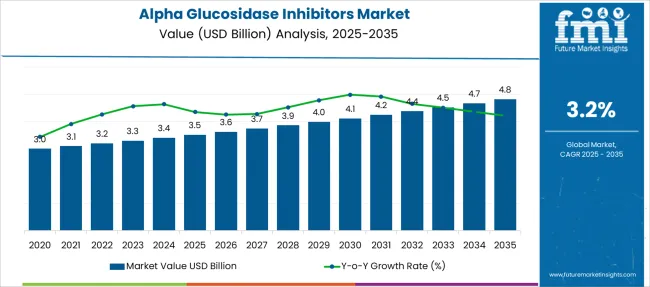

The Alpha Glucosidase Inhibitors Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

| Metric | Value |

|---|---|

| Alpha Glucosidase Inhibitors Market Estimated Value in (2025E) | USD 3.5 billion |

| Alpha Glucosidase Inhibitors Market Forecast Value in (2035F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The Alpha Glucosidase Inhibitors market is experiencing sustained expansion due to the increasing global burden of type 2 diabetes and the growing emphasis on glycemic control as part of comprehensive diabetes management. This therapeutic class is being favored for its mechanism of action that slows carbohydrate absorption and mitigates postprandial blood glucose spikes, which is crucial for long-term metabolic regulation.

The rising adoption of oral antidiabetic agents in combination therapy and the emphasis on low-risk hypoglycemic profiles have strengthened the clinical relevance of alpha glucosidase inhibitors. Furthermore, aging populations, rising obesity prevalence, and shifting dietary patterns in both developed and developing regions are contributing to the rising incidence of diabetes, thereby driving market demand.

Efforts by public health organizations to expand access to affordable therapies, along with support for generic manufacturing, are expected to further catalyze the global uptake of these drugs. The continued integration of alpha glucosidase inhibitors in evidence-based treatment guidelines highlights their critical role in diabetes care..

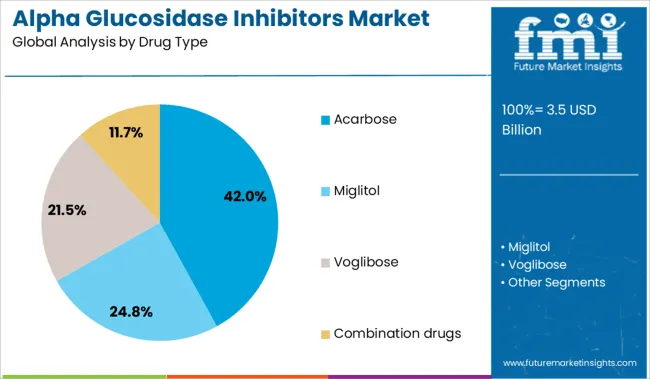

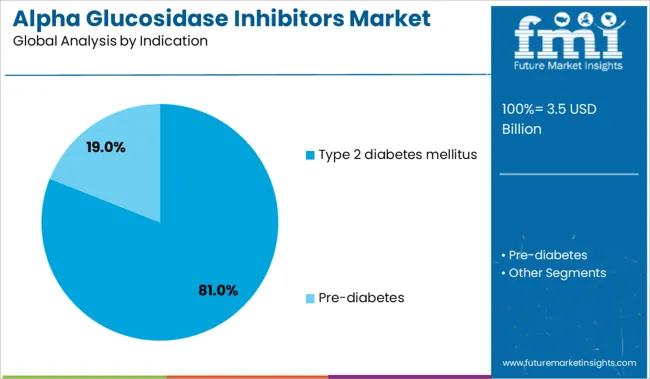

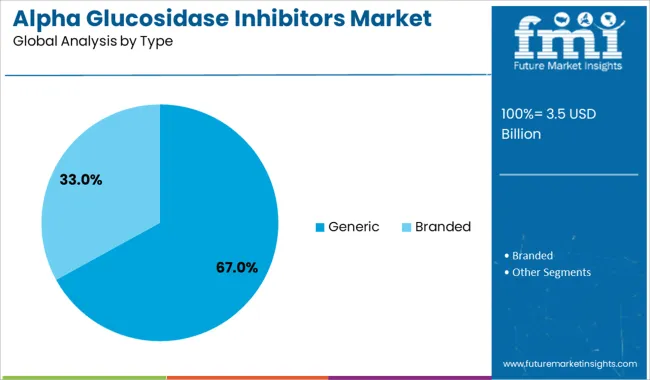

The market is segmented by Drug Type, Indication, Type, and Distribution Channel and region. By Drug Type, the market is divided into Acarbose, Miglitol, Voglibose, and Combination drugs. In terms of Indication, the market is classified into Type 2 diabetes mellitus and Pre-diabetes. Based on Type, the market is segmented into Generic and Branded. By Distribution Channel, the market is divided into Hospital pharmacies, Retail pharmacies, and Online pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Acarbose drug type segment is projected to contribute 42% of the Alpha Glucosidase Inhibitors market revenue in 2025, establishing it as the leading drug category. Growth in this segment has been driven by the extensive clinical validation of acarbose as a first-line or adjunct therapy in managing type 2 diabetes. The drug’s ability to reduce postprandial hyperglycemia without inducing hypoglycemia has enhanced its safety profile and broadened its adoption across various patient groups.

Acarbose has been favored for its compatibility with other oral antidiabetic agents, offering physicians greater flexibility in customizing treatment plans. Increased availability in generic form has improved affordability, especially in regions with limited access to newer therapeutic agents.

Regulatory approvals in multiple geographies and strong physician familiarity have also supported widespread prescribing patterns. As health systems continue to emphasize preventative strategies and cost-effective therapies, acarbose remains a central component in achieving long-term glycemic targets within the diabetic population..

The type 2 diabetes mellitus indication segment is anticipated to account for 81% of the Alpha Glucosidase Inhibitors market revenue in 2025, making it the dominant therapeutic area. This prominence is being sustained by the escalating prevalence of type 2 diabetes globally, driven by sedentary lifestyles, urbanization, and dietary changes. Alpha glucosidase inhibitors have been recognized for their efficacy in managing postprandial glucose excursions, a critical aspect of type 2 diabetes treatment that complements fasting glucose control strategies.

The inclusion of these agents in international diabetes management guidelines has reinforced their clinical importance. Moreover, their oral administration and minimal systemic absorption have enhanced patient compliance and safety, particularly among the elderly.

The focus on early pharmacological intervention and the need to delay disease progression have resulted in the consistent use of these inhibitors throughout different stages of diabetes care. As healthcare systems prioritize the containment of diabetes-related complications, these agents continue to play a significant role in controlling this chronic condition..

The generic type segment is expected to represent 67% of the Alpha Glucosidase Inhibitors market revenue in 2025, affirming its position as the market leader. Growth in this segment has been supported by the widespread expiration of branded drug patents, which has facilitated the entry of cost-effective generic formulations across numerous regions. The availability of generics has significantly improved access, particularly in emerging markets where healthcare resources are constrained.

Payers and providers have increasingly opted for generic alternatives to manage drug expenditure without compromising therapeutic efficacy. Generic alpha glucosidase inhibitors have demonstrated equivalent clinical outcomes, leading to their inclusion in national formularies and treatment protocols. Additionally, government procurement programs and insurance coverage policies have further boosted demand for generics.

The segment’s prominence is being maintained by strong manufacturing and distribution networks that ensure consistent supply. As cost containment remains a critical goal across healthcare systems, the uptake of generic formulations continues to strengthen the economic viability of diabetes care..

The alpha glucosidase inhibitors market has been shaped by two major opportunity pathways: therapy integration and regional expansion. From 2023 to 2025, fixed-dose combinations with agents like metformin and SGLT-2 inhibitors have created room for broader clinical adoption and improved compliance. Simultaneously, approvals and low-cost launches in Asia and Latin America have positioned off-patent formulations for scale. These trends indicate that both product reformulation and geographic penetration will anchor future market growth.

The growing incidence of type 2 diabetes has been recognized as a primary catalyst for alpha glucosidase inhibitor uptake. In 2023, widespread deployment of acarbose and miglitol was reported among adult populations to manage post-meal glucose spikes. By 2024, expanded prescriptions were being observed in hospital and retail settings as diagnostic rates rose steadily. In early 2025, global patient pools were further inflated by aging demographics and increasing obesity trends, thus further validating alpha glucosidase inhibitors as essential options for carbohydrate-modulated glycemic control. These patterns reinforce that patient volume growth is shaping market expansion, and overlooking this trend would be a critical misread of long-term demand drivers.

Opportunities have been identified in 2023 when fixed-dose combinations featuring alpha glucosidase inhibitors were trialed alongside SGLT-2 inhibitors, aiming to offer complementary glucose control mechanisms within a single pill format. In 2024, this strategy was further adopted through co-formulations with metformin, which were reported to improve cardiovascular risk profiles while minimizing gastrointestinal side effects. Advancing into 2025, long-acting alpha glucosidase inhibitors are being evaluated for extended-release oral therapies tailored to postprandial glucose stabilization, reducing dosing frequency and improving patient compliance. These developments indicate that reformulation strategies and broader therapy alignment within diabetes regimens are setting the stage for significant market expansion.

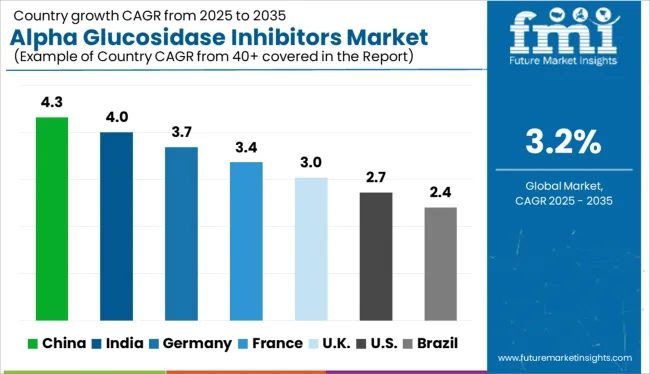

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| U.K. | 3.0% |

| U.S. | 2.7% |

| Brazil | 2.4% |

The alpha glucosidase inhibitors market is forecast to expand globally at a CAGR of 3% from 2025 to 2035. Of the 40 countries studied, China leads with 4.3%, followed by India at 4.0% and Germany at 3.7%. France is growing modestly at 3.4%, while the United Kingdom posts the slowest rate at 3.0%. China and India are advancing due to rising diabetic populations, generic drug production, and government-subsidized treatment schemes. Germany’s structured healthcare system supports steady uptake of postprandial glucose-lowering therapies. France and the UK see slower growth due to stricter reimbursement controls and increasing adoption of alternative anti-diabetic drug classes.

China is forecast to grow its alpha glucosidase inhibitors market at a 4.3% CAGR, propelled by extensive diabetes management programs and state-supported generics. Acarbose and voglibose are widely prescribed across rural and urban clinical networks. Provincial governments have included these in essential drug lists, encouraging long-term use. Chinese generics firms continue to dominate the market with increased bulk API manufacturing and lower cost formulations.

India is expected to grow its alpha glucosidase inhibitors market at a 4.0% CAGR, driven by broader access to diabetes care and demand for cost-efficient oral glucose modulators. Voglibose and acarbose remain essential in diabetic treatment plans across private clinics and urban hospitals. Government price caps and local manufacturing have ensured stable patient-level availability. Formulations optimized for gastrointestinal tolerability are gaining ground.

Germany is forecast to grow its alpha glucosidase inhibitors market at a 3.7% CAGR, supported by use in multi-drug diabetes regimens under insurance-backed health plans. Physicians prescribe these agents for elderly and postprandial glycemic control scenarios where insulin intensification is avoided. Drug formulary stability and predictable reimbursement support gradual growth. Demand is reinforced by efforts to reduce complications from uncontrolled post-meal spikes.

France is projected to grow at a 3.4% CAGR, shaped by a conservative market limited by restricted use of older anti-diabetic classes. Acarbose remains approved but is typically prescribed in specialized care settings. The French National Health System favors alternatives with fewer gastrointestinal side effects. As a result, alpha glucosidase inhibitors remain underutilized outside of clinical trials and legacy users.

The United Kingdom is expected to grow its alpha glucosidase inhibitors market at a 3.0% CAGR, reflecting a steady decline in prescriptions. NHS protocols now recommend DPP-4 and GLP-1 analogues over older classes like acarbose. While the drug is still available, its use is confined to patients already stabilized on therapy. Lack of innovation in delivery and slow physician endorsement curb potential growth.

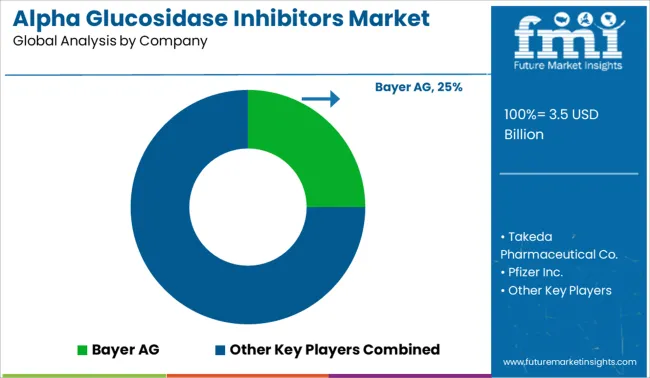

The alpha glucosidase inhibitors market is moderately consolidated, led by Bayer AG with a significant market share. The company holds a dominant position through its acarbose-based formulations, long-standing therapeutic presence, and broad reach across primary diabetes care markets. Dominant player status is held exclusively by Bayer AG. Key players include Takeda Pharmaceutical Co., Pfizer Inc., Glenmark Pharmaceuticals, and Sun Pharmaceutical Industries - each offering branded or generic alpha glucosidase inhibitors aimed at postprandial glucose control, supported by extensive physician networks and regional approvals. Emerging players are limited in this category due to the mature nature of the segment and strict regulatory pathways. Market demand is driven by increasing type 2 diabetes incidence and growing use of combination therapies in glycemic management.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Drug Type | Acarbose, Miglitol, Voglibose, and Combination drugs |

| Indication | Type 2 diabetes mellitus and Pre-diabetes |

| Type | Generic and Branded |

| Distribution Channel | Hospital pharmacies, Retail pharmacies, and Online pharmacies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bayer AG, Takeda Pharmaceutical Co., Pfizer Inc., Glenmark Pharmaceuticals, and Sun Pharmaceutical Industries |

| Additional Attributes | Dollar sales by inhibitor type (acarbose, miglitol, voglibose), Dollar sales by indication (type 2 diabetes, prediabetes, polycystic ovary syndrome), Trends in extended‑release and fixed‑dose combinations, Use of oral tablet vs granular formulations, Growth in emerging markets driven by rising diabetes prevalence, Regional adoption across North America, Europe, and Asia‑Pacific. |

The global alpha glucosidase inhibitors market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the alpha glucosidase inhibitors market is projected to reach USD 4.8 billion by 2035.

The alpha glucosidase inhibitors market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in alpha glucosidase inhibitors market are acarbose, miglitol, voglibose and combination drugs.

In terms of indication, type 2 diabetes mellitus segment to command 81.0% share in the alpha glucosidase inhibitors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alpha Olefin Market Forecast and Outlook 2025 to 2035

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Linolenic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Arbutin Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Methylstyrene Market Size and Share Forecast Outlook 2025 to 2035

Alpha-1 Antitrypsin Deficiency Market Size and Share Forecast Outlook 2025 to 2035

Alpha-lactalbumin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha Olefin Sulfonates Market Growth - Trends & Forecast 2025 to 2035

Linear Alpha Olefin Market

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

SGLT2 Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

NF-KB Inhibitors Market

Mould Inhibitors Market

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Inhibitors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA