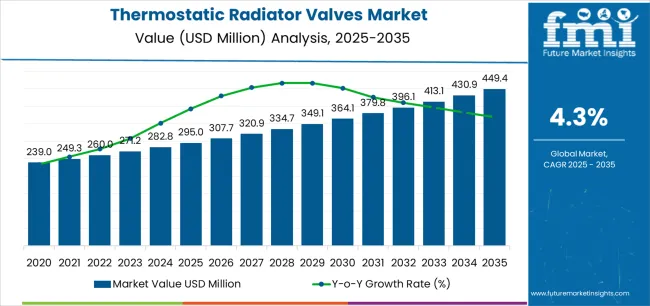

The thermostatic radiator valves market stands at the threshold of a decade-long expansion trajectory that promises to reshape heating control technology and energy efficiency solutions. The market's journey from USD 295.0 million in 2025 to USD 449.4 million by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced valve technology and temperature regulation optimization across residential buildings, commercial facilities, and smart heating sectors.

The first half of the decade (2025 to 2030) will witness the market climbing from USD 295.0 million to approximately USD 364.1 million, adding USD 69.1 million in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of electric operated valve systems, driven by increasing energy efficiency requirements and the growing need for advanced temperature control solutions worldwide. Enhanced automation capabilities and smart home integration will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness continued growth from USD 364.1 million to USD 449.4 million, representing an addition of USD 85.3 million or 55% of the decade's expansion. This period will be defined by mass market penetration of IoT-enabled valve technologies, integration with comprehensive building management platforms, and seamless compatibility with existing HVAC infrastructure. The market trajectory signals fundamental shifts in how building operators approach heating optimization and energy management, with participants positioned to benefit from growing demand across multiple valve types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New valve sales (electric, manual) | 52% | Energy efficiency-driven, retrofit-focused |

| Replacement & aftermarket | 28% | Building maintenance, valve upgrades | |

| OEM supply & integration | 15% | HVAC system manufacturers, building contractors | |

| Installation & commissioning | 5% | Professional services, system calibration | |

| Future (3-5 yrs) | Smart electric valves | 45-50% | IoT integration, app-based control |

| Building automation integration | 20-25% | BMS connectivity, energy management systems | |

| Subscription-based monitoring | 10-15% | Performance analytics, predictive maintenance | |

| Replacement & retrofit | 15 to 20% | Aging building stock, efficiency upgrades | |

| OEM partnerships | 8-12% | Smart HVAC systems, integrated solutions | |

| Energy-as-a-service | 5-8% | Performance guarantees, outcome-based pricing |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 295.0 million |

| Market Forecast (2035) | USD 449.4 million |

| Growth Rate | 4.3% CAGR |

| Leading Technology | Electric Operated Valves |

| Primary Application | Residential Segment |

The market demonstrates strong fundamentals with electric operated valve systems capturing a growing share through advanced automation capabilities and energy efficiency optimization. Residential applications drive primary demand, supported by increasing energy cost consciousness and smart home adoption requirements. Geographic expansion remains concentrated in developed markets with established heating infrastructure, while emerging economies show accelerating adoption rates driven by building modernization initiatives and rising energy efficiency standards.

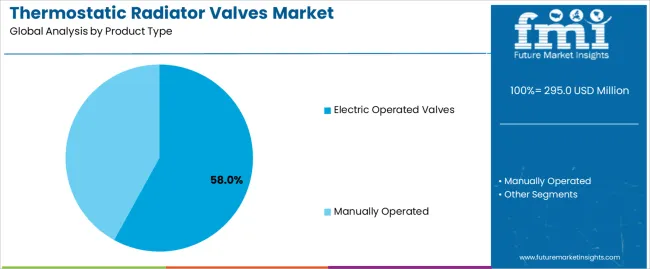

Primary Classification: The market segments by product type into electric operated and manually operated thermostatic radiator valves, representing the evolution from basic temperature control equipment to sophisticated automation solutions for comprehensive heating management optimization.

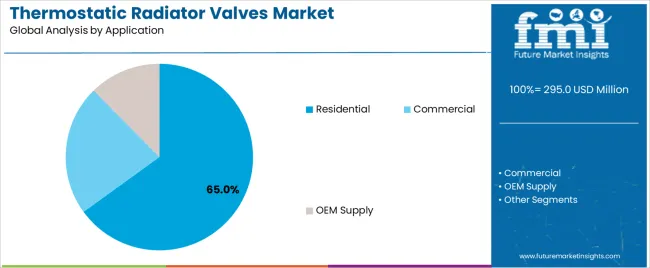

Secondary Classification: Application segmentation divides the market into residential, commercial, and OEM supply sectors, reflecting distinct requirements for energy efficiency, control sophistication, and installation standards.

Tertiary Classification: Distribution channel segmentation covers offline and online channels, while regional distribution spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa.

The segmentation structure reveals technology progression from manual control equipment toward sophisticated automation systems with enhanced connectivity and energy management capabilities, while application diversity spans from residential buildings to commercial facilities requiring precise temperature control solutions.

Market Position: Electric Operated Valves command a growing position in the thermostatic radiator valves market with 58% market share through advanced automation features, including superior temperature control accuracy, remote operation capability, and smart home integration that enable building operators to achieve optimal energy efficiency across diverse residential and commercial environments.

Value Drivers: The segment benefits from building owner preference for automated control systems that provide consistent temperature performance, reduced energy consumption, and operational convenience without requiring manual intervention. Advanced design features enable integration with smart home platforms, wireless connectivity, and automated scheduling, where energy savings and user convenience represent critical building requirements.

Competitive Advantages: Electric Operated Valves differentiate through proven energy efficiency, consistent temperature characteristics, and integration with smart building systems that enhance heating effectiveness while maintaining optimal comfort standards suitable for diverse residential and commercial applications.

Key market characteristics:

Manually Operated Valves maintain a 42% market position in the thermostatic radiator valves market due to their cost-effectiveness and simplicity advantages. These systems appeal to budget-conscious building owners requiring basic temperature control with lower initial investment for retrofit applications. Market presence is sustained by replacement demand in existing installations and preference for mechanical reliability through traditional valve designs.

Market Context: Residential applications demonstrate the highest market presence in the thermostatic radiator valves market with 65% share due to widespread adoption of energy-saving systems and increasing focus on home heating optimization, utility cost reduction, and comfort enhancement applications that maximize living quality while minimizing energy expenditure.

Appeal Factors: Residential property owners prioritize heating efficiency, cost savings, and comfort control that enables room-by-room temperature management across multiple living spaces. The segment benefits from substantial energy efficiency investment and smart home adoption trends that emphasize the acquisition of automated valves for heating optimization and energy bill reduction applications.

Growth Drivers: Energy efficiency programs incorporate thermostatic valves as recommended upgrades for home heating systems, while smart home growth increases demand for connected heating capabilities that comply with energy standards and minimize operational complexity.

Market Challenges: Varying building types and heating system configurations may limit valve standardization across different residential properties or installation scenarios.

Application dynamics include:

Commercial applications capture 25% market share through professional building requirements in office complexes, retail facilities, and institutional buildings. These facilities demand reliable temperature control systems capable of operating efficiently while providing zone-based heating management and energy cost optimization capabilities.

OEM Supply applications account for 10% market share, including HVAC system manufacturers, building contractors, and heating equipment integrators requiring factory-installed valves for system integration and new construction projects.

Market Position: Offline distribution channels command dominant market presence with 68% share through established HVAC distributor networks that provide professional installation support and technical expertise for valve deployment.

Value Drivers: This channel provides hands-on product evaluation, professional consultation, and immediate availability that meets requirements for contractor procurement and urgent replacement applications without shipping delays.

Growth Characteristics: The segment benefits from established HVAC trade relationships, professional installer preferences, and local distributor networks that support widespread market access and technical support availability.

Online distribution channels capture 32% market share through e-commerce platforms enabling direct consumer access, competitive pricing, and growing DIY installation trends in residential applications.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Energy efficiency regulations & building codes (EU directives, carbon reduction targets) | ★★★★★ | Mandatory energy performance standards require heating optimization; thermostatic valves become essential compliance tools for building owners and operators. |

| Driver | Rising energy costs & utility bill pressure (natural gas prices, electricity costs) | ★★★★★ | High heating expenses drive retrofit adoption; homeowners seek ROI through reduced consumption and improved temperature control. |

| Driver | Smart home & IoT adoption (connected devices, home automation systems) | ★★★★☆ | Electric valves integrate with smart home ecosystems; app-based control and automated scheduling increase appeal beyond traditional efficiency benefits. |

| Restraint | High upfront cost for electric valves (especially full-building retrofits) | ★★★★☆ | Price sensitivity limits electric valve adoption; residential customers weigh installation costs against long-term energy savings, slowing market penetration. |

| Restraint | Complex installation & compatibility issues (existing radiator systems, HVAC integration) | ★★★☆☆ | Older heating systems require adaptation; installation complexity and potential compatibility problems create adoption barriers in retrofit scenarios. |

| Trend | Wireless connectivity & app-based control (Bluetooth, Wi-Fi, Zigbee protocols) | ★★★★★ | Remote temperature management via smartphone; geofencing and occupancy-based automation transform user experience and energy savings potential. |

| Trend | Building management system integration (commercial buildings, multi-unit residential) | ★★★★☆ | Centralized heating control for building operators; data analytics and performance monitoring enable proactive energy management and tenant comfort optimization. |

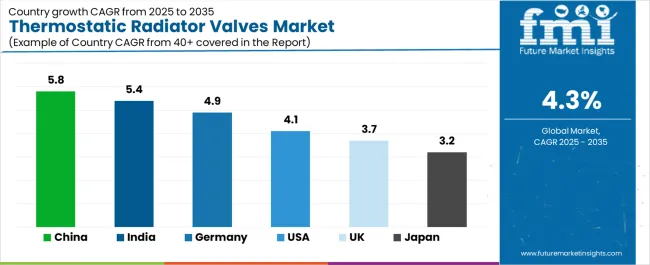

The thermostatic radiator valves market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through building modernization initiatives and energy efficiency programs. Steady Performers encompass Germany (4.9% growth rate), United States (4.1% growth rate), and developed regions, benefiting from established heating infrastructure and smart building adoption. Emerging Markets feature developing regions where building upgrade initiatives and energy awareness support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through construction expansion and smart building development, while European countries maintain strong expansion supported by stringent energy regulations and heating modernization requirements. North American markets show moderate growth driven by energy efficiency programs and smart home integration trends.

| Region/Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.8% | Focus on smart electric valves; competitive pricing | Local competitors; rapid market commoditization |

| India | 5.4% | Lead with cost-effective manual valves | Limited heating infrastructure; seasonal demand |

| Germany | 4.9% | Emphasize energy savings; regulatory compliance | Over-specification; complex certification |

| United States | 4.1% | Push smart home integration; DIY solutions | Market fragmentation; varying regional climates |

| UK | 3.7% | Offer retrofit solutions; energy bill reduction | Aging housing stock; budget constraints |

| Japan | 3.2% | Premium quality; compact designs | Conservative adoption; earthquake resilience |

China establishes fastest market growth through aggressive building modernization programs and comprehensive energy efficiency development, integrating advanced thermostatic radiator valves as standard components in smart building projects and residential heating installations. The country's 5.8% growth rate reflects government initiatives promoting energy conservation and green building standards that mandate the use of efficient heating control systems in residential and commercial facilities. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where building automation development showcases integrated valve systems that appeal to property developers seeking advanced energy optimization capabilities and smart building applications.

Chinese manufacturers are developing cost-effective valve solutions that combine domestic production advantages with smart control features, including wireless connectivity and mobile app integration. Distribution channels through building materials markets and e-commerce platforms expand market access, while government energy efficiency programs support adoption across diverse residential and commercial segments.

Strategic Market Indicators:

In Delhi, Mumbai, and Bangalore, commercial facilities and premium residential complexes are implementing thermostatic radiator valves as standard equipment for heating optimization and energy management applications, driven by increasing energy awareness and building modernization programs that emphasize the importance of temperature control capabilities. The market holds a 5.4% growth rate, supported by growing middle-class purchasing power and urban construction expansion programs that promote efficient heating systems for commercial and upscale residential facilities. Indian consumers are adopting valve systems that provide cost-effective temperature control and energy savings, particularly appealing in northern regions where winter heating represents significant energy consumption.

Market expansion benefits from growing commercial real estate sector and hospitality industry development that enable widespread deployment of heating control solutions for comfort and efficiency applications. Technology adoption follows patterns established in building services, where ROI and operational savings drive procurement decisions and system deployment.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive energy efficiency regulations and advanced building technology infrastructure development, integrating thermostatic radiator valves across residential and commercial heating applications. The country's 4.9% growth rate reflects stringent EU energy directives and mature building services adoption that supports widespread use of automated heating control systems in both new construction and retrofit facilities. Growth concentrates in major urban areas, including Berlin, Munich, and Hamburg, where building technology advancement showcases mature valve deployment that appeals to property owners seeking proven energy savings capabilities and regulatory compliance applications.

German equipment providers leverage established HVAC distribution networks and comprehensive technical support capabilities, including energy consultation programs and installation services that create customer relationships and operational advantages. The market benefits from mature building energy standards and government incentive programs that support valve system adoption while encouraging technology advancement and heating optimization.

Market Intelligence Brief:

United States demonstrates growing thermostatic valve adoption with 4.1% growth rate, driven by smart home technology integration and energy cost awareness. Major metropolitan areas including New York, Chicago, and Boston showcase retrofit installations where smart electric valves integrate with home automation platforms and voice assistant systems to optimize heating operations. The market benefits from DIY home improvement culture, established e-commerce channels, and growing interest in whole-home energy management solutions. American consumers prioritize wireless connectivity, smartphone control capabilities, and compatibility with popular smart home ecosystems including Google Home and Amazon Alexa.

Distribution patterns favor online channels and home improvement retailers, while professional HVAC contractors drive commercial segment adoption through energy service offerings. Market growth concentrates in northern climate zones where heating represents substantial energy consumption, creating compelling ROI for valve adoption.

Market Intelligence Brief:

United Kingdom's heating control market demonstrates strong thermostatic valve adoption with 3.7% growth rate, supported by aging building stock requiring heating system upgrades and high energy costs driving efficiency investments. Major cities including London, Manchester, and Birmingham showcase extensive retrofit activity where valves provide cost-effective heating optimization in existing radiator systems without complete system replacement. The market benefits from established central heating prevalence, government energy efficiency programs, and growing awareness of heating control benefits for bill reduction.

British consumers prioritize energy cost savings, straightforward installation, and reliable operation in existing heating systems. Distribution channels through plumbing merchants, builders' merchants, and online retailers expand market access for both professional installers and DIY homeowners.

Strategic Market Considerations:

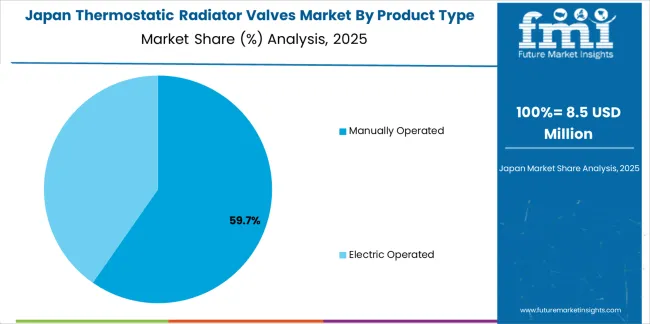

Japan's market expansion benefits from premium building demand, including earthquake-resistant construction in Tokyo and Osaka, energy-conscious commercial facilities, and government efficiency programs that increasingly incorporate valve solutions for heating optimization applications. The country maintains a 3.2% growth rate, driven by quality expectations and recognition of energy management benefits, including precise temperature control and automated heating efficiency.

Market dynamics focus on compact valve designs that balance advanced control performance with space efficiency considerations important to Japanese building standards. Growing energy awareness creates continued demand for efficient heating systems in residential and commercial infrastructure modernization projects.

Strategic Market Considerations:

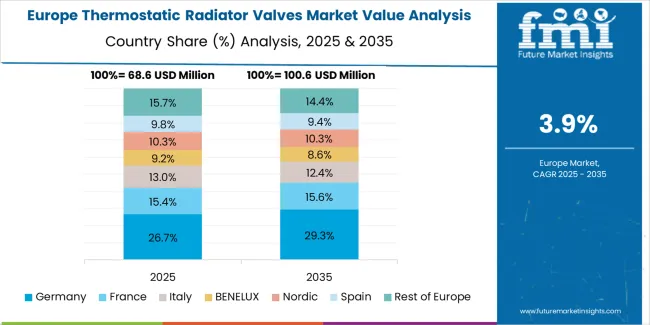

The thermostatic radiator valves market in Europe is projected to grow from USD 156.4 million in 2025 to USD 241.8 million by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 38.2% market share in 2025, supported by its stringent energy efficiency regulations and advanced building technology infrastructure in major urban centers including Berlin, Frankfurt, and Munich.

United Kingdom follows with a 24.6% share in 2025, driven by extensive retrofit market activity and high energy cost pressures. France holds a 16.8% share through residential heating modernization programs and commercial building energy compliance requirements. Italy commands a 11.3% share, while Spain accounts for 9.1% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.4% to 6.2% by 2035, attributed to increasing valve adoption in Nordic countries and emerging Eastern European markets implementing building energy efficiency programs.

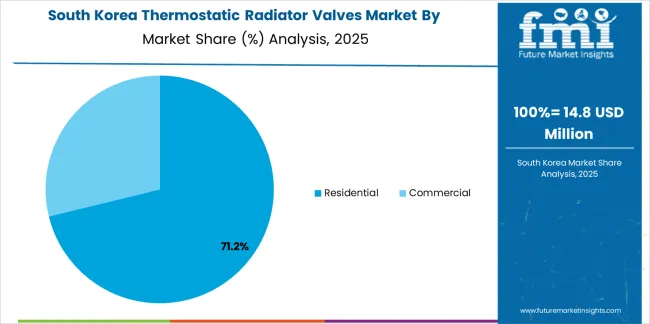

South Korea demonstrates sophisticated thermostatic valve adoption with 4.8% growth rate, driven by advanced building automation infrastructure and comprehensive energy management systems. Major cities including Seoul, Busan, and Incheon showcase smart building installations where electric valves integrate with centralized building management platforms and district heating networks to optimize energy distribution. The market benefits from high-rise residential construction, strong technology adoption culture, and government smart city initiatives promoting integrated building solutions.

Korean property developers prioritize system integration capabilities, remote monitoring features, and compatibility with district heating infrastructure prevalent in urban areas. Market growth reflects both new construction adoption and retrofit activity in existing apartment complexes seeking energy optimization. Distribution channels through construction material suppliers and building systems integrators serve professional market segments, while growing consumer awareness drives residential aftermarket adoption for older buildings seeking heating efficiency improvements.

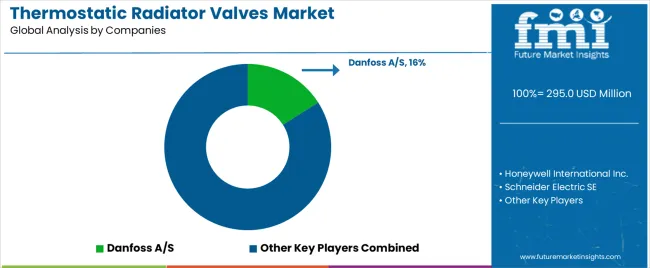

The thermostatic radiator valves market demonstrates consolidated competitive dynamics with approximately 15-20 credible manufacturers globally, where top 5 players control 65-70% revenue share through technology leadership, distribution networks, and brand reputation. Market leadership requires balancing multiple capabilities including valve precision engineering, smart connectivity development, energy management integration, and professional installer relationships.

Structure: Competitive landscape divides between established HVAC component manufacturers with comprehensive heating portfolios, specialized valve technology companies focused on advanced control solutions, and emerging smart home device manufacturers entering through IoT connectivity. Traditional building services brands maintain advantage through installer relationships and proven reliability, while technology-focused companies differentiate through wireless connectivity, smartphone control platforms, and building management system integration.

Leadership is maintained through: extensive distribution networks, technical support capabilities, energy efficiency certification, and professional installer partnerships (training programs, specification support, warranty backing).

What's commoditizing: basic manual thermostatic valves, standard temperature sensing mechanisms, and basic electric actuators without smart features.

Margin Opportunities: smart electric valves with IoT connectivity, building automation integration services, energy monitoring platforms, subscription-based analytics, and predictive maintenance services.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global HVAC leaders | Distribution reach, installer networks, comprehensive product lines | Brand trust, technical support, multi-product solutions | Consumer direct channels; smart home ecosystem integration |

| Technology innovators | Smart valve platforms, IoT connectivity, energy analytics software | Latest control features, app interfaces, data insights | Professional installer relationships; traditional channel access |

| Regional specialists | Local compliance expertise, distributor relationships, service networks | "Close to market" support, regional standards knowledge, competitive pricing | Technology innovation pace; global scale limitations |

| Building automation players | BMS integration, commercial installations, centralized control | Large-scale project capability, system integration expertise | Residential market access; small installation economics |

| Smart home entrants | Consumer electronics channels, ecosystem integration, UX design | Modern interfaces, wireless connectivity, consumer marketing | HVAC technical depth; professional installer engagement |

Market competition intensifies around wireless technology advancement, smart home ecosystem compatibility, and energy analytics capabilities. Companies investing in open protocol support, intuitive mobile applications, and comprehensive building management integration position themselves advantageously for sustained market share gains. Success increasingly depends on balancing technology innovation with installer training programs and proven energy savings documentation that drive specification preferences across diverse building segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 295.0 million |

| Product Type | Electric Operated, Manually Operated |

| Application | Residential, Commercial, OEM Supply |

| Distribution Channel | Offline, Online |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | China, India, Germany, United States, United Kingdom, Japan, South Korea, France, Italy, Spain, and 20+ additional countries |

| Key Companies Profiled | Danfoss A/S, Honeywell International Inc., Schneider Electric SE, IMI Hydronic Engineering, Siemens AG, Oventrop GmbH & Co. KG, Caleffi S.p.A., Giacomini S.p.A., Herz Armaturen GmbH |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across Europe, East Asia, and North America, competitive landscape with HVAC component manufacturers and building automation suppliers, building operator preferences for energy efficiency and temperature control, integration with smart home platforms and building management systems, innovations in valve technology and wireless connectivity, and development of automated heating solutions with enhanced performance and energy optimization capabilities. |

The global thermostatic radiator valves market is estimated to be valued at USD 295.0 million in 2025.

The market size for the thermostatic radiator valves market is projected to reach USD 449.4 million by 2035.

The thermostatic radiator valves market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in thermostatic radiator valves market are electric operated valves and manually operated.

In terms of application, residential segment to command 65.0% share in the thermostatic radiator valves market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermostatic Mixing Valve Market Size and Share Forecast Outlook 2025 to 2035

Radiator Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway Radiator Market - Growth & Demand 2025 to 2035

Hydronic Radiator Market Size and Share Forecast Outlook 2025 to 2035

Locomotive Radiator Fans Market Growth - Trends & Forecast 2024 to 2034

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Slurry Valves Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Breakdown of Aerosol Valves Industry

Aerosol Valves Market Growth and Trends 2025 to 2035

Pigging Valves Market

Blow-Off Valves Market Growth – Trends & Forecast 2025 to 2035

Isolator Valves Market

Degassing Valves Market Size and Share Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Aerospace Valves Market Growth - Trends & Forecast 2025 to 2035

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Cryogenic Valves Market Growth - Trends & Forecast 2025 to 2035

Assessing Degassing Valves Market Share & Industry Trends

Automotive Valves Market Size and Share Forecast Outlook 2025 to 2035

Anti Siphon Valves Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA