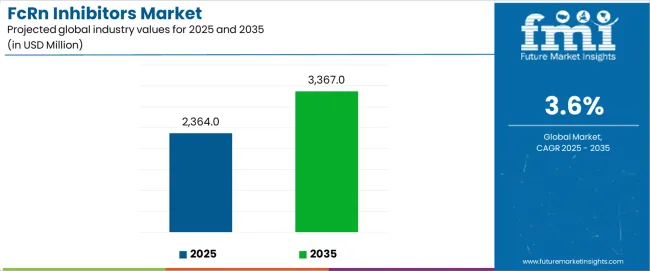

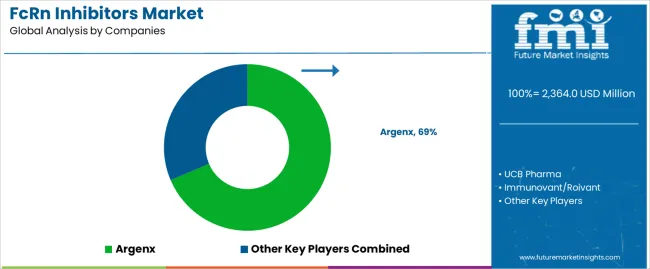

The global FcRn inhibitors market, projected to expand from USD 2,364.0 million in 2025 to USD 3,367.0 million in 2035, reflects total growth of 42.4% over the forecast horizon. This represents an absolute gain of USD 1,003.0 million and a compound annual growth rate (CAGR) of 3.6%, leading to a nearly 1.4X increase in market size during the ten-year span. The reasoning behind this forecast lies in the interplay of epidemiological patterns, therapeutic innovation, healthcare investment priorities, and adoption cycles across developed and emerging economies.

The rising prevalence of autoimmune and rare immunological disorders directly shapes the addressable patient pool for FcRn inhibitors. Conditions such as myasthenia gravis, pemphigus vulgaris, and immune thrombocytopenia are becoming more frequently diagnosed, and biologics targeting FcRn pathways are gaining traction as advanced treatment options. This epidemiological backdrop provides a stable foundation for expansion, ensuring consistent demand. Yet, because the therapy segment focuses on a limited range of indications compared with larger pharmaceutical categories, the expected CAGR of 3.6% remains moderate, reflecting steady rather than rapid adoption.

Growth projections are also reinforced by innovation in therapeutic development. Biopharmaceutical companies are advancing monoclonal antibodies and next-generation FcRn inhibitors that promise better safety, efficacy, and patient convenience. Multiple pipeline candidates in late-stage clinical trials are scheduled for launch within the early years of the forecast period. Their entry into commercial markets will add incremental value, expand prescriber confidence, and increase uptake beyond leading medical centers, aligning with the projected USD 1,003.0 million gain over the decade.

Healthcare systems and specialty treatment centers are also allocating more resources to biologics that deliver measurable improvements in outcomes for autoimmune disorders. The anticipated 1.4X market expansion fits within the broader shift toward value-based care, where biologics adoption is balanced by cost-effectiveness considerations. Reimbursement policies in North America and Europe, combined with accelerating biologics penetration in Asia Pacific, provide structural support for growth. At the same time, pricing pressures and competition from biosimilars and alternative therapies help explain why growth remains steady rather than exponential.

Regional variation adds further context. North America leads with its strong healthcare infrastructure and faster regulatory approvals, providing a reliable revenue base. Europe follows with robust adoption under strict but supportive reimbursement environments. Asia Pacific is set to record the highest relative growth rate, although from a smaller base, driven by expanding healthcare access and rising biologics adoption. Latin America and Africa contribute gradually, signaling long-term opportunities rather than immediate acceleration.

Between 2025 and 2030, the FcRn inhibitors market is projected to expand from USD 2,364.0 million to USD 2,821.3 million, resulting in a value increase of USD 457.3 million, which represents 45.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for targeted therapeutic solutions, increasing applications in autoimmune disease management and specialty care infrastructure, and growing penetration in emerging therapeutic markets. Pharmaceutical manufacturers are expanding their production capabilities to address the growing demand for customized FcRn inhibitor therapies in various clinical applications and specialty treatment programs.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,364.0 million |

| Forecast Value in (2035F) | USD 3,367.0 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

The FcRn inhibitors market is largely driven by demand in autoimmune disease therapeutics, which contributes about 30-35% of the FcRn inhibitors market share. These inhibitors show potential for treating diseases like immune thrombocytopenia (ITP), myasthenia gravis (MG), rheumatoid arthritis (RA), and lupus, where immune system dysregulation leads to the production of harmful antibodies. The immunology market contributes another 25-30%, as FcRn inhibitors target the underlying mechanisms of immune responses by regulating the recycling of IgG antibodies, reducing pathogenic immune reactions. The oncology therapeutics market plays a key role, accounting for about 10-15%, as FcRn inhibitors are explored for their potential to enhance the efficacy of cancer treatments, particularly in targeting tumor-specific antigens and improving immune responses in cancer therapy.

The pharmaceutical and biotechnology market accounts for approximately 15-20%, driven by the significant number of biopharmaceutical companies investing in the development of FcRn inhibitors. Lastly, the rare disease therapeutics market contributes 10-12%, due to the potential of FcRn inhibitors to treat rare diseases where IgG-mediated immune dysfunction is prevalent. As research advances, this market is expected to expand, with more clinical trials and innovative treatment options. The success of FcRn inhibitors in clinical settings depends on regulatory approvals, patient access, and successful outcomes in trials.

Market expansion is being supported by the increasing demand for effective autoimmune treatments and the corresponding need for high-efficacy therapeutic solutions in clinical applications across global healthcare and specialty medical operations. Modern healthcare systems are increasingly focused on advanced drug technologies that can improve patient outcomes, reduce treatment burden, and enhance therapeutic performance while meeting stringent safety requirements. The proven efficacy of FcRn inhibitors in various autoimmune applications makes them an essential component of comprehensive treatment strategies and clinical care programs.

The growing emphasis on precision medicine and advanced therapeutic optimization is driving demand for ultra-efficient drug systems that meet stringent performance specifications and clinical requirements for specialized applications. Healthcare providers' preference for reliable, high-performance therapeutic solutions that can ensure consistent treatment outcomes is creating opportunities for innovative drug technologies and personalized clinical solutions. The rising influence of specialty care protocols and precision medicine standards is also contributing to increased adoption of premium-grade FcRn inhibitors across different clinical applications and treatment systems requiring advanced therapeutic technology.

The FcRn inhibitors market represents a specialized growth opportunity, expanding from USD 2,364.0 million in 2025 to USD 3,367.0 million by 2035 at a 3.6% CAGR. As healthcare providers prioritize clinical efficacy, treatment optimization, and patient outcomes in complex autoimmune treatment processes, FcRn inhibitors have evolved from a niche therapeutic technology to an essential component enabling disease management, therapeutic optimization, and multi-stage clinical care across healthcare operations and specialized medical applications.

The convergence of clinical expansion, increasing precision medicine adoption, specialized therapeutic infrastructure growth, and safety requirements creates momentum in demand. High-efficacy formulations offering superior therapeutic performance, cost-effective intravenous systems balancing performance with economics, and specialized subcutaneous variants for patient convenience will capture market premiums, while geographic expansion into high-growth Asian markets and emerging market penetration will drive volume leadership. Clinical emphasis on efficacy and safety provides structural support.

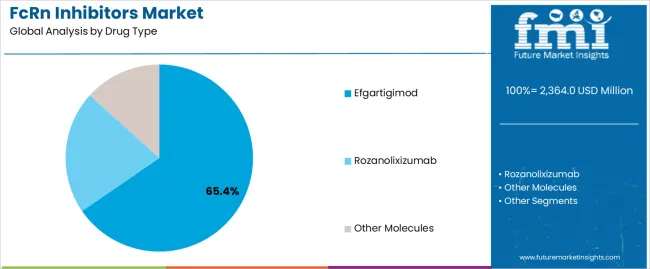

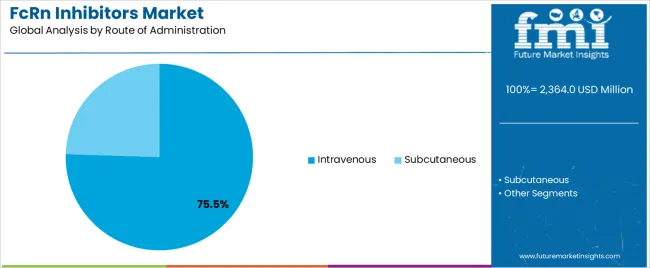

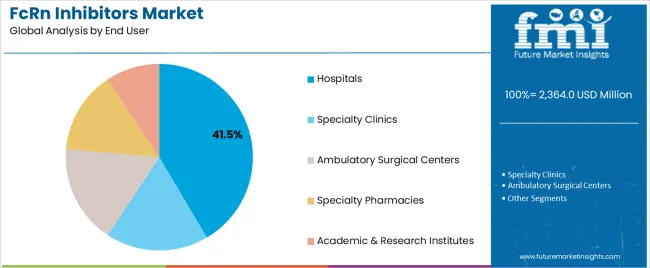

The FcRn inhibitors market is segmented by drug type, route of administration, end user, and region. By drug type, the FcRn inhibitors market is divided into efgartigimod, rozanolixizumab, and other molecules. Based on the route of administration, the FcRn inhibitors market is categorized into intravenous and subcutaneous. By end user, the FcRn inhibitors market is divided into hospitals, specialty clinics, ambulatory surgical centers, specialty pharmacies, and academic & research institutes. Regionally, the FcRn inhibitors market is divided into Asia Pacific, North America, Europe, Latin America, Middle East & Africa.

The efgartigimod segment is projected to account for 65.4% of the FcRn inhibitors market in 2025, reaffirming its position as the category's dominant drug type. Clinical operators increasingly recognize the optimal balance of efficacy and safety profile offered by efgartigimod for most autoimmune applications, particularly in myasthenia gravis and other antibody-mediated diseases. This drug type addresses both therapeutic requirements and long-term clinical considerations while providing reliable treatment outcomes across diverse medical applications.

This drug type forms the foundation of most clinical protocols for autoimmune treatment applications, as it represents the most widely accepted and commercially viable level of therapeutic technology in the industry. Safety standards and extensive clinical testing continue to strengthen confidence in efgartigimod formulations among healthcare and medical providers. With increasing recognition of the efficacy-safety optimization requirements in autoimmune treatment, efgartigimod systems align with both clinical efficiency and patient safety goals, making them the central growth driver of comprehensive therapeutic strategies.

Intravenous administration is projected to represent 75.5% of FcRn inhibitors demand in 2025, underscoring its role as the primary delivery method driving market adoption and growth. Healthcare providers recognize that complex autoimmune requirements, including severe disease states, specialized clinical needs, and multi-stage treatment systems, often require intravenous FcRn inhibitors that standard delivery methods cannot adequately provide. Intravenous administration offers enhanced therapeutic control and clinical compliance in hospital-based treatment applications.

The segment is supported by the growing complexity of autoimmune disease management, requiring sophisticated delivery systems, and the increasing recognition that advanced therapeutic technologies can improve treatment performance and clinical outcomes. Healthcare providers are increasingly adopting evidence-based treatment guidelines that recommend specific FcRn inhibitors for optimal therapeutic reliability. As understanding of disease complexity advances and clinical requirements become more stringent, FcRn inhibitors will continue to play a crucial role in comprehensive treatment strategies within the healthcare market.

Hospitals are projected to represent 41.5% of FcRn inhibitors demand in 2025, demonstrating their critical role as the primary end user segment driving market expansion and adoption. Healthcare administrators recognize that hospital requirements, including complex patient management processes, specialized treatment protocols, and multi-level care systems, often require advanced FcRn inhibitors that standard healthcare technologies cannot adequately provide. Hospital-based FcRn inhibitors offer enhanced patient management and clinical compliance in specialized care applications.

The FcRn inhibitors market is advancing steadily due to increasing recognition of targeted immunomodulation importance and growing demand for high-efficacy therapeutic solutions across the healthcare and specialty medical sectors. The FcRn inhibitors market faces challenges, including complex regulatory processes, potential for clinical variations during treatment and monitoring, and concerns about supply chain consistency for specialized pharmaceutical products. Innovation in drug technologies and personalized clinical protocols continues to influence product development and market expansion patterns.

The growing adoption of advanced healthcare facilities is enabling the development of more sophisticated FcRn inhibitors production and clinical control systems that can meet stringent regulatory requirements. Specialized medical facilities offer comprehensive therapeutic services, including advanced treatment and monitoring processes that are particularly important for achieving high-efficacy requirements in autoimmune applications. Advanced healthcare infrastructure provides access to premium services that can optimize treatment performance and reduce clinical costs while maintaining cost-effectiveness for large-scale medical operations.

Modern healthcare organizations are incorporating digital technologies such as real-time therapeutic monitoring, automated delivery systems, and clinical integration to enhance FcRn inhibitors deployment and treatment processes. These technologies improve therapeutic performance, enable continuous clinical monitoring, and provide better coordination between healthcare providers and patients throughout the treatment cycle. Advanced digital platforms also enable personalized treatment specifications and early identification of potential therapeutic deviations or supply disruptions, supporting reliable clinical care.

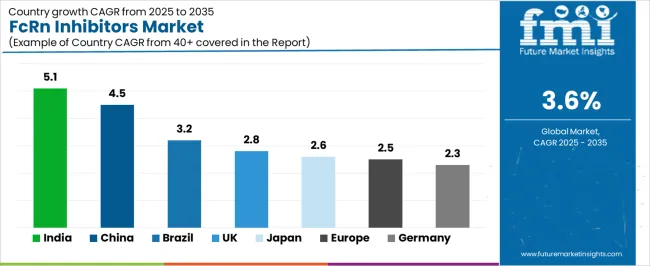

| Country | CAGR (2025-2035) |

|---|---|

| India | 5.1% |

| China | 4.5% |

| Brazil | 3.2% |

| UK | 2.8% |

| Japan | 2.6% |

| Europe | 2.5% |

| Germany | 2.3% |

| USA | 2.2% |

The FcRn inhibitors market is experiencing varied growth globally, with India leading at a 5.1% CAGR through 2035, driven by the expansion of healthcare infrastructure development, increasing clinical capacity capabilities, and growing domestic demand for high-efficacy therapeutic solutions. China follows at 4.5%, supported by healthcare expansion, growing recognition of advanced drug technology importance, and expanding medical capacity. Brazil records 3.2% growth, with a focus on developing the healthcare infrastructure and specialty medicine industries. UK shows 2.8% growth, representing an emerging market with expanding clinical frameworks. Japan demonstrates 2.6% growth with focus on advanced healthcare adoption. Europe demonstrates 2.5% growth, emphasizing healthcare infrastructure expansion and systematic treatment approaches. Germany demonstrates 2.3% growth, emphasizing clinical infrastructure expansion and systematic medical approaches. USA demonstrates 2.2% growth, emphasizing healthcare infrastructure expansion and systematic clinical approaches.

fcrn inhibitors market is in India projected to grow at a CAGR of 5.1% from 2025 to 2035. The rise in autoimmune diseases, including rheumatoid arthritis and systemic lupus erythematosus, is a key factor contributing to the increasing demand for FcRn inhibitors. The country’s expanding healthcare infrastructure, rising healthcare awareness, and growing access to advanced biologic treatments are propelling market growth. India is also witnessing an increasing number of clinical trials and research activities in the field of immunology, which is fostering the adoption of novel therapies. The availability of affordable healthcare options, combined with government initiatives to improve access to healthcare, further enhances the FcRn inhibitors market outlook. With a large patient population and a demand for cost-effective treatments, India represents a significant growth opportunity for FcRn inhibitors, especially in underserved regions.

fcrn inhibitors market in China is expected to expand at a CAGR of 4.5% from 2025 to 2035. The growth is driven by an increasing number of autoimmune diseases such as rheumatoid arthritis, IgG4-related disease, and autoimmune hemolytic anemia, coupled with the country’s aging population. China’s healthcare reforms are making innovative treatments more accessible, and the adoption of biologics has increased significantly. local manufacturers are focusing on producing cost-effective biosimilars, which has attracted more patients to consider FcRn inhibitors as a viable treatment option. The FcRn inhibitors market is also being shaped by the growing focus on immunology research, leading to new developments and applications for FcRn inhibitors in treating rare and complex conditions. With the expansion of insurance coverage and a rise in disposable income, there is a stronger demand for biologic therapies across both urban and rural populations.

fcrn inhibitors market in the UK is expected to grow at a CAGR of 2.8% from 2025 to 2035, supported by the rising prevalence of autoimmune diseases and the increasing focus on biologic treatments. The National Health Service (NHS) plays a critical role in facilitating the availability of advanced therapies, including FcRn inhibitors. The FcRn inhibitors market is driven by the need for effective treatments for conditions like rheumatoid arthritis, systemic lupus erythematosus, and IgG4-related diseases. With a highly developed healthcare infrastructure and ongoing research into immunology, the UK is well-positioned to support the adoption of FcRn inhibitors. The FcRn inhibitors market faces challenges in terms of the high cost of biologics and funding constraints, which may limit the widespread use of these therapies.

Advanced medical technology market in the USA demonstrates sophisticated healthcare deployment with documented FcRn inhibitors effectiveness in medical departments and clinical centers through integration with existing healthcare systems and treatment infrastructure. The country leverages clinical expertise in medical technology and therapeutic systems integration to maintain a 2.2% CAGR through 2035. Medical centers, including major metropolitan areas, showcase premium installations where FcRn inhibitors integrate with comprehensive patient information systems and care platforms to optimize treatment accuracy and clinical workflow effectiveness.

American healthcare providers prioritize treatment reliability and regulatory compliance in clinical development, creating demand for premium systems with advanced features, including performance validation and integration with USA medical standards. The FcRn inhibitors market benefits from established healthcare industry infrastructure and a willingness to invest in advanced therapeutic technologies that provide long-term clinical benefits and compliance with medical regulations.

Europe's market expansion benefits from diverse healthcare demand, including clinical infrastructure modernization across major cities, treatment development programs, and government healthcare programs that increasingly incorporate FcRn inhibitors solutions for patient care applications. The region maintains a 2.5% CAGR through 2035, driven by rising clinical awareness and increasing adoption of therapeutic benefits, including superior treatment capabilities and reduced complexity.

Market dynamics focus on cost-effective therapeutic solutions that balance advanced treatment features with affordability considerations important to European healthcare operators. Growing clinical infrastructure creates demand for modern drug systems in new medical facilities and healthcare equipment modernization projects.

The FcRn inhibitors market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market share of 28.7% in 2025 and 28.1% in 2035, supported by its advanced healthcare infrastructure, precision treatment management capabilities, and strong pharmaceutical presence throughout major medical regions.

UK follows with 17.3% market share in 2025 and 17.0% in 2035, driven by advanced clinical protocols, medical innovation integration, and expanding healthcare networks serving both domestic and international markets. France holds 15.4% market share in 2025 and 15.1% in 2035, supported by healthcare infrastructure expansion and growing adoption of high-efficacy therapeutic systems. Italy commands 11.7% market share in 2025 and 11.4% in 2035, while Spain accounts for 8.7% in 2025 and 8.6% in 2035. BENELUX holds 7.1% market share in 2025 and 7.0% in 2035. Nordic Countries account for 6.1% in 2025 and 6.0% in 2035. The Rest of Western Europe region, including smaller Western European markets, holds 4.9% market share in 2025 and 6.8% in 2035, representing diverse market opportunities with established healthcare and clinical infrastructure capabilities.

The FcRn inhibitors market is characterized by competition among established pharmaceutical companies, specialty biotechnology companies, and therapeutic technology suppliers focused on delivering high-efficacy, consistent, and reliable therapeutic solutions. Companies are investing in drug technology advancement, clinical control enhancement, strategic partnerships, and customer medical support to deliver effective, efficient, and reliable therapeutic solutions that meet stringent healthcare and clinical requirements. Treatment optimization, clinical validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

Argenx leads the FcRn inhibitors market with a 68.6% market share, offering comprehensive high-efficacy FcRn inhibitors with a focus on clinical consistency and therapeutic reliability for medical applications. UCB Pharma provides specialized treatment systems with emphasis on clinical applications and comprehensive technical support services. Immunovant/Roivant focuses on advanced therapeutic technologies and customized medical solutions for treatment systems serving global markets. Johnson & Johnson (Janssen) delivers established pharmaceutical systems with strong clinical control systems and customer service capabilities.

Viridian Therapeutics operates with a focus on bringing innovative therapeutic technologies to specialized medical applications and emerging markets. HanAll Biopharma/Harbour BioMed provides comprehensive treatment system portfolios, including advanced therapeutic services, across multiple clinical applications and healthcare processes.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,364.0 million |

| Drug Type | Efgartigimod, Rozanolixizumab, Other Molecules |

| Route of Administration | Intravenous, Subcutaneous |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Specialty Pharmacies, Academic & Research Institutes |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | USA, Germany, France, UK, Italy, Spain, Japan, South Korea, China, India, Brazil and 40+ countries |

| Key Companies Profiled | Argenx, UCB Pharma, Immunovant/Roivant, Johnson & Johnson (Janssen), Viridian Therapeutics, and HanAll Biopharma/Harbour BioMed |

| Additional Attributes | Dollar sales by drug type and route of administration, regional demand trends, competitive landscape, healthcare provider preferences for specific therapeutic systems, integration with specialty pharmaceutical supply chains, innovations in drug technologies, clinical monitoring, and treatment optimization |

The global FcRn inhibitors market is estimated to be valued at USD 2,364.0 million in 2025.

The market size for the FcRn inhibitors market is projected to reach USD 3,367.0 million by 2035.

The FcRn inhibitors market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in FcRn inhibitors market are efgartigimod, rozanolixizumab and other molecules.

In terms of route of administration, intravenous segment to command 75.5% share in the FcRn inhibitors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

NF-KB Inhibitors Market

Mould Inhibitors Market

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Inhibitors Market

Paraffin Inhibitors Market

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Proton Pump Inhibitors Market Insights - Demand, Size & Industry Trends 2025 to 2035

Angiopoietin Inhibitors Therapeutic Market

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Protein Kinase B Inhibitors Market

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Immune Checkpoint Inhibitors Market

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Low dosage Hydrate Inhibitors Market - Demand, Growth & Industry Outlook 2025 to 2035

Janus Kinase (JAK) Inhibitors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA