global kinase inhibitor in autoimmune diseases market is estimated to be valued at USD 52.7 billion in 2025.

The market size for the kinase inhibitor in autoimmune diseases market is projected to reach USD 89.2 billion by 2035.

The kinase inhibitor in autoimmune diseases market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in kinase inhibitor in autoimmune diseases market are physical therapy, treatment for deficiency and surgery.

In terms of drug, anti-inflammatory drugs segment to command 38.0% share in the kinase inhibitor in autoimmune diseases market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Janus Kinase (JAK) Inhibitors Market

Protein Kinase B Inhibitors Market

Creatine Kinase Reagent Market Size and Share Forecast Outlook 2025 to 2035

Combination Kinase Inhibitor Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cyclin-Dependent Kinase Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Bruton's Tyrosine Kinase (BTK) Inhibitors Market

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

PARP Inhibitor Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Global KRAS Inhibitor Market Analysis – Size, Share & Forecast 2024-2034

PCSK9 Inhibitor Market Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

NF-KB Inhibitors Market

Mould Inhibitors Market

Enzyme Inhibitors Market

Galectin Inhibitor Therapeutics Market

Paraffin Inhibitors Market

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA