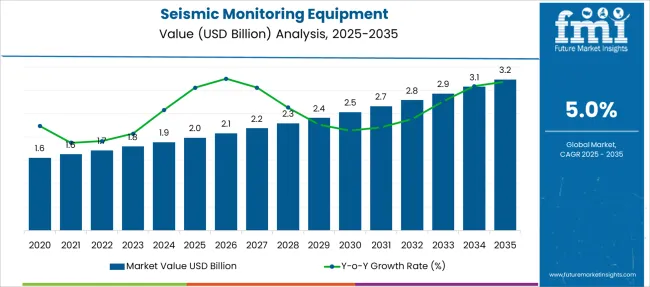

The Seismic Monitoring Equipment Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Seismic Monitoring Equipment Market Estimated Value in (2025 E) | USD 2.0 billion |

| Seismic Monitoring Equipment Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

Governments and research institutions are investing heavily in early warning systems and infrastructure monitoring, which has created sustained demand for advanced seismic technologies.

The shift toward digital and real-time data acquisition systems is further accelerating growth, as decision-makers prioritize accuracy, speed, and predictive capabilities. Aging infrastructure in seismic-prone regions and increased urban development in geologically sensitive zones are also contributing to the adoption of sophisticated monitoring solutions.

Regulatory mandates and international frameworks promoting disaster preparedness have reinforced the importance of continuous seismic data acquisition and analysis. As climate-related risks and tectonic activity continue to rise globally, the need for reliable, scalable, and software-integrated Seismic Monitoring Equipment Market is becoming more urgent, positioning the market for robust growth over the forecast period..

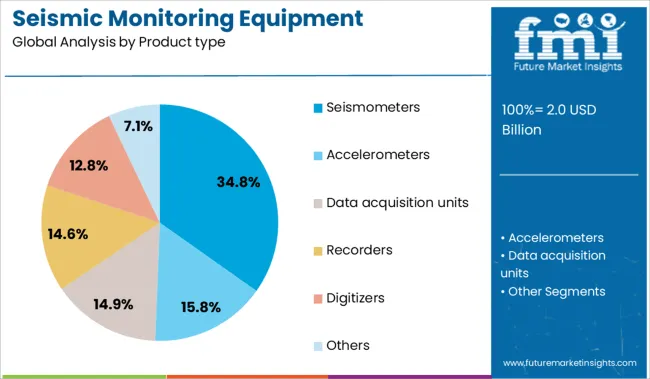

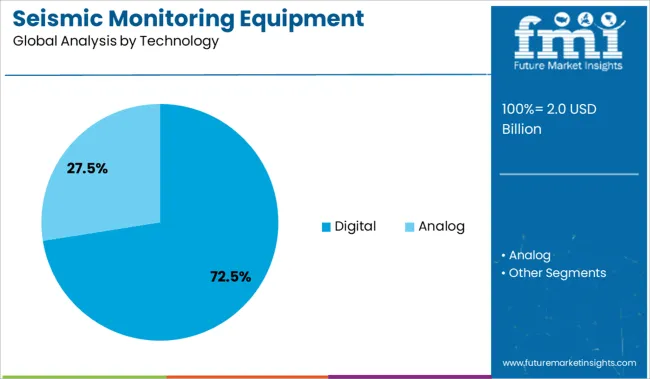

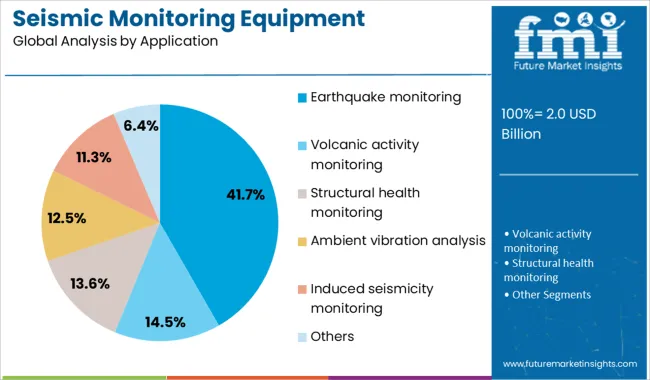

The market is segmented by Product type, Technology, Application, End User, and region. By Product type, the market is divided into Seismometers, Accelerometers, Data acquisition units, Recorders, Digitizers, and Others. In terms of Technology, the market is classified into Digital and Analog. Based on Application, the market is segmented into Earthquake monitoring, Volcanic activity monitoring, Structural health monitoring, Ambient vibration analysis, Induced seismicity monitoring, and Others.

By End User, the market is divided into Government and research institutions, Oil and gas, Mining and construction, Aerospace and defense, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The seismometers product type segment is anticipated to account for 34.80% of the Seismic Monitoring Equipment Market revenue in 2025, establishing it as the leading product category. This growth has been primarily influenced by the critical role of seismometers in accurately detecting and recording ground movements during seismic events. Their widespread use in both short-term and long-term monitoring initiatives has made them an essential tool for earthquake detection and structural health monitoring.

The enhanced sensitivity and range of modern seismometers have supported their deployment in diverse geographies, from urban centers to remote fault zones. The advancement of sensor technologies has allowed for greater accuracy and integration with digital platforms, which improves data processing and interpretation.

Continued governmental funding for national and regional seismic networks has also contributed to increased installations. The proven reliability and data precision offered by seismometers have reinforced their position as the foundational component in most seismic monitoring systems..

The digital technology segment is projected to capture 72.50% of the Seismic Monitoring Equipment Market revenue in 2025, representing the dominant technological approach. This leadership has been driven by the rapid transition from analog to digital systems, which offer superior data resolution, faster transmission, and seamless integration with advanced analytics platforms. Digital seismic monitoring solutions enable real-time event detection and reporting, which are essential for early warning and rapid response strategies.

The ability to store, analyze, and transmit high-frequency seismic data without degradation has positioned digital systems as the preferred choice for government agencies, research institutions, and commercial users alike. In addition, digital platforms support remote accessibility and cloud-based analytics, which reduce the need for physical site visits and enhance monitoring efficiency.

The scalability of digital systems has further supported large-scale deployments across regional seismic networks, reinforcing their adoption. As precision and automation remain top priorities, digital technology continues to define the next generation of seismic monitoring infrastructure..

The earthquake monitoring application segment is expected to hold 41.70% of the Seismic Monitoring Equipment Market revenue in 2025, making it the leading application area. The consistent occurrence of tectonic activity and the devastating impacts of major earthquakes have driven the demand for continuous seismic surveillance systems. This segment’s dominance has been reinforced by national mandates and global frameworks aimed at mitigating natural disaster risks through improved detection and preparedness.

Earthquake monitoring systems have been widely adopted by seismic research centers, geological institutes, and urban development agencies seeking to protect lives and critical infrastructure. The integration of AI and predictive analytics into seismic monitoring solutions has improved accuracy and response times, enhancing their effectiveness in earthquake-prone regions.

Additionally, public and private sector investments in seismic resilience have encouraged the installation of dense sensor networks specifically for earthquake detection. The segment continues to benefit from growing awareness, policy initiatives, and technological advancements that support robust seismic event forecasting and response..

Challenges such as high equipment costs, complex data analysis, and regional regulatory requirements continue to limit its widespread adoption.

The demand is primarily driven by the increasing focus on disaster preparedness and the need for resource exploration. Seismic systems help detect early signs of natural events such as earthquakes, tsunamis, and volcanic eruptions, enabling authorities to implement timely evacuations and minimize risks. In addition, the oil, gas, and mining industries are adopting seismic technologies to assess underground resources more accurately, contributing to the market’s expansion. With increasing investments in infrastructure and resource exploration, Seismic Monitoring Equipment Market remains vital for ensuring safety and operational efficiency across various industries.

Despite its growth, the market faces significant challenges related to the high costs of equipment and the complexities of data interpretation. Seismic sensors and systems can be expensive to install, especially for small or developing companies, limiting their adoption. Moreover, the vast amount of data generated requires specialized skills and technology to analyze, creating a barrier to entry for many potential users. These challenges make it difficult for certain regions and industries to fully leverage seismic technology fully, slowing down the broader market growth.

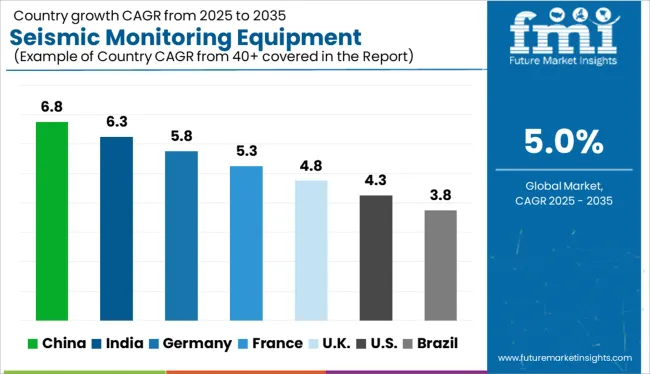

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| US | 4.3% |

| Brazil | 3.8% |

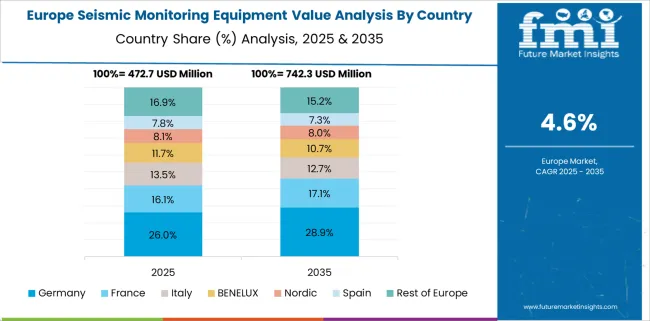

Demand is projected to rise at a 5% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 6.8%, followed by India at 6.3%, and Germany at 5.8%, while the United States posts 4.3% and the United Kingdom records 4.8%. These rates translate to a growth premium of +36% for China, +26% for India, and –14% for the United States versus the baseline, while Germany and the United Kingdom show slower growth. Divergence reflects local catalysts: growing demand for seismic monitoring and natural disaster preparedness in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to market saturation and established infrastructure.

Sales of Seismic Monitoring Equipment Market in the United Kingdom are projected to grow at a CAGR of 4.8% through 2035. The market is being driven by national mandates for structural resilience, especially in historic and critical infrastructure. Investment in underground transit expansions and nuclear facilities necessitates advanced seismic sensing and vibration isolation. The country’s regulatory alignment with geophysical safety protocols further enhances market uptake, particularly in offshore infrastructure and tunneling projects.

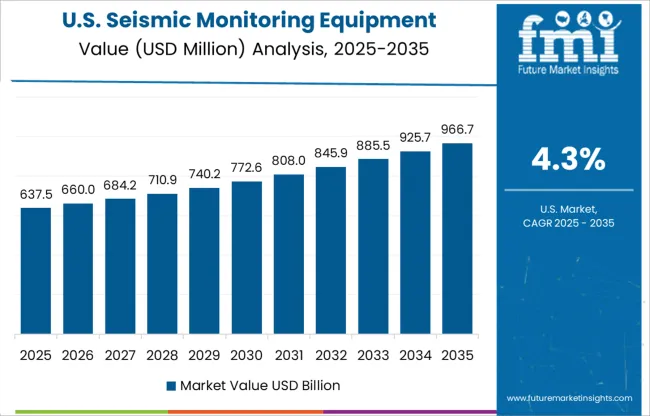

The United States Seismic Monitoring Equipment Market is forecasted to grow at a CAGR of 4.3% through 2035. The market is shaped by coastal fault line vulnerability and retrofitting mandates in California, Washington, and Alaska. Federal and state infrastructure funding has enabled public agencies and universities to expand seismic observatory networks. Equipment purchases are aligned with early warning systems, dam monitoring, and structural response analytics.

The Seismic Monitoring Equipment Market in China is expected to grow at a robust CAGR of 6.8% from 2025 to 2035. Demand is influenced by high seismic exposure in western provinces and state-level directives for early warning systems. Expansions in high-speed rail, hydropower, and urban metro systems are integrating real-time geophysical monitoring tools. Local manufacturers are scaling production of broadband seismometers and intelligent data acquisition units.

The market in India is forecasted to expand at a CAGR of 6.3% during 2025 to 2035. Growth is underpinned by vulnerability along the Himalayan belt and seismic-prone zones in Gujarat and the Northeast. State disaster management agencies are deploying real-time seismic monitoring stations. Infrastructure developers are integrating sensors into dams, refineries, and high-rise buildings for post-event structural analytics.

The Seismic Monitoring Equipment Market in Germany is projected to rise at a CAGR of 5.8% through 2035. While not highly earthquake-prone, Germany invests heavily in monitoring induced seismicity related to mining, geothermal drilling, and infrastructure excavation. Public research institutions and engineering firms are deploying high-resolution seismic arrays for risk profiling and geotechnical diagnostics.

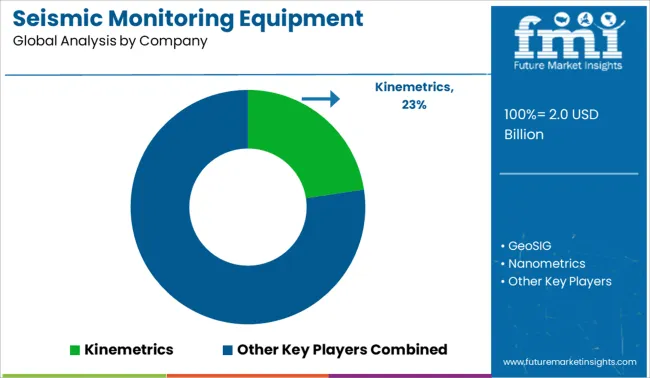

Kinemetrics has emerged as the most prominent supplier of seismic monitoring equipment, commanding a significant share through its high-precision instruments and data acquisition systems widely deployed across research, governmental, and industrial seismic networks. Alongside Güralp Systems, it holds a significant combined share of the global market. Nanometrics and GeoSIG are also influential, offering broadband sensors and accelerometers for both scientific and commercial applications. Reftek provides rugged field recorders, while other competitors support niche applications in earth science, energy, and infrastructure monitoring.

In June 2023, Interface Inc. acquired LCM Systems to strengthen its global footprint in seismic and hazardous-area load monitoring. The move expands Interface’s instrumentation portfolio, addressing rising demand in structural, mining, and industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Product type | Seismometers, Accelerometers, Data acquisition units, Recorders, Digitizers, and Others |

| Technology | Digital and Analog |

| Application | Earthquake monitoring, Volcanic activity monitoring, Structural health monitoring, Ambient vibration analysis, Induced seismicity monitoring, and Others |

| End User | Government and research institutions, Oil and gas, Mining and construction, Aerospace and defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kinemetrics, GeoSIG, Nanometrics, Güralp Systems, and Reftek |

| Additional Attributes | Dollar sales concentrated in geotechnical services and oilfield exploration, share driven by broadband seismometers and strong motion accelerometers, demand rising for AI-assisted early warning systems in infrastructure safety, retrofitting prioritized in legacy dam and tunnel monitoring networks, ergonomic deployment essential for field technicians in rugged terrains, and solid-state MEMS sensors gaining preference over conventional geophones for low-noise, high-resolution ground motion detection. |

The global seismic monitoring equipment market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the seismic monitoring equipment market is projected to reach USD 3.2 billion by 2035.

The seismic monitoring equipment market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in seismic monitoring equipment market are seismometers, accelerometers, data acquisition units, recorders, digitizers and others.

In terms of technology, digital segment to command 72.5% share in the seismic monitoring equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seismic Survey Market Size and Share Forecast Outlook 2025 to 2035

Seismic Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

Seismic Reinforcement Material Market Size and Share Forecast Outlook 2025 to 2035

Seismic Sensors Market Size and Share Forecast Outlook 2025 to 2035

Seismic Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Neuro-monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Nerve Monitoring Devices Market Insights - Growth & Forecast 2025 to 2035

Power Monitoring Market Report - Growth, Demand & Forecast 2025 to 2035

Urine Monitoring Systems Market Analysis - Size, Trends & Forecast 2025 to 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flare Monitoring Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA