The proton pump inhibitors or gastric acid suppressants market is valued at USD 3.2 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 5.2% and reach USD 5.46 billion by 2035. In 2024, the gastric acid suppressants market grew at a consistent rate as demand for chronic treatment of GERD continued to rise, especially among the aging populations of Western Europe and North America.

FMI research revealed that Omeprazole maintained its leadership position, supported by continued over-the-counter availability and strong clinical familiarity. Significantly, esomeprazole and pantoprazole gained renewed popularity as a result of positive clinical trials highlighting reduced long-term side effects and enhanced bioavailability.

Hospitals and ambulatory surgical centers raised PPI purchasing as surgical procedures for reflux and ulcer treatment remained elevated. Consumer preference has moderately shifted toward prescription-strength products as awareness of the dangers of self-medication has increased.

FMI suggests that 2025 will witness a stronger shift toward combination therapies that include PPIs and antibiotics for H. pylori eradication, especially in Asia. Regulatory approvals and policy shifts favoring generic entries will also support industry growth, spurring price competition and increasing access.

In the coming decade, increasing digestive issues associated with sedentary lifestyles, NSAID use, and obesity will continue to will sustain robust demand for acid-suppressive therapies and support long-term industry expansion. Increased confidence in the clinical effectiveness of PPIs will continue to drive prescription volumes despite increasing debate regarding long-term safety.

Market Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.2 Billion |

| Industry Value (2035F) | USD 5.46 Billion |

| CAGR (2025 to 2035) | 5.2% |

The gastric acid suppressants industry will grow steadily up to 2035 as a result of the increasing global prevalence of acid-related disorders like GERD and peptic ulcers. Increased geriatric populations and extensive usage of NSAIDs continue to fuel demand for sustained acid suppression treatment. Generic and OTC manufacturers are poised to gain the most, while brands relying on legacy products and lacking innovation risk losing market share.

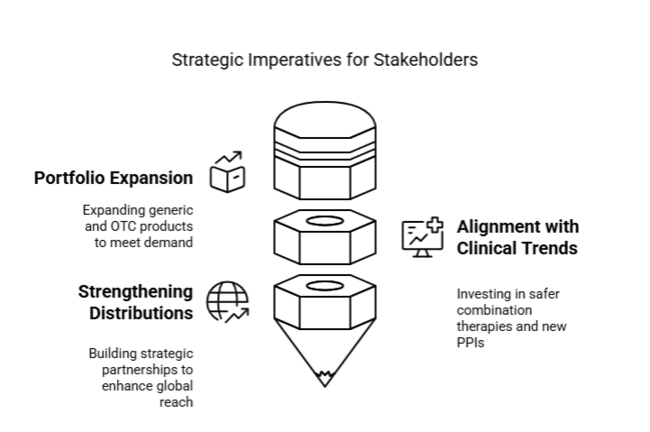

Expand Generic and OTC Portfolios

Invest in expanding the portfolio of over-the-counter and generic products for gastric acid suppressants to meet increasing consumer demand and stay competitive in price-sensitive industries.

Align with Emerging Clinical Trends

Focus on investing in research and development for combination therapies and new PPIs that are safer, to meet the evolving preferences of doctors and the expectations of patients for long-term use.

Strengthen global distributions and partnerships.

Seek strategic partnerships with local wholesalers and pharmacy groups, particularly in Asia and Latin America, to accelerate industry reach and strengthen brand footprint in high-growth geographies.

| Risk | Probability - Impact |

|---|---|

| Regulatory scrutiny over long-term safety of PPIs | Medium - High |

| Rising competition from H2 blockers and antacids | High - Medium |

| Supply chain disruptions affecting API availability | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Reformulation Strategy | Conduct feasibility study on low-dose, extended-release PPI blends |

| Pharmacovigilance Enhancement | Launch real-world long-term safety and efficacy data collection on PPI usage |

| Emerging Industry Penetration | Establish local licensing deals in Southeast Asia and Latin America |

To gain a competitive edge, companies need to focus on growing the generic and OTC portfolio and accelerate investment in safer, next-generation drugs. This insight supports a move away from focusing exclusively on volume to a value-plus strategy-combining affordability with clinical innovation.

The board should approve deeper penetration in Asia and Latin America through licensing and co-marketing arrangements while implementing a global pharmacovigilance system. These actions will future-proof the pipeline, create industry resilience, and establish the company as a differentiated leader in long-term gastrointestinal care.

Regional Variations

Innovation and technology adoption

Formulation Preferences

Pricing and Accessibility Pressures

Manufacturers

Distributors

Retailers/Pharmacists

Variance vs. Consensus

Key Variances

Strategic Insight

| Countries | Policy & Regulatory Impact on Proton Pump Inhibitors Industry |

|---|---|

| United States | The FDA requires stringent post- market ing monitoring of PPIs because of long-term risks such as kidney disease and fractures. Although the FDA has not yet implemented REMS, frequent label revisions occur. |

| United Kingdom | Traceability is required from generic manufacturers in compliance with the Drug Supply Chain Security Act (DSCSA). MHRA applies pharmacovigilance revisions following Brexit -driven changes to approvals of medicines. Parallel imports are subject to closer examination. Firms need to have a UK-specific market ing Authorization (UKMA) after Brexit, even if previously authorized by EMA. |

| France | Every year, the National Agency for the Safety of Medicines (ANSM) revises prescription guidelines to enforce strict controls on PPI overuse. Eco-pharmacovigilance regulations now include impact assessments of the environmental discharge of medicines. |

| Germany | Under BfArM, PPIs fall under the purview of AMNOG law for early benefit assessment. There is a requirement to prove added clinical value in order to be eligible for positive reimbursement. EU GMP certification is obligatory, and green packaging requirements are increasing in popularity. |

| Italy | The Italian Medicines Agency (AIFA) limits reimbursement for chronic PPI unless supported by diagnostic confirmation. E-PILs (electronic patient information leaflets) will be compulsory from 2026 for all prescription drugs. |

| South Korea | The MFDS has raised bioequivalence testing requirements for all generic PPIs after the 2023 safety re - evaluation. K-GMP compliance is required for domestic and foreign suppliers. Patient information should be in bilingual form (Korean-English). |

| Japan | PMDA requires localized clinical trials or bridging studies for any new PPI formulation. Strict advertising regulations limit DTC (Direct-to-Consumer) campaigns for GI drugs. Reimbursement remains tightly regulated through centralized NHI pricing mechanisms. |

| China | NMPA categorizes PPIs as high-risk based on misuse issues and now mandates periodic reassessments of long-term data. The MAH system decentralizes responsibility to regional licensees. The eCTD submission is now mandatory. |

| Australia-NZ | TGA and Medsafe together mandate extensive risk labeling for OTC PPIs, citing rebound acid hypersecretion. Serialization and traceability compliance under the Medicines Traceability Framework will be mandatory by 2025. |

| India | Every generic PPI launch must include bioequivalence and stability studies, as mandated by CDSCO. Price controls in DPCO (Drug Price Control Order) restrict profit margins. Although there is no central pharmacovigilance certification, the proposed draft rules mandate mandatory ADR (Adverse Drug Reaction) reporting by 2026. |

Between 2025 and 2035, esomeprazole will be the most profitable drug type segment, driven by its improved pharmacokinetic profile and widespread use as a first-line treatment for acid-related disorders. This industry is expected to grow at a CAGR of 5.9% from 2025 to 2035, ahead of traditional proton pump inhibitors like lansoprazole and rabeprazole.

Esomeprazole, a version of omeprazole, is better absorbed by the body and maintains intragastric pH suppression for an extended duration. This benefits patients with gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome leading to symptom relief and mucosal healing. Clinical studies have repeatedly demonstrated its efficacy to hold intragastric pH at over 4 for a long duration of time, which aids in mucosal healing and symptom relief.

Its dual presence in the industry as a generic and branded product, as well as its OTC availability in most areas, broadens patient access and reduces treatment cost. Insurance coverage for prolonged usage, especially in the USA and Europe, favors long-term use. Esomeprazole's strong lifecycle plan, covering pediatric and IV formulations, has broadened its application across patient segments.

Oral administration will continue to be the leading and most profitable path in the proton pump inhibitor (PPI) industry during the forecast period. This will be propelled by patient convenience, positive safety profiles, and extensive formulation availability.With formulary placement and retail pharmacy accessibility as supports, FMI believes that the oral administration segment will grow at a CAGR of 5.6% from 2025 to 2035.

Oral dosing is versatile, suitable for acute and chronic conditions, and commonly used across outpatient and inpatient settings. Tablets and capsules are widely available across branded and generic options, contributing to pricing competition and accessibility. Patients prefer oral formulations due to their non-invasive nature, which enhances adherence over long treatment durations, especially in GERD and peptic ulcer cases.

Additionally, oral administration aligns well with OTC consumer behavior, as most patients self-manage conditions like heartburn and indigestion. Healthcare providers and hospitals also opt for oral formats for discharged patients, thereby supporting repeat sales. With increased prevalence of fixed-dose combinations and enteric-coated tablets that provide improved gastric tolerance, further boosts the preference for oral administration.

The tablet segment is expected to continue as the dominant and most profitable dosage form in the PPI industry space, based on their ease of manufacture, economy, and strong consumer acceptance. With tablet generics achieving robust penetration in emerging nations and branded forms maintaining loyalty in mature industries, FMI analysis predicts a CAGR of 5.5% for this segment between 2025 and 2035.

Tablets provide dose uniformity, longer shelf stability, and greater convenience in packaging for distribution through retail and hospital channels. Tablet manufacturing cost-effectiveness renders them an attractive proposition for generic manufacturers seeking scalable, high-volume production, particularly in Latin America and Asia.

Moreover, tablets are most amenable to long-term regimens of medications, specifically in chronic acid-related illnesses such as GERD and functional dyspepsia. Methods like delayed-release and enteric-coating technology have made tablet-form PPIs more effective and easier on the stomach. Patients are more likely to comply with once-daily treatment regimens when provided with tablet forms.

Between 2025 and 2035, generics will become the most profitable segment within the proton pump inhibitors industry, driven by sheer patent expirations across large areas, efforts in healthcare cost-containment, and a transformation to high-volume, low-margin prescription models.

With strong penetration in retail pharmacy and hospital chains alike, coupled with increasing volume in telemedicine and mail order channels, FMI anticipates this segment growing at a 6.1% CAGR, ahead of branded variants.

Since the branded exclusivities for generic leader molecules such as omeprazole, esomeprazole, and pantoprazole have expired in most parts of the world, generics have gained significant industry share in both developing and mature economies. Regulatory bodies such as the FDA and EMA have accelerated generic approval pathways to facilitate quicker entry into the marketplace.

Generic PPIs translate into substantial savings for public and private payers, which adds to reimbursement favourability. Pharmacies favor generics due to their higher margins and quicker turnover and ready availability. Patient access also increased through aggressive pricing strategies in large out-of-pocket expenditure nations like India and Southeast Asia's select regions.

Between 2025 and 2035, Gastroesophageal Reflux Disease (GERD) is expected to continue as the most dominant and profitable indication for using proton pump inhibitors. The FMI study reveals this indication segment to progress gradually at a CAGR of 6.0% through the forecast period, backed by ongoing formulation innovation and robust patient efficacy.

GERD affects approximately 20% of the world's adult population and is further associated with lifestyle factors including unhealthy diet, obesity, physical inactivity, and stress. Long-term GERD can lead to serious problems like damage to the esophagus, changes in the esophagus lining, and even cancer of the esophagus if not treated, underscoring the clinical necessity of sustained acid suppression.

Clinical guidelines advocate for the use of PPIs as the first-line treatment for symptom control and mucosal healing. With increased awareness of GERD through DTC (direct-to-consumer) advertising and telemedicine consultations, early diagnosis rates are on the rise worldwide. Secondly, the chronic condition of GERD has patients dependent on PPIs for prolonged periods, which results in high prescription volumes.

Retail pharmacies will be the most profitable distribution channel for proton pump inhibitors to maintain consistency, backed by the global transition to OTC availability and the growing consumer inclination toward direct purchase access. As DTC marketing and pharmacist-driven care models mature, FMI expects this segment to grow at a CAGR of 5.8%, solidifying its leadership in volume and revenue terms in the ecosystem for proton pump inhibitors.

Retail pharmacies are a primary access channel for self-medication in minor cases of GERD and heartburn, particularly among urban and suburban populations. These outlets provide flexible hours, instant access, and visibility for promotional campaigns from both branded and generic manufacturers.

With increasing awareness and ease of consultation with the pharmacist, patients are increasingly turning to OTC PPIs without official prescriptions. Furthermore, retail chains from developed nations are incorporating e-prescriptions and individualized refill systems, which improve chronic treatment compliance. In developing economies, retail pharmacy networks are growing at a rapid pace, fuelled by urbanization and increasing middle-class incomes.

The United States industry for proton pump inhibitors is projected to grow at the CAGR rate of 4.9% from 2025 to 2035. The USA industry is highly mature; however, it remains one of the largest revenue generators worldwide due to high GERD prevalence, extended acid suppression treatments, and a significant aging population.

Despite growing concerns about long-term PPI use, the demand from chronic users remains unabated. Generic penetration is close to saturation, but next-generation products with enhanced safety features and dual-release mechanisms are picking up pace. FMI analysis found that trends based on real-world evidence will likely encourage hospital networks and outpatient clinics to adopt these products more widely.

In the United Kingdom, the industry for proton pump inhibitors is projected to grow at a CAGR of 4.7% in the assessment term. Prescription guidelines are becoming more stringent under NHS cost-containment policies, restricting indiscriminate use of PPIs. FMI, however, believes that demand will be stable in aging populations and H. pylori treatment.

With MHRA setting up post-Brexit pharmacovigilance regulations, manufacturers now have to maintain UK-specific approvals and adopt sustainable labeling practices. FMI analysis found that the growing demand for ODTs and medication reviews started by pharmacists will influence how new products are developed and how they are distributed in communities.

From 2025 to 2035, projections indicate a CAGR of 5.7% for the proton pump inhibitor industry in France. France demonstrates robust clinical use of PPIs for gastroprotection, particularly among elderly patients who are on NSAIDs or corticosteroids. The National Agency for the Safety of Medicines (ANSM) requires periodic re-evaluation of chronic therapies, but reimbursement by the government of important generics guarantees high accessibility.

The FMI analysis found that systems for monitoring drug safety and hospital purchasing networks tend to favor suppliers who provide transparent information about the full life cycle of their products. Advances in more environmentally friendly packaging and low-dose versions designed for long-term therapy are likely to capture share.

In Germany, the proton pump inhibitors' industry is approximated to grow at a rate of 5.5% CAGR during the forecast period. Pharmaceutical firms are mandated by the country's early benefit assessment law (AMNOG) to present evident clinical excellence or cost-efficacy as a prerequisite to gain positive reimbursement. Despite this fact, FMI maintains that there is a strong demand for PPIs in both outpatient and in-hospital settings due to the high prevalence of acid-related disorders.

Germany also leads Western Europe in the adoption of oral dispersible formulations, especially in pediatric and geriatric segments. Green packaging and digitalized delivery of patient information are becoming regulatory mandates at a rapid pace, leaving the field open for differentiation.

Sales in Italy is projected to grow at a CAGR of 5.3% between 2025 and 2035. National reimbursement schemes continue to prioritize the diagnostic confirmation policy, yet FMI analysis indicates that the therapeutic demand in gastroenterology and internal medicine has remained resilient.

The trend is growing as hospitals increasingly import low-priced generics, but drug makers who make value-added versions-such as rapid-release capsules or fixed-dose combinations-gain share. The e-labeling obligations set to come into force in 2026 will accelerate the digitalization process among distributors. Italy's decentralized procurement system also presents regional opportunities for nimble distributors that match local public health policy objectives.

The South Korean industry of proton pump inhibitors is expected to grow at a CAGR of 5.4% during the period from 2025 to 2035. Through its analysis, FMI’s research indicates that rising diagnoses of gastric ulcers and acid reflux due to lifestyle habits and the aging population are propelling prescription volumes.

The Ministry of Food and Drug Safety (MFDS) has strengthened bioequivalence and stability tests, increasing the entry barriers to the industry. However, local companies are innovating in a big way, with patient-friendly formulations like easy-to-swallow granules becoming popular. Government price controls continue to be a limitation, but co-pay subsidies and broader insurance coverage facilitate industry growth.

The Japanese industry for proton pump inhibitors is projected to grow at a CAGR of 4.6% during the period 2025 to 2035. High generic formulation penetration and conservative prescribing habits dominate the industry. The Pharmaceuticals and Medical Devices Agency (PMDA) requires domestic clinical bridging studies for new PPI drugs, imposing entry barriers on foreign companies.

FMI believes that even with the challenges, there are opportunities in geriatric-oriented drug delivery systems, particularly as Japan's elderly population increases. Insurer-driven cost containment has delayed new product launches, but branded companies with effective post-marketing surveillance programs continue to have a competitive advantage.

The projections indicate a CAGR of 6.1% for the proton pump inhibitors industry in China between 2025 and 2035. China is the most dynamic growth industry in the world, driven by increasing diagnosis rates, growing middle-class access to healthcare, and urban hospital growth.

FMI research discovered that e-pharmacy and e-prescription integration is driving retail penetration in Tier II and Tier III cities. The NMPA's tightening regulations, which include mandatory local clinical data and central procurement, are raising the standard of quality. With the implementation of the marketing Authorization Holder (MAH) system, international firms are forming joint ventures to establish local control and minimize risk.

From 2025 to 2035, projections indicate a CAGR of 6.3% for the proton pump inhibitors industry in India. India continues to be among the fastest-growing and most competitive PPI industries, fueled by excessive use of NSAIDs, a high incidence of H. pylori infections, and over-the-counter demand.

FMI research identified public sector procurement and Jan Aushadhi schemes as key drivers of high-volume generic sales. The Drug Price Control Order (DPCO) imposes ceiling prices on several key PPI formulations, limiting profitability but ensuring access. Bioequivalence testing, cost-effective production and rural logistics optimization position manufacturers for long-term success.

Competing fiercely, major players in the gastric acid suppressants industry are adopting a combination of generic pricing strategies, product life cycle extension, and geographic expansion. Major players such as Pfizer, Takeda, and AstraZeneca are making incremental innovation investments in terms of dual-release formulations and combination treatments to ensure brand salience.

At the same time, generic leaders in the industry are gaining momentum through competitive pricing and local collaborating in emerging economies. FMI analysis has revealed that leading companies are diversifying their revenue streams by expanding their OTC products, digital health integrations for compliance tracking, and licensing arrangements to gain positions in Asia-Pacific and Latin America.

In March 2024, Pfizer acquired Seagen, a leader in antibody-drug conjugate (ADC) technology, for USD 43 billion. This acquisition aimed to bolster Pfizer's oncology portfolio. In October 2024, the company partnered with the Ignition AI Accelerator to utilize artificial intelligence in expediting drug discovery, improving operational efficiency, and optimizing manufacturing processes.

In March 2024, AstraZeneca acquired Fusion Pharmaceuticals for USD 2 billion in cash, aiming to enhance its cancer treatment capabilities through Fusion's proprietary platform. In March 2024, the company acquired Amolyt Pharma for USD 1.05 billion, focusing on expanding its rare-disease portfolio.

Sun Pharma acquired Checkpoint Therapeutics, a USA-based immuno-oncology company, for USD 355 million to enhance its oncology portfolio in March 2025. Before that, in January 2024, the company completed a merger with Taro Pharmaceuticals, acquiring the remaining stake for USD 347.73 million to expand its presence in the dermatology segment.

Pfizer Inc.

Share: ~20-25%

A global leader in the pharma industry, Pfizer has a strong foothold in the PPI industry with products such as Protonix (pantoprazole), based on its large distribution network and brand equity.

AstraZeneca PLC

Share: ~18-22%

AstraZeneca continues to be aindustry leader with Nexium (esomeprazole) through high prescription demand and key industry partnership strategies.

Takeda Pharmaceutical Company Limited

Share: ~15-20%

Takeda is a major player with its lead PPI, Prevacid (lansoprazole), especially in the Asia-Pacific and North American regions.

Bayer AG

Share: ~10-15%

With its PPI brands, such as Nexium (licensed from AstraZeneca in certain industries), Bayer is a challenger, concentrating on over-the-counter (OTC) extensions.

Procter & Gamble (P&G) and Teva Pharmaceutical Industries Ltd.

Share: ~8-12%

P&G (via its joint venture with Teva) sells Prilosec OTC (omeprazole), enjoying a large part of the non-prescription PPI industry.

Sun Pharmaceutical Industries Ltd.

Share: ~5-10%

Sun Pharma has been strengthening its generic PPI portfolio, especially in emerging industries, with cost-saving alternatives for branded products.

Other Generic Manufacturers (Dr. Reddy's, Mylan, etc.)

Share: ~10-15% combined

Generic manufacturers continue to undermine branded PPI sales, selling cheaper products and reaping the rewards of patent expirations.

The industry is segmented intoesomeprazole, omeprazole, dexlansoprazole, pantoprazole, rabeprazole, lansoprazole and others.

The industry is segmented into oral and injectable.

The industry is segmented into tablet, capsules, injection and others.

The industry is segmented into branded and generics.

The industry is segmented into gastroesophageal reflux disease, heartburn, peptic ulcers and others.

The industry is fragmented into hospital pharmacies, retail pharmacies, drug stores and specialty clinics.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

The sales is propelled by the growing incidence of GERD, growing OTC accessibility, and enhanced awareness regarding acid-related diseases.

FMI analysis determined that the industry will continue to grow steadily until 2035, aided by generics uptake, aging populations, and widening access in emerging industries.

Major firms are AstraZeneca, Bayer AG, Cadila Pharmaceuticals, Eisai Inc., GlaxoSmithKline PLC, Pfizer Inc., Takeda Pharmaceuticals, Sanofi SA, Perrigo Company PLC, Dr. Reddy's Laboratories, Redhill Pharma Limited, Cipla Limited, Sun Pharmaceutical Industries Ltd., and Mylan N.V.

Oral tablets and capsules are expected to be the leading dosage forms owing to the convenience of administration and patient preference.

FMI believes that the overall value will amount to around USD 5.46 billion by 2035.

Table 01: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 02: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 03: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 04: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 05: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 06: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 07: Global Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Region

Table 08: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 09: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 10: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 11: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 12: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 13: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 14: North America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 15: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 16: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 17: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 18: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 19: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 20: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 21: Latin America Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 22: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 23: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 24: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 25: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 26: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 27: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 28: Europe Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 29: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 30: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 31: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 32: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 33: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 34: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 35: East Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 36: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 37: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 38: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 39: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 40: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 41: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 42: South Asia Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 43: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 44: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 45: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 46: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 47: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 48: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 49: Oceania Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Table 50: Middle East & Africa Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Country

Table 51: Middle East & Africa Market Value (US$ Million) Analysis 2017–2022 and Forecast 2023 to 2033, By Drug Type

Table 52: Middle East & Africa Market Analysis 2017–2022 and Forecast 2023 to 2033, By Route of Administration

Table 53: Middle East & Africa Market Analysis 2017–2022 and Forecast 2023 to 2033, By Dosage Form

Table 54: Middle East & Africa Market Analysis 2017–2022 and Forecast 2023 to 2033, By Prescription Type

Table 55: Middle East & Africa Market Analysis 2017–2022 and Forecast 2023 to 2033, By Indication

Table 56: Middle East & Africa Market Analysis 2017–2022 and Forecast 2023 to 2033, By Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2017–2022

Figure 02: Global Market Forecast & Y-O-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022–2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, By Drug Type

Figure 05: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Drug Type

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, By Drug Type

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, By Route of Administration

Figure 08: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Route of Administration

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, By Route of Administration

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, By Dosage Form

Figure 11: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Dosage Form

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, By Dosage Form

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, By Prescription Type

Figure 14: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Prescription Type

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, By Prescription Type

Figure 16: Global Market Value Share (%) Analysis 2023 and 2033, By Indication

Figure 17: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Indication

Figure 18: Global Market Attractiveness Analysis 2023 to 2033, By Indication

Figure 19: Global Market Value Share (%) Analysis 2023 and 2033, By Distribution Channel

Figure 20: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Distribution Channel

Figure 21: Global Market Attractiveness Analysis 2023 to 2033, By Distribution Channel

Figure 22: Global Market Value Share (%) Analysis 2023 and 2033, By Region

Figure 23: Global Market Y-O-Y Growth (%) Analysis 2023-2033, By Region

Figure 24: Global Market Attractiveness Analysis 2023 to 2033, By Region

Figure 25: North America Market Value (US$ Million) Analysis, 2017–2022

Figure 26: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 27: North America Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 28: North America Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 29: North America Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 30: North America Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 31: North America Market Value Share (US$ Million), By Indication (2023 E)

Figure 32: North America Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 33: North America Market Value Share (US$ Million), By Country (2023 E)

Figure 34: North America Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 40: North America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 41: U.S. Market Value Proportion Analysis, 2022

Figure 42: Global Vs. U.S. Growth Comparison

Figure 43: U.S. Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 44: U.S. Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 45: U.S. Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 46: U.S. Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 47: U.S. Market Share Analysis (%) By Indication, 2023 & 2033

Figure 48: U.S. Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 49: Canada Market Value Proportion Analysis, 2022

Figure 50: Global Vs. Canada. Growth Comparison

Figure 51: Canada Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 52: Canada Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 53: Canada Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 54: Canada Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 55: Canada Market Share Analysis (%) By Indication, 2023 & 2033

Figure 56: Canada Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 57: Latin America Market Value (US$ Million) Analysis, 2017–2022

Figure 58: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 59: Latin America Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 60: Latin America Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 61: Latin America Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 62: Latin America Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 63: Latin America Market Value Share (US$ Million), By Indication (2023 E)

Figure 64: Latin America Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 65: Latin America Market Value Share (US$ Million), By Country (2023 E)

Figure 66: Latin America Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 67: Latin America Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 68: Latin America Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 71: Latin America Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness Analysis By Country, 2023 to 2033

Figure 73: Mexico Market Value Proportion Analysis, 2022

Figure 74: Global Vs Mexico Growth Comparison

Figure 75: Mexico Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 76: Mexico Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 77: Mexico Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 78: Mexico Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 79: Mexico Market Share Analysis (%) By Indication, 2023 & 2033

Figure 80: Mexico Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 81: Brazil Market Value Proportion Analysis, 2022

Figure 82: Global Vs. Brazil. Growth Comparison

Figure 83: Brazil Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 84: Brazil Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 85: Brazil Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 86: Brazil Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 87: Brazil Market Share Analysis (%) By Indication, 2023 & 2033

Figure 88: Brazil Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 89: Argentina Market Value Proportion Analysis, 2022

Figure 90: Global Vs Argentina Growth Comparison

Figure 91: Argentina Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 92: Argentina Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 93: Argentina Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 94: Argentina Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 95: Argentina Market Share Analysis (%) By Indication, 2023 & 2033

Figure 96: Argentina Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 97: Europe Market Value (US$ Million) Analysis, 2017–2022

Figure 98: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 99: Europe Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 100: Europe Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 101: Europe Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 102: Europe Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 103: Europe Market Value Share (US$ Million), By Indication (2023 E)

Figure 104: Europe Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 105: Europe Market Value Share (US$ Million), By Country (2023 E)

Figure 106: Europe Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 107: Europe Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 108: Europe Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 109: Europe Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 110: Europe Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 111: Europe Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 112: Europe Market Attractiveness Analysis By Country, 2023 to 2033

Figure 113: UK Market Value Proportion Analysis, 2022

Figure 114: Global Vs. UK Growth Comparison

Figure 115: UK Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 116: UK Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 117: UK Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 118: UK Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 119: UK Market Share Analysis (%) By Indication, 2023 & 2033

Figure 120: UK Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 121: Germany Market Value Proportion Analysis, 2022

Figure 122: Global Vs. Germany Growth Comparison

Figure 123: Germany Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 124: Germany Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 125: Germany Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 126: Germany Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 127: Germany Market Share Analysis (%) By Indication, 2023 & 2033

Figure 128: Germany Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 129: Italy Market Value Proportion Analysis, 2022

Figure 130: Global Vs. Italy Growth Comparison

Figure 131: Italy Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 132: Italy Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 133: Italy Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 134: Italy Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 135: Italy Market Share Analysis (%) By Indication, 2023 & 2033

Figure 136: Italy Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 137: France Market Value Proportion Analysis, 2022

Figure 138: Global Vs France Growth Comparison

Figure 139: France Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 140: France Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 141: France Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 142: France Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 143: France Market Share Analysis (%) By Indication, 2023 & 2033

Figure 144: France Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 145: Spain Market Value Proportion Analysis, 2022

Figure 146: Global Vs Spain Growth Comparison

Figure 147: Spain Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 148: Spain Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 149: Spain Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 150: Spain Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 151: Spain Market Share Analysis (%) By Indication, 2023 & 2033

Figure 152: Spain Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 153: Russia Market Value Proportion Analysis, 2022

Figure 154: Global Vs Russia Growth Comparison

Figure 155: Russia Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 156: Russia Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 157: Russia Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 158: Russia Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 159: Russia Market Share Analysis (%) By Indication, 2023 & 2033

Figure 160: Russia Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 161: BENELUX Market Value Proportion Analysis, 2022

Figure 162: Global Vs BENELUX Growth Comparison

Figure 163: BENELUX Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 164: BENELUX Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 165: BENELUX Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 166: BENELUX Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 167: BENELUX Market Share Analysis (%) By Indication, 2023 & 2033

Figure 168: BENELUX Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 169: Nordic Countries Market Value Proportion Analysis, 2022

Figure 170: Global Vs Nordic Countries Growth Comparison

Figure 171: Nordic Countries Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 172: Nordic Countries Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 173: Nordic Countries Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 174: Nordic Countries Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 175: Nordic Countries Market Share Analysis (%) By Indication, 2023 & 2033

Figure 176: Nordic Countries Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 177: Switzerland Market Value Proportion Analysis, 2022

Figure 178: Global Vs Switzerland Growth Comparison

Figure 179: Switzerland Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 180: Switzerland Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 181: Switzerland Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 182: Switzerland Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 183: Switzerland Market Share Analysis (%) By Indication, 2023 & 2033

Figure 184: Switzerland Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 185: Poland Market Value Proportion Analysis, 2022

Figure 186: Global Vs Poland Growth Comparison

Figure 187: Poland Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 188: Poland Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 189: Poland Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 190: Poland Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 191: Poland Market Share Analysis (%) By Indication, 2023 & 2033

Figure 192: Poland Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 193: East Asia Market Value (US$ Million) Analysis, 2017–2022

Figure 194: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 195: East Asia Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 196: East Asia Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 197: East Asia Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 198: East Asia Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 199: East Asia Market Value Share (US$ Million), By Indication (2023 E)

Figure 200: East Asia Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 201: East Asia Market Value Share (US$ Million), By Country (2023 E)

Figure 202: East Asia Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 203: East Asia Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 204: East Asia Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 205: East Asia Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 206: East Asia Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 207: East Asia Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 208: East Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 209: China Market Value Proportion Analysis, 2022

Figure 210: Global Vs. China Growth Comparison

Figure 211: China Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 212: China Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 213: China Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 214: China Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 215: China Market Share Analysis (%) By Indication, 2023 & 2033

Figure 216: China Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 217: Japan Market Value Proportion Analysis, 2022

Figure 218: Global Vs. Japan Growth Comparison

Figure 219: Japan Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 220: Japan Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 221: Japan Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 222: Japan Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 223: Japan Market Share Analysis (%) By Indication, 2023 & 2033

Figure 224: Japan Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 225: South Korea Market Value Proportion Analysis, 2022

Figure 226: Global Vs South Korea Growth Comparison

Figure 227: South Korea Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 228: South Korea Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 229: South Korea Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 230: South Korea Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 231: South Korea Market Share Analysis (%) By Indication, 2023 & 2033

Figure 232: South Korea Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 233: South Asia Market Value (US$ Million) Analysis, 2017–2022

Figure 234: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 235: South Asia Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 236: South Asia Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 237: South Asia Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 238: South Asia Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 239: South Asia Market Value Share (US$ Million), By Indication (2023 E)

Figure 240: South Asia Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 241: South Asia Market Value Share (US$ Million), By Country (2023 E)

Figure 242: South Asia Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 243: South Asia Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 244: South Asia Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 245: South Asia Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 246: South Asia Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 247: South Asia Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 248: South Asia Market Attractiveness Analysis By Country, 2023 to 2033

Figure 249: India Market Value Proportion Analysis, 2022

Figure 250: Global Vs. India Growth Comparison

Figure 251: India Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 252: India Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 253: India Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 254: India Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 255: India Market Share Analysis (%) By Indication, 2023 & 2033

Figure 256: India Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 257: Indonesia Market Value Proportion Analysis, 2022

Figure 258: Global Vs. Indonesia Growth Comparison

Figure 259: Indonesia Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 260: Indonesia Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 261: Indonesia Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 262: Indonesia Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 263: Indonesia Market Share Analysis (%) By Indication, 2023 & 2033

Figure 264: Indonesia Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 265: Malaysia Market Value Proportion Analysis, 2022

Figure 266: Global Vs. Malaysia Growth Comparison

Figure 267: Malaysia Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 268: Malaysia Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 269: Malaysia Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 270: Malaysia Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 271: Malaysia Market Share Analysis (%) By Indication, 2023 & 2033

Figure 272: Malaysia Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 273: Thailand Market Value Proportion Analysis, 2022

Figure 274: Global Vs. Thailand Growth Comparison

Figure 275: Thailand Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 276: Thailand Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 277: Thailand Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 278: Thailand Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 279: Thailand Market Share Analysis (%) By Indication, 2023 & 2033

Figure 280: Thailand Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 281: Oceania Market Value (US$ Million) Analysis, 2017–2022

Figure 282: Oceania Market Value (US$ Million) Forecast, 2023-2033

Figure 283: Oceania Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 284: Oceania Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 285: Oceania Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 286: Oceania Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 287: Oceania Market Value Share (US$ Million), By Indication (2023 E)

Figure 288: Oceania Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 289: Oceania Market Value Share (US$ Million), By Country (2023 E)

Figure 290: Oceania Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 291: Oceania Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 292: Oceania Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 293: Oceania Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 294: Oceania Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 295: Oceania Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 296: Oceania Market Attractiveness Analysis By Country, 2023 to 2033

Figure 297: Australia Market Value Proportion Analysis, 2022

Figure 298: Global Vs. Australia Growth Comparison

Figure 299: Australia Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 300: Australia Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 301: Australia Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 302: Australia Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 303: Australia Market Share Analysis (%) By Indication, 2023 & 2033

Figure 288: Australia Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 304: New Zealand Market Value Proportion Analysis, 2022

Figure 305: Global Vs New Zealand Growth Comparison

Figure 306: New Zealand Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 307: New Zealand Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 308: New Zealand Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 309: New Zealand Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 310: New Zealand Market Share Analysis (%) By Indication, 2023 & 2033

Figure 311: New Zealand Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 312: Middle East & Africa Market Value (US$ Million) Analysis, 2017–2022

Figure 313: Middle East & Africa Market Value (US$ Million) Forecast, 2023-2033

Figure 314: Middle East & Africa Market Value Share (US$ Million), By Drug Type (2023 E)

Figure 315: Middle East & Africa Market Value Share (US$ Million), By Route of Administration (2023 E)

Figure 316: Middle East & Africa Market Value Share (US$ Million), By Dosage Form (2023 E)

Figure 317: Middle East & Africa Market Value Share (US$ Million), By Prescription Type (2023 E)

Figure 318: Middle East & Africa Market Value Share (US$ Million), By Indication (2023 E)

Figure 319: Middle East & Africa Market Value Share (US$ Million), By Distribution Channel (2023 E)

Figure 320: Middle East & Africa Market Value Share (US$ Million), By Country (2023 E)

Figure 321: Middle East & Africa Market Attractiveness Analysis By Drug Type, 2023 to 2033

Figure 322: Middle East & Africa Market Attractiveness Analysis By Route of Administration, 2023 to 2033

Figure 323: Middle East & Africa Market Attractiveness Analysis By Dosage Form, 2023 to 2033

Figure 324: Middle East & Africa Market Attractiveness Analysis By Prescription Type, 2023 to 2033

Figure 325: Middle East & Africa Market Attractiveness Analysis By Indication, 2023 to 2033

Figure 326: Middle East & Africa Market Attractiveness Analysis By Distribution Channel, 2023 to 2033

Figure 327: Middle East & Africa Market Attractiveness Analysis By Country, 2023 to 2033

Figure 328: GCC Countries Market Value Proportion Analysis, 2022

Figure 329: Global Vs GCC Countries Growth Comparison

Figure 330: GCC Countries Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 331: GCC Countries Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 332: GCC Countries Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 333: GCC Countries Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 334: GCC Countries Market Share Analysis (%) By Indication, 2023 & 2033

Figure 335: GCC Countries Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 336: Türkiye Market Value Proportion Analysis, 2022

Figure 337: Global Vs. Türkiye Growth Comparison

Figure 338: Türkiye Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 339: Türkiye Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 340: Türkiye Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 341: Türkiye Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 342: Türkiye Market Share Analysis (%) By Indication, 2023 & 2033

Figure 343: Türkiye Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 344: South Africa Market Value Proportion Analysis, 2022

Figure 345: Global Vs. South Africa Growth Comparison

Figure 346: South Africa Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 347: South Africa Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 348: South Africa Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 349: South Africa Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 350: South Africa Market Share Analysis (%) By Indication, 2023 & 2033

Figure 351: South Africa Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Figure 352: Northern Africa Market Value Proportion Analysis, 2022

Figure 353: Global Vs Northern Africa Growth Comparison

Figure 354: Northern Africa Market Share Analysis (%) By Drug Type, 2023 & 2033

Figure 355: Northern Africa Market Share Analysis (%) By Route of Administration, 2023 & 2033

Figure 356: Northern Africa Market Share Analysis (%) By Dosage Form, 2023 & 2033

Figure 357: Northern Africa Market Share Analysis (%) By Prescription Type, 2023 & 2033

Figure 358: Northern Africa Market Share Analysis (%) By Indication, 2023 & 2033

Figure 359: Northern Africa Market Share Analysis (%) By Distribution Channel, 2023 & 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

FcRn Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Vane Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA