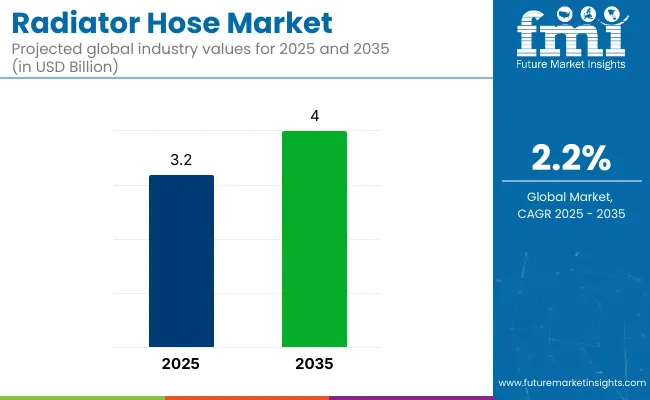

The global radiator hose market is valued at USD 3.2 billion in 2025 and is slated to reach USD 4 billion by 2035, reflecting a CAGR of 2.2% over the forecast period. This expansion is being driven by increasing vehicle production, rising demand for aftermarket components, and the adoption of durable materials such as silicon and EPDM rubber.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.2 billion |

| Forecast Value (2035) | USD 4 billion |

| Forecast CAGR (2025 to 2035) | 2.2% |

With the ongoing shift toward electric and hybrid vehicles, radiator hoses are being redesigned to support advanced cooling requirements, improved thermal management, and greater environmental compliance.

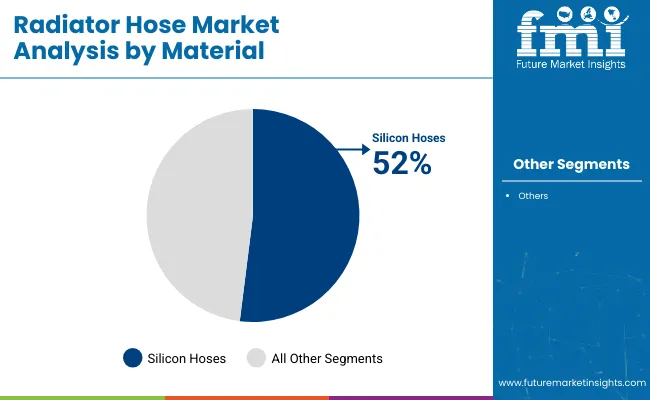

The preference for lightweight, heat-resistant, and long-lasting hose materials has been reinforced by stricter emissions regulations and increased maintenance cycles for internal combustion engine vehicles. Silicon radiator hoses are expected to dominate due to superior performance under high temperatures.

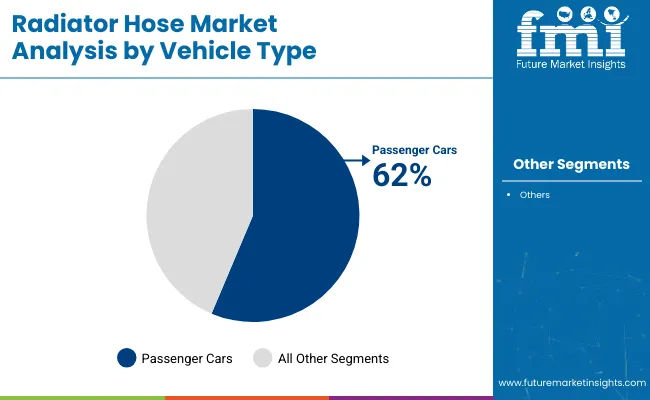

Additionally, the growing popularity of SUVs and passenger cars across emerging markets is anticipated to fuel segment growth further. With advancements in material science, manufacturers are focusing on improving hose durability, reducing weight, and enhancing performance in extreme conditions.

Innovations in radiator hose technology include the use of silicon materials for superior heat resistance and durability, and reinforced hoses with stainless steel or synthetic fiber braids to enhance strength and pressure resistance. Lightweight thermoplastics and composites are being utilized to reduce weight without compromising performance.

Heat-resistant coatings and eco-friendly materials are becoming popular for improved longevity and sustainability. Additionally, 3D-printed hoses allow for custom designs, while advanced sealing technologies reduce leaks, improving cooling system efficiency.

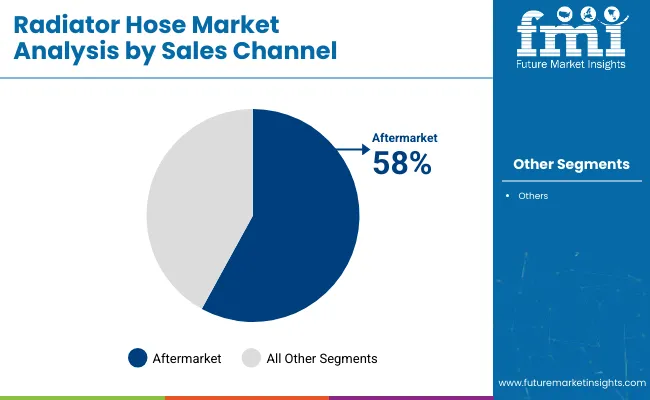

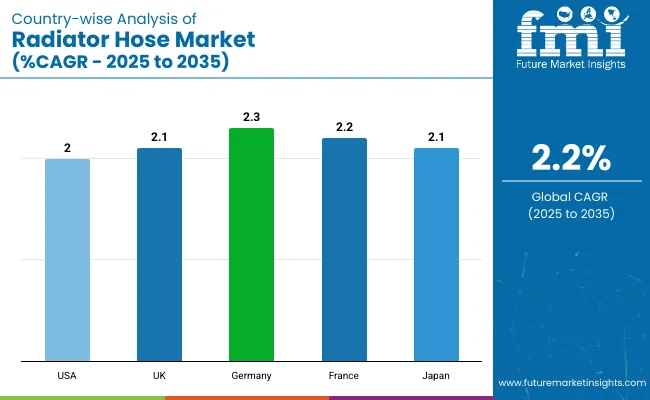

The USA is expected to be one of the fastest-growing markets for radiator hoses, with a projected CAGR of 2% from 2025 to 2035. Silicon hoses are set to dominate the material segment, capturing 52% market share in 2025, while passenger cars will lead by vehicle type with a 62% share. The aftermarket segment will account for 58% of the sales channel in 2025. Germany is projected to have the fastest growth rate in the market, with a CAGR of 2.3% from 2025 to 2035.

The market is segmented into material type, vehicle type, sales channel, and region. By material type, the market is divided into silicon radiator hoses, rubber radiator hoses, and others (neoprene, nitrile rubber (NBR), polyurethane, EPDM blend). Based on vehicle type, the market is bifurcated into passenger cars and commercial vehicles. In terms of sales channel, the market is segmented into OEM and aftermarket. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East and Africa.

The silicon hose segment is projected to lead the material type category, accounting for 52% of the global market share by 2025. These hoses have been considered ideal for their high thermal stability, durability, and flexibility under extreme operating conditions, making them highly suitable for modern engine designs, including electric and hybrid vehicles.

The passenger car segment is expected to dominate the vehicle type segment, capturing 62% of the global market share by 2025. With the surge in vehicle ownership and rising disposable income, radiator hoses have been increasingly installed in hatchbacks, SUVs, sedans, and MPVs globally.

The aftermarket segment is anticipated to lead the sales channel category, holding 58% of the global market share by 2025. As vehicle fleets continue to age and car ownership expands, radiator hose replacements have been widely demanded by service centers and independent repair networks.

The radiator hose market is experiencing steady growth, driven by the increasing demand for heat-resistant, long-lasting components, the expansion of global automotive production, and the rising emphasis on sustainable and high-performance thermal management systems in vehicles.

Recent Trends in the Radiator Hose Market

Challenges in the Radiator Hose Market

The USA radiator hose market is expected to grow at a CAGR of 2% from 2025 to 2035. This steady growth is supported by strong demand for replacement parts, aging vehicle fleets, and the robust presence of automotive service networks across the country.

The UK radiator hose market is projected to expand at a CAGR of 2.1% during the forecast period. Growth is being driven by aftermarket activity for older vehicles, increasing environmental standards, and evolving consumer expectations for vehicle reliability. Hoses made with improved material strength and emission compliance features are gaining popularity.

Germany’s radiator hose market is forecasted to grow at a CAGR of 2.3% from 2025 to 2035. As a global automotive hub, the country has consistently adopted high-efficiency thermal components for both ICEVs and EVs. Emphasis on lightweight materials, sensor integration, and emission control shaping hose development.

The French radiator hose market are anticipated to grow at a CAGR of 2.2% over the forecast period. The market is supported by sustainable automotive practices and a rising demand for hybrid and EV-compatible hoses. Hose suppliers are focusing on reducing environmental impact and improving product lifecycle value.

Japan’s radiator hose market is projected to grow at a CAGR of 2.1% through 2035. Rising demand for thermal management in electric vehicles and the country’s strong automotive manufacturing ecosystem have driven the adoption of advanced radiator hose technologies. Lightweight, modular, and high-temperature-resistant materials are being increasingly utilized to meet evolving OEM standards and sustainability goals.

The radiator hose market is moderately consolidated, with several global players holding substantial market shares, while regional manufacturers and aftermarket specialists continue to innovate in material science and customization. Competitive dynamics are being shaped by cost optimization, thermal performance innovation, EV compatibility, and expanded aftermarket networks across high-growth regions.

Tier-one firms such as Gates Corporation, Continental AG, Hutchinson SA, Toyoda Gosei Co., Ltd., and Sumitomo Riko Company Ltd. are competing through OEM-approved product lines, smart sensor integration, and thermal optimization for EVs. These companies are expanding their global supply chains and investing in durable, eco-compliant hose materials to cater to regulatory and customer requirements.

Recent Radiator Hose Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.2 billion |

| Projected Market Size (2035) | USD 4 billion |

| CAGR (2025 to 2035) | 2.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions / Volume in thousand units |

| Material Type Analyzed | Silicon Radiator Hose, Rubber Radiator Hose, Others (Neoprene, Nitrile Rubber (NBR), Polyurethane, EPDM Blends) |

| Vehicle Type Analyzed | Passenger Cars and Commercial Vehicles |

| Sales Channel Analyzed | OEM and Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Goodyear, Tokyo Rub, APA/URO Parts, Shandong Meichen, Hutchinson, Gates, Mishimoto, Auto 7, Sichuan Chuanhuan, and Continental |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The radiator hose market is valued at USD 3.2 billion in 2025.

The market is forecasted to reach USD 4 billion by 2035, reflecting a CAGR of 2.2%.

Silicon radiator hoses are expected to lead the market with a 52% market share in 2025.

Passenger cars are expected to hold a 62% share of the market in 2025.

Germany is anticipated to be the fastest-growing market with a CAGR of 2.3% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hose Reinforcement Wires Market Analysis Size and Share Forecast Outlook 2025 to 2035

Hose Pump Market Size and Share Forecast Outlook 2025 to 2035

Fire Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Railway Radiator Market - Growth & Demand 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Radiator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Luxury Car Hoses Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Locomotive Radiator Fans Market Growth - Trends & Forecast 2024 to 2034

Oil and Gas Hose Assemblies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Carbon Free Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thermostatic Radiator Valves Market Size and Share Forecast Outlook 2025 to 2035

Sewer Cleaning Hose Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

China Industrial Hoses Market - Size, Share, and Forecast 2025 to 2035

Concrete Delivery Hose Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA