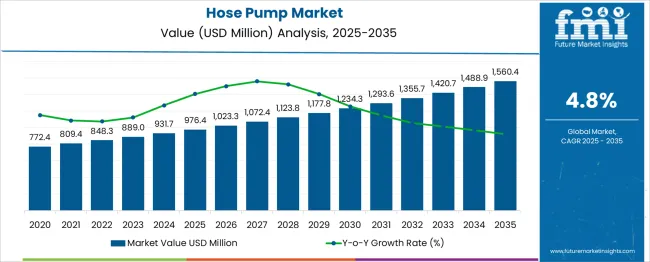

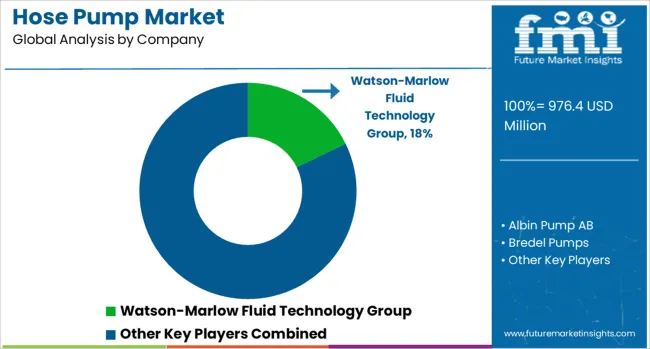

The Hose Pump Market is estimated to be valued at USD 976.4 million in 2025 and is projected to reach USD 1560.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Hose Pump Market Estimated Value in (2025 E) | USD 976.4 million |

| Hose Pump Market Forecast Value in (2035 F) | USD 1560.4 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The chemical industry, in particular, has driven growth as it demands pumps that can handle corrosive and abrasive fluids safely. Advances in pump design have improved durability and efficiency while reducing maintenance requirements. The growing emphasis on operational safety and environmental compliance has encouraged the adoption of hose pumps capable of leak-free operation. Rising infrastructure development and industrialization worldwide have further supported market expansion.

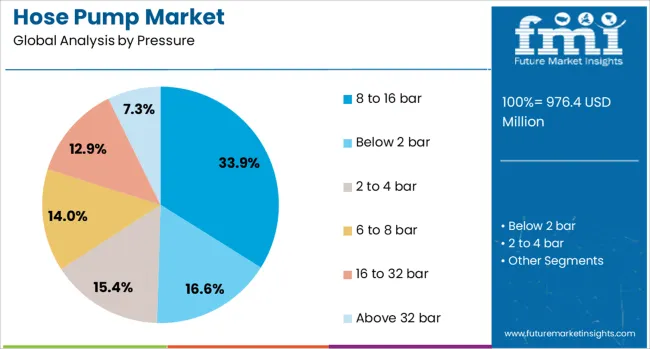

Emerging economies are investing heavily in chemical processing facilities, increasing the need for robust pumping equipment. Segmental growth is expected to be led by pumps operating within the 8 to 16 bar pressure range, natural rubber as the preferred hose material, and the chemical industry as the primary application sector.

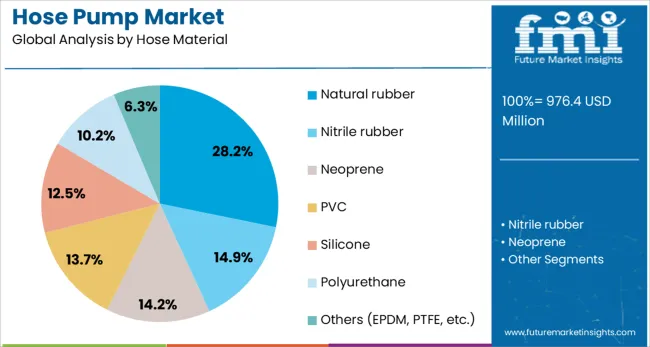

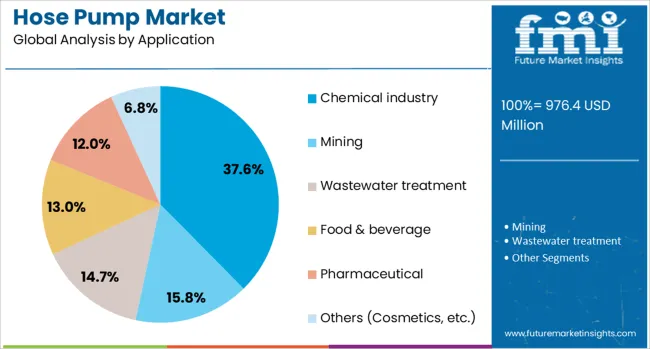

The hose pump market is segmented by pressure, hose material, application, and distribution channel and geographic regions. By pressure of the hose pump market is divided into 8 to 16 bar, Below 2 bar, 2 to 4 bar, 6 to 8 bar, 16 to 32 bar, and Above 32 bar. In terms of hose material, the hose pump market is classified into Natural rubber, Nitrile rubber, Neoprene, PVC, Silicone, Polyurethane, and Others (EPDM, PTFE, etc.). Based on the application, the hose pump market is segmented into the Chemical industry, Mining, Wastewater treatment, Food & beverage, Pharmaceutical, and Others (Cosmetics, etc.). The distribution channel of the hose pump market is segmented into Direct sales and Indirect sales. Regionally, the hose pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 8 to 16 bar pressure segment is projected to account for 33.9% of the hose pump market revenue in 2025, maintaining its position as the leading pressure category. This pressure range is favored due to its suitability for a wide variety of industrial pumping applications, balancing sufficient force with energy efficiency.

It supports safe and consistent fluid movement in processes that involve viscous or abrasive liquids, common in the chemical industry. The segment’s popularity is reinforced by its compatibility with standard hose materials and widespread availability of compatible pump models.

Operators prioritize this range for its reliability under moderate pressure conditions, which helps reduce equipment wear and extend operational life. Given its versatility across applications, the 8 to 16 bar segment is expected to continue dominating the market.

Natural rubber hoses are projected to hold 28.2% of the market share in 2025, positioning them as the preferred material choice. This preference is driven by natural rubber’s excellent flexibility, abrasion resistance, and chemical compatibility with a range of substances encountered in industrial processes.

Its elastic properties allow the hose to withstand repeated compression cycles, which is crucial for hose pump operation. Furthermore, natural rubber offers cost advantages and ease of maintenance compared to synthetic alternatives.

Industries often select natural rubber hoses when durability and resilience against harsh media are required. The environmental friendliness of natural rubber as a renewable resource also aligns with growing sustainability priorities. Due to these advantages, the natural rubber segment is expected to sustain its leadership position.

The chemical industry segment is projected to contribute 37.6% of the hose pump market revenue in 2025, maintaining its status as the leading application area. Growth in this sector is propelled by the need for reliable and safe fluid transfer solutions in chemical processing plants.

Hose pumps are valued for their gentle pumping action, which minimizes shear-sensitive product degradation and handles corrosive or abrasive fluids effectively. Regulatory pressures and safety standards have heightened the demand for leak-free, enclosed pumping systems, further boosting hose pump adoption.

Additionally, expanding chemical manufacturing capacity in emerging markets has increased the requirement for robust pump technologies. The chemical industry’s diverse pumping needs—from acids to slurries—continue to favor hose pumps, positioning this segment as a primary driver of market growth.

Hose pumps are gaining traction in the chemical, mining, and wastewater sectors due to durability, leak-free operation, and precise dosing. Emerging opportunities focus on hygienic transfer, advanced hose materials, and integration with automated and IoT-enabled fluid handling systems.

The hose pump market has been influenced by rising usage in chemical processing, mining, and wastewater management. These pumps have been adopted for their ability to handle abrasive, viscous, and shear-sensitive fluids without damaging product integrity. Maintenance requirements have been considered lower than traditional pumps, which has strengthened demand among industries focused on operational continuity. Higher adoption in slurry transfer and aggressive chemical dosing has been observed due to leak-free operation and precise metering capabilities. End users have prioritized designs with long hose life and easy replacement, making these pumps a preferred choice in fluid handling applications requiring durability and accuracy.

New opportunities have been created in sectors demanding hygienic transfer of sensitive materials, including food processing and pharmaceuticals. Manufacturers have targeted improved hose compositions to enable compliance with stringent safety norms. Expansion in bioprocessing and specialty chemical manufacturing has supported the need for pumps that maintain purity and reduce contamination risk. Increasing reliance on automated dosing systems has resulted in a push for integration-friendly designs suitable for industrial IoT frameworks. Adoption of advanced elastomer hoses for aggressive media and temperature variations has been seen as a differentiator for suppliers. Growth potential lies in customization for challenging operating environments with limited downtime tolerance.

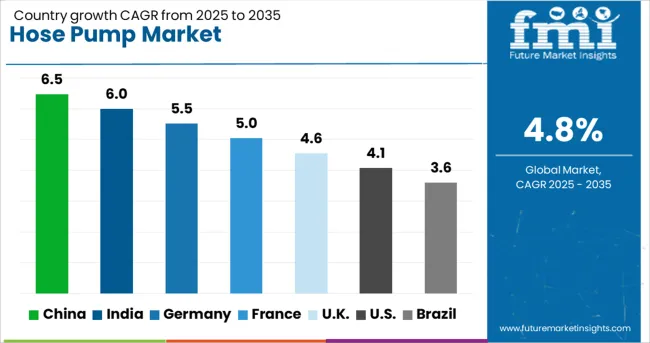

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The hose pump industry, projected to grow at a global CAGR of 4.8% from 2025 to 2035, is witnessing diverse growth across major regions. China, a BRICS member, is leading with a CAGR of 6.5% driven by large-scale adoption in chemical and mining operations. India, also a BRICS nation, follows closely with 6.0%, supported by infrastructure projects and increasing industrial fluid handling needs. Germany, an OECD member, is seeing 5.5% growth due to strong utilization in the food and beverage and pharmaceutical sectors. The United Kingdom, another OECD member, is expected to expand at 4.6%, supported by investments in wastewater treatment and energy sectors. The United States, also an OECD nation, shows 4.1% growth as process industries shift toward efficient pumping solutions. High-growth prospects are being observed in BRICS economies due to industrial capacity expansion, while steady performance is being maintained in mature OECD markets with stable demand patterns. The report includes an in-depth analysis of over 40 countries, with the top five highlighted as examples.

China recorded a CAGR of approximately 6.5% during 2025-2035, up from nearly 4.7% in 2020-2024, as large-scale mining and chemical processing projects expanded their reliance on durable pumping solutions. The shift was influenced by strong investment in industrial automation and stricter compliance with chemical handling standards. Government-backed infrastructure projects demanded high-capacity slurry handling, resulting in wider hose pump integration. Local manufacturers improved elastomer technology for better chemical resistance, creating a competitive domestic supply chain. Exports surged as Chinese suppliers strengthened their presence in Southeast Asia. The market also experienced growth due to a surge in wastewater treatment plants adopting low-maintenance pumping equipment.

The CAGR for India is projected at 6.0% between 2025 and 2035, rising from an estimated 4.5% during 2020-2024 as the demand for efficient slurry transfer and chemical dosing solutions increased in construction, mining, and cement sectors. Accelerated infrastructure development programs and enhanced investment in industrial process safety created strong uptake for peristaltic pumping systems. Regional suppliers introduced elastomer-based hoses suited for abrasive material handling, which reduced operating downtime. Domestic production initiatives under “Make in India” expanded capacity and reduced dependency on imports. The presence of mid-sized process industries in Tier 2 and Tier 3 cities further strengthened growth dynamics.

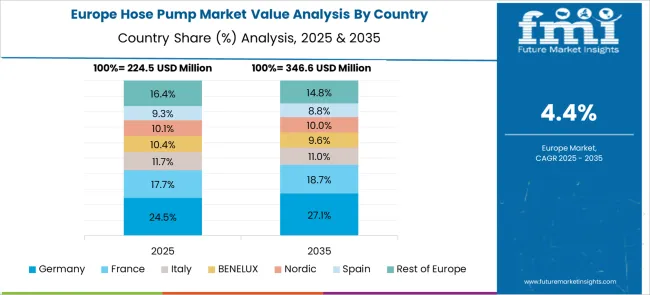

Germany experienced an upward shift in CAGR to 5.5% in 2025–2035, from about 3.9% recorded during 2020-2024, supported by robust demand in hygienic fluid transfer within the pharmaceutical and food sectors. Rising automation in bioprocessing plants required low-shear pumps that preserved material integrity, which enhanced hose pump usage. Increased investments in wastewater modernization projects amplified the installation of peristaltic systems in municipal facilities. Stringent EU safety norms led manufacturers to adopt compliant elastomer compounds, strengthening market trust. Expansion in renewable energy operations such as biogas plants also drove the integration of hose pumps in sludge handling operations.

The United Kingdom registered a forecast CAGR of 4.6% between 2025 and 2035, up from roughly 3.5% seen in 2020-2024, as water treatment utilities and energy projects transitioned toward more efficient pumping systems. Adoption was reinforced by environmental regulations demanding precision dosing and leak-proof handling of chemicals. Integration with digital monitoring systems in process industries added traction for automated hose pump solutions. Import-driven procurement was gradually replaced by regional assembly units that catered to niche specifications, reducing delivery timelines. Industrial contractors working on large-scale municipal wastewater projects favored hose pumps for their proven durability and low maintenance intervals.

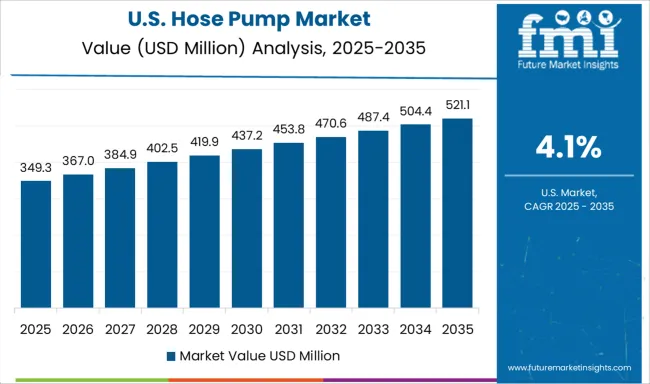

The CAGR estimates for the United States have moved to 4.1% for 2025-2035, compared to about 3.2% during 2020-2024, as process industry operators favored precision pumping for chemical and slurry dosing. Growing investment in oil and gas downstream segments increased the relevance of hose pumps in abrasive fluid handling applications. Upgrades in food and beverage facilities toward contamination-free processing supported additional demand. Domestic OEMs incorporated IoT-ready dosing solutions to provide predictive maintenance capabilities, leading to faster adoption in high-throughput environments. Wastewater management utilities also integrated these pumps into sludge treatment and chemical injection systems for operational reliability.

In the hose pump industry, top manufacturers are focusing on delivering precision dosing, chemical resistance, and reliable fluid handling for sectors such as mining, wastewater, food processing, and pharmaceuticals. Companies like Watson-Marlow Fluid Technology Group, Albin Pump AB, and Bredel Pumps have emphasized developing peristaltic pumping systems capable of handling abrasive and viscous fluids while maintaining low maintenance requirements. Curtiss-Wright Corporation, Flowrox, and Grundfos Holding A/S have invested in high-performance elastomer hose technologies and integration with automation platforms for enhanced process efficiency. Notable players such as Graco Inc., Ingersoll Rand, and Verder Group have expanded their offerings to include IoT-compatible pumps for real-time monitoring and predictive maintenance. Brands like PSG Dover, ProMinent Group, and Wanner Engineering Inc. are recognized for robust designs suited for aggressive chemical environments and hygienic applications. Companies including PCM Group, Lobeflo Pumps, Rotho Peristaltic Pumps GmbH, SEKO S.p.A., and the Peristaltic Pump Company are contributing significantly to regional demand with specialized configurations for customized industrial requirements.

In October 2024, Ingersoll Rand announced three acquisitions (APSCO, Blutek, UT Pumps), adding $50M+ revenue in high-pressure pumps for water, wastewater, food/bev, and pharma.

| Item | Value |

|---|---|

| Quantitative Units | USD 976.4 Million |

| Pressure | 8 to 16 bar, Below 2 bar, 2 to 4 bar, 6 to 8 bar, 16 to 32 bar, and Above 32 bar |

| Hose Material | Natural rubber, Nitrile rubber, Neoprene, PVC, Silicone, Polyurethane, and Others (EPDM, PTFE, etc.) |

| Application | Chemical industry, Mining, Wastewater treatment, Food & beverage, Pharmaceutical, and Others (Cosmetics, etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Watson-Marlow Fluid Technology Group, Albin Pump AB, Bredel Pumps, Curtiss-Wright Corporation, Flowrox, Grundfos Holding A/S, Graco Inc., Ingersoll Rand, Lobeflo Pumps, PCM Group, Peristaltic Pump Company, ProMinent Group, PSG Dover, Rotho Peristaltic Pumps GmbH, SEKO S.p.A., Verder Group, and Wanner Engineering Inc. |

| Additional Attributes | Dollar sales, share, growth by region, competitive landscape, pricing trends, demand drivers, regulatory impact, raw material outlook, end-use applications, distribution models, and technology adoption patterns for future expansion. |

The global hose pump market is estimated to be valued at USD 976.4 million in 2025.

The market size for the hose pump market is projected to reach USD 1,560.4 million by 2035.

The hose pump market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in hose pump market are 8 to 16 bar, below 2 bar, 2 to 4 bar, 6 to 8 bar, 16 to 32 bar and above 32 bar.

In terms of hose material, natural rubber segment to command 28.2% share in the hose pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pump Jack Market Forecast Outlook 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Hose Reinforcement Wires Market Analysis Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Vane Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA