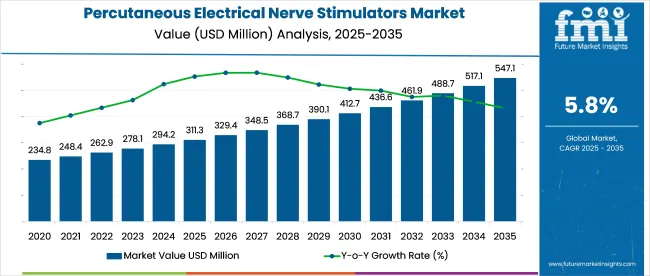

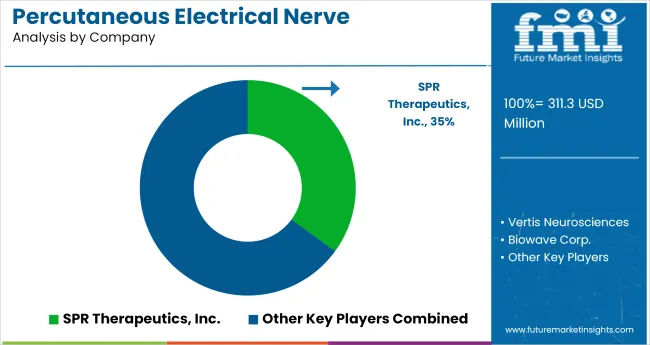

The percutaneous electrical nerve stimulators market is valued at USD 311.3 million in 2025 and is projected to grow to USD 547 million by 2035, at a CAGR of 5.8%. This expansion is being fueled by the mounting prevalence of chronic pain and neurological disorders, with electrically based neuromodulation increasingly favored over pharmacological therapies.

Technological sophistication is being introduced via percutaneous modalities, such as fine-needle electrodes, which are believed to offer better depth targeting than non-invasive transcutaneous units. It is suggested that early adoption of image-guided insertion and remote programming platforms will differentiate premium suppliers. Industry consolidation is being anticipated as larger medtech firms acquire niche nervestimulator specialists to build integrated chronicpain portfolios.

In November 2024, NeurAxis secured expanded FDA 510(k) clearance for its IB-Stim device, enhancing its position in the industry. This regulatory milestone significantly increases the device’s clinical application across broader patient groups, reinforcing its role in non-opioid pain management and neuromodulation therapy.

The IB-Stim system delivers targeted electrical stimulation through the ear to influence autonomic nervous system function. Addressing this expansion, Brian Carrico, President and CEO of NeurAxis, stated, “We are excited to receive this new 510(k) clearance for IBStim, which expands the IBStim addressable market by roughly 75%.” The quote reflects the commercial potential unlocked by this clearance.

The industry holds a specialized share within its parent markets. In the medical devices market, it accounts for approximately 2-3%, as it is a niche segment focused on pain relief and nerve stimulation. Within the pain management market, its share is around 5-7%, driven by the increasing demand for non-invasive pain treatment options for chronic pain conditions.

In the neurology market, the share is about 3-5%, as these stimulators are used for neurological disorders, such as nerve pain and rehabilitation. In the physical therapy market, its share is approximately 4-6%, as these devices are commonly used in rehabilitation therapies for muscle and nerve stimulation. In the electrotherapy market, the share is around 6-8%, reflecting its growing application in various therapeutic treatments.

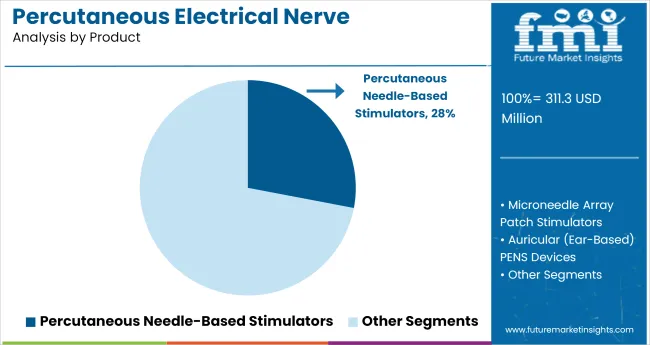

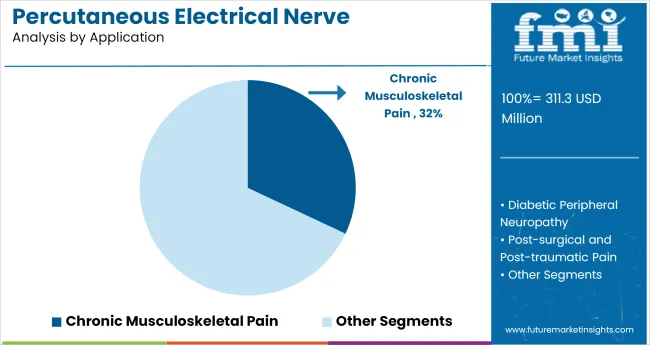

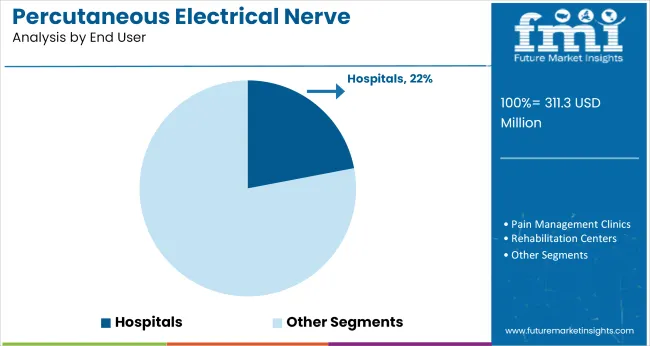

The industry is projected to grow, with percutaneous needle-based stimulators capturing 28% of the industry, chronic musculoskeletal pain leading the application segment with 32%, and hospitals representing 22% of the end-user share.

Percutaneous needle-based stimulators are expected to account for 28% of the industry share in 2025. These devices are commonly used for targeted nerve stimulation in treating pain, particularly in patients with musculoskeletal conditions.

Percutaneous needle-based stimulators are known for their precise delivery of electrical impulses to specific nerves, offering an effective treatment for chronic pain conditions. Their ability to provide localized pain relief while minimizing systemic side effects makes them a popular choice among healthcare providers and patients.

Chronic musculoskeletal pain is expected to hold 32% of the application industry share in 2025. This condition is one of the most common reasons for seeking percutaneous electrical nerve stimulation therapy.

The growing prevalence of musculoskeletal disorders, such as arthritis, back pain, and neck pain, is driving the demand for pain management therapies like nerve stimulators. As non-invasive treatment options gain popularity, the chronic musculoskeletal pain segment continues to be the largest application for percutaneous electrical nerve stimulators.

Hospitals are projected to capture 22% of the end-user industry share for percutaneous electrical nerve stimulators in 2025. Hospitals are the primary setting for advanced pain management therapies, including percutaneous nerve stimulation, due to their comprehensive medical infrastructure and specialized staff.

The growing use of non-invasive treatments in hospitals, along with increased adoption of nerve stimulators in pain management protocols, reinforces their dominant position in the industry.

The industry is expanding due to rising demand for non-invasive pain management solutions, driven by preferences for alternatives to opioids. However, high costs and the need for specialized training limit accessibility, especially in regions with constrained healthcare resources.

Growing Demand for Non-Invasive Pain Management Solutions

The industry is experiencing growth due to increasing consumer preference for non-invasive pain relief options. As the demand for alternatives to traditional pain management methods, such as opioids, rises, percutaneous electrical nerve stimulators are gaining popularity.

These devices offer targeted pain relief for conditions like chronic back pain, arthritis, and post-surgical recovery. The shift towards safer, non-invasive treatments is driving the adoption of nerve stimulators, particularly among patients seeking alternatives with fewer side effects.

High Cost and Accessibility Limit Industry Growth

Despite growing demand, the industry faces challenges from high costs and limited accessibility. The devices often require significant investment, making them less accessible to patients in regions with constrained healthcare budgets.

These devices typically require specialized training for proper use, creating barriers to adoption in smaller clinics or non-specialized healthcare settings. These factors limit the widespread use of percutaneous electrical nerve stimulators, especially in developing industries where affordability and infrastructure are concerns.

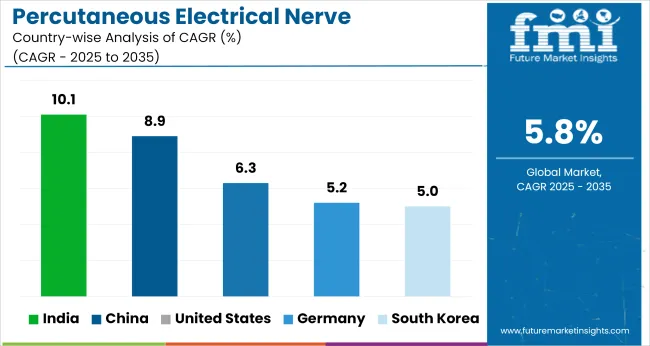

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 10.1% |

| China | 8.9% |

| United States | 6.3% |

| Germany | 5.2% |

| South Korea | 5% |

Global industry demand is projected to rise at a 5.8% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 10.1%, followed by China at 8.9%, and the United States at 6.3%, while Germany posts 5.2% and South Korea records 5.0%. These rates translate to a growth premium of +74% for India, +53% for China, and -9% for Germany versus the baseline, while South Korea shows the slowest growth.

Divergence reflects local catalysts: expanding healthcare access and rising demand for non-invasive pain management solutions in India and China, steady demand in the United States due to established healthcare infrastructure, and slower adoption in Germany and South Korea driven by industry saturation and more mature healthcare systems.

The industry in India is projected to grow at a CAGR of 10.1% through 2035, led by rising pain therapy adoption across outpatient and homecare settings. Regional hospitals are using these devices for musculoskeletal and post-surgical recovery programs. State-led tenders have incorporated nerve stimulators under physiotherapy equipment packages.

Insurance inclusion under Ayushman Bharat has widened access to low-income patients. Clinical demand is further driven by orthopedic surgeons integrating electrical nerve stimulation post-arthroscopy and fracture fixation.

The industry in China is forecast to expand at 8.9% CAGR from 2025 to 2035. Strong integration into outpatient physical medicine departments supports nationwide device uptake. Reimbursement through the Urban Employee Basic Medical Insurance (UEBMI) and fast-track approvals under NMPA have allowed local production to scale.

Tertiary hospitals are using multi-channel stimulators for nerve regeneration in diabetic neuropathy cases. Adoption is also growing in sports clinics and senior care institutions.

The United States industry is projected to grow at a CAGR of 6.3% between 2025 and 2035. Ambulatory surgical centers and pain clinics are driving volumes, especially for sciatica, spinal stenosis, and shoulder impingement cases.

Medicare Part B includes coverage under durable medical equipment for defined indications. Adoption has risen in veteran hospitals and occupational therapy centers. Demand has intensified as opioid alternatives are being promoted by insurers and state health agencies.

The industry in Germany is expected to grow at 5.2% CAGR. Public hospitals use stimulators in physiotherapy programs reimbursed under statutory health insurance (GKV). Neurology and orthopedic centers use percutaneous devices for nerve entrapment and neuropathic pain.

Preference for CE-certified products, combined with outpatient rehab mandates, sustains hospital-level demand. Device leasing models are emerging in rural clinics.

South Korea is forecast to register a 5.0% CAGR from 2025 to 2035. Demand is centered around physiotherapy chains and tertiary hospitals in Seoul and Busan. Coverage under the National Health Insurance Service (NHIS) has expanded access. Surgeons are adopting these stimulators for managing post-laparoscopic nerve pain. Government-backed R&D investments support local device refinements for chronic lower back pain.

The industry is led by SPR Therapeutics, Inc., a pioneer in the development of non-invasive, short-term neurostimulation therapies. Their flagship product, the SPRINT® PNS System, has demonstrated significant efficacy in treating chronic pain conditions, including chronic low back pain and post-surgical pain, with sustained relief reported even after the treatment period.

SPR Therapeutics has expanded its industry presence through strategic partnerships and clinical studies, establishing a strong foothold in the USA and international industries.The company's focus on minimally invasive, outpatient procedures aligns with the growing demand for effective pain management solutions that minimize patient recovery time and healthcare costs.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Current Industry Size (2025) | USD 311.3 million |

| Projected Industry Size (2035) | USD 547 million |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Segmentation | Percutaneous Needle-Based Stimulators, Microneedle Array Patch Stimulators, Auricular PENS Devices, Hybrid PENS-TENS Devices, Extended-Wear PENS Systems |

| Application Segmentation | Chronic Musculoskeletal Pain, Diabetic Peripheral Neuropathy, Post-surgical and Post-traumatic Pain, Headache and Migraines, Surface Hyperalgesia and Neuropathic Pain, Cancer-related Pain |

| End-User Segmentation | Hospitals, Pain Management Clinics, Rehabilitation Centers, Specialty Clinics, Ambulatory Surgical Centers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | IonClinics, Vertis Neurosciences, Biowave Corp., SPR Therapeutics, Inc., DyAnsys, Inc. |

| Additional Attributes | Dollar sales by product type, application, and end-user, rising demand for non-invasive pain management solutions, growth in chronic pain and neuropathic pain treatment, increasing adoption in hospitals and pain management clinics, advancements in PENS technology and extended wear systems. |

Product segmentation includes Percutaneous Needle-Based Stimulators, Microneedle Array Patch Stimulators, Auricular PENS Devices, Hybrid PENS-TENS Devices, and Extended-Wear PENS Systems.

Applications encompass Chronic Musculoskeletal Pain, Diabetic Peripheral Neuropathy, Post-surgical and Post-traumatic Pain, Headache and Migraines, Surface Hyperalgesia and Neuropathic Pain, and Cancer-related Pain.

End users consist of Hospitals, Pain Management Clinics, Rehabilitation Centers, Specialty Clinics, and Ambulatory Surgical Centers.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA), have been covered in the report.

The industry in 2025 is estimated to be valued at USD 311.3 million.

The industry in 2035 is projected to reach USD 547 million, with a CAGR of 5.8%.

Chronic musculoskeletal pain dominates the application segment with a 32% industry share.

India will lead industry with a 10.1% CAGR from 2025 to 2035.

SPR Therapeutics, Inc. is the leading company in the industry with a 35% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Service Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA