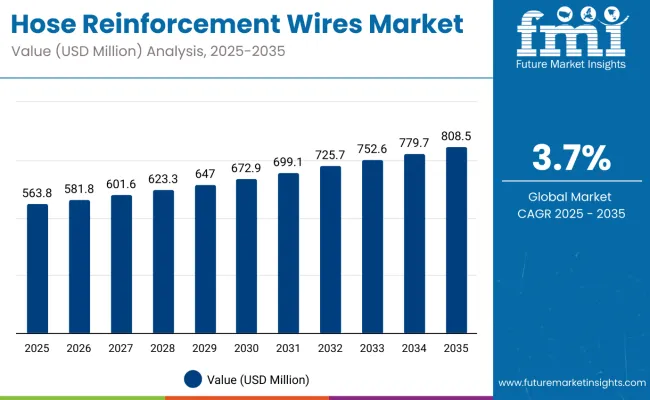

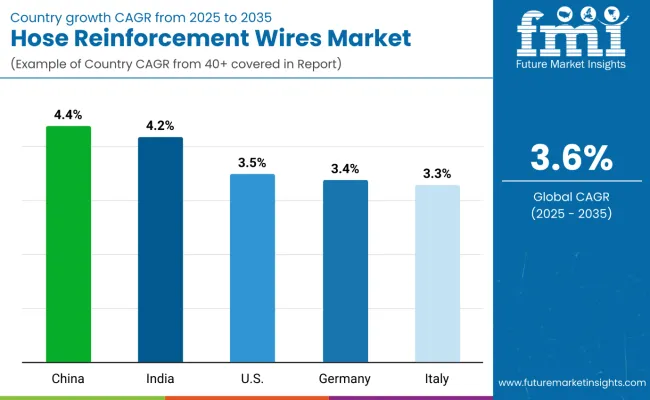

The global hose reinforcement wires market is projected to reach USD 563.8 million in 2025 and is expected to expand to approximately USD 808.5 million by 2035. This reflects an absolute increase of USD 244.7 million, representing a 43.4% rise in value over the forecast period. The market is forecast to grow at a compound annual growth rate (CAGR) of 3.7%, with the overall market size projected to expand by nearly 1.43X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 563.8 Million |

| Industry Size (2035F) | USD 808.5 Million |

| CAGR (2025-2035) | 3.7% |

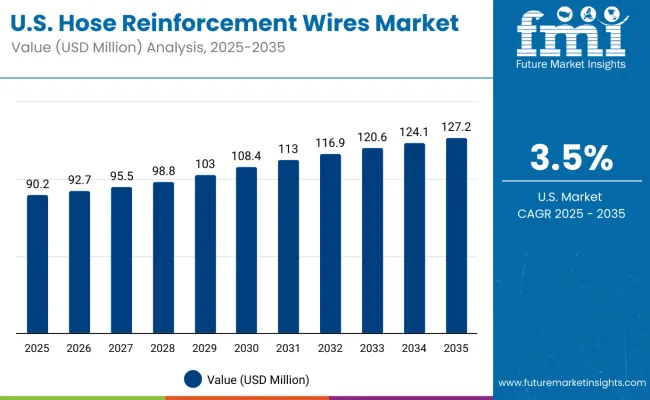

Between 2025 and 2030, the hose reinforcement wires market is projected to grow from USD 563.8 million to USD 672.9 million, resulting in a value addition of USD 109.1 million over the first half of the forecast period. This phase of growth is expected to be supported by rising hydraulic hose consumption in construction equipment, mining, and agricultural machinery across high-demand regions.

Expansion in fluid power systems, driven by infrastructure development and mechanization trends in emerging economies, is fueling procurement of steel-reinforced hose assemblies with higher pressure ratings and improved fatigue resistance.

From 2030 to 2035, the market is forecast to advance from USD 672.9 million to USD 808.5 million, contributing an additional USD 135.6 million in value. The latter phase is likely to be characterized by increasing demand for multi-spiral and braided wire reinforcement formats compatible with compact hose designs and flexible routing. Rising emphasis on leak prevention, extended service life, and temperature resilience in hydraulic systems is expected to further influence product innovation and adoption across OEMs and aftermarket suppliers.

Between 2020 and 2025, the hose reinforcement wires market expanded from USD 487.3 million to USD 563.8 million, adding approximately USD 76.5 million in absolute value. This growth phase was driven by sustained demand from the construction, mining, and agricultural sectors, which continued to rely on high-pressure hydraulic hose assemblies for equipment reliability and performance. Manufacturers experienced moderate volume increases, supported by gradual recovery in global construction activity post-2020 disruptions.

The period also witnessed a preference for wire-reinforced thermoplastic and rubber hoses, particularly in fluid transfer systems requiring compact bend radii and enhanced pressure containment. Steel wire braiding and spiral winding technologies gained traction, with suppliers expanding capabilities for multi-layered reinforcement formats. Western Europe, China, and North America emerged as key production and consumption hubs, while supply chain stability and raw material price volatility remained areas of concern for OEMs and tiered suppliers during the early part of the decade.

The hose reinforcement wires market is expanding due to increasing investments in construction equipment, agricultural machinery, and industrial fluid systems. These segments rely heavily on hydraulic hoses that require wire reinforcement to maintain structural integrity, high pressure endurance, and flexibility in demanding environments. Applications involving high mechanical loads, cyclic pressure surges, and tight routing conditions are driving the need for multi-layer braided and spiral-wound steel reinforcement formats.

Growth is also being supported by expanding infrastructure and industrial activity in Asia, Latin America, and Eastern Europe. These regions are witnessing increased deployment of hose-based systems in sectors such as energy, mining, material handling, and manufacturing.

Equipment manufacturers are actively sourcing reinforcement wires that enable hose designs with extended service life, higher temperature tolerance, and reduced weight without compromising pressure ratings. Improvements in production technologies such as precision braiding, inline quality inspection, and high-tensile wire forming are further enabling consistent supply to hose producers across global value chains.

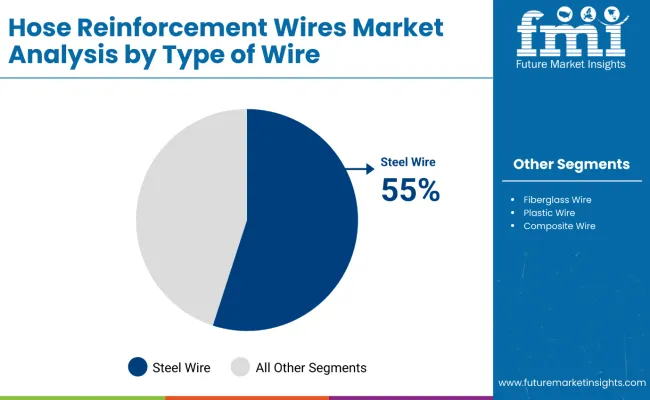

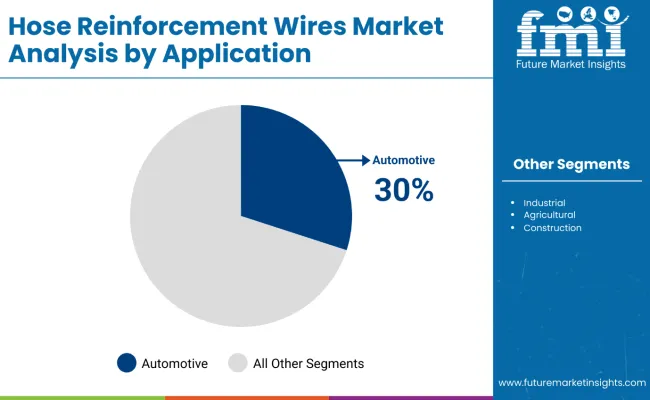

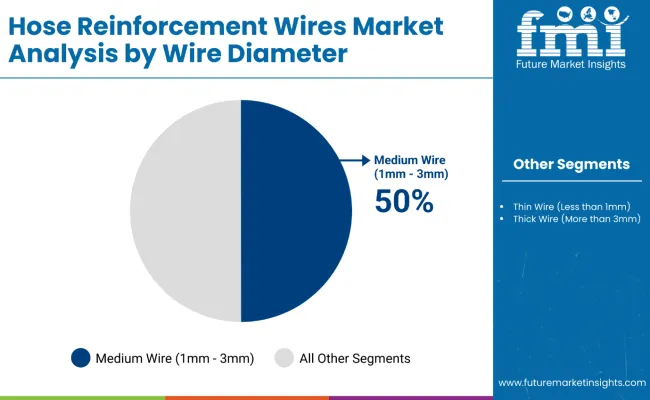

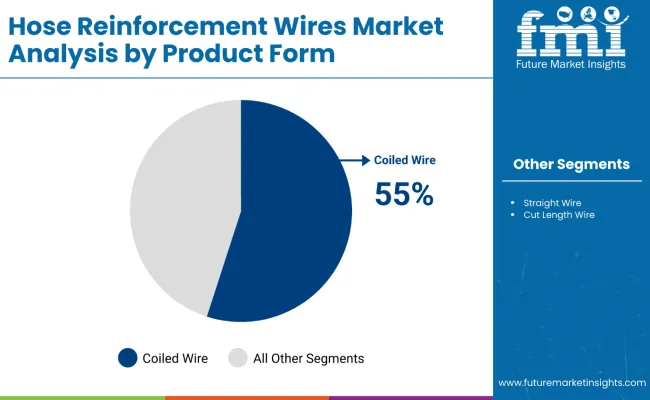

The hose reinforcement wires market is segmented by wire type into steel, fiberglass, plastic, and composite wires, each offering varying strength and temperature resistance profiles. Application areas include automotive, industrial, agricultural, construction, and home and garden use. Wire diameter classifications range from thin wires under 1mm to thick wires above 3mm, reflecting the pressure and flexibility requirements across hose types. Product forms include coiled, straight, and cut-length wire formats, tailored to fit production setups across global hose manufacturing operations.

Steel wires are projected to hold 55% of the global hose reinforcement wires market in 2025 and are expected to expand at a CAGR of 3.6% through 2035. Their high tensile strength and durability make them ideal for hydraulic and industrial hoses operating under extreme pressure. These wires are widely utilized in construction machinery, agricultural equipment, and heavy vehicles where structural integrity and burst resistance are essential. The consistent mechanical performance of steel wire reinforcements continues to drive their demand across OEM and aftermarket hose production.

The automotive sector is estimated to account for 30% of global demand in 2025 and is forecast to grow at a CAGR of 3.8% through 2035. Hose reinforcement wires are extensively used in brake systems, power steering assemblies, and engine cooling hoses across passenger and commercial vehicles. As vehicle production continues to expand in Asia and electric vehicles integrate high-performance fluid transfer systems, demand for reinforced hose materials is expected to remain robust.

Medium wire diameters between 1mm and 3mm are projected to represent 50% of the total demand in 2025 and are likely to grow at a CAGR of 3.7% over the decade. These wires offer the necessary flexibility for hose routing while maintaining pressure resistance and fatigue life. The segment is widely adopted across industrial, automotive, and construction hoses where moderate reinforcement is required without compromising maneuverability or coilability.

Coiled wires are estimated to make up 55% of the total product form segment in 2025 and are expected to grow at a CAGR of 3.6% through 2035. This format supports efficient bulk handling and automated feeding into braiding and spiraling machines during hose manufacturing. Coiled wires are particularly preferred in high-volume production environments, such as those serving OEM automotive hoses and industrial hydraulic assemblies.

The hose reinforcement wires market is experiencing steady growth due to rising demand for high-pressure hose assemblies across construction, mining, agriculture, and industrial automation sectors. However, the market continues to face challenges from raw material price volatility, particularly related to high-carbon steel and alloyed wires.

Performance consistency, manufacturing complexity, and the need for compatibility with evolving hose materials remain areas of concern for suppliers. As the market matures, opportunities are emerging through product customization, region-specific hose formats, and integration of lightweight reinforcement solutions.

Hydraulic Equipment Demand is Sustaining Volume Growth

The proliferation of hydraulic machinery in infrastructure projects, agricultural mechanization, and utility services is sustaining demand for wire-reinforced hose assemblies. As OEMs require hoses capable of operating at higher pressures and in tighter configurations, multi-spiral wire reinforcement is gaining relevance. Applications such as excavators, tractors, cranes, and drilling equipment rely on steel wire reinforcement to maintain burst resistance and cyclic fatigue life, particularly in mobile systems exposed to harsh outdoor conditions.

Braiding and Spiral Technology Improvements are Enabling Product Differentiation

Technological advances in braiding machinery, die-forming, and automated coiling systems are allowing wire manufacturers to meet stringent tolerances in hose construction. The ability to produce consistent tensile strength, surface finish, and elongation profiles across wire batches is enhancing product standardization. Suppliers offering pre-treated, rust-inhibited, and low-carbon variants are gaining traction among global hose manufacturers. These process improvements are supporting the transition toward lightweight, yet high-performance reinforcement layers for compact and flexible hose systems.

| Countries | Value Share 2025 |

|---|---|

| Germany | 28% |

| France | 15% |

| UK | 14% |

| Italy | 10% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 4% |

| Rest of Europe | 14% |

| Countries | Value Share 2035 |

|---|---|

| Germany | 26% |

| France | 16% |

| UK | 13% |

| Italy | 11% |

| Spain | 9% |

| BENELUX | 8% |

| Russia | 3% |

| Rest of Europe | 14% |

Germany is projected to remain the largest market for hose reinforcement wires in Europe, with a 28% share in 2025. While its share is expected to decline slightly to 26% by 2035, demand will continue to be supported by advanced manufacturing, industrial hydraulics, and automation in machinery production. The presence of leading OEMs and tiered suppliers sustains high domestic consumption of multi-layer reinforced hose solutions.

France is estimated to grow from a 15% share in 2025 to 16% by 2035, driven by investments in energy infrastructure, aerospace manufacturing, and high-pressure hydraulic systems in construction machinery. Italy and Spain are also expected to increase their shares by 1% each over the forecast period due to growth in fluid handling applications in agricultural equipment and municipal services.

BENELUX countries are set to rise from 7% to 8%, benefiting from compact automation systems and material handling equipment. Meanwhile, Russia’s share is projected to fall from 4% to 3%, impacted by trade limitations and restricted access to advanced production technologies.

China’s wire consumption is increasing in line with hydraulic hose manufacturing, supported by industrial automation and infrastructure development. Wire-reinforced hose demand is rising across construction, mining, and OEM machinery lines.

India’s market is driven by growing production of hydraulic hoses for tractors, harvesters, and two-wheelers. Domestic wire manufacturing is scaling up to support low-cost hose exports.

Reinforcement wires are widely used in hose replacements across oil & gas, industrial hydraulics, and mobile equipment. Long-term demand is stable as capital goods see consistent uptime usage.

Germany’s wire demand is centered around precision applications in chemical plants, robotics, and smart machinery. Export-grade hose assemblies require high-quality wire input.

Italy’s market is shaped by demand from industrial hose exporters and machinery integrators. Reinforcement wires are increasingly being used in flexible hose systems for pressure washers, shipyards, and hydraulic presses.

In South Korea, coiled wire is projected to account for 40% of hose reinforcement wire consumption in 2025, led by its compatibility with high-pressure hydraulic hose winding systems. The form is preferred by OEMs due to its ease of feeding into automated braiding lines. Straight wire follows with a 35% share, supporting mid-pressure hose applications across industrial machinery and factory automation. Cut length wires, with a 25% share, are increasingly used in precision hose fittings and repair kits.

Japan’s application-wise demand is led by the automotive sector, representing 40% of the total market, driven by long lifecycle requirements and material integrity for brake, fuel, and AC hoses. Industrial applications account for 25%, driven by demand from factory automation and equipment exports. Construction and agricultural sectors follow at 15% and 10% respectively, while home and garden hoses also hold a consistent 10% share.

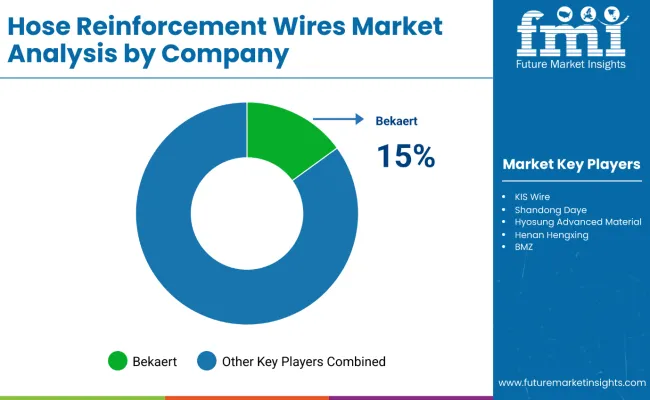

Competition in the hose reinforcement wires market is intensifying as manufacturers focus on expanding product portfolios and enhancing performance attributes. New wire-reinforced hoses are being introduced with higher burst pressure, improved flexibility, and compatibility with standard couplings to serve high-pressure and heavy-duty applications across construction, oil and gas, and industrial sectors. Reinforcement wires are being engineered for uniform tensile strength, superior adhesion, and suitability with rubber and thermoplastic hoses, addressing both domestic and export-oriented demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 563.8 Million (2025) |

| Product Form | Coiled Wire, Straight Wire, Cut Length Wire |

| Wire Diameter | Thin Wire (Less than 1mm), Medium Wire (1mm - 3mm), Thick Wire (More than 3mm) |

| Application | Automotive, Industrial, Agricultural, Construction, Home and Garden |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, Italy, Japan, China, South Korea |

| Key Companies Profiled | Bekaert, Kiswire Ltd., Bridgestone Corp., Shandong Daye Co., Ltd., Zhejiang Jindun Group, Tianjin Huichi Metal Products Co., Ltd., Trefilados Inoxidables H.A. S.A., Yieh Hsing Enterprise Co., Ltd., Dongil Steel, Teufelberger Group |

The global hose reinforcement wires market is valued at USD 563.8 million in 2025 and is projected to reach USD 808.5 million by 2035.

Coiled wire holds the largest share, led by its extensive use in high-pressure hydraulic and automotive hose applications.

Automotive applications dominate the market, accounting for a significant share due to extensive use in brake, fuel, and AC hose reinforcement.

The hose reinforcement wires market is expected to grow at a CAGR of 3.7% between 2025 and 2035.

Asia Pacific, particularly China and India, shows strong growth due to increasing demand in construction equipment and industrial automation hoses.

Challenges include fluctuations in raw material costs, increasing demand for lightweight alternatives, and evolving hose designs requiring tighter wire tolerances.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reinforcement Geosynthetics Market Size and Share Forecast Outlook 2025 to 2035

Hose Pump Market Size and Share Forecast Outlook 2025 to 2035

Fire Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Guidewires Market Analysis - Demand, Growth & Forecast 2024 to 2034

Sound Reinforcement Market Size and Share Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Seismic Reinforcement Material Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Radiator Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Silver Nanowires Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Carbon Free Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Clutch Spring Wires Market

Coronary Guidewires Market

Sewer Cleaning Hose Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA