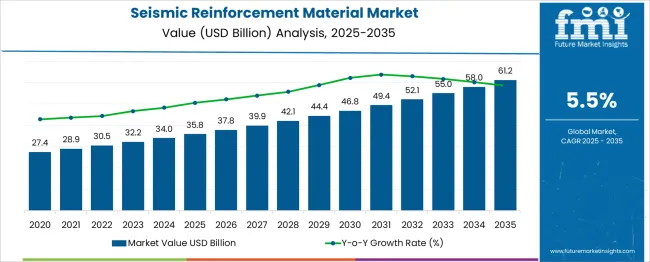

The Seismic Reinforcement Material Market is projected to grow from USD 27.4 billion in 2020 to USD 61.2 billion by 2035, at a CAGR of 5.5%, driven by increasing infrastructure resilience requirements, stricter building codes, and growing awareness of seismic risk. In the early adoption phase (2020–2024), the market expands from USD 27.4 billion to USD 34.0 billion as early adopters mainly in earthquake-prone regions integrate advanced reinforcement materials in new builds and retrofits. This phase features pilot adoption of Electric Hydraulic reinforcement systems and niche deployment of EPS (engineered polymer systems) alongside traditional Hydraulic technologies. The scaling phase (2025–2030) sees growth from USD 35.8 billion to USD 46.8 billion, driven by mass adoption in urban infrastructure, transportation projects, and high-rise construction. Hydraulic and Electric Hydraulic solutions reach widespread usage due to proven cost-effectiveness and compliance with evolving safety standards, while EPS gains market share in lightweight, high-strength applications. In the consolidation phase (2030–2035), the market grows from USD 49.4 billion to USD 61.2 billion, with slower expansion as regulations stabilize and market leaders consolidate. Technology lifecycle mapping positions Hydraulic as mature, Electric Hydraulic transitioning from scaling to maturity, and EPS in the scaling stage, maturing toward consolidation, reflecting the classic S-curve of adoption and market stabilization.

| Metric | Value |

|---|---|

| Seismic Reinforcement Material Market Estimated Value in (2025 E) | USD 35.8 billion |

| Seismic Reinforcement Material Market Forecast Value in (2035 F) | USD 61.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The seismic reinforcement material market is witnessing notable growth, supported by the rising demand for structural durability and resilience in earthquake-prone regions. Governments and regulatory bodies across the globe are enforcing stringent seismic design standards, which is compelling developers to incorporate high-performance materials capable of resisting dynamic stress and displacement. Advances in composite technologies, engineered steel variants, and fiber-reinforced polymers have transformed reinforcement strategies from traditional retrofitting methods to proactive structural reinforcement.

The increasing focus on safeguarding urban infrastructure, residential developments, and critical facilities such as hospitals, schools, and transport hubs has resulted in consistent market expansion. In particular, retrofitting initiatives for aging structures and smart city developments are playing a critical role in driving adoption.

The ability of seismic reinforcement materials to enhance load distribution, absorb shock, and maintain structural coherence under lateral loads is positioning the market for continued advancement. Over the forecast period, integration with digital structural health monitoring and predictive maintenance systems is expected to further elevate demand.

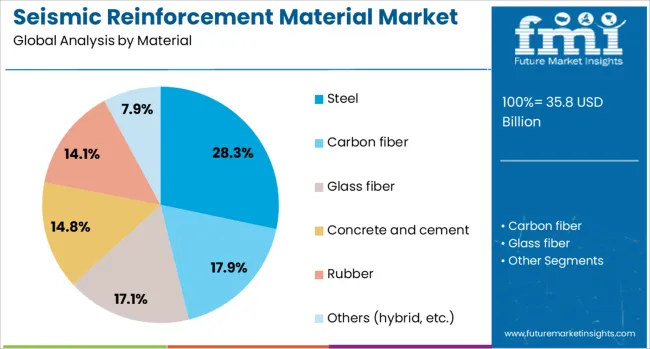

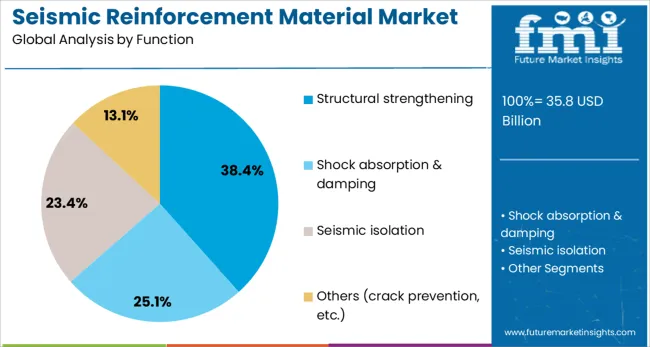

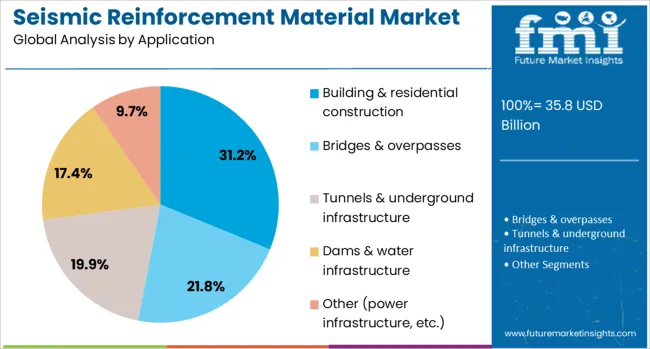

The seismic reinforcement material market is segmented by material, function, application, end use, distribution channel, and region. By material, the market is divided into steel, carbon fiber, glass fiber, concrete and cement, rubber, and others (hybrid, etc.). In terms of function, it is classified into structural strengthening, shock absorption and damping, seismic isolation, and others (such as crack prevention). Based on application, the market is segmented into building and residential construction, bridges and overpasses, tunnels and underground infrastructure, dams and water infrastructure, and others (including power infrastructure). By end use, it is categorized into construction, transportation, energy and utilities, public infrastructure, and others (such as marine). In terms of distribution channel, the market is divided into direct and indirect. Regionally, the seismic reinforcement material industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel is projected to contribute 28.3% of the total revenue share in the seismic reinforcement material market in 2025, establishing it as a dominant material choice. This leading position has been driven by the superior tensile strength, ductility, and energy dissipation capacity that steel provides under seismic loading conditions. Its adaptability in various structural forms, such as bars, meshes, and plates, has enabled its deployment across both new constructions and retrofitting projects.

Steel’s consistent mechanical performance and compatibility with traditional concrete systems have strengthened its use in reinforced concrete structures, where seismic resistance is critical. Moreover, advancements in corrosion-resistant alloys and prefabricated reinforcement systems have improved installation efficiency and long-term reliability.

Regulatory endorsement of steel-based solutions in seismic codes, along with their cost-effectiveness and recyclability, have reinforced its acceptance across global construction markets. The increasing focus on sustainable yet resilient infrastructure continues to position steel as a key enabler of seismic safety and performance.

The structural strengthening segment is expected to account for 38.4% of the revenue share in the seismic reinforcement material market in 2025. This segment’s growth is being influenced by the need to improve the load-carrying capacity and deformation tolerance of both existing and newly built structures. With the escalation of seismic risks in urban zones and the vulnerability of aging infrastructure, structural strengthening is gaining preference as a preventive measure.

Materials used for this function are being increasingly integrated into critical joints, columns, and beams to reduce the likelihood of progressive failure during seismic events. Software-enabled structural assessment tools and simulation-based designs have enhanced the precision of strengthening efforts, thereby improving their efficiency and effectiveness.

The ability to integrate strengthening solutions with minimal disruption to existing structures has supported their implementation across densely populated and operational areas. As structural resilience becomes a priority in public policy and real estate development, the demand for reinforcement materials in structural strengthening is expected to remain substantial.

The building and residential construction application segment is forecast to hold 31.2% of the total market share in the seismic reinforcement material market in 2025. The segment’s lead is being reinforced by rising urbanization, population density, and the growing necessity to protect life and property in seismically active regions. Reinforcement materials are being increasingly applied in residential high-rises, apartment complexes, and low-rise structures to comply with evolving building codes and reduce structural vulnerability.

The surge in retrofitting programs, especially in older housing stock, is contributing significantly to material demand. Lightweight, high-strength materials that support rapid deployment without compromising livability are being favored. Additionally, the integration of reinforcement with modular construction techniques and pre-engineered building systems is facilitating scalability and cost control.

The residential sector's growing awareness of disaster resilience and insurance-driven compliance requirements are further supporting the segment’s sustained expansion. As homeownership and multi-family housing developments continue to grow, the relevance of seismic reinforcement in residential applications will remain a central focus.

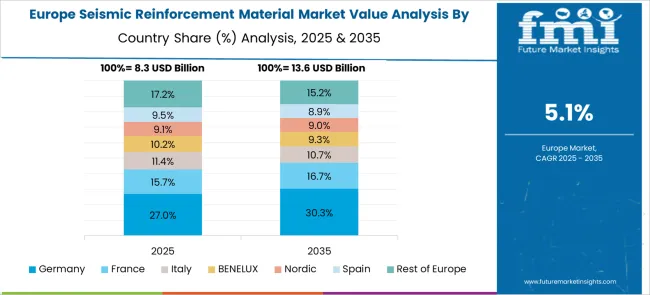

The seismic reinforcement material market is expanding as infrastructure safety gains priority in earthquake-prone regions. Rising investments in retrofitting existing buildings, bridges, and industrial structures are driving demand for high-strength steel, fiber-reinforced polymers, and advanced concrete composites. Governments and urban planners are implementing stricter building codes, encouraging the adoption of certified reinforcement solutions. Asia-Pacific, North America, and parts of Europe are key growth regions, supported by public safety awareness, infrastructure modernization projects, and technological improvements in reinforcement materials for long-lasting durability and performance.

Stricter building codes and safety regulations are significantly increasing the demand for seismic reinforcement materials. Governments and municipalities in earthquake-prone areas are mandating retrofitting projects to enhance structural resilience. Public safety campaigns are raising awareness about the risks of outdated infrastructure, prompting property owners to invest in compliance upgrades. Engineering firms are incorporating certified seismic-resistant materials into new builds and renovations. Financial incentives, subsidies, and insurance benefits are encouraging adoption, particularly in commercial and residential construction. This regulatory-driven demand ensures consistent market growth, as compliance with safety standards becomes non-negotiable for both public and private infrastructure projects.

Manufacturers are innovating high-performance seismic reinforcement materials to deliver greater strength, flexibility, and corrosion resistance. Fiber-reinforced polymers, high-tensile steel bars, and engineered concrete mixes are being developed for improved seismic energy absorption and structural integrity. These materials reduce installation time, lower maintenance costs, and extend the service life of infrastructure. Enhanced bonding technologies and lightweight components enable easier application in retrofitting projects without significantly adding to structural loads. Collaboration between research institutes, construction companies, and material suppliers is accelerating product validation and certification. These advancements position manufacturers to meet growing demand for high-quality, long-lasting solutions in both new construction and refurbishment projects worldwide.

Asia-Pacific is a leading growth region due to high seismic risk zones in Japan, China, and Indonesia, alongside active infrastructure expansion. North America benefits from strict safety codes in the USA and Canada, especially in states like California. European markets are driven by modernization projects in Italy, Greece, and Turkey. Local seismic activity patterns, construction practices, and economic conditions influence demand levels. Public-private partnerships and international funding initiatives are helping emerging economies upgrade infrastructure safety. Tailored material solutions for regional building styles and regulations give suppliers a competitive advantage in penetrating diverse geographic markets.

Timely delivery of seismic reinforcement materials is essential for meeting construction schedules, especially in retrofitting projects with strict deadlines. Suppliers are establishing strong relationships with raw material providers to ensure stable availability and quality. Multi-location manufacturing facilities and strategically located warehouses reduce lead times. Digital supply chain monitoring enables better inventory control and demand forecasting. Logistics planning ensures on-time delivery to remote or disaster-affected areas. Streamlined procurement and reliable distribution networks improve contractor trust and project efficiency. Companies investing in robust supply chain management can support faster infrastructure upgrades and expand market reach, even in regions with challenging transportation networks.

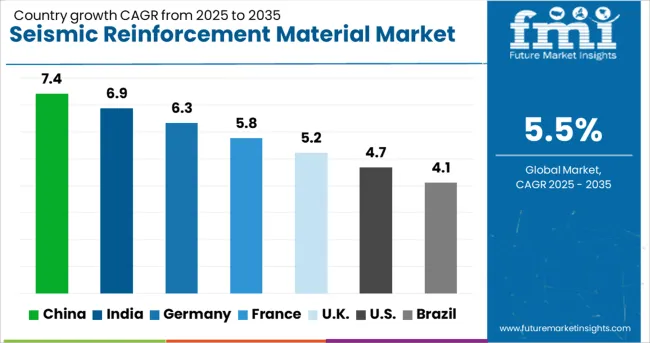

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The seismic reinforcement material market is anticipated to grow at a CAGR of 5.5%, supported by increasing demand for infrastructure safety in earthquake-prone regions. China leads with a growth rate of 7.4%, driven by extensive construction activity and stricter building codes for seismic resilience. India follows at 6.9%, supported by urban development projects and growing awareness of earthquake-resistant construction methods. Germany records 6.3% growth, attributed to advanced engineering practices and adoption of high-performance reinforcement materials. The UK shows 5.2% growth, reflecting steady investment in retrofitting older structures to improve seismic safety. The USA registers 4.7% growth, supported by infrastructure upgrades and regulatory focus on building safety in high-risk zones. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the seismic reinforcement material market with a growth rate of 7.4%. Increasing urban development and large-scale infrastructure projects drive the need for advanced earthquake-resistant construction solutions. Compared to India, China benefits from stricter enforcement of building safety regulations in seismic zones. Government-backed investments in public infrastructure, such as bridges, tunnels, and high-rise buildings, fuel demand for high-performance reinforcement materials. The construction sector’s rapid modernization encourages adoption of innovative composites and steel reinforcements. Educational campaigns and industry training promote awareness about structural safety. Research and development activities focus on cost-efficient yet durable materials. China’s combination of regulatory support, technological innovation, and massive construction demand positions it as a global leader in seismic reinforcement materials.

Indian Market grows at 6.9%, driven by infrastructure expansion and heightened safety awareness. Earthquake-prone regions, particularly in northern and northeastern states, see rising use of seismic reinforcement materials. Compared to Germany, India focuses on cost-effective solutions that balance performance with affordability. Public and private sector collaborations encourage the development of stronger building codes. Growth in metro rail projects, commercial complexes, and residential high-rises drives consistent demand. Educational outreach by industry associations helps builders adopt advanced construction technologies. Import and domestic production partnerships improve supply chain stability. India’s growing urban footprint and seismic risk awareness make reinforcement materials a strategic investment.

Germany records a steady 6.3% growth rate, with demand centered on quality and precision-engineered materials. While the country experiences lower seismic activity than China or India, its stringent engineering standards ensure consistent adoption of reinforcement products for critical structures. Compared to the United Kingdom, Germany prioritizes advanced composites and eco-friendly production methods. Infrastructure modernization projects, such as bridges and transportation hubs, sustain market demand. The emphasis on sustainable construction materials aligns with EU environmental targets. Research initiatives focus on enhancing material strength while reducing carbon footprint. Exports to other European nations also contribute to market resilience.

The United Kingdom’s market grows at 5.2%, driven by safety upgrades in public infrastructure and historic building preservation. Compared to the United States, the UK focuses on retrofit projects for older structures in regions with moderate seismic risk. Government funding supports improvements in hospitals, schools, and transport networks. Demand is also supported by new construction adopting international safety standards. Industry collaboration with research institutes promotes the development of high-performance materials. Supply chain efficiency and project-specific customization remain key competitive advantages. Overall, the UK combines heritage preservation with modern safety standards to maintain steady growth in this sector.

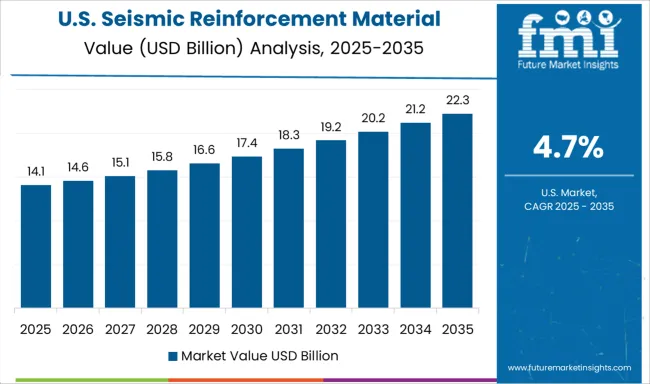

The United States grows at 4.7%, with demand concentrated in earthquake-prone regions like California, Alaska, and the Pacific Northwest. Compared to China, the US emphasizes high-performance composite materials and modular reinforcement systems for rapid installation. Federal and state building codes mandate the use of seismic-resistant structures in vulnerable zones. Growth in urban redevelopment projects and public safety programs supports consistent demand. Partnerships between manufacturers and construction firms drive innovation and market expansion. Disaster preparedness initiatives also encourage adoption in schools, hospitals, and emergency facilities.

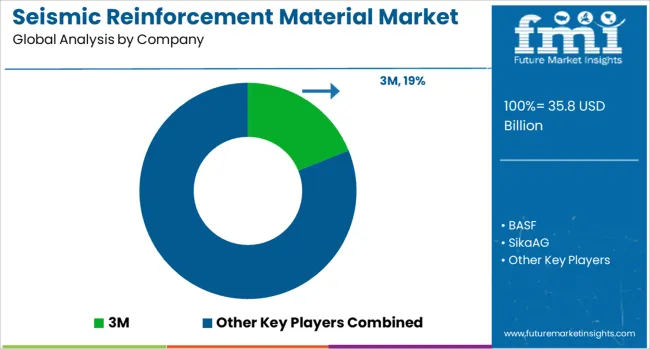

The seismic reinforcement material market is supported by major global companies specializing in construction chemicals, advanced materials, steel products, and engineering solutions aimed at improving earthquake resilience in infrastructure. Leading players include 3M, BASF SE, and Sika AG, which provide high-performance adhesives, resins, and composite systems for seismic retrofitting. Hilti Group is well-known for anchoring systems and fastening technologies designed for structural strengthening.

Steel manufacturers such as Tata Steel and ArcelorMittal supply high-strength steel products critical for reinforcement applications. Freyssinet and Tensar International specialize in structural strengthening, geogrid solutions, and ground stabilization, while US Concrete offers advanced concrete mixes for seismic-resistant construction.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Material | Steel, Carbon fiber, Glass fiber, Concrete and cement, Rubber, and Others (hybrid, etc.) |

| Function | Structural strengthening, Shock absorption & damping, Seismic isolation, and Others (crack prevention, etc.) |

| Application | Building & residential construction, Bridges & overpasses, Tunnels & underground infrastructure, Dams & water infrastructure, and Other (power infrastructure, etc.) |

| End Use | Construction, Transportation, Energy & utilities, Public infrastructure, and Others (marine, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, BASF, SikaAG, HiltiGroup, TataSteel, Arcelor Mittal, Schneider Electric, Freyssinet, Tensar International, US Concrete, Arup Group, Mammoet, Hitech Materials Inc., Lintec & Toray, and Alemite |

| Additional Attributes | Dollar sales in the Seismic Reinforcement Material Market vary by material type including steel, composites, and wood, application across residential, commercial, and industrial buildings, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing earthquake-prone area construction, stricter building safety regulations, and rising demand for resilient infrastructure. |

The global seismic reinforcement material market is estimated to be valued at USD 35.8 billion in 2025.

The market size for the seismic reinforcement material market is projected to reach USD 61.2 billion by 2035.

The seismic reinforcement material market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in seismic reinforcement material market are steel, carbon fiber, glass fiber, concrete and cement, rubber and others (hybrid, etc.).

In terms of function, structural strengthening segment to command 38.4% share in the seismic reinforcement material market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seismic Survey Market Size and Share Forecast Outlook 2025 to 2035

Seismic Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

Reinforcement Geosynthetics Market Size and Share Forecast Outlook 2025 to 2035

Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

Material Shrinkage-reducing Agents Market Size and Share Forecast Outlook 2025 to 2035

Material Handling Integration Market Size and Share Forecast Outlook 2025 to 2035

Material-Based Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Monitoring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seismic Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Material Tester Market Growth – Trends & Forecast 2025 to 2035

Material Handling Equipment Market Growth - Trends & Forecast 2025 to 2035

Material Handling Monorails Market

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial In Surgical Mesh Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Market Analysis – Size, Share & Forecast 2025 to 2035

Metamaterial Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metamaterial Absorbers Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA