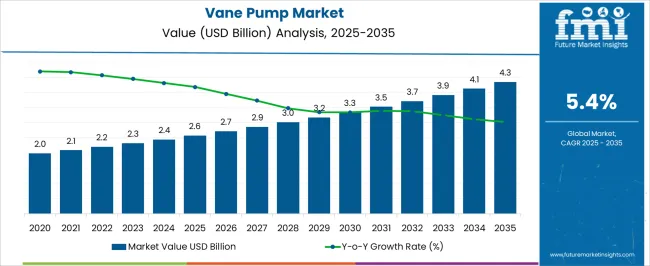

The Vane Pump Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Vane Pump Market Estimated Value in (2025 E) | USD 2.6 billion |

| Vane Pump Market Forecast Value in (2035 F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The vane pump market is expanding steadily. Growth is being supported by rising industrial automation, increasing demand for efficient hydraulic systems, and the need for precise fluid handling in critical applications. Current market conditions are marked by steady adoption across oil and gas, chemicals, automotive, and manufacturing sectors.

Producers are focusing on improving efficiency, durability, and energy savings through advanced materials and innovative pump designs. Regulatory pressure to reduce operational emissions and improve energy efficiency is further shaping product development and adoption. The future outlook reflects continued investments in oil and gas infrastructure, growth in manufacturing activities in emerging markets, and modernization of hydraulic systems in industrial machinery.

Growth rationale is also reinforced by aftermarket services and maintenance contracts that extend product life and improve reliability With a balanced demand outlook across mature and developing economies, the vane pump market is positioned for consistent long-term expansion supported by technological progress and diversified industrial applications.

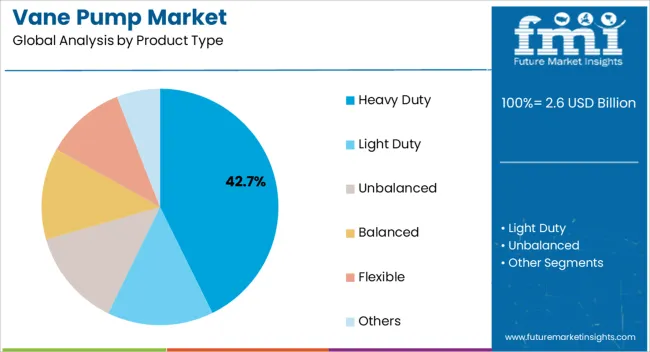

The heavy duty segment, accounting for 42.70% of the product type category, has retained its leadership position owing to high performance requirements in demanding industrial environments. Its market share is supported by the ability to operate under extreme pressure and temperature conditions with consistent efficiency.

Adoption has been strong in large-scale hydraulic systems where reliability and durability are critical to operational continuity. Manufacturers have focused on enhancing wear resistance, optimizing vane configurations, and extending service intervals, which have reinforced confidence among end users.

Growth is also being driven by the deployment of heavy-duty vane pumps in industries requiring continuous operations and high output, supported by advancements in precision engineering and robust quality control systems This segment is expected to maintain dominance as industrial demand for durable and efficient hydraulic solutions continues to expand.

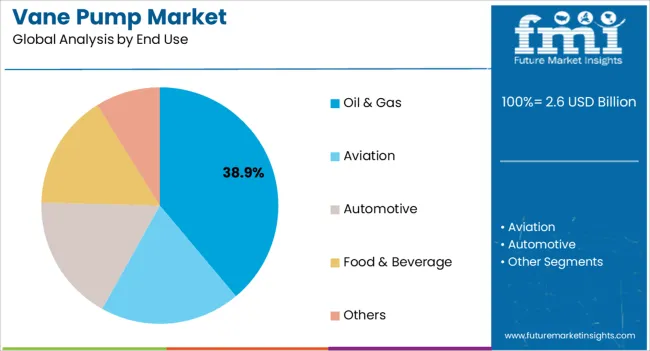

The oil and gas segment, holding 38.90% of the end use category, has emerged as the leading application due to the high demand for reliable pumping systems in exploration, drilling, refining, and distribution processes. The segment’s prominence is supported by the ability of vane pumps to handle a range of fluids, including lubricants and fuels, with precision and efficiency.

Operational reliability, coupled with compliance with stringent safety and performance standards, has sustained market preference in this sector. Growth has also been influenced by ongoing investments in upstream and downstream oil and gas infrastructure, particularly in regions with expanding production capacity.

The adaptability of vane pumps to harsh field conditions and their suitability for continuous operations reinforce their adoption As global energy demand continues to rise and infrastructure modernization accelerates, the oil and gas segment is expected to sustain its share and provide long-term opportunities for vane pump manufacturers.

The vane pump market valuation was USD 1,844.5 million in 2020. During the historical period from 2020 to 2025, the market grew at a CAGR of 5.8%.

The adoption of vane pumps in industries continued to accelerate during the historical period. As positive displacement found more of a place in industries, vane pumps had a positive outlook. The growth of the automobile and aerospace industries over the historical period also contributed to the growth of the market. The market value reached USD 2,311.1 million by 2025.

| Market Valuation (2020) | USD 1,844.5 million |

|---|---|

| Historical CAGR (2020 to 2025) | 5.8% |

| Historical Market Valuation (2025) | USD 2,311.1 million |

For 2025, the value of the vane pump market is estimated at USD 2,442.4 million. During the period from 2025 to 2035, the market is expected to progress at a CAGR of 5.6%.

The easy-to-handle and easy-to-operate features of vane pumps make the machine viable for several industrial processes. With positive displacement equipment’s popularity set to continue over the forecast period, vane pumps are also set to find greater industrial use. The rise of industrialization is expected to positively affect the vane pump market.

However, the presence of numerous alternatives like gear pumps and piston pumps are set to restrict the pace of progress in the market. The market is projected to reach USD 4,292.1 million by the end of the forecast period.

Industrialists are inclined toward the heavy duty subset when it comes to vane pumps. In 2025, heavy duty vane pumps are estimated to hold 32.0% of the market share by product type.

Ease of handling regarding heavy duty vane pumps starts from the installment itself. The machine is easy to install, and when working, it provides operational ease to end-users too. Thus, heavy duty vane pumps are popular in the market.

| Attributes | Details |

|---|---|

| Top Product Type | Heavy Duty |

| Market Share in 2025 | 32.0% |

Vane pumps are widely employed in the aviation industry. For 2025, the aviation segment is anticipated to hold 24.0% of the market share by end-use industry.

Vane pumps have numerous applications in planes. Vane pumps are used in braking systems for all kinds of planes. As the size of the plane gets bigger, the hydraulic system required also increases. Thus, bigger planes have a bigger need for vane pumps. Therefore, the aviation industry is representing a significant end-user base for vane pumps.

| Attributes | Details |

|---|---|

| Top End-use Industry | Aviation |

| Market Share in 2025 | 24.0% |

Rising industrialization in Asia Pacific, especially in China and India, is propelling the demand for vane pumps. As a result, Asia Pacific represents significant opportunities for market players.

Europe is another region with potential for market growth. Europe drives the global market demand due to the wide acceptance of hydraulic systems in the region.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| Australia | 5.3% |

| United Kingdom | 5.2% |

| India | 6.3% |

| China | 6.1% |

India is anticipated to be one of the fastest-growing countries in the market. The CAGR for the market in India is marked at a promising 6.3% from 2025 to 2035.

Government initiatives have broadened the scope of industrialization in India. For example, the ‘Make in India’ initiative has helped industries to grow in the country. Market players such as HHV Pumps have taken advantage of the initiative to expand facilities. Thus, the market is getting propelled in India.

China is not far behind India when it comes to Asian countries with regard to the progress of the market. The CAGR for the market in China is pegged at an encouraging 6.1% over the forecast period.

With rapid advancements in the automobile and aviation industries, the adoption of hydraulic systems is increasing in China. Thus, the market is expected to have bright prospects in China.

Various industrial plants for renewable energy are dotting the Australian landscape. With an increasing focus on renewable energy as one of the emerging sectors, demand for vane pumps is rising in Australia and is thus rife with opportunity for the market. The CAGR for Australia over the forecast period is pegged at a solid 5.3%.

In the United Kingdom, the demand for sliding vane pumps is increasing. Manufacturers are paying attention by developing new technologies in sliding vane pumps. Thus, there is an increase both in the production and in the use of sliding vane pumps in the United Kingdom. For the forecast period, the United Kingdom market is pegged to register a reasonable CAGR of 5.2%.

In the United States, pumps and pump systems are viewed positively by industries and regulatory bodies. For example, the ‘Pump Systems Matter’ program has been developed by the Hydraulic Institute in the United States. Vane pumps, too, are benefitting due to the positive outlook towards pumps. Over the forecast period, it is predicted the market will register a sturdy CAGR of 5.2%

Efficiency and low noise levels are two of the important aspects that appeal to end-users while purchasing vane pumps. Manufacturers are further trying to improve efficiency and reduce the noise levels to make vane pumps even more appealing. The help of technology is being sought to meet the dual objectives.

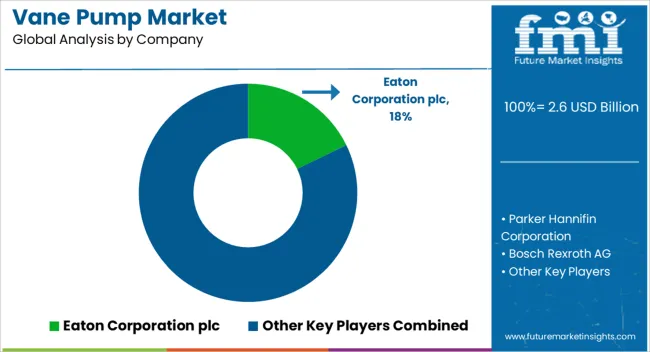

The market for vane pumps is highly competitive. Several well-established companies compete with local players to gain higher profits. Expanding into untapped regions is a common concern among many of the higher-end players.

Recent Developments in the Vane Pump Market

The global vane pump market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the vane pump market is projected to reach USD 4.3 billion by 2035.

The vane pump market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in vane pump market are heavy duty, light duty, unbalanced, balanced, flexible and others.

In terms of end use, oil & gas segment to command 38.9% share in the vane pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA