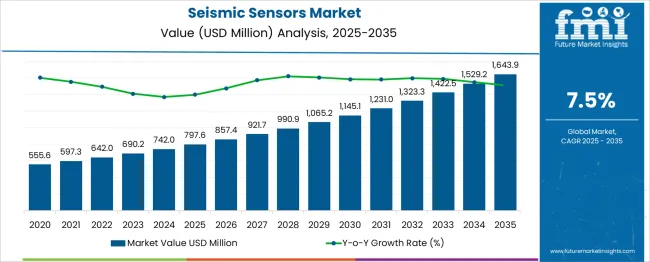

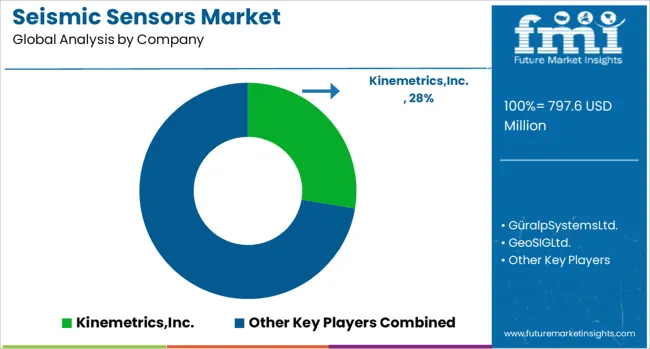

The Seismic Sensors Market is estimated to be valued at USD 797.6 million in 2025 and is projected to reach USD 1643.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. In the early adoption phase (2020 to 2024), the market expands from USD 555.6 million to USD 742.0 million, fueled by pilot deployments in critical infrastructure, research facilities, and early warning systems, with

Hydraulic sensor systems are the most established technology, and Electric Hydraulic solutions are gaining attention for improved precision. The scaling phase (2025 to 2030) sees growth from USD 797.6 million to USD 1,145.1 million, driven by regulatory mandates, smart city projects, and integration with IoT-based monitoring networks.

Hydraulic systems maintain dominance in large-scale deployments, while electric hydraulic systems enter mainstream use, and EPS (electronic positioning sensors) gain traction in compact, high-sensitivity applications. In the consolidation phase (2030–2035), the market expands from USD 1,231.0 million to USD 1,643.9 million, with slower growth as market leaders consolidate and USD technology performance becomes standardized.

Technology lifecycle mapping places Hydraulic in the mature stage, Electric Hydraulic in the scaling-to-maturity stage, and EPS emerging during scaling but maturing toward consolidation, following a classic S-curve pattern from innovation to saturation.

| Metric | Value |

|---|---|

| Seismic Sensors Market Estimated Value in (2025 E) | USD 797.6 million |

| Seismic Sensors Market Forecast Value in (2035 F) | USD 1643.9 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The seismic sensors market is undergoing substantial transformation, fueled by advancements in sensor miniaturization, edge data processing, and the growing urgency for disaster preparedness in seismic-prone regions. Increasing investments in smart city infrastructure, public safety, and oil and gas exploration have led to the expanded deployment of seismic monitoring systems with intelligent analytics.

Governments and private entities are increasingly relying on sensor-based early warning systems to mitigate the risks associated with earthquakes and ground vibrations. The ability of modern sensors to provide real-time feedback, high sensitivity, and integration with cloud-based monitoring platforms is enhancing their relevance in structural health assessments and energy exploration.

Innovations in low-power consumption, wireless connectivity, and remote configurability have further elevated the adoption of seismic sensors in both stationary and mobile deployments. As global attention intensifies around natural disaster response and infrastructure resilience, the seismic sensors market is expected to witness strong momentum driven by both regulatory pressure and technological enablement.

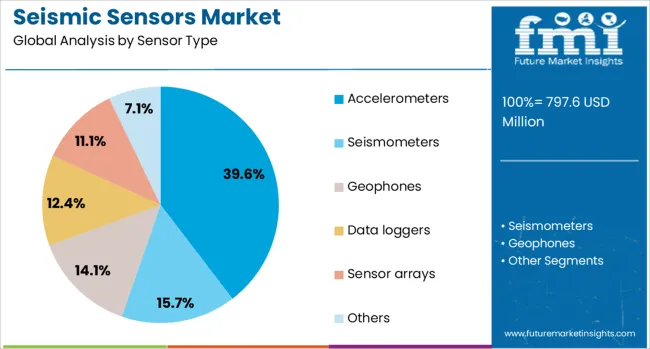

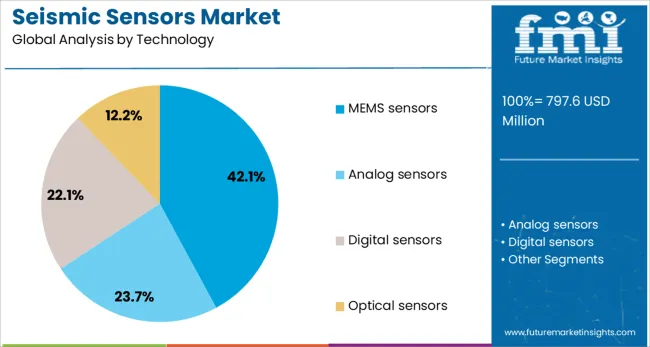

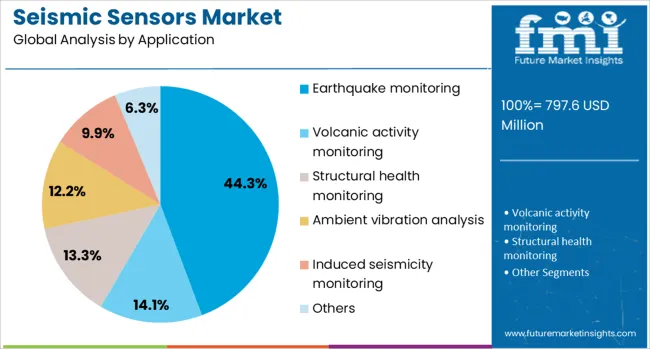

The seismic sensors market is segmented by sensor type, technology, application, end use, and geographic regions. By sensor type, the seismic sensors market is divided into Accelerometers, Seismometers, Geophones, Data loggers, Sensor arrays, and Others. In terms of technology, the seismic sensors market is classified into MEMS sensors, Analog sensors, Digital sensors, and Optical sensors. Based on application, the seismic sensors market is segmented into Earthquake monitoring, Volcanic activity monitoring, Structural health monitoring, Ambient vibration analysis, Induced seismicity monitoring, and Others.

The end use of the seismic sensors market is segmented into Oil and gas, Mining and construction, Aerospace and defense, Government and research institutions, and others. Regionally, the seismic sensors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Accelerometers are projected to account for 39.6% of the seismic sensors market revenue share in 2025, establishing them as the dominant sensor type. Their leadership has been attributed to their high sensitivity to ground motion, ability to measure both linear acceleration and vibration, and widespread applicability in earthquake detection and structural monitoring systems.

The compact size, robustness, and ease of integration into embedded systems have supported their usage in both permanent installations and portable units. Advancements in digital signal processing and multi-axis capabilities have further increased the precision of accelerometers in capturing seismic events across different geological environments.

Their compatibility with remote telemetry systems and cloud-based analytics platforms has reinforced their utility in modern seismic networks. As the demand for continuous monitoring and early warning systems intensifies, accelerometers are expected to remain critical to next-generation seismic sensing frameworks.

MEMS sensors are expected to represent 42.1% of the revenue share in the seismic sensors market by 2025, highlighting their significance in enabling scalable and cost-effective seismic monitoring solutions. These sensors have gained traction due to their low power consumption, high reliability, and ability to be mass-produced for wide-area deployments.

The miniaturization of sensor components without compromising sensitivity has allowed MEMS-based seismic sensors to be embedded in dense sensor grids, critical for detailed geophysical mapping and urban monitoring applications. Their integration with wireless communication technologies and real-time data acquisition systems has improved the responsiveness and adaptability of seismic networks.

The increasing application of MEMS sensors in smart infrastructure and Internet of Things ecosystems has positioned them as essential tools for enhancing situational awareness and predictive maintenance. The balance between performance, cost-efficiency, and deployment scalability has made MEMS sensors a preferred choice for modern seismic data acquisition systems.

The earthquake monitoring segment is anticipated to account for 44.3% of the overall seismic sensors market revenue in 2025, making it the leading application. The growth of this segment is being driven by heightened awareness around earthquake preparedness and the need for real-time seismic data to inform emergency response and public safety strategies.

Government agencies, research institutions, and infrastructure operators are increasingly investing in advanced seismic monitoring networks that rely on precise and durable sensor systems. The deployment of sensors capable of detecting ground motion in real time and transmitting data to centralized control centers has become essential for early warning systems and post-event impact analysis.

Technological enhancements in sensor durability, frequency range, and environmental adaptability have further elevated their relevance in high-risk zones. As cities expand and the stakes for infrastructure resilience increase, earthquake monitoring remains the foundational application for seismic sensor deployments.

The seismic sensors market is expanding as demand for earthquake monitoring, structural health analysis, and resource exploration grows. Governments, research institutions, and energy companies are investing in advanced sensor technologies to improve detection accuracy and response times. Miniaturization, wireless connectivity, and higher sensitivity are enhancing real-time data acquisition capabilities. Regions with high seismic activity, such as Asia-Pacific and North America, are driving adoption. Market growth is further supported by infrastructure safety initiatives, disaster preparedness programs, and exploration activities in oil, gas, and mining sectors.

Increased awareness of earthquake risks and the importance of early warning systems are fueling the adoption of seismic sensors. Governments are allocating budgets for nationwide seismic networks to protect populations and infrastructure. Research institutions are using these sensors to study fault lines and predict seismic events more accurately. Educational institutions are also incorporating seismic data into disaster preparedness programs. Affordable sensor solutions are making adoption possible for smaller municipalities and private facilities. Integration with public alert systems and smart infrastructure ensures faster emergency response, reducing potential damage and casualties. As global urbanization continues, the demand for precise and reliable earthquake monitoring technology is expected to remain strong in both developed and developing nations.

Seismic sensors are benefiting from significant improvements in sensitivity, durability, and connectivity. Enhanced microelectromechanical systems (MEMS) allow for compact, low-power designs without sacrificing accuracy. Wireless and IoT-enabled devices facilitate real-time data transmission, enabling faster response during seismic events. Advanced algorithms filter out environmental noise, increasing the precision of seismic readings. Ruggedized designs withstand extreme environmental conditions, making them suitable for offshore platforms, remote installations, and deep-earth applications. Multi-axis sensors and integrated data analytics platforms improve fault line mapping and vibration analysis. These technological enhancements are positioning seismic sensors as essential tools not only for earthquake monitoring but also for applications in construction, mining, and energy exploration.

Regions with frequent seismic events, such as Japan, Chile, and Indonesia, have extensive networks of seismic sensors for public safety. North America deploys advanced systems in earthquake-prone states like California and Alaska, as well as in oil and gas fields for induced seismicity monitoring. Europe focuses on both urban safety and infrastructure preservation in countries such as Italy and Greece. Deployment strategies vary by geography, with some regions prioritizing early warning systems and others focusing on industrial monitoring. Regional geology, government policies, and available funding influence the type, quantity, and location of sensors.

Beyond earthquake detection, seismic sensors are increasingly used in oil, gas, and mineral exploration to map subsurface structures. These sensors help identify drilling locations, assess reservoir potential, and monitor induced seismic activity from extraction processes. In construction and civil engineering, sensors are installed to track vibrations and structural stability in high-risk zones. They are also utilized in dam safety monitoring, tunnel construction, and offshore platform stability assessments. The growing industrial adoption expands market opportunities and diversifies revenue streams for manufacturers. Companies offering multipurpose sensors with customizable features are better positioned to capture demand across multiple sectors, ensuring steady growth even outside high seismic risk regions.

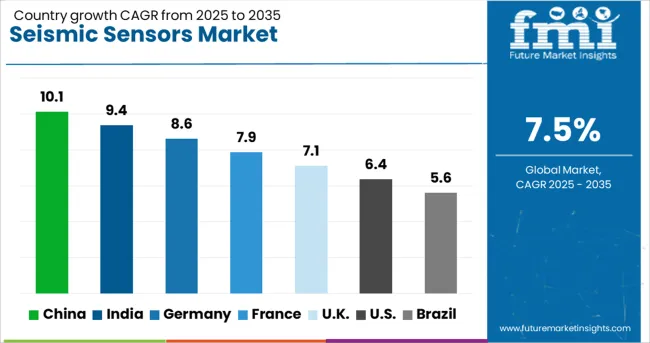

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

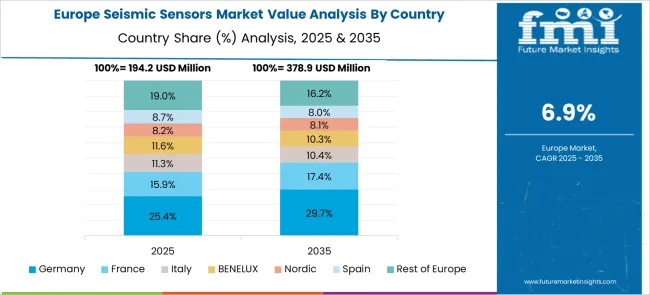

The seismic sensors market is projected to expand at a CAGR of 7.5%, driven by the growing need for real-time earthquake detection, infrastructure monitoring, and oil & gas exploration activities. China leads with a robust 10.1% growth rate, fueled by investments in nationwide seismic monitoring networks and advancements in sensor technology. India follows with 9.4% growth, supported by expanding seismic hazard mapping initiatives and industrial applications. Germany’s market, growing at 8.6%, benefits from strong engineering expertise and integration of seismic sensors into smart infrastructure systems. The UK shows a 7.1% growth rate, propelled by infrastructure safety programs and increased adoption in offshore energy projects. The USA records a 6.4% growth rate, driven by earthquake-prone regions’ preparedness measures and research-based deployments. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the seismic sensors market with a 10.1% growth rate, driven by rapid infrastructure expansion and growing investments in earthquake monitoring systems. The government prioritizes public safety through nationwide seismic detection networks in earthquake-prone regions. Compared to India, China benefits from larger-scale R&D funding for sensor technology, resulting in higher accuracy and reliability. Industries such as oil and gas, mining, and construction increasingly integrate seismic sensors for safety and operational efficiency. Collaboration between local universities and global manufacturers accelerates innovation and adoption. Export opportunities across Asia also strengthen the country’s manufacturing base. Rising awareness among municipal authorities regarding disaster preparedness further boosts demand. With its mix of policy support, technological progress, and diverse applications, China maintains a strong leadership position in the global seismic sensors market.

Seismic sensors market in India grows at 9.4%, fueled by increasing seismic risk awareness and urban infrastructure development. Government initiatives to upgrade disaster monitoring systems enhance demand across high-risk regions, especially in the Himalayan belt and coastal areas. Compared to Germany, India focuses on affordable, scalable sensor solutions for broad deployment. Academic institutions and research centers play a crucial role in developing low-maintenance, energy-efficient devices suited to remote locations. Mining, oil exploration, and hydropower projects also contribute significantly to market expansion. Private sector involvement in public safety infrastructure is increasing, enabling faster adoption in municipal projects. Growing collaborations with international suppliers help improve technological capabilities and manufacturing capacity.

Germany records an 8.6% growth rate in the seismic sensors market, supported by a strong emphasis on precision engineering and data accuracy. Although the country experiences relatively low seismic activity compared to China or India, it invests in advanced detection systems for critical infrastructure and scientific research. Compared to the United Kingdom, Germany prioritizes sustainability in manufacturing sensor components. The energy sector, particularly in geothermal projects, increasingly adopts seismic monitoring equipment to ensure safety. Public funding for research institutions encourages the development of next-generation sensors with improved sensitivity. Export demand within the EU further boosts production and innovation. Overall, Germany’s combination of engineering expertise and cross-sector applications sustains market momentum.

The United Kingdom’s seismic sensors market grows at 7.1%, driven by infrastructure modernization and enhanced safety protocols. Although seismic events are rare, sensors are deployed for early detection in offshore oil platforms, rail networks, and key energy facilities. Compared to the United States, the UK focuses more on compact, portable detection systems suited for varied environments. Academic research partnerships with industry accelerate product innovation and integration into structural monitoring. Public agencies increasingly include seismic sensors in national safety programs. Export potential to Commonwealth countries also adds to growth prospects. The focus on precision, portability, and application diversity helps maintain market stability.

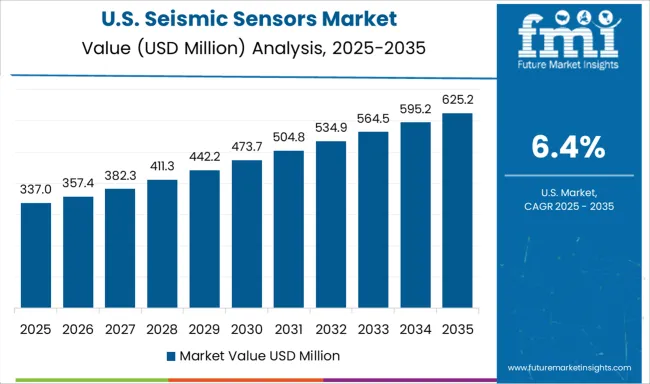

The United States grows at 6.4%, with demand concentrated in high-risk states such as California, Alaska, and Washington. Compared to China, the US market emphasizes ultra-high-performance seismic sensor technology for real-time monitoring and rapid alert systems. Federal agencies and state governments invest heavily in seismic detection networks to protect critical infrastructure. The oil and gas industry remains a major adopter, using sensors to monitor subsurface activity during drilling and extraction. Increasing private-sector participation in early warning systems is boosting adoption across urban areas. Partnerships with global tech companies enhance product capabilities and ensure international competitiveness.

Leading players such as Kinemetrics and IMT focus on critical infrastructure, oil and gas, and geotechnical applications, offering highly integrated systems combining seismic sensing with structural health monitoring platforms. These solutions provide long-term reliability, real-time data acquisition, and compatibility with advanced telemetry and IoT networks, creating a high barrier to entry for smaller suppliers. Geosense and RBR Ltd. differentiate through niche specialization, with Geosense excelling in low-noise geophones for mining and civil engineering, while RBR dominates offshore and deep-sea applications, leveraging pressure-velocity sensors and deployment expertise.

Emerging players, including regional IoT-focused suppliers, gain traction by offering edge-processing, low-latency analytics, and integration with industrial automation systems, addressing the growing demand for intelligent monitoring in mining, energy, and urban infrastructure. Companies like Honeywell and Bosch Sensortec emphasize MEMS technology for compact, cost-efficient deployment in industrial IoT and building safety systems, although their integration depth remains lower than that of specialized monitoring providers. Overall, competitive advantage is now determined by the ability to embed sensors within broader ecosystems, offer robust analytics, maintain global service coverage, and provide application-specific expertise, reshaping market hierarchies beyond traditional product-level comparisons.

| Item | Value |

|---|---|

| Quantitative Units | USD 797.6 Million |

| Sensor Type | Accelerometers, Seismometers, Geophones, Data loggers, Sensor arrays, and Others |

| Technology | MEMS sensors, Analog sensors, Digital sensors, and Optical sensors |

| Application | Earthquake monitoring, Volcanic activity monitoring, Structural health monitoring, Ambient vibration analysis, Induced seismicity monitoring, and Others |

| End Use | Oil and gas, Mining and construction, Aerospace and defense, Government and research institutions, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kinemetrics,Inc., GüralpSystemsLtd., GeoSIGLtd., NanometricsInc., and RogueSeismic |

| Additional Attributes | Dollar sales in the Seismic Sensors Market vary by type including broadband, short-period, and strong-motion sensors, application across oil and gas exploration, earthquake monitoring, and civil engineering, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for natural disaster monitoring, infrastructure safety, and energy exploration activities. |

The global seismic sensors market is estimated to be valued at USD 797.6 million in 2025.

The market size for the seismic sensors market is projected to reach USD 1,643.9 million by 2035.

The seismic sensors market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in seismic sensors market are accelerometers, seismometers, geophones, data loggers, sensor arrays and others.

In terms of technology, mems sensors segment to command 42.1% share in the seismic sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seismic Survey Market Size and Share Forecast Outlook 2025 to 2035

Seismic Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

Seismic Reinforcement Material Market Size and Share Forecast Outlook 2025 to 2035

Seismic Monitoring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seismic Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Weft Sensors Market - Size, Share, and Forecast Outlook 2025 to 2035

ADAS Sensors Market Growth - Trends & Forecast 2025 to 2035

PM2.5 Sensors for Home Appliances Market Size and Share Forecast Outlook 2025 to 2035

Image Sensors Market Growth – Trends & Forecast through 2034

Chest Sensors Market

PPG Biosensors Market – Size, Share & Growth Forecast 2025 to 2035

Motion Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA