The global Nerve Monitoring Devices Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.3 billion |

| Projected Market Size in 2035 | USD 2.2 billion |

| CAGR (2025 to 2035) | 5.6% |

The nerve monitoring devices market is experiencing a transformative phase, driven by a confluence of technological advancements, demographic shifts, and evolving surgical practices. The increasing prevalence of neurological disorders, coupled with a growing geriatric population, has heightened the demand for precise intraoperative nerve monitoring to prevent postoperative complications.

Technological innovations, such as AI-enhanced signal processing and the integration of nerve monitoring systems with robotic-assisted surgeries, are enhancing surgical precision and patient outcomes. Furthermore, the shift towards minimally invasive procedures necessitates advanced monitoring solutions to ensure nerve integrity during complex surgeries. Healthcare institutions are increasingly adopting these devices to improve surgical safety and efficiency, reflecting a broader trend towards value-based care.

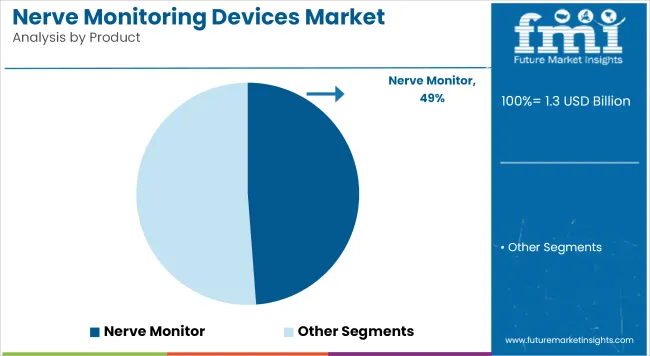

The nerve monitors segment has been projected to hold a 48.8% revenue share in the global nerve monitoring devices market by 2025. This dominance has been attributed to the increasing integration of these systems in high-risk surgeries, where intraoperative nerve damage is a critical concern. Greater emphasis has been placed by surgical teams and hospital systems on ensuring nerve preservation, particularly during neurosurgical and spinal procedures.

Advanced monitor platforms have been preferred due to their ability to deliver real-time nerve function assessments, contributing to better post-surgical outcomes and minimized complications. Continuous innovations by OEMs in signal accuracy, portability, and multi-modal compatibility have further supported their adoption. Hospitals and specialty clinics have steadily invested in these devices due to their cost-benefit potential in complex procedures.

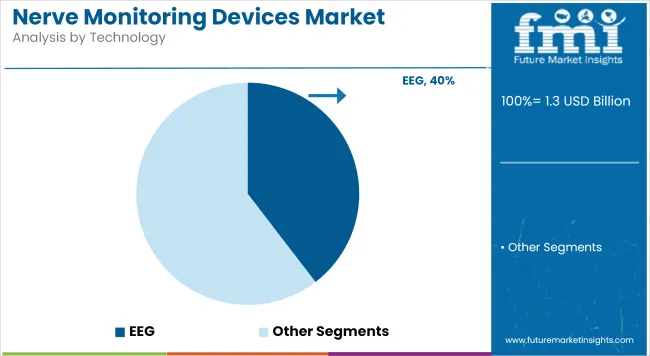

Electroencephalography (EEG) technology is estimated to command 39.6% of the total market share in 2025, leading the technology segment. The dominance of EEG has been underpinned by its established role in monitoring electrical activity in the brain, which is crucial during neurosurgical procedures.

Enhanced utility in detecting seizure thresholds, cortical mapping, and assessing anesthesia depth has made EEG an indispensable modality in neurophysiology. This segment’s growth has been accelerated by technological advancements that have improved the resolution, portability, and signal processing capabilities of EEG devices. High adoption has been observed in tertiary care centers, driven by the growing incidence of neurological disorders requiring precise intraoperative mapping. Moreover, its non-invasive nature and compatibility with multimodal monitoring systems have made EEG a preferred solution among neuro-specialists.

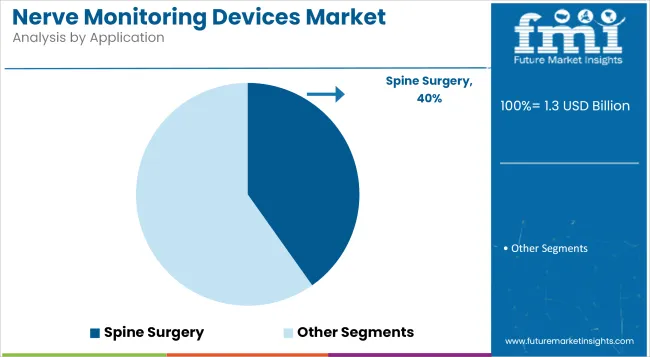

Spine surgery is expected to retain the leading position in the application segment, with a 40.2% market share in 2025. This has been driven by the rising global burden of spinal disorders, including herniated discs, scoliosis, and spinal stenosis. Surgical interventions in this area often pose a high risk of nerve damage, necessitating the intraoperative use of nerve monitoring devices to ensure functional preservation.

The segment’s dominance has been reinforced by an increasing preference for complex spine procedures such as spinal fusion and deformity correction surgeries. Regulatory agencies and surgical associations have emphasized nerve safety protocols, leading to broader use of EMG and SSEP-based monitoring solutions. Furthermore, improvements in minimally invasive spine surgery techniques have heightened the demand for precision-guided monitoring tools.

Challenge: Reimbursement Gaps, Equipment Sensitivity, and Training Requirements

There are many systemic as well as clinical adoption hurdles in the nerve monitoring devices market. The high costs of equipment, surgical staff training requirements and limited reimbursement frameworks in emerging regions are preventing wider adoption particularly in outpatient and low-budget surgical centers.

And such devices need to be very precise and the signal stable in real time to avoid false positives or misinterpretation of nerve signals. This does not only add equipment to surgical products, but significantly increases the workload of hospitals to ensure the accuracy of electrode placement, the configuration of technicians, and the integration of multidisciplinary workflows, especially in otolaryngology (ENT), spinal surgery, neurosurgery or thyroid surgery. Older monitoring systems are not able to integrate with the latest robotic-assisted platforms, which inhibits their flexibility in advanced OR environments.

Opportunity: Surgical Safety, Robotics Integration, and AI-Augmented Monitoring

Despite these limitations, the market is witnessing rapid growth, primarily owing to the increasing global demand for neuroprotective surgical procedures, particularly in complex, minimally invasive or robotic-assisted procedures. Intraoperative Nerve Monitoring (IONM) systems have become a standard of care for surgical procedures that may put cranial, spinal, and peripheral nerve pathways at risk.

New IONM platforms won't be far behind, with breakthroughs in EMG/EEG signal capture, real-time visualization, and wireless, electrode-free (aquatic) systems, thanks to technological advances. Integration with robotic surgery systems, 3D surgical navigation, and AI-based pattern recognition reduce false alerts and improve response time. Furthermore, increasing focus on tracking post-operative outcomes and medico-legal compliance are also pushing the need for automated reporting, along with cloud-enabled data archiving.

The nerve monitoring devices market in the USA is projected to grow at a steady pace owing to an increasing number of neurological surgeries, growth in an aging population, and higher adoption rates of intraoperative neurophysiological monitoring (IONM).

Also, high amount of healthcare expenditure coupled with presence of widespread awareness regarding prevention of nerve injury along with strong presence of topmost device manufacturers, are also going to drive the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.7% |

In United Kingdom nerve monitoring devices market is gaining acceleration due to growing investment in neurodiagnostics, increasing prevalence of spinal disorders and neurological diseases and higher adoption of IONM technologies in surgical centers. Healthcare infrastructure improvements and greater access to neurosurgical care will further boost the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The nerve monitoring devices market in Europe is also growing steadily, driven by a strong emphasis on patient safety during high-risk surgeries, increase in prevalence of neurodegenerative disorders, and support for technology innovation in surgical monitoring systems. Countries such as Germany, France and Italy are embracing both public and private healthcare sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.6% |

The Japan nerve monitoring devices market is moderately growing, backed by the developed neurosurgical expertise of the country, a growing geriatric population, and growing preferences towards minimally invasive surgical procedures. Government initiatives encouraging medical technology upgradation, as well as neuro-care programs, are also fueling growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The market in South Korea is anticipatory to grow due to rising consciousness towards preventing intra-operative nerve injury, enhance availability of neuro-monitoring services offered in supplementary hospitals along with integration of electrophysiological monitoring instruments in ENT, orthopedic and neurosurgery. Technological advancements alongside medical tourism is serving as a tailwind to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

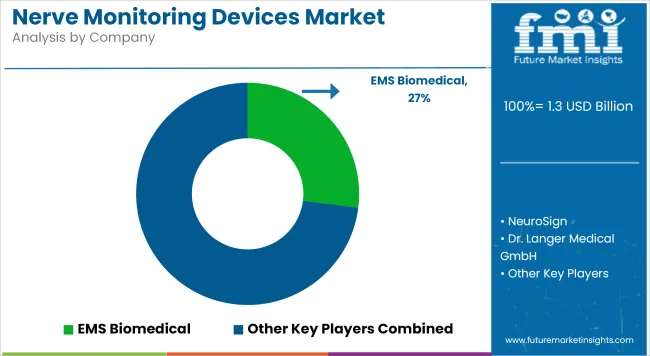

The nerve monitoring devices market is characterized by intense competition, with a strong emphasis on technological innovation and clinical integration. Key players are actively engaged in expanding their product portfolios through the development of multifunctional, AI-enabled, and minimally invasive monitoring systems.

Strategic collaborations with hospitals and surgical centers are being pursued to strengthen clinical adoption and feedback-driven product design. Increased investment in R&D and real-time signal processing enhancements has intensified the competitive landscape. Additionally, firms are focusing on vertical integration across hardware, software, and service models to deliver end-to-end solutions. Regulatory approvals and CE mark expansions are being prioritized to enhance geographic presence.

Key Development

The overall market size for the nerve monitoring devices market was USD 1.3 billion in 2025.

The nerve monitoring devices market is expected to reach USD 2.2 billion in 2035.

Growth is driven by the increasing prevalence of neurological disorders, rising number of complex surgeries requiring intraoperative nerve monitoring, advancements in neuromonitoring technology, and growing awareness about postoperative nerve damage prevention.

The top 5 countries driving the development of the nerve monitoring devices market are the USA, Germany, Japan, China, and the UK.

Nerve Monitors and EMG Technology are expected to command a significant share over the assessment period due to their critical role in spinal, ENT, and neurosurgical procedures.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Noise Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Lactate Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Epilepsy Monitoring Devices Market Growth - Trends & Forecast 2025 to 2035

Compliance Monitoring Devices Market Trends and Forecast 2025 to 2035

Vital Signs Monitoring Devices Market Analysis - Trends & Forecast 2025 to 2035

Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Remote Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Demand for Glucose Monitoring Devices in EU Size and Share Forecast Outlook 2025 to 2035

Continuous Cardiac Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Frictionless Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Intraoperative Neuromonitoring Devices Market

Cardiac Rhythm Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Non-Invasive Blood Glucose Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Nerve Repair Market Growth - Trends, Demand & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA