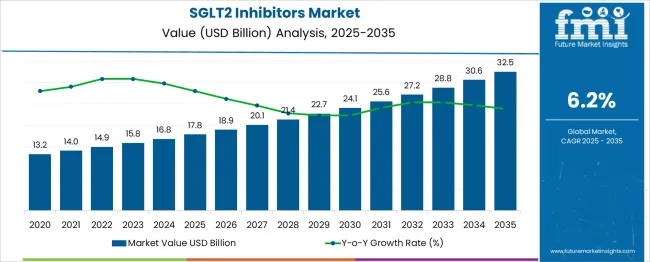

The global SGLT2 inhibitors market is projected to grow from USD 17.8 billion in 2025 to approximately USD 32.5 billion by 2035, recording an absolute increase of USD 14.7 billion over the forecast period. This translates into a total growth of 82.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.82X during the same period, supported by increasing prevalence of type 2 diabetes globally, expanding cardiovascular disease indications, growing awareness of chronic kidney disease management, and enhanced drug accessibility through improved healthcare infrastructure.

Between 2025 and 2030, the SGLT2 inhibitors market is projected to expand from USD 17.8 billion to USD 24.09 billion, resulting in a value increase of USD 6.25 billion, which represents 42.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising diabetes prevalence in emerging markets, expanding cardiovascular protection indications, growing adoption of combination therapies, and increasing penetration of premium diabetes care products in developing regions. Pharmaceutical companies are expanding their SGLT2 inhibitor portfolios to address the growing demand for multifunctional glucose-lowering solutions with cardiovascular and renal benefits.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 17.8 billion |

| Forecast Value in (2035F) | USD 32.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

From 2030 to 2035, the market is forecast to grow from USD 24.09 billion to USD 32.5 billion, adding another USD 8.44 billion, which constitutes 57.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of biosimilar and generic alternatives, integration of digital health monitoring systems with SGLT2 therapy management, and development of next-generation SGLT2 inhibitors with enhanced selectivity profiles. The growing adoption of personalized medicine approaches and real-world evidence generation will drive demand for premium SGLT2 inhibitors with proven cardiovascular and renal protective benefits.

Between 2020 and 2025, the SGLT2 inhibitors market experienced robust expansion, driven by increasing recognition of cardiovascular benefits beyond glycemic control and growing awareness of diabetic kidney disease management. The market developed as healthcare providers recognized the need for comprehensive diabetes management solutions that address multiple comorbidities simultaneously. Clinical trial evidence and regulatory approvals for expanded indications began to focus on the importance of SGLT2 inhibitors in reducing hospitalizations for heart failure and slowing the progression of chronic kidney disease.

Market expansion is being supported by the increasing global prevalence of type 2 diabetes and the corresponding demand for effective glucose-lowering medications with additional cardiovascular and renal protective benefits. Modern healthcare providers are increasingly focused on comprehensive diabetes management approaches that can address multiple complications simultaneously, reduce hospitalization risks, and improve long-term patient outcomes. SGLT2 inhibitors' proven efficacy in glucose control, weight management, blood pressure reduction, and cardiovascular protection makes them preferred therapeutic options in diabetes care algorithms.

The growing focus on evidence-based medicine and outcomes-driven healthcare is driving demand for SGLT2 inhibitors with robust clinical trial data demonstrating cardiovascular and renal benefits. Healthcare systems' preference for cost-effective treatments that can reduce long-term complications and healthcare utilization is creating opportunities for the adoption of SGLT2 inhibitors across diverse patient populations. The rising influence of diabetes care guidelines and endocrinologist recommendations is also contributing to increased prescribing patterns across different geographic regions and healthcare settings.

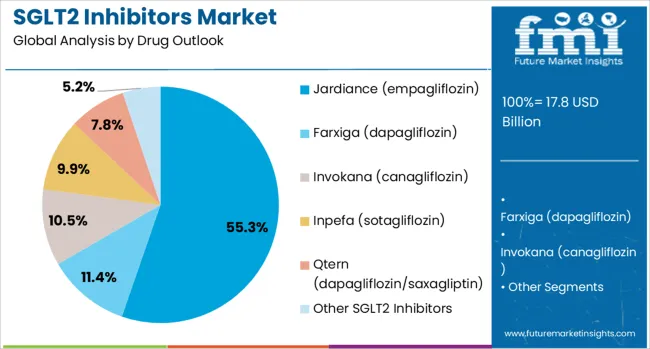

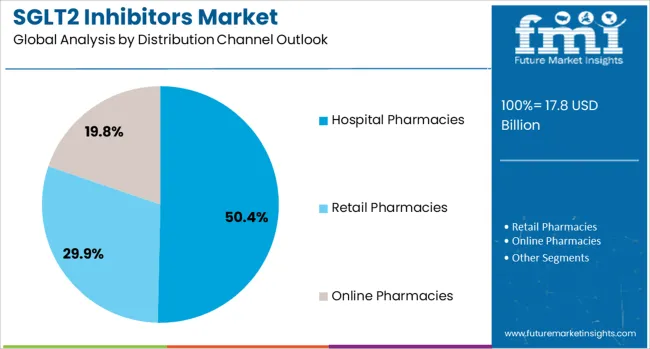

The market is segmented by drug, indication, distribution channel, and region. By drug, the market is divided into Jardiance (empagliflozin), Farxiga (dapagliflozin), Invokana (canagliflozin), Inpefa (sotagliflozin), Qtern (dapagliflozin/saxagliptin), and other SGLT2 inhibitors. Based on indication, the market is categorized into type 2 diabetes, cardiovascular diseases, chronic kidney disease (CKD), and others. In terms of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The type 2 diabetes indication is projected to account for 71.8% of the SGLT2 inhibitors market in 2025, reaffirming its position as the category's primary therapeutic application. Healthcare providers increasingly recognize SGLT2 inhibitors as essential components of modern diabetes management algorithms, particularly for patients requiring comprehensive glycemic control with additional cardiovascular and weight management benefits. The mechanism of action, which involves glucose excretion through the kidneys independent of insulin, addresses fundamental pathophysiological aspects of type 2 diabetes while providing complementary benefits beyond glucose lowering.

This indication forms the foundation of most prescribing patterns, as it represents the original and most extensively studied application of SGLT2 inhibitors in clinical practice. Endocrinologist endorsements and ongoing real-world evidence continue to strengthen confidence in SGLT2 inhibitor efficacy and safety profiles. With global diabetes prevalence continuing to rise and healthcare systems seeking effective treatments that address multiple complications, type 2 diabetes management aligns with both treatment optimization and healthcare economic goals. Its broad clinical acceptance across diverse patient populations ensures dominance, making it the central growth driver of SGLT2 inhibitor demand.

Jardiance (empagliflozin) is projected to represent 55.3% of SGLT2 inhibitor demand in 2025, underscoring its role as the market-leading therapeutic option with the most comprehensive clinical evidence base. Healthcare providers gravitate toward Jardiance for its well-established cardiovascular outcomes data, demonstrated reduction in heart failure hospitalizations, and proven benefits in chronic kidney disease management. Positioned as a premium, evidence-based treatment, Jardiance offers both primary diabetes management benefits and secondary cardiovascular and renal protection, justifying its widespread adoption across diverse patient populations.

The segment is supported by robust clinical trial programs including EMPA-REG OUTCOME, EMPEROR-Reduced, and EMPEROR-Preserved studies, which have established empagliflozin's benefits across multiple therapeutic areas. The regulatory approvals for expanded indications, including heart failure with reduced ejection fraction and heart failure with preserved ejection fraction, have enhanced prescribing opportunities beyond traditional diabetes management. As evidence-based medicine continues to drive prescribing decisions, Jardiance's comprehensive clinical profile will continue to dominate market demand, reinforcing its premium positioning within the SGLT2 inhibitor therapeutic class.

The hospital pharmacies distribution channel is forecasted to contribute 50.4% of the SGLT2 inhibitors market in 2025, reflecting the complex nature of diabetes management and the need for specialized healthcare provider oversight during treatment initiation and monitoring. Hospital pharmacies serve as critical access points for SGLT2 inhibitor therapy, particularly for patients with complex diabetes presentations, multiple comorbidities, or those requiring careful monitoring during treatment optimization phases.

Hospital-based distribution provides healthcare systems with opportunities for comprehensive diabetes care coordination, enabling endocrinologists, cardiologists, and nephrologists to collaborate in patient management decisions. The channel also benefits from institutional purchasing power, formulary management, and quality assurance programs that ensure appropriate patient selection and monitoring protocols. With increasing recognition of SGLT2 inhibitors' role in managing diabetic complications requiring specialized care, hospital pharmacies serve as essential distribution points for ensuring optimal therapeutic outcomes and patient safety monitoring.

The SGLT2 inhibitors market is advancing rapidly due to increasing global diabetes prevalence, expanding cardiovascular and renal indications, and growing demand for comprehensive diabetes management solutions. The market faces challenges including pricing pressures from healthcare systems, potential safety concerns requiring careful patient monitoring, and competition from newer diabetes therapeutic classes. Innovation in combination therapies and expanded indication approvals continue to influence prescribing patterns and market expansion opportunities.

The growing recognition of SGLT2 inhibitors' cardiovascular and renal protective benefits is enabling expanded therapeutic applications beyond traditional diabetes management. Clinical trial evidence demonstrating reduced heart failure hospitalizations, cardiovascular death prevention, and chronic kidney disease progression slowing is driving adoption among cardiologists and nephrologists. These expanded indications represent significant market growth opportunities as healthcare providers seek comprehensive approaches to managing diabetes-related complications.

Modern SGLT2 inhibitor therapy is increasingly supported by digital health platforms that enable continuous glucose monitoring, medication adherence tracking, and remote patient management capabilities. These technologies improve treatment outcomes by providing real-time data to healthcare providers and enhancing patient engagement in diabetes self-management. Advanced monitoring systems also enable personalized dosing adjustments and early identification of potential complications, improving overall therapy safety and efficacy profiles.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.7% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.6% |

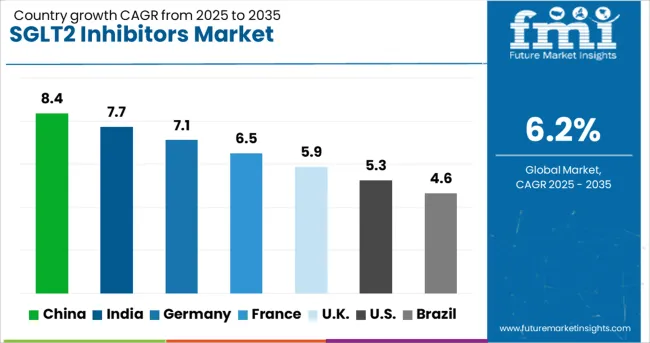

The SGLT2 inhibitors market is experiencing robust growth globally, with China leading at an 8.4% CAGR through 2035, driven by increasing diabetes prevalence, government healthcare reforms, and growing penetration of international pharmaceutical brands. India follows closely at 7.7%, supported by large diabetic population, improving healthcare access, and increasing adoption of modern diabetes management approaches. Germany shows steady growth at 7.1%, focusing evidence-based prescribing practices and comprehensive diabetes care protocols. France records 6.5%, focusing on healthcare system optimization and patient-centered diabetes management. The UK shows 5.9% growth, prioritizing cost-effective diabetes treatments with proven cardiovascular benefits.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from SGLT2 inhibitors in China is projected to exhibit strong growth with a CAGR of 8.4% through 2035, driven by rapid expansion of diabetes care infrastructure and increasing adoption of international treatment guidelines among healthcare providers. The country's growing middle class and aging population are creating significant demand for premium diabetes medications with comprehensive health benefits. Major international pharmaceutical companies are establishing comprehensive market access strategies to serve the growing population of diabetes patients across urban and rural healthcare systems.

Revenue from SGLT2 inhibitors in India is expanding at a CAGR of 7.7%, supported by the world's largest diabetic population, increasing healthcare access, and growing adoption of modern diabetes management protocols. The country's diverse healthcare landscape and increasing penetration of specialist diabetes care are driving demand for effective glucose-lowering medications with additional health benefits. International pharmaceutical companies and domestic manufacturers are establishing comprehensive distribution networks to serve diverse patient populations across urban and rural markets.

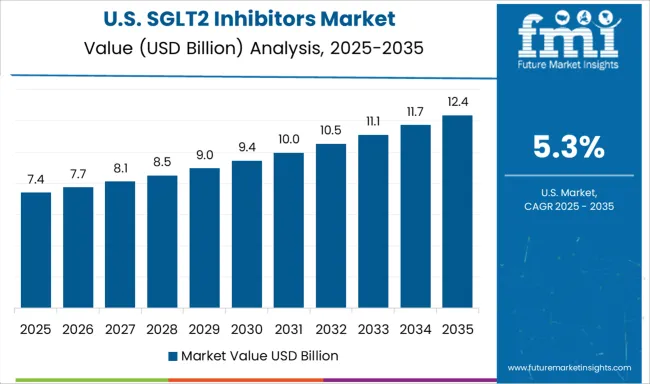

Demand for SGLT2 inhibitors in the USA is projected to grow at a CAGR of 5.3%, supported by comprehensive clinical evidence, healthcare provider familiarity, and insurance coverage for diabetes medications with proven cardiovascular benefits. American healthcare systems increasingly focus on value-based care approaches that focuses on long-term patient outcomes and complication prevention. The market is characterized by strong adoption of evidence-based treatment algorithms that position SGLT2 inhibitors as essential components of comprehensive diabetes management.

Revenue from SGLT2 inhibitors in Germany is projected to grow at a CAGR of 7.1% through 2035, driven by the country's strong focuses on evidence-based medicine, comprehensive diabetes care protocols, and healthcare provider expertise in complex diabetes management. German healthcare systems consistently prioritize treatments with robust clinical evidence and proven long-term benefits for patient outcomes.

Revenue from SGLT2 inhibitors in the UK is projected to grow at a CAGR of 5.9% through 2035, supported by National Health Service focus on cost-effective diabetes treatments and comprehensive health technology assessments. British healthcare providers value evidence-based treatments with proven cardiovascular benefits that align with population health management objectives.

Revenue from SGLT2 inhibitors in France is projected to grow at a CAGR of 6.5% through 2035, supported by the country's comprehensive healthcare system, specialist diabetes care networks, and focuses on patient-centered treatment approaches. French healthcare providers prioritize personalized diabetes management strategies that address individual patient risk profiles and comorbidity patterns.

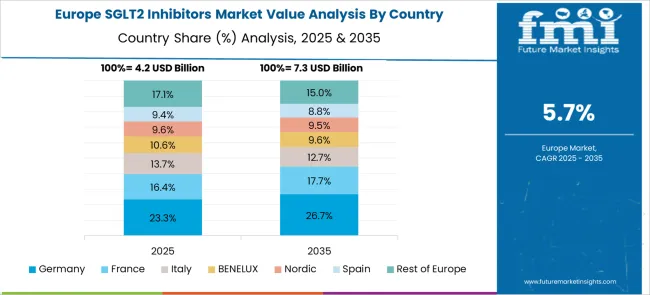

The European SGLT2 inhibitors market demonstrates sophisticated development across major economies with Germany leading through its precision clinical research excellence and advanced diabetes care capabilities, supported by pharmaceutical companies focusing evidence-based prescribing protocols, comprehensive cardiovascular outcomes studies, and integrated diabetes management solutions while maintaining strict regulatory standards and clinical safety monitoring. The UK shows strength in cost-effective diabetes care and health technology assessments, with healthcare systems specializing in value-based treatment approaches that prioritize proven cardiovascular and renal protective benefits.

France contributes through its comprehensive healthcare system approach and specialist diabetes care networks, delivering personalized treatment strategies that combine clinical effectiveness with patient-centered care coordination. Sweden and Nordic countries focuses on integrated diabetes management and preventive care approaches. Italy and Spain demonstrate growth in specialized diabetes care solutions for aging populations and traditional healthcare delivery systems. The market benefits from stringent EU pharmaceutical regulations, established clinical research infrastructure, and growing healthcare provider demand for SGLT2 inhibitors with comprehensive therapeutic benefits.

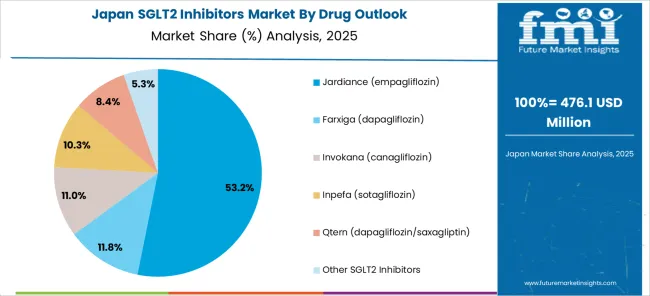

The Japanese SGLT2 inhibitors market demonstrates steady growth driven by precision diabetes care focus, advanced clinical research capabilities, and healthcare provider preference for evidence-based treatments that ensure superior patient outcomes and safety compliance throughout diabetes management. Japanese healthcare systems prioritize sophisticated treatment protocols and comprehensive patient monitoring, creating demand for SGLT2 inhibitors featuring robust clinical evidence, proven cardiovascular benefits, and integrated diabetes care approaches that align with Japanese clinical practice standards.

The market focuses on technological integration in diabetes management, comprehensive patient education programs, and advanced monitoring systems that reflect Japanese attention to detail in clinical care delivery and patient safety protocols. Growing investment in diabetes complications prevention and cardiovascular risk management supports adoption of premium SGLT2 inhibitors with real-time patient monitoring, predictive analytics, and personalized treatment optimization capabilities. Japanese healthcare providers focus on treatment reliability, consistent clinical outcomes, and long-term patient protection effectiveness.

The South Korean SGLT2 inhibitors market shows exceptional growth potential driven by expanding diabetes care infrastructure, increasing adoption of international treatment guidelines, and growing healthcare provider demand for advanced glucose-lowering medications requiring comprehensive patient management and monitoring capabilities. The market benefits from South Korea's technological advancement in healthcare delivery and increasing focus on preventive care initiatives that drive investment in premium diabetes medications meeting international clinical standards.

Korean healthcare systems increasingly adopt evidence-based diabetes management protocols, cardiovascular risk assessment frameworks, and integrated chronic disease management programs to improve patient outcomes and healthcare system efficiency while ensuring regulatory compliance requirements. Growing influence of Korean healthcare technology companies supports demand for sophisticated diabetes management platforms that ensure comprehensive care coordination while maintaining cost-effectiveness and clinical reliability. The integration of digital health monitoring and telemedicine capabilities creates opportunities for enhanced SGLT2 inhibitor therapy management with remote patient monitoring capabilities.

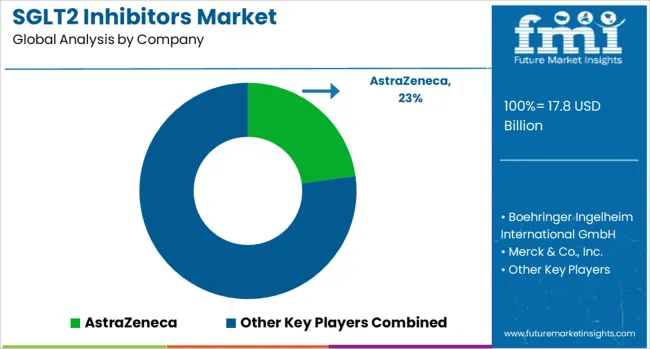

The market is characterized by competition among established pharmaceutical companies, specialty diabetes care organizations, and emerging biotechnology firms developing next-generation glucose-lowering therapies. Companies are investing in clinical research programs, real-world evidence generation, market access strategies, and healthcare provider education to deliver effective, safe, and accessible diabetes treatment solutions. Clinical differentiation, indication expansion, and healthcare system partnerships are central to strengthening product portfolios and market presence.

AstraZeneca, UK-based, leads the market with significant global market share through Farxiga (dapagliflozin), offering comprehensive SGLT2 inhibitor solutions with proven cardiovascular and renal benefits. Boehringer Ingelheim International GmbH, Germany, provides Jardiance (empagliflozin) with extensive clinical evidence and broad indication approvals for diabetes, heart failure, and chronic kidney disease management. Merck & Co., Inc., USA, delivers Invokana (canagliflozin) with focus on diabetes management and cardiovascular risk reduction. Johnson & Johnson Services, Inc., USA, focuses on comprehensive diabetes care solutions through Janssen Pharmaceuticals division.

TheracosBio, LLC operates with specialized SGLT2 inhibitor development programs, while Lexicon Pharmaceuticals, Inc. provides Inpefa (sotagliflozin) for specialized therapeutic applications. Eli Lilly and Company, Bristol-Myers Squibb Company, and Glenmark Pharmaceuticals Ltd. contribute through diverse diabetes care portfolios and combination therapy development programs that integrate SGLT2 inhibitors with complementary glucose-lowering mechanisms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 17.8 billion |

| Drug | Jardiance (empagliflozin), Farxiga (dapagliflozin), Invokana (canagliflozin), Inpefa (sotagliflozin), Qtern (dapagliflozin/saxagliptin), Other SGLT2 Inhibitors |

| Indication | Type 2 Diabetes, Cardiovascular Diseases, Chronic Kidney Disease (CKD), Others |

| Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | AstraZeneca, Boehringer Ingelheim International GmbH, Merck & Co. Inc., Johnson & Johnson Services Inc., TheracosBio LLC, Lexicon Pharmaceuticals Inc., Eli Lilly and Company, Bristol-Myers Squibb Company, and Glenmark Pharmaceuticals Ltd. |

| Additional Attributes | Revenue analysis by drug concentration and formulation type, regional prescribing trends, competitive landscape analysis, healthcare provider preferences for branded versus generic alternatives, integration with combination therapy positioning, innovations in extended-release formulations, patient-centric delivery systems, and real-world evidence generation programs |

Drug:

The global SGLT2 inhibitors market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the SGLT2 inhibitors market is projected to reach USD 32.5 billion by 2035.

The SGLT2 inhibitors market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in SGLT2 inhibitors market are jardiance (empagliflozin), farxiga (dapagliflozin), invokana (canagliflozin), inpefa (sotagliflozin) , qtern (dapagliflozin/saxagliptin) and other SGLT2 inhibitors.

In terms of indication outlook, type 2 diabetes segment to command 71.8% share in the SGLT2 inhibitors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

SGLT2 Inhibitors Treatment Market Overview – Trends & Growth 2024-2034

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

NF-KB Inhibitors Market

Mould Inhibitors Market

Kinase Inhibitors For Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Inhibitors Market

Paraffin Inhibitors Market

Corrosion Inhibitors Market Growth - Trends & Forecast 2025 to 2035

PD-1/PD-L1 Inhibitors Market – Trends, Growth & Forecast 2025 to 2035

Proton Pump Inhibitors Market Insights - Demand, Size & Industry Trends 2025 to 2035

Angiopoietin Inhibitors Therapeutic Market

Small Molecule Inhibitors Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Protein Kinase B Inhibitors Market

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Immune Checkpoint Inhibitors Market

Volatile Corrosion Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Volatile Corrosion Inhibitors (VCI) Packaging Market Insights - Growth & Demand 2025 to 2035

Low dosage Hydrate Inhibitors Market - Demand, Growth & Industry Outlook 2025 to 2035

Janus Kinase (JAK) Inhibitors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA